#gst basic course

Explore tagged Tumblr posts

Text

Why Taking A GST Return Filing Course Is Worth It

The Goods and Services Tax system was introduced in India in 2017. GST operates as a complete solution for indirect tax reform which provides numerous benefits. Getting a GST return filing course enables you to utilize benefits when you need to file your returns. This course isn’t only a valuable investment for individuals but businesses also.

Why Taking A GST Return Filing Course Is Worth It?

Master The GST Return Filing:

GST return filing demands a comprehension of supply determination, place of supply, input tax credit (ITC) utilization, valuation methods and different types of GST returns. The best course will simplify these essential concepts. Following this training, you will gain both understanding and practical competence in handling GST and preparing correct returns.

Avoid Costly Errors And Penalties:

Wrong GST return filing triggers financial penalties with additional issues. The course provides instruction about detecting and avoiding common mistakes that occur with GST return filing. Relying on this knowledge will end up saving you both time and money in the long run.

Latest GST Regulations:

The GST regime constantly changes and updates. You need to keep yourself updated on these matters. The GST return filing courses provide up-to-date information about changes in this process. You can comply with the latest regulations.

Boost Your Career Prospects:

The increased demand shows that GST professionals now have a bright career path. Enrolling in this course provides students with substantial career benefits in the employment sector. Job recruiters specifically seek job candidates who know this domain. So take advantage of this course.

Gain Valuable Skills For Your Business:

Are you abusiness owner, entrepreneur, or freelancer? The GST course will be extremely beneficial. Understanding GST return filing is crucial. It provides you with all the tools necessary to manage a business's GST compliance successfully.

Enhance Knowledge:

The course will provide you with GST knowledge and education on tax principles and systems and recording methods.

Invest in your future:

The knowledge and skills you acquire are valuable assets for your professional career.

Do you want to gain a comprehensive understanding of GST? Join the best GST return filing course today! Our Course covers How to prepare & Claim GST Refund from the Basic to Advanced level, covering all Taxation parts related to GST Refund, legal aspects, major compliances and Procedures. We also offer online courses. For more information, visit us at www.rtsprofessionalstudy.com

Resource: https://rtsprofessionalstudyindia.wordpress.com/2025/03/03/why-taking-a-gst-return-filing-course-is-worth-it/

#gst registration service#partnership firm registration services#income tax certification course#best income tax course#basic gst course#best income tax course online#basic gst course online#best income tax preparation courses#gst filing training#gst basic course

0 notes

Text

How an Income Tax Practitioner Course Can Boost Your Career

Income Tax Practitioner Course: Unlocking Opportunities in Taxation

Income tax practitioner course is rapidly becoming one of the most sought-after training programs for individuals interested in the taxation field. With an ever-increasing need for financial experts who understand tax laws, this course offers valuable skills to navigate complex tax regulations. In this article, we’ll explore the benefits, scope, and importance of enrolling in an income tax practitioner course.

Understanding Income Tax Practitioner Course

The income tax practitioner course is designed for those who wish to become professionals in the field of taxation. This course teaches the nuances of income tax laws, filing tax returns, and providing expert advice to individuals and businesses. It equips students with the knowledge to handle tax-related queries, prepare returns, and guide clients through the taxation process.

What Does the Course Cover?

This course typically covers key aspects of income tax law, including income computation, exemptions, deductions, tax returns, and more. Students will also gain insights into recent changes in tax laws and how to apply them efficiently. Moreover, this training program equips students with the tools required to manage taxes in various sectors, ensuring they stay updated with government tax policies.

Key Benefits of Enrolling in an Income Tax Practitioner Course

Taking an income tax practitioner course has several advantages. Let’s explore the key benefits that make this course an excellent choice for those pursuing a career in taxation.

1. Skill Development for Career Growth

The course provides a strong foundation in tax-related knowledge, making it a must-have for anyone pursuing a career in accounting, finance, or taxation. Understanding tax laws and being proficient in tax filing can open doors to job opportunities in various industries.

Tax practitioners can also offer their services as consultants or advisors, helping businesses and individuals save money and comply with tax regulations. The expertise gained from the course will make you more competitive in the job market.

2. Stay Updated with Tax Regulations

Tax laws are constantly evolving. Enrolling in an income tax practitioner course helps you stay updated with the latest amendments in tax policies. You’ll learn about new tax reforms, filing procedures, and government guidelines that are crucial for accurate and efficient tax filing.

With the rapid changes in the financial world, staying informed about tax laws is essential for both professionals and businesses. This course keeps you equipped to handle any new regulations confidently.

3. Better Career Opportunities

Being a certified tax practitioner can significantly enhance your career prospects. With a professional qualification, you are eligible to work in various sectors like accounting firms, financial advisory services, government bodies, and more. You may even start your own consultancy, providing tax-related services to clients.

Moreover, tax professionals are in high demand across industries, ensuring a steady stream of job opportunities. The knowledge gained through the income tax practitioner course will boost your career and help you stand out.

Why Should You Choose This Course?

Choosing the right course can determine your success in the taxation field. The income tax practitioner course offers several unique features that make it an ideal choice for aspiring professionals.

4. Wide Range of Applications

Whether you plan to work for a corporation, a tax consultancy, or start your own practice, the skills learned in the income tax practitioner course have wide applications. This course is designed to teach you the skills necessary to handle tax filing for individuals, businesses, and other entities.

As a tax practitioner, you can offer a range of services such as tax planning, tax filing, consultation, and auditing. This broad scope ensures that your skills are valuable in multiple areas of finance and taxation.

5. Work Flexibility

Many tax practitioners work independently, providing a level of work flexibility that most other careers may not offer. Whether you work for a firm or run your own practice, you have the freedom to choose your work hours and clients.

As a tax practitioner, you also have the option to work remotely, making this career choice even more attractive for individuals seeking flexibility in their professional lives.

Income Tax Practitioner Course Eligibility and Duration

While the eligibility criteria may vary depending on the institution, most income tax practitioner courses require candidates to have a basic understanding of accounting or finance. Some courses may also require previous experience in the financial sector.

6. Duration of the Course

The duration of an income tax practitioner course varies depending on the institution offering it. Typically, it can range from a few months to a year, depending on the level of the program. Some courses may also offer part-time or online options for working professionals.

The comprehensive course duration ensures that students get ample time to master tax filing, computation, and tax law application.

What Skills Do You Gain from the Course?

The income tax practitioner course provides you with a wide range of essential skills. Below are some of the key skills developed during the course:

7. Tax Calculation and Filing

The course covers the process of tax calculation, including how to compute taxable income, deductions, exemptions, and the overall tax liability. You’ll also learn how to file tax returns for individuals, corporations, and other entities.

8. Tax Planning and Consultation

You will gain a deep understanding of tax planning strategies. This involves identifying tax-saving opportunities for clients, suggesting the best investment options, and ensuring their financial situation complies with tax laws.

Moreover, the course prepares you to consult businesses on minimizing tax liabilities and maximizing returns, making you a valuable resource for businesses seeking tax advice.

9. Problem-Solving and Legal Knowledge

Income tax practitioners often face complex tax-related issues, such as tax disputes and penalties. The course equips you with problem-solving skills, allowing you to navigate through these challenges. You’ll also learn how to deal with tax authorities and manage legal issues related to tax filing.

The Scope of the Income Tax Practitioner Profession

The demand for skilled tax practitioners is increasing in various sectors. Whether it’s helping businesses with tax compliance, offering tax planning strategies, or resolving tax disputes, the scope of this profession continues to expand.

10. Wide Employment Opportunities

As an income tax practitioner, you have the opportunity to work in multiple industries, such as:

Corporate Sector: Many large organizations hire tax experts to manage tax compliance and planning.

Government: Various government agencies require tax professionals to ensure adherence to tax regulations.

Financial Advisory Firms: Tax consultants and practitioners are integral to advisory firms offering financial services to individuals and businesses.

Moreover, you may choose to work as a freelancer or open your own tax consultancy, providing flexibility and higher earning potential.

How to Enroll in an Income Tax Practitioner Course?

Enrolling in an income tax practitioner course is a simple process. Most institutions offer online applications, and you can choose the course that best suits your career goals.

11. Choose the Right Institution

Before enrolling, research various institutions offering income tax practitioner courses. Look for accredited programs that offer comprehensive training, practical sessions, and support.

12. Consider Online or Offline Options

Many institutions provide online courses, which are suitable for working professionals. Alternatively, offline courses may offer more hands-on training. Select the option that best fits your schedule and learning preferences.

Conclusion

In conclusion, the income tax practitioner course offers excellent opportunities for individuals interested in tax-related careers. It equips you with the skills needed to navigate the complexities of tax laws and file returns accurately. This course enhances career prospects, ensures job security, and provides a competitive edge in the taxation and finance industry. Whether you’re looking to work for a company or start your own consultancy, this course is an excellent investment in your professional future. Enroll today and take the first step towards becoming an expert in taxation.

Accounting interview Question Answers

How to become an accountant

Tax Income Tax Practitioner Course

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#Diploma in Computer Application#Business Accounting and Taxation (BAT) Course#Basic Computer Course#GST Course#SAP FICO Course#Payroll Management Course#Diploma in Financial Accounting#Diploma In Taxation#Tally Course

0 notes

Text

0 notes

Text

Transform your creative passion into a rewarding career with a comprehensive Graphic Designing course. Learn to create stunning visuals, logos, websites, and marketing materials using industry-standard tools like Adobe Photoshop, Illustrator, and InDesign. This course covers key concepts such as color theory, typography, layout design, and branding, ensuring you develop the skills needed to thrive in the competitive design industry. Whether you’re a beginner or looking to enhance your design expertise, gain the practical experience and confidence to bring your creative ideas to life.

Visit Attitude Academy :-

for your valuable Training Course insights and content.

Call: For Yamuna Vihar +91 9654382235 Or For Uttam Nagar +91 9205122267 or

Visit Website: https://www.attitudetallyacademy.com Email: [email protected]

#graphic design#multi media#ui ux design#graphic designing#graphic designers#graphic design tutorials#skills

2 notes

·

View notes

Text

VIP Studies Scholarship Exam

Vinayak Institute of Professional Studies (VIP Studies) in Pathankot introduces Entrance Cum Scholarship Test Dec 2024. Now its time to learn from VIP Studies and getting 100% scholarship. With the help of this test students get 100% scholarship from our institute. In the scholarship test first 100 students get the benefit of this test. We recognized these types of tests for students. These types of exams help students to get admission with the 100% scholarship. This test is designed to identify talented students and reward them with scholarships, offering a golden opportunity for those who wish to excel in their academic journey.

The Pattern for the Scholarship exam

Main Objectives of scholarship tests

The objectives of the scholarship test are to identify the students with academic talent. The exam provides them a platform to appear in competitive examinations. These types of exams provide financial assistance to successful students. These types of scholarships help students to obtain education.

Benefits of Scholarship exam

There are several benefits of Scholarship exam for students. Scholarship exams offer a range of benefits for students and educational institutions. They provide access to funding that can alleviate tuition costs and other educational expenses, making higher education more accessible. These exams motivate students to excel in their studies and can enhance overall academic performance. Scholarship exams can identify and recognize students with exceptional abilities, helping them gain opportunities they might not have otherwise. They can lead to a variety of scholarships, including merit-based, need-based, and talent-specific awards, catering to a wide range of student needs. Preparing for scholarship exams can improve critical thinking, problem-solving, and test-taking skills, which are beneficial in further education and careers. Scholarship exams can play a crucial role in shaping a student’s educational journey and future opportunities.

Vinayak institute of professional studies in Pathankot

Vinayak institute of professional studies in Pathankot is the best institute for all types of computer courses. We provide computer basic, computer languages ( java, python, C/C++), Digital marketing course, Web designing course, spoken English course, tuition classes, Special classes for kids, Communication classes, Multi activities classes, Accounting courses, Tally, Tally Prime, Taxation courses, GST Course, TDS courses etc. This is the golden opportunity for the students to learn with VIP studies. Its time to learn with 100% scholarship. This is the best chance for students to learn with 100% scholarship, they learn any course in VIP Studies. These types of scholarship exams are helpful for students to be admitted into an institute within a few fees. Those students who clear these exams with 100% score have chance to learn free in the institute.

Conclusion

Don’t miss out on this incredible opportunity to secure a scholarship and access high-quality education at VIP Studies. This scholarship test is your chance to prove your abilities, gain recognition, and reduce the financial burden of your education.

Register today at VIP Studies and take the first step toward a bright and successful future!

Originally Posted: https://vipstudies.in/scholarship-exam-in-pathankot-for-vip-studies/

2 notes

·

View notes

Text

Part 1: A Chat with Paul Hutchinson

While I usually interview musicians, Paul is a programmer first, and musician when he needs to be. However, I still had a lot to ask about, as he was able to provide a fascinating window into what gamedev was like in the late 80s and early 90s.

This interview was conducted across several emails in 2024Q1. The exchange has been rearranged to flow more naturally as a conversation, with quote blocks mostly removed. There's a part 2, in a different format with more of a music focus. Both are mirrored on patreon.

GST: I'd like to start with a somewhat open-ended question: most of your online presence is under the handle "Z80GameCoder". that's a really interesting processor to embrace! I'd like to know why you embraced that, and I guess how you got started on that path. I got the impression that you were part of the UK's "bedroom coder revolution" era, but it seems like the 6502 was more popular (C64, BBC Micro). Was the ZX Spectrum your first computer, perhaps?

PH: It all began when I was about 13 years old, in 1977. Technically, the very first computer I had experience with was via a 300 baud modem teletype (playing Tic-Tac-Toe, on a print-out), but I don't recall what was on the other end of the telephone line. This was an interim solution, until the new machines arrived at my school. Computer Studies (O-level) was a brand new course at the time, and my mum said I should give it a try, on account of it being such a new thing. When the first machines arrived, after a few weeks, they were RML 380Z desktop computers. Made by Research Machines Limited, as I recall, and Z80 based.

They were a lot more fun than the teletype. I dove right in, and became quite familiar with them. So that is probably why I got into the Z80 in the first place. I wrote some BASIC games at the time. A version of Tic-Tac-Toe, and a version of Star Trek, which was another game they had on the teletype. Man, we used up a lot of paper playing that game on the teletype.

I left school at 16, to go to College, where I took Computer Science (A-level). There was a computer lab with a bunch of RML 380Z desktops. I continued to program games in BASIC, including a version of Pong, Breakout, and even a rudimentary implementation of Space Invaders. The graphics were very blocky, four pixels per character square, with black, white, and two shades of gray, if I remember coirrectly. Yeah, that was pretty basic stuff.

I got a Sinclair ZX-Spectrum 16k in 1982, for my 18th birthday, my very first computer. We quickly replaced it with a 48k version, as 16k clearly was not enough RAM to be working with, even at the time. I bought, and played, all the games I could, spending many hours with my beloved 'Speccie'.

Meanwhile, back at college, a friend, and one of the teachers, challenged me to write my games in Assembler, instead of BASIC. So I then set about learning Z80 code. I basically taught myself, although, later on, the Computer Science class began working with Assembler. But by that time, I was already fairly proficient. And the rest, as they say, is history.

GST: So in other words, you taught yourself Z80 assembly outside of school. What resources were you using to teach yourself all that? It's a few years before google, after all.

PH: Yes, I taught myself BASIC programming, Assembler, and everything related to game development. You had to be able to do everything back then, so I did.

The resources I used were …

Sinclair ZX Spectrum BASIC Programming - Steven Vickers - Appendix A

(For some reason Appendix A has been removed from the PDF that is online, I have no idea why, it's very strange.)

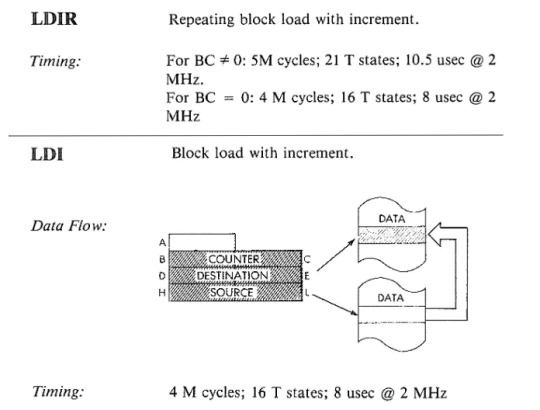

I referred to the assembler code there, but it was not enough, long term, and I very soon got …

Programming The Z80 - Rodnay Zaks

This was the resource for the Z80 at the time. Very detailed descriptions, and, most importantly, the execution time T-states, along with the byte length, for each and every instruction. With this I was able to determine that using a bunch of LDI instructions in a row, with a JR instruction to loop back, was much faster than using an LDIR. This got used in the V-blank routines used to dump memory to the display, for example. It used up more memory, but it got the job done way faster.

GST: How did you get into PSS? Did Xavior come first, and you found PSS as a publisher? Or did PSS find you? It looks to me like you found PSS and they brought you in to work on other projects, since your Amstrad games all came after 1984

PH: The first real piece of code I wrote in Assembler was for LBC's "Computer Club", a radio show hosted by Clive Bull. They would broadcast a program over the air every week. I sent in a version of Pacman I called MacMan, because it had a burger theme. (It's at the bottom of my game page at z80gamecoder.com ) After that I wrote Xavior. I spent about two months teaching myself Assembler, and coding the game. We were moving back up to Coventry from London, so I looked for a publisher in Coventry. That was PSS. I pitched the game to them, and they accepted it, and offered me a job. It was my first job. Pretty basic, not well paid though, but it got me into the industry. I got to work alongside Alan Steele (a really good bloke, I miss him), who was the leading War Game programmer at the time (at least in the UK). I worked with Mike Simpson (on Swords & Sorcery), who went on to do the Total War series of games, at Creative Assembly.

(As a side note, a member of Creative Assembly (I think his name was Ingi? Ingimar? [EDITOR'S NOTE: it was Ingimar Guðmundsson]) showed up to work at Gogogic in Iceland, when I was there. It's a small world, eh. re: the gaming industry)

I have worked alongside some of the biggest names in the history of game programming, looking back, it's pretty cool, tbh.

GST: I'm kind of surprised to see a game development job described as "pretty basic"!

"Not well paid" is easy to believe, but games are complicated! What made it basic?

PH: I say "basic" firstly because of the low pay. With the contract I had after leaving PSS, a project with Firebird (BT), I earned my yearly salary in just two months, which would be a six-fold increase in earnings in one jump. Secondly, the place where we worked was a residential house, nothing fancy.

(this off-white building is the same place in 2014, via google street view)

Mike's office was behind the top left window, our office space was at the back on the same floor. Humble beginnings. Although the bosses, Gary and Richard, drove around in super fancy sports cars.

GST: Actually, I'd like to ask about the names you mentioned. Maybe you can dig up some old memories about working with everyone and use those stories to illuminate what it was like at the time.

Or at least I think anecdotes are fun and interesting. :P

The credits I can find on Swords & Sorcery are all quite vague, saying that you and Mike Simpson both did "unknown".

I assume that he took the role of a designer while you programmed? Or is it impossible to cleanly divide who did what?

PH: Names …

Mike wore sweaters that were not the most fashionable, as I recall, and, as a result, got some degree of ribbing from co-workers. He was not always in the office, he came in when necessary. My involvement with Swords & Sorcery was with rendering the action window, Mike did the bulk of the coding, obviously, and he was the game designer. I contributed some graphics too, as I have some natural artistic ability. I worked on both the Spectrum and Amstrad versions (the full code conversion for Amstrad). The project took quite a bit longer than we expected, by my recollection. I remember a conversation with Mike about how excited he was with the possibility of fractal generation of environment, what is called 'procedural'? An example he gave was being able to generate graphic renderings of trees in games, using maths, rather than having a pre-rendered image of a tree. He was a bit ahead of himself, as he needed to get S&S finished first. … and now we have games like "No Man's Sky".

As an example, I did the graphics for this:

GST: Looking at mobygames, you're in the credits for the ZX Speccy version of Bismark alongside Alan Steele.

It says he designed everything and you just provided "graphic help"?

PH: Alan was a really nice bloke, and very talented. One day he showed me a book he had gotten, and at the back was mention of Jacqui Lyons, who was just starting to represent game developers, having been representing authors for some time.

Alan said I should get in touch with her and see where it would lead. I took his advice, and ended up as one of her clients. She got the contract with Firebird. It was definitely a good move, and I am really grateful to Alan for that advice. In turn, after a couple of contracts with Firebird, Jacqui said I should consider an opportunity in America. The first one that presented itself was with EA, in California. I did an interview with them, I think it was with Trip Hawkins (if I recall correctly).

However, I was not ready to make the move, so I declined their offer. Subsequently, I was rather glad about that, as I have heard that working for EA was not easy.

Later, the offer from MicroProse presented itself, and I was ready by then, and accepted. I interviewed with Steve Meyer, who had a firm handshake, which was something I noted about the Americans that I met. A level of confidence, assertiveness, that was not typical of your average Brit, including myself. I liked Steve, he was a good boss.

For Bismarck, I was working on the arcade screens, and the Amstrad version of those when I left. When I look now, I do not see that it ever got published for the Amstrad? Hmm. I commented the heck out of the code, right before I departed, and printed it all out, just to be certain it was well documented. That way I could not be said to have left things in a mess. I guess they never got someone to pick up the project. Oh, well. [EDITOR'S NOTE: this version was advertised as "coming soon", but never released.]

I had asked PSS to give me a contract right from the beginning, but they never did, so I had the freedom to leave whenever. When I told them I was leaving, they offered to double my wages, and give me a bonus there and then. However, double is still less than six times, and I had already committed to the contract with Firebird.

In my experience, and my life in general, everything happens for a reason. Looking back I can see all the turning points, and how everything just fell into place at exactly the right moment in time.

GST: I'm very fascinated with the situation you described with Jacqui Lyons. She's like an agent… for game developers? I'm surprised I've never heard of this!

PH: Yes, Jacqui was an agent for quite a few developers, some big names, apparently. She would find contracts, negotiate the best deal, and receive a percentage in recompense. It was well worth it. I got work, was well compensated for it, and I could just get on with doing what I loved, coding. I would go down to London from time to time, for a meeting with her, and for interviews with potential clients for projects. It worked out very well. She looked out for me, and I appreciated that too. When she got me the position with Microprose, all that came to an end, obviously.

GST: Looking at your gameography, it looks like Project Stealth Fighter is the only released game from Microprose.

Did you do anything else there? Or was it just a series of contracted projects once you came to America?

PH: At Microprose I did the 128k version of PSF for the ZX-Spectrum, and then I squeezed it down to the 48k version, as I recall. By the time I was done, two years had passed. In the meantime I had met my wife-to-be, and we had a wedding date planned, so I was kind of committed to staying in America by then. Once the PSF project was completed, I tried to convince the management at Microprose that I was worth keeping on as an employee (because I knew for a fact that I was). However, I was not able to do so. The new boss (not Steve Meyer) decided to let me go. They claimed I was not useful for anything else, and could only do Spectrum related projects, which they had no need of any longer. At the time, it seemed like a bad situation, but, as with everything else in my experience, it was just a transition to something much better.

When they let me go, I had to pack up all my stuff immediately, and vacate the building. That is how it worked in the software business. Once they were done with you, you had to leave. Supposedly due to industry secrecy etc. I would continue to be paid, I just could not be in the office once I was being let go.

As I was leaving, walking to the end of the corridor, there was a fellow coder, who had his office door open. He asked me about what was happening, and I told him. He quickly produced a business card for "Innerprise", a nearby company that was started by Paul Lombardi, a former Microprose employee. The co-worker said I might want to try giving those guys a call. And so, there was another stepping stone to a brighter future.

After leaving I did give Innerprise a call, got an interview, and was offered a job. I just had to wait until after I was allowed to work again, with the correct paperwork. There was a gap, where I went back to the UK briefly, returned, got married, and got the necessary paperwork.

I do have some anecdotes related to MicroProse, if you are interested in those?

GST: Absolutely! Anecdotes are great brushstrokes that help paint a picture of the era.

PH: MicroProse was a great experience for me. For the first year and a half the "MicroProse Family" (which I think it was actually referred to as) was a lot of fun. There were a lot of social activities going on, which was actively encouraged. This was a good business strategy, because a happy workforce is a productive workforce. We were more of a team as a result.

The whole company went to the Air Show at Andrews Air Force base, for example. Where the Blue Angels put on quite a display. Then there was the company trip to have a flight on the "Miss MicroProse", an old WWII airplane, with a single propeller. "Wild" Bill Stealey was the pilot, and we each took our turn up in the air, donning a flight suit and clambering up into the cockpit. I remember it being a pretty wild, and noisy, ride. Much more fun/exhilarating than any rollercoaster I had been on. We all went on a trip to an aircraft museum also. No chance was missed to participate in Aeronautical activities related to the flight sims the company was developing at the time.

(from an advertisement, courtesy SidMeiersMemoir)

The company purchased season passes for Merriweather Post Pavilion, for the summer concerts. We could select which concert we wanted to attend, based on availability. I remember going to see Herbie Hancock and Chick Corea, which was most agreeable. Herbie Hancock being one of my favourite artists at the time, an excellent keyboard player/musician. The weather was suitably "summery", and the music was excellent.

GST: Herbie Hancock and Chick Corea! That's a great pair already! This would've been not long after "Perfect Machine", one of my fav HH albums.

I'm very curious about your music tastes, but I don't want to derail your thoughts just yet.

PH: Each Monday there was a company meeting, where everyone gathered in the main area of the building. Bill Stealey would address us all, along with the other management, keeping us up to date on the various goings on. That was fairly mundane, tbh, and not the most fun. However, one time, someone (and I do not recall exactly who it was) had an idea to help make it more fun. They ordered some comical headwear for all of us, which we paid for ourselves. And so, one Monday, we all showed up wearing a fez. It took a few moments to become noticed, as we filed in and sat down. It was rather silly, but it did lighten things up, with a round of laughter to follow.

Sid Meier was a cool dude to hang out with. One time, after work, a small group of us, including Sid, played M.U.L.E. on an Atari 400. We each took turns on the console, making our moves, as the game is turn based. Pizza was ordered, so we would have something to eat for dinner. As I recall, whilst we were waiting for the pizza to be delivered, Sid came up with the idea of "Pizza Hijackers", where you would order the pizza to be delivered, then hijack it on its way, and end up being the one who delivered it to the customer, thereby removing all the (unnecessary) overhead of actually having a pizza business. After consuming the rather delicious pizza, we drove to the local 7-Eleven, and picked out a pint of Ben & Jerry's, each. Then returned to the office, and devoured the entire pint in one go. Ah, the joys of being young and carefree, eh.

My (humble) contribution to making things a little "funner" was a "Name The Gorilla" competition. I purchased a bunch of small stuffed gorillas, and posted details of the competition, the prize for a winning name was a doughnut (the budget for the project was somewhat limited, obviously, going mostly for the gorillas). There were a few participants, including Bruce Shelley. I think Bruce's winning name was "DrillBit". The only other name I can recall is "Gorilla MyDreams", which was John Kennedy's entry(?). I still have "DrillBit", in a box somewhere here. I used to hangout and chat with Bruce from time to time, he was a big fan of the Saturn cars, which I think were fairly new at the time. I remember him mentioning, more than once, how popular they were.

Man, I just remembered the pit beef. Was it "Sharkey's Pit Beef"? There was a nearby food shack that sold pit beef. My first lunch in America was a pit beef sandwich. I always ordered it the same way from that day forward: pit beef, salt and pepper, American cheese, on a kaiser roll. We grabbed the sandwich and went to a local field, where we ate, and threw a softball around for a bit. The company had a softball team, which I joined for a while (although I do not remember us ever winning a game).

I seem to remember the food quite a bit. My first burger, which was about twice the size of anything you would get in the UK at the time, and I was unable to finish it. The ribs at "The Corner Stable" too, which I really enjoyed at the time. Ah ... Roy Rogers ... One lunch time, we went out to get burgers from "Roy Rogers". When we got there, the restaurant was quite busy. So, my roommate, Kevin, said we should go through the drive through instead. Except, he suggested we park the car, and walk through the drive through in formation. Okay, so off we went, on foot, in formation, to order and collect our lunch. I think the drive through staff were a little perplexed, but we got our food, and had a laugh at the same time.

All in all, the first 18 months at MicroProse were a lot of fun for me, which helped me adjust to life in America. I can remember when I first arrived I had some culture shock. America was quite different from England. It felt a bit weird because everyone was talking with an accent, and, unlike on TV, it did not stop, I could not turn it off. I did get homesick for a while, as it was my first time living away from my family home. In the end, I adjusted pretty well, and grew to prefer America as a place to live.

GST: Man, that drive-through prank in particular is perfect. Beautiful. lol

Let's see... after Innerprise, you moved to Sega of America. How did that work? I recall reading that you were in a unique position with SoA…

PH: I was at Innerprise working on the Sega Master System version of Spider-Man vs. The Kingpin. As such, I was in touch with Ed Annunziata, the project manager at Sega of America. The project was moving along, although maybe not as smoothly as it could have been. However, Ed and I worked together well, and had a good relationship. There were some things going on behind the scenes with the management at Innerprise, and I was not privy to such activity. What I did know, was that my paychecks were bouncing. I am not one to be working for free, and the cost/inconvenience of a bounced check is not to be tolerated for long. Ed came out to visit, we met and discussed the situation. Ed appreciated my honesty. After the third bounced paycheck, I had had enough, and I left my position at Innerprise as a result. After a brief period, I was contacted by Sega Of America and offered the contract to finish up the SMS version of Spider-Man vs. The Kingpin. (The Genesis version was still under development by Innerprise.) Thus, I found myself working directly with Sega Of America, as an independent contractor (rather than as a company), which made me unique. SoA seemed quite pleased with the choice, and so we continued our relationship across quite a few projects, moving on to the Game Gear right after Spider-Man was finished (beginning with that conversion).

GST: Oh yeah, I had a very specific question about your work on Spiderman vs The Kingpin: the in-game credits say that you were the programmer "with assistance by John Kennedy". I assumed that this was a senior programmer that helped onboard you to the project, but I actually can't find any other credits to his name.

Do you recall what the situation was, here?

PH: John Kennedy helped with some subroutines on Spiderman vs The Kingpin, I was the majority programmer.

GST: I'm curious about these conversions in general, actually. What was it like working as an independent contractor? Specifically, I noticed that the credits always had a tiny number of people, and your name was often in programming, music, art, AND design.

Were you doing all of this with some kit at home?

PH: It was great working as an independent contractor. I got to do what I loved to do, and without a lot of additional stuff to deal with (business-wise). After I left Innerprise, and got the contract with SoA direct, I had to go pick up the development kit from the Innerprise Office. Then I went and bought a new PC to hook it up to. I remember paying about $2200 for it. A 486 DX2 66, as I recall. With a $300 14" CRT monitor. I think that is the most I ever paid for a PC. Later I got an Amiga 2000HD also, for doing art (using Dpaint), and music (using Pro-Tracker). The Sega development kit included a ZAX-ICE (In-Circuit Emulator), which plugged into an SMS where the Z80 cpu would be (the SMS top cover was removed in order to achieve that). Those ZAX units ran about $50,000 a piece at the time. SoA provided a second one later on, when I was doing Game Gear work, as backup. I still have both units (SoA said I could just keep them or throw them out at the end of the GG development cycle, they did not want them back), and last time I looked, some years ago, they were on Ebay selling for only about $500. The Game Gear had a special development board, into which the ZAX-ICE plugged, it looked nothing like an actual Game Gear. I coded, and then uploaded to an SoA BBS (this was before there was an internet for that sort of thing). Once a year they would fly me out to visit, and we would meet and discuss the next project. I worked from home, and I was a stay-at-home dad too. My wife was an anesthesiologist, so she was busy full-time with that career. It was a lot to handle, and I did the best I could.

I was involved in all aspects of the games' development to varying degrees. There would be a designer who wrote the initial design paper, and we would work from that blueprint, going back and forth to get the best possible game we could make that was practical. There would be a musician who composed music for some of the projects too. And, of course, an artist to take care of the bulk of the necessary artwork. I contributed to everything that I was able to. I would touch up bits of art in order to make it work right, particularly sprites. I had prior experience with Spectrum and Amstrad, where I did everything myself. I really enjoyed having a hands-on approach to projects, it was very satisfying to have that much influence.

GST: I also spotted a Judy Hutchinson in the credits for the 2nd X-Men game. Any relation?

PH: Judy was my wife at the time, she was quite supportive. We supported each other. When the Game Gear projects ended, and the final X-Men 3 SMS conversion for Brazil was done, I was done working with SoA. I continued on as a stay-at-home dad. That was enough to keep me busy, with about three jobs worth of activity. A doctor for a wife, who was often on call. Three young children, all growing up. A large household, on 18.5 acres, that needed a lot of attention. Up to five horses, two pygmy goats, a pot-bellied pig, a rabbit, and around ten cats (at one point). I had my hands full all the time. I planned, drove, shopped, cooked, cleaned, mowed, planted, tended, … all the things. It was a great experience, which I would not repeat. I was a stay-at-home dad before that was even really a thing, so I was pretty much on my own (very challenging).

Looking at the .ASM files I can see the dates/years. We moved to the Gettysburg farm in 1995, I think. Before that we lived in a townhouse in Timonium, MD. There I worked in the basement. Slightly less work for me there.

GST: It's funny to hear that you were making these games on a farm! (Or, well, mostly basement.) I think most people imagine video games are made exclusively in high tech offices filled to the brim with cutting edge technology. I keep finding just the opposite! (Thinking of David Wise having to furnish his studio from a cattle shed...)

Anyway, from the above, it sounds like you were kind of a funnel: The person that put every asset and idea into the ROM.

... And you took advantage of that by polishing everything you got as you put it in.

Or am I misreading? I suppose you could've been uploading pieces to the BBS, for someone else to assemble/compile…

PH: That is correct. I put everything together, and built the finished ROM. I used the Avocet Z80 Assembler for coding. Turbo C++ to write utilities to convert data into assembler files (with db/dw statements, and lots of hex values). Dpaint artwork, and music files had to be converted from native formats. Maps were built in TUME (The Ultimate Map Editor). TUME was made by my friend, and ex-colleague from MicroProse, Dan Chang (Echidna, who made NES "Cool Spot", "M.C. Kids", etc.). He went on to work for Nintendo, and was in Washington state, last I heard. I programmed the EPROMs using a Needham's Electronics EPROM programmer. I put those into a test cartridge and ran it on a regular system.

GST: I'd like to circle back and talk about music. You were getting into game making at what I think was a time of transition, when people were starting to expect music to be part of the game experience…

…but the ZX Speccy only had a beeper.

Your first 2 games featured (as best I can tell on my emulators) purely beeper music on their title screens. It's simple, but that's par for the course considering the hardware. I'm curious if you recall any of your thoughts/philosophy about music on the ZX and CPC.

I mean, you could probably have gotten away with a silent title screen, but you put the effort in to make some music, so you had to see some value in that, right?

PH: Absolutely, title music had value to me. Music on the Spectrum was quite limited, due to the nature of the hardware. The Amstrad had more to work with, obviously. Actually, I remember making an attempt at "Acid House" on the Amstrad. I made a demo tape from simple loops I constructed, in BASIC. I took it down to Jazzy M's record store in London (Michael Schiniou, Oh'Zone Records). I used to listen to him on LWR, a pirate radio station in London. I would go down and buy House Music from his store. He was a cool dude.

(Interview, 1h 50m 38s)

GST: Man, this interview is wild. It feels like a very distinct slice of time. I'm not familiar with pirate radio but it makes sense that someone like that would be the "A&R guy for the A&R guys", as he put it 🤣

PH: On a later visit I purchased an LP of UK Acid House (I think the cover is yellow, mostly), which had a track on it which sounded very familiar. I think my Amstrad demo tape was inspiration for it. This happened also with a track I did on the Amiga. I posted several tracks I made on an Amiga Music BBS, when I was living in Timonium, MD (1991?). One was called "Baby Beat", which I made whilst my then wife was pregnant with our first child, Samantha.

And this is the track that I think it helped inspire:

Orbital - Midnight (Live)

I am unable to prove this, since my Amiga is long gone. I am not able to prove the Amstrad track either, unless there is a tape somewhere here that still has that recording on it (maybe I will find it one day, who knows).

GST: Man, I'd LOVE to hear a comparison between your CPC acid and the vinyl it inspired. Too bad it's been lost to time…

I also tried a quick search for any archived amiga tunes with "baby beat" in the instrument text, with no luck. alas…

PH: I released "Baby Beat" into the public domain, so it's fair game for anyone. I think I used my Mista "P" handle for that. That was the handle I ran with for pirate radio. We used to listen to Radio Invicta back in the day. Another pirate radio station, playing mostly soul, funk, jazz-funk etc. Stuff you could not hear on the BBC or even commercial radio at the time. I made, and sent in, large envelopes covered in funky artwork. Something to get noticed. We had lots of dedications read out, which were also designed to be stand-out (funky/quirky). Invicta was a South London based pirate station. They got to be quite familiar with us, due to our consistent interaction (via mail and phone). We (me and my younger brother, who called himself "Jam Thang", his name is James, btw) got to host a show once, with Steve DeVonne. We brought in all the Funk and P-Funk we had on vinyl, and Steve played it for us. We were teenagers at the time. The shows were recorded ahead of time, to cassette, then broadcast on a Sunday. Invicta would pick a block of flats somewhere, and set up their transmitter on the roof, for that afternoon. They had to stay ahead of the authorities, since it was not licensed. We even answered the phones one week too, so our home phone was used (just the once). It felt very cool at the time. I have a lot of the dedications on tape still, and the show we did with Steve too. I visited with Tony Johns, who ran the station. And I also made a banner for them in 1982 (when the "Falklands War" broke out, as I remember hearing it on LBC when I was painting the letters on the canvas). I met Steve Walsh (DJ), to deliver the banner, as I recall, when it was completed. I remember getting BBC Radio Medway to say stuff they were not allowed to say, that was fun. Dave Brown used to have a show on there. I sent in a dedication that included a "hi" to "Ray, Dee, Owen, Victor …" Hahaha … Dave read it out, before realizing what he had just said on air, then quickly said "Oops, who got caught out there? …" and laughed. That is on a tape I have. Man, I have to digitize those things before they fall apart, eh.

GST: I encourage this! It looks like it'd be in great company, too: https://archive.org/details/70s-80s-radio-shows/

Skimming through some of these shows, I imagine this is what I'd be into if I were there at the time. Especially when they bring in the jazz fusion.

I even spotted some Shakatak! Seven years before my favorite album of theirs!

This kinda answers an earlier thought, where I was wondering about your musical tastes.

Though these roots don't show very much in your game scores, which feel more dancefloor inspired, to my ear. Looking it up, I guess the music on LWR is a closer match

PH: Shakatak!

I remember buying their first 12" (1980)

Back when Brit-Funk was starting to be a thing.

I was recalling going up into town (when I lived in South London), to visit Groove Records (to get Surface Noise's 12" "The Scratch") and Bluebird Records (Manfredo Fest "Jungle Kitten"). I think both stores were in the Soho area? (generally)

I still have the plastic carrier bags from those stores. :D

GST: I keep being amazed at all the little details you can find online. Check this out, a website dedicated to remembering these old record stores: https://www.britishrecordshoparchive.org/shops/blue-bird-records/

PH: That is cool.

Ok, Counterpoint is where I bought my first vinyl, it was just up the road from where we lived. I even worked there for a time. Dang. This is a different location. The one I shopped/worked at was on Westow Hill, Upper Norwood. https://www.britishrecordshoparchive.org/shops/counterpoint/

GST: Circling back a bit, you mentioned you that you wrote an acid tune... I think it's kind of funny to imagine the square waves of a CPC in rotation on a pirate radio!

Were you able to get that "ringmod" sound with the AY using BASIC? (This "triangular" sound.) I've never worked with the AY so I don't fully understand it, but I always figured that was a fast CPU trick…

PH: I don't think I achieved that with the Amstrad audio in BASIC. I remember I was doing bending/ramping somehow. It wasn't actual Acid House sound, but was as close to it as I could manage. It sounded funky, and had that chip-tune quality to it.

I am happy at the thought I might have inspired some actual musicians. :)

GST: That's a funny choice of words, I think. What is an "actual musician" and how does that definition exclude you?

To be fair, I've been making and sharing music for decades but haven't signed any record deals, so perhaps I'd exclude myself from a category of "actual musicians".

It's an interesting thought to me, though. "No true Scotsman" and all that.

PH: "Actual musician" … hmm … I guess I mean "professional"? Like, it's something the person projects as what they inherently are? Technically I got paid for my music, so simply earning money from it is not what I mean. I would say I was a Game Coder, who made music, as opposed to a musician. But maybe, if I look at it, then I am a musician, by simple fact of making music?

GST: You definitely carry the essence of a Game Coder, specifically on the Z80. ;)

I'd describe these as hats. You may primarily be a game coder, but you've worn your musician hat plenty as well.

PH: Back on the topic of games … My time at Gogogic was even more of a family experience than it had been at MicroProse (the first 18 months there, that is). Such a cool bunch of people. I really enjoyed that time. There were co-workers who had grown up playing my games as kids (e.g. Jonathon Osborne, Australian, now in Montreal, Canada, I think).

GST: Was that the first time you had experienced that? I can imagine this being a shock, both with the realization that your work reached others, and the feeling of "I can't believe that I'm old now"

PH: Yes, that was the first time I experienced meeting someone who had played my games as a kid. It was kind of cool. It's heartwarming to know that I helped bring some fun/joy into the world. I don't regard game programming as something that has much impact on the world, in general, but knowing that it has had a positive effect is comforting. Yeah, there is a disconnect between programming games and the audience that plays them, for the most part. There are a few people in the industry who are "rock stars" that get that kind of experience. Most of us are just coding away, and getting on with our lives (and getting older).

GST: I'm also noting that you skipped straight to Gogogic, not really talking about what I presume was an era of self-study, learning how to write iOS apps. I suppose it was too transitional to mention?

PH: Ah, yes, the time before Gogogic …

I was doing the stay-at-home dad thing, on the farm, as I mentioned. I spent the time collecting consoles and games, in order to keep up with the industry in general. I was "The Entertainment Committee", and I had a (weekly) budget even. I built a home theater in the basement, with a projector, a 12' screen, large surround sound system, and six La-Z-Boy chairs, with the back row on a raised platform. It was super cool, especially when the THX sound played, at some volume. There was also an array of consoles set up, so the kids could all be playing whatever game they wanted, simultaneously. Then, after some years, I was being encouraged by my then wife to get back to work (since the kids were growing up, and requiring somewhat less supervision). I saw the growth of the iOS market, and people making a decent living from it. I had an iPhone, so I had played games on that. I set about finding out how to program iOS. It's a lot different from Z80 Assembler, the whole approach is different (high level vs low level).

We had a two story home, so I sequestered myself in the (finished) basement every morning for some months. I just pushed myself forward until it finally clicked. If game programming is supposed to be like "riding a bicycle", then it was more like having had muscles atrophy, and having to grow back muscle mass, before even getting to ride anywhere. It was literally painful to get my brain accustomed to programming again, but I persevered. I wrote a word puzzle game for iOS. I am sure the structure is terrible, because I did not apply the new philosophy of high level languages to the process. But, it worked. I made a word dictionary using a DAWG (Directed Acyclic Word Graph), which kept the size down to a minimum, and traversing it to find words was fast. Little did I know that it would come in very handy when I interviewed for Gogogic, and then getting hired within two weeks of arriving in Iceland.

We had developed a friendship with the team at Gogogic through their Facebook game "Vikings of Thule". We played it a lot, and interacted with the development team, providing bug reports and feedback on gameplay. We were getting very interested in Iceland, after visiting during a stop-over on the way to see my family in the UK. To the point of wanting to live there, at least for a part of the year (it was a mutual preference/desire). When we bought a summer house in Kjós, near Hvalfjörður, we hosted the entire team at our home (during one of our stays in the summer). It was the "Gogogic Fanfest". CCP had their big annual Fanfest each year, and so we decided to host one for Gogogic. They hired a mini-bus, and drove up to visit. It was so much fun.

GST:

It was literally painful to get my brain accustomed to programming again

yeah, I feel that! I took a class on iOS development around the same time (~2012) and it's far, far removed from assembly! I was curious about that transitional period specifically for that reason.

I can't help but zoom in on some of the things you say: You make it sound like you were playing Vikings of Thule, noticed a bug, reported it, then heard back from the developers… and then repeated that cycle until you became friends and coworkers.

Is that what happened?

PH: Yes, that is it in a nutshell. We (Judy and I) played the game a lot, found bugs, as it was still under development, and reported the bugs. We also made suggestions for improvements and features. It was really cool to interact with them. We visited Iceland a number of times before buying the summer house. Firstly, we met Gogogic at their office, before they moved to Laugavegur, which was here …

Glass building on the left, I think it was the third floor. The Japanese embassy is also in the building. To the right is the petrol/gas station that was used for the TV show "Næturvaktin" (highly recommended, very funny).

GST: that's a funny way to move to Iceland :P

PH: Actually, it was the perfect way to move to Iceland. Everything fell into place in exactly the right way. When our marriage came to an end, everything was in place for me to move there as smoothly as can be. The timing was perfect. I had just three days notice, from the time I was told "You have to go!", to when I was on the ground in Iceland. When I arrived, I had a car, a home, and a job lined up within two weeks. Jón Heiðar kindly picked me up, once I arrived in Reykjavík (on the bus from the airport), and we chatted on the drive up to the summer house (where the car was parked). He said Gogogic was looking for an iOS programmer, and I should interview. Which I did, not knowing how vital that would be at the time.

I also had developed a friendship with Jared and Hulda, and their friend Tim, which revolved around paragliding. They looked out for me, a lot, being concerned about my well-being, given the circumstances. I learned paragliding with them, up to the point of making an actual flight (a small flight, but nonetheless, I flew). I probably would not have made it without them. I am forever grateful.

I had been corresponding with Jared on account of his blog about moving to Iceland, and we had met at least once before I moved there. So I had actual friends as well, not just friends who were co-workers. Given that I ended up going through a divorce, everything else was perfect. It helped immensely, and I thank God for all of it.

GST: Paragliding? That's a funny recurring motif: flight!

PH: I bloody loved paragliding. I got really good at ground handling, which they told me is harder than flight, because in flight you don't have the ground to deal with. They all said they had never seen anyone learn so fast, and I was good. Tim said I could be one of the best if I continued.

(37s) "Hola Hop"

Hulda is holding the camera, and that's her voice. Jared is the other paraglider in the video.

They moved to Switzerland. During a flight, where Hulda was given instructions, which she followed, she got into a spin that was not recoverable from. She went all the way into the ground and died as a result. When I heard of this I quit. Hulda was the one who managed to get through to me with instruction the best, and we clicked as regards teacher/pupil. She trusted that instructor, and I would do the same. So I saw the potential of being in a similar situation. I could not risk that. My kids were pleased I gave it up.

GST: oh, that's a really tragic turn of events :(

I suppose it's nice to have experienced flight at all, but that's got to be haunting…

PH: Yes, it is a bit haunting. However, I remember all the good times we spent together, and I am forever grateful to Jared, Hulda, and Tim. I cherish those memories, and they always bring a smile.

GST: I'd like to circle back to gogogic. so, although both involve programming, working on high level iOS code in the 10s is extremely different from working on machine code in the 90s. I'm wondering if you experienced any culture shock, not just from moving to Iceland, but from jumping 15 years into the future of game development so to speak.

PH: yes, very much so. It was not just the Assembler to Objective C jump, in terms of type of language. It was also the jump from a lot of constraints, to relatively few. Space was at a premium on the Z80 devices I coded for. Whereas, it was not so on iOS. My co-workers at Gogogic were very helpful in guiding me in how to change the way I wrote code. On Z80 I used a lot of abbreviations, due to space. This makes code harder to read, obviously. On iOS they told me to name things according to what they were, or what they did. I did not have to abbreviate to save space. Then there is the object oriented aspect of the higher level coding. It is very different indeed. Working as part of a team was a change too. I mean, I worked on a team before, but I had more hands-on control over things on Z80. I enjoyed learning. We used Git, so I had to learn about version control etc. The way I did debugging was not to their liking, as I recall. I relied on intuition a lot, and it worked very well for me. They prefered a more systematic approach to debugging. I remember having my bug fixes rejected, after I came up with them very quickly. Then they went through the process they had adopted and fixed the same bug over again. It took them hours to do, but that is how they wanted it done. So that would be a change too, having to use the same methods as the team, with no room for bringing my own. I am good either way. My focus is on delivering the product, and doing the best job I can possibly do, regardless of anything else. If something is worth doing, it is worth doing well. That is how I have always worked, and it applies to everything in life.

GST: They didn't like your debugging? Interesting… I remember looking at your linkedin and seeing that you particularly enjoyed debugging code. I suppose this means you became accustomed to the team's "newschool" methods?

PH: Yes, I love debugging. I like fixing things in general, so that is the coding version of it. I did learn how to debug their way, and fit in with the team as needed. At AppDynamic I was praised by the boss for how I helped take the product(s) from something that functioned, to something that was really polished. Pratik was quite pleased with my debugging. He was really good at getting code up and running, but I don't think he liked debugging as much as I did. It's like a puzzle, you have to solve it. Puzzles are fun.

Fixing things is great. Taking something broken and making it of use, I love that. I can do anything I put my mind to as well. My friend Kent said "You can do anything that you want to do, if people do it, you can do it." "If you don't want to do it, have someone else do it" I took his advice, and I did all sorts of things. I bought a secondhand big dish (10') system, for $300, and installed it, so we had satellite tv. That required digging in the ground, hitting a boulder, drilling into the boulder, inserting rebar, pouring concrete, and setting a pole, perfectly vertical. I mounted the dish, ran the cable to the house, drilled through the wall, ran more cable. I set up the receiver, I buried an earthing rod and ran cable for that too. I aligned the dish with the satellite, and got C-Band stations across the entire arc. I had never done anything like it. It stayed in place throughout the years, through all kinds of wind and weather. We got a lot of enjoyment out of it. It builds confidence to achieve things like that. I did many projects like it whilst we had the farm.

Anyway, I digress, again …

GST: no, that makes sense! I think this mindset is why programmers are considered engineers.

I think I've covered all of the ground I was interested in, so I'd like to wrap up this interview with a few final questions.

First, since you mentioned it earlier [EDITOR'S NOTE: this mention was moved to part 2], have you worked with the PICO-8 at all yet?

PH: I have not worked on the Pico-8 yet. I bought the app, and I have it running on a Powkiddy RGB30 handheld. Which is the ideal platform for it, as the screen is square, and just the right size. I've played a few games, and watched a few videos (e.g. Pico Playtime on YT), and I just like the whole concept. It would be a fun thing to try, and not too much of a stretch.

GST: Another recurring theme I noticed: it's kind of fascinating that you still have an archive of all of your project files from so long ago.

Were you actively trying to preserve everything at the time? Or was it just a recurring thought of "hmm, maybe I shouldn't delete this"?

PH: I definitely meant to backup the files to the CD in 1999. I am a bit of a digital packrat, I have podcasts (including all the raw files from my own podcast) and all-sorts of digital archives from years gone by, because I don't like to throw out digital stuff. I started putting the Sega directory on whatever was my latest computer, so I would have it on hand for reference. I don't know if Sega still keeps that stuff after all this time, I would guess not, since it has been so long. I am not sure how long the NDA lasts, so I would not release the code into the public domain without asking them first (I don't have any of the paperwork I signed for them any longer).

GST: And finally, to endcap this interview, I'd like to open up a space for you to talk about what you're up to these days. Any upcoming projects you'd like to promote?

PH: We skipped over AppDynamic, where I coded for the iOS apps: AirServer, AirMediaCenter, and RemoteHD. Largely bug fixes, and some minor feature updates. I discovered that coding on its own is still fun for me, not just games. Again, because it is puzzles to solve.

I also spent a year without work, in Iceland, in between jobs, which was a challenge, but very necessary. Before I returned to the US, for the sake of my partner, and my (grown) children.

The last bit of coding I did was on the Ethereum blockchain. A project for my daughter's company (now dissolved, I think). So I taught myself that too. It was kind of fun. When it was published the contract number had "1dad" in it (what are the odds of that?), so my daughter had a t-shirt made for me with the address on it. :)

These days I am continuing to collect items related to retro gaming. I got into emulation pretty heavily, with a view to experiencing older titles on newer machines (for ease/convenience), and preserving them too. I want to have my own little video game museum, which maybe I can pass on to generations that follow me. I have most consoles going all the way back to pong. I recently acquired a bunch of retro systems, including a Wii, Wii U, PS2 fat, PS Vita, and a 3DS. Some of the hardware is getting harder to find, I got the last two devices from Japan. I collect games on the PC too. I have over 1300 games on my gaming PC, for example. Even though I have mostly just played Fortnite (with my sister) and Destiny 2 (with my youngest daughter). I bought Return To Monkey Island, and played that all the way through with my partner, as I just love point and click adventures. I have many fond memories of playing those types of games in the past. I listen to music a lot, and I make playlists on YT, either based on mixes, or of my own choices (lately, select tracks from a single label). I watch a lot of movies, and have a personal collection of DVDs/Blu-rays in the thousands. I have archived those too, and converted to them MKV, for convenient playback on a mini PC running Kodi. I love old movies, it's like time travel. Fascinating to see how the world was, over 100 years ago, for example. And for the nostalgia factor, for the years I experienced myself.

So … video games, music, and movies. That takes up a lot of my time currently, since I am basically retired (for now).

We live in a one-person apartment (it's a bit cramped, to say the least), so I am always looking for a house, to make into a home for us. When I get that, I will be able to spread out a little/lot. Set up all my old systems like I used to have them (they are currently in tubs, on shelves). I want to set up a home theatre again, so I can have that full movie experience once more. The audio in particular was what I enjoyed (I still have the speakers from that). I would get a new projector though, as now there are 4k projectors for less than the $3,000 I paid for my 720p projector for my old home theatre. I want to set up my podcasting gear again, and do some more recording. I miss that, it was a lot of fun. I want to set up my dual Technics SL-1200 turntables too, and listen to all my vinyl again (for now, they are all sat here on shelves).

I definitely want to do more creating, I do miss that quite a bit. I have been consuming a lot lately, but producing very little. Be it music, art, audio or video. Certainly doing some coding too. Maybe Ed Annunziata and I can collaborate on something cool, just like the old days. I would love that.

4 notes

·

View notes

Text

One-on-One Tally Training in Laxmi Nagar – Book Demo

Tally Course in East Delhi Laxmi Nagar – Career Ka Right Direction

Aaj ke time mein, Tally course ek must-have skill ban chuka hai for accounting students. East Delhi, especially Laxmi Nagar, is known for top coaching institutes.

Yeh jagah not only offers quality training but also job placement ka strong network deti hai. Let’s explore why this course is trending in this area.

Why Tally Training in Laxmi Nagar East Delhi is Trending

Students aur professionals dono hi Laxmi Nagar choose karte hain for best accounting courses.

This area offers institute clusters, certified trainers, aur practical-oriented coaching. Most importantly, yahan ki fee structure is pocket-friendly.

Nearby metro connectivity makes it easily reachable.

Institutes yahan Tally Prime ke latest versions se training dete hain.

Batch timing flexible hote hain for school and college students.

What is Tally and Kyun Yeh Zaroori Hai

Tally ek accounting software hai jo financial transactions manage karta hai.

Yeh software use hota hai for GST, TDS, payroll, inventory, aur bank reconciliation. India mein lakhs of businesses Tally ERP 9 ya Tally Prime use karte hain.

Toh agar aap accounting field mein career banana chahte ho, Tally knowledge is must.

Tally Course Syllabus in Laxmi Nagar – Full Details

East Delhi ke reputed institutes ek structured syllabus provide karte hain.

Below is the common module:

H3: Basic Modules Covered:

Company creation aur configuration

Ledger and group creation

Journal entries and vouchers

GST setup & filing

Inventory management

Payroll processing

TDS and tax reports

Bank reconciliation

Balance Sheet & P&L generation

All modules are taught in live practical format. Har session ke baad assignments milte hain for hands-on practice.

Benefits of Learning Tally in Laxmi Nagar East Delhi

Yahan ke institutes sirf theory nahi, real-time learning environment dete hain.

H3: Key Advantages:

Certified trainers with 5+ years’ experience

100% job placement support

Resume aur interview preparation included

Doubt-clearing sessions in Hindi + English

Affordable course fee with EMI options

Free demo classes available

Yeh sab features aapko confidence aur clarity dono denge in learning.

Who Should Join Tally Course – Eligibility & Requirements

Tally course is open for all students after 10+2.

Even B.Com, BBA aur M.Com students bhi join karte hain to upgrade their resume. Working professionals who want to shift to accounting also benefit.

Minimum Requirements:

Basic computer knowledge

10th or 12th pass

Interest in accounting and finance

Kisi bhi stream ke students is course ko kar sakte hain without restrictions.

Course Duration and Fees – Flexible Options Available

Tally Course ki duration average 2 to 3 months hoti hai in most Laxmi Nagar institutes.

Some institutes also offer fast-track batch for working individuals.

Fee Range:

₹5,000 to ₹20,000 depending on syllabus and modules

GST + Advanced Tally courses thode expensive hote hain

Fees usually include study material, software access, and certifications.

Career Scope After Tally Course in East Delhi

Ek baar Tally ka certificate mil jaye, toh aapko multiple job roles ke options milte hain.

Popular Job Roles:

Tally Operator

Accounts Executive

GST Filing Assistant

Data Entry Accountant

Inventory Manager

Freelance Tax Consultant

Companies prefer Tally-trained candidates kyunki they are job-ready from day one.

Top Institutes Offering Tally Course in Laxmi Nagar East Delhi

Aapko confusion na ho, isliye humne list banayi hai of top-rated institutes:

Institute of Professional Accountants (TIPA)

Location: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar

Highlights: 100% placement, certified trainers, live practicals

Student Testimonials – Real Voices, Real Experiences

“I joined TIPA’s Tally course in East Delhi aur within 3 months, I got placed!” – Rohit Kumar

“Trainers yahan bohot helpful the, aur GST ka topic was explained very well.” – Priya Sharma

“Course content updated tha and fully practical-based learning thi.” – Anjali Mehta

Yeh sab testimonials aapko idea dete hain about learning quality in this area.

Tally Certification Value in India – Kya Important Hai?

After completing the course, aapko certification milta hai jo aapke resume mein value add karta hai.

A certified Tally professional is preferred in small to mid-level businesses as they handle day-to-day accounting.

Government jobs, CA firms, aur startups sabhi Tally operators hire karte hain regularly.

Conclusion – Right Place, Right Skill, Right Time

Tally Course in East Delhi Laxmi Nagar ek smart decision hai for those aiming for a quick career boost.

You get industry-ready training, placement assistance, and valuable practical exposure.

Toh agar aap accounting field mein interested ho, don’t wait – enroll today in a Tally course near Laxmi Nagar!

Frequently Asked Questions (FAQs)

1. Kya Tally course online available hai in Laxmi Nagar?

Yes, most institutes offer online + offline hybrid classes for flexibility.

2. What is the average salary after Tally training?

Freshers usually start at ₹12,000 – ₹20,000/month, depending on skills and company.

3. Kya Tally certificate government recognized hota hai?

Yes, if it’s from a certified institute, it is valid for both private and public jobs.

Best Tally Course Training

Accountant Course

Accounting Institutes

Tally Course Training Institutes in East Delhi NCR Laxmi Nagar

Institute of Professional Accountants

Tally Institutes

Computer Course

Computer Institutes

Diploma in Computer Application , Business Accounting and Taxation (BAT) Course ,Basic Computer Course , GST Course , SAP FICO Course , Payroll Management Course , Diploma in Financial Accounting , Diploma In Taxation, Tally Course

Education Business Ideas

UPI

Stock Market Course

SAP FICO Course Delhi

SAP FICO Course in Gurugram

Tally Course in Delhi

Data Entry Operator Course

sitemap

Tally Course in Guwahati

Referral Program

Sitemap

Refund Policy

Privacy Policy

Thank you

BAT Course

Tally Course in Noida

Tally Course in Pune

Tally Course in Ahmedabad

Tally Course in Hyderabad

Tally Course in Bangalore

Tally Course in Mumbai

Corporate Training

Download Brochure

Contact Us

GST Course

SAP FICO Course

6 Six Months Diploma Course

Diploma Taxation Course

Payroll Management Course

15 Months Course

18 Months Diploma Course

Diploma in Financial Accounting

Diploma Courses

Old – Courses after B Com

Tally Course

1 One-year Diploma Course after B com Graduation in India

Advanced Excel Course

Basic Computer Course

Blog

About Us

Disclaimer

Student Reviews & Placements

Home

Terms & Conditions

Accounting Entry for Prepaid Expenses

What is TDS Certificate? | टीडीएस प्रमाणपत्र क्या है?

Tax Accountant Course: Apka Guide Ek Shandaar Career Ke Liye

GST Certification Course: Ek शानदार Career Opportunity

Government Examinations After Graduation in India: Complete Guide

0 notes

Text

Master Accounting with DICS Laxmi Nagar

In the era of digital finance and automated bookkeeping, Tally has emerged as one of the most trusted accounting software used by businesses across India. Whether you are a commerce student, aspiring accountant, or business owner, mastering Tally can significantly boost your career. Among various training centers, DICS (Delhi Institute of Computer Science) stands out as the best Tally institute in Laxmi Nagar, offering top-tier education, expert faculty, and industry-relevant curriculum.

Why Choose DICS for Tally?

DICS is renowned for its commitment to quality education and career-focused training. Recognized as the best Tally institute in Laxmi Nagar, it provides a well-structured course that covers all the essential features of Tally Prime, including GST, TDS, inventory management, payroll, and more. The course is designed for both beginners and advanced learners, ensuring that every student gains practical and theoretical proficiency.

Industry-Ready Curriculum

The best Tally course at DICS is not just about software operation—it’s a complete package that equips students with real-time skills. The curriculum includes:

Basics of Accounting & Tally

Company Creation & Ledger Management

Voucher Entry and Reconciliation

GST Implementation and Filing

Payroll Configuration

MIS Reporting and Data Security

Each module is supported by hands-on training, case studies, and real-world examples to give students a competitive edge in the job market.

Experienced Faculty & Supportive Environment