#gst data

Explore tagged Tumblr posts

Text

Unlock Career Opportunities by Joining the Best GST Course in Noida at GVT Academy

Looking to kickstart or upskill your career in taxation? At GVT Academy, our Best GST Course in Noida is designed with real industry challenges in mind, ensuring practical and job-ready training. This course is perfect for students, professionals, and business owners who want to gain hands-on knowledge of Goods and Services Tax and become job-ready.

Why Choose GVT Academy?

✅ Comprehensive Curriculum – Learn everything from GST Basics, ITC, Registration, Returns, and E-Way Bill to advanced concepts like Audit, Refunds, TDS, and E-commerce taxation. ✅ Real-time Practical Training – File real client data on GST Portal, Tally, and BUSY software with expert guidance. ✅ Includes Income Tax & TDS Modules – Understand personal taxation, ITR filing, TDS returns, exemptions, and much more. ✅ Exclusive Tally + BUSY Training – Learn to generate GSTR reports, TDS returns, and balance sheets directly in accounting software. ✅ Finalization & Banking Module – Gain advanced skills in balance sheet creation, CMA data, project reports, and tax planning.

Learn from experienced faculty and get certified training that enhances your resume and boosts your career growth!

Flexible Timings: 📌 Weekday and Weekend Batches Available 📌 Morning and Afternoon Slots

Join GVT Academy today and become a certified GST expert! Limited Seats – Book Your Spot Now!

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#e accounting#data analytics#advanced excel training#data science#python#sql course#advanced excel training institute in noida#best powerbi course#power bi#advanced excel

0 notes

Text

1 note

·

View note

Text

What to consider when selecting reconciliation software? Why Businesses Need Reconciliation Software

Reconciliation is a critical financial process that ensures accuracy by matching internal records with external statements, such as bank transactions, supplier invoices, and customer payments. Without proper reconciliation, businesses risk financial misstatements, fraud, and compliance issues.

To streamline this process, companies rely on reconciliation software, which automates transaction matching, detects errors, and ensures data accuracy. By reducing manual effort, businesses save time, enhance compliance, and maintain financial transparency.

Types of Reconciliation

Bank Reconciliation: Matches internal cash records with bank statements to prevent errors.

Vendor Reconciliation: Ensures payments align with supplier invoices.

Customer Reconciliation: Verifies that all payments are correctly recorded.

Intercompany Reconciliation: Ensures consistency across subsidiaries.

Payroll Reconciliation: Confirms payroll transactions match records.

General Ledger Reconciliation: Validates financial transactions for accurate reporting.

Choosing the Right Reconciliation Software

Selecting reconciliation software involves considering compatibility with existing tools, scalability for business growth, automation capabilities, and compliance with financial regulations. Features like real-time processing, fraud detection, and multi-currency support can further enhance financial control.

How Automation Simplifies Reconciliation

Manual reconciliation is time-consuming and error-prone. Automation speeds up transaction matching, reduces human errors, improves compliance, and enhances fraud detection. It ensures businesses are always audit-ready while cutting costs and increasing efficiency.

To read the full article, click on the link here.

#business intelligence software#bi tool#bisolution#businessintelligence#bicxo#data#business solutions#business intelligence#businessefficiency#reconciliation#gst reconciliation software#reconciliation software#software#India

0 notes

Text

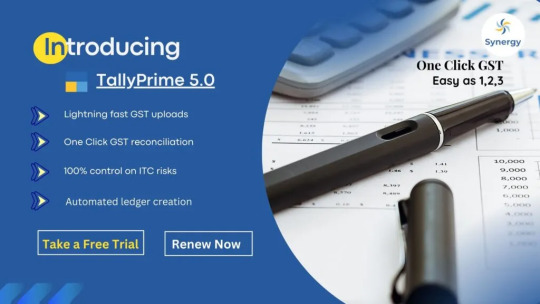

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

Government Monitors GST E-Way Bills Analytics in Real Time Amid Demand Surge

In response to an unexpected surge in demand for certain goods and services, the Election Commission of India announced on March 16 that the government is closely monitoring Goods and Services Tax (GST) e-way bills analytics in real time. “GST e-way bills analytics will be tracked real time to track unusual spikes seen in the demand for some goods and services,” stated Chief Election…

View On WordPress

#Business-to-Business#compliance#Data Privacy#Demand Surge#E-Way Bills#Election Commission#Goods and Services Tax#Government#gst#Insights#Market Trends#Real Time Monitoring#Regulatory Considerations#Supply Chain Optimization#Tax Compliance

0 notes

Text

US IRS chief quits after immigration data-sharing deal 👇

https://www.reuters.com/world/us/us-irs-chief-quit-over-deal-share-data-with-immigration-officials-report-says-2025-04-08/

Accounts Receivable Tax

Airline surcharge tax

Airline Fuel Tax

Airport Maintenance Tax

Building Permit Tax

Cigarette Tax

Cooking Tax

Corporate Income Tax

Goods and Services Tax (GST)

Death Tax

Driving Permit Tax

Environmental Tax (Fee)

Excise Taxes

Income Tax

Fishing License Tax

Food License Tax

Petrol Tax (too much per litre)

Gross Receipts Tax

Health Tax

Heating Tax

Inheritance Tax

Interest Tax

Lighting Tax

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Mortgage Tax

Pension Tax

Personal Income Tax

Property Tax

Poverty Tax

Prescription Drug Tax

Real Estate Tax

Recreational Vehicle Tax

Retail Sales Tax

Service Charge Tax

School Tax

Telephone Tax

Value Added Tax

Vehicle License Registration Tax

Vehicle Sales Tax

Water Tax

Workers Compensation Tax

Tax (VAT) on Tax.

And Now they want to add Carbon Tax!

Not one of these taxes existed 100 years ago and nations still functioned and the middle class was much larger and mums could stay at home to raise their kids if they wanted.

We are free range animals in a tax farm. 🤔

#pay attention#educate yourselves#educate yourself#reeducate yourselves#knowledge is power#reeducate yourself#think about it#think for yourselves#think for yourself#do your homework#do your own research#do your research#do some research#ask yourself questions#question everything#government corruption#government lies#government secrets#truth be told#lies exposed#evil lives here#taxes#irs#news

119 notes

·

View notes

Note

Shinigami worked very hard on her data collection. @tmnt-fandom-family-reunion (cabin 3)

"..."

That.

Was not concerning. Not a little bit.

...Why was their counterpart a zombie? As much as Leo loved the hair he couldn't help but wonder what happened. Did they gst hurt? Were they experimented on? Was that something Leo had to look out for now?

"Are they... alright?"

@tmnt-fandom-family-reunion

#The Leo's are a bit concerned qwq#tmnt#rottmnt#teenage mutant ninja turtles#rise of the teenage mutant ninja turtles#tmnt fandom family reunion#the wrong side of the portal#cabin 10#cabin 3#tmnt ffr science fair event#rottmnt leo#tmnt leo 2012

22 notes

·

View notes

Text

Gabriel - WOLVES ON ICE

Location: Northern Boreal Zone, 300 km Northwest of Castle Erebor

Time: 04:52 GST, 20 September 3153

Operation: Final readiness drill—Joint Winter Warfare Exercise

The forests of Merdengard lay silent and ghostly beneath a blanket of snow, ancient conifers stretching like pale sentinels into the twilight sky. The dawn was still a whispered promise; stars lingered stubbornly above the horizon as if reluctant to cede ground to daybreak.

Hidden among the towering trees, nearly invisible beneath patterned layers of white and frost-blue camo, over five hundred BattleMechs moved with cautious, methodical purpose.

Inside the cockpit of his Kodiak, named Mánagarmr, Generalleutnant Margrave Gabriel Bisclavret von Thiess III keyed his comm, his deep voice rumbling calmly across the encrypted channel reserved for command officers.

"All units, this is Generalleutnant von Thiess. Stand by for exercise commencement. Confirm readiness."

Across dozens of comm channels, responses rolled back swiftly and clearly.

"Sixth Royals confirm, Generalleutnant," came Generalfeldmarschall Olivia von Arnsburg's authoritative tone, sharp and unwavering from inside her massive tripod Ares, named Fenrir’s Judgement. Her cerulean eyes flicked across sensor readouts, calm and calculating. "All battalions report green. Awaiting your command."

"Merdengard MTM Regiment is green across the board," replied Generalleutnant Markus Elst crisply. "Standing by."

Star Colonel Ze'ev Winson did not open his eyes—he had no need. Cocooned inside a sensory cradle, encased in his specialized suit of Elemental interface armor, he was one with his Skinwalker II. With enhanced imaging implants blazing softly against his pale skin, the heavy 'Mech’s sensors became his senses—its pulse laser barrels his hands, its armor plates his skin.

The line between warrior and machine was a dream—soft, pliable, indistinct.

"The Omega Provisional Cluster stands ready," Ze'ev's voice murmured, as even and regal as ever, though his lips barely moved inside the interface harness. "My warriors hunger for battle—even if it is only a simulation."

Gabriel acknowledged all, then switched smoothly to their private, intimate comm frequency.

"Everyone holding up well?" His voice softened imperceptibly, losing its martial edge.

"Nothing like cold morning air and imminent simulated carnage," came the wry reply from Leutnant Anika Dray aboard her lithe Wolfhound IIC, the famously unique Grinner – technically, it was Gabriel’s personal ‘Mech, but he had the sense to recognize it was best used as a combat asset, not a hangar queen. Her 'Mech shifted its weight from foot to foot, as eager and restless as its pilot. "Beats coffee."

"No, it does not," Olivia replied flatly, but her tone was touched by warmth.

From inside Gabriel’s comm suite, a voice interrupted gently. "Castle Erebor observing," Thalia Marten’s familiar voice filtered through clearly, a comforting anchor from far away. "You have my undivided attention. I will be taking notes, Gabriel. Try to impress me."

"I always do," Gabriel rumbled affectionately.

In hir Cyclops, nicknamed Bifrost, Stabshauptmann Eike Fischer adjusted a control slightly, glowing with tactical data flowing seamlessly through hir neural implants. Behind hir, Stabskorporal Kaia Erzberger sat tucked into the drone station, a cluster of tactile controls and monitors flickering with precise readiness.

"Confirming drone array ready, Margrave," Eike reported crisply, professional once more. Ze smiled faintly when Kaia’s hand brushed hir shoulder in silent, encouraging support.

Aboard Fenrir’s Judgement, Vizeleutnant Lyra Channing rapidly completed her last system checks. Her bubbly voice lit the crew channel. "Olivia, heat sinks optimal, weapons cycling beautifully. Veika?"

Oberstabsfeldwebel Veika Morr’s low voice, steady as stone, drifted down from her gunnery station. "Gauss and PPC capacitors at full readiness. All ordnance locked."

"Outstanding," Olivia murmured softly to them alone. "Your work is flawless, as always."

The brief moment of warmth ended as Gabriel’s powerful voice returned, a wave of calm authority washing over the line. "Commence Operation Snowblind. Advance to contact and execute training plan Gamma-One."

A symphony of affirmations flooded the channels as 'Mechs moved in perfect choreography through dense snow and ice-crusted forests.

From Castle Erebor’s command center, Thalia observed silently, her hands clasped behind her back, watching the holographic displays bloom with data. Her eyes lingered on the signals of her lovers. Each name a heartbeat, each heartbeat a loved one.

"Good hunting," she whispered, knowing they could not hear.

Back in the field, Gabriel watched his displays, content as the vast war machine of four separate commands rolled forward as one cohesive force.

"All elements," he intoned, voice deep and resonant, "begin combat maneuvers."

Dawn crept over the frosted forest, washing the landscape with pale shades of lavender and cold, metallic blue. Through the ghostly trees, tons of armor moved as softly as falling snowflakes—Star Colonel Ze’ev stalking forward, his motion eerily fluid, almost organic. Under the influence of the EI, he had ceased to consciously think of himself as separate from the great machine he piloted; he was his ‘Mech now—its limbs his own, its senses integrated seamlessly with his brain. Every subtle shift of armor plating, every twitch of the torso-mounted pulse lasers, felt as natural as breathing. To observers, the Skinwalker II moved effortlessly through the forest like a predator on the hunt.

A target flickered ahead—an enemy Mech from the opposing training group. Ze'ev smiled internally, the Skinwalker's targeting reticle shifting effortlessly. The opposing 'Mech pilot saw nothing, even at fifty meters. Ze'ev was the snow itself—silent, deadly, perfect camouflage in motion.

He opened a direct, private channel. "Sable, I am in position. Your move."

A soft chuckle drifted over the comm, warm and amused. "Copy that, Glowstick. Standby for chaos."

A blur of motion tore across the clearing—Grinner moving at lightning speed, jump jets flaring brightly through the mist. Her voice carried mischief. "Contact! Enemy lance in sector 3-Bravo. Marking targets."

Ze'ev felt her data tag appear instantly on his HUD. "Targets received. Thank you, Anika."

"Anytime," she purred back.

Further back, in the hulking form of his Kodiak, Gabriel keyed the main command channel. "All units, contacts at sector 3-Bravo. Execute plan Delta-Four."

Olivia responded without hesitation. "Sixth Royals, engage targets at maximum simulated range. Oberstabsfeldwebel Morr, fire pattern Sigma."

From the elevated gunner's seat in Fenrir’s Judgement, Veika's steady voice replied: "Confirmed, Generalfeldmarschall. Sigma locked, gauss up. On the way."

Veika’s whisper-soft Old German mantra floated gently across their internal comm. Olivia’s mouth curved slightly in appreciation. Veika did not miss.

"Bifrost, sensor sweep and drone advance," Gabriel ordered.

Eike’s fingers danced elegantly over hir consoles. Behind hir, Kaia bent forward, immersed in tactile drone controls, her amber eyes intent. "Deploying UAV flight now," she murmured, leaning forward so her warmth pressed lightly against Eike’s shoulder. "Scanning sectors three through six."

Eike smiled faintly. "Well done, Kaia. Good eyes."

The drones launched smoothly from Bifrost’s dorsal pods, gliding gracefully above the trees, relaying visual data streams directly into Kaia’s helmet. She exhaled softly, feeling the gentle thrill of connection—the birds were her senses now, her extended hands and eyes.

"Multiple OpFor clusters identified," Kaia confirmed calmly. "Sending tactical overlays to all units."

At Castle Erebor, Thalia watched the data streams blend effortlessly onto the main holotank. Her heart swelled quietly with pride.

Ze'ev took Kaia’s data, weaving it instinctively into his own view. He shifted silently through a gap in the trees, almost invisible, pulse lasers aligning. The Skinwalker’s torso twisted gracefully, fluid and predatory—exactly mirroring Ze'ev’s subtle body movements.

A perfect extension of himself.

A brilliant volley of simulated energy pulses flashed across the snow, tagging the enemy BattleMech with virtual hits. The target stopped dead, signal lights flashing—simulation-confirmed kill.

"Kill registered," Ze’ev murmured calmly, as if discussing the weather.

Gabriel’s voice filled his ear. "Excellent shot, Ze’ev."

"Thank you, Gabriel."

Lyra’s bubbly tone came through Olivia’s internal comm from Fenrir’s Judgement's technical station. "All systems green, Liv. Heat nominal, energy reserves optimal. And that was one sexy gauss shot, Veika."

Veika, deadpan, replied simply: "Thank you, Lyra."

Olivia allowed herself a small, fond smile at their quiet camaraderie. "Maintain focus," she said evenly. "There are still more targets."

Anika’s cheerful voice crackled back in comms. "Gabriel, I've stirred up the hive. Four hostiles in pursuit. Leading them to your position—hope you're feeling sociable."

Gabriel's rumbling chuckle resonated through everyone's speakers. "We are ready for guests, Leutnant Dray."

From behind the lines, Markus Elst’s voice broke in respectfully. "MTM Regiment deploying screening units. Confirming your perimeter secure, Margrave."

"Excellent, Markus," Gabriel acknowledged warmly.

Eike opened a private comm to Gabriel. "They are adapting quickly. Better than expected."

"They know what is at stake," Gabriel replied. "Good. We must be sharp for TOUCHDOWN."

The morning deepened, the sky brightening to a hard, crisp blue. The battlefield simulation intensified, the combined forces flowing seamlessly through drills, maneuvers, and combat scenarios that tested their limits.

In the Cyclops cockpit, Kaia’s voice was tender, intimate in Eike’s ear. "Are you enjoying yourself, love?"

Eike smiled, unseen by anyone else. "More now than ever."

In Fenrir's Judgement, Lyra laughed softly. "Liv, remind me after this to give you a proper victory kiss."

"Do not distract me, Lyra," Olivia replied—voice stern, eyes sparkling warmly.

Gabriel watched the holomap thoughtfully, a calm satisfaction settling over him. They were ready, and he was proud. His warriors—his loves—were ready for what was coming. He keyed their private polycule channel, voice low and steady, filled with quiet authority and affection.

"Well done, everyone. Now finish strong."

At last, the pale dawn had fully broken, flooding Icefall Ridge with crystalline radiance. The ridge itself—a massive, ice-glazed stone formation—rose sharply from the forest, crowned by an SLDF-built mock fortress shimmering with frost and sunlight.

Gabriel’s Kodiak paused just behind the treeline, its arctic camouflage perfectly masking its massive bulk. He studied the simulated fortress on his monitors carefully. His deep voice cut gently but firmly through command comms.

"All units, we have reached final objective: Icefall Ridge. Prepare assault formations."

A chorus of disciplined acknowledgments flowed back. His focus narrowed, assessing the disposition of friendly and opposing forces.

Olivia’s voice sounded first, calm and precise. "Sixth Royals confirm artillery simulation ready. Awaiting command to initiate suppressive barrage."

"Hold for my order," Gabriel said.

"Confirmed, Generalleutnant."

Eike’s softer tones came next, quick and composed. "Drone flights confirm enemy strength and positioning. Uploading now."

Instantly, detailed tactical overlays appeared on Gabriel’s holomap. He nodded slightly in satisfaction. "Exceptional work."

Inside Bifrost’s cockpit, Eike turned slightly and squeezed Kaia’s hand. "Well done, Kaia."

Kaia leaned forward warmly. "My pleasure. I have your back, love."

Ze’ev’s Skinwalker II paused effortlessly, seemingly melting into the pale woodland backdrop. Within his EI harness, Ze'ev breathed slowly, feeling every centimeter of terrain, every pulse of his ‘Mech’s lasers as extensions of his own being.

"Gabriel," Ze’ev murmured gently over their private channel, "The Omega Cluster is positioned for a flanking assault. Awaiting your order."

Gabriel smiled softly at the familiar voice. "Stand ready, Ze’ev."

Anika’s Wolfhound crouched nearby, sleek and poised for motion. "Gabriel, I’m good to go," she teased lightly. "Say the word and they’ll never see me coming."

"Patience, Anika," Gabriel chuckled gently.

In Fenrir’s Judgement, Olivia spoke evenly: "Veika, Lyra, confirm final status."

Lyra’s voice was bright, cheerful even amidst tension. "Heat and power stable, Liv. Fenrir’s ready to pounce."

Veika whispered her mantra softly, then calmly replied: "Weapons locked and steady."

Olivia inclined her head slightly. "Good. Stand ready."

Gabriel took one final breath, visualizing the battle’s flow, then opened the full command channel. "All units—commence objective assault."

Staring out of the cockpit at the enemy's defensive line, Olivia’s voice cracked sharp and clear, on a comm line to the artillery battalion in the rear: "Hateful, this is Ice Queen, fire mission, over."

"Ice Queen, this is Hateful, fire mission, out," responded the Fire Direction Center.

"Grid 347 689, over."

"Grid 347 689, out."

"'Mechs, two companies, in the open. Danger Close. ICM, over."

"'Mechs, two companies, in the open. Danger Close. ICM, out."

There was a pause of several seconds before the FDC responded: "Message to observer, T, ICM, ten rounds, target number AA 7732, over."

"Message to observer, T, ICM, ten rounds, target number AA 7732, out," echoed Olivia. Then she waited. Waited to hear the word that would announce the-

"Shot, over."

"Shot, out." Olivia imagined the thumping of the great Long Tom guns, dozens of kilometers behind her, as they sung their war-song and filled the air with cluster rounds.

Seconds ticked by.

"Splash, over." Five seconds until impact.

"Splash, out."

Five seconds later, dozens of simulated artillery submunitions exploded vividly across the ridge’s forward slope, bathing Icefall Ridge in harmless flashes of holographic fire. Olivia gauged the simulated fall of the single round.

It was perfect. She smiled.

"On target, fire for effect, over."

"On target, fire for effect, out."

"Shot, over."

"Shot, out."

"Splash, over."

"Splash, out."

Five seconds later, the entire ridgeline seemed to completely disappear under the weight of thousands of detonating submunitions.

Olivia transmitted back to the fire direction center. "End of mission, ten 'Mechs destroyed, estimate 150 additional casualties, over.”

At the moment Olivia finished her final transmission, Gabriel surged forward, his Kodiak lumbering into the open with unstoppable momentum.

"All Grenadiers, follow my advance!" he commanded, voice like thunder.

The 1st Merdengard Grenadiers, disciplined and fluid, broke cover with fierce, coordinated precision.

"Bifrost," Gabriel instructed, "Maintain sensor coverage."

Eike’s Cyclops moved steadily, protective at Gabriel’s flank. "Understood, Generalleutnant."

Kaia’s fingers glided across her interface, guiding drones high above. "Enemies scattering," she relayed calmly. "They're confused. We have an opening."

"Ze’ev, Anika—now!" Gabriel called sharply.

The Omega Provisional Cluster and Anika’s Wolfhound erupted from concealment in perfect synchronization. Ze'ev’s Skinwalker moved like a living predator, pulses of virtual laser fire cutting enemy formations into chaos. Anika darted swiftly, effortlessly weaving through simulated enemy fire, harassing heavier ‘Mechs.

Ze’ev murmured softly on their private channel, "You dance beautifully today, Anika."

"Only because I have a good partner, Glowstick," she laughed back warmly.

In Fenrir’s Judgement, Veika targeted calmly, methodically disabling enemy targets with pinpoint simulated accuracy. Lyra tracked system diagnostics, her voice singing out technical data joyfully. Olivia’s steady commands guided her forces forward, her voice crisp, authoritative, powerful.

Gabriel’s Kodiak crashed through the last enemy position at the foot of Icefall Ridge, stopping briefly to survey the fortress above. He keyed his mic again, triumphant but controlled: "Secure the ridge. Final wave—advance!"

Ze’ev’s mind and ‘Mech flowed together, effortlessly graceful, a storm of fluid steel and purpose. His Skinwalker crested the ridge first, sensors painting targets, Ze'ev dispatching them as easily as breathing.

"Suppress eastern fortifications," Olivia ordered as she lumbered the Ares forward at its somewhat stately flank speed.

"Understood," Veika answered softly, firing carefully, precisely.

Lyra laughed cheerily, relaying data: "Fenrir’s eating this up, Liv!"

Olivia’s lips curled in subtle pride. "Outstanding."

Within twenty minutes, the ridge fell silent. All simulated enemy indicators faded to neutral green. Eike exhaled softly into hir comm. "Objective secured. Bifrost confirms no active threats."

"Castle Erebor confirms successful capture," Gabriel’s voice intoned, warm with pride. "Exercise complete. Excellent work, everyone." He paused, looking down from atop Icefall Ridge, watching the dozens of reserve OPFOR 'Mechs stand down. He opened the private channel between himself and his lovers, his voice deeply tender:

"My loves, you did beautifully."

A chorus of warm, private murmurs came back instantly:

"Of course we did," Anika teased.

"Flawless," Kaia purred softly, her voice warm against Eike’s ear.

"With all of you, always," Olivia’s voice was steady, proud, intimate.

Ze’ev’s quiet voice gently joined last. "Together."

Gabriel nodded once, slowly, a quiet pride settling deep within his heart.

"Together," he echoed softly. "Always."

5 notes

·

View notes

Text

Income Tax Consultant in Delhi by VATSPK – Expert Guidance for Stress-Free Tax Filing

When it comes to handling income tax matters, having a professional by your side can make all the difference. If you’re searching for a reliable Income Tax Consultant in Delhi, VATSPK is your trusted partner for comprehensive tax planning, filing, and compliance services. With years of expertise and an in-depth understanding of Indian tax laws, VATSPK ensures your financial affairs are always in order.

Why You Need an Income Tax Consultant in Delhi

Delhi, being a bustling economic hub, witnesses complex financial activities across individuals, businesses, and startups. Filing income tax returns accurately and on time is not just a legal obligation—it’s a financial responsibility. Here’s why hiring an income tax consultant in Delhi is a smart move:

Expert Knowledge of Indian Tax Laws Tax laws can be confusing and frequently updated. VATSPK stays ahead of all changes, ensuring your filings are always accurate and compliant.

Time-Saving and Stress-Free Let professionals handle the paperwork, documentation, and communication with tax authorities while you focus on your core activities.

Avoid Penalties and Notices Mistakes in filing may lead to hefty fines or legal trouble. VATSPK ensures error-free returns and timely submissions to protect you from penalties.

Maximize Deductions and Benefits Whether it's HRA, investments, or business expenses—VATSPK helps you claim every deduction you are legally entitled to.

Income Tax Services Offered by VATSPK in Delhi

VATSPK provides end-to-end solutions for all your tax-related needs. Services include:

Individual Income Tax Filing Personalized ITR filing for salaried individuals, freelancers, and high-net-worth individuals.

Business Tax Filing & Consultancy Specialized tax filing for small businesses, partnerships, LLPs, and private limited companies.

Tax Planning and Advisory Legal strategies to reduce tax liabilities and optimize your financial plan.

GST Compliance & Return Filing From registration to monthly filings—complete GST support for businesses.

Representation Before Tax Authorities Assistance in case of scrutiny, reassessment, or tax notices from the Income Tax Department.

Why Choose VATSPK as Your Income Tax Consultant in Delhi?

✅ Years of Experience: A team of seasoned professionals well-versed in tax regulations and industry practices.

✅ Client-Centric Approach: Personalized solutions tailored to your income structure and goals.

✅ Affordable Pricing: Transparent pricing with no hidden charges.

✅ Confidential and Secure: 100% data privacy and ethical practices.

✅ Timely Support: Prompt responses and timely updates to keep you informed.

Who Can Benefit from VATSPK’s Income Tax Consultancy?

Salaried professionals

Freelancers and consultants

Business owners and entrepreneurs

Startups and SMEs

NRIs with income in India

Senior citizens and pensioners

Get in Touch with the Best Income Tax Consultant in Delhi

Don’t let tax season stress you out. With VATSPK’s Income Tax Consultancy in Delhi, you can be assured of peace of mind, compliance, and maximum savings. Whether you need help with tax filing, planning, or dealing with notices, the expert team at VATSPK is just a call away.

Contact VATSPK today and experience reliable, professional, and affordable tax consultancy services in Delhi.

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

2 notes

·

View notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional ��� it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Want to Become a GST Expert in 2025?

GST isn’t just a tax update—it’s a powerful boost for your career path! If you're dreaming of becoming a certified GST practitioner, tax consultant, or accounts executive, then this is your moment. Step into the world of taxation with GVT Academy’s Best GST Course in Noida — expertly crafted to make you industry-ready from day one.

🔥 What Makes Our GST Course the Best in Noida?

✅ Includes every essential concept and detail related to GST From GST basics, registration, returns, ITC, e-way bill, to refunds—our course covers ALL 174 GST sections with 100% practical implementation.

✅ Income Tax + TDS Training Included Learn to file ITRs under all heads—Salary, Business, Capital Gains & more using real offline utilities.

✅ Tally + BUSY Mastery Become a pro in GST-enabled accounting software. Gain hands-on skills in GSTR filing, reconciliation, and ledger auditing using Tally and BUSY software.

✅ Live Client Data Practice No boring theory. We train you on real data with actual return filings, so you learn exactly what the job demands.

✅ Finalization of Balance Sheet & Tax Planning Learn how to finalize books like a CA, avoid tax scrutiny, and prepare CMA/project reports to impress your future employers.

🎓 Who Should Join? Students, working accountants, tax consultants, freelancers, or anyone who wants a high-paying, future-proof career in finance.

🎯 If you're looking for the Best GST Course in Noida with a real chance at career growth, practical skills, and job opportunities, GVT Academy is where your future begins.

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#data analytics#advanced excel training#data science#python#sql course#best powerbi course#power bi#gst services

0 notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Highlighting the importance of finance and business analytics in corporate finance

How finance and business analytics revolutionize corporate finance

In the fast-paced business world, finance and business analytics have become essential tools for empowering corporate finance teams. These capabilities go beyond traditional financial management, offering actionable insights that shape strategic decisions, enhance efficiency, and fuel growth.

The Role of Business Analytics

Business analytics leverages data, statistical models, and technology to optimize financial processes. It transforms decision-making by enabling finance teams to rely on real-time insights rather than outdated reports. This data-driven approach improves forecasting accuracy, cost management, and risk mitigation. By analyzing patterns and trends, finance professionals can anticipate challenges and devise proactive strategies.

Transformative Impact on Corporate Finance

The integration of analytics into corporate finance processes elevates performance. For example, automation accelerates reporting, reduces stress, and enhances decision-making. Case studies demonstrate how companies can generate reports within minutes, streamline reconciliations, and improve cash flow management. Additionally, features like version control and audit trails ensure accuracy, accountability, and transparency in planning processes.

Driving Strategic Value

Finance and business analytics enable organizations to identify profitable investments, reduce inefficiencies, and align financial strategies with business goals. Tools like financial consolidation software simplify complex processes, allowing finance teams to focus on long-term growth and resilience.

By harnessing analytics, corporate finance evolves into a strategic powerhouse, equipping organizations to thrive in a competitive market.

To read the full article visit our website by clicking here

#business intelligence software#bi tool#bisolution#business intelligence#business solutions#businessintelligence#bicxo#data#businessefficiency#data warehouse#software#software services#epm software#gst software#analytics#services#mumbai#india

0 notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Only 10 of the 195 nations on board for the Paris Agreement have met the February 10, 2025, deadline to release their “nationally determined contributions” (NDCs). These NDCs are presented as detailed blueprints for how nations will continue cutting emissions to meet each five-year global stocktake (GST) goal. The problem is that 95% of nations have no plan in place.

The Paris Agreement began ten years and trillions of dollars ago, but no noticeable progress has been made. The United Nations admitted back in 2019 that the Paris Agreement or Accord was destined to fail. Even if every pledging nation met 100% of the UN mandates, they would still fall 2/3 short of meeting their targets. They admit that even if every country involved in those accords complied with their pledges between now and 2030, temperatures would still rise by 3 degrees Celsius by 2100. It is astonishing that nations continue to buy into this agreement that is destined to fail because the targets were created with no regard for naturally occurring weather cycles.

Yet, 195 nations agreed to continue tackling this losing battle. The GST is split into three phases: data collection, technical assessment, and consideration of outputs. Governments and climate scientists have compiled over 170,000 pages spanning over 252 hours of meetings and the final advice from the United Nations is always the same – nations are failing to meet their objectives.

Of the 10 nations who complied with the latest deadline, the US and UK were the only G7 nations to submit plans. The US submitted its plan before Donald Trump pulled out of the Paris Agreement. This is yet another example of how the US has been funding globalist initiatives.

3 notes

·

View notes