#flexcube consulting

Explore tagged Tumblr posts

Text

Top Flexcube Core Banking Solutions & Tech Challenges for Banks in 2025

Customization complexity, system integration, and regulatory compliance are major hurdles for financial institutions. That’s why we decided to consult with API Connects—a leading IT services provider in New Zealand—to explore how advanced technologies are overcoming these challenges and optimizing Flexcube core banking solutions.

Key Tech Solutions for Banking: 🔹 Tailored Customization – Customizes Flexcube core banking solutions to meet specific banking needs while maintaining system stability. 🔹 Seamless Integration – Connects Flexcube with digital platforms, payment gateways, and third-party systems for an optimized customer experience. 🔹 Flexcube Upgrades & Migrations – Ensures smooth system updates, preserving customizations and minimizing downtime. 🔹 Regulatory Compliance – Keeps Flexcube in line with evolving global regulations like KYC, AML, and GDPR. 🔹 Scalable Architecture – Designs Flexcube core banking solutions to support growth in transaction volumes and user base. 🔹 Legacy System Integration – Seamlessly connects Flexcube with legacy systems for continued operational efficiency. 🔹 Expert Support – Provides proactive support and liaises with Oracle for rapid issue resolution.

Conclusion: Banks are modernizing core banking systems through tailored Flexcube core banking solutions, ensuring efficiency, compliance, and future scalability. With API Connects' expertise, financial institutions can transform operational challenges into growth opportunities, ensuring a seamless banking experience for all.

Don’t forget to check their most popular services:

Automation Solutions

robotic process automation solutions

machine learning services

core banking solutions

IoT business solutions

data engineering services

DevOps services

mulesoft integration services

ai services

0 notes

Text

Proexcellency Solutions Presents: Oracle Flexcube Online Training for Professionals

In today’s virtual-first banking landscape, the call for for strong center banking platforms is higher than ever. Among the maximum trusted names in this area is Oracle Flexcube—a comprehensive solution used by main banks and economic institutions around the globe. As monetary businesses continue to modernize their systems, there may be a growing need for specialists who understand the inner workings of Oracle Flexcube. To meet this demand, Proexcellency Solutions proudly offers a specialized Oracle Flexcube Online Training program designed for running experts and aspiring banking era experts.

Why Oracle Flexcube?

Oracle Flexcube is a complicated, included core banking platform that helps a couple of banking functions along with retail, corporate, and investment banking. It helps digital transformation by way of supplying a scalable and stable framework for processing transactions, coping with debts, onboarding clients, and making sure compliance with economic policies. With substantial adoption across extra than a hundred nations, Oracle Flexcube understanding has come to be a fairly treasured skill set inside the banking and IT process markets.

About Proexcellency Solutions

Proexcellency Solutions is a depended on name in expert IT and ERP education. With a dedication to delivering job-orientated and industry-applicable packages, we've trained heaps of professionals across the globe in regions like SAP, Oracle, Workday, and core banking technologies. Our Oracle Flexcube Online Training is crafted specially for specialists looking to beautify their area knowledge and technical competencies.

What the Training Offers

The Oracle Flexcube Online Training via Proexcellency Solutions is designed to provide in-intensity purposeful and technical insights into the platform. The route consists of modules on:

Introduction to Core Banking and Oracle Flexcube Architecture

Customer Onboarding and Account Management

CASA (Current and Savings Accounts) Operations

Loan Origination and Processing

Trade Finance, Payments, and Clearing Modules

Product Setup, Interest & Charges, GL Mapping

Flexcube Configuration, Customization, and Integration

Report Generation and Compliance Management

Delivered via Flexcube-certified professionals, the schooling consists of each stay online periods and get right of entry to to recorded substances, allowing inexperienced persons to examine at their personal pace without disrupting their work schedules.

Key Benefits of Learning with Proexcellency Solutions

Choosing Proexcellency Solutions to your Oracle Flexcube schooling comes with numerous blessings:

Industry Expert Trainers: All sessions are led by using professionals with actual-international Flexcube implementation revel in.

Practical Exposure: Get fingers-on training with system get admission to to simulate stay banking situations.

Flexible Learning Options: Choose from weekend batches, nighttime classes, or self-paced modules.

Interview Preparation & Job Assistance: Benefit from resume support, mock interviews, and process referrals through our network.

Certification Guidance: Receive step-through-step support to clear Oracle Flexcube certification exams and raise your credentials.

Who Should Enroll?

This education is ideal for:

IT specialists searching for to focus on middle banking generation

Banking area specialists trying to move into tech-primarily based roles

ERP and CRM consultants wanting to enlarge into financial structures

Freshers with a historical past in finance or laptop science aiming to break into the banking IT area

Whether you are looking to switch careers or develop inside your modern function, getting to know Oracle Flexcube with Proexcellency Solutions offers you a aggressive part within the financial era process marketplace.

Start Your Journey with Proexcellency Solutions

At Proexcellency Solutions, we agree with in empowering professionals thru extraordinary, practical training that leads to real-global fulfillment. Our Oracle Flexcube Online Training is extra than just a route—it’s a stepping stone to a worthwhile and future-proof career in banking technology.

Join the loads of professionals who have converted their careers with our training applications. Enroll in Oracle Flexcube Online Training with the aid of Proexcellency Solutions today and come to be a part of the following technology of banking tech specialists.

[email protected], +91-9148251978,+91-9008906809use this Promocode you have discount Promocode :PROROJA

0 notes

Text

What are the learning prerequisites for Oracle Flexcube?

Oracle FLEXCUBE Online Training & Certification Course by ProExcellencyLearn is one of the best core banking products with ProExcellency's expert-led online training. Learn about retail, corporate, and digital banking, as well as how to install, customize, and integrate. Get hands-on experience, best practices, and ready for certification to drive your career forward in the banking industry. Sign up now and enhance your skill in Oracle FLEXCUBE!

What is Oracle Flexcube?

Oracle FLEXCUBE is a core banking technology developed by Oracle Financial Services to help banks and financial institutions streamline their operations. It provides account management, payments, loans, trade finance, treasury, and digital banking services to retail, corporate, and investment banking clients. Oracle FLEXCUBE helps financial institutions drive efficiency, customer experience, and change in response to the evolving banking landscape through robust automation, risk management, regulatory compliance, and API integration.. Its scale-invariant architecture provides smooth digital transformation, rendering it a bank of choice globally.

What are the learning prerequisites for Oracle Flexcube?

Prerequisites for Learning Oracle FLEXCUB

Although Oracle FLEXCUBE training is intended for both freshers and experienced professionals, the following knowledge will prove useful:

Basic Banking Knowledge – Knowledge of banking fundamentals, financial deals, and banking activities.

Database & SQL – Acquaintance with Oracle Database as well as SQL queries can assist in customization and reporting.

ERP & Financial Systems – Familiarity with banking ERP packages or financial management solutions is a plus.

IT & Programming (Optional) – Java, APIs, and integration frameworks knowledge is beneficial for technical positions.

Banking Regulations & Compliance (Optional) – Industry regulation awareness can assist in implementation and compliance management.

Modules of Oracle FLEXCUBE Covered in Training:-

ProExcellency's Oracle FLEXCUBE Online Training includes key modules to enable you to master this core banking solution.

1. Core Banking Operations

Customer Account Management

Deposits & Loans Processing

Payments & Fund Transfers

Interest & Charges Management

2. Retail & Corporate Banking

Retail Banking Services

Corporate Banking Solutions

Trade Finance & Treasury Management

Wealth & Asset Management

3. Digital & Internet Banking

Omni-Channel Banking

Mobile & Internet Banking

Customer Onboarding & Self-Service

4. Risk & Compliance Management

Regulatory Compliance & Reporting

Fraud Identification and Risk Control

AML (Anti-Money Laundering) and KYC (Know Your Customer)

5. Technical & Customization

FLEXCUBE Architecture & Database

APIs & System Integrations

FLEXCUBE Customization & Configuration

Troubleshooting & Support

Who Should I Take Oracle FLEXCUBE Training?

Oracle FLEXCUBE training is suitable for professionals wishing to develop knowledge in core banking solutions. The course is most appropriate for:

Banking & Financial Professionals – Individuals employed in banks, financial institutions, and fintech firms.

IT & Software Professionals – Software developers, system administrators, and IT consultants engaged in banking technology.

Business Analysts & Functional Consultants – Individuals examining and streamlining banking operations.

Database Administrators (DBAs) – Individuals dealing with Oracle databases in banking setups.

Project Managers & Implementation Consultants – Professionals managing FLEXCUBE implementation and integration projects.

Fresh Graduates & Career Switchers – Professionals who want to make a career transition into the banking technology sector with in-demand skills.

Topics Covered in Oracle FLEXCUBE Training:-

ProExcellency's Oracle FLEXCUBE Online Training is aimed at offering a thorough knowledge of this core banking solution. The following are the major topics covered in the course:

1. Introduction to Oracle FLEXCUBE

Overview of FLEXCUBE and its architecture

Key functionalities and features

FLEXCUBE versions and industry adoption

2. Core Banking Operations

Customer account creation and management

Deposits, loans, and lending process

Fund transfers and payments

Interest, charges, and fee management

3. Retail & Corporate Banking

Retail banking workflows

Corporate banking processes

Trade finance and treasury operations

Wealth and asset management

4. FLEXCUBE Digital Banking

Internet and mobile banking solutions

Omni-channel banking experience

Customer onboarding and self-service

5. Risk & Compliance Management

Regulatory compliance and reporting

Fraud detection and risk mitigation

KYC (Know Your Customer) and AML (Anti-Money Laundering) integration

6. FLEXCUBE Technical & Customization

FLEXCUBE database and architecture

APIs and system integrations

Customization and configuration

Troubleshooting and issue resolution

7. FLEXCUBE Implementation & Administration

FLEXCUBE installation and setup

User roles and access management

Performance monitoring and maintenance

Why Choose ProExcellency for Oracle FLEXCUBE Online Training?

ProExcellency provides top-rated Oracle FLEXCUBE training that enables you to become an expert in core banking technology. Here's why we are the best choice:

Expert-Led Training – Learn from certified experts with hands-on FLEXCUBE experience.

In-Depth Course Content – Core banking, retail & corporate banking, digital banking, risk management, and technical customization.

Hands-on Learning – Real-world exercises, live case studies, and live demonstrations.

Flexible Online Training – Instructor-led or self-directed sessions to accommodate your schedule.

Access to Recorded Sessions – View sessions anytime for improved understanding.

Certification Assistance – Get prepared for Oracle FLEXCUBE certification.

Job-Oriented Training – Acquire industry best practices and career advice.

0 notes

Text

Proexcellency offers expert-led Oracle Flexcube Online Training, designed to provide in-depth knowledge of Oracle’s core banking solution. This course covers essential modules such as retail and corporate banking, customer service management, loan processing, and risk management. With hands-on exercises and real-time scenarios, participants gain practical expertise in implementing and managing Oracle Flexcube. Whether you are a banking professional or an IT consultant, this training will enhance your skills and career prospects. Enroll with Proexcellency today and master Oracle Flexcube with flexible online learning.

0 notes

Text

Levarus: Achieving a Quick and Smooth Oracle Flexcube 14.6 Core Banking System Implementation in 3 Months at Mauritius

In the world of banking, speed, efficiency, and reliability are critical, especially when it comes to core banking solutions. For financial institutions, implementing a robust core banking system like Oracle Flexcube 14.6 can transform operations, improve customer experiences, and enhance regulatory compliance. As a dedicated banking software consulting company, Levarus recently showcased its expertise by successfully implementing Oracle Flexcube 14.6 in a commercial bank in Mauritius within an impressive three-month timeline. This swift Oracle Flexcube 14.6 core banking system implementation has underscored Levarus's position as a top-notch Oracle Flexcube implementation partner.

In this blog, we’ll dive into Levarus’s unique approach to fast core banking system implementations, highlighting their expertise in Oracle Flexcube 14.6 and what makes them a sought-after partner for financial institutions across Africa, the Middle East, Europe, the United States, and beyond.

Why Choose Oracle Flexcube 14.6 for Core Banking?

Oracle Flexcube 14.6 has become a preferred choice for banks worldwide, offering a comprehensive, modular, and scalable solution that meets diverse banking needs. Designed to streamline banking operations, Flexcube 14.6 enables seamless integrations with a bank's existing digital ecosystem, supports various payment systems, and is highly adaptable to emerging digital banking trends. Financial institutions across different regions – including Africa, Germany, the Middle East, Nigeria, the United Kingdom, and the United States – have increasingly adopted this system to stay competitive and compliant.

Levarus: Oracle Flexcube 14.6 Implementation Partner

Levarus has earned a reputation for being an Oracle Flexcube 14.6 implementation partner, consistently delivering successful projects across the globe. Their recent project in Mauritius, completed in record time, is a testament to their expertise and commitment to client satisfaction. The team at Levarus took charge of both the consulting and implementation phases, offering a smooth, structured approach that left no room for disruptions.

Quick Oracle Flexcube 14.6 Core Banking System Implementation in Mauritius

The recent implementation of Oracle Flexcube 14.6 core banking system at a commercial bank in Mauritius was completed in an impressive three-month period. This achievement speaks to Levarus’s experience, strategic planning, and a structured approach to core banking implementations. By partnering closely with the bank’s stakeholders, Levarus tailored the solution to fit the bank's unique requirements while ensuring a smooth transition to the new platform.

Key Success Factors in Fast Core Banking System Implementation

Levarus’s success in Mauritius is rooted in their commitment to excellence and innovation. Here are some critical factors that contributed to the rapid and seamless implementation:

In-depth Consultation and Analysis: Before beginning any implementation, Levarus conducts a thorough analysis of the bank’s existing infrastructure, processes, and requirements. This allows them to create a tailored project plan that minimizes disruptions and optimizes resources.

Comprehensive Testing: Levarus places a strong emphasis on Oracle Flexcube 14.6 testing to ensure the system's robustness and functionality. They conduct rigorous Oracle Flexcube core banking system testing during each stage, identifying and addressing potential issues before they can impact the bank’s operations.

Efficient Resource Allocation: Levarus employs highly skilled professionals specializing in Oracle Flexcube 14.6, enabling them to execute the implementation with precision and speed. The company’s project management strategy emphasizes clear communication, accountability, and rapid issue resolution.

Post-Implementation Support: Levarus goes beyond just delivering the core banking system – they provide comprehensive support to ensure the system operates smoothly post-implementation. Their team remains available to address any challenges that may arise, ensuring a seamless experience for the bank and its customers.

Levarus’s Role in Consulting and Testing for Oracle Flexcube 14.6

A major advantage of working with Levarus is their dual expertise in both consulting and testing. The company doesn’t just install software – they ensure it aligns with the bank’s strategic objectives. By performing extensive Oracle Flexcube 14.6 testing, Levarus can guarantee the reliability of the core banking solution in diverse scenarios. This attention to detail has positioned them as a trusted partner for banks worldwide looking for fast, efficient Oracle Flexcube 14.6 core banking implementations.

Levarus's Global Reach in Core Banking Implementations

The successful Oracle Flexcube 14.6 implementation in Mauritius is part of a broader trend, with Levarus expanding its services to multiple regions, including Africa, the Middle East, Europe, the United States, and Asia. They have demonstrated proficiency in core banking implementations across different financial landscapes, adapting Oracle Flexcube 14.6 to meet regulatory requirements and operational needs in diverse regions. This global reach ensures that Levarus is well-equipped to handle Oracle Flexcube core banking system implementations in areas as varied as Nigeria, Germany, the United Kingdom, and India.

Oracle Flexcube 14.6 Core Banking Implementation in Africa and Middle East

In regions like Africa and the Middle East, where banking needs are evolving rapidly, Levarus has been instrumental in enabling financial institutions to modernize their core banking systems with Oracle Flexcube 14.6. By working closely with banks in these areas, Levarus customizes implementations to meet regulatory standards, operational goals, and customer expectations. Their quick implementation timelines allow banks in these regions to stay competitive and offer advanced services to their customers sooner.

Oracle Flexcube 14.6 Core Banking Implementation in Germany and the United States

In mature banking markets like Germany and the United States, Levarus has proven to be a valuable partner for banks looking to upgrade or transition to Oracle Flexcube 14.6. The team’s meticulous approach to testing and implementation ensures that banks in these countries can integrate new core banking features without disrupting their operations. With a focus on efficiency and compliance, Levarus enables financial institutions in these regions to offer enhanced services to their customers quickly and securely.

Oracle Flexcube 14.6 Core Banking Implementation in India, Nigeria, and London

Levarus’s footprint in core banking extends to emerging and established financial hubs alike, including India, Nigeria, and London. As an Oracle Flexcube implementation partner, Levarus tailors each project to meet the unique demands of the market, be it adapting to local regulatory requirements, supporting various payment systems, or integrating digital banking services. This flexibility and expertise make Levarus a top choice for banks in these locations seeking reliable Oracle Flexcube 14.6 core banking implementations.

Future of Core Banking Implementations with Levarus

As a specialized banking software consulting company, Levarus is committed to keeping pace with industry advancements. With a dedicated team and a proven methodology, they are well-positioned to lead future Oracle Flexcube 14.6 core banking implementations worldwide. Their ability to adapt the software to meet the needs of banks in diverse regions is a testament to their commitment to excellence. By offering fast, efficient, and reliable implementations, Levarus is helping banks across the globe modernize their core banking systems and improve customer satisfaction.

For more details, please contact https://www.levarus.com/oracle-flexcube-core-banking-implementation-partner-si

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle gold partner, specialized in Flexcube Implementation, Flexcube Upgrade and Flexcube Training and consulting services in India.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partner in India#Flexcube Implementation Partners in India#Flexcube Implementation Partner in Bangalore#Flexcube Implementation Partners in Bangalore#Flexcube Implementation and Consulting Services#flexcube consulting#Flexcube Consulting Services

0 notes

Link

Flexcube Implementation Partners - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube#Flexcube Implementation partner in India#Fexcube Implementation partenr#Flexcube Core Banking Solution'#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Core Banking System#Core Banking Solutio

1 note

·

View note

Link

Flexcube Core Banking Solutions - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. expertise on Training & Implementation on Flexcube in India.

#Flexcube Core Banking Solution#Flexcube Core Banking System#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Flexcube Training Center in Bangalore#Digital Banking Solutions#Flexcube Testing Services

1 note

·

View note

Photo

We don’t only help banks growing digitally but also growing socially!

#core banking solutions#banking#consulting#fintech#bank#financial#digital marketing#digital#digital transformation#oracle#flexcube#impacto#sirma#sirmabc#sirmabci

1 note

·

View note

Text

Oracle Flexcube: A Comprehensive Examination of its Role in Automation Solutions

Oracle Flexcube is an integrated, enterprise-wide software that provides a single platform for all financial product processing activities by providing centralize data management and enhanced automation workflow processes. In this article, we'll take a closer look at how Oracle FlexCube can be used to streamline enterprise operations across the entire organization.

Oracle Flexcube is designed to provide users with an end-to-end platform that simplifies financial product processing and increases operational efficiency of the customer-centric services. The software offers features such as one view reporting, dynamic business rule creation engine, personalized dashboard designer, maximum utilization of existing resources and extensive support for multiple languages. It also integrates with a variety of existing solutions provided by Oracle to automate activities that are necessary to effectively run the business.

These features give organizations the tools they need to efficiently manage customer relationships and transactions on a wide range of devices including web-based applications and mobile phones. With Flexcube’s data integration technology, organizations can access their customer information from any location without additional hardware or IT infrastructure investments. This helps them increase their performance in customer service as well as reduce IT costs associated with manual data entry tasks.

Flexcube also provides advanced analytics capabilities which enable businesses to gain insights into customer behaviors and interactions through data analytics tools such as machine learning algorithms and natural language processing (NLP) technology. By leveraging these technologies businesses can ensure that customers receive better services in both online and offline channels; this leads to a higher level of satisfaction among clients who actively participate in the process through self-service options or real-time interactions with support representatives via chatbot conversations or virtual assistants.

With its advanced analytics capabilities, businesses can use Flexcube not only for automation but also for predictive scenarios such as market segmentation or proactive marketing campaigns which can help enterprises stay ahead of the competition by recognizing market changes earlier than its rivals do. Ultimately, Oracle Flexcube has become an increasingly valuable tool for organizations looking for optimized solutions within increasingly demanding industries such as banking & finance, insurance & healthcare, or retail & logistics due its capability to integrate easily with enterprise systems while providing robust data management capabilities across multiple dimensions including customers, accounts/transactions., products portfolios & markets served.

#RPA software#RTA software#RMA software#EOD process#Banking and financial Automation#Oracle Flexcube Automation#Insurance automation#Healthcare automation#IT and Consultancy services automation#Intelligent Document Processing#Banking and financial services#IT and Consultancy services#iBorg automation#iBorg automation tool#all in one hybrid automation tool#iBorg hybrid automation tool#Automation Tool#Automation Software#Robotic Process Automation#Robotic Test Automation#Robotic Mobile Automation#Intelligent Process Documentation#Oracle flexcube#automation solution#robotic automation#Banking software

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

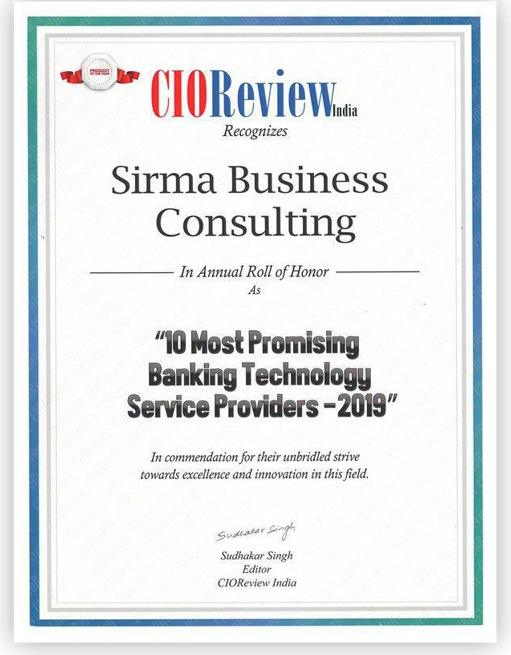

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Text

Oracle Flexcube Online Course for Professionals: Advance Your Career in Core Banking Solutions

In a international where economic institutions are swiftly adopting digital platforms to enhance operational performance, professionals inside the banking and IT sectors want to stay beforehand of the curve. One of the maximum broadly applied core banking structures throughout the globe is Oracle Flexcube — a effective solution designed to streamline and modernize banking operations. For specialists looking to grow in the banking and fintech sectors, enrolling in an Oracle Flexcube Online Course is a strategic and profession-defining decision.

Why Oracle Flexcube?

Oracle Flexcube is a complete center banking answer advanced by Oracle Financial Services. It supports each retail and company banking operations and is depended on by way of masses of banks global. Its key strengths encompass:

Real-time transaction processing

Product configurability

Seamless integration with 0.33-birthday party structures

Multi-forex and multi-entity guide

Compliance with global regulatory standards

Professionals who master Flexcube advantage the potential to work on excessive-impact initiatives in implementation, customization, aid, and consulting roles inside the BFSI (Banking, Financial Services, and Insurance) region.

Course Overview

The Oracle Flexcube Online Course for Professionals is designed to provide a sensible and comprehensive know-how of the way Flexcube works in actual-world banking environments. Unlike fashionable theoretical publications, this schooling focuses on arms-on revel in, real-time eventualities, and enterprise-relevant practices.

Key Modules Covered:

Introduction to Core Banking and Oracle Flexcube

Customer Information File (CIF) Management

Account and Product Configuration

Loan and Deposit Processing

Payments and Transfers

End-of-Day (EOD) Operations

Integration with External Systems (APIs, Interfaces)

Reporting, Auditing, and MIS

Flexcube Technical Customization and Extensions

This direction is adapted to each practical and technical specialists, supplying role-particular insights and activities.

Who Should Take This Course?

This on-line training is good for mid-degree and skilled specialists in:

Banking operations

IT consulting and software development

Core banking aid roles

Business evaluation in financial domains

Project management in banking transformation tasks

It’s also ideal for professionals transitioning from a conventional banking background right into a greater IT-focused or hybrid function in digital banking.

Benefits of the Online Format

Learning online offers most flexibility, mainly for working professionals. The direction shape includes:

Live instructor-led sessions and recorded videos

Hands-on sporting events and real challenge scenarios

Interactive Q&A classes with expert mentors

Downloadable assets and documentation

Certification final touch for credibility in the activity market

Professionals can take a look at at their personal pace at the same time as applying what they analyze directly of their work environments.

What You’ll Gain

By the quit of the path, contributors will:

Understand the overall lifecycle of middle banking operations

Configure and manipulate purchaser information and banking merchandise

Execute and reveal monetary transactions in Flexcube

Perform troubleshooting and help sports

Communicate efficaciously with technical and enterprise groups all through implementation

Most importantly, freshmen will be process-ready for roles in Oracle Flexcube implementations, assist, or transformation tasks.

Career Opportunities After Training

Completing this route opens doors to high-demand roles which include:

Oracle Flexcube Functional Consultant

Technical Consultant or Developer (Java/XML/PLSQL-primarily based)

Core Banking Support Analyst

Business Analyst – BFSI Domain

Quality Assurance Tester for Flexcube Projects

Banks and IT corporations global are actively recruiting professionals with Flexcube understanding because of the vital nature of middle banking modernization tasks.

Conclusion

In the digital age, banking structures are evolving — and so need to your profession. The Oracle Flexcube Online Course for Professionals is designed to empower you with the realistic skills, hands-on experience, and enterprise know-how you need to excel in center banking roles. Whether you're in IT, finance, or operations, this route will enhance your profile and function you as a valuable asset in any center banking transformation mission.

[email protected], +91-9148251978,+91-9008906809

0 notes

Link

Course Information

Nisa Trainings

· Oracle Flexcube Online Training

· Duration: 25 Hours

· Timings: Weekdays (1-2 Hours per day) [OR] Weekends (2-3 Hours per day)

· Training Method: Instructor Led Online One-on-One Live Interactive Sessions.

#oracleflexcubetraining#oracleflexcubecourse#oracleflexcubetutorial#oracleflexcubejobs#oracleflexcubecertifcation#oracleflexcubesoftware#whatisoracleflexcube#oracleflexcubecorporatecourse

0 notes

Link

#oracleflexcubetraining#oracleflexcubecourse#oracleflexcubetutorial#oracleflexcubejobs#oracleflexcubecertification#oracleflexcubesoftware#whatisoracleflexcube#oracleflexcubecorporatecourse

0 notes

Link

Flexcube Consulting Services- Trempplin is specialized in banking advisory services. Get started now for Flexcube Implementation and Consulting services.

#Flexcube Consulting Services#Flexcube Consulting Services in India#Flexcube Consulting Services in Bangalore#Flexcube Consulting#Flexcube Implementation and Consulting Services

0 notes

Link

Flexcube Implementation Partners - Trempplin is an IT products & services company focused on banking & financial services. Started in 2016 with presence in 4 countries and 17+ satisfied customers in Cambodia, Laos, Nepal & Uganda, we are an Oracle Partner specialized in Oracle FLEXCUBE Implementation, Support & Training Services in India.

#Flexcube Implementation Partners#Flexcube Implementation partner in India#Flexcube Core Banking Solution'#Flexcube Consulting in Bangalore#Flexcube Implementation in Bangalore#Flexcube Implementation in India

0 notes