#income tax registration process

Text

KVR TAX Services is the Udyam Registration services in Hyderabad. Apply now for the new udyam aadhar registration, in Gachibowli, Flimnagar, Kondapur, Lingampally.

#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#register a business in hyderabad#register company in hyderabad#firm gst registration process in hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in hyderabad#Msme Registration Consultants in hyderabad#MSME Registration Online in hyderabad#iec code registration in hyderabad#export and import registration in hyderabad

0 notes

Text

ITR Filing Online Process

File your income tax return (ITR) online hassle-free. Our streamlined process at PSR Compliance ensures accurate and timely submissions. Simplify tax compliance, maximize refunds, and avoid penalties. Trust us for efficient ITR filing.

To learn more about the ITR Registration process, documents, and fees you can simply visit our blog page.

https://www.psrcompliance.com/blog/step-by-step-guide-to-itr-filing-and-income-tax-return

0 notes

Text

Documents required for 12a and 80g registration

Introduction

Young and Right, a promising company driven by social welfare objectives, can greatly benefit from 12A and 80G registrations. These registrations, provided by the Income Tax Department, confer your organization with tax benefits and make your initiatives more appealing to potential donors.

Understanding 12A and 80G Registrations

12A registration establishes your company's eligibility to claim tax exemptions for the income generated for charitable activities. 80G registration, on the other hand, allows donors to claim deductions on donations made to your organization. Both registrations require meticulous documentation to be considered for approval.

Documents Required for 12A Registration

Application Form

A duly filled Form 10A is the initial step for 12A registration. It includes essential details about your organization's objectives, activities, and financials.

Memorandum and Articles of Association

These documents outline your company's mission, vision, and operational framework. They reflect the authenticity and transparency of your organization.

Income and Expenditure Statements

Clear and audited financial statements demonstrate the legitimacy of your non-profit’s financial transactions and utilization of funds.

PAN and TAN Details

Your organization's Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) are crucial for tax-related procedures.

List of Board Members

Providing comprehensive details of your board members establishes the credibility and competence of your organizational leadership.

Documents Required for 80G Registration

Detailed Project Report

A well-structured project report outlines your charitable initiatives, expected outcomes, and how donations will be utilized for social welfare.

Audited Accounts and Balance Sheets

Audited financial records ensure transparency and accountability, indicating the proper allocation of funds for your initiatives.

Trust Deed

For trusts, a copy of the trust deed, highlighting the objectives and functioning of the trust, is essential.

Registration Certificate

Submitting a copy of your organization's registration certificate verifies its existence and legal standing.

Form 10G

This form is a crucial aspect of the 80G registration process, requiring detailed information about your organization's activities, beneficiaries, and financials.

The Application Process

Upon compiling the necessary documents, submit the application to the Income Tax Department. After submission, a thorough verification process takes place, which includes scrutinizing your organization's activities, financials, and compliance with legal norms.

Benefits of 12A and 80G Registrations

Tax Exemptions for Donors

Donors are more likely to contribute when they know their donations are tax-deductible, incentivizing larger and more frequent contributions.

Eligibility for Government Funding

Registered non-profits gain access to government grants and funding opportunities, aiding the execution of their social initiatives.

Enhanced Credibility and Transparency

Obtaining these registrations builds trust among donors, stakeholders, and beneficiaries, establishing your organization as a legitimate and impactful entity.

Maintaining Compliance

Regularly filing annual returns and adhering to financial transparency are paramount to retaining your non-profit status and registrations.

Frequently Asked Questions

Is 12A registration mandatory for non-profit organizations? Yes, it is necessary to avail tax benefits for charitable activities.

Can foreign donations be considered for tax deductions under 80G? Yes, if the organization is registered under the Foreign Contribution (Regulation) Act (FCRA).

What is the validity period of 80G registration? Usually, 80G registration is valid for a perpetuity, but it's advisable to check for any amendments.

Can an organization with 12A registration automatically claim 80G benefits? No, 80G registration requires a separate application process.

Is the renewal of these registrations necessary? Yes, both 12A and 80G registrations require renewal to maintain their validity.

Conclusion

Securing 12A and 80G registrations for Young and Right is a strategic move that brings multiple advantages. Apart from encouraging donations, these registrations amplify your organization's credibility and expand its outreach. By adhering to the documentation requirements and following compliance procedures, Young and Right can thrive in its noble endeavors.Access Now: https://www.companyshurukaro.com/12A-and-80G-registration

#trust registration#branding#accounting#income tax#best ca firm#ca firm#finance#adventure#trust#12a and 80g registration process#12aregiatration

0 notes

Text

Best Accounting and Tax Services Providers in Madhapur Hyderabad.

#income tax filing services in film nagar#gst new registration process in film nagar#Tax Return Filing Services in gachibowli

0 notes

Link

income tax services

#income tax services#trademark application#trademark#trademark registration#trademark registration online#apply for trademark#trademark registration process#trade mark registration online#gst registration online#federal tax#company compliance#business management services#business set up#income tax return#taxation service#Company Formation#income tax registration

0 notes

Text

Before the Registrar accepts your registration application, you are required to adhere to certain guidelines. For Best Trademark Registration Process Online, contact us.

#Online Trademark Objection#Online Process#Online Company Registration#Online Income Tax Filing#Online Income Tax Registration

0 notes

Note

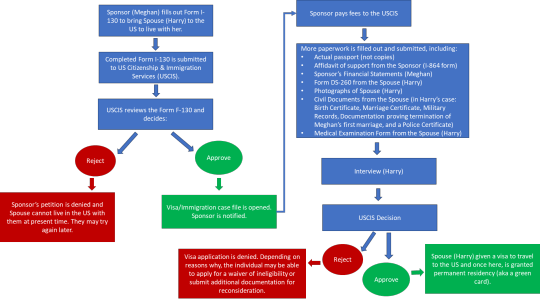

I’m confused. Why would he get deported? He’s married to (presumably) a US citizen already. Not sure if I missed something?

Well, the simplest explanation is that everyone who immigrates/emigrates to the US has to fill out paperwork to stay here. Doesn't matter who you are, who your family is, who you're married to, where you're from, what money you have. Everyone fills out the paperwork.

Being married to a US citizen only affects the type of visa (Spouse of US Citizen) you get and which application (Form I-130, the Petition for Alien Relative) your sponsor fills out to start the process.

The longer/more detailed explanation of the process, and the background for the lawsuit about Harry's visa application, is this:

(Apologies for how small the text is. I didn't want it to be a multi-page thing.) I'll describe it below the jump.

But essentially, Harry's process to become a legal permanent resident through his marriage to a US citizen is:

Sponsor/Meghan submits Form I-130 to the US Citizenship and Immigration Service (USCIS), requesting approval to bring her spouse to live with her in the US.

USCIS reviews the form and will approve (left green circle) or deny (left red circle) the application. If they deny it, that ends the process. They can try again later. If they approve it, then:

Sponsor/Meghan pays a bunch of fees and a visa case is opened.

(The big giant square text) More paperwork and documents are submitted. Meghan and Harry do this together. (I'll explain this in a bit.)

The Spouse/Harry has his immigration interview.

USCIS will review the visa case file and make a decision on whether to approve or deny the visa request. If they deny the visa, then depending on the justification for denial, the Spouse/Harry may request a waiver or he can submit additional documentation for further consideration. If the visa is approved, then the Spouse/Harry is given approval to travel to the US and once he's here, he gets permanent residency - aka "the green card."

Now, getting back to the giant text block and the "more paperwork" requirement. In this phase of the process for a spousal visa, the couple must provide:

An affadavit of support from the Sponsor/Meghan (this basically says that she has enough income to support Harry and they won't need government assistance)

Supporting financial documents (probably tax declarations)

Harry's passport

Additional photographs of Harry

Form DS-260, the Immigrant Visa and Alien Registration Application from Harry (this is Harry's application for residency)

Harry's birth certificate

Their marriage certificate

Harry's military records (the US requires anyone with military service in any country to submit)

Harry's police certificate (information about whether he has been arrested or charged with crimes/what kinds)

Harry's Medical Examination form (which sometimes is done after the interview)

Form DS-260 is the big one. It basically asks the immigrant (Harry, in this case) about everything in his life: his childhood, his work history, his social media accounts, where he's lived, his family of origin, his children, previous travel to the US, medical and health details (including history of substance abuse. communicable diseases, and vaccination record), criminal history, security and background details, and social security.

If you're found to have lied about anything on this form - for instance, something pops on the background check that isn't disclosed or your answers in the interview are inconsistent with what's reported on the form or your social media tells a totally different story - it's grounds for your application to be denied and, if you're already here in the US, you to be deported.

This is what the DHS/Homeland Security lawsuit is about. The DS-260 has a question about drug use. The Heritage Foundation (the plaintiff in the case) is suing DHS to find out what Harry reported about his drug use on the form and in his medical history because historically, the US does not allow people with drug addictions or past drug use into the country. After Harry's admissions in Spare that he's basically a functioning addict, the Heritage Foundation assumed that Harry said "no" on the drug use question (which would be a lie) and they want to find out if he was given special treatment because of being Queen Elizabeth's grandson. (I also suspect the Heritage Foundation wants to find out if Harry has a regular passport or is traveling/living in the US on a diplomatic passport as well.)

So going back to your original question, yes, Harry can still be deported even if he is the spouse of a US citizen and even if he is a permanent resident. All the marriage to a US citizen means is what forms get filled out and what supporting documentation is submitted. That's all; there aren't any other protections involved in being married to a US citizen.

But there is a benefit to immigrating via a "green card marriage" - if you come to the US on any other kind of visa, the requirements are much stricter and the waiting period for eligibility can sometimes take much longer. Particularly on the latter, the US actually has requirements on how many people per country can immigrate/travel in a given a year, even if you're sponsored by a business or a friend or a family member (eg a brother or uncle). So some people end up waiting years to move to the US; that's just the demand on the system. But with a "green card marriage," you get to jump most of the queues and your waiting period for eligibility disappears in an instant. You can literally begin your application to move to the US the day you get engaged to a US citizen or the day you get married.

But you still have to go through all the hoops and fill out all the paperwork anyway. No way around that. No matter who your grandmother is.

Now for the part that makes all of this even more complicated: COVID.

A lot of rules government-wide were relaxed because of the COVID national emergency. One of the areas in which a lot of rules, standards, and regulations were relaxed is immigration, which caused an enormous backlog of paperwork and cases. Why? Because we're the goverment, y'all, and we move at slower-than-glacial-pace. In March 2020, we still processed a million things by hand on actual physical paper. (Remember, I'm a fed. I've got horror stories for days about this.) So part of the issue with everyone going home is that the paperwork didn't come home with us. It just kept stacking up and stacking up and stacking up in the office because we were still using paper systems and there hadn't been enough time to automate processes or digitize systems when we were ordered to work from home on March 16th. (Particularly in the DC area, talks/plans to send us all home started literally the week before, on March 9th. That was zero time to do anything but scale up the VPN and give everyone a laptop so whole entire agencies can work from home - because remember, before March 2020, it wasn't a thing for us in government to work from home.) So in June/July 2020 when the local stay-at-home orders were finally lifted, we all went back to the office to huge backlogs of paperwork and casework. Backlogs that were still growing by the day, and backlogs that needed to be handled quickly. As a result, there were a lot of decisions made to just "rubber-stamp" everything as quickly as possible. In DHS/USCIS, that meant citizenship and visa applications weren't as closely reviewed as they may have been in the past because the bosses were telling us "just get it done" because the Trump Administration was breathing down everyone's necks to deliver results that they could use in his re-election campaign.

So there's speculation now that Harry's visa/immigration application is one of those cases that got "rubber stamped" to get through the backlog. And part of that speculation is an attempt to understand when exactly did the visa paperwork get processed and whether there was undue special treatment in doing so. Was he part of the backlog that was grandfathered/rubber-stamped into the US? Or was his application processed before that?

Because if his application was processed before he moved here in March 2020, well, then the Sussexes aren't telling the truth about where they lived or what they were doing. Reason being that typically on a spousal visa, you usually can't already be living here in the US when you apply for it. You apply from your home country and come to the US only once your visa request has been granted.

So did the Sussexes apply for Harry's visa when they were living in Canada, starting the process as early as November 2019 when the BRF forced them into a vacation and panicking in February 2020 when COVID started closing borders? In that case, did the Sussexes apply diplomatic pressure to expedite DHS's review of Harry's case so they could be in the US before borders closed? Or did they say "screw it" and moved to the US without waiting for a decision and then applied diplomatic pressure to have Harry's case approved retroactively?

Or did the Sussexes apply for Harry's visa much earlier, when they were still living in the UK/working as full-time royals? And if that's the case, then did they really go to Canada like they said they did, or did they just hide out in the US for a bit so Harry could pick up his green card, and then they traveled to Vancouver/Canada for New Year's?

Or - perhaps the more tinhatty scenario - did the Sussexes apply for Harry's visa right after the marriage, at the earliest opportunity Meghan could've filed the paperwork? In which case, their secret honeymoon could really potentially have been a trip to the US so Harry could claim his green card.

Option 3 is incredibly farfetched. We know the Sussexes can't keep their stories straight so I feel like if that's what had actually happened, there would've been holes poked into their "fleeing to Canada" narrative already.

I probably lean towards Option 1 (they exploited COVID to move here) but Option 2 is pretty plausible too.

Anyway, that's a ton more than you/anon probably expected. (It's a whole lot more than I expected to write about too.) But hopefully this clears up some confusion about what exactly is happening with Harry's immigration status, why it's possible he can still be deported, and sheds a little light on the Homeland Security lawsuit.

Edit: added some clarification (see bolded part under the flowchart)

44 notes

·

View notes

Text

Taxes. You CAN do this!

To those of you who have not filed your taxes (Deadline is tomorrow) or who are putting it off because it is too complex I have some good news. I paid a CPA for years, sometimes 200.00 or more to do my taxes. My parents helped me or did them for years and then, once married, I was convinced they were too complicated for me to handle. Most of us, even me with three jobs, a chiild and owning a home etc, are eligible for free tax preperation. Certainly we should not be paying 200 some bucks to some service that is just following along the same form we could be doing for ourselves.

TODAY go to irs.gov. There is an application to ask for an extension. FILL IT OUT. Get yourself more time to avoid loosing money in fees and penalties.

The IRS site will ask you some questions to help you find a FREE or discounted service to file your taxes on line. Look for a site that does your state (some list specific states and others say all states) for free if you file your federal with them and you can do it all at once.

If you don't have access to your tax records from last year you can contact the company you used last year OR follow the link they provide to access/set up your IRS account. This is good to have in any case because there is lots of good information about your income etc on there. It takes some back and forth on your phone/computer (you need a smart phone for quick IDME set up but there are other options). You can also get all your information off of the hard copies from the previous year.

Once you choose the right tax prep account from the IRS suggstions you simply follow the easy instructions and match my the form number listed on the tax papers mailed to you by your bank, employers, etc. Match the box numbers as you go. It is really a easy process if you just follow the numbers of each box. You will need your checking account and bank routing number for direct deposit AND your Adjusted Gross income (on last years tax form OR available from the IRS/you preparer) AND the "over payment" ie REFUND From state and federal last year. (Also available on your irs site or on the forms form last year).

They email and or text confirmation and if there is an issue they give you the specific space that needs correcting.

You CAN do this!

ALSO> rememeber to have your tax exemption 0 going forward to insure taxes are withheld all year so you are less likely to owe. (DO not claim yourself).

AND remember you can deduct your Vehicle registration from many state taxes (you will need the title OR at least the cost you pay, year, and WEIGHT of the model you own-I was able to google the weight using the year and model).

If you get hung up the IRS also lists free services to help you. Many libraries and local social sevices entities will have information on the free filing help.

82 notes

·

View notes

Text

How to Publish a Book, pt 1

I told @tryxyhijinks I was gonna turn this into a shitpost, so here we go: how to publish an ebook in ten easy steps.

Write the book. This is, believe it or not, the fun part.

Edit the book. Slightly less easy, but you have to do this, no matter what anyone else has told you about "minimum viable product" or what have you. You can force your friends to read it, you can have a program read it aloud to you, you can read it backwards, you can hire someone to line edit your work, you can do some or most of the above, just get it edited. (Additional point: when hiring a professional, if you're happy with the plot, ask for line or copyediting; if you're not sure about plot points, ask for developmental editing; if you just need guidance, you may want to start with an editorial letter.)

Get a cover. You can make one yourself or pay someone to do it. You're going to want it to be about 1600x2500 pixels and 72 dpi. It's good to have a really nice cover, because covers sell books.

Typeset the book. I use Atticus to create an epub file. If you are also doing a print version or you are a control freak, I recommend it. Vellum and Reedsy are about the same, I think. If you have a lot of illustrations--big ones, I mean, not just an author photo--you should beg, borrow, or steal a copy of InDesign. You can use Calibre to compress your output epub file if you want to make sure you earn every available penny. However, my book is 6mb and it is about 8 cents to download. Also, if you're trying to do this on the cheap, you really can just do it in Word. The layout won't be as fancy, but you can do it. (Layout granularity, from least to most granular, is probably Word->Atticus->InDesign.)

If you want to publish under a press name that is not your name, you will need to start a business. Laws around taxes and registration may vary depending on where you are, but in general, you will want to register your name with your state or county registrar (for me, this cost $30 and I had to get a piece of paper notarized). Then you can get a business checking account (for me this part was free--I went through the bank I already have accounts with). In the US, sole proprietorships like this are taxed as pass-through entities, so you will pay personal income taxes on whatever money you make, but you don't have to pay corporate income taxes. If you are publishing books that could possibly get you sued (e.g., The Big Book of Welding While Juggling or Now You're Cooking with Napalm) you may want to form an LLC. Talk to a lawyer.

Open a KDP account. If you hate the Zon and want to only publish somewhere else (Apple Books, Kobo, Barnes and Noble, Smashwords, whatever), that's fine--the process is about the same. If you think you previously had a KDP account and then didn't use it, search your emails etc. to try to find out, because if they figure that out, they'll close both accounts and then you won't get paid.

Add your new title to the catalog (you will need to add metadata, like your name, series name if there is one, and a description of the book) and set the prices. Unless your book is super big, you'll probably earn more if you select the 70% option. For some reason, I changed a few of the prices. If you're planning to publish on several platforms, I don't recommend this--just set your price in one place and then let it convert those. Otherwise, you'll have to reinput everything over and over, because it's in the terms of service that you need to price things the same on Kobo as you do on Amazon (and so on).

Set the day of publication and tell people about it. Like your mom. Your weird aunt who's always so supportive. Your friend who has been listening to you bitch about how hard writing is for the past six months.

???

Profit.

Q: Hey, I want my book in several online stores, not just Amazon.

A: You have a few options. Draft2Digital/Smashwords and IngramSpark both distribute digitally to various places so you only have to set things up once. But they take a cut of the profit for this service. You can also set up independent accounts with each store and upload your stuff.

Q: What happens in step 9?

A: You know. Meet other indie writers and try to gain their trust. Read a lot. Work on the sequel. Get some sleep, because deadlines are exhausting, even self-imposed ones. Learn about advertising. That sort of thing.

Next time, I'll do the paper side of things.

26 notes

·

View notes

Text

Streamline Your Business with KVR TAX: Your Go-To Partner in Hyderabad

Starting and managing a business in Hyderabad involves several critical steps, from registration to tax filing. Navigating the complex regulatory landscape can be overwhelming, but with the right guidance, it becomes a seamless process. At KVR TAX, we specialize in offering comprehensive solutions for all your business needs, including gst registration certificate in hyderabad, income tax filing in Hyderabad, and much more.

Goods and Service Tax Registration in Hyderabad

One of the primary requirements for any business in India is the goods and service tax registration in hyderabad. GST is a crucial tax that every business dealing in goods or services must comply with. Our team at KVR TAX ensures a smooth and hassle-free firm gst registration process in hyderabad. From understanding the legal requirements to completing the paperwork, we assist you at every step.

Register Your Business Effortlessly

If you're planning to register a business in hyderabad, KVR TAX is your reliable partner. Whether you want to register a company in Hyderabad or set up a small firm, we provide end-to-end services. The registration of firm process in hyderabad can be daunting, but our experts make it simple and straightforward. We guide you through each phase, ensuring that your business complies with all necessary regulations.

Income Tax Filing Made Easy

Tax filing is another essential aspect of running a business. Whether you're an individual or a corporate entity, timely and accurate tax filing is crucial. KVR TAX offers expert services in income tax filing in hyderabad. Our professionals are well-versed in the latest tax laws and help you with incometax return filing in hyderabad, ensuring compliance and minimizing liabilities.

MSME Registration Consultants in Hyderabad

For small and medium enterprises, obtaining MSME registration is vital for availing various benefits. At

#gst registration certificate in hyderabad#goods and service tax registration in Hyderabad#register a business in hyderabad#register company in Hyderabad#firm gst registration process in Hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in Hyderabad#Msme Registration Consultants in Hyderabad#MSME Registration Online in hyderabad#iec code registration in Hyderabad#export and import registration in hyderabad

0 notes

Text

Thai Limited Company Registration

Establishing a limited company in Thailand can be a strategic move for businesses seeking to operate within the country. This legal structure offers several advantages, including limited liability, tax benefits, and credibility. However, the registration process involves specific requirements and steps that must be followed meticulously.

Understanding the Thai Limited Company

A Thai limited company, often referred to as a "Company Limited" or "Co., Ltd.", is a legal entity separate from its shareholders. This separation provides shareholders with limited liability, meaning their personal assets are protected from the company's debts.

Key Steps to Registration

Company Name Reservation: The first step is to reserve a unique company name. The name must end with "Limited" or its Thai equivalent. Availability can be checked and reserved through the Department of Business Development (DBD).

Preparation of Documents: Several essential documents need to be prepared, including the Memorandum of Association, Articles of Association, and a list of shareholders and directors. These documents outline the company's objectives, structure, and management.

Statutory Meeting: A statutory meeting of shareholders must be held to approve the company's formation and appoint directors.

Registration: The completed documents, along with the necessary fees, are submitted to the DBD for registration. Upon approval, the company receives a registration certificate.

Tax Registration: The company must register for corporate income tax and value-added tax (VAT) with the Revenue Department.

Bank Account Opening: A corporate bank account is essential for conducting business transactions.

Required Documents and Information

Passport copies of shareholders and directors

Proof of address for shareholders and directors

Proposed company name

Registered office address

Share capital and share distribution

Business objectives

Considerations for Foreign Investors

Foreigners can own 100% of a Thai limited company in most industries. However, there are restrictions in specific sectors, such as media and agriculture. It's crucial to understand the foreign ownership limitations applicable to the intended business activity.

Benefits of a Thai Limited Company

Limited liability for shareholders

Clear legal structure

Tax advantages

Enhanced business credibility

Access to government incentives and support

Challenges and Considerations

Complex registration process

Ongoing compliance requirements, including financial reporting and tax filings

Potential for language and cultural barriers

While establishing a Thai limited company can be complex, understanding the process and seeking professional guidance can streamline the process and ensure compliance with legal requirements.

#lawyers in thailand#thailand#Thai Limited Company Registration#corporate in thailand#company registration in thailand#corporate lawyers in thailand

2 notes

·

View notes

Text

12a and 80g Registration - Process, Documents

Introduction

12A and 80G registration are two important tax registrations for Indian charities that allow them to access certain exemptions from the Income Tax Act. 12A allows a charitable institution to be eligible for exemption from income tax while 80G permits donors of such organizations to claim deductions on their donations. These registrations provide several advantages such as allowing organisations to avail various kinds of tax benefits, risk mitigation and compliance with legal requirements. The process of obtaining these registrations is both time-consuming and tedious but it is essential in order to ensure smooth functioning of the organization. With this guide, we aim to make the process easier by providing step-by-step instructions on how to apply for 12A or 80G registration as well as details about its various benefits.

Requirements for 12A Registration

Eligibility Criteria for 12A Registration: In order to apply for a 12A registration, the organisation must be a charitable or religious trust/society registered under the Indian Trusts Act of 1882 or any other law that applies in India. Furthermore, it should have been set up with an intention to promote charitable activities and not be engaged in carrying out any commercial activity.

Registration Process: After submitting all relevant documents along with your application form, you will receive an acknowledgement letter from income tax department confirming that your request has been received. You will then need to submit Form 10G which is used by IT department officials to inspect your organization’s premises before they can grant approval for taxation purposes. Once this step is completed successfully, you will receive an official letter granting permission for availing exemption from income tax under Section 11(

(a) as per Rule 21AAB(. This document must be renewed every 5 years in order to continue enjoying exemptions provided under Section 11((a).

Requirements for 80G Registration

Eligibility Criteria for 80G Registration: In order to be eligible for an 80G registration, the organisation must be a charitable or religious trust/society registered under the Indian Trusts Act of 1882 or any other law that applies in India. Furthermore, it should have been set up with an intention to promote charitable activities and not be engaged in carrying out any commercial activity.

Registration Process: After submitting all relevant documents along with your application form, you will receive an acknowledgement letter from income tax department confirming that your request has been received. You will then need to submit Form 10B which is used by IT department officials to inspect your organization’s premises before they can grant approval for taxation purposes. Once this step is completed successfully, you will receive an official letter granting permission for availing deductions under Section 80G(

(vi) as per Rule 11AAB(. This document must be renewed every 5 years in order to continue enjoying deductions provided under Section 80G((vi).

Required documents for 80G & 12A registration online?

The details & documents required for 80G & 12A registration are-

The applicant's Income Tax Portal login ID and password

A copy of the applicant's PAN card

The applicant's contact information (mobile number and e-mail ID)

Nature of the applicant's activity

Copy of the applicant's registration certificate

Trust deed along with the applicant's MOA

List of the applicant's items or modified objects, if any

The details of DARPAN registration, if the applicant is registered on the DARPAN portal;

The details of FCRA registration, if the applicant is registered under this Act.

Settlor/trustee/members of the trust/charitable institution details such as PAN, Aadhar number, address, mobile number, and e-mail ID

Financial statements since foundation/previous three years

A self-certified copy of any existing registration under Section 80G, if any

A self-certified copy of any existing registration under sections 12A, 12AA, or 12AB, as applicable.

Benefits of 12A and 80G Registration

Tax Benefits: The 12A and 80G registrations provide several tax benefits to registered organisations. The 12A registration allows the organisation to avail exemptions from income tax, while the 80G registration permits donors of such organisations to claim deductions on their donations. This means that donors can reduce their taxable income by the amount they donate which in turn reduces their tax liability. Additionally, it also helps in attracting more donations as many people are willing to donate if it gives them a financial benefit or advantage.

Risk Mitigation and Advantages of Compliance: These registrations ensure that all activities undertaken by the charitable organization are compliant with legal requirements. As a result, not only does this help mitigate any potential risks associated with non-compliance but also provides assurance to stakeholders about the legitimacy of its operations and activities. Furthermore, having these registrations is important for building trust among donors which can be beneficial for fund-raising efforts as well as increasing visibility and credibility for an organization within its respective sector or industry.

Process of Filing Returns

The process of filing returns is an important aspect of the taxation system and it must be done timely in order to avoid any penalties or legal hassles. As such, it is essential to understand the various documents and requirements needed for filing returns as well as the deadlines associated with them.

Required Documents: Depending on your tax slab, you will need to submit certain documents along with your return form which are required for verification purposes. These include proof of income such as salary slips, bank statements/passbooks indicating investments made throughout the financial year, details about capital gains from sale of assets etc. Additionally, if you have received any reimbursement from your employer then you will also need to provide relevant receipts and bills in order to claim deductions under section 80C or other applicable sections.

Submission of Returns: Once all necessary documents are collected, they can be uploaded onto the e-filing portal provided by Income Tax Department (ITD) where one can file their taxes electronically using a digital signature. Alternatively, individuals may also opt for manual submission where they must fill out Form 2A or Form 3CA depending on their status and submit it at their respective ITD office within due date i. e 31st July every year (for both salaried employees and self-employed individuals).Deadlines for Filing Returns: The deadline for filing returns varies according to different categories; salaried employees must do so before 31st July while those who fall under presumptive tax scheme have until 30th September every year. Furthermore, taxpayers who receive income from sources like house property rental income should file their return either on or before 31st March after end of assessment year whereas those earning foreign remittances need not file unless there’s a specific requirement mentioned in law books applicable in India (such as Section 115E).

The Impact of 12A and 80G Registration

The 12A and 80G registrations have a positive impact on charitable organisations as they provide several tax benefits to registered organisations. Firstly, the 12A registration allows the organisation to avail exemptions from income tax, while the 80G registration permits donors of such organisations to claim deductions on their donations. This means that donors can reduce their taxable income by the amount they donate which in turn reduces their tax liability. Additionally, it also helps in attracting more donations as many people are willing to donate if it gives them a financial benefit or advantage.

Furthermore, these registrations ensure that all activities undertaken by the charitable organisation are compliant with legal requirements. As a result, not only does this help mitigate any potential risks associated with non-compliance but also provides assurance to stakeholders about the legitimacy of its operations and activities. Moreover, having these registrations is important for building trust among donors which can be beneficial for fund-raising efforts as well as increasing visibility and credibility for an organization within its respective sector or industry.

Finally, registering under 12A and 80G makes filing returns easier since all necessary documents can be uploaded onto the e-filing portal provided by Income Tax Department (ITD). This eliminates time consuming paperwork associated with manual submissions making filing taxes much faster and efficient process than before thus saving valuable resources like money & energy while eliminating potential errors due to manual entry of data into forms etc.

Conclusion

In conclusion, it is evident that registering an organization under 12A and 80G can provide a wide range of tax benefits to both the charity itself as well as donors. It helps in promoting charitable activities by providing exemptions from income tax while also allowing donors to claim deductions on their donations thus reducing their overall taxable income. Moreover, having these registrations ensures compliance with legal requirements which not only helps avoid potential risks associated with non-compliance but also builds trust among stakeholders regarding the legitimacy of its operations and activities. In addition, filing returns becomes easier due to the availability of e-filing portal provided by ITD making taxation process faster and efficient than manual submissions. Therefore, it is important for all organizations involved in charitable activities to register themselves under 12A and 80G registrations in order to avail these benefits.

#12a and 80g Registration#accounting#branding#finance#adventure#12aregiatration#12a and 80g Registration - Process#income tax#gst registration#gst#ca#gst refund#financial services#financial#Process of Filing Returns#trust registration

0 notes

Text

Understanding a Private Company Limited by Guarantee: A Guide by Masllp

Introduction:

In the realm of business structures, a Private Company Limited by Guarantee (PCLG) is a unique entity that offers specific benefits, especially for non-profit organizations and charitable institutions. At Masllp, we specialize in helping organizations navigate the complexities of establishing and managing a PCLG. In this comprehensive guide, we will delve into what a Private Company Limited by Guarantee is, its advantages, and how Masllp can assist you in leveraging this structure for your organization.

What is a Private Company Limited by Guarantee?

A Private Company Limited by Guarantee is a type of company structure typically used by non-profit organizations, clubs, associations, and charitable bodies. Unlike traditional companies that have shareholders, a PCLG has members who act as guarantors. These members agree to contribute a predetermined amount towards the company's debts if it is wound up.

Key Features of a Private Company Limited by Guarantee

No Share Capital

One of the distinguishing features of a PCLG is that it does not have a share capital. Instead, it is funded by members' contributions and other sources of income, such as donations and grants.

Limited Liability

The liability of the members is limited to the amount they agree to contribute in the event of the company being wound up. This ensures that members' personal assets are protected.

Non-Profit Focus

A PCLG is often established for non-profit purposes. Any profits generated are typically reinvested into the organization's activities rather than distributed to members.

Governance and Control

The governance of a PCLG is similar to other companies, with a board of directors responsible for managing the company's affairs. Members have a say in the company's operations through voting rights.

Advantages of a Private Company Limited by Guarantee

Credibility and Trust

Establishing a PCLG can enhance the credibility and trustworthiness of your organization. Donors and stakeholders are often more willing to support entities with a recognized legal structure.

Legal Protection

As a separate legal entity, a PCLG can enter into contracts, own property, and sue or be sued in its own name. This provides legal protection for the members and the organization's assets.

Tax Benefits

Depending on the jurisdiction, a PCLG may be eligible for certain tax exemptions and benefits, especially if it operates as a charitable organization.

Perpetual Succession

A PCLG has perpetual succession, meaning it continues to exist even if its members change. This ensures continuity and stability for the organization.

How Masllp Can Help You Establish a Private Company Limited by Guarantee

Expert Guidance

At Masllp, we provide expert guidance on the legal and regulatory requirements for establishing a PCLG. Our team of professionals will assist you in navigating the complexities of incorporation and ensure compliance with all relevant laws.

Tailored Solutions

We understand that each organization is unique. Masllp offers tailored solutions to meet your specific needs, from drafting the articles of association to setting up governance structures.

Ongoing Support

Our support doesn’t end with the incorporation process. We offer ongoing services to help you manage your PCLG effectively, including financial management, compliance, and reporting.

Comprehensive Services

From registration and legal documentation to financial planning and advisory, Masllp provides a comprehensive range of services to support your organization at every stage.

Conclusion

A Private Company Limited by Guarantee is an ideal structure for non-profit organizations and charitable institutions seeking to enhance their credibility, legal protection, and operational efficiency. With the expertise of Masllp, you can successfully establish and manage a PCLG that aligns with your organization's goals and objectives. Contact Masllp today to learn more about how we can assist you in leveraging the benefits of a Private Company Limited by Guarantee for your organization.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services#ajsh

3 notes

·

View notes

Text

Thailand Board of Investment

The Thailand Board of Investment (BOI), established in 1966, stands as a cornerstone institution promoting foreign direct investment (FDI) in Thailand. It plays a pivotal role in propelling the nation's economic growth and diversification by offering a plethora of incentives and streamlining the investment process. This article delves into the intricacies of the BOI, exploring its objectives, investment promotion strategies, and the advantages it offers to foreign investors.

Guiding Principles: The BOI's Vision and Mission

The BOI operates under the purview of the Office of the Prime Minister, highlighting its significance within the Thai government's economic development agenda. Here's a closer look at the driving forces behind the BOI:

Vision: To transform Thailand into a globally competitive and innovation-driven economy, fostering balanced and sustainable growth.

Mission: To attract high-quality foreign investments that contribute to technological advancement, knowledge transfer, and job creation in Thailand.

Strategic Arsenal: The BOI's Toolbox for Investors

The BOI employs a multi-pronged approach to incentivize foreign investment. Here are some of the key offerings that make Thailand an attractive investment destination:

Tax Incentives: Corporate income tax exemptions or reductions, import duty exemptions on machinery, and exemption from import duties on raw materials for export production are some of the tax benefits offered.

Investment Allowance: Companies can deduct a portion of their investment costs from their taxable income over a specified period.

Land Leasehold Rights: Foreigners can be granted extended leasehold rights for land plots under specific BOI-promoted activities.

Simplified Business Registration: The BOI facilitates a faster and smoother business registration process for promoted companies.

One-Stop Service: The BOI acts as a central point of contact, providing guidance and assistance to investors throughout the investment process.

Tailored Assistance: BOI's Promotion Sectors and Activities

The BOI prioritizes specific sectors and activities deemed crucial for Thailand's economic development. These sectors are categorized into clusters, each with its own set of promotional strategies and incentives. Some of the key focus areas include:

Advanced Technologies: The BOI actively promotes investments in industries like robotics, artificial intelligence, and digital technology.

Future Industries: Sectors like bioeconomy, medical and wellness services, and aviation and logistics receive significant support from the BOI.

Targeted Industries: The BOI offers incentives for investments in targeted industries like automotive, electronics, and food processing, which contribute significantly to Thailand's export sector.

Beyond Incentives: Additional Advantages of BOI Promotion

While the financial perks are substantial, BOI promotion offers a range of additional benefits:

Enhanced Credibility: BOI-promoted companies gain a mark of recognition from the Thai government, potentially boosting investor confidence.

Streamlined Bureaucracy: The BOI assists in navigating complex regulations and obtaining necessary permits, saving investors time and resources.

Access to Networks: The BOI connects investors with potential business partners, suppliers, and research institutions within Thailand.

Eligibility and Application Process: Demystifying BOI Promotion

Not all foreign investments qualify for BOI promotion. Here's a breakdown of the eligibility criteria and the application process:

Eligibility: Companies involved in activities aligned with the BOI's promotional sectors, demonstrating potential for technology transfer, job creation, and export generation, are most likely to be considered.

Application Process: Investors submit detailed proposals outlining their business plans, projected investments, and anticipated contributions to the Thai economy. The BOI thoroughly evaluates each proposal before making a decision.

A Look Ahead: The BOI's Role in Thailand's Future

As Thailand strives to navigate a dynamic global economic landscape, the BOI's role remains crucial. By continuously refining its promotional strategies, attracting high-value investments in cutting-edge sectors, and fostering a supportive business environment, the BOI is well-positioned to propel Thailand's economic transformation and secure its place as a leading investment destination in the region.

#lawyers in thailand#thailand#thailand board of investment#corporate in thailand#corporate lawyers in thailand#business in thailand#business lawyers in thailand#business#corporate

2 notes

·

View notes

Text

Thailand Board of Investment

The Thailand Board of Investment (BOI), established in 1966, serves as a vital gateway for foreign businesses seeking to invest and establish a foothold in the Southeast Asian nation. Acting as a one-stop shop, the BOI offers a range of incentives and support mechanisms to make Thailand an attractive and competitive investment destination.

Who Benefits from the BOI?

The BOI's programs target a broad spectrum of foreign investors, including:

Manufacturers: Companies engaged in the production of goods, particularly those aligned with Thailand's focus industries (like automotive, electronics, and food processing).

Technology Companies: Businesses involved in areas like software development, biotechnology, and digital innovation are highly encouraged.

Service Providers: The BOI welcomes foreign companies offering services in sectors like healthcare, tourism, and logistics.

What Incentives Does the BOI Offer?

The BOI provides a compelling package of incentives to attract foreign investment. These benefits can include:

Corporate Income Tax Exemptions: Partial or complete exemption from corporate income tax for a set period.

Import Duty Exemptions: Reduced or waived import duties on machinery, raw materials, and technology crucial for business operations.

Tax Breaks on Investment Costs: Incentives to encourage investment in research and development, infrastructure development, and employee training.

Simplified Business Registration: The BOI streamlines the business registration process for promoted companies.

Work Permit Facilitation: Assistance in obtaining work permits for foreign skilled workers needed for the project.

Focus Industries and Thailand's Development Goals

The BOI's promotional programs strategically align with Thailand's national development goals. By prioritizing industries like advanced manufacturing, digital technology, and environmentally friendly practices, the BOI aims to:

Drive Economic Growth: Attract foreign investment that fosters job creation and boosts Thailand's export capabilities.

Enhance Technological Advancement: Encourage technology transfer and innovation to elevate Thailand's industrial competitiveness.

Promote Sustainable Development: Support businesses that implement environmentally responsible practices and contribute to a greener future for Thailand.

How to Apply for BOI Promotion

Foreign businesses can apply for BOI promotion by submitting a detailed proposal outlining their investment project, including the nature of the business, target market, and projected economic benefits to Thailand. The BOI provides clear guidelines and application procedures on their website https://www.boi.go.th/en/index/.

Investing in Thailand's Future

The Thailand Board of Investment presents a compelling proposition for foreign businesses seeking to expand their reach in Southeast Asia. With its attractive incentives, strategic focus, and commitment to development, the BOI paves the way for a successful and mutually beneficial partnership between foreign investors and Thailand's growing economy.

2 notes

·

View notes