#icici bank

Text

Freezing of bank account for unconnected entities is legally untenable.

M/s Jermyn Capital LLC Dubai v. Central Bureau of Investigation

Fact:

M/s Jermyn Capital LLC Dubai (#Appellant Company) was Permitted by Securities Exchange Board of India (#SEBI) to buy & sell share & securities in the #Indian Stock Market.

The appellant company had its shares in its account with #ICICI Bank.

However, due to certain litigation the appellant company quit the trading in the Indian Market in 2006.

But appellant company was subjected to 02 #freeze orders under section 102 #Cr PC. (This section empowers police officers to seize any property which gives suspicion for commission of any offence.)

The freeze order for an amount of Rs.42.51 crore was initiated because of the #pending #investigation against Dharmesh Doshi

Against the freeze order the appellant company approached the Apex Court & the #ApexCourt allowed the appellant Company to sell its shares & convert into cash and repatriate the funds with interest but without bank guarantee.

Rs. 42.51 Crore was repatriated.

Issue arose when appellant company was incapacitated by second freeze order for an amount of Rs. 38.52 crores to repatriate.

Aggrieved by the freeze the appellant company again approached the Apex Court.

The Apex Court gave liberty to the appellant company to approach trial court for release of the said amount.

The trial court allowed the repatriation of Rs.38.52 Crores subject to the #Bank Guarantee of an equivalent amount.

Aggrieved by the imposition of Bank Guarantee Clause the appellant Company approached High Court.

High Court confirmed the decision of Trial Court.

Against the order of the High Court present Criminal Appeal is filed before Apex Court.

Observation of the Apex Court:

Imposition of Bank Guarantee clause as due to pending investigation against Dharmesh Doshi, alleged to have been connected with the appellant company.

Record shows that Dharmesh Doshi has been discharged by the trial court, was never an employee/shareholder/director or holding key managerial position in the appellant company.

Dharmesh Doshi & Appellant Company are 02 separate entities.

Freezing order as such not legally tenable when two entities are unconnected.

Neither in the FIR nor in the chargesheet filed against the Dharmesh Doshi, appellant company was named.

Further during hearing CBI informed the Apex Court that no criminal proceedings is pending against the appellant company pertaining the dispute discussed here.

The freeze order against the appellant company’s properties is redundant as the appellant company is not necessary for the conclusion of the investigation.

The purpose of the freeze order, and the bank guarantee in extension of the freeze order, can only be in operation to aid in the investigation against the alleged crime.

Since the investigation against the appellant company has become redundant as such freeze order has also become redundant.

The operation of the freeze order has been active for a period of 17 years and has caused huge losses to the appellant company.

Decision:

The Division Bench of Hon’ble Mr. Justice Krishna Murari J & Hon’ble Sanjay Kumar J vide their order dt.09.05.2023 set aside the order of the High Court and permitted the appellant company to withdraw the said amount with 4% simple interest from May08, 2006.

Seema Bhatnagar

#criminalappeal#freezingofbankaccount#unconnectedwiththeoffence#namedinFIR&Chargesheet#foreigninstitutionalinvestor#cbi#highcourt#supremecourtofindia#icici bank#tradinginstockmarket

1 note

·

View note

Text

EDUPRIZM INFOTECH Pvt.Ltd.

ICICI BANK

🔰 Urgent Requirement 🔰

Location -Bihar

#ICICI BANK#Location -Bihar#eduprizminfotech#jobhiring2023#opportunities#vacancies#jobvacancy2023#jobalert#APPLYNOW#LimitedSeats#hiringnow#bankjobs2023#indianjobs#jobsearching

0 notes

Text

#onesarv#ICICI Bank DSA Partner#ICICI Bank#loan#loans#onesarvfintech#DSA Partner#agent#dsaagent#dsapartnerbenefits

0 notes

Text

Top 5 Credit Cards That Offer Free Lounge and Club Memberships

If you are bitten by the travel bug, you won’t actually realise before spending on a range of expenses such as airport lounges, eating out and spas, among others, thus leaving a hole in the pocket.

One of the convenient ways, however, to get seamless access to lounges and club memberships is through a credit card that offers these services free of charge.

Here, we present an indicative, not…

View On WordPress

#airport lounge access credit cards#bank credit card#best bank credit cards#best credit cards#credit cards#HDFC Bank#HDFC Bank Diners Club Black Metal Edition Credit Card#ICICI Bank#ICICI Bank Sapphiro card#Kotak Mahindra Bank#Kotak Mahindra Bank’s Zen Signature Credit Card#Marriott Bonvoy HDFC Bank Credit Card#personal finance#SBI card#SBI Card Elite#Top bank credit cards#top credit cards#Travel plans

0 notes

Text

Empowering Business Growth: ICICI Bank Canada Commercial Loans

Fuel your business ambitions with ICICI Bank Canada's tailored commercial banking solutions. From short-term financial assistance to secured operating loans, and strategic Term Loans, we are your partner in driving success. Choose financial support that aligns with your business goals

0 notes

Text

NRE Fixed Deposit - Explore ICICI Bank's Non-Resident External Fixed Deposit Account for NRI Services

NRE Recurring Deposit Account - The NRE RD account stands out as an excellent option for NRIs seeking substantial savings through modest monthly investments. Easily transfer funds from your NRE Savings Account to capitalize on this opportunity.

0 notes

Text

Broker’s call: Axis Bank (Buy)

Target: ₹1,150

CMP: ₹1,008.15

Axis Bank hosted an Analyst Day to demonstrate its progress at future-proofing the franchise on both sides of the balance sheet. Although Axis Bank has benefitted from margin tailwinds in a rising interest rate regime (+62bps NIM expansion over the past six quarters), we believe there is still significant ground to be covered in terms of enhancing the quality of its…

View On WordPress

1 note

·

View note

Text

ICICI बैंक के Q2 परिणाम मजबूत हैं, लेकिन मार्जिन की चुनौती अब भी बनी हुई है; क्या आपको स्टॉक खरीदना चाहिए या बेचना चाहिए?

ICICI बैंक के Q2 परिणाम मजबूत हैं, लेकिन मार्जिन की चुनौती अब भी बनी हुई है; क्या आपको स्टॉक खरीदना चाहिए या बेचना चाहिए?23 अक्टूबर को ICICI बैंक के स्टॉक में 1 प्रतिशत की वृद्धि हुई और हर हिस्सेदार के लिए 944 रुपये प्रति शेयर तक पहुँच गए, जब लेंडर के स्वतंत्र लाभ और जुलाई-सितंबर तिमाहि (Q2FY24) में नेट ब्याज आय की वृद्धि सड़क के अनुमानों को पार कर गई। विश्लेषकों का बड़ा हिस्सा उम्मीदवार के…

View On WordPress

0 notes

Text

#आरबीआई ने ICICI BANK और कोटक महिंद्रा बैंक पर लगाया 16 करोड़ का जुर्माना#icici bank#kotak mahindra bank#rbi#share market news#ICICI Bank share Price#stock market news in hindi#stock market news in india#share market news today#share market

0 notes

Text

Unlock Financial Freedom with ICICI Personal Loans from Arena Fincorp

In today's fast-paced world, fulfilling our dreams often requires a little financial boost. Whether it's renovating your home, planning your dream wedding, or dealing with unexpected medical expenses, personal loans can be a lifesaver. Arena Fincorp, your trusted loan agency, is here to introduce you to the world of ICICI Personal Loans. Join us as we explore how ICICI Personal Loans can be your key to achieving your financial goals.

Why Choose ICICI Personal Loans?

1. Competitive Interest Rates: ICICI Bank offers some of the most competitive interest rates in the market. This means you can borrow the money you need without breaking the bank with high-interest charges. Arena Fincorp, in partnership with ICICI Bank, ensures that you get access to these attractive rates.

2. Flexible Loan Amounts: Whether you need a small or substantial loan, ICICI Personal Loans can accommodate your needs. You can borrow as little as ₹50,000 or go for a larger sum, depending on your requirements.

3. Easy Application Process: Applying for an ICICI Personal Loan through Arena Fincorp is a breeze. Our user-friendly online application process ensures that you can complete the necessary steps from the comfort of your home.

4. Quick Approval and Disbursement: One of the standout features of ICICI Personal Loans is the quick approval and disbursal process. In many cases, you can have the funds in your account within a few business days, allowing you to address your financial needs promptly.

5. Attractive Repayment Tenures: ICICI Bank offers flexible repayment tenures that can be customized to match your financial situation. Whether you prefer a short-term loan or a longer repayment period, ICICI Personal Loans have you covered.

6. No Collateral Required: Personal loans from ICICI Bank are unsecured, which means you don't need to pledge any collateral. This is a great option for individuals who may not have valuable assets to secure a loan.

7. Online Account Management: ICICI Bank provides online account management tools, making it easy to keep track of your loan, payments, and remaining balance. Arena Fincorp also offers dedicated customer support to assist you at every step.

8. Wide Range of Purposes: ICICI Personal Loans can be used for various purposes, including debt consolidation, travel, education, medical expenses, and more. The choice is yours, and ICICI Bank is here to support your financial aspirations.

Conclusion:

At Arena Fincorp, we understand that life is full of surprises and opportunities, and sometimes, you need financial assistance to make the most of them. With ICICI Personal Loans, you have a reliable partner to help you achieve your dreams and manage your financial needs efficiently.

Whether you're planning a major life event or dealing with unexpected expenses, ICICI Personal Loans offers a smart and flexible solution. Let Arena Fincorp guide you through the process, making your financial journey smoother and more accessible than ever before. Don't let financial constraints hold you back—unlock your potential with ICICI Personal Loans today! Appy Now…

0 notes

Text

How a bank closes your account without informing you.

Whoever is the highest authority, please feel free to connect with me here.

Read my story and let me know if it is legal for the bank to close my account without getting a hold of me for an explanation.

My husband’s childhood friend in India has cancer, and he is in remission. He has undergone surgery, and is now on immunotherapy, for which each injection costs him approx. CAD 5000 each. He has run out of money, as you may know that India doesn’t have a public health…

View On WordPress

0 notes

Text

Indian Stock Market Updates for November 2023

If you are interested in investing in the Indian stock market, you need to read our comprehensive guide on the Indian stock market updates for November 2023. It will help you gain more knowledge and insight into the market and enable you to make inf.....

Indian Stock Market Updates for November 2023: A Comprehensive Guide

The Indian stock market is one of the most dynamic and exciting markets in the world. It offers a plethora of opportunities for investors who are willing to learn, research, and invest carefully. However, it also poses many challenges and risks, especially in times of volatility and uncertainty.That is why we have prepared this…

View On WordPress

#Aurobindo Pharma#Bajaj Hindustan#Best Agrolife#BSE#Canara Bank#Ceinsys Tech#Cigniti Technologies#Dhanlaxmi Bank#DIIs#Eco Recycling#FIIs#government reforms#HFCL#ICICI Bank#Indian Bank#Indian economy#Indian stock market#Indian stock market guide for investors#Indian stock market news and developments#Indian stock market opinion and tips#Indian stock market results and recommendations#Indian stock market updates for November 2023#J&K Bank#Jubilant Food#Nestle#Nifty#November 2023#NSE#RBI#sectoral indices

0 notes

Text

#HDFC Bank#HDFC Bank fd#HDFC Bank Vs SBI Vs ICICI Bank#ICICI Bank#ICICI Bank rd#rd#Recurring Deposit#SBI#SBI rd

0 notes

Text

Elevate Your Lifestyle with ICICI Bank Emeralde Credit Card

The ICICI Bank Emeralde Credit Card is a remarkable financial offering that stands as a symbol of luxury, exclusivity, and unparalleled privileges. Tailored for high-net-worth individuals and discerning customers, this credit card opens doors to a world of unparalleled benefits and experiences. From exceptional travel perks to personalized concierge services, the Emeralde Credit Card redefines the concept of credit card indulgence.

Key Points:

Luxurious Travel Perks: The ICICI Bank Emeralde Credit Card is designed to cater to the wanderlust of its cardholders. With complimentary access to airport lounges worldwide, preferred rates at luxury hotels, and travel insurance coverage, this card makes every journey a delightful experience.

Personalized Concierge Services: As an Emeralde cardholder, you are entitled to personalized concierge services, available 24/7, to assist you with travel planning, restaurant reservations, event bookings, and much more. This exclusive service ensures that your needs and desires are met promptly and efficiently.

Rewarding Rewards Program: The credit card rewards program is tailored to amplify your spending. Earn generous reward points for every transaction and redeem them for a wide range of rewards, including premium merchandise, travel vouchers, and exclusive experiences.

Complimentary Golf Access: For the golf enthusiasts, the Emeralde Credit Card offers complimentary access to some of the finest golf courses in the country. Tee off in style and enjoy a day of leisure and sportsmanship.

Dining Privileges: Savor delightful culinary experiences with the Emeralde Credit Card's dining privileges. Enjoy discounts at select restaurants and cafes, making every meal a celebration.

Zero Foreign Currency Markup: When you use the ICICI Bank Emeralde Credit Card for international transactions, you benefit from zero foreign currency markup, saving you money and providing you with a hassle-free experience.

Contactless Technology: With contactless payment technology, the Emeralde Credit Card offers convenience and security in every transaction. Simply tap your card at the payment terminal and breeze through your purchases.

Bottom Line:

The ICICI Bank Emeralde Credit Card is an elite financial instrument that embodies sophistication, convenience, and luxury. From traveling the world in style with complimentary lounge access and preferred hotel rates to experiencing personalized concierge services at your fingertips, this credit card elevates your lifestyle. The generous rewards program, complimentary golf access, dining privileges, and zero foreign currency markup further enhance the cardholder's experience.

For those who seek more than just a credit card, the Emeralde Credit Card is an invitation to a world of unparalleled experiences and benefits. Whether you are a frequent traveler, a gourmet connoisseur, or a golf aficionado, this card is designed to cater to your every need. Indulge in the exclusivity and privileges that come with the ICICI Bank Emeralde Credit Card and open the doors to a life of luxury and convenience.

In conclusion, the ICICI Bank Emeralde Credit Card is not just a financial tool but a lifestyle companion that makes every moment extraordinary. Experience the opulence and embrace the possibilities that this credit card brings, and redefine the way you view credit cards forever.

0 notes

Text

Large Cap Stocks under 1000rs

0 notes

Text

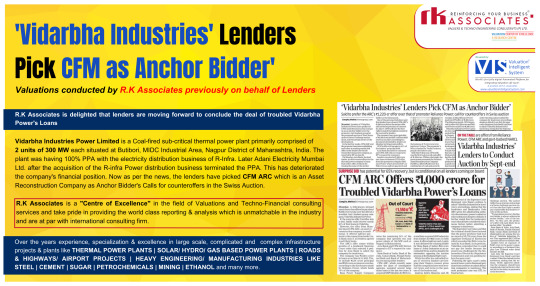

'𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬' nears resolution. 𝐋𝐞𝐧𝐝𝐞𝐫𝐬 𝐏𝐢𝐜𝐤 𝐂𝐅𝐌 𝐚𝐬 𝐀𝐧𝐜𝐡𝐨𝐫 𝐁𝐢𝐝𝐝𝐞𝐫𝐬'.

Valuation of this Power Plant was previously conducted by 𝐑.𝐊 𝐀𝐬𝐬𝐨𝐜𝐢𝐚𝐭𝐞𝐬 𝐨𝐧 𝐛𝐞𝐡𝐚𝐥𝐟 𝐨𝐟 𝐋𝐞𝐧𝐝𝐞𝐫𝐬.

𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬 𝐏𝐨𝐰𝐞𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 which is a Coal-fired sub-critical thermal power plant primarily comprising of 𝟐 𝐮𝐧𝐢𝐭𝐬 𝐨𝐟 𝟑𝟎𝟎 𝐌𝐖 each situated at Butibori, MIDC Industrial Area, Nagpur District of Maharashtra, India. The plant was having 100% PPA with the electricity distribution business of R-Infra. Later Adani Electricity Mumbai Ltd. after the acquisition of the R-infra Power distribution business terminated the PPA. This has deteriorated the company's financial position.

The Loans of 𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐏𝐨𝐰𝐞𝐫 were a distressed asset for the lenders. We are delighted that the lenders have picked CFM ARC as Anchor Bidder for the Calls for counteroffers in the Swiss Auction to conclude the deal of the troubled Vidarbha Power’s Loans.

More Info:

Website: https://www.rkassociates.org/

Facebook: https://www.facebook.com/rkavaluers

Instagram: https://www.instagram.com/rka_valuers/

Linkedin: https://www.linkedin.com/company/rkassociatesvaluers/

Twitter: https://twitter.com/rkavaluers

#valuationservices#valuations#axis bank#idbi bank#hdfc bank#icici bank#sbibank#bank of india#bank of baroda#union bank of india

0 notes