#gstr9c

Explore tagged Tumblr posts

Text

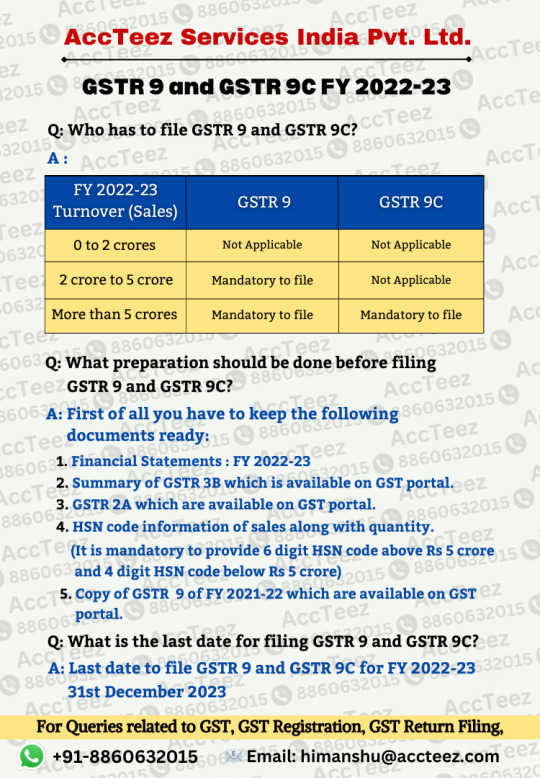

Gear up for compliance! GSTR-9 & GSTR-9C—essential annual filings for GST taxpayers. Ensure accuracy and compliance with these consolidated returns. Simplify your year-end filings with AccTeez.

📋 Contact us: +91-8860632015

#accteez#accteezindia#gstcompliance#gstr9#gstr9c#gst#tax#gstindia#taxes#itr filing#incometaxindia#gstreturns#startup#busness#faridabad#delhi#noida#gurugram#mumbai#india

1 note

·

View note

Text

GST Amnesty Schemes Extended: Relief for Non-Filers and Reporting Simplifications Continue

Title: GST Amnesty Schemes Extended: Relief for Non-Filers and Reporting Simplifications Continue Introduction In a significant move aimed at providing relief to taxpayers and simplifying compliance procedures, the GST Council has recommended the extension of several crucial amnesty schemes and relaxations. These measures, covering non-filers of certain returns, the revocation of registration…

View On WordPress

#gst#gstindiadaily#amnesty scheme#annual returns#gst amnesty schem#gstr9#gstr9c#non filing of gstr9 and gstr9c

0 notes

Video

youtube

What is GSTR 9C, Who is required to file GSTR 9C, Due date, Who are exempted from filing gstr9c

#youtube#what is gstr9c#who is required to file gstr9c#due date for filing gstr9c#who is exempted from filing gstr9c#ca devesh thakur

0 notes

Text

Online Basic GST Course: Learn from Anywhere, Anytime

GST (Goods and Services Tax) is an integral part of the Indian economy. This is why people who find the function of GST in their work must understand the fundamentals of GST. Now you can join a Basic GST course online. The online courses offer the flexibility to learn at your own pace.

Why Does A Basic GST Course Matter?

GST is the backbone of indirect taxation in India. It replaces different old taxes to simplify things. However, it is complex to understand.

To understand GST properly, joining a Basic GST course is important. It helps you understand the core concepts.

During this course, you will understand different things like what is GST and its different types, GST registration, Filing GST returns, and invoices and input tax credits.

Benefits Of Learning Basic GST Course Online:

Learn From Anywhere:

You don’t need to commute anywhere or stick to a fixed schedule. Learn GST online from the comfort of your home, anytime. Online courses ensure flexibility and convenience.

Cost-effective:

Online courses are often more affordable compared to traditional classroom courses. It saves you time and transportation charges.

Access To Expert Faculty:

Online GST courses, offered by reputed providers, are specially crafted by experienced professionals with in-depth knowledge of GST. This ensures you will learn many things and experience the difference.

Interactive learning:

Professional providers use different methods to make learning engaging. They provide you with Recorded sessions, videos, notes in PDF, interactive exercises, etc.

Choosing The Right Online Basic GST Course:

With so many online courses available, choosing the right one can make all the difference. You need to consider certain things to make your decision such as Course content, Faculty expertise, Learning platform, and Support and guidance. Read reviews and ratings of such courses.

How To Make The Most Of Your Online Learning Experience?

Set your clear learning goals

Create a study schedule

Find a dedicated study space

Participate in discussions, ask questions, and complete all assignments.

Practice regularly

Are you looking to join a Basic GST course online? Look no further! We include four courses included in this course, Gstp Exam Preparation Course, Gst Refund Course, Gst Annual Return GSTR-9/GSTR9C Course and Gst Return Filing Course. The Course covers the filing of GST1-GSTR-11 Basic to Advanced level, Preparation and computation of GST return, reply of GST Notice, covering legal aspects, major compliances, Procedure and many more. Visit www.rtsprofessionalstudy.com for more information.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#best income tax course online#basic gst course#gst filing training#basic gst course online#best income tax preparation courses#gst basic course

0 notes

Link

GSTR-9 is the GST form that has to be filed yearly through a regular assessee using all the consolidated and combined information pertaining to CGST, SGST, and IGST provided for the year. This also requires complete information of outward liability, Input Tax Credit, Interest, late fees, HSN wise total turnover, HSN wise gross turnover, etc. for the full financial year. Read more here - https://bit.ly/3IZOG1G

0 notes

Link

Recently, the CBIC had notified the Annual Return (GSTR9) and Reconciliation Statement (GSTR9C) for the Financial Year 2020-21. On 01-08-2021, both online filing and offline utility has been enabled on GSTN portal. Thus, it is the need of the hour to dissect and understand the forms (GSTR9 and GSTR9C) for the FY2020-21 to ensure hassle-free compliance and understand the implication of Self-Certification.

0 notes

Text

GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31

GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31

[ad_1]

Image Source : PTI

GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31

GSTR Filing FY19: The Central Board of Indirect Taxes & Customs (CBIC) has extended the deadline for filing GST annual returns (GSTR-9) and Reconciliation Statement (GSTR-9C) for FY 2018-19 by two months till December 31, 2020.

The government had last month extended the last date…

View On WordPress

0 notes

Photo

GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31 Image Source : PTI GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31…

#31#CBIC#Deadline#Dec#Extends#Filing#FY19#GST#GST annual returns#GST annual returns filing#GST annual returns filing last date#GSTR#GSTR9#GSTR9C#Return

0 notes

Photo

GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31 Image Source : PTI GST Return FY19: CBIC extends deadline for filing GSTR-9, GSTR-9C filing till Dec 31…

0 notes

Photo

GSTR 9C GST Audit date Whether Extended till 30/09/2020??? Yes, Both GSTR 9 (Annual Return) and GSTR 9C (GST Audit) for the year FY 2018-19 dates has been extended till 30th September, 2020 and you can file the same without late fees and penalty. Previosly, both these forms were extended till 30th June,2020.

0 notes

Video

youtube

How to file GSTR 9C Reconciliation Statement Annual Return FY 2023 24

#youtube#how to file gstr9c#how to file gstr9c reconciliation statement#how to file gst annual return#cadeveshthakur

0 notes

Text

Mastering GST Basic Course: A Comprehensive Course For Small Businesses

Understanding of the Goods and Services Tax (GST) is required for business growth and success. That’s where a GST basic course enters. It empowers you to maintain the system with confidence.

How GST Basic Course Helps Small Businesses:

Clearing Fundamentals- You will understand what GST, its purpose is and how it impacts your business. The course will make you understand terms like supply, taxable persons, and registration thresholds. You can know the core principles.

GST Framework- Delve into the GST framework. There are different tax rates like CGST and IGST and they are applied in different scenarios. It allows you to learn how to categorize your goods and services under the appropriate GST brackets. You can easily calculate the tax and compliance.

Easy Registration- GST registration is a daunting process. That’s where GST experts enter. They will guide your business and help you in the registration application flawlessly. They can make you aware of the eligibility criteria and operate the online portal. It shows the demand for GST experts in the current business market. Many small businesses hire professional GST experts to handle this task for them.

Mastering GST Invoicing- This basic GST course will delve into the fundamentals of GST invoicing. You will learn how to make compliant invoices with all the required details.

GST Returns- Filing GST returns is a stressful job. Many small businesses face challenges in completing this task, so they search for professionals. In this course, you will learn different types of returns and the online filing process. You can gather related information, complete the forms, and file the returns on behalf of a business owner. It helps business owners to avoid penalties.

Practical Applications- This basic GST course covers real-life scenarios. It provides interactive exercises and case studies to learn how to apply GST principles to handle different business situations. In addition, you will stay updated on the latest GST rules and regulations.

Benefits For Small Businesses:

You can manage your taxes efficiently. It saves time and money.

Accurate tax return filings minimize the risk of penalties and fines.

It allows you to make informed financial decisions for your business.

It improves business efficiency

Moreover, having a solid understanding of GST can be a game-changer for small businesses. Take control of your tax compliance.

Looking to pursue a GST basic course? We are your right stop. There are four courses included in this course, Gstp Exam Preparation Course, Gst Refund Course, Gst Annual Return GSTR-9/GSTR9C Course and Gst Return Filing Course. The Course covers the filing of GST1-GSTR-11 Basic to Advanced level, Preparation and computation of GST return, reply of GST Notice, covering legal aspects, major compliances, Procedure and many more.Learn more at www.rtsprofessionalstudy.com.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#gst filing training#basic gst course online#best income tax course online#best income tax preparation courses#basic gst course#gst basic course

0 notes

Link

GSTR 9/9C Due Date Extended

0 notes

Link

In the Union Budget 2021, major changes in GSTR-9 and GSTR-9C were suggested to reduce the compliance burden and simplify the filing procedure. So, in this blog, we will try to cover all the major changes introduced in GSTR-9 and GSTR-9C. Read here - https://bit.ly/3tkLzJx

0 notes

Photo

GSTR9 Annual return filing FAQ

0 notes