#globaleconomics

Text

The Convergence of Economic Interests and Drug Trafficking: Lessons from Prohibition and the U.S. War on Drugs

The prohibition of drugs in the United States, a policy widely contested for its social and economic consequences, finds historical parallels in the Prohibition era (1920–1933). During Prohibition, the production, distribution, and sale of alcoholic beverages were banned in the U.S. Like today’s drug prohibition, Prohibition was driven by moral and public health arguments but resulted in a parallel economy of illegal activities and an increase in organized crime. This economic history essay aims to draw parallels between Prohibition and current drug policy, highlighting how prohibition simultaneously benefits large corporations, organized crime, and ultimately shapes global geopolitics and economic structures.

1. Prohibition: A Moratorium and the Growth of the Black Market

Prohibition in the United States was enforced by the passage of the 18th Amendment and the creation of the Volstead Act. Its declared purpose was to improve public health, reduce crime, and boost societal morality by eliminating alcohol consumption. However, the economic effect of Prohibition was the opposite of what its proponents envisioned. Far from eradicating alcohol, the ban fostered the creation of a lucrative black market, managed by mafia groups that saw opportunities to enrich themselves through the illegal sale of alcohol.

Entrepreneurs of the illegal market, such as Al Capone, quickly amassed fortunes by exploiting the continuous demand for alcohol, demonstrating that the criminalization of widely demanded products tends to create highly profitable underground markets. The rise of organized crime, the bribery of politicians and law enforcement, and the violence associated with territorial control among gangs were some of the most visible consequences. The black market became an essential part of the parallel economy, moving significant amounts of money and directly influencing politics.

Similarly, the international drug trade that flourished under drug prohibition has replicated many patterns established during Prohibition. Today, drug cartels operate in ways comparable to the organized crime bosses of the 1920s, profiting immensely from prohibition while perpetuating networks of corruption, violence, and political instability.

2. The Dual Benefit: Corporations and Organized Crime

During Prohibition, large corporations were not directly involved in the illegal alcohol trade, but other sectors of the economy benefited from the ban. A notable example was the pharmaceutical industry, which retained exclusive access to alcohol for medicinal purposes. Medicinal alcohol, legalized under medical supervision, was widely sold in pharmacies and distributed by doctors who prescribed "alcohol treatments" for a range of ailments.

Thus, the pharmaceutical industry found a way to profit from Prohibition by controlling access to a still-demanded substance that was now heavily regulated. The monopoly these companies held on medicinal alcohol offered them a chance to profit through exclusivity at a time when recreational alcohol consumption was outlawed.

This model is clearly reflected in today’s drug policy. The prohibition of recreational drugs, such as cannabis or even cocaine derivatives, provides large pharmaceutical corporations with a monopoly over controlled substances that might otherwise be produced more cheaply and widely. Through patents and stringent regulatory processes, these companies dominate the market for legal treatments for pain, anxiety, and other conditions, often utilizing opioid derivatives and anxiolytics that are sometimes more dangerous and addictive than the recreational drugs targeted by legislation.

This convergence of interests—between corporations that benefit from prohibition and criminal organizations that profit from the black market—creates a complex economic structure resistant to reform, as both sides have economic incentives to maintain the status quo.

3. Drug Trafficking and the Control of the Drug Market

In the absence of government regulation and competition in a legal market, international drug trafficking emerged as the primary supplier of recreational drugs to the United States and other global markets. Prohibition creates artificial barriers that drive up the prices of these substances, generating disproportionately high profit margins for those who control supply.

In the case of cocaine trafficking, for instance, growing coca in Latin American countries such as Colombia and Peru is extremely inexpensive. However, prohibition and the risks associated with international trafficking inflate the price of cocaine in consumer markets like the U.S. and Europe. Just like the crime bosses during Prohibition, drug cartel leaders have become powerful figures, controlling territories and wielding influence over local politicians and law enforcement.

The economic model of drug trafficking is, therefore, similar to that of organized crime during Prohibition, with a lucrative parallel economy based on illegality. Violence and territorial control are essential to securing market access and ensuring the continuity of illegal operations. Moreover, just like in the 1920s, political corruption and the complicity of local authorities are key elements that facilitate the persistence of these activities.

4. Trump, Drug Prohibition, and Economic Interests

Amidst this scenario, Donald Trump’s position against the legalization of drugs is a clear example of how the prohibition economy benefits both large corporations and criminal organizations. Although Trump has adopted tough rhetoric on combating drug trafficking and illegal drugs, his resistance to legalization or decriminalization policies reflects deeper economic interests.

On the one hand, Trump’s stance protects the profits of large pharmaceutical corporations, which rely on the exclusivity of controlled substances. The legalization of drugs like cannabis could threaten these profits by opening the market to new competitors who might provide natural, more affordable alternatives. On the other hand, by keeping the black market intact, his "law and order" policy ensures that drug trafficking profits remain high, much like the profits of organized crime during Prohibition.

The economic logic behind these policies suggests a "double game" in which the interests of different groups are protected at the expense of a more effective and socially beneficial solution. Drug law reform, focusing on legalization and regulation, has the potential to drastically reduce drug-related violence, dismantle corruption networks, and open the market to new businesses that could provide safer and more affordable alternatives for consumers.

Conclusion

Prohibition and the current drug ban share many similarities in terms of their economic and social consequences. Both periods witnessed the rise of lucrative black markets, the strengthening of organized crime, and the protection of large corporate interests that control legal markets. Prohibition, in both cases, creates artificial barriers that benefit those who hold monopolies over controlled substances, whether in the pharmaceutical industry or in drug trafficking.

Donald Trump’s stance against drug legalization, far from being a mere reflection of moral or public health concerns, can be seen as a manifestation of broader economic interests. Both large corporations and international drug traffickers benefit from maintaining prohibition, creating a vicious cycle that resists reform and perpetuates a system of violence, corruption, and inequality.

The economic history of Prohibition offers valuable lessons for today’s debate on drug legalization. Just as the repeal of Prohibition reduced the power of organized crime and created a regulated market for alcohol, drug policy reform has the potential to weaken drug cartels and create a legal market that benefits society as a whole.

#EconomicHistory#DrugProhibition#ProhibitionEra#DrugPolicy#OrganizedCrime#BlackMarket#PharmaceuticalIndustry#DrugTrafficking#LegalizationDebate#PublicHealth#EconomicInterests#SocialImpact#CriminalEconomy#TrumpAndDrugs#DrugWar#HistoricalParallels#PolicyReform#CriminalJustice#GlobalEconomics#RegulatoryImpact

0 notes

Text

History's Pulse: Tracking Market Movements During Global Conflicts.

A look into the economic heartbeat through times of turmoil.

0 notes

Text

youtube

#Davos2024#ImaniVsSchwab#GlobalEconomics#EconomicJustice#DavosDebate#WorldEconomicForum#WEF#LeadershipChallenge#SocialJustice#GlobalDebate#EconomicDisparities#CorporateAccountability#GlobalLeadership#EconomicReform#PoliticalSatire#youtube#small youtuber#branding#marketing#digitalmarketing#Youtube

1 note

·

View note

Text

Get the fxck off my Ferrari. - ML

#moniquelewis#Ferrari#globaleconomics#global economy#fashion#luxuryfashion#style#ayf are#areyoufabulous

0 notes

Text

Agreementpaper

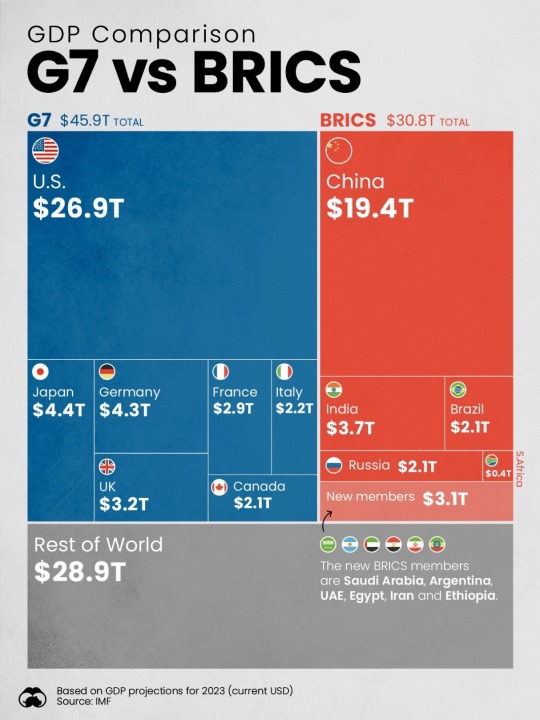

As #BRICS prepares to welcome six new member countries, let's explore how the bloc's combined #GDP stacks up against the G7.

#BRICSExpansion#GlobalEconomics#agreementpaper#g7#economy#economicdevelopment#economy2023#findjobs#australia#india#softwaredevelopment#entrepreneur#businessanalytics

0 notes

Text

Selling Out Our Economic Heart: To China

Introduction: In recent years, there has been a growing concern over the increasing influence of China in global economics and, more specifically, the extent to which our own country has become entangled in this economic relationship. It is disheartening to witness how our leaders have seemingly sold out our economic heart to China, prioritizing short-term gains over long-term sustainability and jeopardizing our national interests. In this post, I will delve into the alarming consequences of this sell-out and the urgent need for a reevaluation of our economic ties with China.

Economic Dependence: By relying heavily on China as a trading partner and a source of investment, we have become dangerously dependent on their economy. This economic reliance leaves us vulnerable to the fluctuations and policies of the Chinese government, putting our economic stability at risk. It is essential to diversify our economic relationships and reduce this overreliance to safeguard our own economic interests.

Job Losses and Outsourcing: The sell-out to China has resulted in the loss of numerous domestic jobs and the outsourcing of manufacturing and production to Chinese companies. Our own industries and workforce have suffered as a result, as companies seek cheaper labour and lower production costs in China. This erosion of domestic industries undermines our economic resilience and jeopardizes the livelihoods of our own citizens.

Intellectual Property Theft: China's lax enforcement of intellectual property rights has been a significant concern for our country. By conducting business with China, we inadvertently expose our technological advancements, proprietary knowledge, and trade secrets to the risk of theft. This intellectual property theft not only undermines innovation but also harms the competitive edge of our own industries on a global scale.

Unfair Trade Practices: China's unfair trade practices, including subsidies for their own industries and the manipulation of currency values, have had a detrimental impact on our economy. These practices create an uneven playing field, putting our businesses at a disadvantage and compromising the competitiveness of our products and services in the global market. It is imperative to address these unfair trade practices and establish a level playing field for fair economic competition.

Human Rights Concerns: China's well-documented record of human rights abuses, including forced labour, suppression of dissent, and violations of basic freedoms, should raise alarm bells regarding our economic ties. By turning a blind eye to these human rights abuses, we risk being complicit in supporting and perpetuating such atrocities. Our economic interests should never come at the expense of our ethical principles and human rights values.

National Security Risks: The deepening economic ties with China also pose significant national security risks. The Chinese government's potential access to critical infrastructure, sensitive information, and strategic assets can compromise our sovereignty and national security. It is crucial to reassess our economic partnerships with a careful consideration of the potential security implications involved.

Conclusion: The sale of our economic heart to China has resulted in numerous detrimental consequences, including economic dependence, job losses, intellectual property theft, unfair trade practices, human rights concerns, and national security risks. It is high time for our leaders to prioritize our national interests, diversify our economic relationships, and establish a more balanced and sustainable approach to global trade. We must not sacrifice our economic autonomy and ethical principles for short-term gains, but rather foster a resilient and independent economy that safeguards the interests and values of our nation and its citizens.

#China#EconomicDependency#JobLosses#Outsourcing#IntellectualPropertyTheft#UnfairTradePractices#HumanRightsConcerns#NationalSecurityRisks#GlobalEconomics#EconomicRelationships#EconomicStability#TradePartnership#ManufacturingIndustry#GlobalMarket#CompetitiveEdge#EthicalPrinciples#HumanRightsAbuses#Sovereignty#NationalInterests#Diversification#TechnologyAdvancements#CurrencyManipulation#ForcedLabor#TradeDeficit#NationalSecurityImplications#DomesticIndustries#StrategicAssets#ForeignInvestment#EconomicAutonomy#GlobalTrade

1 note

·

View note

Text

Mind Over Money: Unraveling the Psychological and Economic Factors Influencing Financial Decisions

In the intricate world of finance, understanding the psychological factors that influence our decisions is as crucial as knowing the numbers. The interplay between psychology, economics, and individual financial choices forms a complex web that can either lead to success or downfall. This article delves into the cognitive biases, emotions, technical analysis tools, and the global macroeconomic…

View On WordPress

#BehavioralEconomics#CognitiveBiases#EconomicInsights#EmotionalInvesting#FinancialGuidance#financialliteracy#FinancialPsychology#FinancialWellBeing#GlobalEconomics#InvestmentDecisions#InvestmentStrategies#MacroeconomicTrends#MindOverMoney#My-Financials.com#PersonalFinance#TechnicalAnalysis

0 notes

Photo

I thought this was interesting. I bit heady for early morning but still. Taken from a Mastodon post #globaleconomics #moneyispower https://www.instagram.com/p/Cmq7JsZOUSh/?igshid=NGJjMDIxMWI=

0 notes

Text

India Soars in Logistics Performance-A Reflection of the Remarkable Achievements of The Modi Government

This remarkable progress showcases the government's achievements across various industrial sectors, including infrastructure development, renewable energy, digital transformation, skill development, and the Make in India campaign, which have all significantly contributed to India's growth story from 2014 to 2023.

Over the past two years, the Indian economy has demonstrated steady recovery, thanks to the administration's proactive measures such as stimulus packages, policy reforms, and infrastructure investments.

With optimistic projections for 2047, India is poised to emerge as a global economic powerhouse in the coming decades. In this blog, we take a deep dive into these awe-inspiring developments and their implications for India's future, offering a comprehensive understanding of the strategic efforts that have propelled the nation toward a brighter economic horizon.

As we examine the key milestones in India's journey, we gain valuable insights into the driving forces behind the country's progress, the role of the Modi government in fostering growth, and India's potential to achieve unprecedented success in the years to come.

Dive into the incredible ascent of India in the World Bank Logistics Performance Index and discover how the Modi government has been able to perform across various industrial sectors to contribute to the growth story of India and future economic prospects.

#PMModi #IndiaShines #GrowthMindset

#SuccessStory #LeadershipMatters

#India2023 #G20SummitIndia

Let's read on PM Modi Applauds India's 16-Place Climb in the World Bank's Logistics Performance Index and also recap some of the Highlights that the Government has Achievements under his able Leadership.

India Soars in Logistics Performance- A Reflection of the Remarkable Achievements of The Modi Government

India's Remarkable Leap in the Logistics Performance Index

Prime Minister Narendra Modi has expressed happiness over India's significant rise of 16 places in the World Bank's Logistics Performance Index (LPI).

The LPI, which measures the efficiency of the logistics sector in a country, is a strong indicator of a nation's economic competitiveness and growth.

In response to a tweet by Union Minister of Textiles, Commerce & Industry, Consumer Affairs, and Food & Public Distribution, Mr. Piyush Goyal, Prime Minister Mr. Narendra Modi tweeted, "An encouraging trend, powered by our reforms and focus on improving logistics infrastructure.

Read More

0 notes

Text

youtube

InvestTalk - 7-3-2023 – What Do Supply Cuts Mean for Oil Investors?

The two largest oil exporters in the world, Saudi Arabia and Russia, increased their oil cutbacks on Monday, driving up prices in spite of worries about a slowdown in the world economy.

0 notes

Text

China’s Manufacturing Activity Contracts for Fifth Consecutive Month, Pressuring Beijing for Stimulus Measures

China’s manufacturing sector faced a downturn for the fifth consecutive month in February, as indicated by the official manufacturing Purchasing Managers’ Index (PMI) released on Friday. The National Bureau of Statistics (NBS) reported a decrease from 49.2 in January to 49.1 in February, below the critical 50-mark that separates growth from contraction. The ongoing contraction underscores the challenges faced by China’s economy, intensifying the call for more substantial stimulus measures, especially as the parliament gears up for its annual meeting next week.

Lunar New Year Impact and Uneven Economic Recovery

Seasonal factors, including the Lunar New Year falling on February 10, contributed to China’s manufacturing weakness. Factories typically shut down during this period as workers return home for the holiday. Despite these seasonal factors, the Caixin/S&P Global survey, released shortly after the official PMI, depicted a steady expansion in manufacturing activity, with increased production and new orders. The contrasting PMIs highlight an uneven economic recovery, intensifying pressure on authorities to implement bolder stimulus measures and reforms for China’s long-term growth stability.

China’s Manufacturing Contracts for Fifth Consecutive Month

youtube

Persistent Contraction and Economic Concerns

China’s manufacturing official PMI has remained in contraction since March 2023, with only a brief exception in September of the previous year. Analysts, including Ting Lu, Chief China Economist at Nomura, anticipate the weak growth momentum to persist into March. Lu forecasts China’s first-quarter GDP growth to be 4.0% year-on-year, a notable slowdown compared to the 5.2% pace recorded in the fourth quarter of the previous year. As China faces internal challenges, such as a property crisis and consumer spending hesitation, external challenges, including global conflicts, further hamper the economic outlook.

Mixed Indicators and Future Policy Actions

While new export orders have contracted for 11 consecutive months, the official non-manufacturing PMI, encompassing services and construction, rose to 51.4 from 50.7 in January, marking its highest reading since September last year. However, construction activity saw a slight decline, signaling ongoing challenges in the property sector. Policymakers, acknowledging the need for further support, cut the reserve requirement ratio for banks on February 5, releasing substantial liquidity. Despite short-to-medium-term measures, analysts caution that structural issues could undermine China’s long-term growth potential, calling for a delicate balance in policy support.

Curious to learn more? Explore our articles on Enterprise Wired

#chinamanufacturing#economics#newstoday#ChinaEconomy#manufacturing#lunarnewyear#economicrecovery#GlobalEconomic#policysupport#structuralreforms#Youtube

0 notes

Text

How technology and globalization are reshaping our economic landscape. Learn to navigate these changes and position yourself for success in an uncertain future.

#FutureOfWork #GlobalEconomics #DigitalEmpowerment https://finixyta.com/the-future-of-work-and-wealth-navigating-the-changing-landscape-of-global-economics/

0 notes

Text

Empire of shadows: True story of the richest family in history

Empire of shadows: True story of the richest family in history

https://ift.tt/oIkCp4i

Discover the true story of the richest family in history in “Empire of Shadows.” This captivating documentary explores the rise and fall of one of the most powerful dynasties the world has ever seen.

Join us as we journey through the shadowy corridors of history, revealing the truth behind the riches and the power that defined an era.

Don’t forget to like, share, and subscribe for more in-depth stories and historical documentaries!

#empireofshadows #richestfamily #wealthhistory #untoldstories #historicaldocumentary #richestfamilyInhistory #powerandwealth #secretlegacy #influentialfamilies #globaleconomics #entrepreneurialedge

from Entrepreneurial Edge https://www.youtube.com/watch?v=XbEfqh7tMnE

from Majestic Moments https://ift.tt/5Ho7CUA

via Majestic Moments https://ift.tt/n9uzTRy

July 14, 2024 at 01:25AM

0 notes

Text

youtube

#Davos2024#ImaniVsSchwab#GlobalEconomics#EconomicDebate#WorldLeaders#WEF#SocialJustice#EconomicInequality#Leadership#GlobalIssues#DavosDiscussion#EconomicPolicy#GlobalLeadership#DavosDebate#EconomicJustice#EconomicSummit#youtube#small youtuber#united nations#Youtube

0 notes

Text

I’ve worked in and around luxury product since I was like 21 years old. And loved it since age 10. Luxury fashion is what I’m known in real life for, and I have none of it left. - Monique Lewis ✨

#moniquelewis#luxuryfashion#fashion#style#areyoufabulous#instagram#globaleconomics#global economy#markzuckerberg

0 notes

Text

Empire of shadows: True story of the richest family in history

Empire of shadows: True story of the richest family in history

https://ift.tt/mGxXYOl

Discover the true story of the richest family in history in “Empire of Shadows.” This captivating documentary explores the rise and fall of one of the most powerful dynasties the world has ever seen.

Join us as we journey through the shadowy corridors of history, revealing the truth behind the riches and the power that defined an era.

Don’t forget to like, share, and subscribe for more in-depth stories and historical documentaries!

#empireofshadows #richestfamily #wealthhistory #untoldstories #historicaldocumentary #richestfamilyInhistory #powerandwealth #secretlegacy #influentialfamilies #globaleconomics #entrepreneurialedge

from Entrepreneurial Edge https://www.youtube.com/watch?v=XbEfqh7tMnE

via Majestic Moments https://ift.tt/iUdntCw

July 14, 2024 at 12:30AM

0 notes