#good real estate investments

Text

the thing with dabloons disappeared from my info space as quickly as it entered it but i still had time to make a dabloonsona. so here, meet Kruk

#dabloonsona#dabloon oc#dabloon inflation#cat stole all my dabloons#i literally lost millions#good thing i invested in real estate

8 notes

·

View notes

Text

God, I hope I manage to get people reading this fic even a HUNDREDTH as invested in this character and the family I completely invented out of whole cloth for him who have been living rent-free in my head for like two years now and steadfastly refused to make a story work until now, because I needed to get a good bit out of my head before I went to sleep, made myself cry because I cry ABSURDLY easily, and now it’s like four hours later and I need to actually get to FUCKING BED ALREADY but words keep coming, my fic is too sad, and I use a CPAP that already finds my face shape tricky and don’t want to combine that with my messy crying.

I’m just saying, it’s not fair I inflict this on myself while WRITING it. Rereading it later, sure, I’m fine with that, but writing it? What am I doing, using these characters as an outlet for emotional catharsis? Gross. Inefficient. I can’t keep writing when I need to routinely stop and wipe my eyes.

#writing with regalli#wips#I haven’t even gotten to the part that’s making me sad just to think about#no but seriously this is an actual problem for me that has happened more than once#if it works even a fraction as much as I’m hoping it will it’ll be SO GOOD and I will be SO PROUD OF THIS#but see I’m already invested and other people are not because you know. OCs.#I am deeply and profoundly attached to these OCs who have literally no implication in canon#seriously even the canon character in question is just a step or two removed from blank slate#and by this point I could write an entire fucking NOVEL in which there are maybe a couple hints of a second canon character offecreen#and then it ends with him meeting a third.#if someone talks shit about AUs not potentially engaging with the themes of the source material I fucking might.#like a really good AU that tries is DEEPLY concerned with where characters change and where they stay the same when this changes#and this particular threat of spite would be very much invested in the setting and deal with themes#but while looking at a spot that’s particularly thin in a movie that is admittedly more Vibes than plot and going ‘It’s free real estate’.#I can’t do AUs like that I struggle with differentiating character voice enough. but you know what I can do?#THIS BULLSHIT. and I am genuinely proud I can.#but it does bring a lot of anxiety when the emotional core is around characters who /I/ care deeply about#but who no one else has ever heard of because they are mine#god though THIS is the first idea I wanted to do this holiday prompt challenge for and it is WORKING for me.#the others have been aggressively Not at times and another one will be the full climax but this one actually fully fits the prompt#without the association that already existed in MY mind but which I will have to sell to not feel totally shoehorned for readers#which is admittedly a big ask under the circumstances#because the association would not be obvious if you DIDN’T know I had in fact had this idea for ages#and why would you? I have not brought it up before

6 notes

·

View notes

Text

I tell ya though, grind culture is one of the most destructive things around

If there's every any kind of grindset/hustle/ whatever culture going on, you can know for a fact I hate it and oppose it. I may not be perfect, but I'm better off than if I was buying into that insane way of thinking

Might just seem like sour grapes, but I'll tell you a big reason I'm so against it, is cause that old phrase of "slow is fast" really does hold true

Places where people have hustle tends to be places people make mistakes and things go bad. There's a big difference between hard work and grind/hustle

#like half the problems with the furnace I got installed was cause the guy was a 'I'm on call 24/7' type of person#which made him take on a project he wasn't up for#it's not totally people's fault; I get there's bills to pay and you do what you do#but you get that moronic 'I'd rather have 5 minutes picking a billionaire's brain than get a million dollars'#dummy; I'm taking the cash which gives me the ability to invest it or pay an accountant to manage it#the only time when a lump sum of cash isn't the right call is if you somehow win the lottery#or I suppose... if your choice is between a lump sum and passive monthly cash; usually take the passive cash#though not if you can leverage the lump sum into something like a house that's gonna knock away a lot of bills#but... speaking of houses; the number of people who are like 'oh yeah; real estate is a very smart investment' to me#you damn fools; it's not an investment; it's my home#it's a good deal financially; but not cause it has a good roi for my portfolio or something; it's cause I don't pay rent#not everything is for a portfolio; some things are cause you like them

3 notes

·

View notes

Text

Viceroy McKinley 19D Foreclosed Condo

Looking for an incredible deal in McKinley Hill? This foreclosed studio unit in Viceroy Tower 3 is your chance to own a piece of luxury living at a fraction of the cost! ✨ DM for details! #JMListings

📍 UNIT 19D @ 19TH FLOOR, VICEROY – TOWER 3, FLORENCE WAY, BRGY. PINAGSAMA, TAGUIG

Property Features

Type: Studio Unit Condo19th Floor, Viceroy Tower 3📐 Floor Area: 26.10 Sqm🛌 Studio, 1 Bath, Built 2017✅ AS-IS-WHERE-IS BASIS✅ Complete Property Documents

ABOUT VICEROY CONDOMINIUM

The Viceroy Residences is a 4-tower, 22-story condominium development by Megaworld Corporation in McKinley Hill,…

#best property#brickell#Broker JM#Condo#condo mckinley hill#foreclosed mckinley hill#foreclosed viceroy#foreclosed viceroy mckinley hill#good deal property#Investment#jm listings#jm real estate#mckinley#mckinley hill#mckinley hill condo#mckinley hills#mckinley taguig#megaworld mckinley#philippine property#Philippines#properties in bgc#property#property finder#psbank#Real Estate#real property#realestateproperty#the viceroy#venice condo#viceroy

0 notes

Text

10 Investment Options to Explore in India in 2024

Investing in India offers a multitude of opportunities for both domestic and international investors seeking to grow their wealth and diversify their portfolios. With a rapidly evolving economy, favorable demographic trends, and ongoing reforms, India remains an attractive destination for investment in 2024. In this comprehensive guide, we will explore 10 investment options to consider in India, covering a range of asset classes and risk profiles.

1. Equities and Stock Market:

Investing in Indian equities provides exposure to the country's dynamic economy and the potential for long-term capital appreciation. Consider investing in blue-chip stocks, diversified mutual funds, or exchange-traded funds (ETFs) to gain exposure to India's leading companies across various sectors.

Here's a breakdown of why investing in Indian equities can be a lucrative option:

1. Growth Potential: India is one of the fastest-growing major economies globally, with a young and aspirational population, robust consumption demand, and ongoing structural reforms. Investing in Indian equities allows investors to tap into the growth potential of various sectors such as technology, consumer goods, financial services, healthcare, and infrastructure.

2. Diversification: Indian equities offer diversification benefits for investors looking to diversify their portfolios beyond their domestic markets. By investing in Indian stocks, investors gain exposure to a different set of companies, industries, and economic drivers, reducing portfolio risk and enhancing potential returns through global diversification.

3. Blue-Chip Stocks: India boasts several blue-chip companies with strong fundamentals, established market presence, and track records of consistent performance. Investing in blue-chip stocks provides stability, dividends, and potential capital appreciation over the long term. These companies often operate in sectors with high growth potential and competitive advantages.

4. Diversified Mutual Funds and ETFs: For investors seeking diversification and professional management, Indian mutual funds and exchange-traded funds (ETFs) offer convenient options. Diversified mutual funds invest in a portfolio of stocks across various sectors and market capitalizations, managed by experienced fund managers. ETFs provide exposure to specific indices or sectors, offering liquidity and cost-effectiveness for investors.

5. Attractive Valuations: Indian equities may offer attractive valuations compared to developed markets, presenting opportunities for value investors. Periods of market volatility or corrections may create buying opportunities for investors with a long-term investment horizon. Conducting thorough research and fundamental analysis can help identify undervalued stocks with growth potential.

6. Liquidity and Accessibility: India's stock market is characterized by liquidity and accessibility, with well-regulated exchanges, electronic trading platforms, and a diverse investor base. Foreign investors can invest in Indian equities through participatory notes (P-notes), foreign institutional investment (FII) routes, or dedicated emerging market funds.

7. Investment Horizon and Risk Profile: Investors should assess their investment horizon, risk tolerance, and financial goals before investing in Indian equities. While equities offer the potential for high returns, they also carry inherent risks such as market volatility, company-specific risks, and geopolitical uncertainties. Investors should adopt a disciplined approach, diversify their holdings, and periodically review their investment strategy.

2. Real Estate:

India's real estate sector continues to offer promising investment opportunities, driven by urbanization, rising disposable incomes, and government initiatives such as affordable housing schemes. Explore residential properties in growing cities, commercial real estate, or real estate investment trusts (REITs) for potential rental income and capital appreciation.

Here are several reasons why investing in Indian real estate can be lucrative:

1. Growing Demand: India's population is rapidly urbanizing, leading to increased demand for residential, commercial, and retail spaces. The growing middle class, rising disposable incomes, and migration to urban centers drive demand for housing, office spaces, retail outlets, and other real estate assets.

2. Government Initiatives: The Indian government has launched various initiatives to boost the real estate sector, such as affordable housing schemes, infrastructure development projects, and regulatory reforms. Initiatives like Pradhan Mantri Awas Yojana (PMAY), Smart Cities Mission, and Real Estate (Regulation and Development) Act (RERA) aim to promote transparency, accountability, and affordability in the real estate market.

3. Potential for Capital Appreciation: Indian real estate has historically delivered attractive returns on investment, with properties appreciating in value over time. Investing in prime locations in growing cities or emerging micro-markets with development potential can lead to substantial capital appreciation over the long term.

4. Rental Income: Rental income from residential, commercial, or retail properties can provide a steady source of cash flow for investors. With the growing demand for rental accommodation and commercial spaces, investing in income-generating properties can offer a regular income stream and enhance overall portfolio returns.

5. Diversification: Real estate investment provides diversification benefits for investors seeking to spread their risk across different asset classes. Adding real estate to an investment portfolio alongside equities, bonds, and other assets can help reduce overall portfolio volatility and enhance risk-adjusted returns.

6. Investment Vehicles: Investors can access the Indian real estate market through various investment vehicles, including direct ownership of properties, real estate investment trusts (REITs), and real estate mutual funds. REITs and real estate mutual funds offer a convenient and diversified way to invest in real estate without the hassle of property management.

7. Infrastructure Development: Infrastructure development projects such as metro rail networks, expressways, airports, and industrial corridors drive real estate growth in surrounding areas. Investing in properties located near upcoming infrastructure projects can capitalize on future appreciation and rental demand driven by improved connectivity and amenities.

8. Stable Asset Class: Real estate is considered a tangible and stable asset class, providing a hedge against inflation and currency depreciation. Unlike stocks and bonds, which are subject to market volatility, real estate investments offer greater stability and long-term value appreciation potential.

9. Tax Benefits: Indian tax laws provide various incentives and deductions for real estate investors, such as tax deductions on home loan interest payments, capital gains exemptions on property sales, and tax benefits for investment in affordable housing projects. These tax benefits can enhance the overall returns on real estate investments.

10. Professional Management: Investors can choose to invest in real estate through professional property management firms or real estate developers with a track record of delivering quality projects. Professional management ensures proper maintenance, tenant screening, rent collection, and overall value enhancement of the investment property.

3. Mutual Funds:

Mutual funds offer a convenient and diversified way to invest in Indian markets across various asset classes, including equities, debt, and hybrid funds. Choose from a wide range of mutual fund schemes based on your investment objectives, risk tolerance, and investment horizon.

Here's why investing in mutual funds can be advantageous in the Indian market:

1. Diversification: Mutual funds offer diversification benefits by spreading investments across various asset classes, sectors, and securities. This diversification helps reduce overall portfolio risk by minimizing the impact of volatility in any single investment.

2. Professional Management: Mutual funds are managed by professional fund managers who have expertise in selecting and managing investments. These fund managers conduct thorough research, analysis, and portfolio management to optimize returns and mitigate risks. Investors benefit from the expertise and experience of fund managers, who make informed investment decisions on behalf of the investors.

3. Affordability: Mutual funds offer affordability and accessibility to retail investors, allowing them to participate in the financial markets with relatively small investment amounts. Investors can start investing in mutual funds with as little as a few thousand rupees, making it accessible to a wide range of investors, including individuals, families, and small businesses.

4. Liquidity: Mutual funds provide liquidity to investors, allowing them to buy or sell units at prevailing net asset value (NAV) prices on any business day. This liquidity feature ensures that investors can access their investments quickly and easily without incurring significant transaction costs or delays. It provides flexibility and convenience for investors to manage their investment portfolios as per their financial needs and objectives.

5. Transparency: Mutual funds are required to disclose their portfolios, performance, expenses, and other relevant information to investors regularly. This transparency helps investors make informed decisions and evaluate the performance of their mutual fund investments. Investors can access fund-related information through fund fact sheets, monthly statements, and online portals provided by mutual fund companies.

6. Tax Efficiency: Certain mutual fund schemes offer tax benefits to investors under the Indian tax laws. For example, equity-oriented mutual funds held for more than one year qualify for long-term capital gains tax exemption, making them tax-efficient investment options for long-term investors. Investors can also benefit from tax-saving mutual fund schemes such as Equity Linked Savings Schemes (ELSS), which offer tax deductions under Section 80C of the Income Tax Act.

7. Flexibility: Mutual funds offer flexibility in terms of investment options, investment strategies, and investment durations. Investors can choose from a wide range of mutual fund schemes, including equity funds, debt funds, hybrid funds, index funds, and thematic funds, based on their investment preferences and risk appetite. Additionally, investors can opt for systematic investment plans (SIPs) to invest a fixed amount regularly over time, enabling them to benefit from rupee-cost averaging and disciplined investing.

4. Fixed Deposits and Bonds:

Fixed deposits and bonds provide a stable and predictable source of income for conservative investors. Consider investing in government bonds, corporate bonds, or fixed deposit schemes offered by banks and financial institutions for steady returns and capital preservation.

5. Gold and Precious Metals:

Invest in physical gold, gold ETFs, or gold savings schemes to diversify your portfolio and protect against market volatility and currency depreciation.

6. Cryptocurrency:

With the growing popularity of cryptocurrency globally, consider allocating a portion of your investment portfolio to digital assets such as Bitcoin, Ethereum, or other cryptocurrencies. While cryptocurrency investments carry higher risks, they also offer the potential for significant returns in the long term.

7. Startup Investments:

India's startup ecosystem is thriving, fueled by innovation, entrepreneurship, and supportive government policies. Explore opportunities to invest in early-stage startups through angel investing, venture capital funds, or crowdfunding platforms to participate in India's growth story and potentially earn high returns.

8. Healthcare and Pharma Stocks:

The healthcare and pharmaceutical sectors in India are poised for robust growth, driven by increasing healthcare spending, rising demand for quality healthcare services, and a growing pharmaceutical market. Consider investing in leading healthcare and pharma companies with strong fundamentals and growth prospects.

9. Renewable Energy:

India's focus on renewable energy and sustainable development presents investment opportunities in the solar, wind, and other renewable energy sectors. Invest in renewable energy companies, infrastructure projects, or green bonds to capitalize on India's transition towards clean energy and environmental sustainability.

10. Infrastructure Development:

India's ambitious infrastructure development plans offer investment opportunities in sectors such as roads, railways, ports, and urban infrastructure. Explore infrastructure-focused mutual funds, infrastructure bonds, or direct investments in infrastructure projects to benefit from India's infrastructure growth story.

In conclusion, investing in India in 2024 offers a diverse range of opportunities across various asset classes and sectors. Whether you're a conservative investor seeking stable returns or a risk-taker looking for high-growth opportunities, India's dynamic economy and favorable investment climate provide avenues for wealth creation and portfolio diversification. Conduct thorough research, assess your risk tolerance, and consult with financial experts to make informed investment decisions that align with your financial goals and objectives. By exploring the 10 investment options outlined above, you can capitalize on India's growth potential and unlock opportunities for long-term wealth creation.

This post was originally published on: Foxnangel

#good investment plan#investment plans#top investment options in india#invest in india#invest in indian stock market#invest in real estate#best mutual funds in india#renewable energy shares#foxnangel

1 note

·

View note

Text

Is Buying a Property During Holi 2024 Auspicious?

Ultimately, the decision to buy a property during Holi 2024 or any other time should consider factors such as personal circumstances, financial readiness, market conditions, and legal considerations rather than solely relying on auspiciousness. It's advisable to conduct thorough research, seek expert advice, and proceed according to your individual situation and beliefs.

#Is Buying a Property During Holi 2024 Auspicious?#Buying a Property During Holi 2024#Is Holi An Auspicious Time To Buy A Home in 2024#Is 2024 good time to invest in real estate?#Is it a good time to buy property in India?#Real estate#Bricksnwall

0 notes

Text

As the festival of colors, Holi, approaches, the excitement and joy in the air become evident, making it an ideal time for celebrations and new beginnings. What better way to commemorate this auspicious milestone than by pursuing the purchase of a property? Purchasing a house during Holi not only adds a vivid and festive backdrop to your investing journey, but it also gives various advantages that make it an appealing option. In this blog, we'll look at why buying a house around Holi can be a sensible move.

#Is Buying a Property During Holi 2024 Auspicious?#Investing in Property During Holi in 2024#Can we buy new things during Holi?#Can we buy property in Holi?#Is 2024 good time to invest in real estate?#real estate#holi#holi 2024#Bricksnwall

0 notes

Text

Is Real Estate Investment Trusts A Good Career Path?

Imagine a way to be part of the real estate world without owning properties directly.

That’s where Real Estate Investment Trusts, or REITs, come in.

REITs are like a team effort where people invest their money together to own and operate different properties.

This could be office buildings, apartments, shopping centers, and more.

But here’s the exciting part:

REITs also offer a possible career path.

Instead of just owning a single house, you could be a part of a big real estate adventure.

In this blog, we’ll explore what REITs are, how they can be a career choice, and why they’ve become such a big deal in the real estate industry.

To read more, visit now - https://www.pennycallingpenny.com/is-real-estate-investment-trusts-a-good-career-path/

0 notes

Text

Buying Real Estate In Pittsburgh

How To Buy Real Estate In Pittsburgh – A Guide By the Pittsburgh Property Diva

Pittsburgh, known for its steel industry history, has much more to offer today, including scenic views, unique architecture, reputable universities, and iconic sports teams. Moreover, it boasts an affordable real estate market. If you’re considering investing in Pittsburgh real estate or simply curious about the…

View On WordPress

#buying a home in pittsburgh#buying real estate in pittsburgh#East End Pittsburgh Real Estate#East Pittsburgh Real Estate#Is Pittsburgh Real Estate A Good Investment#pittsburgh real estate#Pittsburgh Real Estate Agencies#Pittsburgh Real Estate Agents#Pittsburgh Real Estate Trends#Pittsburgh Real Estate Website#Real Estate In Pittsburgh

0 notes

Text

Is Real Estate Investment Trusts a Good Career Path?

Introduction

In the dynamic landscape of career choices, the question often arises: Is real estate investment trusts (REITs) a good career path?

This article digs into the multifaceted world of REITs, exploring their advantages, considerations, opportunities, and challenges, and even providing insights from industry surveys.

Through this comprehensive analysis, we aim to help you make an…

View On WordPress

#Is Real Estate Investment Trusts a Good Career Path#Is Real Estate Investment Trusts a Good Career Path?#Real estate career path#Real Estate Investment Trusts Career Path#REIT career path

1 note

·

View note

Text

#farmlands in turkey#agriculture investment companies turkey#farm real estate investment#agriculture investment company in turkey#farmers#is farmland a good investment#agriculture investment company

0 notes

Note

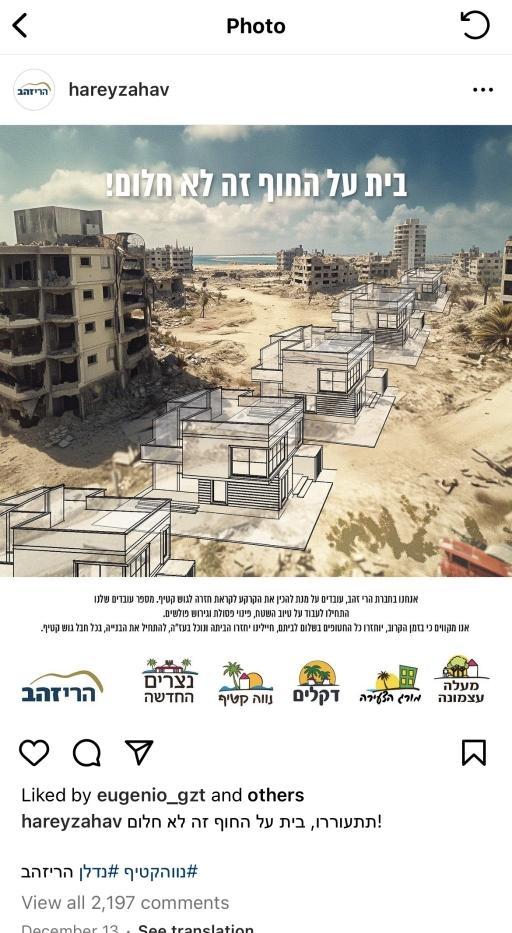

Israel doesn't want to repopulate Gaza, you loveable dummy

Seriously, find one Israeli on this site who'll say otherwise. And no, quoting Ben Gvir doesn't count (assuming you even know who that is) anymore than quoting, say, Rudy Giuliani would count for anything, even though he supposedly spoke for the president of the USA for a time.

Hamas has 136 hostages. Including women, and actual literal babies, assuming they're still alive, that is. This could all have ended weeks ago if they'd fucking returned them. Israeli society would physically march on Benjamin Netanyahu's home and remove him in a coup if the hostages were returned tonight. But as long as they have Israeli people, and are unwilling to negotiate their return, that's an ongoing war crime. Is Israel evil for being a bull in a China shop trying to get back a "mere" 136 innocent civilians? Maybe. But Hamas started this and they can end it, they just don't want to. Please, justify that.

Hello, since you asked for one Israeli, here, I'll give you multiple statements:

Hundreds of activists at an Ashdod gathering in late November called for the reestablishing of Jewish settlements. “Let it be known that you support the appeal to renew Jewish settlement throughout all of the Gaza Strip. The nation is waiting for you”— Yossi Dagan, head of the Samaria Regional Council.

Israel “should fully occupy the Gaza Strip”— Heritage Minister Amichai Eliyahu, of the far-right Otzma Yehudit party.

An Israeli real estate firm pushes to build settlements for Israelis in Gaza. “Wake up, a beach house is not a dream” reads the ad.

Israeli Knesset member Limor Son Har Melech posted a video of herself in a boat with other settlers off the coast of Gaza. “Settlement in every part of the Gaza Strip … A large, extensive settlement without fear, without hesitation, without humiliation. This land is the land that the creator of the world gave to us.”

Israeli Settler, Daniella Weiss says Palestinians who live in Gaza, have no right to stay in Gaza.

An Israeli soldier saying that Israelis should start “investing” in Khan Younis.

Also why would the words of Ben Gvir not count? He is an elected minister, his words hold weight and they expose Israel’s clear intent to make Gaza inhabitable for Palestinians so that Israelis could settle in there— by destroying the infrastructures, making the health system collapse entirely, bombing entire residential neighborhood, Israel is trying to ensure that Palestinians wouldn't be able to return back to their land, because there is nothing livable left there.

And I'm glad you bring up all of this ending if the hostages were returned— Hamas tried to strike up a deal for the return of ALL the hostages, in exchange of the release of all Palestinian prisoners. Israel refused. You know why? Because this has never been about hostages and their safety for Israel.

There is a reason why Israel shot its own hostages when it mistook them for Palestinian civilians, waving a white cloth. There is a reason why the IDF called to shoot indiscriminately on Oct. 7, knowing that it could kill some of the hostages too. Because Israel wants to kill Palestinians, to "thin out its population" (or maybe we shouldn't take into account the says and actions of Netanyahu too ://). This is why it targets schools and mosques and hospitals and ambulances and refugee camps. Israel knows that if it does get all its hostages back, then there would be nothing to “justify” its genocide in Gaza (although, as UN Secretary-General said : "Nothing can justify the collective punishment of the Palestinian people. The humanitarian situation in Gaza is beyond words")

Israel is the only reason why the hostages aren't fred yet. THEY are unwilling to negotiate the return because they don't want to stop this genocide. What good is a five days ceasefire only for the bombings to return? Do you even realize how psychologically traumatizing it is to have a countdown of when your massacre would resume? The only acceptable deal is for Israel to establish a permanent ceasefire, something that it refuses to do. The only one to blame is Israel.

And you say Israelis would instigate a coup to oust Netanyahu, that's nice, then what? Will you return the land to its rightful people? Will you give back Palestinians their rights unequivocally? Will you call for the dismantlement of Israel that was built on massacres? The reason why Israelis are angry at Netanyahu is rooted in the unresolved hostage situation. Just because you don't support Netanyahu doesn't mean that you aren't a zionist who finds the murder of more than twenty thousands Palestinians justifiable. A young girl had her leg amputated with no anesthesia on the kitchen counter of her home and you talk about “Israel being a bull in a China shop”? You consider the targeted attacks on civilians as careless actions by Israel? It actually astonishes me how inhumane some of you can be.

And here is what Dr. Refaat, who was targeted and murdered by the IDF btw, had to say about this matter:

Whether it's Netanyahu or someone else, it does not matter because Israel as a whole is an occupation, one built on the bloodshed of palestinians.

And it is funny how you choose to distort history whichever way you like it, to regard October 7th as an isolated instance that happened out of the blue. Hamas didn't start anything, Hamas was created in response to the indiscriminate and careless shooting of palestinian civilians in the first Intifada, that was decades ago. October 7th was a resistance to an ongoing colonization, Israel started this when it displaced and murdered palestinians on 1948. None of this would've happened if Israel did not colonize Palestine. It has been 100 days of this ongoing genocide, wake up and stop deluding yourself into a reality where Israel is the victim.

#dismissing Ben Gvir's statements#(yes i know who it is thank you for your concern)#then diluting this genocide into a mere matter of “hamas should return the hostages”#it must feel nice to change up the narrative so you'd be able to sleep nicely at night#and not take into account the statements that disturb you#but thanks for thinking im loveable! you are right on that point#maybe there is still hope left for you then#free palestine#palestine#gaza#free gaza

4K notes

·

View notes

Text

7 Tips To Recession Proof Real Estate Investing

Real estate generally shifts from seller's to buyer's market during a recession, so investing in real estate is an excellent option. Many people sell their homes at a lower price during recessions.

#recession-proof real estate investing#how to make money in real estate during a recession#is industrial real estate recession-proof#recession impact on commercial real estate#is real estate a good hedge against recession#recession impact on real estate#commercial property recession#recession real estate#recession-proof investing

0 notes

Text

What Questions To Ask When You Find A Property Agent?

If you are looking to buy or sell a property, navigating the real estate market on your own can be a daunting task. That's why many investors find property agent for help. Property agents can help you find properties that match your needs and budget, negotiate deals, and handle the paperwork involved in buying or selling a property. However, not all property agents are created equal, and it's essential to ask the right questions before deciding to work with one.

Top Questions To Ask When You Find Property Agent

By asking the right questions, you can easily ensure that you are working with a reputable and experienced agent who can help you achieve your real estate goals. So, if you want to know what questions to ask when you find property agent, continue reading to know more!

1. What Is Your Experience As A Real Estate Agent?

It is necessary to ask about the agent's experience to understand their level of expertise in the industry. You can ask questions like "How long have you been working as a real estate agent?" or "How many successful transactions have you completed?"

2. What Types Of Properties Do You Specialize In?

Knowing the agent's area of expertise will help you determine if they are a good match for your needs. You can ask questions like "What types of properties do you typically work with?" or "Do you have experience with the type of property I am looking for?" Or you can also ask them about good investment properties in Florida.

3. How Many Clients Do You Currently Have?

This question will give you an idea of the agent's workload and availability. You can ask questions like "How many clients are you currently working with?" or "How many properties are you currently managing?"

4. What Is Your Approach To Finding The Right Property For Your Clients?

Understanding the agent's approach to finding the right property can help determine if their process aligns with your needs. You can ask questions like "How do you determine what properties to show your clients?" or "What criteria do you use to match properties to your client's needs?"

5. How Do You Stay Up-To-Date On Market Trends And Property Values?

It is necessary to work with an agent who is knowledgeable about the current market conditions. You can ask questions like "What resources do you use to stay up-to-date on market trends?" or "How do you stay informed about changes in property values?"

6. How Do You Communicate With Your Clients, And What Is Your Availability?

Communication is key in any business relationship, so try to know how your agent will keep you updated. Therefore, when you find property agent, you can ask questions like "How often will you communicate with me?" or "What is the best way to get in touch with you?"

7. What Is Your Commission Rate And How Is It Calculated?

Understand the agent's commission rate upfront to avoid any surprises later. You can ask queries like "What is your commission rate?" or "How is your commission rate calculated?"

Connect With The Right Property Agents Today!

It's always the best idea to do your due diligence before working with any property agent. However, if you're looking for a reputable and experienced property agent, consider contacting Peay Wealth Investments. With their expertise in Florida investment real estate, they can help you find properties that match your needs and budget, negotiate deals, and handle the detailed paperwork involved in buying or selling a property.

1 note

·

View note

Text

Foreclosed House in Lexberville Subdivision, Baguio City

📍 Lots 4, 5, & 6 Block 7 Carnation Street, Lexberville Subdivision, Brgy. Sto. Tomas Proper, Baguio City

Property Features

TYPE: 3-story House📐 Lot: 159.00 square meters | Floor: 373.00 square meters✅ AS-IS-WHERE-IS Basis✅ Complete property documents

Terms:

✅ Option 1 CASH10% initial upon submission of offer90% payable within 30 days of approval

✅ Option 2 INSTALLMENT10% initial upon…

#Baguio City#baguio city real estate investment#baguio condominium#baguio house for sale#bank foreclosed#brand new house and lot for sale in baguio city#Broker JM#Condominium#find foreclosed homes#FORECLOSED#foreclosed homes#foreclosed house and lot#Foreclosed Properties#Foreclosed Property#house and lot for sale in baguio city#house and lot for sale in baguio city 2022#house for sale in baguio#how to get a good house in foreclosed properties#jm listings#jm real estate

0 notes

Text

Best Real Estate And Best Property Management - Naples Vibe Realty

Naples Vibe Realty has extensive expertise in real estate as well as property management, They have minimal charges which makes them the best asset management provider in USA. Contact our sales experts to discuss your requirement. Click on the link for details: https://naplesviberealty.com/about-us/

Follow Us: Facebook:https://www.facebook.com/groups/1852956518123638GMB:- https://goo.gl/maps/4U2HNKqq3DA1saZR9

#Best Property Management#Best Real Estate near Me#Cheap Houses for Sale in Usa#Cheap Apartments for Rent Naples Fl#Best Way to Buy Rental Property#Rental Property Good Investment

0 notes