#highcreditscores

Photo

Happy #Thursday If you have questions about your credit, feel free to send me a message or visit https://bit.ly/2TIDAD6 to schedule a #FREE Credit Consultation! I speak to lots of people that are unsure about how credit really work...I understand because I didn’t always know either so I found out the hard way! No one taught me about credit in school. So I’m here to help as many people as I can! #letmehelpyou #creditrepair #creditagent #creditrepairthatworks #betterin2019 #CreditRepair #creditagent #creditispower #jointhemovement #highcreditscores #louisiana #Birmingham #stylists #barbers #entupernures #beagrownup #CreditRepair #newhouse #newcar #dreambig https://www.instagram.com/p/Bwr9BakBwnl/?utm_source=ig_tumblr_share&igshid=1909v9qkzy6vf

#thursday#free#letmehelpyou#creditrepair#creditagent#creditrepairthatworks#betterin2019#creditispower#jointhemovement#highcreditscores#louisiana#birmingham#stylists#barbers#entupernures#beagrownup#newhouse#newcar#dreambig

0 notes

Photo

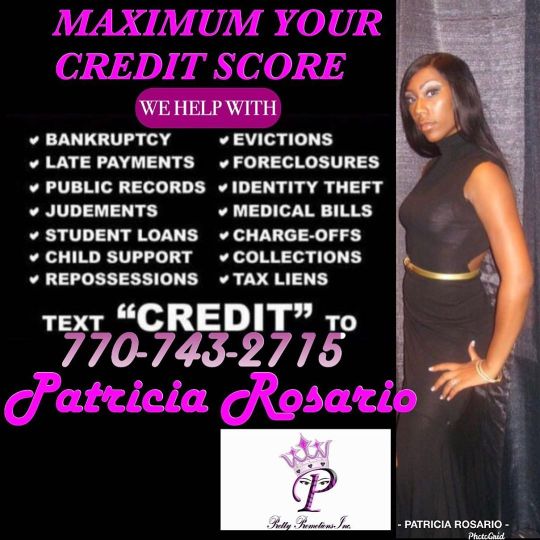

Hey 👋🏾 y’all ! Having A high credit score gives you amazing purchasing powers! Click the link in my bio or dm so we can discuss Maximizing your credit score! #2020 #2020vision #prettycredit #highcreditscore #goals #goaldigger #creditrepair #bankruptcy #lein #studentloans #studentloansremoved #debtelimination #investing #repossessions #carloans #homeowner #homeownershipgoals #prosperity #financialfreedom #moneymonday (at Lovejoy, Georgia) https://www.instagram.com/p/B7RIFLoA6HA/?igshid=20go69im8jmu

#2020#2020vision#prettycredit#highcreditscore#goals#goaldigger#creditrepair#bankruptcy#lein#studentloans#studentloansremoved#debtelimination#investing#repossessions#carloans#homeowner#homeownershipgoals#prosperity#financialfreedom#moneymonday

0 notes

Text

How A Healthy Credit Score Can Reduce Your Home Loan Rate…

If you have a dependable track record of loan repayment and an independent credit information bureaus rating that's high, you have something to cheer for.

Now, based on your credit score you can avail of cheaper home loans. Bank of Baroda (BOB), a state-run bank, recently announced that anyone with a Credit Information Bureau (India) Limited (CIBIL) score of 760 and above would be eligible for a home loan at 8.35%. This is the lowest offering so far, beating even SBI's 8.65%.

The Marginal Cost Lending Rate (MCLR) of BOB stands at 8.35%. In other words, the bank doesn't charge a premium to those with high credit scores. Without a doubt, mortgages provide additional safety but it seems post demonetisation, there is now a competition among banks to promote the credit growth.

There's a caveat though. Those who have a sub-724 credit score would get a rate of 9.35%. While those in the mid-range (725 to 759) will be charged 8.85% interest rate. Amongst the existing borrowers of BOB, clients who are still following the base rate mechanism may also be delighted. The bank has been offering a migration from the base rate system to MCLR system free of cost.

Let's see what affects your credit score...

Independent credit information agencies such as CIBIL collect information about your running loan repayments from a financial institution. And provides you with a score based on factors such as:

Your timeliness of repayment;

Usage of credit limits;

Duration of credit;

Types of loans—secured, unsecured, etc.; and

The number of credit inquiries you made in the past

Can you improve your credit score?

Of course, you can. But it's not possible overnight. For that, you need to change your credit behaviour and maintain consistency thereafter. Here are some tips for improving your credit score:

You should pay all your EMIs on time

Use credit limits rather conservatively

Avoid opting for multiple credit cards

And as far as possible, maintain a healthy balance between secured and unsecured loans

When you opt for long-duration secured loans, rating agencies consider this as a positive, provided you pay all your EMIs in time.

Now it remains to be seen if other banks also follow suit. However, having a high credit score may not be just enough for other lenders. Many banks and financial institutions consider a whole host of other factors before they offer you loans at cheaper rates. Those factors include:

You income

Nature of your job/work

Your age

Your residual working span

Your average monthly bank balance

The list above is not exhaustive, and financial institutions may consider other factors too.

A note for those who are still on a base-rate regime

Unless you switch to MCLR regime, you won't experience lowered borrowing cost as much as new borrowers for now. However, keep in mind the MCLR regime will transfer any increase in interest rates equally efficiently. We are not far away from seeing a bottom on borrowing rates, especially for retail borrowers. Under such a scenario, you should do a thorough assessment of options available to you. Depending on the remaining duration of your loan, the quantum of EMI and type of loan, you could decide whether it makes sense to migrate from base rate regime to MCLR regime at this juncture.

This post on " How A Healthy Credit Score Can Reduce Your Home Loan Rate… " appeared first on "PersonalFN"

0 notes

Photo

Today on #ZamundaRadio we Discuss Owning a Home in #DC, #Maryland and #Virginia With Award Winning Mortgage Professional Grace Olabosipo. #Tunein 3:00-4:00 PM EST on WERA 96.7 FM or online at www.wera.fm #home #realestate #property #buyvsrent #loans #lowcreditscore #highcreditscore #100%financing #interestrates #homeownership #dti #loanofficer #mortgage #mortgagevsrent #community #singlefamilyhomes #townhouse #condo (at Arlington, Virginia)

#community#dti#home#interestrates#buyvsrent#realestate#highcreditscore#homeownership#condo#maryland#singlefamilyhomes#loanofficer#dc#virginia#loans#tunein#property#100#mortgage#townhouse#lowcreditscore#zamundaradio#mortgagevsrent

0 notes