Text

Living Below Your Means – Simple Charts

Living Below Your Means – Simple Charts

Introducing the Simple Chart Series: Simple Charts to help explain powerful concepts.

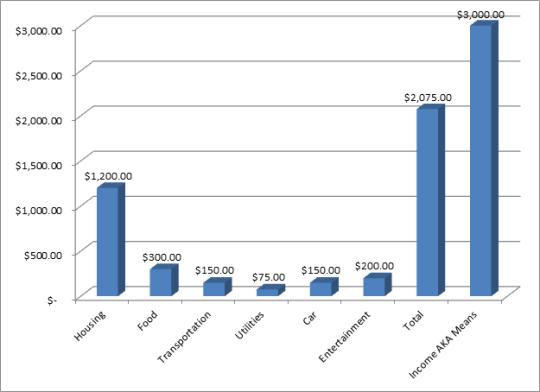

Living Below Means – Yes 🙂

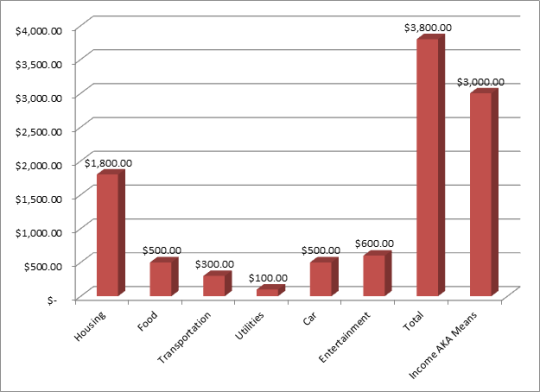

Living Below Means – No 😦

______________________________________________________________________________

I use Personal Capitalbecause (1) it’s free, (2) it tracks all of my accounts and overall net worth, (3) my account balances automatically update, (4) it shows how my…

View On WordPress

0 notes

Text

Compound Interest – Simply Explained

Compound Interest – Simply Explained

This is arguably one of the most compelling reasons to invest your money instead of letting it sit in a plain old checking account. Compound interest is a phenomenon. A phenomenon that simply helps your existing money, earn more money. And then helps that earned money earn more money (don’t worry that’ll make sense soon).

And the best part is you don’t have to do a thing.

There’s compound…

View On WordPress

0 notes

Text

Enjoy The Journey Of Achieving Financial Freedom

Enjoy The Journey Of Achieving Financial Freedom

There are savers, super-savers and then there are people on another level of saving, like savers on steroids of something. It’s highly commendable that there are people out there who can save upwards of 80% to 90% or more of their income.

Yes that is the fast track with a boost of nitrous to financial freedom. But in this process of achieving financial freedom, don’t forget to stop and smell…

View On WordPress

0 notes

Text

Always Earn While You Spend

Always Earn While You Spend

Sometimes spending is inevitable. When things break down, emergencies come up, or if you want to indulge in something (we’re only human).

So if you’re going to spend, do it wisely. What does this mean?

In a nutshell, you want to get something back for spending and these days it’s easier than ever to do so, mainly via credit card points which result in rewards.

I’d like to mention that…

View On WordPress

0 notes

Text

Kevin Hart & Personal Finance

Kevin Hart & Personal Finance

On a recent trip to the library, I decided to do something a bit different. I decided to check out an audiobook, unrelated to Personal Finance. I do this from time to time just to get a break from personal finance.

It was Mark Twain who said that “[t]oo much of anything is bad.”

So I ended up checking out I Can’t Make This Up – Life Lessons By Kevin Hart. You may have heard of Hart, he is…

View On WordPress

0 notes

Text

Financial And Non-Financial Aspects of Being Sick

Financial And Non-Financial Aspects of Being Sick

Do you know what’s worse than being sick; when your whole family including your kids being sick.

It was the first time this happened to our household in almost 8 years. The whole house was sick at the same time. We were at home, mostly in our master bedroom with both of our kids around each other’s germs for almost 5 days. Collectively, we had a viral infection, bronchitis, and the flu.

Th…

View On WordPress

0 notes

Text

Tidying Up Your Finances

Tidying Up Your Finances

Recently I finished watching Tidying Up with Marie Kondo on Netflix. It’s a show that helps people organize their home. Marie helps people get rid of clutter, unwanted items, and learn to keep items which “spark joy” into their lives in an organized and structured manner.

After just the first couple of episodes, I was motivated to tackle my own closet. As a result, I removed almost…

View On WordPress

0 notes

Text

Maybe You Shouldn’t Pay Off Your Car Loan

Maybe You Shouldn’t Pay Off Your Car Loan

Having excess funds is considered a good problem. Even Warren Buffett agrees. He has currently over a billion in cash and he does not know what to do with it.

My problem is not as good though. Like I have the ability to pay off my car loan, but I don’t know if I should.

So right now, I’m included in the 45% of Americanswhom have a car loan. It’s true that, unless you have some classic or…

View On WordPress

0 notes

Text

Apple’s Credit Card – Simple & Simply Explained

Apple’s Credit Card – Simple & Simply Explained

I don’t know if I’ve ever mentioned it before, but I’m a big Apple fan. I like their products mainly because they are simple, and I’m Simple Money Man, so it makes sense.

Apart from simplicity, in my experience, Apple products are durable, efficient, and intuitive.

And I understand that folks who specialize in Information Technology argue that Apple products limit customization, but I…

View On WordPress

0 notes

Text

Universal Personal Finance Rules

Universal Personal Finance Rules

Ever heard of the saying, the more we’re different, the more we’re the same. This applies to our personal finance situation too.

All of us want to feel financially secure.

If we have kids, all of us want to provide for our kids.

All of us are willing to take a certain amount of risk, whether that is super-small (i.e. a money market account or super big – a venture fund).

So what are some…

View On WordPress

#active#diversify#ETFs#exposure#index funds#monitor#passive#Personal Finance#risk#rules#universal#vanguard#voo

0 notes

Text

Simple ETF Analysis – Vanguard S&P 500 (VOO)

Simple ETF Analysis – Vanguard S&P 500 (VOO)

Nowadays, there are so many ETFs to choose from and so many providers offering similar choices. And in the world of low-cost index funds and ETFs, Vanguard is at the top of the game. With a variety of products to suit your investment style, Vanguard has something for every investment style. So let’s a take a look at the popular Vanguard S&P 500 ETF, ticker symbol VOO and see how it stacks up.

View On WordPress

0 notes

Text

Comparing Personal Finance & Netflix

Comparing Personal Finance & Netflix

Personal Finance is about making choices, actually personal choices. The choices you make will determine how satisfied you are once you move on to different stages of your life.

Similarly Netflix is about making choices. The choices here are in terms of movies and shows available for you to watch. Your choices will determine how satisfied you are once the movie or episode(s) come to an end.

View On WordPress

0 notes

Text

Personal Finance For Life

Personal Finance For Life

As I read the across the world wide web of ours, I’ve noticed a bit of a trend with other personal finance writers. Apart from writing about Personal Finance, I’ve noticed many also write about life, happiness, purpose, relationships and similar intangibles. They say that money can’t buy happiness. But can the comfort of having enough money create a sense of relief and even joy perhaps?

And…

View On WordPress

1 note

·

View note

Text

We Really Don’t Need A Huge Home

We Really Don’t Need A Huge Home

When I’m at home, you can usually find me in the family room or the kitchen. I don’t go to my room unless I need to change or am going to bed. And I don’t go to the bathroom unless I need to go. 🙂

And yet there are so many people living in homes with rooms they hardly use. This is, of course, attributable to owning a HUGE house. While I’m not in agreement with living in mega-gigantic homes, I…

View On WordPress

#bedrooms#down payment#expense ratio#harvard#home#huge#income#property#property taxes#rent#renting#square foot#warren buffett

0 notes

Text

Jack Bogle – How To Remember Him

Jack Bogle – How To Remember Him

Recently, a legend from our investing world passed away. Jack Bogle, also known as John Bogle, died this past January at the age of 89. He was the founder of Vanguard, which is the largest provider of index funds with over $5 trillion in assets.

Bogle was not always rich. His family lost their wealth during the stock market crash of 1929. His father left the picture early in his life due to…

View On WordPress

0 notes

Text

Are Fidelity’s Zero Expense Ratio Funds For Real?

Are Fidelity’s Zero Expense Ratio Funds For Real?

For the past couple of years, I’ve been acquiring shares of a few Vanguard funds. They are a super-low fee provider and have a diversified set of index funds and ETFs.

It’s all based on my latest strategy of set it and almost forget it investment management. Hey maybe I’ll use this as a future post topic. I’ve even written about some of their funds and ended up buying them.

By the way,…

View On WordPress

0 notes

Text

Simple Money Man's Big Purchase Checklist

Simple Money Man’s Big Purchase Checklist

Sometimes we may not be able to really tell if something is a want or a need. It’s hard when you’re at a store running an errand and you peek over to a different department, see something on sale that potentially costs hundreds or thousands and then convince yourself that you don’t really need it.

A big purchase can be a different for everyone. A big purchase basically means you are thinking…

View On WordPress

0 notes