#from $80.24

Explore tagged Tumblr posts

Text

#Name: Kobe Bryant x Nike Air Force 1 Low “Home”#Colorway: White/Varsity Maize/Varsity Purple#SKU: FZ1151-100#MSRP: $130 USD#Release Date: December 6#2024#Where to Buy: Nike SNKRS#THANK YOU MAMBA (Limited Edition) - Hoodie#2 Store Reviews#from $80.24#In What Would've Been His 46th Year on Planet Earth#The OtherWordly Legend Gets Immortialized in WLCM Aesthetic Again#In His Greatest Iteration Yet. Featuring Superb Detailing and Craftsmanship#That Would've Made The GOAT Beyond Proud.#Hand Drawn Art by JAEVONN#Inspired by My New Track#"MYSELF (Thank You Kobe) Which You Can Stream Today#Head to freshthoughts2020 tab for more#This is a limited edition hoodie!#kobe bryant#jimmy iovine#the bigger picture#snoop dogg#dj hed#outta da blue#dodger blue#kendrick lamar#squabble up#gnx

11 notes

·

View notes

Text

Building-integrated Photovoltaics Market size was valued at US$ 18.57 Bn. in 2023 globally and revenue is expected to grow at 23.25 % from 2024 to 2030, reaching nearly US$ 80.24 Bn.

0 notes

Text

Security National Financial Corporation (SNFC) announced its financial results for the quarter ended September 30, 2023. The company reported positive earnings of $0.18 per share, compared to a loss of $0.11 per share in the previous year. However, there was a decrease in income by -35.71% from the preceding reporting period.The companyns revenue also contracted by -3.876% to $80.24 million from $83.48 million in the same reporting period a year ago. Sequentially, the revenue decreased by -4.299% from $83.85 million. Despite these figures, Security National Financial Corporation saw an improvement in its net margin, which increased to 5.04% in the fiscal interval c https://csimarket.com/stocks/news.php?code=SNFCA&date=2023-12-03115853&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Global Industrial lubricants Market Trends, Industry Report 2026

New York, NY 22 May 2021: The global industrial lubricants market is anticipated to reach USD 80.24 billion by 2026 according to a new study published by Polaris Market Research. The industrial lubricants market is expected to be driven by minimizing cost, optimization of operations and maximizing impact on the end use sectors. The industry is focusing on channel marketing to sell these products through distribution network establishments, service providers or adjacent industry which forecast potential growth in the client base. The worldwide Industrial lubricants market is driven by dynamic advancements in industrial process design and changing fuel quality that provides a driving force for its manufacturers to develop high end formulations. The performance requirements are driven by Original Equipment Manufacturer’s demands for reduced carbon footprints, improved efficiency and optimized fuel consumption. The business transformation in the lubricant industry is to shift from the models of carrying on business in the same manner to modifying and establishing various aspects of the same business.

These transformations have added to several variations of shifting from current competitive positioning to help improve that position with certain advancements in the approach. The shift from minimizing cost to maximizing the impact downturns the entire process and have added on to the optimization of the entire operational process. The back-end process of the customers and channels includes the OEMs and their workshops, independent workshops, quick services and many more. Industry participants to have a relevant position in the market has to work on three dimensions, that is to capture the critical elements of business, drive customer preferences or an important attribute, and to categorize competition. Hence, the business transformations in the lubricant industry have shifted the business model variably for the customer’s viewpoint. Consumer centric approach is an important approach because it values the customers, develops the relations for valued customer base.

Request For Sample Copy @ https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-sample

The market with such competitiveness owing to the presence of large number of industry participants is expected to grow significantly, as the companies involve themselves in newer marketing and sales techniques along with frequent innovation of novel products that meet the OEM’s lubricant requirements perfectly.

Asia Pacific Industrial Lubricants Market is expected to generate the highest demand for these products by 2026 with an increasing market share of approximately 40% in 2017 to further increase by the end of forecast period. Increasing rate of industrialization in the emerging economies such as India, Vietnam, Philippines, Malaysia, Indonesia etc. along with high demand from China, South Korea, Japan and Australia is the major factor expected to drive demand for the products over till 2026 and beyond.

The few of the leading industry participants currently operating in a worldwide scale include Arabol Lubricants, Total Oil, BP, Indian Oil Corporation, Phillips 66 Lubricants, Bel-Ray Company LLC., Amsoil (Wisconsin), Bharat Petroleum, Morris Lubricants, Ultrachem Inc , Penrite Oil, Valvoline , Rock Valley Oil and Chemical Co., Peak Lubricants Pty Ltd , Lubrizol, Liqui Moly, Eni S.P.A. and Emulsichem Lubricants Pvt. Ltd.

To get Incredible Discounts on this Premium Report, Click At : https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-discount-pricing

About Polaris Market Research

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for our clientele spread across different enterprises.

Contact Us:

Polaris Market Research

Phone: 1–646–568–9980

Email: [email protected]

Web: http://www.polarismarketresearch.com

0 notes

Text

Stock Market Analysis: 11/17/09

Daily Finan. Bull 3X Shs(ETF)(FAS) - FAS continues to be on fire as the financials rip higher. Daily Finan. Bull 3X Shs(ETF)(FAS) - FAS is now trapped between the 50 day moving average ( $80.24 ) and the 10 day moving average ( $75.76 ). I feel a big move one way or the other is coming. I am looking to add FAS to my portfolio below $20 if we see another correction. Meanwhile, the chances of a stimulus package coming together before the election next Tuesday are looking increasingly slim, and the possibility, if President Trump is defeated, of no additional relief coming before late January is rising. “February-quarter pricing for DRAM is tracking above our previous expectations, and while NAND prices are weaker, they are less bad than our estimates,” Moore said. You could potentially spend many heart-wrenching years waiting out for a potential take-over, while the share price declines (as the management pays themselves a high salary).

You will not make the maximum profit out of every trade. The market is the arena in which the players gather to trade. A market source said "anyone who thought they were voting for this to get a tax advantage should think again". Before I go on this subject, companies often get funding from two main sources-debt or equity. There are 3 main reasons why a company will go private. Look for deals on closeout merchandise, over boutiques near me, and liquidation merchandise since you can buy these products at deeply discounted rates compared to what your main supplier would charge you. This brief and efficient method of communication has proven extremely beneficial for the stock broking businesses because SMSs are easy to read, and can be sent out over regular intervals during a trading day with the necessary data. You can trade anywhere along with your own devices. You will get too stressed out if you trade every day, week, or even month.

RD - It’s very expensive and is a difficult to do significant SaaS busineses out of cashflow. stock analysis is carried out through fundamental, technical, and quantitative methods. When the stock Market opened, we hit 7776 on the dow and then bounced on word the big 3 automakers were getting some kind of bail out. Getting listed in the stock exchange is one way a company get funds. Eventually, the company might get listed, or what we call an IPO. I assume, refers to a party taking over a publicly-listed company in SGX, or what we call going-private transation. This multiple, is what we call enterprise value over earnings before interest and tax (EBIT), or EV/EBIT. GE is a cashcow, its FCF, that comprise of its operating cash flow and investing income(dividend and interest income) is around $14.32 per share on a four years annualized basis. When the owners decided that listing fees, paying dividends, reporting finances to regulators and shareholders is getting too costly, a low interest rate environment is very conducive for de-listing from the exchange. Or, the currency used for financial reporting isn’t the same as the market cap’s.

A very well run company that shares the same reasons for its downturn with the likes of Pumpkin Patch and all other retailers. TLDR: There are many reasons why a company privatize. Sometimes these companies (who got took over) aren’t even priced cheaply, and neither are the value of their assets glaringly obvious. This company cost $45 million for someone to take over. Assuming this company earns $9 million a year, that gives it an EV/EBIT multiple of 5, or five years to recoup cost, which is very attractive. Although consumers were decorating their Crocs clogs years ago, the effort wasn't organized. This means I need 45 years to recoup the cost. “cost of capital.” A sound management should choose a lower cost of capital-that is capitalism. Personally, I avoid any companies where management is the root of the problem. 1) The share price has become too cheap in the eyes of management.

0 notes

Link

The global industrial lubricants market is anticipated to reach USD 80.24 billion by 2026 according to a new study published by Polaris Market Research. The industrial lubricants market is expected to be driven by minimizing cost, optimization of operations and maximizing impact on the end use sectors. The industry is focusing on channel marketing to sell these products through distribution network establishments, service providers or adjacent industry which forecast potential growth in the client base. The worldwide Industrial lubricants market is driven by dynamic advancements in industrial process design and changing fuel quality that provides a driving force for its manufacturers to develop high end formulations. The performance requirements are driven by Original Equipment Manufacturer’s demands for reduced carbon footprints, improved efficiency and optimized fuel consumption. The business transformation in the lubricant industry is to shift from the models of carrying on business in the same manner to modifying and establishing various aspects of the same business.

These transformations have added to several variations of shifting from current competitive positioning to help improve that position with certain advancements in the approach. The shift from minimizing cost to maximizing the impact downturns the entire process and have added on to the optimization of the entire operational process. The back-end process of the customers and channels includes the OEMs and their workshops, independent workshops, quick services and many more. Industry participants to have a relevant position in the market has to work on three dimensions, that is to capture the critical elements of business, drive customer preferences or an important attribute, and to categorize competition. Hence, the business transformations in the lubricant industry have shifted the business model variably for the customer’s viewpoint. Consumer centric approach is an important approach because it values the customers, develops the relations for valued customer base.

Get Sample copy of this report: https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-sample

The market with such competitiveness owing to the presence of large number of industry participants is expected to grow significantly, as the companies involve themselves in newer marketing and sales techniques along with frequent innovation of novel products that meet the OEM’s lubricant requirements perfectly.

Asia Pacific Industrial Lubricants Market is expected to generate the highest demand for these products by 2026 with an increasing market share of approximately 40% in 2017 to further increase by the end of forecast period. Increasing rate of industrialization in the emerging economies such as India, Vietnam, Philippines, Malaysia, Indonesia etc. along with high demand from China, South Korea, Japan and Australia is the major factor expected to drive demand for the products over till 2026 and beyond.

The few of the leading industry participants currently operating in a worldwide scale include Arabol Lubricants, Total Oil, BP, Indian Oil Corporation, Phillips 66 Lubricants, Bel-Ray Company LLC., Amsoil (Wisconsin), Bharat Petroleum, Morris Lubricants, Ultrachem Inc , Penrite Oil, Valvoline , Rock Valley Oil and Chemical Co., Peak Lubricants Pty Ltd , Lubrizol, Liqui Moly, Eni S.P.A. and Emulsichem Lubricants Pvt. Ltd.

Request For Discount: https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-discount-pricing

About Polaris Market Research

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for our clientele spread across different enterprises. We at Polaris are obliged to serve our diverse customer base present across the industries of healthcare, technology, semi-conductors and chemicals among various other industries present around the world

Contact us

Polaris Market Research

Phone: 1-646-568-9980

Email: [email protected]

Web: www.polarismarketresearch.com

0 notes

Text

THANK YOU MAMBA (Limited Edition) - Hoodie

2 Store Reviews

from $80.24

In What Would've Been His 46th Year on Planet Earth, The OtherWordly Legend Gets Immortialized in WLCM Aesthetic Again, In His Greatest Iteration Yet. Featuring Superb Detailing and Craftsmanship, That Would've Made The GOAT Beyond Proud.

Hand Drawn Art by JAEVONN Inspired by My New Track, "MYSELF (Thank You Kobe) Which You Can Stream Today, Head to freshthoughts2020 tab for more,

This is a limited edition hoodie!

#kobe#kobeprotro#kobebryant#nike#nikekobe#mambamentality#protro#kobeshoes#blackmamba#sneakerhead#sneakers#lakers#mambaforever#kb#jordan#kicksonfire#nba#mamba#nikebasketball#basketball#basketballshoes#undefeated#lakernation#kicks#sneakshow#complexsneakers#shoes#airforce#osskobe#ripkobe

14 notes

·

View notes

Photo

$80.24 32% off sell - Men's San Diego Padres Manny Machado Majestic White Patch Flex Base Player Jersey (M) - CR18Q6KRCKW Material: 100% Polyester Import Hand wash better Short sleeve more product select from our Shirts:https://www.lilyes.com/931-shirts #& # # 's #(M) #

#Shirts#Sports#Fitness#Clothing#Men#San#Diego#Padres#Manny#Machado#Majestic#White#Patch#Flex#Base#Player#Jersey#CR18Q6KRCKW

0 notes

Text

Research - Top 6 Japanese Competitors

Because my outcome is related to the Olympics, in this post I’m going to look at the top 6 Japanese competitors and what their best performances were.

NOTE: This list is not in any particular order, it is just a show of the six best competitors from Japan who have participated in, or have potential to participate in, the Olympics.

6 - Abdul Hakim Sani Brown

Abdul Hakim Sani Brown is a Japanese sprinter who won the 100-metre dash at the 2015 World Youth Championship Final. Not only that, but he set a championship record of 10.28 seconds (9.72m/s). He also holds the country record for fastest 100-metre sprint, at 9.97 seconds.

He also won the 2019 Doha World Championship with a bronze medal, which doesn’t seem too promising for if he participates in the 2020 Olympic tournaments, which he will be because he qualified for it with a 9.99 second time during the qualification process in 2019.

5 - Kazuhiro Mizoguchi

youtube

Kazuhiro Mizoguchi is a Japanese javelin thrower who set a world best year performance during a meet in the USA in 1989, at a distance of 87.60 metres. Not much is known about this athlete apart from some of his best achievements, which have been:

Coming 2nd in the Kuwait Asian Championships in 1983 (distance unknown).

Coming 1st in the South Korea Asian Games in 1986 (distance unknown).

Coming 6th in the Italy World Championships in 1987 (distance of 80.24 metres).

And finally, coming 19th in the 1988 South Korea Olympic Games (distance of 77.46 metres).

4 - Shotaro Shiroyama

Shotaro Shiroyama is a Japanese athlete who participated in the long jump at both the 2017 Asian Championships and the 2018 Asian Games. Unfortunately, he only has one achievement, where he won a bronze medal in the 2017 Asian Championships, while placing fifth at the 2018 Asian Games.

There is no further record on this athlete, but he shows potential to do well in the long jump at the Olympics, with his personal longest jump at 8.4 metres done very recently in 2019... he’s like the Flash that came out of the blue!

3 - Shunya Takayama

Shunya Takayama is a Japanese athlete that won a bronze medal in the 2018 Asian Games, surpassing Shotaro Shiroyama by two places. He specialises in the 110-metre hurdles, with his personal best time being 13.25 seconds, set recently in 2019 in Fukui. He participated in the 2017 World Championships, but failed to be good enough to get past the first round.

Given that the fastest time on hurdles is 12.8 seconds (by Aries Merritt in 2012), he has a lot of potential to do well in the Olympics if he keeps up his abilities to run fast and get good times consistently.

2 - Naoyuki Daigo

Naoyuki Daigo is a Japanese high jumper, who came in the top 3 in not one, not three, but FIVE championships! He also holds two top-three records in the Games. His best records are, in order:

Gold medal in the 1999 Singapore Asian Junior Championships (height 2.21m).

Gold medal in the 2006 Thailand Asian Indoor Championships (height 2.17m).

Silver medal in the 1997 Thailand Asian Junior Championships (height 2.19m).

Silver medal in the 2005 South Korea Asian Championships (height 2.23m).

Silver medal in the 2005 Macau East Asian Games (height 2.23m).

Bronze medal in the 2006 Qatar Asian Games (height 2.23m).

Bronze medal in the 2003 Philippines Asian Championships (height 2.19m).

There is no further record on this athlete, but all we know about him is that he participated in the 2008 Beijing Olympic Games, and came 36th, with a height of 2.15 metres. This falls under a poor performance, but it won’t surprise anyone if he joins the 2020 Olympic Games and breaks records.

1 - Koji Murofushi

Koji Murofushi is a Japanese hammer-thrower. He holds the most top-three titles out of everyone I have covered in this post, with a whopping 16 top-three records:

Gold medal in:

1997 South Korea East Asian Games (distance 73.40m)

1998 Thailand Asian Games (distance 78.57m)

2001 Japan East Asian Games (distance 79.68m)

2001 Australia Goodwill Games (distance 82.94m)

2002 Sri Lanka Asian Championships (distance 80.45m)

2002 South Korea Asian Games (distance 78.72m)

2004 Athens Olympic Games (distance 82.91m)

2011 South Korea World Championships (distance 81.24m)

Silver medal in:

1993 Philippines Asian Championships (distance 65.54m)

1994 Japan Asian Games (distance 67.48m)

1995 Indonesia Asian Championships (distance 69.24m)

1998 Japan Asian Championships (distance 74.17m)

2001 Canada World Championships (distance 82.92m)

Gold medal in:

1993 China East Asian Games (distance 66.78m)

2003 France World Championships (distance 80.12m)

2012 London Olympic Games (distance 78.71m)

He has had an outstanding performance in tournaments over the last 20 years, which means that he could potentially win a gold medal in the 2020 Olympic Games, because of his performances in the Asian Games.

In my outcome, I plan to include all of these characters. Don’t worry, I will do it in a way that is easy to manage them all, this won’t take as long that way.

0 notes

Text

Copper On MCX Settled Up 1.27% At 450.35 - Research Icon

Copper on MCX settled up 1.27% at 450.35, supported as dollar weakened amid trade tensions between the US and China and concerns of slowing global economic growth. China's imports of unwrought copper and copper products in July climbed to the highest since February and stood at 420,000 mt, showed data from China Customs. However, imports in January-July shrank by 11.7% from a year ago, to 2.69 million mt, with import prices averaging 45,500 yuan/mt, down 3.5% on the year. The year-over-year decline in import volumes narrowed from 12.5% in January-June. Separately, domestic imports of copper concentrate expanded from 1.47 million mt in June, to 2.07 million mt in July. Operations across Chinese manufacturers of copper tubes and pipes in July continued to slow on both yearly and monthly basis as a seasonal lull intensified, an survey showed. Data showed that operating rates across copper tube and pipe producers averaged 80.24% last month, down 9.25 percentage points from July 2018 and down 6.14 percentage points from June. Copper stocks across Shanghai bonded areas this week continued their slide that began since May. Stocks shrank 12,000 mt from a week ago and 216,500 mt from April 26, to stand at 371,500 mt as of Friday August 9. Technically market is under short covering as market has witnessed drop in open interest by -2.07% to settled at 4310 while prices up 5.65 rupees, now Copper is getting support at 445.7 and below same could see a test of 440.9 level, and resistance is now likely to be seen at 453.3, a move above could see prices testing 456.1.

Contact Me On Whatsapp-9479884143 For Quick Trial – 8871888787 ✔ or mail us here: [email protected] or visit http://www.researchicon.com/free-trial

0 notes

Text

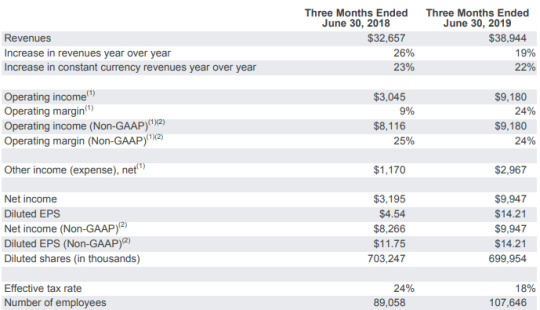

Google Q2 利潤暴增 211% 但業務營收危機依然在

一份可觀的財報數據

首先,先看一下 Alphabet 2019 第二季度財報的關鍵數據:

Q2 營收為 389.44 億美元,較去年同期的 326.57 億美元增長 19%,市場預期為 381.49 億美元;

Q2 淨利潤為 99.47 億美元,較去年同期的 31.95 億美元增長 211%,市場預期為 80.24 億美元。

從Alphabet 的業務板塊來看,來自Google 的營收依然是絕對主體,Alphabet 旗下Google 部門第二季度營收(由廣告營收和其他營收組成)為387.82 億美元,高於去年同期的325.12 億美元,佔比99.58%。

當然,就收入來源而言,Alphabet 的主體收入來源還是廣告。 Alphabet 第二季度廣告營收(由網站營收和網絡營收組成)為 326.01 億美元,高於去年同期的 280.87 億美元,佔比 83.7%。

不同於第一季度財報,在這份財報發布後,Alphabet 的股價有了明顯提升,最高價為 1241.43 美元,漲幅近 8%。總體而言,Alphabet Q2 財報的表現相對 Q1 較為出色,營收以及淨利潤也都超過了市場預期。

Google 硬件、雲業務收入增加

業績公佈之後,Google CEO Sundar Pichai 和 CFO Ruth Porat 召開了分析師電話會議。在電話會議中,Sundar Pichai 透露 GooLGe Cloud 業務的年營收運轉率(annual revenue run rate)已經達到 80 億美元。值得一提的是,上一次披露 Google 雲業務收入是在 2018 年年初,當時年營收運轉率只有 40 億美元。

據國外媒體報導,亞馬遜 AWS 的運轉率估計已經超過 300 億美元,微軟 Azure 約為 110 億美元。在雲計算市場,Google 更像是“追隨者”。不過,從 Sundar Pichai 披露的信息來看,目前 Google 在該市場的地位正在提升。

另外,Sundar Pichai 還表示,用戶現在能夠靈活地進入雲端,雖然此前微軟等公司已經這樣做了,但 Google 正在迎頭趕上。

除了 Goolge Cloud 業務, Google 硬件同樣表現得可圈可點。 Sundar Pichai 在電話會議中提到,隨著 5 月份推出了 Pixel 3a,Google Pixel 手機在 2019 年第二季度的銷量是去年同期的兩倍以上。

此外,Sundar Pichai 還指出,銷量增長的部分原因是 Google 拓展銷售網絡,Pixel 的銷售從原來的自有商店和 Verizon,拓展至 T-Mobile、Sprint、US Cellular、Spectrum Mobile 等運營商。他強調,Pixel 3a 獲得了 Google 最高淨推薦值(Net Promotor Score)。

投資重點是人工智能領域

從電話會議內容可以看出,Google 十分重視人工智能領域的投資。 Sundar Pichai 表示,目前的投資重點將放在人工智能領域,並在全球範圍內建立相關的科研團隊,加強對人工智能工程師的培訓。

不僅如此,Ruth Porat 還提及第二季度營收的顯著增長主要得益於長期以來對人工智能技術的研發,不斷致力於優化用戶體驗和廣告商服務體驗。

此外,Google 還借用人工智能技術初步實現保護用戶信息。當用戶在使用產品的時候,會涉及到很少的用戶隱私信息,建立起安全的使用環境,讓用戶可以更好的控制個人信息管理。

除了隱私保護,Sundar Pichai 還表示,對機器學習技術的投資主要是為了進一步提升用戶體驗和廣告表現。這一技術簡化了營銷戰略繁瑣的程序,以及加深對用戶的理解,並取得了比較顯著的成效。比如,廣告商希望了解到用戶的真實需求,機器學習可以實時地追踪到用戶使用路徑,從而讓市場營銷戰略更加的簡潔高效。

最後,Ruth Porat 表示:

在未來的兩年內,公司長期的戰略還是保持不變,會繼續加強對 Google 的投資。同時,進一步研發機器學習技術。總之,Alphabet 會關注長期發展的機會,並為了這個目標而製定投資策略。

.

from Google Q2 利潤暴增 211% 但業務營收危機依然在 via KKNEWS

0 notes

Text

Comparison of the Fit of Lithium Disilicate Crowns made from Conventional, Digital, or Conventional/Digital Techniques

First published: 08 August 2018

https://doi.org/10.1111/jopr.12961

Abstract

Purpose

To evaluate the fit of single crowns fabricated using conventional, digital, or cast digitization methods.

Materials and Methods

One subject with a peg‐shaped maxillary lateral incisor was selected in this study. Tooth preparation for an all‐ceramic crown was performed and 10 conventional poly(vinyl siloxane) impressions, and 10 digital impressions using an intraoral scanner were made. Each working cast was scanned using a laboratory scanner and an intraoral scanner. Four groups were tested Group 1: conventional impressions. Group 2: cast laboratory scans. Group 3: cast scans using intraoral scanner. Group 4: direct intraoral scans. For group 1, heat‐pressed glass ceramic crowns (IPS e.max Press) were fabricated using casts produced from the conventional impressions. For groups 2‐4, crowns were milled using ceramic blocks (IPS e.max CAD). Ten crowns were fabricated for each group. Marginal and internal gaps were measured using a replica technique. Replicas were sectioned mesiodistally and buccolingually and were observed under a stereomicroscope. Three measurements were selected for each cut: occlusal, axial, and marginal. Statistical analysis was performed using two‐way ANOVA and Tukey HSD tests.

Results

For each replica, 6 measurements were made for the mesiodistal and the same for the buccolingual cuts, producing 12 measurement points per crown (4 measurements for marginal, 4 for axial, 4 for occlusal), 120 measurements for each group (40 measurements for marginal, 40 for axial, 40 for occlusal), and 480 measurements in total. Two‐way ANOVA revealed location to be a significant factor (p = 0.001). No significant differences among groups (p = 0.456), and no interactions between groups and locations (p = 0.221) were found. Means for the occlusal site were significantly larger than other sites in most group combinations, while the difference between the marginal and axial sites was not significant. No significant differences among groups were found for each measurement. The marginal gaps ranged from 125.46 ± 25.39 μm for group 3 to 135.59 ± 24.07 μm for group 4. The smallest axial mean was in group 1 (98.10 ± 18.77 μm), and the largest was 127.25 ± 19.79 μm in group 4. The smallest occlusal mean was in group 2 (166.53 ± 36.51 μm), and the largest occlusal mean was in group 3 (203.32 ± 80.24 μm).

Conclusions

Ceramic crowns, which were made using all‐digital approach or cast digitization by a laboratory or intraoral scanner had comparable fit to those produced by conventional approach.

0 notes

Link

The Global industrial lubricants market is anticipated to reach USD 80.24 billion by 2026 according to a new study published by Polaris Market Research. The industrial lubricants market is expected to be driven by minimizing cost, optimization of operations and maximizing impact on the end use sectors. The industry is focusing on channel marketing to sell these products through distribution network establishments, service providers or adjacent industry which forecast potential growth in the client base. The worldwide Industrial lubricants market is driven by dynamic advancements in industrial process design and changing fuel quality that provides a driving force for its manufacturers to develop high end formulations. The performance requirements are driven by Original Equipment Manufacturer’s demands for reduced carbon footprints, improved efficiency and optimized fuel consumption. The business transformation in the lubricant industry is to shift from the models of carrying on business in the same manner to modifying and establishing various aspects of the same business.

These transformations have added to several variations of shifting from current competitive positioning to help improve that position with certain advancements in the approach. The shift from minimizing cost to maximizing the impact downturns the entire process and have added on to the optimization of the entire operational process. The back-end process of the customers and channels includes the OEMs and their workshops, independent workshops, quick services and many more. Industry participants to have a relevant position in the market has to work on three dimensions, that is to capture the critical elements of business, drive customer preferences or an important attribute, and to categorize competition. Hence, the business transformations in the lubricant industry have shifted the business model variably for the customer’s viewpoint. Consumer centric approach is an important approach because it values the customers, develops the relations for valued customer base.

Request for sample copy of this report @ https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-sample

The market with such competitiveness owing to the presence of large number of industry participants is expected to grow significantly, as the companies involve themselves in newer marketing and sales techniques along with frequent innovation of novel products that meet the OEM’s lubricant requirements perfectly.

Asia Pacific Industrial Lubricants Market is expected to generate the highest demand for these products by 2026 with an increasing market share of approximately 40% in 2017 to further increase by the end of forecast period. Increasing rate of industrialization in the emerging economies such as India, Vietnam, Philippines, Malaysia, Indonesia etc. along with high demand from China, South Korea, Japan and Australia is the major factor expected to drive demand for the products over till 2026 and beyond.

The few of the leading industry participants currently operating in a worldwide scale include Arabol Lubricants, Total Oil, BP, Indian Oil Corporation, Phillips 66 Lubricants, Bel-Ray Company LLC., Amsoil (Wisconsin), Bharat Petroleum, Morris Lubricants, Ultrachem Inc , Penrite Oil, Valvoline , Rock Valley Oil and Chemical Co., Peak Lubricants Pty Ltd , Lubrizol, Liqui Moly, Eni S.P.A. and Emulsichem Lubricants Pvt. Ltd.

Request for Discount on This Report @ https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-discount-pricing

About Polaris Market Research

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for our clientele spread across different enterprises. We at Polaris are obliged to serve our diverse customer base present across the industries of healthcare, technology, semi-conductors and chemicals among various other industries present around the world.

Contact us

Polaris Market Research

Phone: 1-646-568-9980

Email: [email protected]

Web: www.polarismarketresearch.com

0 notes

Text

Industrial lubricants Market to Witness Huge Growth by 2026

The global industrial lubricants market is anticipated to reach USD 80.24 billion by 2026 according to a new study published by Polaris Market Research. The industrial lubricants market is expected to be driven by minimizing cost, optimization of operations and maximizing impact on the end use sectors. The industry is focusing on channel marketing to sell these products through distribution network establishments, service providers or adjacent industry which forecast potential growth in the client base. The worldwide Industrial lubricants market is driven by dynamic advancements in industrial process design and changing fuel quality that provides a driving force for its manufacturers to develop high end formulations. The performance requirements are driven by Original Equipment Manufacturer’s demands for reduced carbon footprints, improved efficiency and optimized fuel consumption. The business transformation in the lubricant industry is to shift from the models of carrying on business in the same manner to modifying and establishing various aspects of the same business.

Request for a sample copy of this research report @ https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market/request-for-sample

These transformations have added to several variations of shifting from current competitive positioning to help improve that position with certain advancements in the approach. The shift from minimizing cost to maximizing the impact downturns the entire process and have added on to the optimization of the entire operational process. The back-end process of the customers and channels includes the OEMs and their workshops, independent workshops, quick services and many more. Industry participants to have a relevant position in the market has to work on three dimensions, that is to capture the critical elements of business, drive customer preferences or an important attribute, and to categorize competition. Hence, the business transformations in the lubricant industry have shifted the business model variably for the customer’s viewpoint. Consumer centric approach is an important approach because it values the customers, develops the relations for valued customer base.

The market with such competitiveness owing to the presence of large number of industry participants is expected to grow significantly, as the companies involve themselves in newer marketing and sales techniques along with frequent innovation of novel products that meet the OEM’s lubricant requirements perfectly.

Complete Summary with TOC Available @ https://www.polarismarketresearch.com/industry-analysis/industrial-lubricants-market

Asia Pacific Industrial Lubricants Market is expected to generate the highest demand for these products by 2026 with an increasing market share of approximately 40% in 2017 to further increase by the end of forecast period. Increasing rate of industrialization in the emerging economies such as India, Vietnam, Philippines, Malaysia, Indonesia etc. along with high demand from China, South Korea, Japan and Australia is the major factor expected to drive demand for the products over till 2026 and beyond.

The few of the leading industry participants currently operating in a worldwide scale include Arabol Lubricants, Total Oil, BP, Indian Oil Corporation, Phillips 66 Lubricants, Bel-Ray Company LLC., Amsoil (Wisconsin), Bharat Petroleum, Morris Lubricants, Ultrachem Inc , Penrite Oil, Valvoline , Rock Valley Oil and Chemical Co., Peak Lubricants Pty Ltd , Lubrizol, Liqui Moly, Eni S.P.A. and Emulsichem Lubricants Pvt. Ltd.

Purchase This Report @: https://www.polarismarketresearch.com/checkouts/1151

About Polaris Market Research

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for our clientele spread across different enterprises.

Contact Us:

Polaris Market Research

Phone: 1–646–568–9980

Email: [email protected]

Web: www.polarismarketresearch.com

0 notes

Text

Caraga corn production up in 1H 2019: DA

#PHnews: Caraga corn production up in 1H 2019: DA

BUTUAN CITY -- Effective interventions and the provision of support programs are seen as the main factors to the increased corn production in Caraga Region during the first six months of this year, an official of the Department of Agriculture-13 (DA-13) said. DA-13 Corn Coordinator Melody Guimary told Philippine News Agency on Tuesday that interventions made by the agency include the provision of quality seeds and post-harvest facilities to corn farmers in the area. The over-all corn production (white and yellow corn) in Caraga Region from January to June this year was recorded at 42,002 metric tons (MT), or 80.24 percent higher compared to 33,704 MT recorded in the same period last year. Areas devoted to corn farming also increased in the two quarters this year with a total land area of 11,218 hectares compared to 9,265 hectares in the same period last year. Increased production of yellow corn was also noted during the period compared to white corn, Guimary said, noting that a total of 24,998 MT of yellow corn were harvested from January to June this year in the region compared to 18,000 MT for the same period last year. White corn production during the period was recorded at 17,004 MT compared to 15,705 MT last year. Data showed that more areas in the region are devoted to white corn. Area planted to white corn was 6,247 hectares during the period compared to 5,704 hectares in 2018, while areas planted to yellow corn in the first six months this year were 4,971 hectares compared to 3,499 hectares last year. Guimary said corn production in Caraga Region this year -- both yellow and white -- is concentrated in the province of Agusan del Sur. During the first six months this year, 38,251 MT of corn production was recorded in Agusan del Sur with a total land area of 9,944 hectares. Agusan del Norte was next in high corn production during the period with 844 MT of production in 2,851 hectares. Guimary said DA-13 is now working to increase corn production next year. Among the preparations done by the agency is the conduct of a pre-procurement conference with the leaders of farmers’ associations and representatives of the local government units (LGUs) in the region. The pre-procurement conference includes the gathering of requests from corn farmers on the interventions they wanted from the agriculture department. “As we gather their requests, DA-13 also apprises our beneficiaries on their roles and responsibilities in taking care of the equipment they receive,” she added. Among the equipment farmers’ groups requested from DA-13 for next year include corn shellers, mechanical dryers, tractors, and quality seeds. Last month, DA-13 Regional Executive Director Abel James I. Monteagudo led the conduct of the "Corn Debry" in the provinces of Agusan del Sur and Surigao del Sur to encourage more farmers in Caraga Region to venture into corn production. (PNA)

***

References:

* Philippine News Agency. "Caraga corn production up in 1H 2019: DA." Philippine News Agency. https://www.pna.gov.ph/articles/1088940 (accessed December 18, 2019 at 12:54AM UTC+14).

* Philippine News Agency. "Caraga corn production up in 1H 2019: DA." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1088940 (archived).

0 notes

Text

Leagoo M11 launched with Notch Display and Dual Rear Camera

Leagoo M11 is now official guys, the smartphone has been launched by Leagoo as its latest smartphone for those on a budget. It comes with a notch just like the Leagoo S9 and sports dual rear shooters at the back. Even though there's a MediaTek chip doing the work underneath, it's powered by a 4000mAh battery.

Design

Leagoo knows exactly how to make stunning affordable smartphones. The M11 is beautiful and comes cheap. Made with plastic but with an exquisite taste. It measures 9.95mm in thickness, not to bulky to hold and operate. The device is available in Gold and Grey colours.

Display

The M11 is built around a 6.18-inch HD+ IPS LCD 19:9 notch display. The screen boasts of 720 x 1500 pixels in resolution along with a 272 pixel per inch density for clear visuals. The screen also got up to 80.24% screen-to-body ratio as well.

Software and Hardware

It runs on Android 8.1 Oreo out of the box with Leagoo OS 3.0 skin on top. Under the hood, the MT6739 chipset from MediaTek runs the show, coming with 4-cores of processor which clocks at 1.3GHz for a smooth ride. The PowerVR GE8100 graphics card manages graphics. For storing files, the device packs 16GB internal storage space which is expandable up to 128GB using a memory card. It boasts of 2GB RAM space as well for multitasking through apps.

Camera

Explore your photography potentials with the 8MP + 2MP dual rear shooters. The cameras are loaded with other internal features to enhance photography. For taking selfies, there's a single 5MP selfie shooter on the notch as well.

Battery

Powering the M11 up is a 4000mAh battery capacity with no fast charging technology. Without the fast charging feature, charging the battery from 0% to 100% might take up to 3 hours.

Leagoo M11 Specs

・6.18-inch HD+ IPS LCD capacitive touchscreen, 720 x 1500 pixels ��Android 8.1 Oreo ・MediaTek MT6739 ・Quad-core 1.3GHz ・2GB RAM ・16GB Internal Storage ・8MP + 2MP rear camera ・5MP selfie camera ・4000mAh battery

Leagoo M11 Features and Video Review

Place your YouTube unboxing video review of this device here, see About Our Review.

Leagoo M11 Full Specifications

General Device Type Smartphone Model Leagoo M11 Announced September, 2018 Released September, 2018 Status Available on Shopping stores Network 2G Network GSM 850 / 900 / 1800 / 1900 MHz 3G Network WCDMA: HSDPA 850 / 900 /1700(AWS) / 1900 / 2100 MHz 4G Network LTE 1700/2100 MHz LTE 1900 MHz LTE-TDD 2500 MHz (B41) LTE 700 MHz (B12) LTE 1900 MHz (B25) LTE 850 MHz (B26) LTE 1700/2100 MHz (B66) LTE 600 MHz (B71) SIM Type Nano + Nano SIM Count Dual SIM Design Type Plastic Dimensions 76.6 x 155.6 x 9.95 mm Weight - Water Resistant No Protection Yes Colours Gold Gray Display Display Type HD+ IPS LCD capacitive touchscreen Size 6.18-inch Resolution 720 x 1520 pixels Colors 16M colors Pixel Density 272ppi Screen-To-Body Ratio 80.24% Aspect Ratio 18:9 Touch Screen Model Capacitive Touch Screen Yes Multitouch Yes Protection Yes Features Multitouch, Scratch Resistant, Viewing angle - 178° Secondary Display No Camera Rear 8MP + 2MP Image Yes Video 720p@30fps FHD Recording Yes Features Autofocus Continuous shooting Digital zoom Exposure compensation Face detection Geotagging HDR ISO settings Panorama Scene mode Self-timer Touch focus White balance settings Advanced Features 4-element lens Flash Yes, dual-LED Aperture f/2.2 + f/2.8 Pixel Size 1.4 μm Sensor Size 1/4" Front/Selfie 5MP Front Flash No Aperture f/2.4 Pixel Size - Sensor Size - Software Operating System Android 8.1 Oreo User Interface (UI) Leagoo OS 3.0 Java Support Yes Skype Yes Whatsapp Yes Facebook Yes Youtube Yes Hardware Chipset (SoC) MediaTek MT6739WA Process Technology 28nm CPU Quad-core 1.3GHz Cores 4-Cores Bit Architecture 64-bit GPU (Graphics) PowerVR GE8100 GPU (Cores) 2-Cores GPU (Frequency) 450MHz RAM (Memory) 2GB Memory Speed 667MHz Internal Storage 16GB Card Slot Yes, up to 128GB Card Type microSD, microSDHC, microSDXC Sensors Fingerprint (Rear) Accelerometer Proximity Ambient Light - Controls Touchscreen, Lock Button, and Volume Key Connectivity Bluetooth Yes Infrared - Wi-Fi Yes Wi-fi Hotspot Yes USB Type Yes, Type C GPS Yes, with A-GPS, GLONASS NFC - HDMI Yes 3.5mm jack Yes Facial Identification Yes Wireless Charging No Battery Battery Type Li-Po Battery Capacity 4000mAh Placement Removable Fast Charging No Standby - Talk Time - Video Play - Normal Use - Media Audio Playback Yes, MP3, AAC, AAC+, eAAC+, WMA, MIDI, WAV, AC3, FLAC Video Playback Yes, 3GP, Mp4, MPEG4, H.263, H.264 player Video Out - FM Radio - Alert Types Vibration, Ringtones Ring Tones MP3, WAV Loudspeaker Yes Handsfree Yes Other Features - MP3/WAV/eAAC+/FlAC player - Active noise cancellation with dedicated mic - DivX/Xvid/MP4/H.265 player - Photo/video editor - Document viewer

Leagoo M11 Unboxing

Inside The Box NB: Details may vary. - Charger - USB Data Cable - Earphone - Quick Start Guide - SIM Ejector Pin

Leagoo M11 Price

Starting From $89 - $99 ==> Disclaimer: Specifications, features & price shown for this device was inserted manually. We cannot guarantee that the info on this page is 100% correct. If you think that any information of this particular device is wrong or missing, please don't hesitate to Contact Us. Mobile Crypto Tech wants to hear from you, don't forget to share and use the comment box below… Read the full article

#Android#crypto#Device#Gadgets#gizmo#internet#Leagoo#LeagooM11#mobile#online#Phone#phones#Review#Smartphone#smartphones#tech#technology#unboxing

0 notes