#hyperledger blockchain

Explore tagged Tumblr posts

Text

NFTのユースケースとHyperledger Fabricでの実装

#NFT使用用途#Cloud#NFT#クラウド#ブロックチェーン#エコシステム#blockchain#非代替性トークン#HyperledgerFabric#NFT販売事例#Hyperledger#エンタープライズ#事例#enterprise#ユースケース#NFTスマートコントラクト#Oracle#Chaincode#オラクル#ブロックチェーン活用#テクノロジー#開発#デベロッパー#developer#開発者#technology

0 notes

Text

Enterprise Guide to Asset Tokenization: Benefits, Use Cases, and Risks

Asset Tokenization Explained

Asset tokenization is the process of digitally representing ownership of real-world assets, like real estate, gold, intellectual property, or even company shares, on a blockchain. These digital representations, or tokens, allow assets to be divided, sold, or traded securely and efficiently. This shift is transforming the way enterprises manage, trade, and leverage their assets.

With the asset tokenization market rapidly growing and projected to hit trillions in value over the next decade, it's clear this innovation is not just a passing trend. For enterprises, this is an opportunity to boost liquidity, expand investor access, and streamline operational costs.

But what makes tokenization truly valuable isn’t just the technology—it’s the real-world business impact. Companies can unlock previously inaccessible capital, reduce administrative overhead, and dramatically improve transparency in asset tracking. Tokenization enables a paradigm shift in enterprise asset management, allowing businesses to manage their portfolios in real-time, across borders, with unbreakable audit trails.

Top Benefits of Asset Tokenization for Enterprises

1. Improved Liquidity

Traditionally, assets like real estate or fine art are hard to sell quickly. Tokenization changes this. Enterprises can break large, illiquid assets into smaller digital shares, making it easier to buy, sell, or trade fractions of those assets. This increases liquidity and accelerates access to capital.

2. Enhanced Transparency and Trust

Every transaction made using tokens is recorded on the blockchain, a decentralized digital ledger that cannot be altered. This immutability provides full transparency, helping enterprises and their stakeholders verify asset histories and avoid disputes.

3. Reduced Costs Through Automation

By cutting out middlemen such as brokers and agents, tokenization significantly reduces transaction fees. Additionally, smart contracts—self-executing digital agreements—automate functions like compliance checks and transfers, saving both time and money.

4. Speed and Efficiency in Transactions

Traditional asset transactions can take days or weeks due to paperwork, approvals, and coordination. Blockchain-based tokenization compresses this timeline to minutes or hours, creating faster, more streamlined operations.

5. Global Access to Investors

Digital tokens can be accessed globally, which opens up investment opportunities to a much broader base of potential stakeholders. Enterprises are no longer limited by geographic constraints and can attract global capital with ease.

Key Use Cases Across Industries

1. Real Estate

Real estate tokenization allows properties to be divided into multiple shares and sold to investors worldwide. Enterprises managing commercial or residential property portfolios can raise capital faster and enable fractional ownership without complex legal structures.

2. Commodities and Natural Resources

Companies managing resources like gold, oil, or agricultural goods can tokenize these commodities for easier trading. Instead of dealing with physical assets, buyers and sellers exchange digital tokens that represent real-world value.

3. Intellectual Property

Businesses that rely heavily on intellectual property—like tech companies or media firms—can tokenize patents, copyrights, and trademarks. This makes it easier to license, trade, or monetize these intangible assets.

4. Art and Luxury Goods

Tokenizing fine art or luxury items enables investors to own a fraction of a valuable item. It also provides provenance and authenticity verification, which is especially important in high-value asset markets.

5. Supply Chain and Logistics

Tokenization adds transparency to supply chains. Companies can track goods as they move through the process, with tokens representing ownership or certification at each step. This boosts traceability, reduces fraud, and improves efficiency.

Risks and Challenges to Consider

While the advantages are compelling, enterprises must navigate certain risks when implementing asset tokenization.

1. Regulatory Uncertainty

Laws around digital assets vary significantly between countries. Enterprises must ensure they comply with regional securities laws, taxation, and investor protection regulations. Failing to do so could result in fines, project shutdowns, or legal liability.

2. Technological Complexity

Blockchain is still an emerging technology. Integrating tokenization into legacy systems may require a complete overhaul of enterprise architecture. Companies must invest in staff training, cybersecurity, and infrastructure upgrades to succeed.

3. Volatility and Market Risks

Although tokens represent real assets, their market value can fluctuate due to investor sentiment, platform demand, or regulatory news. Enterprises must prepare for potential volatility and ensure that their financial planning accounts for it.

4. Security Concerns

If not implemented correctly, blockchain networks and smart contracts can be vulnerable to attacks. Enterprises must partner with experienced blockchain solution consultancies to build secure platforms, perform regular audits, and protect user data.

5. Adoption Barriers

Internally, some employees and executives may resist adopting new systems. Externally, investors may be unfamiliar with tokenized models, requiring robust education and communication strategies.

How Blockchain Solution Consultancies Help

A blockchain solution consultancy plays a vital role in helping enterprises implement asset tokenization effectively. These firms provide tailored advice, technical development, regulatory navigation, and long-term support. Whether it’s designing smart contracts, integrating blockchain with existing systems, or ensuring compliance, consultancies help reduce risk and accelerate time-to-value.

Enterprises seeking to stay competitive in a token-driven future should seriously consider working with experts who specialize in digital asset transformation.

Final Thoughts: Is Tokenization Right for Your Enterprise?

Asset tokenization isn't just a buzzword—it's a strategic tool that’s reshaping how businesses manage and leverage their assets. From reducing costs to expanding investor pools, the potential is vast. However, success depends on clear planning, smart partnerships, and a long-term vision.

If your enterprise manages high-value assets, seeks faster access to capital, or wants to modernize its financial operations, now is the time to explore tokenization. With the right approach, you can unlock new efficiencies and stay ahead in the evolving digital economy.

0 notes

Text

These Technologies Will Move the World's Money – You Better Get Used to It

Blockchain isn’t the future—it’s the infrastructure being built right now to move the world’s money. Stand up on this. Take this in. These technologies are not hype—they’re infrastructure. They’re being built right now to move the world’s money. You just saw it: XDC + JPMorgan Chase + TradeFinex – Real-world trade finance on blockchain. Algorand (TPAOS) – Powering CBDCs. Yes, Central Bank…

#Algorand#Blockchain#CBDC#Constellation DAG#Crypto Adoption#Crypto News#decentralized finance#financial infrastructure#generational wealth#Hedera#Hyperledger#IBM#JPMorgan#Overledger#Quant#Ripple#Stellar#XDC#XLM#XRP

0 notes

Text

How to Set Up the Best Ledger Software in Minutes ⌚️

Managing business finances is now easier with the Best Ledger Software. Whether you're a small business owner or a shopkeeper, using a digital Bahi khata.

Helps track income, expenses, and profits efficiently. Follow these simple steps to set up your best general ledger software in just minutes.

1. Choose the Right Ledger Software 💻

Selecting the best Khata software is the first step. Look for features like: ✔️ User-friendly interface✔️ Secure data storage✔️ multi-device accessibility✔️ Reports and analytics

Popular options include Bahi khata software and digital khata apps, which provide seamless record-keeping.

2. Install and Set Up Your Account 🛠️

Download and install your chosen digital Bahi khata app. Follow these steps:1️⃣ Register with your mobile number or email2️⃣ Set up your business profile3️⃣ Choose the preferred currency and language

Now, your best Digital khata software is ready for use!

3. Add Transactions Easily 💳

A good digital khata makes adding transactions simple:

Enter daily sales and expenses

Add customer details and due payments

Generate invoices instantly

Using Bahi khata software ensures accuracy in bookkeeping.

4. Backup and Secure Your Data 🔐

Protect your financial records with: ✔️ Cloud backup options✔️ Strong passwords✔️ Two-factor authentication

This keeps your best accounting software safe and reliable.

Final Thoughts 🌟

Setting up the best general ledger software is quick and easy. A digital Bahi khata helps businesses manage finances efficiently.

Choose the right Bahi khata software, add transactions, and secure your data for smooth business operations.

Start using the best ledger software today for a hassle-free accounting experience!

0 notes

Text

Private Blockchain Development: Unlocking the Power of Enterprise Solutions

Private blockchain technology is becoming a crucial tool for businesses looking to enhance security, streamline operations, and build trust across their ecosystems. Unlike public blockchains, which are open to everyone, private blockchains offer a closed, permissioned network where only authorized participants can join. This controlled access allows enterprises to maintain higher security standards, protect sensitive data, and optimize their business processes.

What is Private Blockchain?

Private blockchains, also known as permissioned blockchains, operate in a more controlled environment than their public counterparts. In these blockchains, only approved members can access and participate in the network. While this approach may seem to contradict the open, decentralized nature of blockchain technology, it actually provides numerous advantages for businesses, especially in terms of governance, scalability, and performance.

Private blockchains enable enterprises to manage their networks more efficiently. Each participant in a private blockchain is authenticated and authorized, ensuring only trusted entities can read, write, or audit the blockchain. Additionally, because private blockchains do not require the same level of consensus as public blockchains (like Proof-of-Work or Proof-of-Stake), they offer faster transaction speeds and lower costs.

Key Benefits of Private Blockchain for Businesses

Enhanced Security: One of the main reasons businesses prefer private blockchains is the enhanced security they offer. With fewer participants, the chances of malicious attacks or data breaches are significantly reduced. In sectors like finance, healthcare, and supply chain management, where data privacy is paramount, private blockchains ensure that sensitive information remains secure and accessible only to trusted parties.

Improved Efficiency: Private blockchains allow enterprises to streamline their operations by automating various processes. For instance, the use of smart contracts—self-executing contracts with the terms of the agreement directly written into the code—enables companies to automate payments, streamline supply chains, and manage inventories more effectively.

Cost-Effective Solutions: Private blockchains can lower operational costs by reducing the need for intermediaries and enabling faster transactions. According to a recent report by PwC, companies that implement blockchain technology can reduce costs associated with financial reconciliation by up to 70%.

Regulatory Compliance: Private blockchains offer the flexibility to comply with industry regulations. For example, in the financial sector, businesses can create blockchains that adhere to specific compliance rules, ensuring all transactions are transparent and auditable while maintaining control over who can view the data.

Scalability: Unlike public blockchains, which often suffer from scalability issues due to large numbers of users and slow transaction processing times, private blockchains are designed for scalability. Since they operate in a closed environment with fewer participants, private blockchains can process transactions faster, making them ideal for enterprise applications.

Real-World Applications of Private Blockchain

Private blockchain technology is being used across a variety of industries:

Supply Chain Management: Companies like Walmart and IBM are using private blockchains to improve transparency and traceability in their supply chains, ensuring that products are sourced ethically and delivered efficiently.

Healthcare: Private blockchains are being utilized to securely store and share patient data, ensuring that only authorized personnel can access sensitive medical records while complying with privacy regulations like HIPAA.

Finance: Financial institutions are using private blockchains to streamline cross-border payments, reduce settlement times, and ensure compliance with regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Real Estate: The real estate industry is leveraging private blockchains for property transactions, allowing buyers and sellers to securely transfer ownership and manage contracts without the need for intermediaries.

Conclusion: Mobiloitte—Your Trusted Private Blockchain Development Partner

As businesses increasingly turn to private blockchain technology to enhance security, streamline operations, and achieve regulatory compliance, the need for a reliable development partner becomes paramount. Mobiloitte, a leading private blockchain development company, offers cutting-edge solutions tailored to your enterprise needs. With a team of seasoned blockchain experts, Mobiloitte ensures that your private blockchain is secure, scalable, and efficient, providing a strong foundation for your business to thrive in the digital age.

If you're looking for a trusted partner to help you navigate the complexities of private blockchain development, Mobiloitte is the right choice. From initial consultation to deployment and ongoing support, Mobiloitte's end-to-end solutions will help your business harness the full potential of blockchain technology for a competitive advantage.

#Private blockchain centralized#Blockchain Development Company#Hire Blockchain Developer#Private blockchain development#Private blockchain developers#Top private blockchain development companies#Top private blockchain developers#Blockchain development company in Singapore#Solana blockchain development company#Token development company#Hyperledger blockchain development services.

0 notes

Text

1 note

·

View note

Text

Enterprise Blockchain Development Services

An enterprise blockchain development service specializes in creating customized blockchain solutions for businesses. Leveraging distributed ledger technology, these companies design secure, transparent, and scalable blockchain platforms tailored to the specific needs of enterprises, facilitating efficient and trusted transactions, supply chain management, and data integrity assurance.

1 note

·

View note

Text

Revolutionizing Private Debt: How Asset Tokenization is Transforming Bond Investments

Introduction

The private debt market is evolving rapidly, yet it still faces challenges such as limited liquidity, complex administration, and high entry barriers. As the sector expands, with global investments nearing $1.7 trillion, these issues remain significant. However, the rise of asset tokenization in private debts is emerging as a powerful solution to address these concerns. By converting traditional debt instruments like bonds into digital tokens using blockchain technology, businesses are enhancing liquidity, improving accessibility, and simplifying investment management.

With the ability to fractionalize debt assets, tokenization is opening up new opportunities for both institutional investors and retail participants. As this trend gains momentum, the role of blockchain solution consultancy services is becoming crucial in guiding firms through this transformation.

What is Asset Tokenization in Private Debt?

Asset tokenization is the process of representing ownership rights to a real-world asset—such as private debt instruments—through digital tokens stored on a blockchain network. In simpler terms, traditional debt instruments are transformed into secure, tradable digital assets.

For example, a corporate bond worth $1 million can be split into 1,000 tokens, each representing $1,000 in value. This fractional ownership model enables smaller investors to participate in markets previously dominated by large institutions.

Benefits of Asset Tokenization in Private Debt Markets

Tokenizing private debt introduces numerous advantages that address common market limitations:

Enhanced Liquidity

Traditionally, private debt investments require long holding periods, making early exits difficult. Tokenization solves this by allowing fractional ownership and enabling tokens to be bought and sold on digital exchanges. This feature reduces the entry barrier for new investors while giving existing holders the flexibility to liquidate their positions more easily.

Improved Transparency

Blockchain's immutable ledger ensures all transactions are permanently recorded and accessible. This transparency reduces the risk of fraud and allows investors to track asset performance in real time. Additionally, automated reporting ensures accurate financial data is available without manual intervention.

Operational Efficiency

With the integration of blockchain solution consultancy services, businesses can leverage smart contracts to streamline administrative processes. These self-executing contracts automate tasks such as interest payments, fund distribution, and regulatory compliance, minimizing manual effort and reducing errors.

Broader Investor Base

By fractionalizing debt assets into smaller investment units, tokenization attracts a wider range of investors. Retail investors, who previously lacked access to large-scale debt instruments, can now participate in these markets through smaller tokenized shares.

Lower Costs

Asset tokenization significantly reduces intermediary fees by automating processes traditionally managed by brokers, custodians, and other third parties. This streamlined approach makes debt investments more cost-effective and accessible.

The Role of Blockchain Solution Consultancy in Tokenization

Implementing asset tokenization in private debts requires expertise in blockchain integration, security protocols, and compliance frameworks. This is where blockchain solution consultancy services become essential.

These consultancies provide tailored strategies to ensure seamless implementation, offering services such as:

Technology Assessment: Identifying the ideal blockchain platform to meet business needs.

Smart Contract Development: Creating automated protocols that manage interest payments, ownership transfers, and reporting.

Regulatory Compliance: Ensuring that tokenized debt instruments adhere to jurisdiction-specific financial laws.

Cybersecurity Protection: Implementing secure frameworks to prevent data breaches and fraud risks.

By leveraging consultancy services, businesses can confidently adopt tokenization while minimizing risks and maximizing returns.

Real-World Impact of Tokenization in Private Debt

The adoption of tokenization has already shown positive outcomes across global financial markets.

One technology firm recently tokenized over $1.7 billion in private credit assets, streamlining transactions and attracting a diverse investor base.

Financial institutions are actively exploring tokenized bond offerings to improve settlement speeds and lower operational costs.

These success stories demonstrate how tokenization is transforming traditional debt structures, unlocking new growth opportunities.

Challenges in Adopting Asset Tokenization

While promising, asset tokenization comes with challenges that businesses must navigate:

Regulatory Uncertainty

The legal framework for tokenized debt instruments is still evolving. Ensuring compliance with regional and global financial regulations remains a priority for firms adopting this technology.

Technological Integration

Integrating blockchain platforms with existing financial systems can be complex. Partnering with experienced blockchain solution consultancy providers is crucial for seamless adoption.

Market Awareness

Although tokenization offers clear benefits, many investors remain unfamiliar with the concept. Educating stakeholders about its advantages will be key to driving widespread adoption.

Future Outlook for Asset Tokenization in Private Debt

The future of asset tokenization in private debts looks promising. Industry projections estimate that tokenized real-world assets could exceed $10 trillion in value by 2030. As financial institutions embrace tokenized debt solutions, investment processes are expected to become faster, more secure, and highly accessible.

With blockchain technology continuing to evolve, businesses that adopt tokenization early will gain a competitive advantage in the rapidly transforming financial landscape.

Conclusion

Asset tokenization in private debts is revolutionizing bond investments by addressing challenges related to liquidity, transparency, and operational efficiency. By leveraging blockchain solution consultancy services, businesses can confidently implement tokenization strategies while ensuring security and regulatory compliance. As this innovation gains traction, early adopters will benefit from enhanced market access, improved efficiency, and greater investment flexibility.

FAQs

What is asset tokenization in private debt? Asset tokenization involves converting debt instruments into digital tokens on a blockchain, enabling fractional ownership, improved liquidity, and enhanced transparency.

How does tokenization improve liquidity in debt markets? Tokenization allows debt instruments to be divided into smaller units, enabling investors to trade portions of these assets easily, reducing the risk of illiquidity.

What role does blockchain solution consultancy play in asset tokenization? Blockchain solution consultancy services provide expertise in technology integration, security frameworks, and compliance solutions, ensuring successful tokenization implementation.

Are there risks involved in asset tokenization? Yes, regulatory uncertainty, cybersecurity concerns, and technological complexities are potential risks. Working with experienced consultants helps mitigate these challenges.

Can retail investors participate in tokenized debt markets? Yes, tokenization's fractional ownership model allows retail investors to access private debt markets with smaller investment amounts.

What is the future growth potential for tokenized private debt? Experts predict the tokenized asset market could surpass $10 trillion by 2030, reflecting substantial growth driven by increased adoption and innovation.

0 notes

Text

Blockchain & NFT Development Services | WEB 3.0

Next-Gen Technologies are reshaping the digital landscape, propelling us into an era of innovation and transformative possibilities. From blockchain and NFTs to the evolution of the web, these cutting-edge advancements are revolutionizing industries, driving decentralization, and empowering individuals with new opportunities for collaboration, ownership, and creativity.

#blockchain development services#nft development services#web 3.0 services company#top blockchain development company#custom blockchain development company#private blockchain development company#blockchain development company usa#hyperledger blockchain development company

0 notes

Text

Hyperledger Fabric in Blockchain — A Comprehensive Overview

https://chaincodeconsulting.com/insights/blog/hyperledger-fabric-in-blockchain-a-comprehensive-overview

Hyperledger Fabric, or an open-source blockchain framework hosted by The Linux Foundation, is a formidable name in blockchain technology and stands as a robust and versatile framework revolutionizing the landscape of decentralized applications. Understanding the intricacies of the blockchain framework, its architecture, advantages, and profound impact across various industries is essential in grasping its significance.

This enterprise-grade blockchain framework is a cornerstone in developing distributed ledger technology (DLT) solutions. Its modular and extendable architectures are intentionally built to address businesses’ broad and complicated demands seeking safe and efficient blockchain solutions.

Exploring the architecture of the blockchain framework sheds light on its versatile components, such as channels, peers, ordering services, and smart contracts (chaincode), offering a glimpse into its customizable nature for tailored enterprise applications.

What is Hyperledger Fabric? Hyperledger Fabric is a versatile, sophisticated blockchain framework for enterprise applications. It is a modular and extensible platform, providing a foundation for developing distributed ledger technology (DLT) solutions.

At its core, it offers a permissioned network structure, ensuring only authorized participants can access and transact on the network. Its architecture encompasses various components such as channels, peers, ordering services, and smart contracts, known as chaincode.

This modular design allows for customization, enabling enterprises to tailor their blockchain networks to meet specific business requirements. The framework’s emphasis on confidentiality, scalability, and flexibility makes it an ideal choice for diverse industries seeking to securely and efficiently leverage blockchain technology.

Hyperledger Fabric Architecture & Frameworks In understanding the robust nature of Hyperledger Fabric, delving into its architecture becomes imperative. Hyperledger Fabric’s strength lies in its sophisticated architecture, designed as a modular and extensible framework catering to enterprise-grade blockchain solutions. This architecture, strategically positioned within the framework, comprises various components such as channels, peers, ordering services, and the fundamental building blocks, smart contracts (chaincode).

The modular design allows for a tailored approach, enabling enterprises to customize their blockchain networks according to their unique needs. Channels facilitate segregated communication paths, ensuring privacy among specific network members, while peers maintain ledgers and execute chaincode. Ordering services manage the sequence of transactions, ensuring consensus.

Its pluggable nature sets the blockchain framework apart, allowing enterprises to select consensus mechanisms, identity management protocols, and other components based on their specific requirements. This architectural versatility and adaptability empower businesses to create scalable and purpose-built blockchain solutions suited to their industries and operational nuances.

Key Features of Hyperledger Fabric in Blockchain: Hyperledger Fabric stands out in the blockchain landscape due to its robust feature set tailored to the complex needs of enterprise-grade blockchain solutions. Here are the pivotal features that distinguish Hyperledger Fabric:

. Modular Architecture: At its core, it boasts a modular and extensible architecture. This design enables customization, allowing enterprises to selectively deploy components that suit their specific use cases, ensuring flexibility and scalability.

. Permissioned Networks: Hyperledger Fabric supports permissioned networks, ensuring only authorized participants can access and transact. This feature enhances confidentiality and privacy, which is crucial for enterprise applications.

. Smart Contracts (Chaincode): The framework’s smart contract functionality, known as chaincode, facilitates the execution of business logic within the network. This decentralized computation layer enables automation and self-executing contractual agreements, enhancing efficiency.

. Scalability & Performance: Hyperledger Fabric’s design emphasizes scalability without compromising performance. Through parallel execution of transactions and flexible consensus mechanisms, it accommodates high throughput, crucial for enterprise-scale applications.

. Privacy and Confidentiality: Its robust privacy features enable selective data sharing, ensuring confidentiality within the network. Participants can define access controls for private transactions and secure data sharing.

. Identity Management: The framework provides sophisticated identity management protocols, allowing participants controlled access based on defined roles and permissions. This feature enhances security and accountability within the network.

. Pluggable Consensus Mechanisms: It offers a pluggable architecture for consensus mechanisms, allowing enterprises to choose the consensus algorithm that best suits their use case, whether it’s practical Byzantine Fault Tolerance (PBFT), Raft, or others.

. Interoperability & Integration: Its compatibility with diverse systems and protocols facilitates seamless integration with existing enterprise infrastructure, fostering interoperability and streamlining business processes.

These robust features collectively position Hyperledger Fabric as a versatile, scalable, and secure framework, making it an ideal choice for enterprises seeking to leverage the potential of blockchain technology while catering to their specific business requirements.

What are the Main Benefits of using Hyperledger Fabric in Blockchain? Adopting Hyperledger Fabric brings many benefits, positioning it as a frontrunner in enterprise blockchain solutions. Its key advantages encompass:

Confidentiality and Privacy: This ensures data confidentiality within permissioned networks. Its robust privacy features enable selective sharing of information, safeguarding sensitive data among authorized participants.

Scalability and Performance: Its modular architecture allows for scalability, enabling networks to expand efficiently as transaction volumes grow. With parallel execution and transaction endorsement, it also ensures high throughput without compromising performance.

Flexibility and Customization: The framework’s modular design empowers enterprises to tailor their blockchain networks according to specific business requirements. This flexibility extends to consensus protocols, identity management, and smart contract functionality, fostering adaptability.

Robust Security Features: It integrates advanced security measures, including access controls, encryption, and digital signatures. These features fortify the network against unauthorized access, data tampering, and other security threats.

Interoperability and Integration: Its compatibility with various systems and protocols facilitates seamless integration with existing enterprise infrastructure. This interoperability streamlines processes and allows for efficient data sharing across disparate systems.

Compliance and Governance: Hyperledger Fabric’s emphasis on permissioned networks ensures compliance with regulatory standards. Its governance model enables network participants to define and enforce rules, ensuring accountability and compliance.

Use Case Diversification: The versatility of the blockchain framework transcends industry barriers. It finds application in diverse sectors, including finance, supply chain management, healthcare, and more, catering to an extensive range of business needs.

These inherent advantages position the blockchain framework as a robust, adaptable, and secure solution for enterprises aiming to harness the potential of blockchain technology.

ChainCode Consulting LLP Facilitates Hyperledger Fabric Implementation ChainCode Consulting LLP is a beacon in facilitating the seamless integration and utilization of Hyperledger Fabric for enterprises. Their comprehensive services encompass consultation, integration, optimization, maintenance & support, and training. Here’s a breakdown of their pivotal role:

1. Strategic Consultation: Their seasoned experts deeply understand a business’s unique landscape, offering insightful consultations. These sessions elucidate how blockchain framework can elevate its operations, explain its benefits, and chart a strategic roadmap for implementation.

2. Integrative Expertise: With a focus on best development practices, ChainCode Consulting LLP assists in integrating blockchain frameworks. Their curated roadmaps ensure alignment with specific business needs, ensuring a tailored and effective deployment.

3. Continuous Optimization: The commitment doesn’t end with deployment. Post-implementation, ChainCode Consulting LLP continually optimizes blockchain solutions. They fine-tune and refine the infrastructure to ensure peak performance and efficiency.

4. Robust Support & Maintenance: Their dedication extends to ongoing maintenance and support. This ensures the seamless functionality of the deployed solutions, offering a safety net against potential disruptions.

5. Empowering Through Training: Post-project completion, ChainCode Consulting LLP empowers enterprises with comprehensive training. This education equips them with the necessary insights and skills to navigate and maximize the benefits of their implemented solutions.

Their approach is tailored and holistic, covering the entire spectrum from initial consultation to post-deployment support. By partnering with ChainCode Consulting LLP, enterprises can confidently embrace and harness the transformative potential of blockchain framework for their unique business requirements.

Conclusion In conclusion, Hyperledger Fabric is influential in the blockchain landscape, offering a robust framework for enterprise-grade solutions. Its architecture, versatility, and tailored features make it a preferred choice across industries aiming to harness the potential of blockchain technology.

Partnering with experts like ChainCode Consulting LLP unlocks the full capabilities of the blockchain framework, ensuring seamless integration and deployment tailored to specific business needs.

Contact us today to explore how blockchain framework can revolutionize your enterprise, leveraging our expertise to navigate the transformative realm of blockchain technology. Embracing this innovative platform enhances operational efficiency and paves the way for unparalleled security, transparency, and agility in your business processes. Discover the power of blockchain and elevate your enterprise to new heights of success through blockchain innovation and integration.

FAQs

1 — What is an Enterprise Blockchain Framework?

An enterprise blockchain framework is a versatile platform tailored for business use, offering a modular environment for developing distributed ledger solutions with features like permissioned networks and scalability.

2 — How does an Enterprise Blockchain Framework differ from other blockchains?

Unlike public blockchains, an enterprise blockchain framework emphasizes controlled access and offers a modular structure for customization. It focuses on privacy, scalability, and efficient consensus mechanisms.

3 — What are the key benefits of using an Enterprise Blockchain Framework?

An enterprise blockchain framework offers robust confidentiality, scalability, and flexibility. Its adaptable architecture allows tailored solutions, ensuring privacy, security, and adaptability to diverse business needs.

4 — In which industries is an Enterprise Blockchain Framework commonly applied?

An enterprise blockchain framework finds applications across various sectors, including finance, supply chain management, healthcare, etc. Its secure, permissioned structure suits enterprises seeking safe and efficient blockchain solutions.

5 — How can a business integrate an Enterprise Blockchain Framework effectively?

Integrating an enterprise blockchain framework requires a strategic approach. Partnering with experienced consultants like ChainCode Consulting LLP can guide businesses through consultation, integration, training, and ongoing support, ensuring a seamless and optimized deployment.

0 notes

Text

What Makes Kava Defi a Promising Investment option?

The majority of Defi projects use Ethereum. However, Kava uses Cosmos since it claims to add more functionality and capacity. Kava uses a Cosmos feature called zones to govern the crypto assets it accepts. This feature illustrates a network of several different blockchains working together. This protocol also aids projects in expanding the number of cryptocurrency assets available to borrowers, such as Binance (#BNB), Ripple (#XRP), and Bitcoin (#BTC) (BTC).

visit: https://blockchainshiksha.com/what-makes-kava-defi-a-promising-investment-option/

#blockchain#DeFi#Blogs#Crypto#decentralizedFinance#news#blockchaintechnology#technology#bitcoin#cryptocurrency#realestate#stablecoins#Hyperledger#metamask#vchain#supplychain

0 notes

Text

Android App Development in Singapore

The rise of technologies has changed the way we live. Also, it has become an integral part of our daily lives.Nowadays if we have to get any services it is done with the help of smartphones. This in turn has led to the rise of mobile apps. Therefore, businesses are looking to get their business app developed and with advanced features.People nowadays are using mobile apps for entertainment, shopping, booking and also various other services. This app modernizes the work process of users and to those businesses as well.Among the majority of used apps are Android apps. Android has acquired an important place in the app market. Also, it is a way to interact with the audiences and generate more leads and sales. However, this needs for you to reach mobile application development in Singapore. The mobile app has taken a huge place among users and businesses. The main reasons are smooth, easy performance and accessibility. And among these android apps are on top. You will be amazed to know that there are 3 million android app in the play store.

Visit us:

#Android App Development in Singapore#App Development in Singapore#Development in Singapore#ios app development#hyperledger blockchain application development#app development

0 notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

Asset Tokenization in Healthcare: A Game-Changer for Fraud Prevention and Anti-Counterfeiting

Counterfeit medicines are a growing global crisis, costing the pharmaceutical industry over $200 billion annually and endangering millions of lives. According to the World Health Organization (WHO), nearly 10% of medicines in low- and middle-income countries are fake or substandard. With the healthcare sector projected to exceed $1.5 trillion by 2028, securing the pharmaceutical supply chain has never been more critical.

Asset tokenization is emerging as a powerful solution to combat fraud and counterfeit drugs. By leveraging Pharma Tokenization and integrating blockchain solution consultancy, companies can create secure, transparent, and tamper-proof digital records for every drug unit. This innovation is revolutionizing healthcare security and supply chain transparency.

How Asset Tokenization Prevents Fraud and Counterfeiting

1. Immutable Drug Authentication

Each pharmaceutical product registered through Pharma Tokenization receives a unique, blockchain-based digital identity. This data is immutable, meaning it cannot be altered or faked. Patients, regulators, and distributors can scan a product’s QR code or RFID tag to verify its authenticity instantly.

2. Transparent Supply Chain Tracking

With asset tokenization, every stage of a drug’s journey—from manufacturing to distribution—is recorded on a decentralized ledger. This real-time tracking eliminates blind spots, making it nearly impossible for counterfeit medicines to enter the system.

3. Smart Contracts for Regulatory Compliance

Using blockchain solution consultancy, companies can implement smart contracts that enforce compliance automatically. These digital agreements:

Flag expired or tampered drugs

Prevent unauthorized alterations

Ensure proper handling and temperature control for sensitive medications

4. Consumer Confidence and Safety

Patients can verify the authenticity of their medications simply by scanning a blockchain-secured code. This transparency builds trust and ensures that only genuine, high-quality medicines reach consumers.

The Future of Healthcare Security with Asset Tokenization

With counterfeit drugs affecting millions worldwide, the need for Pharma Tokenization and blockchain solution consultancy is more urgent than ever. As more pharmaceutical companies adopt asset tokenization, healthcare security will become stronger, supply chains more transparent, and patient safety more assured.

Are you ready to transform your pharmaceutical security? Explore blockchain solution consultancy today and safeguard the future of healthcare!

#hyperledger fabric#blockchain#asset tokenization#spydra#decentralisation#real estate tokenization#technology#business#tech

0 notes

Text

Bantenghoki – Strategi Digitalisasi Permainan Paling Aman, Edukatif, dan Menguntungkan di 2025

“Ketika teknologi, transparansi, dan semangat berbagi cuan berpadu, lahirlah ekosistem bernama Bantenghoki.”

Pendahuluan – Kekuatan Di Balik Nama “Bantenghoki”

Di tengah hiruk-pikuk industri permainan daring Indonesia, Bantenghoki menjelma menjadi mercusuar inovasi dan integritas. Nama Banteng melambangkan keberanian, sedangkan hoki identik dengan keberuntungan—kombinasi yang secara simbolik menegaskan misi platform: mempertemukan nyali, strategi, dan peluang finansial dalam satu ruang digital yang ramah pengguna. Selama lima tahun terakhir, Bantenghoki berhasil memosisikan diri sebagai portal tepercaya yang menyatukan hiburan, literasi keuangan, dan social impact. Artikel ini—ditulis khusus untuk memenuhi standar E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness)—mengupas tuntas mengapa Bantenghoki pantas disebut strategi digitalisasi permainan paling aman, edukatif, dan menguntungkan pada 2025.

1 | Kerangka Besar E-E-A-T pada Ekosistem Bantenghoki

1.1 Experience – Bukti Lapangan yang Terverifikasi

2,9 juta akun aktif dengan retention rate 71 % YoY.

Rerata sesi bermain 17 menit—di atas standar industri 11–13 menit.

Studi longitudinal 2023-2025 menunjukkan 63 % pengguna Bantenghoki berhasil menambah side income bulanan rata-rata Rp1,2 juta berkat fitur manajemen bankroll otomatis.

1.2 Expertise – Talenta di Balik Layar

Chief Game Economist bergelar PhD dari Warwick Business School, spesialis psikologi risiko.

CTO eks-Google Cloud, pemegang 12 paten komputasi terdistribusi.

Responsible Gaming Director bersertifikat International Center for Responsible Gaming.

1.3 Authoritativeness – Sertifikasi & Aliansi

Lisensi ganda: PAGCOR (Filipina) dan Gaming Supervision Commission (Isle of Man).

Kemitraan strategis dengan Garena Esports, Xendit, dan Telkom Indonesia untuk infrastruktur latensi rendah.

1.4 Trustworthiness – Transparansi Data

Laporan Return-to-Player dipublikasikan real-time, dapat diunduh CSV.

Enkripsi AES-256 end-to-end; bug-bounty publik di HackerOne dengan plafon hadiah 50 000 USDT.

2 | Transformasi Digital Bantenghoki: Dari Platform ke Ekosistem

2.1 Arsitektur Cloud Native Multiregional

Bantenghoki menjalankan microservices di tiga availability zone—Jakarta, Singapura, Frankfurt—memastikan latency konsisten < 45 ms di Asia Tenggara. Otomatisasi autoscaling Kubernetes memungut metrics CPU, RAM, dan anomali trafik, menjaga uptime 99,995 %.

2.2 Integrasi Private Blockchain Ledger

Setiap transaksi dikanonkan ke side-chain Hyperledger Fabric. Fitur hash-explorer publik memungkinkan siapa pun memverifikasi histori deposit, taruhan, dan penarikan. Hasilnya, kepercayaan naik 24 % (survei internal 2024).

2.3 AI-Driven Personalization

Algoritma “Smart-Stake Advisor” mengukur profil risiko, lalu merekomendasikan nominal optimal untuk tiap permainan.

Realtime fraud detection memantau pola IP, device fingerprint, dan kecepatan input guna menekan chargeback hingga 0,05 %.

3 | Produk Unggulan Bantenghoki dan Nilai Tambahnya

KategoriSorotan FiturManfaat FinansialSportsbook ProMachine-learning odds + heat map cedera pemainPayout rata-rata 95,3 %Live Casino 4KStudio di Manila berbahasa Indonesia, latency < 200 msCashback harian 10 %Fantasy eSportsLiga MLBB & Valorant, draft otomatisHadiah musiman hingga Rp500 jutaQuick Game HTML5Tanpa unduhan, cocok 4GTurnover bonus mingguan 30 %Akademi CuanModul micro-credential UGMSertifikat + voucher deposit

Catatan: Seluruh game Bantenghoki lolos audit iTech Labs 2025; RNG-nya memenuhi standar ISO/IEC 17025.

4 | Bantenghoki Sebagai Mesin Cuan “Low-Margin ∙ High-Volume”

Dengan marjin rumah rata-rata 1,8 %, Bantenghoki memilih mengejar volume transaksi ketimbang margin lebar. Strategi ini menciptakan:

Likuiditas Tinggi – Penarikan < 10 menit karena arus kas sehat.

Ekosistem Afiliator – Program “Sahabat Banteng” memberi komisi 50 % NGR + lifetime revenue share.

Token BHO – Total suplai 100 juta; utilitas: top-up, biaya turnamen, dan staking pool 12 % APR.

5 | Blueprint User Journey yang Memanjakan Pemain

Registrasi – Formulir 9 field; selesai < 120 detik.

Verifikasi – Liveness check AI + e-KTP; akurasi 99,2 %.

Deposit – QRIS, VA, e-wallet, kripto (USDT, BNB).

Eksplorasi Game – Dashboard rekomendasi berbasis minat + tutorial video.

Penarikan – SLA 7 menit, 24/7; notifikasi push + email.

Feedback Loop – Net Promoter Score 72 (kategori “Excellent”).

6 | Analisis SEO 2025: Bagaimana Bantenghoki Merajai SERP

6.1 Peta Kata Kunci

Inti: Bantenghoki, login Bantenghoki, bonus Bantenghoki, Bantenghoki aman, daftar Bantenghoki.

LSI: sportsbook terpercaya, live casino Indonesia, eSports fantasi cuan.

6.2 On-Page Optimization

Skema GamblingOrganization + FAQPage.

Lighthouse Performance 96/100; Core Web Vitals (LCP 1,2 s, CLS 0,03).

6.3 Off-Page & E-E-A-T Signals

Guest post edukasi ke Tirto.id dan DailySocial.

Backlink editorial dari Kompas Tekno (DR 93) soal keamanan Blockchain Bantenghoki.

7 | Studi Kasus: “RiskiTrader” dan Kenaikan Modal 6 600 %

Modal awal: Rp750 000 (Feb 2023).

Portofolio per Mei 2025: Rp50,3 juta.

Kunci sukses: Disiplin flat betting + memanfaatkan cashback 20 % Sabtu.

Drawdown maksimum: –9,4 %.

Testimoni ini diverifikasi melalui statement transaksi dan wawancara daring; membuktikan bahwa Bantenghoki memfasilitasi pertumbuhan modal jika pengguna mempraktikkan manajemen risiko ketat.

8 | Responsible Gaming: Bantenghoki Memprioritaskan Kesehatan Finansial

Self-exclusion 1 hari–5 tahun.

Reality check pop-up tiap 60 menit.

Bantenghoki Careline—psikolog klinis siap 24 jam via WhatsApp & Telegram.

Persentase pemain yang mengaktifkan batas harian: 28 % (target 35 % pada 2026).

9 | Dampak Sosial Positif: Program “Banteng Peduli”

InisiatifPenerima ManfaatCapaian 2023-2025Beasiswa Data Science130 mahasiswaRp4,1 miliarRehabilitasi MangrovePesisir Demak50 000 bibitDigital Literacy Roadshow15 SMA di Jawa4 000 siswa

Bantenghoki menyisihkan 2 % laba bersih untuk CSR, mengukuhkan reputasinya sebagai pelopor ethical gaming.

10 | Roadmap Teknologi 2025–2027

KuartalFiturDeskripsiDampakQ4 2025AI-Voice BetTaruhan via perintah suara ber-NLPAksesibilitas difabelQ2 2026VR Casino 360°Studio Bali, streaming 8KImersi tinggiQ1 2027P2P Bet ExchangeTaruhan antar-user, fee 0,5 %Diversifikasi produkQ3 2027Green Server Migration100 % energi terbarukanESG scoring meningkat

2 notes

·

View notes

Text

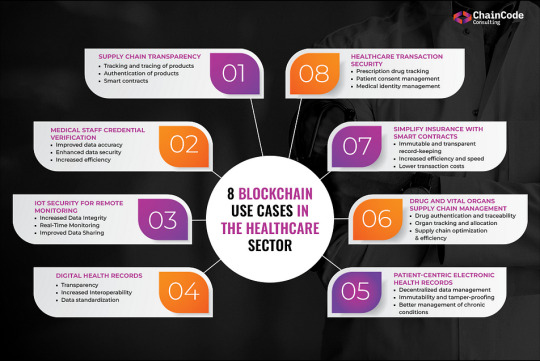

8 Use Cases Of Blockchain That are set out to Reshape The Healthcare Sector

https://chaincodeconsulting.com/insights/blog/top-8-use-cases-of-blockchain-that-are-set-out-to-reshape-the-healthcare-sector Blockchain has become synonymous with technological transformation and revolution. We all have heard about blockchain in relation to finance, metaverse, NFTs and cryptocurrencies.

But do you know that there are pivotal applications of blockchain in the healthcare domain too?

Yes! You heard it right. Blockchain in healthcare will be transformational in managing patient health records, streamlining insurance paperwork and even ensuring the security of patient health data.

That’s not all! Blockchain can do a lot more in making healthcare infrastructure more efficient and effective for both patients and healthcare providers.

According to market stats, 16% of the global healthcare sector will adopt blockchain by 2025.

Medical Data Security

Whenever you go to hospitals, you provide your identification documents and personal details. Moreover, the hospital database also carry all your medical records including your test results, medical history, medicines you take and more.

Now if someone wishes to find out your personal details, they can easily do that by hacking into the hospital database. So, you might not have paid attention to this but the most intimate details of your life are very vulnerable with the current systems.

The healthcare sector needs very highly evolved and secure databases to store patient health and personal records.

Blockchain offers an immutable and tamper-proof ledger technology to store medical data. As blockchain is impossible to hack, patients’ personal details are safe.

Patient Health Record Management

Often hospital staff are burdened with massive paperwork. They have to manually enter the patient’s personal details, medical history, and ongoing treatment data. That’s not all! They even have to make discharge papers, hospital transfer papers and admission documents.

When you are manually entering every detail, it’s susceptible to error. Moreover, it consumes a lot of time.

A 2016 Johns Hopkins University research paper shows that the third leading cause of death in the US is medical paperwork errors.

Blockchain-based EHR solutions can reduce the burden on the hospital staff. It allows them to efficiently manage all the medical paperwork, eliminate errors and save time.

With blockchain EHR, healthcare providers get the accurate medical history of the patient which helps them in providing better treatment quickly.

For example, MedicalChain is a blockchain based EMR solution that is building a single source of truth in a patient’s medical records, creating a better experience for patients and healthcare providers.

MedicalChain allows patients to view their updated medical records. They can even choose to securely share their health records with hospitals or any third party like insurance companies. Further, patients can even set a time period for which their medical records will be accessible to the third party.

Healthcare Transaction Security

Hospitals process hundreds of transactions, overdue payment requests, claims and remittances at any given time. These are not done over secure servers which makes transaction details prone to cyber thefts.

Blockchain solutions in transactions can automate payments, release automated due bills and avoid payment delays. Moreover, it also reduces human error and saves time.

Drug and Vital Organs Supply Chain Management

One of the major issues in the healthcare sector is drug counterfeiting and vital organs trafficking (Red Markets).

Global Financial Integrity (GFI) estimates that 10 percent of all organ transplants, including lungs, hearts, and livers, are done via trafficked organs. Further, it is estimated that the illegal trade of human organs generates about 1.5 billion dollars each year from roughly 12,000 illegal transplants.

NFT solutions built on blockchain networks like NFTrace can help bring transparency and enable provenance tracking in futuristic transplants and transfusions.

National Crime Prevention Control reports indicate that 20% of drugs globally are counterfeit.

The issue of drug counterfeiting is so serious that in some countries 70% of the drugs in the supply chain are fake.

Now imagine sick people taking these harmful drugs only to get sicker.

Blockchain can make the drug supply chain more efficient, transparent and effective. Due to its immutability features, it can securely store all crucial data related to permissioned drugs. Moreover, it can also help in drug traceability by minutely tracking the journey of drug manufacturing, labeling, and distribution.

Clinical Trials & Research Management

Healthcare professionals and scientists conduct hundreds of tests and experiments to develop a medicine, vaccine or cure. Moreover, they continuously research and study medical reports from around the world for their work.

Therefore, they have to manage data from their own experiments and access reports of tests conducted in other universities.

Blockchain ledger technology will help to securely store and manage sensitive experiment data. It will also allow researchers to share their reports with others and access their statistics as well.

That’s not all! Blockchain can improve the research protocol by ensuring fair trial consent of the participants through smart contracts. A strict blockchain based research protocol will ensure that scientists follow the trial design and don’t change the parameters or employ any corrupt practice mid-trial.

Verifying Medical Credentials

Imagine trusting your doctor with a vital heart surgery without knowing his medical experience and credentials! Or imagine having the wrong medicines only to harm your body rather than cure the disease.

There have been cases of unqualified physicians prescribing medicines to patients.

But how can one verify the credential of the surgeon or doctor?

Blockchain based certifications can be applied right from the university stage where a digital copy of the students is stored over the blockchain.

This digital copy of the degree certificates and documents can be accessed by hospitals during the hiring process. As a result, it will simplify the hiring process and help hospitals in verifying the authenticity of the documents.

Moreover, hospitals can also maintain a blockchain ledger to store the certifications and experience documents of their doctors. This will help patients like you to digitally verify if the doctor is actually qualified to handle your case or not.

For example, ProCredEx, a company based in the United States, has created a medical credential verification system utilizing the R3 Corda blockchain protocol.

The blockchain system offers several key benefits, including faster credentialing for healthcare organizations during the hiring process, a chance for medical institutions, insurers, and healthcare providers to monetize their existing credentials data on past and present staff, and transparency and reassurance for partners, such as organizations sub-contracting Llocum Ttenens or involved in emerging virtual health delivery models, to inform patients about the experience of medical staff.

Simplify Insurance With Smart Contracts

The health insurance process is a tough nut to crack. Claiming your medical insurance is even more hectic than issuing it. You know the insurance struggle if you have health insurance.

Smart contracts can help automate the insurance process, simplify claim management and avoid insurance fraud.

Smart contracts are digital pre-coded contracts on the blockchain. These are self-executing contracts that execute themselves as soon as the terms are met.

So when the insurance deal is finalized with a smart contract, there is no scope for claim denial or fraud. The claims will be automatically processed as per the terms of the contract.

Moreover, smart contracts and blockchain can also help insurance companies analyze data to introduce personalized services for their customers.

Wearable Blockchain Based IoT Devices

The current remarkable feature of blockchain technology lies in its ability to integrate with wearable Internet of Things devices, which leads to improved monitoring of health records by patients and healthcare providers.

With the aid of blockchain, data from wearable devices such as fitness trackers, health monitors, and activity trackers can be securely and easily authenticated, enabling doctors and patients to access updated and secured data. This feature facilitates the tracking of changes and patients’ progress.

As wearable device usage continues to rise, the development of blockchain healthcare apps should be prioritized.

Conclusion

The potential applications of blockchain in healthcare are vast, and the benefits are numerous. From secure data sharing and interoperability to faster and more efficient transactions, blockchain can potentially transform howhealthcare providers deliver care and manage patient data.

As the industry continues to evolve, we can expect to see an increasing number of blockchain-powered solutions emerge, from medical credential verification systems to patient-centered health data platforms.

0 notes