#gstr 9c

Explore tagged Tumblr posts

Text

Your Guide to GSTR 9C Return Filing in Delhi

For businesses operating in Delhi with an annual turnover above ₹5 crores, GSTR 9C return filing in Delhi is a crucial compliance requirement under the GST law. This annual return acts as a reconciliation statement between your GST returns and the audited financial records, ensuring transparency and accuracy in tax reporting.

What is GSTR 9C?

GSTR 9C is an annual certified reconciliation statement that must be filed by taxpayers whose turnover exceeds ₹5 crores in a financial year. It is designed to reconcile the details declared in GSTR 9 (Annual Return) with the figures in the audited accounts.

This form requires certification from a Chartered Accountant or Cost Accountant, making it a key document for tax authorities to verify the accuracy of GST compliance.

Who Should File GSTR 9C in Delhi?

Every GST-registered business in Delhi with turnover more than ₹5 crores must file GSTR 9C. This includes companies, partnerships, LLPs, and proprietors.

Given Delhi’s bustling commercial environment, ensuring timely GSTR 9C return filing in Delhi helps businesses avoid penalties and remain compliant with GST regulations.

Key Sections of the GSTR 9C Form

Reconciliation Statement: This section matches the figures between the GST annual return and audited financial statements.

Certification: A CA or Cost Accountant must certify the accuracy of this reconciliation.

This helps tax authorities identify inconsistencies and maintain trust in the GST system.

Why Timely Filing is Essential in Delhi

Delhi’s tax department actively monitors GST compliance. Delays or inaccuracies in filing GSTR 9C return in Delhi can lead to penalties, increased scrutiny, or audit notices.

Timely filing demonstrates your commitment to compliance and fosters trust with both the government and your business partners.

Common Filing Mistakes to Avoid

Failing to reconcile GSTR 9 with audited accounts properly.

Missing certification from a qualified professional.

Late submission beyond the due date.

Insufficient documentation for reconciliation.

Steps to File GSTR 9C in Delhi

Gather your financial and GST return data.

Perform detailed reconciliation between your GST returns and audited accounts.

Prepare the GSTR 9C form either via GST software or with a professional’s help.

Get the form certified by a Chartered Accountant or Cost Accountant.

Upload and file the return on the GST portal using your digital signature.

Many businesses in Delhi opt to work with GST consultants to ensure an error-free filing process.

Conclusion

Complying with GSTR 9C return filing in Delhi is critical for businesses with turnover above ₹5 crores. It ensures regulatory compliance, avoids penalties, and strengthens your business reputation. Stay proactive with your filings and consider professional assistance to navigate the complexities of GST return filing smoothly.

0 notes

Text

Expert GSTR-9C Late Fee Waiver Guide: Key Dates & Eligibility

Struggling with GSTR-9C filing? Taxgoal’s GST Return Filing Services in Delhi offers expert guidance on GSTR-9C late fee waivers. Learn the key dates, eligibility criteria, and step-by-step instructions for filing your GST return. Stay compliant and save on penalties with our efficient, hassle-free services. Contact us (+91 9138531153) today for GST Return Filing Services Near Me.

#Taxgoal#GSTR-9C#GSTReturnFiling#LateFeeWaiver#FilingGuide#KeyDates#Eligibility#GSTCompliance#DelhiGSTServices#TaxFiling#GSTR-9CLateFee

0 notes

Text

Year End Compliance: Complete These Important Tasks Till 31 December 2024

Year End Compliance: Complete These Important Tasks Till 31 December 2024 Year End Compliance: The year 2024 is about to end and the new year 2025 will begin in some days. The end days of 2024 are very special, because deadline for completing some important tasks is going to end on 31 December 2024. These include tasks from ITR to savings schemes. (1.) The Income Tax Department started the…

0 notes

Text

In this blog, we’ll break down why filing GST returns is a big deal and explore the forms you need to know. Think of it as your guide to navigating the tax world without getting lost in the paperwork. Stick around, and we’ll make sure it’s all crystal clear!

#GSTR-9C#GSTR-2#GSTR-6#GSTR-3#GSTR-5#GST return forms#Tax declaration forms#Form GSTR-9#Form GSTR-4#Tax return paperwork

1 note

·

View note

Text

GST Accountants in Delhi by SC Bhagat & Co.

Are you looking for trusted GST accountants in Delhi to manage your tax compliance and GST filings seamlessly? Look no further than SC Bhagat & Co., a renowned chartered accountancy firm with decades of experience in delivering precise, professional, and timely GST solutions for businesses of all sizes.

Why GST Accounting Matters

Since the implementation of the Goods and Services Tax (GST) in India, businesses have had to adapt to a unified indirect tax regime. Navigating the GST system involves multiple tasks including:

GST registration

Timely GST return filings (GSTR-1, GSTR-3B, GSTR-9, etc.)

Input Tax Credit (ITC) reconciliation

E-way bill and e-invoice compliance

GST audit and annual return preparation

Dealing with notices from GST authorities

To handle all these effectively, having a reliable and knowledgeable GST accountant becomes crucial.

GST Services Offered by SC Bhagat & Co.

At SC Bhagat & Co., we provide end-to-end GST services tailored to your business requirements. Our experienced team of GST accountants in Delhi ensures that your compliance is error-free, timely, and in line with the latest amendments.

1. GST Registration & Advisory

We help new businesses get GST registration quickly and offer consulting on applicable tax structures.

2. Monthly/Quarterly GST Filing

Our team ensures accurate and timely submission of GSTR-1, GSTR-3B, and other applicable forms to avoid penalties.

3. Input Tax Credit (ITC) Optimization

We conduct ITC audits and help you maximize your credit claims with proper reconciliation.

4. GST Audit & Annual Return

We assist with GSTR-9 and GSTR-9C filings and conduct GST audits as per legal mandates.

5. Handling GST Notices

Have you received a GST notice? Our team responds to GST queries and notices with complete documentation support.

6. Industry-Specific GST Solutions

Whether you're in e-commerce, manufacturing, real estate, or services—our accountants are equipped with domain-specific GST knowledge.

Why Choose SC Bhagat & Co.?

✔ Over 20 Years of Experience ✔ Registered Chartered Accountants with In-Depth GST Knowledge ✔ PAN-India Clientele ✔ Transparent Pricing & Customized Packages ✔ Dedicated Support for SMEs and Startups

We pride ourselves on providing accurate, timely, and ethical GST accounting services in Delhi. Our goal is to help you stay compliant while you focus on growing your business.

Who Needs GST Accounting Services?

Startups and new businesses

Small and Medium Enterprises (SMEs)

E-commerce sellers

Exporters & Importers

Service providers with interstate operations

Any business with GST obligations

Get in Touch with the Best GST Accountants in Delhi

If you’re seeking reliable GST accountants in Delhi, connect with SC Bhagat & Co. for a free consultation. Whether you need help with monthly filings, audits, or notice handling, we ensure hassle-free compliance and peace of mind.

Let SC Bhagat & Co. be your trusted partner for GST compliance!

FAQs

Q1: Do I need a GST accountant even if I file returns online myself? Yes. A professional accountant ensures accuracy, maximizes your ITC, and avoids legal penalties.

Q2: How often do I need to file GST returns? Generally, GST returns are filed monthly (GSTR-1, GSTR-3B) and annually (GSTR-9, GSTR-9C).

Q3: What happens if I miss a GST return deadline? You may face interest and late fees. Our accountants help you stay on track and avoid such situations.

Boost your tax compliance and save time with SC Bhagat & Co.—the top GST accountants in Delhi.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

4 notes

·

View notes

Text

Understanding Company Audit in India: A Detailed Insight

Company seal matters, as does the audited report of a company’s financials.

When it comes to running a company in India, financial discipline is a legal necessity. One of the most crucial steps in this direction is conducting a company audit. Whether you’re a startup founder, a growing private limited firm, or a large public entity, audit requirements are built into the framework of Indian corporate law.

In this blog, I’ll break down the purpose, types, and legal obligations surrounding company audits in India—and help you understand when and how you should act to stay compliant.

What Is a Company Audit?

In simple terms, a company audit is a structured examination of a company’s financial records and operational controls. The goal is to confirm whether the financial statements reflect a true and fair view of the company’s performance and position.

But an audit is not limited to just numbers. Depending on the type of audit, it also evaluates internal processes, legal compliance, cost records, tax filings, and more.

Who Needs to Get Audited in India?

Under the Companies Act, 2013, every registered company—whether private, public, or listed—is required to undergo a statutory audit, regardless of its size, profit, or turnover.

In addition to the statutory requirement, businesses may also fall under audit obligations under other laws, such as:

Income Tax Act, 1961 (for tax audits)

GST Act, 2017 (for GST reconciliation)

SEBI regulations (for listed companies)

Cost and Works Accountants Act, 1959 (for cost audits)

Companies (Accounts) Rules, 2014 (for internal audits)

Key Types of Company Audits in India

1. Statutory Audit

This is the mandatory audit prescribed by the Companies Act. Its objective is to ensure that the company’s financial statements are accurate and comply with applicable accounting standards.

Applicable to: All companies (private/public/listed)

Conducted by: Independent Chartered Accountant (CA) or CA firm

Submission: Auditor's report is presented to the shareholders and filed with the Registrar of Companies (ROC)

Even if your company has no revenue or is incurring losses, this audit must be done annually.

2. Tax Audit

This is governed by Section 44AB of the Income Tax Act. A tax audit is triggered when:

Business turnover exceeds ₹10 crore (₹1 crore if cash transactions exceed 5%)

Professional receipts exceed ₹50 lakh

A business opts for presumptive taxation but declares lower-than-expected profits

The auditor examines whether books of account are properly maintained and income tax laws are being followed.

Forms Used: 3CA/3CB and 3CD

Due Date: Typically October 31 of the assessment year

3. Internal Audit

Unlike statutory audits, internal audits focus more on risk control, governance, and process improvement. These are generally done at the management’s discretion, though some companies are legally required to conduct them.

Mandatory for listed companies and unlisted public companies with turnover > ₹200 crore or loans > ₹100 crore

Private companies with turnover > ₹200 crore or borrowings > ₹100 crore

The internal auditor could be an in-house team or an external professional.

4. Cost Audit

This audit applies to companies engaged in specified manufacturing or service activities. If your turnover exceeds the limits set under the Companies (Cost Records and Audit) Rules, 2014, and your industry falls under the prescribed tables (3A/3B), cost audit becomes mandatory.

Conducted by: Practicing Cost Accountant

Purpose: To evaluate cost structures and ensure pricing decisions are based on accurate data

Report: Filed with the Board and submitted to the Central Government

5. GST Audit

With the introduction of the Goods and Services Tax, companies must now reconcile their GST filings with their annual financials. Businesses with turnover above ₹5 crore must file GSTR-9 (annual return) and GSTR-9C (reconciliation statement)—self-certified by the company.

Though earlier a GST audit by a CA/CMA was mandatory, post-2021, companies now self-certify these returns.

Still, many businesses continue to seek professional support to avoid mismatches, penalties, and scrutiny.

6. Secretarial Audit

Applicable to:

All listed companies

Public companies with:

Paid-up capital ≥ ₹50 crore or

Turnover ≥ ₹250 crore

This audit checks compliance with various corporate laws (like SEBI regulations, board processes, labor laws) and is conducted by a practicing Company Secretary (CS). The findings are reported in Form MR-3.

Why Company Audits Matter

Beyond legal obligation, here’s why audits should never be taken lightly:

Detect fraud and irregularities early

Build trust with investors, lenders, and partners

Improve operational control

Comply with government and taxation norms

Avoid penalties and reputational damage

Looking for Company Audit Services in Gurgaon?

At our practice, led by CA Sujeet Choudhary, we help businesses of all sizes meet their audit obligations with clarity and confidence.

Whether you're preparing for your first statutory audit or require support for GST or internal audits, our firm brings:

Precision in compliance

Guidance tailored to your business structure

Transparent communication

And most importantly, a practical, no-fluff approach to auditing

Audit compliance in India isn’t just about ticking legal boxes—it’s about building a financially responsible and future-ready business. If your company operates in or around Gurgaon and you're seeking experienced, ethical, and practical audit support, we’re here to help.

Reach out today for trusted Company Audit Services in Gurgaon and Delhi NCR, India.

0 notes

Text

GST Annual Return Filing in Bangalore – File Your GSTR-9 Hassle-Free

Goods and Services Tax (GST) is a crucial tax system in India. Businesses must file annual returns to ensure compliance. In Bangalore, businesses registered under GST must file their annual returns accurately and on time to avoid penalties.

Who Needs to File GST Annual Returns?

All businesses registered under GST, except small taxpayers under the Composition Scheme, are required to file annual returns. This includes:

Regular taxpayers filing GSTR-1 and GSTR-3B

Businesses with an annual turnover exceeding the prescribed limit

E-commerce operators and aggregators

Types of GST Annual Returns

GSTR-9: Applicable for regular taxpayers who file GSTR-1 and GSTR-3B.

GSTR-9A: For businesses under the Composition Scheme (not required since FY 2019-20).

GSTR-9C: A reconciliation statement and audit report for businesses with a turnover above ₹5 crore.

Due Date for GST Annual Return Filing

The due date for filing the GST annual return is 31 December of the following financial year. However, the government may extend this date in some instances.

Steps to File GST Annual Return in Bangalore

Gather Required Data: Collect details of sales, purchases, input tax credits, and tax payments.

Log in to GST Portal: Use your GSTIN and credentials to access the portal.

Select the Applicable Form: Choose GSTR-9 or GSTR-9C based on eligibility.

Fill in the Details: Ensure accuracy while entering sales, tax liabilities, and input credits.

Verify and Submit: After reviewing the details, submit the return and make any necessary tax payments.

Download the Acknowledgment: Save the confirmation for future reference.

Professional Assistance

Businesses in Bangalore can seek assistance from GST consultants and professionals to ensure accurate filing, avoid errors, and comply with GST regulations efficiently.

Conclusion

Filing GST annual returns is essential for businesses in Bangalore to maintain compliance and avoid penalties. Timely filing with accurate data ensures smooth tax management and financial transparency. Business owners should stay updated on due dates and leverage professional support for hassle-free GST filing.

0 notes

Text

Mastering GST Return Filing: A Simple Guide for Businesses in Chennai

If you're a business owner in Chennai, you've probably heard the term GST a lot. But what exactly is it, and why is everyone talking about GST return filing? Whether you run a small local shop or manage a growing enterprise. It becomes crucial to understand GST to stay compliant and avoid unnecessary penalties.

In this article, we’ll break down the process of GST return filing into simple terms and explain how availing GST filing services in Chennai can save time, reduce stress, and help your business grow.

What Is GST Return Filing and Why Does It Matter?

Goods and Services Tax (GST) is a system that combines several indirect taxes into one. If your business is registered under GST, you must regularly report your sales, purchases, and the tax you collect and pay.

This process is known as GST return filing. Think of it like a regular financial check-in with the government. Filing your returns on time makes sure:

You stay compliant with tax rules

You can claim your input tax credit (ITC)

You avoid penalties and interest

Now, with so many forms and deadlines, GST filing can feel confusing. That’s where GST return filing online in Chennai comes into the picture. Online services make it easier and faster to manage your tax obligations without leaving your desk.

Different Types of GST Returns You Should Know

There isn’t just one type of GST return. Depending on your business size and nature, you may need to file different forms. Here’s a simple breakdown:

GSTR-1: Report outward sales

GSTR-3B: Monthly summary of sales and input tax

GSTR-9: Annual return

GSTR-9C: Reconciliation statement for large businesses

Filing the correct form is important to avoid mismatches and penalties. Many small business owners in Chennai rely on professional services to help choose and file the right forms every month.

How does GST Return Filing Work?

Here’s a simple flow to understand the process:

Collect and organise your invoices, sales and purchase bills

Calculate your output tax and input tax credit

Use accounting software or consult a professional

Choose the correct GST form

Log in to the GST portal and submit your return

Pay any balance tax liability

Keep confirmation and receipts for records

With digital support, most of these steps can be automated or outsourced, saving you both time and errors.

Why Timely GST Return Filing is so Important for Your Business

Filing your GST returns on time isn’t just about avoiding penalties. Here’s what else it does:

Maintains legal compliance: Keeps your business registered and running smoothly

Helps in claiming ITC: Delayed filing can cause loss of input tax credits

Boosts your business credibility: On-time filing builds trust with partners, lenders, and clients

Improves cash flow: With regular reconciliation, you understand your tax liabilities better and plan your finances

Late filing leads to interest, fines, and sometimes even suspension of your GST registration.

Benefits of Using Professional GST Filing Services

Handling GST yourself can be overwhelming. That’s why many business owners prefer hiring professionals who offer GST filing services in Chennai. Here’s why:

Expertise in the latest tax rules

Timely filing with no missed deadlines

Accurate data handling and fewer errors

Complete support for audits and notices

A registered GST expert can make sure that all returns are filed correctly and help you in claiming full benefits under the GST regime.

Making the Most of GST Return Filing Online in Chennai

Technology has made GST compliance much simpler. Today, GST return filing online in Chennai offers a quick, transparent, and paperless way to manage taxes.

With online filing, you get:

Access to your returns from anywhere

Real-time data syncing with accounting systems

Alerts and reminders for due dates

Instant payment options and receipt generation

For beginners, online GST platforms and mobile apps have made filing accessible even without accounting knowledge. All you need is the right support.

Common Mistakes to Avoid When Filing GST Returns

Missing due dates: Leads to late fees and interest

Incorrect invoice details: Can cause rejection or mismatch

Filing wrong return types: Each form serves a different purpose

Ignoring notices: Always respond to GST queries from the authorities promptly

Avoiding these common errors is easier with a trusted advisor by your side.

Conclusion

GST return filing doesn’t have to be a stressful task. With proper planning, timely filing, and the help of professionals, you can stay compliant and worry-free. If you're a business looking for reliable support, choosing an expert can ease your compliance process.

Disclaimer: GST laws are subject to change. Please consult a qualified tax professional for updated advice related to your specific business case.

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#gst filing services in Chennai#GST Audit advisor in Chennai#tax filing consultants in Chennai#tax filing advisor in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai#Tax preparation services in chennai#Income tax filing assistance in chennai

0 notes

Text

How Many Times Do Businesses File GST Returns Annually?

GST compliance is an important part of leading an Indian company. One of the first steps towards compliance is to obtain a GST registration for companies that require a valid business address in all operating conditions. For startups and small businesses, using virtual office addresses in India can simplify this process at a high cost. Virtual offices provide legal addresses for GST registrations, allowing businesses to expand efficiently in several countries. Whether you are a service provider or an e-commerce seller, it is important to understand how often you need to submit to comply with GST returns, avoid penalties and receive input tax credits without delay. This guide explains everything small businesses need to know about GST Return Gyms.

Understanding GST Return Filing

Submitting GST returns includes regular reports of sales, purchases and tax obligations to the government. All registered taxpayers must comply with the usual or configuration scheme, planned returns. Businesses working in the state often choose GST registered virtual offices to reduce the costs of their physical infrastructure and at the same time maintain a legal business address for legal compliance. The type and frequency of GST returns vary depending on the sales, type of business, and the GST scheme you choose. Virtual office addresses in India allow you to maintain some jurisdiction. Understanding which returns apply to your company will ensure smooth tax voting and protect you from unnecessary interest or late fees.

Frequency of GST Return Filing

The frequency of filing returns depends on the type of taxpayer and annual turnover. Whether the business is operated by the physical office or using a virtual office address in India, filing returns on time is an important part of the responsibility of GST registration of the business.

3.1 General taxpayer (monthly or quarterly):- Businesses whose annual turnover is more than ₹ 5 crore has to file GSTR-1 and GSTR-3B every month-a total of 24 returns a year. Businesses with a turnover less than ₹ 5 crore can choose QRMP (Quarterly Return Monthly Payment) scheme, in which quarterly GSTR-1 and GSTR-3B is to be filed-only 8 returns in the number.

3.2 Composition Scheme taxpayers:- Small businesses whose turnover is less than ₹ 1.5 crore can choose this simple scheme. They have to file CMP-08 quarterly and GSTR-4 annually-a total of 5 filing in the number. A valid business address or virtual office address in India is mandatory for GST registration.

3.3 e-commerce operator:- Such platforms like Amazon or Flipkart have to file GSTR-8 every month-12 returns in a year. They also require the official address and valid GST registration of business.

3.4 TDS cutting taxpayers:- Government departments or companies who cut TDS under GST have to file GSTR-7 every month-12 times in Sala. A registered business address is also mandatory for this.

3.5 input service distributor (ISD):- They have to file GSTR-6 every month. Many times ISD selects the virtual office for GST registration for credit distribution in its various branches.

Whether the business is operated by physical address or from the virtual office, timely filing of returns and maintaining a valid address is essential for uninterrupted GST compliance.

Annual GST Returns

Submitting an annual GST return is an important requirement for all companies with a valid GST registration. Whether the company is operating from a traditional office or a virtual office for GST registration, it is necessary to submit punitive annual returns to avoid punishment and exam questions. Below you will find the most important points. To understand:

1. GSTR-9 Request:- All regular taxpayers must file GSD-9s each year, summarise them externally and internally, enter tax credits, and pay for tax purposes.

2. GSTR-9C for Audit:- Companies with "more than 5 crores" sales must also file a GSD-9C, a combination of settlements certified by the CA or CMA.

3. Due Date:- The usual deadline for filing GSTR-9 and GSTR-9C is December 31st, the following fiscal year.

4. Applicability to virtual offices:- Companies using virtual offices for GST registration are equally obligated to submit annual returns if registered as part of a regular system.

5. Consequences of non-violation:- Lack of registration or incorrect registration can lead to penalties, interest and communications from tax authorities.

Accurate annual submissions increase reliability and help businesses maintain clean compliance data records as part of their GST systems.

Best Practices for Timely GST Filing

Fast GST registration is extremely important for businesses to avoid punishment and ensure smooth business activities. Best practice compliance optimizes processes, promotes compliance and enhances financial health.

There are five important practices.

1. Manage accurate records and invoices:- Thoroughly document all sales, purchases and related financial transactions. Make sure your invoice is compliant with the tax rate with the correct GSTIN, HSN/SAC code and the correct GSTIN, HSN/SAC code. This forms the basic rock for accurate returns.

2. Regular adjustments:- Start sales and purchase data regularly on the GSTR-2A/2B. This allows for premature identification of early knowledge, timely revisions with suppliers/customers, and guarantees the correct claims of very important tax credits (ITCs) to reduce tax liability.

3. Understand appointments and use memory:- Be familiar with the due dates for all applicable GST returns (GSTR-1, GSTR-3B, GST-9, etc.). Set up an automated memory or compliance calendar to prevent last-minute storms and late fees.

4. Using Technology and Automation:- Use GST-compliant accounting software or submission platforms. These tools automate calculations, recognize errors, validate GSTINS, and allow direct registration that can often significantly reduce manual effort and improve accuracy.

5. Stay up to date and find professional help:- GST laws are dynamic. Continuously notify yourself and your team of new rules and changes. To ensure complex topics and comprehensive compliance, you must include a qualified GST consultant.

Implementing these practices not only ensures timely submission of GST, but also sets up a robust compliance frame, minimizing risk and driving sustainable business growth.

The Annual Return: GSTR-9 and GSTR-9C

Understanding the annual GST returns GSTR-9 and GSTR-9C is important for comprehensive compliance and provides an annual overview of the company's GST activities.

1. Here are five important points:- GSTR-9: Annual Integrated Returns: This is an annual consolidation of all monthly/quarterly GST returns (GSTR-1, GST-3B) filed during the fiscal year. It provides a comprehensive overview of outward supply, internal care, ITC and taxpayer claims. For most regular taxpayers, this is a must for certain small businesses.

2. Purpose of GST-9: The main purpose is to adjust the data registered with regular returns in the degree tested. It helps to identify inconsistencies, ensure that tax obligations are correctly rejected and that the government provides an overall view of taxpayers' annual transactions.

3. GSTR-9C: Declaration of Settlement: This is an explanation for annual sales using sales declared in GSTR-9 to be brought into the settlement in the annual statement tested. Taxes have also been adjusted, which were paid in accordance with the annual financial statements tested, with taxes paid in accordance with GSTR-9.

4. Applicability of GSTR-9C: From 2020 to 21 fiscal year, the accreditation must be certified by the taxpayer himself between the previous auditor or accountant's accountant. Taxpayers have over 5 trillion total revenue per fiscal year.

Importance and deadline: Both the GSTR-9 and GSTR-9C are extremely important to ensure the full transparency and accuracy of your GST report. The dates for filing these annual returns are typically December 31st and the fiscal year (December 31st, 2025, the fiscal year 2024-25). Timely submission is important to avoid punishment.

These annual returns complete the GST compliance cycle, provide detailed financial snapshots, and ensure adjustments between the book and submitted returns.

FAQs- GST Returns: How Often Do Businesses File?

1.How often do standard companies hire GST?

Most companies employ monthly: GSTR-1 (sales) and GSTR-3B (summary). These 24 are annual returns (GSTR-9) in addition to annual returns.

2. Can SMEs represent quarters?

Yes, companies with sales of up to 1-5 crore can choose the QRMP system by submitting quarters (four times a year) to the QRMP system, but tax payments are monthly.

3. What about the configuration scheme?

The music dealer offers CMP-08 forms to Quarterly for tax payments and annual returns. GSD-4. (5 submissions in total).

4. Is it necessary for all to receive annual returns?

Most registered taxpayers are required to submit annual returns (GSTR-9) by December 31st. ¹Companies in selling the 5 Kroll itself have also proven their GSTR-9C.

5. What is the frequency of registration?

Their annual sales and GST registration (e.g., normal composition) are the main factors that determine how often they submit.

Penalties for Late Filing

Timely GST registration is most important to avoid financial punishment and ensure smooth business. Delayed filings attract both late fees and interest costs.

For GSTR-1 and GSTR-3B, a late fee of 50 per day (20 for Nile returns) applies. This is limited based on sales (for example, up to 10,000 for high sales). Additionally, interest of 18% per year will be increased to the amount of unpaid taxes from the due date.

For annual revenue GSTR-9, you will be charged a 200 late fee per day, subject to a maximum of 0.04% of sales. If you do not submit, you can have the next return, ITC (ITC) for the recipient, which could lead to a higher general punishment. Conformers continue to prevent these financial burdens and ensure business continuity.

Conclusion

Understanding the frequency of GST return registrations is extremely important for all companies, regardless of their size or nature. Many monthly GSTR-1 and GSTR 3B applications standard for 24 annual submissions can significantly reduce this burden by submitting quarters with the QRMP system selected. Companies with GST registration as part of the configuration scheme enjoy an even easier schedule. In addition to regular submissions, the annual GSTR-9 (and the large company GSTR-9C) will consolidate this year's data. For new businesses, virtual office spaces allow you to streamline initial compliance and provide registered addresses without physical overhead. Ultimately, the number of returns depends on sales and programs, highlighting the need for accurate records and structures to ensure seamless compliance and avoid penalties.

0 notes

Text

GSTR 9: Annual GST Return

The annual return filing, known as GSTR 9, is required to be filed by every taxpayer before 31st December. This blog aims to provide a comprehensive guide to GSTR 9, helping businesses navigate through the complexities of this crucial annual return.

What is GSTR-9 annual return?

GSTR-9 is the annual return that every registered taxpayer under GST must file. It consolidates the details of all the monthly or quarterly returns filed during the financial year. The purpose of GSTR-9 is to provide a summary of the taxpayer's outward and inward supplies, tax liability, input tax credit (ITC) claimed, and other relevant details.

Who is liable to file GSTR-9, the annual return?

All taxpayers/taxable persons registered under GST must file their GSTR-9. Except:

Casual Taxpayers

Input Service Distributors

Non-resident Taxpayers

Taxpayers under composition scheme (They must file GSTR-9A)

E-commerce operators (They must file GSTR-9B)

TDS deduction or TCS collector under Section 51 or Section 52 of the CGST Act.

For FY 17-18 & 18-19, it is mandatory only if turnover exceeds Rs 2 crore.

What is the due date for filing GSTR-9?

GSTR 9 (GST Annual Return) is to be filed by 31 December of the year following the particular financial year. Accordingly, businesses should file GSTR-9 for FY 2022-23 by 31st December 2023.

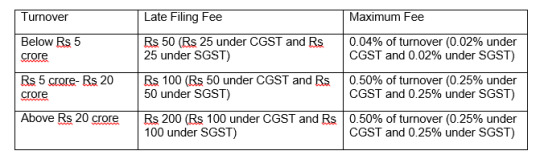

What is the late filing fee for GSTR 9?

The late filing fee for GSTR 9 has been categorized based on the turnover of the taxpayer w.e.f. FY 2022-23:

What details are required to be filled in GSTR-9?

The basic details which have to be provided in GSTR-9 are as follows:

Details of Sales with the breakup of those on which tax is payable and not payable.

Details of Purchases.

Tax payable.

Input Tax Credit available and reversed.

Details of transactions of sales and Input tax credit in the subsequent year but pertaining to the year for which return is being filed.

Besides that other details like HSN wise breakup of Sales & Purchases, Summary of Demands & Refunds, etc have to be provided.

For FY 17-18 & 18-19, some of the sections have been made optional.

Can a “NIL” GSTR-9 return be filed?

Yes, a Nil GSTR-9 can be filed if all the following conditions are satisfied:

No outward supply.

No receipt of goods/services.

No other liability to report.

Not claimed any credit.

No refund claimed.

No demand order received.

No late fees to be paid.

If the figure has to be reported in any of these, nil return cannot be filed.

How Web-GST simplifies your GST filing?

Web-GST is an across the board GST software that simplifies your GST return filing experience with useful tools & insightful reports.

No outward supply. Desktop-based Solution with 100% Data Security.

Easy & Prompt way to prepare & file GSTR 1, 3B, 9, & 9C etc.

Download GSTR-2A in one-click for the whole financial year or YTD.

Automatically identifies data mismatches for GST compliance.

Claim 100% accurate ITC with the Advanced Matching Tool.

Track GST Returns Filing Status on a single dashboard.

Experience Seamless Integration with ERPs and GSTN (Premium version).

1 note

·

View note

Text

GST Consultant

What is GST and Why It Matters

Goods and Services Tax (GST), introduced on 1 July 2017, is India’s most significant indirect tax reform. It merged various state and central taxes like VAT, excise duty, and service tax into a single system, with the aim of simplifying compliance and fostering a unified market across India.

GST is essential for businesses because it:

Eliminates the cascading effect of taxes

Facilitates seamless input credit

Reduces complexities in inter-state transactions

Increases transparency and compliance

🧩 Applicability: Who Must Register?

GST registration is required in the following scenarios:

1. Mandatory Registration

Turnover exceeds ₹20 lakhs (₹10 lakhs for some states)

Inter-state supply of goods/services

Selling through e-commerce platforms

Casual taxable persons or non-resident suppliers

Businesses liable under the Reverse Charge Mechanism (RCM)

2. Voluntary Registration

Even if not mandatory, businesses often register for GST to gain credibility, avail Input Tax Credit (ITC), and expand operations smoothly.

🧭 Ruchi Anand & Associates’ GST Services

Ruchi Anand & Associates, a reputed Chartered Accountancy firm based in Delhi, offers complete GST solutions for businesses of all sizes. With over 20 years of experience in tax advisory and compliance, the firm ensures you stay updated and fully compliant with GST regulations.

Their specialized GST services include:

1. GST Applicability Analysis

Evaluation of registration requirements based on turnover and supply type

Sector-specific compliance needs

Support for e-commerce sellers and exporters

2. GST Registration

End-to-end assistance with GST portal registration

Amendment of registration details

Surrender or cancellation of GSTIN if business is closed

3. GST Return Filing

Timely filing of GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C

Monthly and quarterly compliance management

Reconciliation of sales and purchase data

4. Input Tax Credit (ITC) Reconciliation

2A/2B vs purchase ledger reconciliation

Claim optimization and blockage review

Prevention of credit mismatches

5. GST Audit & Annual Return Filing

Audit support for businesses with turnover above ₹5 crores

Preparation of GSTR-9 and GSTR-9C

Advisory on corrective action for past non-compliance

6. GST Refunds

Assistance with refund applications for exporters, SEZ units, and inverted duty structures

Tracking and liaison with GST officers

7. GST Litigation & Representation

Drafting replies to GST notices and show cause notices

Representation before GST departments and appellate authorities

📋 Ruchi Anand & Associates: End-to-End GST Process

The firm simplifies the entire GST lifecycle:

Preliminary Assessment Review of turnover, supply types, business model

Document Collection PAN, Aadhaar, proof of business, bank statements, photos, and digital signatures

Online Registration Filing on GST portal with regular tracking

Post-Registration Compliance Invoicing format guidance, e-way bill integration, monthly returns setup

Ongoing Advisory Monthly reconciliation, ITC guidance, audit preparedness, and departmental updates

🔍 Why GST Registration is Critical

Registering under GST provides:

Legal recognition for your business

Input Tax Credit benefits on purchases

Nationwide market access

Participation in tenders, contracts, and schemes

Credibility with vendors and clients

🌟 Why Choose Ruchi Anand & Associates?

There are multiple reasons to trust Ruchi Anand & Associates for your GST needs:

✅ Decades of Experience

With over 20 years of expertise in taxation and financial compliance, the firm has helped hundreds of businesses from diverse industries, including IT, pharmaceuticals, construction, e-commerce, and manufacturing.

✅ Sector-Specific Solutions

Their GST solutions are tailored for:

Startups & MSMEs

Exporters & SEZ units

Charitable institutions

E-commerce vendors

Freelancers and professionals

✅ Strong Legal Support

The firm not only ensures compliance but also provides robust litigation support in case of GST notices, audits, or disputes. Their proactive advisory approach helps you avoid common pitfalls.

✅ Client-Centric Approach

Ruchi Anand & Associates is known for its transparency, responsiveness, and integrity. The team ensures clients are well-informed about due dates, legal amendments, and filing statuses.

💼 Beyond GST: A Holistic Compliance Partner

In addition to GST services, Ruchi Anand & Associates offers:

Company Formation & Start-up Services

Private Limited, LLP, NGO, Section 8 company registration

Startup India recognition, MSME registration

Income Tax Filing & Advisory

ITR filing for individuals, corporates, and NRIs

Tax planning and scrutiny support

TDS & Payroll Management

Monthly payroll, Form 16 issuance, TDS return filing

Accounting & Bookkeeping

Day-to-day accounting, virtual CFO, internal controls

Statutory & Internal Audits

Compliance audit, GST audit, stock audit, internal process reviews

📊 GST Return Filing Schedule at a Glance

Return TypeFrequencyApplicabilityGSTR-1Monthly/QuarterlyOutward suppliesGSTR-3BMonthlySummary return with tax paymentGSTR-9AnnuallyAnnual returnGSTR-9CAnnuallyAudit reconciliation (if turnover > ₹5 Cr)GSTR-4AnnuallyComposition scheme taxpayersGSTR-10One-timeFinal return upon cancellation

🔐 Importance of Accurate GST Compliance

Failing to comply with GST rules can lead to:

Interest @ 18% on late payment

Penalties for non-filing or delayed filing

Blocked Input Tax Credit

Notices and audits by GST officers

Litigation, including penalties under anti-profiteering clauses

By partnering with Ruchi Anand & Associates, you avoid these risks and ensure seamless compliance.

🚀 Testimonials from Clients

“RAAAS helped us migrate our business to the GST regime smoothly. Their regular guidance and prompt filing helped us avoid penalties.” — Amit Kumar, MSME Owner

“Their reconciliation support for ITC has saved us lakhs in lost credits. The team is prompt, knowledgeable, and always professional.” — Divya Sharma, CFO of a logistics company

📞 Get in Touch

If you're looking for a reliable GST consultant in India, Ruchi Anand & Associates is your trusted partner.

📧 Email: [email protected] 📞 Phone: +91-98115-68048 🌐 Website: www.raaas.com

🧾 Conclusion

GST compliance is not just about tax—it’s about building a legally sound, growth-ready business. With an experienced partner like Ruchi Anand & Associates, businesses benefit from strategic guidance, timely filings, and peace of mind.

Whether you’re a new business registering for GST or an established enterprise needing reconciliation and litigation support, RAAAS provides end-to-end solutions that let you focus on growth while they handle compliance.

0 notes

Text

GST Compliance in India: Complete Guide for Businesses

Goods and Services Tax (GST) is a unified indirect tax that has transformed the Indian taxation system. But with its dynamic framework and frequent updates, staying compliant is not just mandatory—it’s a competitive advantage.

This guide breaks down everything you need to know about GST compliance, its applicability, key processes, penalties, and answers to common questions.

What is GST Compliance?

GST compliance refers to timely and accurate adherence to all GST rules, regulations, and filing requirements under the Goods and Services Tax law. It ensures that a business:

Files returns on time

Reconciles input and output tax correctly

Issues valid tax invoices

Complies with e-invoicing and e-way bill norms

Avoids penalties, interest, and departmental notices

Who Needs to Be GST Compliant?

Businesses are required to register under GST and follow compliance provisions if they meet any of the following conditions:

Criteria

Threshold (as of current rules)

Aggregate Turnover (Goods - Normal)

₹40 Lakhs (₹20 Lakhs in special category states)

Aggregate Turnover (Services)

₹20 Lakhs (₹10 Lakhs in special category states)

Interstate supply or e-commerce

Mandatory registration irrespective of turnover

Casual taxable person / Input Service Distributor / Non-resident taxable person

Mandatory GST registration

Key Components of GST Compliance

1. Return Filing

GSTR-1 – Monthly/quarterly outward supply return

GSTR-3B – Summary return of outward and inward supplies

GSTR-9 – Annual return

GSTR-9C – Reconciliation statement (if applicable)

2. Reconciliation

Matching books of accounts with GSTR-2A/2B, GSTR-1 vs 3B

Identifying mismatches in ITC and outward tax liability

3. Input Tax Credit (ITC) Optimization

Availing eligible ITC under Section 16 of CGST Act

Ensuring suppliers have filed GSTR-1

Reversals under Rule 42, 43, or ineligible ITC

4. E-Invoicing & E-Way Bill

Mandatory for businesses with turnover > ₹5 Cr (e-invoicing)

Ensuring movement of goods is supported by valid E-Way Bills

5. Registration & Amendments

Timely registration of business

Updating PAN, address, authorized signatories on GST portal

6. Responding to Notices

Proper documentation & timely reply to notices (like DRC-01, ASMT, etc.)

Avoiding litigation through proactive compliance

Why GST Compliance is Crucial

Avoids Penalties & Interest Delayed or wrong filings attract heavy fines and interest.

Ensures Seamless ITC Flow Non-compliance by your supplier can block your input credit.

Enhances Business Reputation Clean compliance record builds trust with clients, vendors & authorities.

Prepares You for Audits & Assessments Ensures you're ready for GST audits or departmental scrutiny.

Penalties for Non-Compliance

Nature of Default

Penalty

Late filing of returns

₹50/day (₹20/day for Nil returns)

Wrong ITC claim

Interest + Penalty under Sec 73/74

Not issuing invoice

₹10,000 or amount of tax evaded (whichever higher)

Not registering under GST

100% tax due or ₹10,000 (whichever higher)

FAQs on GST Compliance

Q1. What are the due dates for GST return filing?

GSTR-1: 11th of the next month / quarterly (IFF)

GSTR-3B: 20th, 22nd, or 24th depending on state

GSTR-9: 31st December following the financial year

Q2. Is GST applicable to freelancers and consultants?

Yes. If your income exceeds ₹20 lakh (₹10 lakh in special category states), GST registration is mandatory for service providers.

Q3. Can I claim ITC if the supplier hasn’t filed GSTR-1?

No. As per Rule 36(4), ITC can only be claimed if it appears in GSTR-2B, which is populated from supplier’s GSTR-1.

Q4. Is GST applicable to export of services?

Export of services is treated as zero-rated supply under GST, but you must file LUT or claim refund of ITC or IGST.

Q5. What is the penalty for wrong ITC claim?

If claimed in good faith – interest @18% p.a. If found fraudulent – 100% penalty + prosecution under Section 74.

Final Word

GST compliance is not just about return filing. It’s about building a robust tax governance system that aligns with changing regulations, prevents revenue leakage, and keeps your business audit-ready.

With ever-increasing departmental scrutiny and real-time data integration, staying compliant is a business necessity.

#gst services#gst registration#company registration#finance#gst billing software#gst return filing#tax

0 notes

Text

Meeting Deadlines: How to Select the Best GST Return Filing Consultants for Your Business

Tax season doesn’t knock politely — it bangs on the door with penalties, late fees, and stress. For businesses navigating the complex Indian tax landscape, GST return filing is one of the most critical yet commonly mismanaged tasks. It isn’t just about submitting numbers on a portal; it’s about compliance, accuracy, and protecting your financial standing.

So, how do you ensure your returns are not just filed, but filed right? That’s where experienced GST return filing consultants step in.

Demystifying GST Return Filing: Beyond Just a Routine Process

The Goods and Services Tax (GST) was created to make India's indirect taxes easier to understand. But for many businesses — especially MSMEs and startups — the filing process often feels anything but simple. Various forms must be addressed, such as GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C, each having distinct filing frequencies and requirements.

A single mismatch in invoices, failure to reconcile Input Tax Credit (ITC), or a missed deadline can lead to interest charges, audit scrutiny, or even loss of compliance rating.

That’s why GST return filing is not a task to be handled casually or internally unless there’s a dedicated tax expert on the team.

What Do GST Return Filing Consultants Actually Do?

Qualified GST return filing consultants go far beyond just data entry. They ensure your filings are:

Accurate: Matching purchase and sales data with GSTN

Timely: Avoiding late fees and interest penalties

Compliant: Complying with the most recent GST regulations and updates.

Reconciled: Cross-verifying ITC claims with vendor filings

Ready for audit: Maintaining appropriate digital records and trail

They act as both advisors and executors, bridging the gap between tax laws and your day-to-day business operations.

Why Businesses Are Moving Away from DIY GST Filing

While online GST portals are designed for accessibility, most business owners are overwhelmed. Here’s why:

Constant changes in rules: GST compliance is dynamic. Notifications and clarifications are released frequently.

High error probability: Manual entries or spreadsheet management can lead to costly mistakes.

Lack of expertise: Understanding the impact of reverse charges, exemptions, or HSN/SAC codes is not always straightforward.

Multi-state complications: Businesses operating across India deal with different registration numbers, adding to the complexity.

By engaging professional GST return filing consultants, businesses can reduce errors, stay updated, and focus on growth rather than grappling with tax portals.

Key Traits to Look for in a Consultant

Choosing a consultant isn’t just about outsourcing paperwork. You’re entrusting them with legal and financial responsibility. Look for:

Domain expertise in indirect taxation and finance

Technology integration to streamline documentation and e-filing

Regular updates and reminders on upcoming due dates

Tailored services based on your business size, type, and industry.

Post-filing support, including handling notices or clarifications from GST authorities

Some firms also offer integrated services that link GST compliance with accounting software and audit support, reducing duplication and increasing accuracy.

Technology Is Changing the Game

Today’s consultants don’t just operate through spreadsheets. Many offer cloud-based dashboards where clients can:

Upload invoices and purchase records

Track filing status

View reconciliation summaries

Receive automated due date alerts

This combination of tech and tax expertise has redefined what businesses expect from GST return filing consultants in 2025.

Penalties Are Expensive – Non-Compliance Isn’t Worth the Risk

Filing GST returns late or incorrectly may result in:

Penalties starting at ₹50 to ₹200 per day

Blocking of Input Tax Credit

Departmental audits and notices

Deterioration of business reputation and GST compliance rating.

Consistent failure to comply may result in the suspension or cancellation of GST registration, a consequence that can be detrimental for any business.

The Bigger Picture: GST Filing as a Business Function

Forward-thinking businesses have begun treating GST compliance not just as a statutory necessity, but as a strategic function. Proper filing offers:

Better cash flow through timely ITC

Stronger vendor relationships through accurate reconciliations

Risk mitigation from tax scrutiny

Improved business valuation in case of investment or exit

Whether you're a small trader, a mid-sized manufacturer, or a rapidly scaling tech startup, accurate and timely GST return filing is essential to stay compliant and stress-free. Given the growing complexity of tax structures and increasing use of data analytics by authorities, businesses are now prioritising qualified, tech-enabled guidance.

Firms like Shah Doshi are playing a pivotal role in offering reliable GST return compliance services across industries. With a combination of domain knowledge, process rigour, and client-focused support, they help Indian businesses navigate GST regulations with confidence and clarity.

0 notes

Text

Tax Due Date: Important Income Tax And GST Due Dates On 30/31 December 2024

Tax Due Date: Important Income Tax And GST Due Dates on 30/31 December 2024 Tax Due Date: Here is the list of important income tax and GST due dates on 30/31 December 2024 which will help you in timely compliance under the Act. Income Tax 30 December 2024 (1.) Due date for furnishing of challan-cum-statement in respect of tax deducted under section 194-IB in the month of November,…

0 notes

Text

GST Experts in India by Neeraj Bhagat & Co.

The implementation of the Goods and Services Tax (GST) has revolutionized the indirect tax system in India. However, the evolving nature of GST laws, regular updates, and compliance requirements can be challenging for individuals and businesses alike. This is where GST experts in India, like Neeraj Bhagat & Co., play a crucial role.

As one of the leading chartered accountant firms in India, Neeraj Bhagat & Co. offers comprehensive GST advisory and compliance services, helping clients navigate the complexities of the GST regime with confidence and clarity.

Why Choose Neeraj Bhagat & Co. for GST Services?

With decades of experience and a strong team of tax professionals, Neeraj Bhagat & Co. has earned a reputation as one of the most trusted GST consultants in India. Here's what sets them apart:

1. Comprehensive GST Advisory

The firm provides end-to-end GST consultancy services including GST registration, return filing, audit assistance, and litigation support. Their team keeps up with every legal change to ensure you stay fully compliant.

2. Expertise Across Industries

From manufacturing to e-commerce, real estate to hospitality—Neeraj Bhagat & Co. has served businesses across a wide spectrum. Their industry-specific GST solutions ensure that clients receive practical, customized advice.

3. Timely & Accurate GST Filing

Late or inaccurate filings can lead to penalties and disruptions. Neeraj Bhagat & Co. ensures that your GST returns are filed accurately and on time, so your business runs smoothly.

4. GST Audit & Assessment Support

Facing a GST audit or scrutiny notice? Their experts provide complete support during audits and assessments, ensuring proper representation and documentation.

5. Litigation and Dispute Resolution

In case of disputes or notices from GST authorities, Neeraj Bhagat & Co. offers strategic representation before GST officers and tribunals, ensuring your rights are protected.

Key GST Services Offered by Neeraj Bhagat & Co.

GST Registration and Amendment

GST Return Filing (GSTR-1, 3B, 9, 9C, etc.)

Input Tax Credit (ITC) Reconciliation

GST Audit and Certification

Handling GST Notices and Legal Representations

HSN/SAC Code Classification

GST Advisory on Transactions and Business Structuring

Serving Clients Across India

Headquartered in New Delhi, Neeraj Bhagat & Co. offers GST consulting services across India, including major business hubs like Mumbai, Bengaluru, Chennai, Kolkata, Hyderabad, and more. Their digital processes also enable seamless collaboration with clients remotely.

Why GST Compliance Matters

Avoids penalties and late fees

Ensures uninterrupted input tax credit

Builds a clean business reputation

Facilitates smooth audits and assessments

Strengthens overall business efficiency

Trusted by SMEs, Startups, and Corporates Alike

Whether you are a startup, MSME, or a large enterprise, Neeraj Bhagat & Co. provides scalable GST solutions tailored to your business needs.

Get in Touch with GST Experts Today

Don’t let GST compliance be a burden. Partner with Neeraj Bhagat & Co., your trusted GST experts in India, for reliable, professional, and proactive GST support.

#accounting#tax services#taxation taxplanning taxreturns#taxauditfirm#income tax#developers & startups#education#quotes#nonprofits#photography

0 notes

Text

Understanding the Basics of GST Annual Return Filing

Every business registered under the Goods and Services Tax (GST) in India must complete GST annual return filing once a year. This is a way for the government to ensure that all tax-related information shared during the financial year matches up and is accurate. While it might sound complicated at first, it’s a straightforward process if you understand the basics.

What is a GST Annual Return?

A GST annual return is a summary of all your monthly or quarterly GST returns filed during the year. It includes information like the total sales, purchases, input tax credit (ITC), and tax paid. Think of it as your business’s tax report card for the financial year.

Who Needs to File It?

Most businesses registered under GST and that have a turnover above a certain limit are required to file this return. Even if your company didn't make any sales during the year, you still need to file the return if registered under GST.

Types of Annual GST Returns

There are different types of returns based on your business type:

GSTR-9: For regular taxpayers.

GSTR-9A: For taxpayers under the composition scheme (no longer applicable after FY 2018-19).

GSTR-9C: For businesses with turnover above ₹5 crore, it includes an audit report and reconciliation statement.

What Documents Do You Need?

Before filing, make sure you have:

All GST returns (monthly/quarterly) for the year.

Sales and purchase data.

Details of input tax credit (ITC) claimed.

Any audit reports, if applicable.

How to File the Return?

Log in to the GST portal using your credentials.

Navigate to the ‘Annual Return’ section.

Select the financial year you want to file for.

Fill in the required details (auto-populated in many cases).

Review the data carefully.

Submit the return and file using a digital signature or EVC (Electronic Verification Code).

Common Mistakes to Avoid

Not reconciling data with the books of accounts.

Missing deadlines.

Claiming wrong input tax credit.

Not correcting errors made in monthly returns.

What Happens If You Don’t File?

If you skip filing, you may face:

Late fees (₹100 per day under CGST and SGST each).

Interest on tax due.

Notices from the GST department.

Difficulty in getting future GST clearances or refunds.

Final Thoughts

To avoid stress and penalties, it’s important to keep your records clean throughout the year and not wait until the last minute. If you’re unsure about anything, it’s a good idea to get help from a tax expert or accountant.

In summary, GST annual return filing is a necessary step for every eligible business. It helps maintain transparency and ensures compliance with the law. Doing it on time and correctly can save you a lot of trouble and keep your business running smoothly.

0 notes