#fx trade

Explore tagged Tumblr posts

Text

TFW MINECRAFT SKINS OF THE GIRLS EXISTS?????

#lanarcher#lana kane#sterling archer#archer fx#oh myyyyy god i simply need to have the one of lana#HER EYES. DAZZLING LIKE THE EMERALDS YOU TRADE WITH VILLAGERS.#he's also there#thanku gene for sharing this with me hehe

13 notes

·

View notes

Text

KNIGHT FROM DARKEST HELL – A BIOENGINEERED, HULKING, MARTIAN MONSTROSITY.

PIC(S) INFO: Mega spotlight on concept art for the Hell Knight, a.k.a., "The Baron," artwork by Aaron Sims (supervised by John Rosengrant), from the “DOOM” 2005 movie trading card series by Artbox.

Source: www.ebay.com/itm/153909442003.

#Hell Knight#Concept Art#DOOM 2005#2005#DOOM 2005 Movie#DOOM#Trading Cards#Sci-fi horror#Sci-fi Fri#Horror Art#The Baron#Stan Winston Studio#Artbox Trading Cards#Sci-fi/Action#Aaron Sims#Science Fiction#DOOM Hell Knight#Monster Art#Monsters#Sci-fi#DOOM Movie 2005#Pre-production Art#DOOM Movie#Hell Knight DOOM#Sci-fi/horror#Artbox#Horror#Aaron Sims Art#Creature FX#Sci-fi Art

6 notes

·

View notes

Video

youtube

how to get a free funded forex accoun? Funded Challenge Accounts MT5 | Best Online prop accounts on a Regulated Trading Platform for free

#youtube#FreePropFirm 5kPropFirm RealOffer TradingFunding PropFirmAccount proptrading forex trader forextrader daytrade daytrading fx trade xprop swi#Giveaways FreePropFirm fundedaccount RealOffer TradingFunding PropFirmAccount proptrading forex trader forextrader daytrade daytrading fx t

3 notes

·

View notes

Text

Meng Xi shi, for all she put shen qiao through in TA, is AFRAID in peerless. not ONCE does she put these men through the real ringer, like yeah this is the whole premise of the novel, that they're literally the best, but there's no real risk! At the end of the day I *know* they're going to be fine with zero consequences. And whatever consequences they do suffer are quickly sped through so you don't really have the time to suffer with them. Give me a devastating emotional loss. It doesn't have to be physical, it doesn't even have to really be a loss but make the price for the win fucking outrageous. Otherwise how can I accept that they're human? If I don't go with them through the best and worst of their journey? I dare you, author, to humanize these gays for me

#warning spoilers in the tags#what if fx had that gu fr#mxs was AFRAID#cui buqu was totally on board to trade some commoners lives for fx's safety#like I wanted to see that!! him being pushed to the max#separated from feng xiao#having to be the one to save him and the only one who could do it at that#like in the caves!#going against the clock#constantly afraid and in danger cause fx is the only strong enough to really protect him from their enemies#knowing his at the mercy of xiao li and tuan qinghe#I guess this'll happen anyway just not with this added risk#but I thought the prison scene was kind of meh for pulling this stunt#it gave a venturi x cullen final fight in breaking dawn vibe#peerlessramble#wushuang

3 notes

·

View notes

Text

PrimeXAlgo's innovative AI trading signal technology. Boasting impressive results with 27, 17, 18, and 20 consecutive successes

#PrimeXAlgo#AITrading#RealTimeSignals#TradingTechnology#GoldInvestment#BitcoinTrading#AIPrediction#TradingSuccessStories#FX#FOREX#GOLD#Chart#Trading Chart#Stock#Finance#Investment

3 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Với hơn 10 năm kinh nghiệm thực tiễn, chúng tôi mang đến thông tin về tài chính và Forex chất lượng cao. Diễn đàn của chúng tôi là nơi lý tưởng để khám phá và học hỏi về cơ hội đầu tư trong thị trường tài chính.

Website: https://forexforums.org/

2 notes

·

View notes

Text

Unlock the potential of your investments with Capital Street FX! 📈 Enjoy a generous 650 deposit bonus that propels your trading journey to new heights. Don't miss out on this exclusive opportunity to amplify your gains. Join us now and let your investments thrive!

5 notes

·

View notes

Text

Get The Best Signals of Gold With TP and SL And Gain More Than 5% Daily

Follow Me on MQL5

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استراتيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعبر_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor #MetalTrading #trick #xauusd #gold #Forex #forextrading #PriceAction #priceactionstrategy

#forex live#live forex signals#live forex trading#forex signals live#eurusd live#live trading#forex live trading#live forex trading session#live signals forex#xauusd#gold#trade#fx#trading ideas#forex trading ideas#supply and demand#xauusd analysis today#gold forecast#gold price#gold live#xauusd forecast#forex signal#live trading forex#live forex#gold usd#gold xauusd indicator#xauusd live#gold trading live#forex trading live#xauusd live signal

4 notes

·

View notes

Text

Trading Definitions - Essential Terms for Successful Forex Trading

Explore our comprehensive glossary of Trading Definitions to enhance your forex knowledge. Whether you're a beginner or seasoned trader, understanding key terms is crucial for success in the forex market. Our glossary covers essential trading concepts, strategies, and terminology, helping you navigate the world of forex with confidence. Stay informed and improve your trading skills by mastering these vital trading definitions today!

#Trading Definitions#Forex Glossary#Basic Forex Terminology#FX terminology#Forex Trading Glossary#Glossary of trading terms#forex terms and definitions#forex terminology#forex trading terms

0 notes

Text

Get some solid Fx Trade News to get ahead in turning profits. Visit FxWeekly to prep yourself for all the opportunities.

0 notes

Text

Swing Trading vs. Scalping with Prop Firms: Which Is Better?

In the dynamic world of trading, selecting the right strategy can make all the difference. Swing trading and scalping offer distinct paths to profit, each appealing to different styles and time commitments.

Prop firms are reshaping the trading landscape by providing the capital and support needed to excel. With the right firm, you can focus on refining your skills while minimizing personal financial risk. Discover how to maximize your potential in trading today.

Introduction to Swing Trading and Scalping

Understanding Swing Trading and Scalping Strategies

Swing trading and scalping are two ways people trade stocks. They fit different types of traders and work best in different situations.

Trading Flexibility: Swing traders hold their trades for days or even weeks. They try to catch bigger price moves. Scalpers do the opposite. They make lots of quick trades in one day.

Trade Frequency: Swing traders trade less often but aim for bigger profits each time. Scalpers trade many times a day, making small profits on each trade.

Position Holding Period: Swing traders keep their positions longer and wait patiently for the right moment. Scalpers act fast, making decisions based on instant market changes.

Swing Trading Definition and Characteristics

Swing trading means trading for a medium time, like several days or weeks.

Swing Traders: They think patiently and pick their trades carefully.

Medium-Term Price Movements: They try to earn money from price changes over days or weeks.

Patient Approach: Swing traders wait for good chances instead of jumping in too soon.

Selective Trades: They choose only the best opportunities to reduce risk and increase gains.

Scalping Definition and Characteristics

Scalping is all about fast trades to get small profits quickly.

Scalper Profile: Scalpers focus hard and react super fast.

Quick Decision-Making: They use live data to spot chances in seconds.

High-Frequency Trading: Scalpers make many trades every day, holding positions for just seconds or minutes.

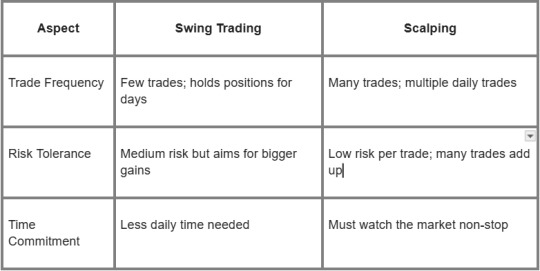

Key Differences Between Swing Trading and Scalping

Both swing trading and scalping can help you make money. Your choice depends on how much time you want to spend, how much risk you can take, and how involved you want to be with the markets.

Swing Trading in a Crypto Prop Firm Environment

Swing trading means holding positions for days or weeks to catch medium-term moves.

Crypto prop firms offer funded trading accounts and more trading capital for this style. These firms provide steady funding that helps traders grow their careers. They cut down on personal money risks and offer tools to trade better.

Crypto prop trading mostly focuses on digital assets but often supports other markets too. This lets traders mix up their strategies. With funded accounts, swing traders get bigger capital pools than their own money allows. That boosts possible profits without risking personal funds.

Working with a good prop firm gives swing traders a stable setup focused on steady results, not quick trades. This setup helps traders build skills and succeed long term in the wild crypto markets.

Benefits of Using Prop Firm Capital for Swing Trading

Using prop firm capital comes with several perks:

More Trading Capital: You get bigger funds than your own account.

Bigger Gains: Larger capital can boost profits when trades go well.

Good Profit Split: Many funded trader programs share profits at 70% or more.

Fast Funding: After passing evaluations, you can start prop firm challenge today and begin trading right away.

These perks let swing traders focus on trading instead of stressing about money limits. The Concept Trading’s system pushes steady funding and pays out quickly—usually within 48 hours—to keep traders motivated and cash flowing.

Challenges of Swing Trading within a Prop Firm Framework

Swing trading with a prop firm also has some tough spots:

Evaluation Pressure: You must hit targets during tests, which can clash with longer hold times swing trading needs.

Risk Rules: Strict drawdown limits force careful sizing of positions and stops to protect firm money.

Drawdown Limits: Going past loss limits might reset or end your account; managing losses is key to staying in the game.

Knowing these rules helps traders adjust methods and follow firm policies. Staying flexible but disciplined keeps success coming in this kind of setup.

Features of Crypto Prop Firms for Swing Traders

Crypto prop firms offer features that suit swing traders well:

Flexibility to Hold Positions Overnight/Weekends

Many crypto prop firms let you hold positions overnight and trade on weekends. This fits swing trading because it needs multi-day moves without forcing you to close early.

No-Time Limit Evaluations

Some firms don’t set strict deadlines for passing evaluations. That takes off pressure so swing traders can wait as trades unfold over time without rushing.

Swing-Friendly Leverage

Leverage options match moderate risk levels typical for swings—not high-risk scalp trades. Position sizes stay balanced by setting limits that fit longer holds, keeping risk in check.

Support for Multiple Instruments

Top crypto prop firms go beyond crypto, letting you trade stocks, indices, metals, and more. This variety gives swing traders chances to balance portfolios across different markets.

Competitive Profit Splits

Profit splits stay attractive at many leading crypto prop firms—often above 70%. Fast payouts mean you get your earnings soon after closing profitable trades.

This rundown shows how The Concept Trading’s platform fits swing traders with flexible rules and strong funding made just for their needs in today’s changing markets.

Understanding Scalping in a Prop Firm Context

Scalping means trading quickly to catch small price changes. Traders who use the scalper trading style make many trades each day. They often hold positions for only seconds or minutes.

Prop firms let scalpers trade with bigger money through funded trader programs. This helps them grow profits without using their own cash.

Many prop firms offer crypto prop trading and other markets. These are good places for scalpers who need fast execution and sharp focus. Unlike swing traders, scalpers close trades fast. This is typical for day trading and short-term trading styles.

Advantages of Scalping with Prop Firms

Scalping at prop firms gives you some clear perks:

Trading Capital: You get more money to trade than your own savings.

Instant Funding: Some firms fund you right after you pass their test.

Prompt Payouts: You can withdraw profits quickly, often in just two days.

Leverage in Trading: Firms let you use leverage to boost gains while controlling risks.

Execution Speed: Fast platforms help grab quick price moves.

Quick Decision-Making: Rules let you act fast without delays or extra approvals.

These points make it easier for scalpers to work fast and earn more without risking their own money much.

Challenges of Scalping within a Prop Firm Environment

Scalping with prop firms also has tough spots:

Trading Risk Management: You must follow strict stop-loss rules to protect money.

Evaluation Pressure: Passing funding tests can stress you because results matter a lot.

Psychological Adjustment: Fast trading needs strong nerves to handle losses and quick choices.

High Stress Levels: Staying alert all the time can wear you down if you don’t take breaks.

Knowing these challenges helps traders get ready mentally before they start.

Choosing the Right Prop Firm for Scalping

The best prop firms balance clear rules with risk control. They help short-term traders scale up without risking too much. Look for firms known for being honest and quick to respond. That makes trading scalp strategies smoother and safer.

Swing Trading vs. Scalping: A Detailed Comparison

Swing trading and scalping are two common trading styles. Swing traders hold their trades for days or weeks. They aim to catch medium-term price moves using swing trading strategies.

Scalpers, by contrast, make very fast trades. Their trades last seconds or minutes, using scalping techniques that grab small profits quickly.

The big difference is how often they trade and manage risk. Swing traders set wider profit targets and stop-loss orders based on technical analysis of chart patterns and momentum indicators.

This helps them handle moderate price swings while keeping risk in check with strict drawdown limits. Scalpers trade many times daily with tight stop-losses but face more risk because they must make fast decisions.

Knowing these differences can help you pick a style that fits your goals and personality.

Profit Potential and Risk Tolerance

Swing trading can bring high profit potential by catching bigger price moves over time. Traders control risk with clear rules like daily drawdown limits that stop big losses in wild markets.

Scalping looks for smaller wins per trade but makes up for it with lots of trades. But it needs perfect timing to keep losses small because many trades add risk.

Both styles rely on strict stop-loss orders—swing traders use broader stops while scalpers use tighter ones—to protect money and grow steadily.

Time Commitment and Effort

Scalping needs intense focus during market hours. It’s fast-paced and demands quick decisions under pressure. That stress means scalpers must stay sharp for hours at a time.

Swing trading asks for less constant watching since trades last days or weeks. This lower time commitment suits people who want flexibility without losing steady portfolio growth.

Which one works better depends on your schedule and how you handle stress while the market is live.

Technical Analysis Requirements

Both swing traders and scalpers depend on technical analysis but use it in different ways:

Swing Trading: Looks for clear chart patterns like head-and-shoulders or flags, plus momentum indicators such as RSI to see trend strength.

Scalping: Focuses on very short-term charts, watching order flow closely, and reading support/resistance quickly to decide when to jump in or out.

Learning the right tools helps no matter what style you pick. Swing trading needs deeper pattern recognition over longer times, while scalping calls for split-second calls.

Psychological Demands

Trading psychology matters a lot in both styles:

Swing Traders: benefit from patience and good emotional control while waiting through price moves.

Scalpers: must handle stress from rapid decisions where hesitation might cost money.

Sticking to rules keeps traders from making impulsive mistakes caused by fear or greed—problems that hit both styles hard.

Choosing the Right Strategy for Your Trading Style

Picking between swing trading versus scalping starts with knowing yourself—your personality, skills, and what fits your lifestyle best if you want long-term success at places like The Concept Trading.

Self-Assessment of Trading Preferences and Skills

Here’s what typical trader types look like:

Swing traders tend to be patient. They pick their trades carefully. They follow rules well and don’t mind holding positions overnight even if prices move moderately.

Scalpers like quick action. They can focus long hours staring at screens. They make split-second choices over and over without losing calm.

Knowing which sounds like you helps pick a style that won’t wear you out or give uneven results.

Alignment of Strategy with Personal Goals and Resources

Think about what fits your goals best:

Choose the style that matches your resources. It should also help keep your work-life balance healthy alongside money goals.

By knowing these key differences between swing trading vs. scalping—and thinking about your strengths—you can pick the approach that fits you best inside prop firms offering flexible funding designed for steady performance growth.

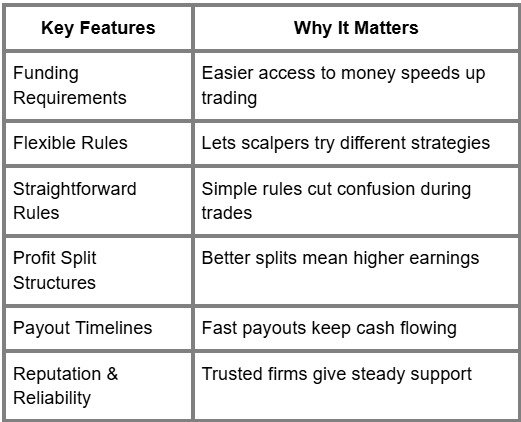

Selecting the Right Prop Firm for Your Trading Strategy

Picking the right prop firm matters a lot. You want one that fits your swing trading or scalping style. Start by checking their account sizes and leverage options. Bigger accounts with flexible leverage let you scale trades without risking too much.

Profit split setups can be very different between prop trading firms. Look for clear profit sharing that pays well, maybe over 70%. Quick payouts matter too. Firms that pay within 48 hours keep your cash moving and your spirits up.

Reputation is key when you pick funded trader programs. Read reviews, check if they follow rules, and see what other traders say. Instant funding can help you start live trading fast after passing evaluation. Easy account verification saves time too.

Transparent execution means no hidden fees or slippage eating your gains. Choose firms known for fair trades and clear funding requirements. These points help make a good fit for your trading style.

Tools and Techniques for Success in Prop Firm Trading

Good risk management keeps your profits safe in prop firm trading. Always use stop-loss orders to cut losses early. Set take-profit points to lock gains at planned levels.

Position size should match both your account and how wild the market is. Don’t risk more than 1-2% of your account on one trade.

Try trailing stops to keep profits as prices move up. Hedging can protect you from sudden market swings.

Use both technical and fundamental analysis to pick better trades. Look at chart patterns, moving averages, RSI, and MACD for tech analysis. Watch news and economic reports for fundamentals.

Know how different order types work (market, limit) and how fast your platform executes them. Fast execution means less chance of bad price fills during volatile times.

Review your trades often using dashboards with metrics like win rate, average return, and drawdown. This helps improve your strategy step by step.

Adapting Your Strategy to Market Conditions

Market conditions change all the time because of news or events. Good traders change their plans to fit those shifts instead of sticking too hard to one way.

In markets trending strongly over days or weeks, trend-following setups work best. Use momentum indicators like MACD there.

If markets move sideways between support and resistance levels, mean-reversion strategies do better.

Crypto markets jump around more than normal assets. That means you might want smaller position sizes or wider stops because of big overnight moves or weekend gaps.

Be careful around big economic data releases; spreads might widen and swap charges could rise if you hold positions overnight.

Sentiment tools like on-chain analytics help with crypto trades too. Also look at project health before trading when things feel uncertain.

Guidance on Selecting the Best Approach

Your choice depends on your goals, time, money, and career plans in trading. If you want less screen time with careful setups, swing trading fits well. If you like pressure and quick results by being active in the market, scalping works better.

Pick a strategy that matches your lifestyle to grow steadily as a trader in a prop firm. Make choices based on honest self-checks to boost your success over time.

Prompt Payouts, Streamlined Process, and 24/7 Support at The Concept Trading

The Concept Trading pays out profits quickly—usually within 48 hours. Their process is simple, so you get funding without waiting or extra hassle. They also offer support any time of day or night.

This setup helps both swing traders and scalpers focus on trading while keeping paperwork easy.

Highlighting The Concept Trading's Advantages

The Concept Trading works well for different styles—including swing trading support. Its platform runs smoothly on many devices and offers strong tools to manage risks.

Joining here means you get clear rules, fair profit shares, and an environment that cares about helping you grow as a trader with funded accounts.

FAQs

What Is the Role of Trading Risk Management in Prop Firm Trading?

Trading risk management is essential for safeguarding capital by implementing strategies such as stop-loss orders and drawdown limits. It helps maintain consistent trading performance while minimizing the impact of significant losses.

How Can Traders Scale Their Accounts Using Prop Firms?

Prop firms enable account scaling by increasing capital allocation as traders achieve profit milestones and adhere to established risk parameters consistently. This structured approach encourages responsible trading behavior.

What Types of Funding Evaluations Do Prop Firms Use?

Prop firms typically employ phased funding evaluations. These evaluations assess traders through specific profit target percentages and maximum drawdown limits to ensure they demonstrate discipline and effective risk management before receiving funded accounts.

How Does Leverage in Trading Affect Swing Trading vs. Scalping?

In swing trading, moderate leverage is utilized for positions held over several days, which helps to mitigate overnight risks. Conversely, scalping often requires lower or adjustable leverage for rapid, intraday trades, allowing traders to better manage the effects of market volatility.

What Support Services Do Prop Firms Offer to Help Trader Career Growth?

Prop firms provide a range of support services, including 24/7 assistance, mentorship programs, performance analytics, and educational resources. These services are designed to empower traders and enhance their overall trading potential.

Why Is Psychological Adjustment Crucial in Scalper Trading Style?

Psychological adjustment is vital for scalpers due to the high-pressure environment created by quick decision-making and frequent trades. Maintaining emotional control is key to preserving discipline and avoiding impulsive mistakes.

How Do Trading Tools Assist with Strategy Optimization in Prop Firm Environments?

Trading tools such as dashboards, performance metrics, technical indicators, and various order types enable traders to make data-driven decisions. These tools facilitate ongoing improvement and strategic optimization in trading results.

What Are Common Challenges Faced During the Funding Evaluation Phase?

During the funding evaluation phase, traders often encounter challenges such as performance pressure, rigid risk management rules, and the need to maintain consistent profitability while adhering to drawdown limits.

How Do Market Volatility and Cryptocurrency Volatility Impact Swing Trades?

Market volatility can lead to price fluctuations that significantly influence stop-loss levels and position sizing. Traders must adjust their strategies, either by widening stops or reducing position sizes, to effectively manage risk in volatile conditions.

Key Elements for Successful Prop Firm Trading

Strict trading discipline keeps losses low with stop-loss orders and daily drawdown limits.

Effective capital allocation balances position size relative to account value.

Using performance metrics like win rate and average return guides continuous improvement.

Employing both technical analysis (chart patterns, momentum indicators) and fundamental analysis (crypto asset fundamentals, news) supports better trade setups.

Understanding order types, such as limit or market orders, helps control trade execution latency.

Managing overnight risk carefully when holding positions during weekends or economic data releases.

Leveraging trader support services, including mentorship and community forums, fosters skill development.

Navigating prop trading challenges, such as evaluation pressure and strict risk rules, requires mental strength.

Choosing firms with transparent profit split structures, quick profit withdrawal, and flexible funding requirements improves the overall experience.

Adjusting strategies for different market conditions, including trending or range-bound markets, enhances trading scalability.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#fx trading#swing trading#scalping

0 notes

Text

Start your prop firm -

In the fast-evolving landscape of financial markets, the concept of prop trading (proprietary trading) has gained significant traction. Aspiring traders are increasingly drawn to the idea of establishing their prop firms, leveraging technology and funded trading opportunities. This article delves into the world of FXPropTech, prop firms, and the journey to becoming a funded trader.

1. Understanding Proprietary Trading (Prop Trading): Proprietary trading, often referred to as prop trading, involves financial firms trading their own capital in the markets. This approach differs from traditional trading where institutions trade on behalf of clients. Prop trading firms seek to generate profits directly from market movements, utilizing various strategies and tools.

2. The Rise of FXProptech: FXProptech, the fusion of foreign exchange (FX) trading and financial technology (fintech), represents a new frontier in the trading landscape. These technologies empower traders with advanced analytics, algorithmic trading, and risk management tools. The marriage of FX and technology has given rise to innovative platforms and strategies, enabling traders to navigate the complex currency markets efficiently.

3. Prop Firms and Funded Trader Programs: Many traders embark on their journey by joining prop firms or participating in funded trader programs. These initiatives provide aspiring traders with an opportunity to trade firm capital, often with minimal personal risk. In return, traders share a percentage of their profits with the sponsoring firm. This arrangement aligns the interests of traders and firms, creating a mutually beneficial partnership.

4. The Benefits of Joining a Prop Firm: Joining a prop trading firm offers several advantages. Traders gain access to substantial capital, advanced trading tools, and often benefit from mentorship programs. Prop firms, in turn, diversify their trading strategies and tap into the potential of skilled and emerging traders.

5. My Funded FX Journey: A Personal Account: In this section, we explore real-life success stories of individuals who have embarked on their funded FX journeys. Understanding the experiences and challenges faced by funded traders can provide valuable insights for those considering a similar path.

6. Steps to Start Your Prop Firm: For those aspiring to establish their prop firms, this section provides a step-by-step guide. From legal considerations to technology infrastructure, we cover the essential elements required to launch and run a successful proprietary trading business.

Conclusion: Starting your prop firm is an exciting venture that combines financial acumen with technological innovation. With the rise of FXPropTech and the opportunities presented by prop firms and funded trader programs, aspiring traders have a unique chance to make their mark in the dynamic world of proprietary trading. Whether you're a seasoned trader or a newcomer to the industry, exploring these avenues can open new doors to success.

#proptech#forex prop firms funded account#ftmo#funded#fxproptech#prop firm#props firms#the funded trader#my funded fx#best trading platform#best prop firms#Start your prop firm

3 notes

·

View notes

Text

#Vantage Markets#Vantage FX#forex broker#CFD trading#ECN broker#MetaTrader 4#MetaTrader 5#WebTrader#Vantage App#copy trading#Myfxbook AutoTrade#ZuluTrade#DupliTrade#VPS hosting#tight spreads#low commissions#ASIC regulated#FCA regulated#CIMA regulated#trading platforms#trading instruments#account types#leverage#demo account#trading 2025#broker review

0 notes

Text

Forex Trading in Dubai – Xelans Markets | Forex & CFD Trading with Tight Spreads

Dubai has rapidly emerged as a hub for global financial activity, and forex trading has taken center stage. Whether you're a seasoned trader or just stepping into the dynamic world of forex and CFD trading, Xelans Markets provides the ideal platform to maximize your trading potential.

Why Choose Forex Trading in Dubai?

Dubai’s strategic location, robust financial infrastructure, and growing investor base make it an attractive destination for forex traders. The city offers a regulated trading environment, tax benefits, and access to a global network of brokers and financial services.

Xelans Markets: Your Trusted Forex & CFD Partner

At Xelans Markets, we offer more than just a trading platform. We provide a complete trading ecosystem that combines technology, reliability, and world-class support. Here's what sets us apart:

✅ Tight Spreads

Maximize your profitability with competitive spreads across major forex pairs and CFDs. Our platform is designed to deliver cost-effective trades, no matter the market conditions.

✅ Reliable Execution

Experience lightning-fast order execution with minimal slippage. Whether you’re day trading or managing long-term strategies, you can count on stable performance and dependable pricing.

✅ 24-Hour Live Support

Markets never sleep — and neither do we. Our expert support team is available 24/5 to assist you in multiple languages, ensuring you always have the help you need.

✅ Trade on the Go with MT5 Mobile

Trading doesn’t have to be tied to a desk. With Xelans Markets MT5 Mobile, you can manage your trades from your smartphone or tablet. Our mobile platform gives you full access to your trading account, real-time data, charting tools, and order management — all from the palm of your hand.

Who Can Benefit from Xelans Markets?

Beginner Traders looking for an intuitive and supportive platform

Experienced Traders seeking tight spreads and advanced analytics

Global Investors interested in a diverse range of CFDs, including commodities, indices, and cryptocurrencies

Start Your Forex Trading Journey in Dubai Today

Take advantage of Dubai’s booming financial scene with a broker that delivers results. Whether you’re in Downtown Dubai, DIFC, or trading from anywhere in the world, Xelans Markets empowers you with cutting-edge tools and unmatched reliability.

👉 Ready to Trade with Confidence? Join Xelans Markets Now: https://xelansmarkets.com/

#Forex Trading in Dubai#Best Forex Brokers in Dubai#Best Forex Brokers in UAE#Forex Trading in Dubai UAE#Most Trusted Forex Brokers#Forex Trading UAE#trading platforms in UAE#best forex broker Dubai#Best Forex Broker in UAE#regulated forex brokers in UAE#Dubai forex broker#UAE best forex broker#top forex brokers in UAE#currency trading in Dubai#FX Dubai#best forex trading platform Dubai#Dubai trading FX#forex trading company Dubai#FX brokerage company in Dubai#UAE Forex Brokers.

1 note

·

View note