#free online bank account

Text

Things to learn regarding zero balance account opening with debit card access:

Zero balance accounts have become popular in today's banking environment as easily accessible options that provide financial inclusion to a larger group of people. These accounts have no minimum balance requirements, which makes them appealing choices for people who want banking services without having to keep a certain amount on hand. Debit cards further improve the usefulness of these accounts by facilitating simple access to money and a host of banking functions. This is a thorough post that will walk you through opening a debit card-accessible account with zero balance savings account online:

Look into your banking options:

Find out which banks offer debit card access and zero balance accounts. Compare the fees they charge for services, the features available for online banking, the availability of physical branches and ATMs, and any other benefits or rewards they may provide. Keep things like savings interest rates, transaction costs, and account management simplicity in mind. To guarantee a smooth financial experience with your debit card and zero balance account, look for companies recognized for their dependable customer support and user-friendly online banking systems.

Have the required documents:

Required documents include gathering valid identity, address evidence, and income-related documentation. Bring official identification, such as a passport, PAN card, or Aadhar card, to prove your identity. You should also have supporting documentation attesting to your address, including utility bills or rental agreements. Get income tax returns (ITR) or salary slips to document your income.

Choose The Account Type:

Once you have these documents together, evaluate each bank's account kinds. Consider straightforward savings accounts or more specialized choices based on your needs, including salary or student accounts. Consider account features that correspond with your financial objectives, such as interest rates, overdraft capabilities, and other benefits. Knowing the many account kinds makes it easier to choose the one that best meets your banking needs and provides the features and perks you want for your financial goals.

Application for Debit Cards

Apply for a debit card connected to the account after opening the zero balance account online. Fill out the bank's debit card application form, including all relevant documentation and personal information. Apply in person at the bank branch or online via the bank's mobile application or website. Following processing, the debit card will be issued by the bank. You may then activate it and use it for various purchases and transactions, taking advantage of the convenient cashless transactions and simple money access that comes with using a debit card.

Turn on and Utilize the Debit Card

Once you receive the debit card, activate it by following the steps provided by the bank, which usually require activating the card via an ATM or phone call. Establish a security PIN (personal identification number). Once activated, use the card for POS, contactless payments, internet purchases, and ATM withdrawals. Learn about the rules of overseas usage, spending caps, and security features. Look for any strange behavior with the card, and immediately notify the bank.

Wrapping It Up:

The above points give you crystal clear insights regarding zero balance account opening online with debit card. People can obtain necessary financial services and efficiently manage their finances by knowing the process and taking advantage of the available features.

#account online opening#application for joint account#bachat khata#bank account#bank account online#bank account open online#bank online account open#bank online account opening#bank open account online#bank saving account open#cibil score#create bank account online#credit card#digital bank app#free online bank account#internet banking

0 notes

Text

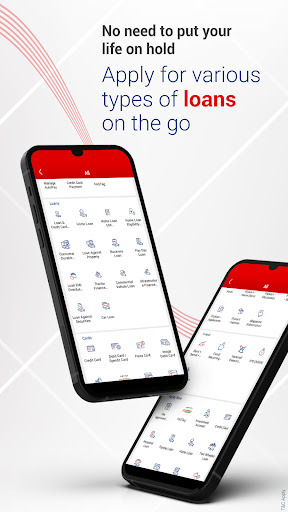

Kotak Mahindra Bank’s official mobile banking app for Android phones.

#best mobile banking app#banking app#mobile banking apps in india#free online bank account#account opening form online

1 note

·

View note

Text

If you sign up we both get $100!

Any of you looking for a free online bank account?

Let me refer you to my son's referral, affiliate link!

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

https://www.chime.com/r/justinbryson15/?fbclid=IwAR1N5sp3XWqQsUoIS0rTusK574pSCKemEe-OV5pU5DVjNi49DYfrvqxWW_4

0 notes

Text

Help myself and you get $100

Sign up for a free online bank account via my affiliate referral link and we both get $100! Read below!

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

#online bank account#make $100#get rewarded#get reward#free online bank account#chime#online banking#online bank

1 note

·

View note

Text

ill never get over how fucking awesome it is to be an adult. the horrors persist and life can still suck sometimes but now when i have a bad day i can get in my car and go on a drive to get myself a treat and i can buy myself fun stuff and yeah shits hard but id take this over being a kid or teenager any day every day forever.

#herbert speaks#being a kid was the worst thing ever. being a teenager was complete and absolute hell#but now? i finally know what its like to be alive and free#and yknow what??? im glad i lived#im glad i didnt kms#because if i died before adulthood i never would have known what its like to drive to the grocery store and buy whatever i want#if i died before adulthood i would never have gotten to see a cool thing online and check my bank account n see its in my budget and BUY IT#being a teenager is literally hell but oh my god they mean it when they say shit does get better#like i didnt believe it at the time but holy shit independence and freedom is AWESOME#im so fucking glad i didnt kill myself when i was 15 because i never would have even know what this is like

9 notes

·

View notes

Text

ohhh don't pirate the media they said ooooh just go to your bookstore and buy it

IT'S NOT AT PHYSICAL STORES AND DOESN'T HAVE A DIGITAL RELEASE YET

#I ned tge poppy playtime book it wasn't at barnes and noblkeeeeee#I want the new loree I heard bobby is in it and I neeeeeed it oughhjh#also I don't feel super comfortable ordering it online and paying out of my bank account when I only got like 90 bucks#and I have yet to put some designs on my redbubble to make it public or get a proper job#if anyone has the pdf (for all the pages not just scholastic's 24 free pages) that would be oh so swag

9 notes

·

View notes

Text

The universe loves me

#i can get the a i need for my online class after all!!!!!!#eeeeeeeeeeeeee#i just have to do 2 things and I'm gonna get the a#then I'll get my full amount of funds instead of half#I'm so excited#i mean first i have to do things for my in person class for that a but that one is super easy#this is such a gift and i don't know what deity did this#i don't worship any luck deities or ones associated with money or fortune or knowledge so idk#like all of mine are chaos and revelry and trickery other than one#but that one is like motherhood and stuff and i worship her to get the comfort of a divine mother#anyway whatever deity decided to blast my ass with fortune i love you#also i got what i needed to up my financial aid for the upcoming school year so double fortune#I'm vibrating with excitement#i may not be getting anywhere in my job search but my bank account won't be negative and I'll have the grades i wanted#life is beautiful today#i also got my doctor to switch me to gel for my t so i won't have a bad reaction hopefully and i see the gastroenterologist tomorrow#i'll get the swallowing problem dealt with soon even if i have to get a camera shoved down my throat again#and my college is doing a free tuition thing that while i don't think i qualify for will still be really good for other people who need it#and my dad leaves town for 2 weeks in the morning#I've just had a ton of good things happen in a row#also i got to see the living tombstone on Saturday and i swear that fixed the funk i was in from what i had to do last week#and i learned sweet tea doesn't taste like pure sugar so it's actually decent#damn I'm feeling good#anyway happy rant over#go be gremlins#and as always#drink water you heathens

2 notes

·

View notes

Note

youre posts are so annoying can’t wait for you to get onto the next clout chasing fandom to shit their tags up with youre mediocre writing

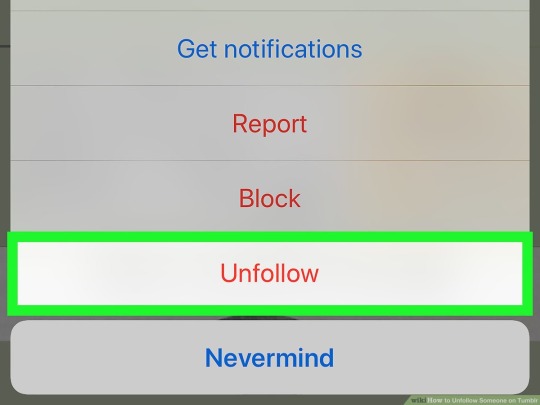

hello anon, let me show you something

you see the unfollow button? there for a reason. see the block one? same!

#nat.txt#negative cw#discourse cw#Curate Your Experience Online: it’s free!!!#anon got me. i actually have no interest in genshin I’m clout chasing nobody look at my bank account or hours played

46 notes

·

View notes

Text

Instant Account Opening: A Hassle-Free Way to Manage Your Finances

In today's fast-paced world, managing finances efficiently has become a priority for individuals and businesses alike. The traditional banking process often involves long queues, paperwork, and a lot of hassle. However, with the advent of digital banking, opening a bank account has never been easier. Instant account opening is revolutionizing the way people access banking services, and Digi Khata is at the forefront of this transformation. In this blog, we will explore how instant account opening works, its benefits, and how you can leverage this service for seamless financial management.

The Rise of Instant Account Opening

Gone are the days when opening a bank account required visiting a branch and filling out lengthy forms. With instant account opening, you can now create an account from the comfort of your home or office in just a few minutes. This is made possible by digital platforms like Digi Khata, which streamline the entire process by offering an easy-to-use interface and secure verification methods.

Digi Khata’s instant account opening service allows users to open a bank account quickly, without any hassle. Whether you're an individual looking to manage your personal finances or a business seeking a convenient way to handle transactions, Digi Khata’s platform makes it simple and efficient.

Benefits of Free Digital Account Opening

One of the standout features of Digi Khata’s service is free digital account opening. Unlike traditional banks that may charge account maintenance fees, Digi Khata offers a completely free digital account opening service. Here are some key benefits:

Convenience: You can open an account anytime, anywhere, without the need to visit a physical bank branch.

Cost-Effective: With no hidden charges or fees, Digi Khata ensures that your digital banking experience is both affordable and transparent.

Time-Saving: The process is quick and easy, enabling users to open an account in just a few minutes.

Paperless Process: Everything is handled online, reducing the need for paperwork and manual submissions.

How Instant Account Opening Works

The instant account opening process with Digi Khata is designed to be user-friendly and accessible to everyone. Here’s a step-by-step guide on how you can open an account instantly:

Sign Up: Visit the Digi Khata website or download the app and sign up with your mobile number.

Verify Your Identity: Upload the required documents, such as your Aadhaar card and PAN card, for identity verification.

Account Activation: Once the verification process is complete, your account will be activated immediately, and you’ll have access to all the banking features.

This entire process takes just a few minutes, making it one of the quickest ways to set up a bank account.

Online Kiosk Banking: A New Frontier

For those who prefer an in-person experience, online kiosk banking is another innovative service provided by Digi Khata. Kiosk banking allows users to perform basic banking transactions, such as deposits and withdrawals, through local agents who are authorized by the platform. This service is especially beneficial for individuals in rural areas or those who may not have easy access to a traditional bank branch.

Digi Khata’s online kiosk banking service is designed to bring financial services to the doorstep of every individual, making banking more inclusive and accessible. Whether you're opening an account or conducting a transaction, kiosk banking offers a convenient and secure way to manage your finances.

Digital Vyapar: Simplifying Business Banking

For small businesses and entrepreneurs, Digi Khata’s digital vyapar platform is a game-changer. Digital Vyapar is an all-in-one solution that allows businesses to manage their transactions, invoicing, and payments through a single platform. With instant account opening, businesses can set up their accounts in minutes and start conducting transactions immediately.

Some of the key features of digital vyapar include:

Easy Invoicing: Generate and send invoices to customers with just a few clicks.

Transaction Tracking: Keep track of all your incoming and outgoing payments in real-time.

Seamless Payments: Accept payments through UPI, bank transfers, or other digital methods, ensuring that your business runs smoothly.

Digi Khata’s digital vyapar service simplifies the financial side of running a business, allowing entrepreneurs to focus on growth rather than paperwork.

Create UPI ID Online for Seamless Payments

One of the most convenient features of modern banking is the ability to create UPI ID online. With Digi Khata, you can easily generate your own UPI ID, which can be used for quick and secure transactions. UPI (Unified Payments Interface) is a real-time payment system that enables users to transfer money instantly between bank accounts using a mobile device.

By creating a UPI ID online, you can enjoy the following benefits:

Instant Transactions: Send or receive money within seconds, with no delays.

Secure Payments: UPI is encrypted and secure, ensuring that your transactions are protected.

No Additional Fees: UPI transactions are typically free, making it a cost-effective way to handle payments.

Whether you're making a personal payment or conducting business transactions, Digi Khata’s UPI feature offers a hassle-free solution for managing your finances.

Open Zero Balance Account with Digi Khata

One of the biggest barriers to opening a traditional bank account is the requirement for a minimum balance. However, with Digi Khata, you can open a zero balance account, meaning you are not required to maintain a specific balance to keep your account active.

Some benefits of opening a zero balance account include:

No Minimum Balance Requirement: Enjoy full access to banking services without the pressure of maintaining a minimum balance.

Free Services: Access all the features of your account without worrying about hidden fees.

Instant Account Opening: Get started with your account immediately and begin managing your finances efficiently.

Conclusion: The Future of Banking with Digi Khata

The future of banking lies in digital solutions, and Digi Khata is leading the way with its instant account opening services. Whether you're an individual looking to manage your personal finances or a business owner in need of efficient banking solutions, Digi Khata offers a hassle-free, paperless, and quick way to get started.

With additional services like free digital account opening, online kiosk banking, digital vyapar, the ability to create UPI ID online, and the option to open zero balance accounts, Digi Khata ensures that everyone has access to the financial services they need.

Embrace the future of finance with Digi Khata and experience the convenience of digital banking at your fingertips!

#Instant Account Opening#free digital account opening#online kiosk banking#digital vyapar#create UPI ID online#open zero balance account

0 notes

Text

what the hell why is a book i need for one semester basically $80

i dont have money to spare i cant afford it.. evil of things to cost so much.

#geem speaks#most of my money is in cash... workbooks online..... i only have $20 in my bank account cause i still dont have a job yet :P#either i must ask my parents if theyll lend me money or i get job fast! or i do commissions but i kinda dont care that about that lately#the free trial for it ends in two days..#whatever. there are bigger issues out there (leaps into a sunset)

1 note

·

View note

Text

How to Choose the Best Free Online Bank

Online banking practices have made financial transactions more easier and secure than before. Considering that the majority of banks and other financial organizations now offer online banking, you may be asking how to find a reliable, cost-free option. Prior to settling on a bank, there are a number of considerations you should make; in this article, we'll go over a few of those. With this info, you will be able to create bank account online free and improve your financial position.

Hidden Charges: Some online bank accounts are “free” in name only and will be straddled with hidden charges like monthly maintenance fee. Such platforms are a red flag and you should do a thorough research before starting an account with any platform. Online banks also use misinformation tactics to get users to start a bank account. You have to be wary of such practices when making the decision to open a free online bank account.

Free ATM Service: Make sure you pick an online bank that lets you use ATMs for free. Some banks make you pay every time you use their machines. It would be ideal to avoid banks that charge you for using ATM services.

FDIC Insurance: FDIC insured banks are the real gold standard. Your money will be safe even if the bank fails. So always choose online banks that are insured by FDIC. This additional security will give you peace of mind.

A Strong Online Platform: The ease of use is the greatest advantage of online banks. This highlights the critical nature of user-friendly and reliable digital banking systems. You should also consider a bank's mobile app for easy account checking and payment processing while making your selection. You can compare the mobile banking apps of different platforms through simple search engine research.

Customer Service: Issues are bound to surface while using online banking services and you should always select a platform with excellent customer service. Since monetary transactions can become complicated from time to time, you should be able to depend on your service provider to resolve issues fast. You don’t want a service provider who does not offer 24/7 customer service.

Other Features: Today we have online banks that offer different services to clients. The option to integrate with investment platforms and money management tools is one of them. This feature will be extremely helpful to manage your finances in a more systematic manner. You will be able to access your spending data and make better decisions to save money with advanced features.

Conclusion:

In this day and age, having an online bank account is certainly a necessity. But when choosing one you have to be careful and study the services provided by a platform in detail. You can never be too careful while making decisions that will affect your financial security. Always ensure that there are no hidden fees, digital banking services are excellent and look for new features that will allow you to develop a holistic money management system when selecting a free online banking platform.

0 notes

Text

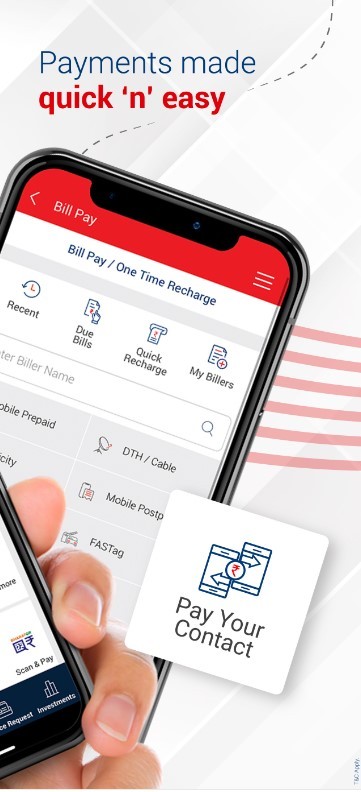

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note

Text

You get $100 and I get $100! I'll tell you how, read below! Thanks!

Anybody looking for an online bank account? I'm helping my son Justin promote his affiliate link for this to help our household meet living expenses.

Justin says "This is a completely free Debit card with no Monthly fees, or any other types of out of the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral affiliate link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

Signing up takes only 2 minutes!"

1 note

·

View note

Text

Latest technologies used in the banking sector

Gaining a thorough understanding of operations can help you perform better. Technology integration in banking has shown a whole new range of capabilities. The global financial services ecosystem is changing quickly due to technological advancements. A thorough understanding of operations can help you perform better, as technology integration in banking has revealed a whole new spectrum of capabilities. Due to technological advancements today, many people apply online bank accounts and enjoy doing banking on their phones. Here you can see about technologies used in the banking sector:

Wearable technology

Imagine your bank is with you with just a simple gesture or touch. Wearable technology makes it conceivable now but a few years ago, it might not have been. By collecting data via technologies like sensors on smartwatches, fitness trackers, communication devices, and more, wearable technology is designed to give you an immersive experience. To assist in identifying users and prevent fraudulent transactions, these digital gadgets save consumers' payments and other crucial information. Customers can gain insights by interacting with other applications, too. Data is gathered and analyzed with the aid of servers, analytics engines, and decision support tools to assist businesses in making best choices for enhancing customer experiences.

Hyper-personalized banking

Personalized banking experiences increase customer loyalty. For this reason, banks today use a variety of tactics and tools, like omnichannel banking, purchase now pay later, and financial advice tools, to customize their products. For instance, omnichannel banking enables customers to communicate with banks through various channels while offering a uniform, customer-centric picture of their financial information. Personalized advice and investment guidelines are also provided through wealth management and financial advising tools, increasing investor and client satisfaction.

Banking of things

The banking sector is using IoT to collect data effectively. This automates data collecting for expediting banking procedures, including KYC and loans, to provide real-time event response. For instance, IoT-enabled smart, automated teller machines transmit alerts when there is insufficient cash or something wrong, ensuring prompt maintenance. Additionally, customers can make purchases using IoT-enabled digital wallets incorporated into their smartphones and wearables. Due to the real-time delivery of customer-specific data through linked devices, IoT in banking facilitates fraud detection, which reduces loss. Due to the advent of technology, many people fill out bank account online application and open digital bank accounts.

Artificial intelligence

The greater usage of artificial intelligence in banking is another one of the major banking technology trends that may be anticipated in 2023. Banks can lower financial crime risk and increase fraud detection with this technology. For instance, banking software and applications can use machine learning to monitor real-time transaction data and automatically send notifications or halt transactions if suspicious behavior is found. AI can also aid in the banking industry's process optimization. By cutting expenses and improving the effectiveness of their operations, banks can save time and resources by automating activities. Banks and other financial institutions can use AI to improve customer service and make more accurate choices.

Parting words Hopefully, you will learn about the technologies used in the banking sector. A fast-growing field, banking technology has a wealth of prospects for the financial industry. This technology development stimulates many people to open digital accounts by completing the bank account online application form.

#apply for bank account online#free bank account opening online#mobile banking app#online banking app#best mobile banking app

0 notes

Text

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak!

Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#account online opening#account opening#free bank account opening online#new bank account opening online#online account open#online bank accounts opening

1 note

·

View note

Text

Kotak Mobile Banking App

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank account opening app#apply online bank account#bank new account opening online#apply for bank account online#free bank account opening online#online banking app#mobile banking apps#online new account open

0 notes