#forextradingstrategy

Text

💹📚 Unlock the Secrets of Forex Trading Strategy: Your Path to Financial Success! 🚀💰

Hey Tumblr fam, Hope you had a great weekend!

This is what I have prepared for you last weekend!

Are you ready to embark on a thrilling journey into the world of forex trading? 🌐💹 Whether you're a seasoned trader or a complete beginner, understanding the art of forex trading strategy is essential for unlocking the door to financial success! 💼📈

🌟 Deciphering Price Patterns: In the fast-paced world of forex, price patterns hold the key to profitable trades! 🗝️💹 By learning to read and interpret candlestick charts, you can spot trend reversals and potential entry and exit points for your trades. From head and shoulders to double tops and triangles, these patterns provide valuable insights into market dynamics. 📊📈

📈 Embrace Technical Indicators: Technical indicators are the trader's best friend! 🕵️📉 From Moving Averages to Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence), these tools help you gauge market momentum and identify overbought or oversold conditions. 📈💪 By mastering these indicators, you can fine-tune your trading strategies and gain a competitive edge in the forex market. 💼🚀

🔄 The Power of Trends: In forex trading strategy, "the trend is your friend"! 🔄📈 Identifying and following market trends is a fundamental principle for successful trading. By understanding trend lines and support/resistance levels on charts, you can make informed trading decisions and ride the wave of profitability! 🌊📈

💡 Logic vs. Emotion: Forex trading is as much about psychology as it is about strategy. 🧠📊 Emotions like fear and greed can cloud your judgment and lead to impulsive decisions. However, by relying on logic and sound analysis, you can navigate the forex market with confidence and discipline. 💼📉

🗝️ The Three Steps to Success: Step 1️⃣: Open a Currency Trading Account Select a reliable forex trading broker and open a currency trading account. Most brokers offer a two-in-one account, providing both trading and a Demat account.

Step 2️⃣: Submit KYC Documents Complete the KYC process by submitting the necessary documents, including proof of identity, address, income, and bank account details.

Step 3️⃣: Choose a Currency Pair Pick a currency pair to trade. While beginners often start with major currency pairs, experienced traders can explore a wide range of options.

🌐💼 Are you ready to take charge of your financial future? Don't miss the opportunity to master the art of forex trading strategy! 🚀📊 Learn the ropes, harness the power of technical analysis, and make informed trading decisions. With dedication, knowledge, and practice, you can chart a course towards financial success! 📈💰

Learn here: Top 10 Must-Know Currency Trading Strategies!

#currencytradinganalysis#currencytradingfundamentalanalysis#onlinecurrencytrading#currencytradingstrategies#onlineforextrading#forextradingstrategy#forexmarketanalysis#forexchartsanalysis#forexwhatisit#forextradinganalysis

0 notes

Link

#daytrading#forextradingstrategy#ictdailybias#ictforex#ictforexstrategy#ICTMentorship#ictstrategy#icttrading#icttradingstrategy#InnerCircleTrader#jayfroneman#millionairemindset#millionairemindsetfunded#priceaction#smartmoneyconcept#smartmoneyconcepts#smctrading

0 notes

Text

This video is going to set you in the right direction. Learning to trade forex can be tough, but that doesn't mean that it needs to be.

#TechnicalAnalysis101#ForexTrading101#EasyForexLearning#ForexEducation#TradingBasics#ForexStrategy#TradingSimplified#LearnForexFast#ForexTips#ForexTradingStrategy#TechnicalAnalysisMadeEasy

0 notes

Text

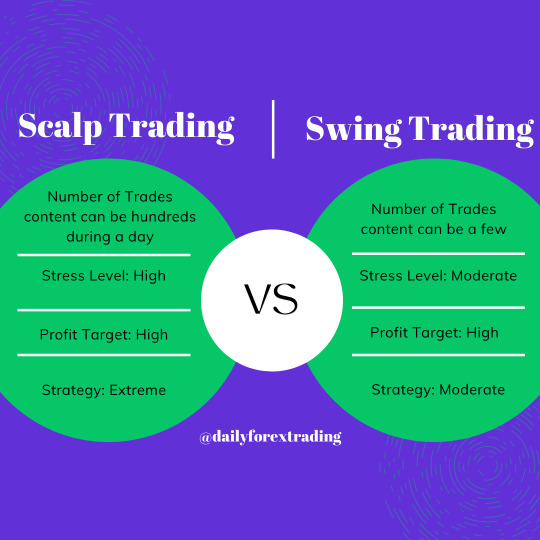

Day Trading and Swing Trading are two different Trading Strategies that are widely used. Being so common and popular, they are yet different from each other.

The infographic below shows it all!

0 notes

Text

AI in Forex Trading: Top Benefits for Traders!

Artificial intelligence (AI) is making big waves in Forex trading. It’s making trading faster, more accurate, and a lot easier to handle. This blog will break down the main perks of using AI in Forex trading and show why it’s becoming a must-have in the trading world.

Quick and Smart Decisions

AI systems can analyze huge amounts of data in a blink. They spot patterns and trends that humans might miss. This means traders can make quick, informed decisions without spending hours on research.

Less Risk, More Reward

AI helps manage risk by predicting possible changes in the market. This helps traders avoid big losses and find the best times to enter or exit a trade.

Trading Non-Stop

Forex markets are open 24/7, and AI systems can work all day and night. This lets traders take advantage of opportunities even when they’re asleep.

Personalized Trading Strategies

AI can learn from your past trades and preferences to suggest customized trading strategies. This tailored approach can often lead to better results.

Fewer Errors

Humans can make mistakes, especially when tired or stressed. AI doesn’t have these issues, so it tends to be more reliable and consistent.

Conclusion

AI in Forex trading isn’t just a fancy tool; it’s becoming essential for traders who want to stay ahead in the fast-paced trading environment. By using AI, traders can enjoy faster decision-making, reduced risks, and personalized strategies that could lead to higher profits.

Ready to give AI Forex trading a try and see how it can change your trading game?

#AIForexTrading#forex analysis#forextrading#forex market#ai forex#forexstrategy#ForexTradingStrategies#InvestmentTechnology#ArtificialIntelligence#trending#trendingnow#viralshorts#viral trends#viral video#viral

0 notes

Text

Why risk management is important in trading? Know Key Strategies for Success

In the world of trading, risk management plays a crucial role in safeguarding your investments and maximizing potential returns. Here’s why it’s so important:

Capital Protection: Implementing risk management strategies helps protect your trading capital from significant losses, ensuring that you can continue trading even after a series of setbacks.

Minimize Emotional Decisions: By setting predefined risk limits, traders can avoid making impulsive decisions driven by fear or greed, which often lead to poor outcomes.

Consistent Performance: Effective risk management fosters consistency in trading performance, allowing for steady growth and reducing the impact of unforeseen market fluctuations.

To maximize your forex trading potential, Myforexeye Fintech Private Limited is a good option. With Their innovative platform they offers real-time risk identification and expert strategies to safeguard your investments.

4. Preservation of Profits: It helps in safeguarding profits by employing stop-loss orders and other risk mitigation techniques, preventing potential gains from turning into losses.

5. Reduced Stress: Proper risk management techniques can alleviate the stress and anxiety associated with trading, promoting a more disciplined and systematic approach.

6. Improved Long-Term Sustainability: By managing risk effectively, traders can enhance the sustainability of their trading activities, ensuring longevity in the market.

In conclusion, incorporating robust risk management practices into your trading approach is essential for long-term success and stability in the ever-changing financial markets.

#RiskManagement#TradingTips#CapitalProtection#forextrading#ForexRiskManagement#riskmanagement#forextradingstrategies#InvestmentStrategy#currencytrading#financialmarketsonline#tradingtips#forexsignals#HedgingStrategies#forexmarket#moneymanagementforex#forexmargin#forexriskcalculator#management#ForeignExchangeRisk

0 notes

Text

Forex Trading Strategies Strategies for Success Currency Trading

Forex Trading Strategies Introduction:

In this article, we explore the foreign exchange (forex) markets, their global significance, and their growing appeal as an investment vehicle. We will outline the article's purpose, emphasizing the benefits and challenges of forex trading while delving into key subheadings that offer valuable insights and strategies for success.

Body:

Understanding Foreign Exchange Markets

We will define forex markets, their functioning, and the role of participants like banks, investors, and governments. We'll examine factors influencing currency exchange rates, such as macroeconomic indicators, interest rates, and geopolitical events. We will also explain liquidity and its impact on the forex market.

Forex Trading Strategies

We'll present popular trading strategies, including technical analysis, fundamental analysis, and sentiment analysis. We'll discuss each approach's pros and cons, providing guidance on selecting suitable strategies for different market conditions and investment goals. Moreover, we'll introduce news trading in forex and its potential risks and rewards.

Risk Management in Forex Trading

This section highlights the importance of risk management strategies,Currency Trading Techniques including setting stop-loss and take-profit orders, as well as portfolio diversification. We'll showcase various tools to manage forex trading risks, such as position sizing and leverage. We'll also emphasize the significance of a trading plan in risk management and maintaining trading discipline.

Choosing the Right Forex Broker

We'll provide guidelines to help traders select a reliable forex broker, considering factors like regulatory oversight, trading platform features, and costs. We'll compare several famous forex brokers and discuss their pros and cons. Additionally, we'll mention customer support and educational resources' impact on a trader's experience.

The Trading Psychology

Finally, Currency Market Strategies we'll stress the importance of trading psychology for long-term success as a forex trader. We'll offer tips on developing a solid trading mindset and effectively handling emotions like fear, greed, and hope during trading. We'll also describe the significance of maintaining a trading journal for self-improvement and emotional management.

Investopedia's Top 5 Attributes Successful Forex Traders

Conclusion:

To summarize, this article addressed understanding forex markets, implementing appropriate strategies, and managing risks as crucial factors in achieving success as a currency trader. As we contemplate possible future developments and challenges in forex trading, we encourage readers to continue learning and seek expert guidance to enhance their forex trading journey.

"Gain deeper insights and data on market analysis."

Read the full article

#Choosingaforexbroker#Foreignexchangemarkets#Forexriskmanagement#Forextradingstrategies#Tradingpsychology

0 notes

Video

youtube

Mastering the ZigZag Indicator: 3 Proven Trading Strategies | Forex | bi...

#youtube#forextradingstrategies#binary options trading#technicalanalysistools#tradingindicators#makemoneyfromhome

1 note

·

View note

Text

Forex trading strategies

Forex trading strategies are plans or approaches that traders use to try to profit from changes in currency values. There are a wide range of strategies that traders can use, and different strategies may be more or less suitable depending on a trader's goals, risk tolerance, and other factors.

One common strategy is trend trading, which involves identifying a trend in the market and then buying or selling in the direction of that trend. Trend traders look for trends that are likely to continue and try to ride them for as long as possible. This strategy can be effective, but it can also be risky if the trend reverses.

Another strategy is range trading, which involves identifying a range or "channel" in the market and then buying at the bottom of the range and selling at the top. Range traders try to capitalize on the fact that prices tend to oscillate within a certain range over time. This strategy can be less risky than trend trading, but it can also be less profitable.

News-based trading is another popular strategy, which involves reacting to market-moving news events and economic data releases. Traders who use this strategy try to anticipate how the market will react to a particular event and then trade accordingly. This strategy can be effective, but it can also be difficult to predict how the market will react to news events.

Other strategies that traders may use include scalping, which involves making many small trades in a short period of time in an attempt to profit from small price movements, and carry trading, which involves holding a currency pair with a high interest rate differential for an extended period of time in order to profit from the interest rate difference.

It is important for traders to carefully consider their own goals and risk tolerance when choosing a forex trading strategy. It is also important to test a strategy before using it in live trading, in order to understand its strengths and limitations.

Read the full article

0 notes

Text

Differentiate between the two most effective forex trading strategies and let's see which one fits you the more!

#dailyforextrading#forex#forextrading#strategies#tradingstrategies#forextradingstrategies#scalptrading#swingtrading

0 notes

Text

Empower Your Trading Journey with Comprehensive Market Insights

#ForexTrading#RetailForexTrading#MoneyTransfer#CurrencyExchange#ForexCard#ForeignTransactionServices#ForexRatesServices#ForexRiskManagement#FinancialServices#FinancialManagement#MoneyManagement#FinancialAdvice#ForexTradingPlatform#ForexTradingStrategies#TradingTips#ForexTradingSignals

0 notes

Text

Copy Trading Enables Individuals In The Financial Markets To Automatically Copy Positions Opened And Managed By Other Selected Individuals. Unlike Mirror Trading, A Method That Allows Traders To Copy Specific Strategies, Copy Trading Links A Portion Of The Copying Trader's Funds To The Account Of The Copied Investor.

Is Copy Trading Profitable?

Copy Trading Can Result In High Profits If The Trader Finds A Successful Trader To Copy. However, The Greatest Risk A Trader Will Face When Copy Trading Is Market Risk. If The Strategy A Trader Is Copying Is Unsuccessful, They Can Lose Money.

The Idea Of Copy Trading Is Simple: Use Technology To Copy The Real-time Forex Trades (Forex Signals) Of Other Live Investors (Forex Trading System Providers) You Want To Follow. This Way, Every Time They Trade, You Can Automatically Replicate (Copy) Their Trades In Your Brokerage Account.

#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#forexfactory#forex#forexbrokers#forextrading#forexcurrency#forexmarkets#forextradingstrategies#malaysiaforexbrokers#malaysiabrokers#malaysia#foreignexchangemarket#forextigressreview

0 notes

Video

Copy Trading Broker Provides Investment Technology To Automatically Copy To Your Own And Personal Account Real-time Positions Opened By A Selected Trader Or Portfolio.

The Idea Of Copy Trading Is Simple: Use Technology To Copy The Real-time Forex Trades (Forex Signals) Of Other Live Investors (Forex Trading System Providers) You Want To Follow. This Way, Every Time They Trade, You Can Automatically Replicate (Copy) Their Trades In Your Brokerage Account.

#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#forexfactory#forex#forexbrokers#forexcurrency#forextradingstrategies#malaysiabrokers#malaysia#forextradingevo

0 notes

Text

What is forex trading and how does it work?

Forex trading, known as foreign exchange trading, allows individuals to participate in the world's largest and most liquid financial market. With a daily trading volume that exceeds $5 trillion, forex trading provides an opportunity to speculate on currency price movements and potentially profit from them. However, it is crucial to grasp the market's intricacies, comprehend the associated risks, and take the necessary steps to begin.

This article serves as a comprehensive guide to help you understand forex trading, how it works, ways to generate profits, risks involved, and essential steps for beginners.

What Is Forex Trading?

Forex trading involves buying and selling currencies, typically in pairs. Currencies have relative values, and traders aim to profit from fluctuations in exchange rates. For instance, traders might buy the EUR/USD currency pair, where they purchase euros while simultaneously selling US dollars. Exchange rates represent the ratio of one currency to another.

How Does Forex Trading Work?

Forex trading operates based on speculating on future currency price directions. Traders analyze economic indicators, geopolitical events, and market sentiment to predict currency movements. When initiating a trade, traders borrow one currency to purchase another. They then close the trade at a later time, aiming to profit from the change in exchange rates.

Making Money from Forex Trading

Profits in forex trading stem from accurately predicting currency price movements. Buying a currency pair and witnessing a price increase results in a profitable trade when closed. Conversely, if the price decreases, traders incur losses. The extent of profit or loss depends on trade size and the magnitude of exchange rate fluctuations.

Risks Involved in Forex Trading

Forex trading entails risks that need to be understood and managed for long-term success. The following risks are associated with forex trading:

a. Market Volatility: Currency prices can exhibit high volatility, experiencing rapid and substantial fluctuations. Sudden market movements can lead to significant losses without proper caution and risk management.

b. Leverage: Forex brokers often offer leverage, enabling traders to control larger positions with a relatively small amount of capital. While leverage can amplify profits, it also magnifies losses, necessitating careful risk management.

c. Commissions and Fees: Forex brokers impose commissions and fees for each trade executed. These costs can impact overall profitability, so it is crucial to consider them when assessing potential gains.

d. Scams: The forex market attracts fraudulent entities, necessitating caution and the selection of reputable brokers. Awareness of potential scams and careful choice of trustworthy partners are crucial for safeguarding investments.

Getting Started with Forex Trading

To embark on your forex trading journey, follow these steps:

a. Conduct Thorough Research: Gain a solid understanding of forex trading concepts, strategies, and risk management techniques. Familiarize yourself with fundamental and technical analysis, trading terminologies, and market dynamics.

b. Choose a Reputable Broker: Select a trustworthy broker by considering factors such as regulation, fund security, trading platforms, customer support, and fees. Read reviews and compare brokers to make an informed decision.

c. Open a Trading Account: Once you've chosen a broker, open a trading account by providing necessary identification documents, completing registration forms, and depositing funds into your account.

d. Develop a Trading Plan: Create a well-defined trading plan that outlines financial goals, risk tolerance, preferred trading strategies, and parameters for entering and exiting trades. A trading plan helps maintain discipline and mitigate impulsive decisions.

e. Practice with a Demo Account: Most brokers offer demo accounts, allowing you to trade in a simulated environment using virtual funds. Utilize this opportunity to practice your trading strategies, gain experience, and build confidence before risking real capital.

f. Start Trading: Once you feel comfortable and confident, commence trading with small positions. Monitor and analyze market conditions, diligently apply your trading plan, and gradually increase trade sizes as you gain experience and achieve consistent profitability.

Overall, Forex trading presents an exciting opportunity to engage in the world's largest financial market and potentially profit from accurately predicting currency price movements. However, it is essential to approach forex trading with knowledge, caution, and risk management practices. By understanding how the market operates, considering associated risks, and following the necessary steps to begin, you can embark on your forex trading journey with confidence and strive for long-term success. Continuous learning, adaptability, and discipline are key elements for navigating the dynamic world of forex trading.

Read the full article

#forextradingbasics#forextradingbooksandcourses#forextradingforadvancedtraders#forextradingforbeginners#forextradingforintermediatetraders#forextradingnewsandanalysis#forextradingpsychology#Forextradingstrategies#forextradingtoolsandresources#howtomakemoneyfromforextrading#stockmarket#UK#unitedkingdom#unitedstates#USeconomy#USA#Whatisforextradingandhowdoesitwork

0 notes

Text

Currency Trading Analysis for Beginners in India

Hey there, fellow traders! 🌟 Are you new to the exciting world of currency trading and looking to unlock the secrets of successful trading in the Indian market? You've come to the right place! 🇮🇳💹

Currency Trading Analysis

Currency trading, also known as forex trading, offers immense potential for financial growth and independence. But, let's admit it, diving into the forex market without a solid understanding can be overwhelming. That's why we're here to share some essential insights on currency trading analysis for beginners in India! 💡

1️⃣ What is Currency Trading Analysis?

Currency trading analysis is the process of evaluating various factors that influence currency pairs' price movements. It helps traders make informed decisions, predict market trends, and execute profitable trades. From understanding technical indicators to keeping an eye on global economic events, analysis is the key to navigating the forex market like a pro! 📈💹

2️⃣ Currency Trading Fundamental Analysis

Fundamental analysis focuses on assessing economic, social, and political factors that influence currency values. As a beginner, keeping track of key indicators, interest rates, and government policies can help you understand a currency's intrinsic value and potential future direction. Knowledge is power, my friends! 📚🔍

3️⃣ Technical Analysis:

Your Trading Superpower! 💪 Technical analysis involves studying historical price charts and patterns to predict future market movements. By learning to read candlestick charts, identify support and resistance levels, and utilize various indicators like Moving Averages and RSI, you'll gain valuable insights to make smart trading decisions. 📊📉

4️⃣ Risk Management:

Protecting Your Capital 💼 A crucial aspect of currency trading analysis is managing risks. As a beginner, it's essential to set stop-loss and take-profit levels, adhere to a trading plan, and avoid over-leveraging. Remember, preserving your capital is just as important as making profits! 🛡️💰

Ready to dive in and explore the exciting world of currency trading analysis? Check out our in-depth blog for Beginners in India, where we've compiled expert tips, real-life examples, and practical strategies to help you kickstart your forex journey! 🌐📚

Here: Currency Trading Analysis for Beginners in India

Happy trading, and may the pips be ever in your favor!

#currencytradinganalysis#currencytradingfundamentalanalysis#onlinecurrencytrading#currencytradingstrategies#onlineforextrading#forextradingstrategy#forexmarketanalysis#forexchartsanalysis#forexwhatisit#forextradinganalysis

0 notes

Text

What is day trading?

Discover the ins and outs of the term "what is day trading" on The Talented Trader. Explore effective strategies, valuable tips, and potential risks associated with day trading.

#daytrading #forextradingstrategy #cheapestpropfirms #propfirmtradingaccount #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #unitedstates #usa #newyork #thetalentedtrader #talentedtrader

#instant funding prop firm#prop firms#trading risk management#cheapest prop firms#funded trading accounts#prop firms instant funding#prop firm challenge#the talented trader#proprietary trading firm#prop firm trading#What is day trading#day trading#stock market#futures trading#investing#investments#investors#forex trading#forexsignals#forex education#forextrading#forex#forex market#forex broker#forexmarket

1 note

·

View note