#forex-trading

Text

Making Money From Forex Trading Systems

Forex trading is most commonly conduced via a financial institution or broker, as they will be able to achieve more leverage than independent traders. It gives the chance for clients to get information, news and annoucnements of trade. Instead, they use complex mathematical algorithms to analyze trends in the market and predict where it will go so that you can trade with limitless confidence.…

youtube

View On WordPress

#forex#forex-machine-56-dual#forex-market#forex-news#forex-scams#forex-trader#forex-trading#forex-trading-app#Youtube

0 notes

Text

Forex Trading Systems

Forex factory is an immensely popular website that deals with currency trading. The primary attraction this site holds for the currency trading community is its active online forum. The Forex factory forum is arguably one of the most popular online forums with Forex trading in mind. There is a wealth of information available for free to anyone that signs up. Al bases are covered and widely discussed from technical and fundamental trading to a wide variety of strategies that have been proven or are currently undergoing testing. However, as is true on the rest of the internet, most people there are technical traders. Which means the bias of information one will find is definitely on the side of technical Forex trading. The wide variety of strategies found on the Forex factory forum were actually developed there by the members. They are constantly evolving strategies that incorporate ideas from respected members and techniques that improve upon its foundation through extensive testing. Eventually, any particular system that the members feel is worth working on will be finely honed until it reaches a point where it is relatively "complete". At any given moment, you will have a free pick of about ten or so strategies that are undergoing development through discussion. The viewer gets all this information without spending a single cent. Another great aspect of Forex factory is their economic calendar, which is a joy to use. Very easy to understand, economic events are color coded according to the likely impact it will have on a given currency. Interest rate changes are colored red while something like wholesale inventories is yellow. Events throughout the week are listed on their calendar. Should you need further information describing what the event touches on, a simple click will expand a window with a detail description. Over all, many people have found a wealth of information on the Forex factory forums and it continues to be very relevant to currency trading on the internet. Another commonly used forex trading strategy is known as the stop loss order. This forex trading strategy is used to protect investors and it creates a predetermined point at which the investor will not trade. Using this forex trading strategy allows investors to minimize losses. This strategy can however, backfire and the investor can run the risk of stopping their forex trading which could actually go higher and it really is up to the individual trader to choose whether or not to use this forex trading strategy. An automatic entry order is another of the forex trading strategies that is commonly used and this strategy is used to allow investors to enter into forex trading when the price is right for them. The price is predetermined and once reached the investor will automatically enter into the trading. All these forex trading strategies are designed to help investors get the most from their forex trading and help to minimize their losses. As mentioned earlier knowledge of these forex trading strategies is vital if you wish to be successful in forex trading. The EUR/USD pip value is always going to be $10 for standard lots and $1 for mini lots. In order to calculate the pip value of the currency you're trading, divide one pip by the exchange rate and then multiply it by the lot size. Converting pip value to your currency value is simple as well; just multiply the pip value by your exchange rate. The standard size per transaction is referred to as the lot. Typically, lot size is 100,000 units of base currency. A mini lot is only 10,000 units, and some Forex brokers will even let you trade in micro lots from 1,000 units all the way down to one unit. Having a mini or micro account requires less investment than a standard account. The difference between the sell quote and the buy quote is known as the spread. The difference in our spread is one pip. There are many economic reports released in the United States that can have a significant impact on forex markets and other financial markets as well. The following is a compilation of most of the market moving reports that track the stability, health and growth of the U.S. U.S. dollar. Almost all are released on a monthly basis with the exception of the Unemployment Insurance Weekly Claims report, the F.O.M.C. Housing Affordability Index being released quarterly. All of the following reports can cause immediate short-term volatility when released and their results can change the direction of any currency pairs involving the U.S. The Bureau of Labor Statistics is the part of the U.S. Department of Labor responsible for collecting and analysing economic data on current labor market and working conditions as well as key inflation indicators. The following reports can have market moving results. Employment Situation is released monthly and includes both non-farm payroll numbers and unemployment rate. I absolutely love automated trading. That being said, what is the best Forex system trading system of software? That is a question for each individual to answer. I have tried and continue to try various systems. Not because they don't work, in fact most of them do work, and very well. I simply like to explore more possibilities and tools. Some of the expert advisors work better in some markets than other one or some I just like the trade logic better. The decision of which one to use is a very personal decision based on your personality and trading objectives and style and understanding. The best Forex system trading methods, in my observation and opinion, are the ones that make sense to my trading background and are very risk averse. I like to sleep at night, better yet I love to get up in the morning, knowing that my trading software has been trading for me all night and making money. Making a mistake in forex trading is natural and sometimes can be looked upon as healthy so as to know firsthand the decisions that will either make or break you. However, if this becomes severe to a point wherein you lose more than you can afford to, then you would have to take measures in order to avoid further damage. One is to not get overly affected emotion-wise. This can result to even more rash decisions and can cloud your strategies, producing even more disastrous results. You should aim for more positive months with good turnovers but face it; there are some periods wherein gain is not achievable. Another is to employ a money management technique; in case is where you went wrong the first time. Since most traders would tend to gamble, instead of making a calculated risk, their bank accounts would be drained each time there is a loss. By managing the amount that you can afford to lose in thinking of all possibilities, you can be assured that you do not get bankrupt with forex. Read more about the market. Each trader has an individual attitude towards forex trading, but learning about the inherent principles can go a long way in helping you develop your own style. You can also develop a trading system and make sure to be disciplined enough to follow what you have created. Remember that since your money is involved and that you are not participating in the market just to lose it, you have to think objectively and learn to foresee the consequences of your decisions. Do not associate loss with the feeling of being a loser. The forex market is an objective industry wherein sound decision-making and strategies are employed and not about judging your emotional capabilities.

youtube

#forex-trading#forex-factory#forex-god#forex-calendar#forex-calculator#forex-market#forex-news#forex

0 notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

141 notes

·

View notes

Text

Exploring the Best Free Forex Signals Providers: A Comprehensive Overview

Trading in the forex market requires a blend of knowledge, strategy, and access to reliable information. Forex signals serve as invaluable tools, offering traders timely insights into potential trading opportunities. In this article, we delve into some of the top free forex signals providers, highlighting Forex Bank Signal for its exceptional service and reliability.

1. Forex Bank Signal

Forex Bank Signal emerges as a standout provider of free forex signals, distinguished for its accuracy and comprehensive market analysis. Catering to traders of all experience levels, Forex Bank Signal delivers signals with precise entry and exit points, accessible via email, SMS, and a user-friendly mobile app. Traders appreciate the clarity and reliability of their signals, which often lead to consistent profitability and enhanced trading strategies.

2. FX Leaders

FX Leaders is renowned for its dependable free forex signals, generated by a team of seasoned analysts skilled in both technical and fundamental analysis. Their signals cover a broad spectrum of currency pairs and are accompanied by detailed explanations and trading strategies. FX Leaders also provides real-time market updates, making it a valuable resource for traders seeking to stay informed and capitalize on market opportunities.

3. DailyForex

DailyForex offers a robust platform for free forex signals, coupled with extensive educational resources suitable for traders at all stages of their journey. Their signals, based on technical analysis, are designed to be user-friendly and actionable. Accessible through their website and mobile app, DailyForex ensures traders can act swiftly on signals wherever they are. Beyond signals, DailyForex provides in-depth market analysis, trading tips, and reviews of forex brokers, fostering a supportive environment for learning and growth.

4. MQL5

MQL5 provides a versatile platform featuring free forex signals from various providers, each offering unique trading strategies and performance records. This diversity allows traders to choose signals that align with their individual trading styles and risk tolerance levels. MQL5 also boasts a vibrant community where traders can share insights, strategies, and market forecasts, enriching the trading experience through collaborative learning and interaction.

5. Trading Central

Trading Central stands out for its comprehensive financial services, including free forex signals backed by rigorous technical analysis. Their signals are designed to offer clear, actionable trading opportunities, integrated seamlessly into popular trading platforms globally. Alongside signals, Trading Central provides detailed market analysis, economic calendars, and trading strategies, empowering traders to make informed decisions and optimize their trading outcomes.

Conclusion

Selecting a reliable forex signals provider is crucial for traders looking to navigate the forex market effectively. Forex Bank Signal, with its precise signals and user-friendly interface, stands out as an excellent choice for traders seeking consistency and profitability. Whether you're new to forex trading or refining your strategy, these free forex signals providers offer valuable tools and insights to enhance your trading experience and achieve success in the competitive forex market.

When evaluating signals providers, consider factors such as historical performance, user reviews, and compatibility with your trading goals and strategies. With the right provider by your side, you can leverage timely insights and strategic guidance to maximize your trading potential. Happy trading!

#forex#forex broker#forex education#forex market#forex signal service#forex signals#forex trading#forexsignals#forextrading#forex signal provider#gold#investingold#investinginyourself#investinginmyfuture#realestate#investingtips#investinginthefuture#investingforus#investinginrealestate#bitcoin#investment#investinghana#investingirls#investor#business#realestateinvesting#invest#money#investinginmemories#investinginourfuture

19 notes

·

View notes

Text

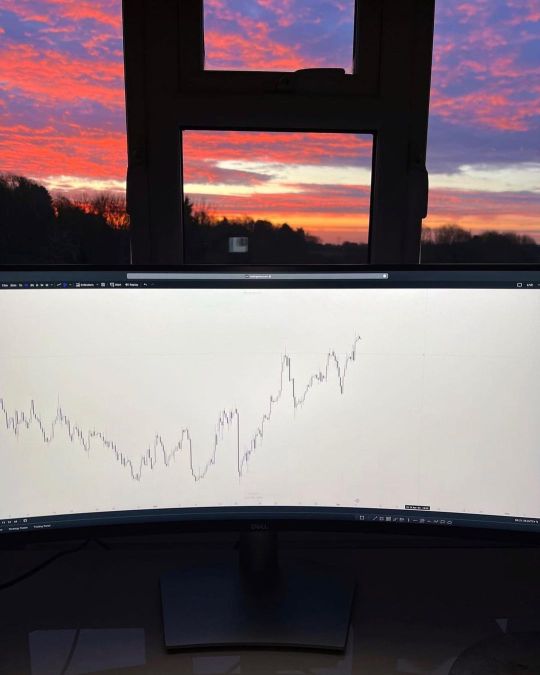

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

25 notes

·

View notes

Text

أهمية التوصيات في تداول الفوركس

يعد تداول الفوركس واحدًا من أكثر أنواع الاستثمارات شيوعًا في العالم اليوم. ومع ذلك، فإن النجاح في هذا المجال يتطلب معرفة متعمقة وتحليل دقيق للسوق. لذلك، يلجأ العديد من المستثمرين إلى استخدام التوصيات للحصول على توجيهات وإرشادات موثوقة.

يقدم موقع InvestTradeGM خططًا متنوعة تلبي احتياجات جميع المستثمرين، من المبتدئين إلى المحترفين. تتضمن هذه الخطط توصيات فوركس مخصصة تساعد المستثمرين على اتخاذ قرارات مستنيرة وزيادة فرصهم في تحقيق الأرباح.

من خلال الاعتماد على توصيات فوركس من موقع InvestTradeGM، يمكن للمستثمرين الاستفادة من الخبرة والمعرفة العميقة التي يتمتع بها فريق التحليل بالموقع. توفر هذه التوصيات رؤى دقيقة وتحليلات موثوقة للسوق، مما يساعد المستثمرين على تحديد أفضل الفرص واتخاذ القرارات الصحيحة في الوقت المناسب.

فهم أهمية التوصيات

تساعد التوصيات في تقليل المخاطر المرتبطة بتداول الفوركس. عندما تعتمد على التوصيات المقدمة من خبراء ذوي خبرة، يمكنك تجنب الأخطاء الشائعة التي يقع فيها العديد من المبتدئين. التوصيات تعتمد على تحليلات دقيقة للسوق وبيانات موثوقة، مما يساعدك على اتخاذ قرارات مدروسة ومبنية على أسس علمية.

خطط وأسعار متنوعة

يوفر موقع InvestTradeGM خططًا متنوعة تناسب مختلف مستويات المستثمرين. سواء كنت مبتدئًا تتطلع إلى دخول سوق الفوركس لأول مرة، أو كنت مستثمرًا محترفًا تبحث عن استراتيجيات جديدة، ستجد الخطة التي تناسبك.

تشمل الخطط المقدمة مزايا عديدة، مثل التحليلات اليومية للسوق، التوصيات الفورية، وتقارير الأداء. هذه الميزات تساعدك في تحقيق أفضل نتائج ممكنة من استثماراتك.

استراتيجيات تداول متقدمة

تعتمد التوصيات المقدمة من InvestTradeGM على استراتيجيات تداول متقدمة تستند إلى تحليلات دقيقة للسوق. يمكنك الاعتماد على هذه التوصيات لتحديد الفرص المثلى للتداول وتحقيق أرباح مستدامة. بالإضافة إلى ذلك، توفر التوصيات توقعات تستند إلى بيانات موثوقة، مما يساعدك على اتخاذ قرارات مستنيرة.

الدعم الفني والتدريب

إلى جانب التوصيات، يوفر موقع InvestTradeGM دعمًا فنيًا شاملًا وتدريبًا مستمرًا للمستثمرين. يمكنك الاستفادة من الدورات التدريبية وورش العمل التي تركز على تعليمك أساسيات التداول واستراتيجيات الفوركس المتقدمة. هذا التدريب يساعدك على تحسين مهاراتك وزيادة فهمك للسوق، مما يعزز فرصك في تحقيق الأرباح.

بالإضافة إلى ذلك، يوفر الموقع دعمًا فنيًا على مدار الساعة للإجابة على أي استفسارات قد تكون لديك. يمكنك التواصل مع فريق الدعم في أي وقت للحصول على المشورة والتوجيهات اللازمة للتعامل مع أي تحديات قد تواجهك في السوق. هذا الدعم المستمر يضمن أنك لن تكون وحدك في رحلتك الاستثمارية.

توصيات فوركس: أداة النجاح

في الختام، يعتبر الحصول على توصيات فوركس من موقع InvestTradeGM أداة حيوية لكل من يسعى لتحقيق النجاح في سوق الفوركس. هذه التوصيات توفر لك التوجيهات الضرورية لاتخاذ القرارات الصحيحة وتقليل المخاطر. بفضل التحليلات الدقيقة والخبرة الواسعة للفريق، يمكنك الاستفادة من أفضل الفرص الاستثمارية المتاحة وتحقيق أهدافك المالية بثقة ونجاح.

إذا كنت ترغب في تح��يق النجاح في سوق الفوركس، فإن الحصول على التوصيات من مصدر موثوق مثل InvestTradeGM يعد خطوة أساسية. ابدأ اليوم واستفد من الخطط المميزة والأسعار المناسبة لتصبح مستثمرًا ناجحًا في هذا السوق المثير.

7 notes

·

View notes

Text

#forex robot#forex#forextrading#forex market#investing#finance#algo trading#forex expert advisor#invest#financial

8 notes

·

View notes

Text

7 notes

·

View notes

Text

Forex Cashpower Indicator NON REPAINT BUY signal trade #XAUUSD #Gold in H4 Timeframe.

Official Website: wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Notification

✅ Minimizes unprofitable/false signals

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#xauusd#trade gold#forex signal#indicatorforex#forexindicator#cashpowerindicator#forexindicators#forex#forextradesystem#forexvolumeindicators#forexprofits#forexsignals#forextrading#forex expert advisor#forex robot#forex broker#forex market#forexchartindicators

3 notes

·

View notes

Text

Buying and Selling Currency Pairs

Introduction

Are you intrigued by the world of Forex trading? Buying and selling currency pairs is a fundamental aspect of this exciting financial market. In this article, we'll dive deep into what currency pairs are, how they work, and how you can start trading them effectively.

Understanding Currency Pairs

Major, Minor, and Exotic Pairs

Currency pairs are the foundation of Forex trading. They are divided into three categories: major, minor, and exotic pairs. Major pairs include the most traded currencies, such as EUR/USD and USD/JPY. Minor pairs are less commonly traded, like EUR/GBP. Exotic pairs involve a major currency paired with a currency from an emerging economy, like USD/TRY.

Base and Quote Currency

In every currency pair, the first currency is the base currency, and the second is the quote currency. For example, in EUR/USD, EUR is the base currency, and USD is the quote currency. The value of the base currency is always 1, and the quote currency shows how much of it is needed to buy 1 unit of the base currency.

How Currency Pairs Work

The Concept of Exchange Rates

Exchange rates indicate how much one currency is worth in terms of another. For example, if the EUR/USD exchange rate is 1.10, it means 1 Euro can be exchanged for 1.10 US Dollars.

Bid and Ask Price

The bid price is the highest price a buyer is willing to pay for a currency pair, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the spread, which is a key component of Forex trading costs.

The Forex Market

What is Forex?

The Foreign Exchange (Forex) market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, allowing traders from all over the globe to participate.

Trading Hours and Global Reach

Forex trading is divided into four main sessions: Sydney, Tokyo, London, and New York. This continuous cycle allows for seamless trading as one market closes and another opens, providing opportunities around the clock.

Getting Started with Forex Trading

Choosing a Broker

Selecting a reliable Forex broker is crucial. Look for one that is regulated by a reputable financial authority, offers competitive spreads, and provides a user-friendly trading platform.

Setting Up a Trading Account

Once you've chosen a broker, you'll need to open a trading account. This typically involves providing personal information, verifying your identity, and funding your account with an initial deposit.

CLICK THE LINK BELOW TO LEARN MORE IN DETAIL.

4 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction

Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions.

1. Stocks

Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader.

2. Bonds

Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns.

3. Forex (Foreign Exchange Market)

The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader.

4. Commodities

Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors.

5. Mutual Funds

Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach.

6. ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities.

7. Options

Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks.

Conclusion

Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

my midst evangelist mutuals will be happy to know i started listening today! it's very good so far. really cool worldbuilding, very interesting setup getting slowly dripped in over time. they do a great job of setting up the tension where i'm sure that these background class frictions and political motivations are going to boil over at some point in the near future but as of right now, i can't begin to guess what that tipping point's going to be.

#midst podcast#liveblogging tag#lark is my favorite#very very much my type of character#i played a gnome with a similar energy for over a decade so as soon as she showed up i was like ooh yes this one#the notion of a religious quasi-currency with an ever fluctuating exchange rate gave me such like#Forex Trading/Crypto Scam Meets Prosperity Gospel energy#it's horrid i love it#i'm on episode 10 of season one rn#given my job i will probably be caught up by monday#maybe even earlier

23 notes

·

View notes

Text

The painfull learning curve

The financial markets tends to be chaotic. The fact of the matter it involves processing huge flow of information and then respond accordingly. This requires patience , managing your emotions and being able to learn from your mistakes.

Took this trade on EUR/USD.

Remember the patience and dicipline is the key.

#forex trading#forex online trading#forex signals#forex education#forexmarket#trader#finance#investing#markets#economy#money#financial independence

35 notes

·

View notes

Text

Successful Forex Trading Plan:

Outline your motivation.

Decide how much time you can commit to trading.

Define your goals.

Choose a risk-reward ratio.

Decide how much capital you have for trading.

Assess your market knowledge.

Start a trading diary.

#forex#forextrading#forexsignals#forexstrategy#trade#planning#grow#learn#experience#reason#following#everyone

6 notes

·

View notes

Text

Navigating the Forex Market with Top Forex Signals Services

In the world of forex trading, access to reliable and timely signals can significantly influence trading outcomes. Forex signals services provide traders with valuable insights and recommendations derived from comprehensive market analysis, helping them capitalize on opportunities and manage risks effectively. Whether you're new to forex trading or a seasoned investor, choosing the right signals service is crucial. Here’s an in-depth look at some of the leading forex signals services available today:

1. Forex Bank Signal

Forex Bank Signal is renowned for its accuracy and user-friendly interface, making it a preferred choice among traders.

Key Features:

High Accuracy: Forex Bank Signal delivers precise signals, allowing traders to execute trades with confidence.

User-Friendly Platform: The platform is designed to be intuitive and easy to navigate, catering to traders of all skill levels.

Real-Time Alerts: Traders receive instant alerts via SMS, email, or app notifications, ensuring they never miss a trading opportunity.

Educational Resources: Forex Bank Signal provides educational materials and market analysis to help traders understand the rationale behind signals.

With its commitment to accuracy and user accessibility, Forex Bank Signal supports traders in making informed decisions.

2. Learn 2 Trade

Learn 2 Trade offers a comprehensive forex signals service combined with extensive educational resources.

Key Features:

Diverse Signal Coverage: Signals cover forex, cryptocurrencies, and commodities, providing traders with diverse trading opportunities.

Educational Content: Learn 2 Trade offers guides, webinars, and tutorials to enhance traders’ knowledge and skills.

Community Interaction: Traders can engage in a supportive community to share insights and strategies, fostering collaborative learning.

Learn 2 Trade caters to both beginners seeking foundational knowledge and experienced traders looking to refine their strategies.

3. ForexSignals.com

ForexSignals.com stands out for its robust signals and mentorship from experienced traders, offering a comprehensive approach to forex education.

Key Features:

Expert Mentorship: Traders benefit from insights and guidance from seasoned professionals through live trading rooms and mentorship programs.

Comprehensive Signals: The service provides signals across various currency pairs, backed by thorough market analysis.

Customization Options: Traders can customize alerts to suit their trading preferences and risk tolerance.

With a focus on mentorship and comprehensive signals, ForexSignals.com empowers traders to improve their trading skills effectively.

4. Signal Skyline

Signal Skyline offers a straightforward forex signals service tailored for beginners entering the forex market.

Key Features:

User-Friendly Interface: The platform’s simplicity allows new traders to navigate and execute trades effortlessly.

Daily Signals: Traders receive multiple signals daily, covering major currency pairs, ensuring frequent trading opportunities.

Customer Support: Signal Skyline provides responsive customer support to assist traders with queries and technical issues.

Signal Skyline’s emphasis on simplicity and support makes it an ideal choice for novice traders gaining confidence in their trading decisions.

5. 1000pip Builder

1000pip Builder is recognized for its high-performance signals and transparent reporting, appealing to traders seeking proven trading strategies.

Key Features:

Proven Track Record: The service boasts a strong track record of successful signals, supported by detailed performance reports.

Multiple Communication Channels: Signals are delivered via email, SMS, and Telegram for quick and efficient trade execution.

Educational Insights: Traders gain insights into the rationale behind each signal, enhancing their understanding of market dynamics.

1000pip Builder’s focus on performance and transparency provides traders with confidence in their trading decisions.

Key Considerations When Choosing a Forex Signals Service

When evaluating forex signals services, consider these essential factors:

Accuracy and Reliability: Look for services with a proven track record of accurate signals and positive feedback from users.

User-Friendliness: Opt for platforms that are easy to use, especially if you’re new to trading.

Educational Resources: Access to educational materials can enhance your trading skills and understanding of market dynamics.

Customer Support: Responsive customer support ensures timely assistance with queries and technical issues.

Subscription Plans: Evaluate pricing structures and trial options to find a service that fits your budget and trading preferences.

Conclusion

Choosing the right forex signals service is crucial for success in the competitive forex market. Each of the mentioned services offers unique strengths tailored to diverse trading needs. By leveraging the insights and recommendations provided by these top forex signals services, traders can enhance their trading strategies, make informed decisions, and navigate the complexities of the forex market with confidence and proficiency.

#forex#forex broker#forex education#forex market#forex signal service#forex trading#forex signals#forexsignals#forextrading#forex signal provider#forexsignalsproviders#forexsignalsuk#forextradingsignals#forexpips#forexmarkets#tradesignals#freepips#freesignalsforex#forextrader#binaryexpert#tradingcharts#forexchart#tradingplan#forexchartanalysis#forexchartpatterns#forexcharts#technicolourcrafters#forexexpert#spreadbetting#learninghowtotrade

5 notes

·

View notes

Note

Sounds like you need to be put back to sleep 🤪 could I come drain your energy? Or just eat it out?

i wish i could but i have to get work done😪 !!

i just need someone between my legs while i edit content & work on other stuff🥺❤️

#that’s what kept me up so late last night & i have like 3 customs i need to get on top of;-;#and like i started day trading & made a bad forex exchange yesterday/fell asleep while trading & lost $5 so i need to make it back today;-;#and like the best time to start is around now;-;#IM SO TIRED AND DONT WANT TO LOOK AT SCREENS ANYMORE;-; !!!#anon asks#replies

4 notes

·

View notes