#i still don’t actually save or gain any money like my net worth continues to decline lmfao

Text

freaking out bc of course i had to replace my tires right before family vacation right before i move so i’m going to have no fucking money for they next several months i hate it here

#being alive is an endless money pit like i started adulthood w decent savings and i feel like no matter how much i work#i still don’t actually save or gain any money like my net worth continues to decline lmfao#shut up chloe

0 notes

Text

7 Resources That Helped Me Understand Money

1. Clever Girl Finance Podcast, Resources, and Courses by Bola Sokunbi

I adore Bola’s life story, hustle, and her laugh. She keeps it real in her podcast and I want to be a leader like her one day, but in the clinical counseling world. Bola is a Certified Financial Education Instructor (CFEI), writer, speaker, and more. The Clever Girl Finance website also provides (free) courses and worksheets, which I used to fully evaluate my finances and myself. I love that she interviews so many Black women and women of color in per podcasts. It really empowers me to hear these women voice their successes, struggles, dreams, etc. At the end of each episode, she asks her interviewee what their “Clever Girl superpower” is and hearing everyone’s responses is my favorite part.

2. How to Money Podcast by Joel and Matt

I think these guys are funny. Nerdy funny. Their motto is “Rich living on less money” and I can resonate with that. I was raised to live frugally and I continue to enjoy a fairly frugal lifestyle. These guys definitely validate my lifestyle choices, ha. I think their podcast also pushed me to start investing. I used Acorns for several months, but switched to Robinhood for my investments. With the information they provided, I will likely move onto more diverse stocks as well as opening a Roth IRA.

3. Mint App

This is such a great app for everyday use. Everything is one place: all my bank accounts, credit cards, bills, budget, financial goals, etc. I open this app every week or so to make sure I’m somewhat within my budget. I also check my net worth reguarly. It’s in the negative ten-thousands right now! I know that sounds rough, but I’ve paid off a lot of it and I feel really motivated to pay everything off within the next 4 years.

4. I Will Teach You to Be Rich by Ramit Sethi

Props to my friend, Yvonne, for providing a digital copy of this book for me to read. I love this guy’s sarcasm. It’s hard for me to get into financial advice books, but this one is an easy read. As a fellow Asian American, Sethi totally gets what it’s like to grow up Asian! My Asian American parents drilled into my brain to save money and never spend more than I earn. It’s helpful advice, but they neglected to teach me about investing. I also furthered this neglect by ignoring the magic of investing. Sethi does a good job explaining the importance of compounding money/investing as well reasonable money habits. It’s just way more fun to learn these things Sethi’s dry humor.

5. My Boyfriend, Terell

Terell’s my accountability partner. I think everyone needs an accountability partner. He also has this huge knowledge base from all the YouTube videos he watches. I’m grateful to have him around to discuss any finanal transactions I’m considering.

6. The Dave Ramsey Show

I don’t agree with everything Dave Ramsey says or what he believes, but I credit him for helping me focus on paying off my debt. His approach is to have an emergency fund and proceed in paying off all debt to gain financial freedom. I don’t exactly follow this approach completely because I feel like a little bit of debt is helpful in building credit. Overall, Dave Ramsey is really great at slapping people in the face with the consequences of their poor financial decisions. It’s entertaining and eye-opening at the same time.

7. Your Money or Your Life by Vicki Robin

Robin’s book helped he reevaluate my relationship with money. Before, I thought money was scary and evil, but it’s actually a tool. In fact, many of the resources I listed helped me understand how money can help me achieve my goals. I no longer think it’s impolite or rude to talk about money (I mean, unless, someone is being arrogant about it. I guess even if someone was bragging, I’m always curious to hear about it!). Her book has a lot of helpful charts and forms that helped me get my numbers in order as well.

Anyway, these are the resources that helped me the most. I’m still eager to learn more so if I find anything helpful, I’ll go ahead and share it here. More importantly, if anyone is reading this and has anything helpful to add, I’d love to know.

#money#finances#financial independence#financial freedom#paying off debt#moving forward#learning#investing#how to money#your money your life#dave ramsey#i will teach you to be rich#clever girl finance#mint app#accountability

5 notes

·

View notes

Text

Addicted to Real Estate - Why I Can Not Cease and Why You Need To Start

Sahil Gupta project management specialist

The All-Money-Down Technique

So How can the all-money-down technique function by buying a house with money? To start with, allow me to repeat that I actually did not have any money, but I had a substantial quantity of equity out of Terry's house and many houses I possessed put together to provide me a significant cash down payment. Banks and mortgage companies likewise will take cash out of a home-equity line of credit as money to buy a house. They did in 1997 under the fiscal guidelines of this day. What you have to remember about lending and mortgages is the guidelines vary continuously, therefore this technique I used in 1997 may or might not have the capacity to be utilised later on. When it is or is not able to be utilized again does not really matter to me personally since I think that there'll always be a means to purchase property with restricted money down earlier or later. There'll always be a method to get property but just how this will be completed later on I am not entirely convinced.

Sahil Gupta project management specialist

I began buying Houses at the Mayfair section of Philadelphia using all the costs in the $30,000 to $40,000 per house cost range. I'd buy a house with three bedrooms and one bath on the second floor with a kitchen, dining area, and living area on the first floor and a cellar. That which we predict a row house in Philadelphia would include a porch out front along with a garden the width of the house. Most row houses in Philadelphia are somewhat less than twenty-two feet broad. For all those who aren't from Philadelphia and can not envision what a Philadelphia row house looks like, I recommend you see the film Rocky. Twenty-two houses on each aspect of each block is really going to test your skill for a neighbor. Matters which will often lead to an argument with your Philadelphia neighbors frequently stem from parking, sound your kids create, in which you leave your garbage cans, parties, and also the overall look of your house.

In 1998 my Lady and I moved in together and into the suburbs of Philadelphia known as Warminster. After residing on a road in Tacony, similar to Rocky did, I truly looked forward to getting distance between my house and my neighbor. I told Terry to not even consider speaking with the men and women who lived next door to people. I told her when one of them comes along with a fruitcake that I will take it punt it like a soccer into their garden. I think I had been afflicted by Philadelphia row house syndrome. My neighbors in Warminster turned out to be wonderful people, but it took me two months earlier I was prepared to understand that.

So you just purchased your row house to get $35,000 in Mayfair, and following $2000 in closing costs and $5000 in repair expenses, you find a fantastic tenant that would like to lease the house. After leasing the house using a positive cash flow of $200 per month, you finally have an outstanding charge of $42,000 on your house equity line of credit which is going to need to be repaid. When buying the house, I didn't receive a mortgage as I just bought a house for money because it's supposed in the company. All currencies I spent this home were spent by the home-equity credit.

The move now is to repay your home-equity line of charge So that you may go do it . We go into a lender along with your fixed-up home and inform the mortgage division which you wish to do a cash-out refinancing of your property investment. It can help to clarify the area you buy your house in should get a larger selection of pricing because the area of Mayfair failed at the mid-90s. The pricing of houses in Mayfair is rather unusual as you'd see a $3000 gap in house values from 1 block to another. This was significant when performing a cash-out refinancing since it's fairly easy for the lender to find I only bought my home for $35,000 no matter the fact that I did lots of fixes. I really could justify the fact that I've spent money in my house to fix it up, and by placing a renter in, it was a rewarding piece of property from an investment perspective.

If I had been blessed like I had been many times over doing so method of buying homes in Mayfair and the appraiser could utilize houses a block or 2 away and return with an evaluation of $45,000. Back then there were apps enabling an investor to buy a house for 10 percent or left as equity carrying a 90 percent cash out refinance lending me back about $40,500. Using this technique let me return the majority of the money I set back on the property. I essentially paid only $1,500 down to this brand new residence. Why did the mortgage businesses and the appraisers keep giving me the exact numbers I desired? I presume because they needed the enterprise. I'd only tell the lender I want this to come in at $45,000 or that I am simply maintaining it funded as is. They always seemed to give me exactly what I needed within reason.

This entire process took three to four Months during which time I might have saved a couple million bucks. Between the money that I saved from my occupation along with my own investments and cash out cash, I'd replenished most or all my funds out of my own home-equity line of credit which was almost back to zero to start the procedure again. And that's just what I supposed to do. I utilized this system to buy four to six houses annually using the identical money to buy home after home after home over and over again. In fact, this technique is really a no-money down or little money down strategy. In the time perhaps I had $60,000 in accessible funds to use to get homes from my HELOC, therefore I'd purchase a house then replenish the cash. It was a terrific method that has been lawful, and that I could see my fantasy of becoming a real estate agent full-time coming into an eventual reality although I was not there yet.

Throughout the years from 1995 to 2002, the actual Estate marketplace in Philadelphia made slow gains of possibly 6 per cent as every year went . I started to monitor my net worth which has been 100 percent equity, meaning that I had no other kinds of investments to check out when calculating my net worth. Broadly , the initial five decades of my real estate profession didn't go well due to the bad choices I made buying buildings and the decrease in the marketplace. What's more, my lack of knowledge and expertise in repairs left it quite demanding. The next five decades of my real estate profession I only finished explaining did not make much money . I encouraged myself mostly during my profession as a salesman, but I could see the writing on the wall which down the street property was going to be my own fulltime gig.

I Possess an office building which has a property business for a renter named Realty Professionals of America. The business has a terrific strategy where a new broker receives 75 percent of their commission and the agent becomes just 25 percent. If you do not understand this, this is a fairly great deal, particularly for a new realtor. The business also supplies a 5 percentage sponsorship fee to the broker who sponsors them every deal they perform. Should you attract an individual who's a realtor into the business which you've sponsored, then the agent will pay you a 5 percentage sponsorship from the agent's end so the new realtor you sponsored may still earn 75 percent commissions. Along with the aforementioned, Realty Professionals of America provides to grow the realtor's commission by 5% after attaining cumulative commission benchmarksup to a max of 90 percent. After a commission amount is attained, a broker's commission fee is just decreased if commissions at the subsequent year don't reach a decrease baseline amount. I keep 85 percent of my trades' commissions; and I get paychecks checks of 5% in the commissions which the brokers I sponsored make. If you want to find out more about becoming sponsored into Realty Professionals of America's amazing strategy, please call me at 267-988-2000.

Obtaining My Real Estate License

One Of all the things which I did in the summer of 2005 after leaving my fulltime occupation was to make plans to receive my real estate license. Obtaining my property license was something that I always wanted to perform but never appeared to have enough opportunity to perform it. I am confident you've heard that explanation a million times. People always say they're likely to do something soon as they find the opportunity to get it done, but they never appear to discover the time, do they? I try to not allow myself make excuses for anything. So I have made my mind up before I left my fulltime occupation that among the first things I'd do was to receive my real estate license. I registered in a college known as the American Real Estate Institute to get a two-week full-time schedule to receive my permit to sell property in the state of Pennsylvania. Two terrific men with a huge experience taught the course, and that I appreciated the time I spent . Immediately after finishing the course in the Real Estate Institute, I reserved the upcoming available day provided by the country to take the state examination. My instructors' guidance to take the examination right after the course turned out to be a superb suggestion. I passed the test with flying colours and also have used my permit many times because to purchase property and lessen the expenses. If you're likely to be a full-time property agent or a business property agent, then you practically have to acquire a license. While I know some men and women who do not think this, I am convinced it is the only method.

I worked on a single bargain at $3 million at which the commission Into the buyer's real estate agent was 75,000. From the time my agent took a talk, I walked $63,000 commission on such bargain . With the average price per year of being a realtor running roughly $1200 per year, this 1 deal alone would have paid for my property license for fifty-three decades. And of course all of the additional fringe benefits like using the multiple listing service provided a lot of realtors within this nation. When there are different means to acquire access to the multiple listing services or a different program like it, a real estate license is a terrific thing to do.

A Few of the drawbacks I hear Over and over again about getting your property license is the simple fact that you need to disclose that you're realtor while purchasing a house when you're representing yourself. Perhaps I am overlooking something, but I really don't find this as a drawback in any way. If you are proficient in the art of discussion, it is just another obstacle that you need to take care of. I guess you may wind up in a lawsuit where a court of law might presume as you're realtor you need to know these things. I really don't spend my entire life worrying about the thousand ways I could be sued any more than I worry about getting hit by a car each time I cross the road.

The Addict

From his very first investment property more than 20 years back to his persistent hunt for the upcoming great deal daily, Falcone is a nonstop property investment system!

Get Addicted

Sometimes addiction is an excellent thing. Inside This publication Phil Falcone, the Ultimate property enthusiast, will explain to you how you can attain amazing Success as a property agent:

1 note

·

View note

Text

Addicted to Real Estate - Why I Can Not Cease and Why You Need To Start

Sahil Gupta project management specialist

The All-Money-Down Technique

So How can the all-money-down technique function by buying a house with money? To start with, allow me to repeat that I actually did not have any money, but I had a substantial quantity of equity out of Terry's house and many houses I possessed put together to provide me a significant cash down payment. Banks and mortgage companies likewise will take cash out of a home-equity line of credit as money to buy a house. They did in 1997 under the fiscal guidelines of this day. What you have to remember about lending and mortgages is the guidelines vary continuously, therefore this technique I used in 1997 may or might not have the capacity to be utilised later on. When it is or is not able to be utilized again does not really matter to me personally since I think that there'll always be a means to purchase property with restricted money down earlier or later. There'll always be a method to get property but just how this will be completed later on I am not entirely convinced.

Sahil Gupta project management specialist

I began buying Houses at the Mayfair section of Philadelphia using all the costs in the $30,000 to $40,000 per house cost range. I'd buy a house with three bedrooms and one bath on the second floor with a kitchen, dining area, and living area on the first floor and a cellar. That which we predict a row house in Philadelphia would include a porch out front along with a garden the width of the house. Most row houses in Philadelphia are somewhat less than twenty-two feet broad. For all those who aren't from Philadelphia and can not envision what a Philadelphia row house looks like, I recommend you see the film Rocky. Twenty-two houses on each aspect of each block is really going to test your skill for a neighbor. Matters which will often lead to an argument with your Philadelphia neighbors frequently stem from parking, sound your kids create, in which you leave your garbage cans, parties, and also the overall look of your house.

In 1998 my Lady and I moved in together and into the suburbs of Philadelphia known as Warminster. After residing on a road in Tacony, similar to Rocky did, I truly looked forward to getting distance between my house and my neighbor. I told Terry to not even consider speaking with the men and women who lived next door to people. I told her when one of them comes along with a fruitcake that I will take it punt it like a soccer into their garden. I think I had been afflicted by Philadelphia row house syndrome. My neighbors in Warminster turned out to be wonderful people, but it took me two months earlier I was prepared to understand that.

So you just purchased your row house to get $35,000 in Mayfair, and following $2000 in closing costs and $5000 in repair expenses, you find a fantastic tenant that would like to lease the house. After leasing the house using a positive cash flow of $200 per month, you finally have an outstanding charge of $42,000 on your house equity line of credit which is going to need to be repaid. When buying the house, I didn't receive a mortgage as I just bought a house for money because it's supposed in the company. All currencies I spent this home were spent by the home-equity credit.

The move now is to repay your home-equity line of charge So that you may go do it . We go into a lender along with your fixed-up home and inform the mortgage division which you wish to do a cash-out refinancing of your property investment. It can help to clarify the area you buy your house in should get a larger selection of pricing because the area of Mayfair failed at the mid-90s. The pricing of houses in Mayfair is rather unusual as you'd see a $3000 gap in house values from 1 block to another. This was significant when performing a cash-out refinancing since it's fairly easy for the lender to find I only bought my home for $35,000 no matter the fact that I did lots of fixes. I really could justify the fact that I've spent money in my house to fix it up, and by placing a renter in, it was a rewarding piece of property from an investment perspective.

If I had been blessed like I had been many times over doing so method of buying homes in Mayfair and the appraiser could utilize houses a block or 2 away and return with an evaluation of $45,000. Back then there were apps enabling an investor to buy a house for 10 percent or left as equity carrying a 90 percent cash out refinance lending me back about $40,500. Using this technique let me return the majority of the money I set back on the property. I essentially paid only $1,500 down to this brand new residence. Why did the mortgage businesses and the appraisers keep giving me the exact numbers I desired? I presume because they needed the enterprise. I'd only tell the lender I want this to come in at $45,000 or that I am simply maintaining it funded as is. They always seemed to give me exactly what I needed within reason.

This entire process took three to four Months during which time I might have saved a couple million bucks. Between the money that I saved from my occupation along with my own investments and cash out cash, I'd replenished most or all my funds out of my own home-equity line of credit which was almost back to zero to start the procedure again. And that's just what I supposed to do. I utilized this system to buy four to six houses annually using the identical money to buy home after home after home over and over again. In fact, this technique is really a no-money down or little money down strategy. In the time perhaps I had $60,000 in accessible funds to use to get homes from my HELOC, therefore I'd purchase a house then replenish the cash. It was a terrific method that has been lawful, and that I could see my fantasy of becoming a real estate agent full-time coming into an eventual reality although I was not there yet.

Throughout the years from 1995 to 2002, the actual Estate marketplace in Philadelphia made slow gains of possibly 6 per cent as every year went . I started to monitor my net worth which has been 100 percent equity, meaning that I had no other kinds of investments to check out when calculating my net worth. Broadly , the initial five decades of my real estate profession didn't go well due to the bad choices I made buying buildings and the decrease in the marketplace. What's more, my lack of knowledge and expertise in repairs left it quite demanding. The next five decades of my real estate profession I only finished explaining did not make much money . I encouraged myself mostly during my profession as a salesman, but I could see the writing on the wall which down the street property was going to be my own fulltime gig.

I Possess an office building which has a property business for a renter named Realty Professionals of America. The business has a terrific strategy where a new broker receives 75 percent of their commission and the agent becomes just 25 percent. If you do not understand this, this is a fairly great deal, particularly for a new realtor. The business also supplies a 5 percentage sponsorship fee to the broker who sponsors them every deal they perform. Should you attract an individual who's a realtor into the business which you've sponsored, then the agent will pay you a 5 percentage sponsorship from the agent's end so the new realtor you sponsored may still earn 75 percent commissions. Along with the aforementioned, Realty Professionals of America provides to grow the realtor's commission by 5% after attaining cumulative commission benchmarksup to a max of 90 percent. After a commission amount is attained, a broker's commission fee is just decreased if commissions at the subsequent year don't reach a decrease baseline amount. I keep 85 percent of my trades' commissions; and I get paychecks checks of 5% in the commissions which the brokers I sponsored make. If you want to find out more about becoming sponsored into Realty Professionals of America's amazing strategy, please call me at 267-988-2000.

Obtaining My Real Estate License

One Of all the things which I did in the summer of 2005 after leaving my fulltime occupation was to make plans to receive my real estate license. Obtaining my property license was something that I always wanted to perform but never appeared to have enough opportunity to perform it. I am confident you've heard that explanation a million times. People always say they're likely to do something soon as they find the opportunity to get it done, but they never appear to discover the time, do they? I try to not allow myself make excuses for anything. So I have made my mind up before I left my fulltime occupation that among the first things I'd do was to receive my real estate license. I registered in a college known as the American Real Estate Institute to get a two-week full-time schedule to receive my permit to sell property in the state of Pennsylvania. Two terrific men with a huge experience taught the course, and that I appreciated the time I spent . Immediately after finishing the course in the Real Estate Institute, I reserved the upcoming available day provided by the country to take the state examination. My instructors' guidance to take the examination right after the course turned out to be a superb suggestion. I passed the test with flying colours and also have used my permit many times because to purchase property and lessen the expenses. If you're likely to be a full-time property agent or a business property agent, then you practically have to acquire a license. While I know some men and women who do not think this, I am convinced it is the only method.

I worked on a single bargain at $3 million at which the commission Into the buyer's real estate agent was 75,000. From the time my agent took a talk, I walked $63,000 commission on such bargain . With the average price per year of being a realtor running roughly $1200 per year, this 1 deal alone would have paid for my property license for fifty-three decades. And of course all of the additional fringe benefits like using the multiple listing service provided a lot of realtors within this nation. When there are different means to acquire access to the multiple listing services or a different program like it, a real estate license is a terrific thing to do.

A Few of the drawbacks I hear Over and over again about getting your property license is the simple fact that you need to disclose that you're realtor while purchasing a house when you're representing yourself. Perhaps I am overlooking something, but I really don't find this as a drawback in any way. If you are proficient in the art of discussion, it is just another obstacle that you need to take care of. I guess you may wind up in a lawsuit where a court of law might presume as you're realtor you need to know these things. I really don't spend my entire life worrying about the thousand ways I could be sued any more than I worry about getting hit by a car each time I cross the road.

The Addict

From his very first investment property more than 20 years back to his persistent hunt for the upcoming great deal daily, Falcone is a nonstop property investment system!

Get Addicted

Sometimes addiction is an excellent thing. Inside This publication Phil Falcone, the Ultimate property enthusiast, will explain to you how you can attain amazing Success as a property agent:

1 note

·

View note

Text

What Makes Personal Finance Exciting?

If you’re somewhat involved in your finances, certain things about it may excite you. You may get excited every time you earn income.

Whether you earn income from a job and a paycheck, through dividends, or through any kind of business or consulting, you may get a feeling of excitement that I’ve been rewarded for the work that I’ve performed.

You Can Gain Something From Doing Nothing

The idea of passive income is exciting. True passive income is the ability to make money while doing practically nothing. I think interest and dividends are the best examples of this.

It’s true that it can take time to build up to a sizeable portfolio where passive income can be of significance. And so it’s not a matter of if, but when we do reach that level, we can make large sums of money while sleeping or watching TV.

You Have A Finance Background

A background can provide inherent excitement. Of if you’ve studied and/or have worked in finance, you may have a bit of an edge. Having an edge in and of itself can be exciting. At the same time, it can also put pressure in a sense that hey I know the risks of not investing, or fail to pay a debt, or spend more than I earn. The pressure can create an opportunity for you to adjust your habits and get on track as well.

I have a finance background and have always been interested in personal finance. Years ago I would just read about personal finance topics on MSN and Yahoo along with other topics like sports, general news, and current events and even, admittedly, celebrity gossip.

For me, the real excitement came when I started writing about personal finance. It’s because writing forced me to take action into my own personal finances. Why would I write that it’s good to invest in a diversified mix of investments if I myself hold only one or two large stock positions? I try to practice what I preach, most of the time. :-)

Writing about personal finance has also made me more accountable to make sure I am on track with my financial goals.

You’ve Struggled Financially In The Past

It’s possible to know a lot about personal finance and yet still struggle with your own finances. Certain things can hurt you financially that are just not in your control. These can include expensive treatment for illnesses or an emergency home repair.

It’s important to take everything that has happened in the past and find a way to learn from it. Control what you can; try to stay healthy to the extent you can and consider current and future costs when contemplating home improvements.

For example, we had a leaky ceiling a couple years back. Above the ceiling is a balcony from my master bedroom. The leak was due to a faulty sliding door that was installed on the balcony. Long story short, a new contractor (whom I trust a whole lot more than the one that originally installed the faulty door) figured out the problem and installed the right door. Thank goodness it hasn’t leaked since.

The lesson I learned is to make sure contractors have a solid body of work, which is verifiable from past projects, and experiences from family and friends rather than cheap labor costs.

The experience gained from a struggle can turn into excitement. I was excited and anxious to get my emergency fund back to its normal level. I had something to work towards again. The struggle allows us to seek opportunity and challenge ourselves.

You’re Excited From Someone Else’s Story

This one pops into my mind right away from the personal finance world. I see so many personal finance writers from other websites who didn’t start out in personal finance but have embraced it and excelled tremendously as a result.

One example I can think of right way is Mr. Money Mustache. He comes from an engineering background. He learned that he can live a great life while still saving more than half of his income and investing it regularly. I suspect a lot of his motivation came from simply the desire to not have to work a regular job anymore and enjoy life.

A recent motivator I found was from millionaire interview I read on ESI. The interview was from a public school teacher. Actually, both the husband and wife are school teachers. It’s not a surprise that public school teachers do not make a crazy ton of money, yet this couple became millionaires through hard work with additional teaching opportunities and smart investing. At the time of this interview, they were in Mexico teaching and vacationing too!

You’ve Stumbled Upon It And Are Now Hooked

I’ve also read on numerous websites the quest for young graduates to get rid of their student loans. It’s inspiring to see their sacrifice by continuing to live like a college student by renting rooms out, living in small quarters, eating at home, limiting spending, and using raises and bonuses to pay off their loans.

From having a goal to pay off student loans, newly graduates may stumble upon other concepts of personal finance like compound interest and investment efficiency from a tax standpoint. Even though it’s sad that this isn’t standard curriculum for all colleges, many college graduates are self-taught shortly after they graduate.

Because you’ve stumbled upon personal finance concepts that quickly be applied to your life and you’re able to see the results, you may be excited.

Anticipating The Outcome May Be The Most Exciting Part

Many of us are diligent in our personal financial lives so we, really, don’t have to work anymore. Or rather so we can spend time working or to do things we actually and truly want to do, all the time. The thought of that is exciting, isn’t it?

When we calculate our retirement needs out and determine we’ve got only five years left, then two years, then less than a year, then three months and then boom, we’re free from doing what we need to do and transition to doing what we want to do!

People say that your finances should be boring. While I partly agree the other part of me thinks, what does excitement really mean? Google defines it as “a feeling of great enthusiasm and eagerness”. As we continue to optimize our financial lives, we can’t help but feel excited.

Your Thoughts:

What excites you about personal finance?

If you’re in a non-financial field, how did you learn about personal finance?

What has driven you to take more control over your personal finances?

_______________________________________________________________________________

I use because (1) it’s free, (2) it tracks all of my accounts and overall net worth, (3) my account balances automatically update, (4) it shows how my investments are diversified and allocated in various sectors, and (5) can use built-in tools like “Investment Checkup” to get….wait for it…free personalized advice!

Read the full article

#College#Education#excitement#exciting#millionaires#moneymoustache#passive#personalfiannce#retirement#struggle#studentloans

1 note

·

View note

Text

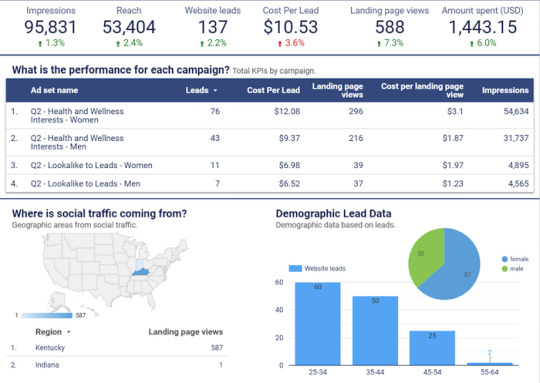

Marketing Trends for 2020: Here’s What Will Happen That Nobody is Talking About

The new year is right around the corner. And I know you are already prepared because you read this blog and tons of other marketing blogs, right?

But here is the thing: I also read most of the popular marketing blogs, follow all of the marketing YouTube channels, and listen to the same podcasts you do.

And I’ve noticed that very few people are talking about what’s really going to happen in 2020.

Sure, they will tell you things like voice search is going to account for over 50% of the search queries next year but all of that stuff has already been talked about.

And there are actually more interesting trends that will affect your marketing that no one is really talking about.

So, what are these trends? What’s going to happen in 2020?

Alright, here goes…

Trend #1: Companies who rely on Google Analytics will get beat by their competition

We all love Google Analytics.

Heck, I love it so much I log in at least 3 or 4 times a day. And here is the kicker: I get so much traffic that my Google Analytics only updates once a day.

I really need to break that habit but that’s for another day.

You are probably wondering, what’s wrong with Google Analytics?

There actually isn’t much wrong with it. It’s a great tool, especially considering that it’s free.

But here is the thing… marketing has been changing. New channels are being constantly introduced, such as voice search.

And transactions no longer are as simple as someone coming and buying from you and that’s it.

These days there are things like upsells, down sells, repeat purchases, and even checkout bumps. On top of that, there are so many different ways you can generate revenue for your online business, such as partnerships, affiliate marketing, and even webinars.

This has caused companies to start using analytics solutions that tie into their database better, such as Amplitude. Or better yet, you are seeing a big push into business intelligence.

A central place where you can tie in all of your data and make better-informed decisions so you can optimize for your lifetime value instead of your short-term income.

In 2020, you will see more companies adopting business intelligence solutions… from paid ones to free ones like Google Data Studio.

If you haven’t checked out Data Studio, you’ll want to start now because it is easy to pass in all of your business and marketing data into one place. For example, you can pass in more granular data from your Facebook ad campaigns into Data Studio while that would be a bit difficult to do with Google Analytics.

Trend #2: Companies will optimize for voice search, but not for revenue

According to ComScore, over 50% of the searches in 2020 will be from voice search. But that’s not really a new trend… everyone has been talking about that for years.

So, what’s the big deal?

Optimizing for voice search is a great way to get your brand out more, but how is that going to convert into sales?

I haven’t seen too many solutions so far when it comes to capitalizing on your voice search traffic, but so far there is Jetson.ai.

If you aren’t familiar with Jetson.ai, it makes it so people can buy from your site using voice search. It doesn’t matter if it is Alexa or Google Home, they work with most of the popular devices.

vimeo

What’s cool about Jetson.ai is that it can learn from each customer and customize the interactions.

For example, if I keep ordering the same toothpaste from a specific store using voice search, Jetson.ai keeps track of that so you can easily keep ordering the same product over and over again with little to no friction.

Heck, it’s easier than logging into your computer or pulling out your phone to make a purchase.

Trend #3: Your lists won’t convert as well, so you’ll have to look for alternative communication channels

Email, it’s something we all use in the corporate world.

But here is something interesting when it comes to marketing emails… I’m in a group with a bit over 109 email marketers across different industries in different parts of the world.

And can you guess what we are all noticing?

Our open rates are staying roughly the same and that’s largely because we all know how to clean and optimizing for deliverability.

But our click rates are going down.

So far as a group we have seen our click rates drop by 9.4% in 2019.

That’s crazy considering as a group we have over 146 million email addresses.

Now does this mean email is dead?

Of course not!!!

Email is here to stay and will be here for a very long time.

But what companies will have to do in 2020 is to leverage more communication channels.

Chatbots will take off drastically. Not necessarily the Intercom’s or Drift’s of the world but more so the solutions like ManyChat and MobileMonkey.

ManyChat and MobileMonkey leverage Facebook Messenger and as they connect it with Instagram and WhatsApp it will get even more popular.

In addition to chatbots, you’ll see more people leveraging tools that allow push notifications like Subscribers.

It’s so powerful, here is the impact I’ve been able to generate from push notifications so far using Subscribers.

You can wait till next year to lever chatbots and push notifications, but I’d recommend you start sooner than later. 😉

Trend #4: Moats will almost be non-existent, other than brands

You’ve probably heard the word “moat” before. If you haven’t, just think about water around a castle.

Back in the day, they had water all around the castle and they used a drawbridge to get in and out of the castle, so it would protect them from invaders.

With your business, you may have a moat. It could be a feature, your cost structure, a technological advantage, or even a marketing advantage.

Over the years, moats in the online world have slowly been disappearing.

It’s easy for anyone to copy these days. So, what’s separating you from your competition?

Something could work right now, but it won’t last forever…

But do you know what will still be a strong moat in 2020 and even a stronger one in the future?

It’s branding.

People buy Jordan shoes because they love Michael Jordan. His brand is stronger than ever even though he hasn’t played in the NBA for roughly 16 years.

His shoes are so popular, it’s helped him boost his net worth to over a billion dollars. Plus owning a basketball team doesn’t hurt either. 😉

But what’s interesting is he’s made more money after retirement than he did as a basketball player.

And it’s not just Jordan who built a strong brand… so have the Kardashians.

Kylie launched a billion-dollar company according to Forbes and it was all because of her personal brand. Her cosmetic company isn’t doing anything revolutionary. She just has a strong brand… and good for her for monetizing her brand.

The same goes for companies like Nike, Ferrari, Tesla, American Express… and the list goes on and on.

It’s why companies are spending over 10 billion dollars a year on influencer marketing.

Just look at my agency NP Digital. It’s literally one of the fastest-growing ad agencies out there. And when I look at all of my competitors’ numbers, we are growing at a much faster pace because of my brand.

Yes, we have a great team, but again, that really isn’t a moat as a lot of agencies have great teams. It’s my brand that gave us a really fast kick start and continues to hopefully push us up.

You’ll want to build a brand in 2020. Whether it is personal or corporate, it’s the best moat you can build in marketing. Plus, it will help you with Google’s EAT.

Trend #5: Marketing will become a more even playing field, you’ll have no choice but to use automation

When I first started off as an entrepreneur, I turned to SEO because I couldn’t afford the big ad budgets as my competitors.

Heck, I couldn’t even afford to run any paid ads.

Over the years, the playing field has become more level.

There are credit card companies like Brex that make it easier for startups to get approved for larger limits and you may not have to pay them back right away.

There are financing companies that will give you cash to spend on marketing, so non-venture funded companies can more easily compete.

There are even companies like Lighter Capital that will give you loans without all of the headaches based on your existing revenue.

And to top it off, software solutions are now starting to integrate AI to give better recommendations. From Clickflow and RankScience to Distilled ODN… everyone is trying to use AI to make SEO and other forms of marketing.

Heck, BrightEdge can even automate your SEO (or at least a large portion of it). According to them, their automated SEO solution increases page views per visit by 60% as well as provides 21% more keywords on page one.

Keep in mind their clients are really big (their software starts in the thousands of dollars per month) so they would probably see better results than most companies, but still, you will start seeing many more software companies leverage AI.

Even with Ubersuggest, I’m working on creating AI that does the SEO for you so you no longer have to spend endless hours while, at the same time, saving you thousands of dollars.

In other words, the marketing playing field is getting more even. And if you want to do well, you are going to have to leverage AI and automation.

If everyone else is using it and you aren’t, you are going to get crushed because it will make changes faster and more accurately than a human. Again, it’s the only option you’ll have if you want to continually compete.

But don’t worry, there will be affordable/free solutions that exist, it’s just a matter of time. 😉

If everyone is leveraging the same AI marketing technology, how can you beat your competitors?

Well, it will come down to everything else… price, customer service, upselling, operations, sales… All of the small stuff is what’s going to help you win.

Trend #6: There will be no more silver bullets, we will all have to optimize for marginal gains

A lot of businesses were built off of one marketing channel.

Dropbox grew through referral marketing. Invite more friends, get more free space.

Facebook was built off your email address book. Facebook used to tap into it and invite all of your contacts to use Facebook on your behalf.

Companies like Quora and Yelp were built off of SEO. All of those rankings really help drive their businesses.

But you no longer can build a business through just one marketing channel. Good channels now get saturated extremely fast.

Even if they work and cause explosive growth, it will only last for a short while before your competitors jump on board and make it harder.

Marketing is now heading in the direction of being about “marginal gains.”

There’s a British cycling coach named Dave Brailsford. His belief was that if you improved every area related to cycling by just 1 percent, then those small gains would add up to remarkable improvement.

And he’s right, that’s how you win a race.

The same will be with your marketing. There will be a big shift from people focusing on one channel and trying to find the “Holy Grail of marketing” to working on slightly improving each area of your marketing.

From split testing your title tags to get a few ranking improvements to adding checkout bumps to your order page so you can spend a little bit more on your paid ads to using Google Data Studio so you can better optimize for your lifetime value…

It’s all about the little things. That’s what is going to add up to winning.

That’s what you’ll have to shift your mindset to in order to win in 2020 and beyond.

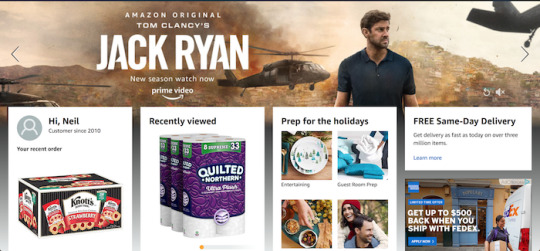

Trend #7: Personalization is the new marketing

The problem with marketing as it exists today is that 95% of your visitors will never convert into a customer. And that’s if you are lucky.

Chances are you are more likely looking at 97% plus of your visitors never converting.

The big reason isn’t that your marketing sucks or that all of those visitors are junk and unqualified.

It’s that your message doesn’t fit every single one of your visitors.

But through personalization, you can convert more of your visitors into customers.

A basic example of this is Amazon. When you go to Amazon, they know your patterns and what you typically buy so they show you what they think you want to see in order to boost their conversions.

And it works! When I log into Amazon I see tons of household supplies because that is what I buy the most often. I never buy dog food (which is smart because I don’t have a dog) so I’ll never see ads for dog food.

Businesses are also trying to personalize each and every single experience both online and offline.

Companies like Amperity are trying to create a customer relationship engine so you can better serve each of your customers, whether it is online or offline.

Marketing is going to become a game of personalization. With ad costs and even general marketing costs rising, you have no choice but to figure out how to convert the 97% of your traffic that just never comes back.

You’ll see a big push for this in 2020.

Conclusion

I know a lot of the stuff I mentioned above isn’t talked about a lot and they aren’t popular marketing topics that everyone wants to hear… but it is the future.

These are trends that will come true, some already are, and you have to adapt for them.

Here’s the beautiful part, though. You just read this, and now have a chance to act on the information before your competition. So, make sure you go and do so.

I want to see you not only succeed but I want you to beat your competition. And I believe you can, whether you are a big company, or just starting off with very little to no money.

So, what do you think of the trends above? Do you see any marketing trends that will come true in 2020 that few people talk about?

The post Marketing Trends for 2020: Here’s What Will Happen That Nobody is Talking About appeared first on Neil Patel.

Marketing Trends for 2020: Here’s What Will Happen That Nobody is Talking About Publicado primeiro em https://neilpatel.com

0 notes

Text

Kill The Buddha

I was in the metro (underground train) once in Milan, Italy. And I was in the first car, standing with my face towards the last car. As the metro was going through the streets towards downtown Milan, suddenly, for a second, all the cars lined up straight and I saw the people sitting and standing in the last car, which was probably the 7th or 8th car from me. I am sure it has happened to many people at many times, but it was the first and probably the last time for me. That's why it was so interesting. I said to myself, "Wow... tunnel vision".

At another level, I think that that is what happens to people branded as geniuses. Through hard work, perseverance and a bit of luck (in different proportions for different people), all the dots in their particular discipline suddenly line up for them and they see something maybe no one has seen before. They make sense of things which could have been non-sensical before.

I think Gautam Buddh, if he existed, was one such genius. He was able to connect the most critical dots about the human psychological and spiritual condition thousands of years before others did. He especially came to understand the effects of attachment like very very few others have before and after him. His words astonish and enlighten us to this day.

His basic saying on attachment is: "Attachment is the source of all suffering."

Another one is, "You only lose what you cling to."

There are many others.

Twenty five hundred years or so after his death, we still don't get it. We still continue to be attached to innumerable things, people, ideas, concepts, thoughts, desires, goals, images, etc.

Gautum inspired thousands of others to start exploring themselves. When Buddhism reached China, one of these inspired ones was Zen Master Linji, who gave one of the most shocking yet illuminating pieces of advice to the disciples, also about attachment, i.e., spiritual attachment in this case. It goes like this:

If you meet the Buddha on the road, kill him immediately.

What? Kill the Buddha? Isn't he like the originator of the Buddhist tradition? How can a seeker / a disciple kill the Buddha?

Lets break up the sentence and go deeper into it.

The sentences has two parts:

- "If you meet the Buddha on the road"

Lets remember that Linji is advising the disciple. Not all disciples are going to have the same path or the same experiences on the path. Hence he used the word, "if".

What is the experience Linji is talking about? "Meet the Buddha". It can have many meanings. One meaning is that when you are on the path, you have to leave all images behind. 'Buddha' is also an image. (And I am not talking about the statues of Buddha, which Gautum Buddh would be shocked and disappointed to find, since he was so much against statues and worship.) When we read about Buddhism or we listen to Buddhist sermons or we see Buddhist quotes or we see the statues, we develop an image in our minds as something good or bad or useless or something to be pursued or something to be converted to. We develop goals, i.e., to be a 'buddhist', to attain enlightenment, etc.

Another meaning could be that, when you are on the path you might come to a point when you start feeling that you are progressing towards enlightenment and that you are becoming a buddha yourself. Again, that is an image you hold in your mind. And Linji is warning that if you start thinking in terms of what you are 'achieving' or 'gaining' on the path, then you have actually left the path. You have lost your way. Thus, he says, if you see the buddha on the road, kill him immediately.

The moment we have developed goals and images and the moment we start thinking of ourselves as 'special' or as a 'buddhist' or as coming close to enlightenment, we are finished. We are no longer going in the right direction. Then the real teachings of Buddha will remain out of our reach and we will be stuck to those goals and images and thoughts.

The moment we we start getting attached to or holding on to a 'scripture' or a 'book of God' or when we start worshipping a prophet or 'son of God' or 'the mother of the son of God' or the Buddha or a 'guru' or 'tirthankara', the spirituality in us dies.

The difference between a living spirituality and a dead spirituality is the difference between a beautiful living flower on a stem and a dead flower someone has saved in a book. If you like to save dead flowers in books, of course there's nothing 'wrong' with it. Its just that it will not have the fragrance and the colors of a living flower. But if you don't want the fragrance or the colors, then it's not a big deal.

Buddha and Linji were talking to people who like living flowers on stem rather than dead flowers. They wanted us to stay alive, not become spiritually dead.

So, as we saw above, the words, "meet the Buddha" can have different meanings. It could mean having images or thoughts of the Buddha in your mind. Or, it could also mean having images about your own buddhahood. Yes, you are a buddha. Its just that you have forgotten that you're a buddha. And you have started thinking of yourself as a much smaller 'I', i.e., the ego

And what is a buddha? Someone who is unattached, silent, observant and unshakeably present in the herenow.

What is the road?

There is only one road, one path. On this path, one direction goes towards the inside, towards God. It is the direction of silence, stillness, quiet observation, simple and content living, a blissfulness without any goals. A world without time. Time is a utility which can be put aside and one can be timeless, without the attachment to the past or the future. Just being in the present. The forever flowing stillness of now. The pendulum stops. The polarities disappear. If someone throws a stone in the lake, it disappears in the lake without creating any ripples. No ripples at all. Someone hits me, I don't respond. Someone abuses me, I don't respond. Someone praises me or says they love me, I don't respond. Someone takes away all of my possessions, I don't respond. There is no response to the 'good' and no response to the 'bad'. There is just silence, stillness and observation. Images are flashing on the inner screen and passing away, then more images and more. And none of the images elicits a response.

The other direction is towards the outside, towards money, towards material possessions, images, goals, desires, discontentment, mental stress, anxiety and fear. 'Time is of the essence'. Goals need to be met. Net worth needs to keep growing. Images need to be maintained. The 'circle of control' needs to be expanded all the time and power needs to be exercised over as many people as possible. The past defines the present and the present must lead to a certain well thought out future. Everything must conform to our own plans. Otherwise, there is discontentment. Stillness is death. Silence is weakness. This direction also includes religious or spiritual goals, dreams and aspirations. Trying to be a good person to win the ticket to heaven, where there are all kinds of pleasures and comforts.

There is a beautiful Native Indian Cherokee story, in which a father teaches his son about good and evil through a parable involving two wolves. He tells his son that there is a terrible fight going on inside him between two wolves. One is good and the other is evil. The evil wolf has anger, envy, sorrow, regret, greed, arrogance, self-pity, greed, resentment, inferiority, lies, false pride, superiority and ego. The good wolf has joy, peace, love, hope, serenity, humility, kindness, benevolence, empathy, generosity, kindness and compassion. This fight, he told the young boy, is going on inside every one, including the little boy.

The boy is listening attentively. He asks, "Which wolf is going to win?"

The father says, "The one you are going to feed."

(see firstpeople.us/CherokeeLegends/TwoWolves)

It is is a beautiful parable. The two wolves are the two directions on the path we are talking about. You can choose which wolf to feed, which direction to start walking in.

Attachment, including attachment to spiritual or religious goals and aspirations, lies on the path of the ego.

Again, there is absolutely nothing 'wrong' with the path of attachment and ego. If that is what you need right now, then that is what you will get.

Whether you know it or not, consciously or sub-consciously, there is one thing you are seeking in life (see my other Post titled, 'The Big Fish'). That is the thing you will give anything to get. That is what you are after. It could be money or power or prestige or spiritual status or any other thing. That one thing, the 'Big Fish' in your life, determines which wolf you are going to feed, which side of the path you are going to choose.

Next, what does it mean to kill the Buddha?

It means, be silent, watchful and still. When the seeker is on the path, he / she has to stay silent,watchful and still.

Linji is warning that on the path, the seeker has to be absolutely naked. There must not be any attachments or images when you start the journey and also during the journey. There will, of course, be moments when the seeker is weak or discouraged or harbouring doubts and tries to get encouragement from the image of the Buddha or the goal of attaining nirvana. And there will be moments when, for example, the seeker has mastered the art of meditation or has attained an insight into some sutra or saying of the Buddha or has achieved something else which he considers as a substantial step on the journey and is ecstatic over it. Linji is saying that all these will pull the seeker back on the path.

If we see the teachings of the great wisdom teachers in parallel, we will find many consistencies / similarities. Why? Because their paths were identical and their destination was the same. Jesus, in one of his parables, has also warned that the seeker can be set back on the path if he is not watchful. This is the parable of the woman with the jar full of wheat grains (Thomas 97). It goes like this: There was a woman who was carrying a jar of wheat grains. As she was walking along, the handle of the jar broke and the grains started dropping out. The woman, not being very mindful and perhaps busy with her thoughts, did not realize what had happened. By the time she reached home and looked inside the jar, it was empty. All the grain was gone.

This is probably what Linji is warning about. We have to be watchful on the path. Otherwise, we will lose whatever understanding we have gained, whatever progress we have made. If there are any images arising in our minds, these need to be discarded. The mind has to be like a mirror. Any dust on the mirror has to be removed, otherwise we will not be able to see ourselves in the mirror. Whatever thoughts, ideas, images, experiences arise, we observe them and let them go. There is no holding on to anything, any thought, any image. If there is a reaction to these thoughts, ideas, images, we observe that reaction too. The more we observe, the more these thoughts, ideas and images will become like clouds passing by in the unchanging sky. There will emerge a silence and a stillness. That silence and that stillness is the path and it is also the destination. In that silence and stillness is the divine / the eternal / the universal, i.e., our true self.

So, "kill the Buddha" means letting go. Osho used to say it brilliantly: spirituality is not about finding God, its about letting go of yourself. The 'I' is the only thing separating God and us. If we let go of the 'I', there is no separation. All is one.

The 'I' / the ego is like a robe we are wearing and this robe is made of images. If we are not watchful, the Buddha or the idea of nirvana or moksha or enlightenment also becomes one of the images that the ego is made up of.

Linji is telling us to remain utterly naked. To maintain the oneness by not letting anything come between ourselves and God, not even the Buddha.

The events in Jesus' life, especially towards the end of his life, are also relevant here. Just before his arrest and trial for blasphemy and sedition, he is at a place called Gethsemane. Judas Iscariot (his disciple who turned traitor) has already told his enemies where Jesus is, so that they could come and arrest him. Jesus knows that he is about to be arrested. He is saying his final prayers, asking to be saved: "---Father, if it is possible, may this cup be taken from me. Yet, not as I will, but as You will"

Jesus knows that he will be tried and crucified. However, as the time is approaching, Jesus is feeling afraid of losing his life. He is fearful of death and is requesting God / Father to help him avoid death, if possible. At the same time, he is also submitting himself to God's will by saying, "not as I will, but as You will"

This is a moment of weakness which Jesus had just before the crucifixion. He has fallen prey to the fear of death. He is an enlightened being, he has felt oneness with God, he has transcended the boundaries ordinary individuals have and has experienced the eternal / universal self, he calls God his 'Father' and himself God's son, he has already become a great teacher, his vision is clear. And, yet, here he is, telling God that he does not want to die. He has lost his Buddha-nature. Or, to be more precise, he has lost his Christ-nature. Here he is just the man Jesus.

In the version given in the Book of Matthew, he says, "My God, my God, why have you forsaken me?"

He is complaining. It is as if he had some image of God and some expectation of what God was going to do if he (Jesus) was about to be hanged and that expectation is not being fulfilled.

But, Jesus is no ordinary being. He does fall, but he bounces back very quickly. When he is being crucified, he says from the cross, "Father, forgive them, for they do not know what they are doing."

For someone beaten mercilessly, hanging on the cross, with nails in his hands and feet, about to die, these are not the words of an ordinary man. No, he is back as the enlightened master and is setting yet another example of love by praying for people who are killing him.

This event from Jesus' life shows vividly what Master Linji was trying to teach. If you fall on the path, you've got to pick yourself up. You've got to kill the Buddha. Jesus killed his buddha, to speak metaphorically. He conquered his weaknesses and doubts. He regained his mindfulness. He let go of the final attachment, i.e., to his own life.

So, in a nutshell, meeting the Buddha on the road means falling down, falling prey to your own attachments... killing the Buddha means getting back up and letting go.

(Image by Charles Rondeau from Pixabay )

0 notes

Text

7 Realistic Methods to MAKE MONEY ONLINE

1. Google Adsense

If you have visited any website, you've seen Google ads. These advertisements are everywhere, and once and for all reason. Not merely are they easy to create on any basic website, however they can be profitable once your website begins bringing in a respectable amount of traffic.

Among the fresh reasons for having Google AdSense is that it is effortless to get set up. When you have a blog or website, you can join a free of charge Google AdSense Accounts. From there, Google will provide you with a unique code that you'll paste on your website. Google requires it following that, tracking your web page views, traffic, and income in your stead. There is absolutely no maintenance or maintenance to understand this thing heading, rendering it a no-brainer if you have a website already.

How much do you want to make? I believe my best month with Google AdSense was almost $5,000 during the last ten years. That amazing month blew my mind since it was actually close to the beginning of my blogging journey. When you are from making zero to $5,000 in a full month, that will rock and roll your world. For me personally, it also got me even more thrilled because I understood there were different ways to monetise.

2: Affiliate marketer Marketing

Whether you have a website or remain thinking up ideas for a blog, you can also consider affiliate marketer marketing. With internet affiliate marketing, you partner with brands and businesses within this content of your website. If you point out something or service, you connect to that produce or service utilising a unique affiliate marketer code you received when you enrolled in that particular affiliate marketer program. Following that, you’ll generate income any time someone buys a product or service through your link.

Speaking generally, you’ll want to partner with affiliates that are related to your site concept. Since I’m a financial consultant, I've concentrated a great deal of my affiliate marketer energy on financial loans like cost savings accounts, bank cards, and investment accounts.

Furthermore, to registering for individual affiliate programs, you can also join an affiliate ad network that offers a massive amount of different affiliates in a single place. That real way, you can view what works and what doesn’t work as time passes.

3. Online Courses

When you have any skill you can train others, it’s also possible to create an internet course you can market online. You'll find online programs that teach anything from cooking food to marketing or even freelance writing. Heck, I also offer my very own course for financial advisors who wish to take their businesses online- THE WEB Advisor Growth Method.

This past year, I profiled my pal Joseph Michael of Easy Course Creation. Michael offers several different classes, including programs on the writing software called “Scrivener.” Over the full years, Michael has gained six figures or even more yearly selling classes that help people achieve the type of success he has learned.

Most people create their online course through a system like Teachable.com. With Teachable, you can publish your course materials and use the system to control customers and acknowledge payments.

4. Podcasting

Another way to make income online is by hosting an online podcast. I have the excellent Financial Cents podcast to go with my blog, and I take advantage of that system to find new sponsors and marketers regularly.

I still remember getting my first sponsor on the podcast and learning these were willing to pay $8,000 for me personally to include a brief clip at the start of every podcast for 3 months. That was insanely fascinating to me at that time since I wasn’t sure I'd have the ability to monetise my podcast very much at first.

However, you will find loads of individuals making much more than me on the podcasts. Take the Business owner BURNING Podcast managed by John Lee Dumas. Based on the show’s latest income statement, this podcast earned a net gain of over $400,000 in March 2018. Now, that’s crazy.

The key for you to get forward with podcasting is finding your niche, growing an audience, and then finding ways to monetise and connect to sponsors. This isn’t the simplest way to generate income online since there are a significant number of logistics that get into writing, documenting, and editing and enhancing a podcast, but it continues to be well worth considering.

5. Book Sales

As the publishing industry used to be heavy on the net, you can complete the whole procedure for writing, publishing, and marketing a publication online nowadays. Websites like Create Space enables you to upload and take your book to print without obtaining a formal publisher included, and you may even get the publication on Amazon.com so people can purchase it there.

A blogger I understand named Joseph Hogue has a useful blog (MIGHT WORK from your home Money) and a thriving reserve posting business. Hogue has written several books he has released online to produce an ongoing way to obtain passive income. He says he averages about 685 books sold monthly to generate typically $1,857 in revenue. Pretty good, huh?

If you believe you could write a reserve people would like to buy, this is an excellent technique to consider because the start-up costs can be minimal and you almost certainly already have a pc and word control software anyway.

6. Lead Sales

Another way to generate income online is by collecting leads. The primary steps you will need to complete to make lead sales work include establishing a website, traffic generation compared to that website, and ensuring you’re collecting leads that someone will in actuality pay for.

Here’s among how business lead sales could work in real to life: My second website, LIFE INSURANCE COVERAGE by Jeff, earns a massive amount of traffic from folks who are looking the net to find answers quick insurance questions. While I used to really have the website set up; therefore, I could sell these folks life insurance coverage myself, it was a lot of work to process all the various requests and clients. As a total result, I began offering the leads I collected instead.

Essentially, lead buyers are prepared to pay for the non-public information I collect from people who visit my website. That is a win-win for everybody since I receive a commission for the leads and my guests are linked with a person who can help them.

Remember, though, you can sell leads in many different sectors -not just life insurance coverage. Really, you merely need to determine a market, create a website and traffic, and observe how much you can get for the leads you gather.

7. Freelance Writing

When you have writing skills and creative skill, it’s also possible to receive a commission to generate online content. I don’t do that in so far as I used to, but I am very alert to how practical this income stream is.

One blogger I understand, Holly Johnson, actually makes over $200,000 per 12 months creating content for other websites. And also, that’s together with the six numbers she earns with her blog, Golf club Thrifty.

Relating to Johnson, the main element to which makes it as a freelance writer is determining a distinct segment, networking with people who might hire you, and delivering high-quality content ultimately of that period. While there are always a lot of writing job planks to obtain began, she says it’s simple enough to find beginner writing jobs online like Upwork.com.

0 notes

Text

i didn’t proofread this

i don’t know how to say it it’s hard to explain can you pull up google translate://

It's weird seeing the things you learn manifest themselves into real life. It's like wow, they actually have application in my life rather than being trapped as beginner theoretics learned in isolation. Earlier this morning I hear my cousin and dad yelling at eachother. It's not exactly yelling. Maybe the type of yelling you do as you're trying to explain a baking recipe while someone is using a very loud whisking machine in a very cramped kitchen. Very frustrating. I turn the music up a bit higher and pay no mind to what I would consider a regular morning, and subsequent, afternoon, or night.

My cousin asks me to come look at his screen. It's a pdf of a neural network broken down into "formulas" with purple and red arrows pointing at different sections along with sparse Chinese characters doing the bare minimum in explanatory work. The file is titled AITrader. AITrader brands itself as an "autonomous trading system" that takes in data input and makes financial crypto-decisions based on that data. Cryptocurrency, I understand as digital $$$, from a previous time of sitting in a conversation between two economics majors talking about exchange rates and whatnot. The output would be trading profits. From the first page of Google, I understand it as a trading bot.

During winter break, I talk to J about the stocktrading he always likes to put on his Snapchat story. It seems like devastating work. You stare at this app on your phone that makes squiggly lines up and down based on whether you're gaining money or losing money. The winning strategy seems to be selling when the price is high or waiting out the lows in hopes that it'll shoot up in prices again. Why not automate that system? Even without a predictive system, if you can program something that tracks the price of the specific stock and sells automatically once it detects the market slightly dropping, you would (theoretically) never lose but you wouldn't gain big either—sort of a median range. I don't think I know enough about stocktrading to make this sweeping proposition but it seems a lot better than manually checking the app every few hours and selling on your own but maybe people like that control of their financial actions and its profits (maaaaybe). We both share an interest in machine learning and he talks about the ML startups in Berkeley and the resources they have there. I notice he loses focus as I rattle off a little more than I should about something I'm only theoretically interested in.

My cousin then asks me how I would calculate a line—a straight line. I'm not sure how calculating a straight line would be able to transfer to creating a deep learning machine but I tell him the Emexplusb shindig. Apparently they had been arguing over my dad's very insistent stance. This is what I understand from my 5th grade knowledge of Cantonese, years of watching my father tap away at an excel sheet, and my small tiny chip of PHI10 2x speeding lecture videos:

A neural network works very much like the neural network in our brain. I'm not much of a biology/neuroscience nut but it mimics much of the neuron firing process including: excitatory/inhibitory signals, those signals that determine whether the cell has reached a threshold, the threshold for an action potential to fire pchoooo through the axon to um I'm assuming release a bunch of neurotransmitters, and those neurotransmitters then consisting of either excitatory/inhibitory signals to repeat the process. There hasn't been any other physical manifestation of a neural network besides our brain but "theoretically" you could make one as long as you have these three ingredients: nodes, weights, and layers (connections between the nodes). What we have so far are simulations of a neural network as a program. This program is no exception to the all-or-nothing credo as the nodes act as the neurons and the weights as activation levels (what it takes to reach a threshold) that either fire or don't/ advance to another node or don't. Advancement to the final layer leads to output—the desired goal.

Basic neural networks, the diagrams we glimpsed at in class, are feed-forward. This means that what happens in one layer does not affect the previous layers. This is where things get interesting but before that, I forgot to include what a neural network actually does. So far, the structure of the neural network discussed (feed forward—advancing forward through a layer and its nodes) handles input and creates output. The programmer has a target output and if the neural net is successful, it should output with 100% accuracy.

Neural networks are generally used to detect objects in a picture—very much like the Captchas we do, painstakingly, to prove we aren't robots. Funnily enough, the data that's collected from the Captchas we do to prove WE aren't robots is the same data used to make robots more like humans. An example I'm making up is detection of a raccoon in a picture. What the programmer does is feed their neural nets a training set of inputs—in my case, it would be pictures upon pictures of raccoons in their natural habitat. To mix up the batch, the programmer would also include pictures of celebrities with smudged makeup after an emotional breakdown in front of TMZ. Both categories have some resemblances to eachother but aren't completely indistinguishable. On the back of these pictures, we metaphorically label them "raccoon" and "human'. The target output is for the neural net to detect when the picture consists of a raccoon or when it does not(imagine that meme with the man holding his hand up asking "is this a butterfly", but replace butterfly with raccoon).

This training set is then used to train the neural net the correct inputs and output—improving their accuracy. It's like training wheels for small kids that want to bike their little tooshes away. The programmer feeds the photos in. Because we know the desired output (and we can use our eyes to see when it's an animal or a human), the programmer can manually go in and change the WEIGHTS of the neural net every time it makes a mistake in its detection. The programmer would then run another trial from the beginning.

Once the net is able to reach 100% accuracy (in that its able to get to the desired outputs from the answer sheet we fed it, it then moves onto another training set and even more trials. This has implications for so many fields. A relevant one would be detection systems for tumors in x-ray scans, facial recognition systems, security systems, e.t.c. Finally, the goal is for the neural net to get to the right outputs with a completely new set of data it has not seen before. What I'm assuming is behind AITrader is that we give the neural net inputs we don't know the outputs to but the machine is able to figure it out.