#income tax return filing online process

Text

KVR TAX Services is the Udyam Registration services in Hyderabad. Apply now for the new udyam aadhar registration, in Gachibowli, Flimnagar, Kondapur, Lingampally.

#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#register a business in hyderabad#register company in hyderabad#firm gst registration process in hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in hyderabad#Msme Registration Consultants in hyderabad#MSME Registration Online in hyderabad#iec code registration in hyderabad#export and import registration in hyderabad

0 notes

Text

How Income Tax Return Online Filling

Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

Step 1: Gather Necessary Documents

Step 2: Register or Login into the Income Tax Portal

Step 3: Select the Appropriate ITR Form

Step 4: Fill in Your Personal Details

Step 5: Provide Income Details

Step 6: Claim Deductions and Exemptions

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

By Paisainvests.com

#digital tax return#e-filing taxes#e-verifying tax returns#filing ITR#filing taxes online#income tax documents#income tax guide#income tax portal#income tax return#online tax filing#online tax return benefits#online tax submission#revised tax return#step-by-step tax filing#tax deductions#tax filing deadline#tax filing mistakes#tax filing tips#tax return process#tax return tips

0 notes

Text

https://thehill.com/business/4694024-irs-direct-file-free-tax-filing-permanent/

The free online tax filing program piloted this year by the IRS will be made permanent and its scope will be expanded, Treasury Secretary Janet Yellen announced Thursday.

Known as “Direct File,” the online platform will be integrated with state tax systems and expanded beyond the limited number of deductions that it can currently process, Yellen and IRS Commissioner Danny Werfel told reporters.

“We’re making Direct File — the new product we piloted this year — permanent,” Yellen said, touting the boost in IRS funding from the Inflation Reduction Act.

Werfel said that the size of the expansion hadn’t yet been decided but that it would gradually become larger over the coming years to include most common tax situations, focusing on those of “working families.”

Currently, the system can only process income earned in the form of W2 wages — the way most U.S. workers are paid — along with a handful of credits like the Child Tax Credit and Earned Income Tax Credit.

Werfel mentioned a number of tax situations where the IRS saw demand for inclusion in direct file, including health care and retirement tax credits.

“The premium tax credit — under the Affordable Care Act, those that get their health insurance in the affordable care act marketplace and therefore receive a premium tax credit. That was something that was not in our eligibility scope this year,” Werfel said.

“There were other refundable tax credits that were out of scope. There was certain retirement income that was out of scope,” he added.

Republicans and the private tax preparation software industry have railed against the new program. House Republicans voted to rescind funding for Direct File as soon as they took control of the lower chamber in 2023.

“There are also significant questions as to whether the IRS has the legal authority to implement such a program without congressional authorization,” Senate Finance Committee ranking member Mike Crapo (R-Idaho) said in a statement last year.

Werfel did not talk Thursday about additional types of income that could be made eligible for direct file, such as investment returns, rental property income, or independent contractor income filed on 1099-Ks.

The process of expanding Direct File will begin with figuring out which additional states will be included beyond the initial 12 where it was available this year.

“It really depends on state readiness,” Werfel said. “There will be no limit to the number of states that can participate in the coming year.”

The cost of the program for next year could be up to $75 million as outlined in the IRS’s strategic operating plan annual supplement, a sum that Werfel said the IRS would not “significantly or materially exceed.”

6 notes

·

View notes

Text

Treasury Secretary Janet Yellen defended the Internal Revenue Service in a speech Tuesday against repeated threats from Republicans to cut the agency’s funding.

“Playing politics with IRS funding is unacceptable. Cutting it would be damaging and irresponsible,” Yellen said.

The IRS was allocated an influx of $80 billion by the Democrats’ Inflation Reduction Act, which passed last year. The funds are intended to help crack down on tax cheats and improve taxpayer service.

But the funding has become politically controversial.

Most recently, House Republicans voted to rescind $14.3 billion from the IRS to pay for an emergency aid package for Israel in the wake of the Hamas terrorist attacks, but the bill is unlikely to even get brought up for a vote in the Democrat-controlled Senate.

Newly minted House Speaker Mike Johnson said the IRS cuts would offset the spending for Israel, but independent budget experts have repeatedly said that taking money away from the IRS’ enforcement actions will actually add to the deficit. In fact, the nonpartisan Congressional Budget Office said last week that cutting $14.3 billion from the IRS would reduce the amount of tax revenue the agency can collect by $26.8 billion over 10 years.

The House GOP has made several efforts to claw back some IRS funds since taking control of the chamber in January, and some Representatives have even called for abolishing the IRS altogether. Earlier this year, Republicans were successful in rescinding $20 billion from the IRS as part of a deal to address the debt ceiling.

Many Republicans claim the IRS will use the money to hound middle-class taxpayers and small business owners, though the Biden administration has said that taxpayers earning less than $400,000 a year won’t face an increase in taxes due to the new funding.

“Let me be as clear as possible. The IRS agenda in using Inflation Reduction Act funds is as follows: If you are middle- or low-income, better service; if you are wealthy, more scrutiny,” said IRS Commissioner Danny Werfel in a speech he gave Tuesday following Yellen’s remarks.

IRS IMPROVEMENTS

The Biden administration is eager to show how the new funding is helping the IRS improve its taxpayer services and ramp up enforcement efforts.

“The new funding is driving change across the IRS, and we are seeing a wave of improvements that the agency hasn’t seen in a generation,” Werfel said.

During the 2023 filing season, the IRS was able to answer 3 million more calls and cut phone wait times to three minutes from 28 minutes compared with the year before after hiring 5,000 new customer service representatives. And by ramping up enforcement on millionaires this year, the IRS has collected $160 million in back taxes.

The IRS has also already met its goal, set earlier this year, to make sure taxpayers can respond to all IRS correspondence online. Previously, there were certain forms that could only be responded to on paper through the mail. As a result of this change, the IRS estimates more than 94% of individual taxpayers will no longer have to send mail to the agency.

The IRS has also put a plan in motion to digitize all paper-filed tax returns by 2025. The move is expected to cut processing times in half and speed up refunds by four weeks.

There are more improvements the IRS expects to roll out next year.

For example, the existing online tool known as “Where’s My Refund?” will be able to give taxpayers more detailed information about the status of their refund after filing their federal tax return, including whether the IRS needs them to respond to a letter requesting additional information.

The IRS is also expecting to provide more in-person tax filing support at its Taxpayer Assistance Centers. Taxpayers can go to those sites to receive free help from trained volunteers. The agency’s goal is to increase the number of taxpayers receiving free tax preparation help by around 50,000 in filing season 2024.

While these improvements are intended to give taxpayers fewer reasons to call the IRS, new technology is cutting down on wait times when they have to pick up the phone. The main IRS line now has a call-back option when the expected wait time exceeds 15 minutes. A caller can hang up and receive a call back later.

In addition, the IRS is currently working on building its own free tax filing program, known as Direct File, that will launch as a limited pilot program next year and be available to some taxpayers in 13 states.

#us politics#news#cnn#cnn politics#2023#biden administration#Janet Yellen#department of Treasury#internal revenue service#IRS funding#republicans#conservatives#Inflation Reduction Act#us house of representatives#house republicans#rep. Mike Johnson#aid for Israel#Congressional Budget Office#Danny Werfel#federal tax returns#tax returns#irs improvements

12 notes

·

View notes

Text

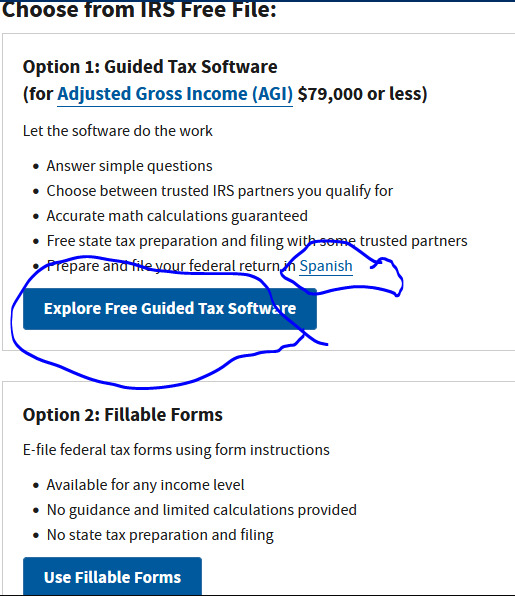

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

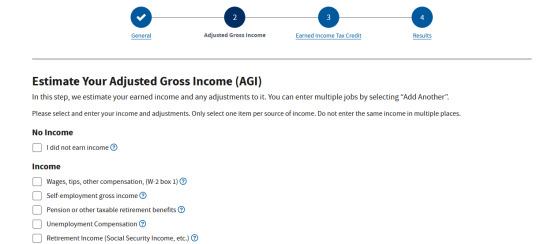

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

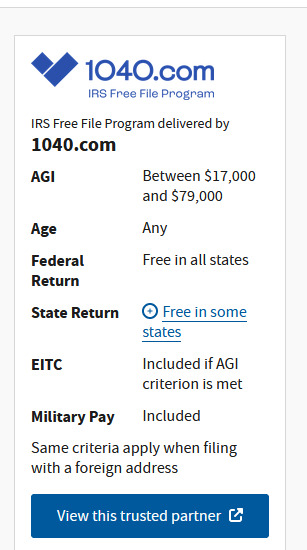

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

4 notes

·

View notes

Text

Smooth sailing through registrar of company filings with our expert team by your side. ✍

~

~

~

✅ Company Registration

✅ GST Registration & Return

✅ Trademark Registration

✅ Income Tax Return

✅ FSSAI Registration

Maurvish Advisors is an MCA (Ministry of Corporate Affairs) & MSME registered company in India.

Our experienced (10 Yrs+) CA/CS will draft & complete all the documentations on the same day.

✅ Hassle Free Process

✅ 100% Online Process

✅ Lowest Cost in India

What are you waiting for?

Apply Now

#tumblr#aesthetic#love#like#tumblrgirl#follow#instagram#instagood#photography#likeforlikes#s#art#likes#tumblrboy#frasi#grunge#girl#o#cute#fashion#sad#photooftheday#photo#frases#followforfollowback#frasitumblr#a#amor#tumblraesthetic#tiktok

2 notes

·

View notes

Text

RECENT ECOMMERCE NEWS (INCLUDING ETSY), Early April 2024

Welcome to my coverage of all the important Etsy and other ecommerce news that microbusinesses need to know! It's been a few weeks since my last update, so there is a fair amount to report.

Want to get the news more often and in a more timely fashion? Please sign up to support my Patreon site, where among other features, I will soon be starting periodical live chats on important topics. (I promise there will be one the day Etsy announces a fee increase)

TOP NEWS & ARTICLES

Etsy has made changes to how processing times and estimated delivery dates work; I covered everything you need to know in this post.

Etsy seems to be sending more Messages to the spam folder, so you may miss a real message. After reading that thread, I checked, and there was one from another seller needing help from just 5 hours ago. Etsy did say engineers are looking into it.

UPS has won the USPS air cargo contract, currently held by FedEx. It kicks in at the end of September. “As of May 31, 2023, FedEx counted the USPS as the largest customer of its Express unit.”

ETSY NEWS

Etsy is rolling out a new seller pricing tool, and it is just as useless as the old version. I posted some early thoughts (with screenshots).

Some shop owners are struggling to cancel Etsy coupons, while others are not having the same problem. Support says the company is aware of the issue.

If you still can't access most of the Etsy forum after the changes on Tuesday March 26, post in this Technical Issues thread so that your account can be fixed.

Periodically, some shops suddenly stop getting deposits. If your shop has recently had a security warning, you may want to check to see if your bank account is still verified with Etsy.

Looks like Etsy has an issue with misrepresenting how many items are left for each listing on the app; I wrote about it here.

Canadians getting harassed by Etsy to sign up for TurboTax should know that the company has told a seller that it doesn’t import Etsy data into your tax return for you; that is only available for Americans. [If you can’t import your info from your various platforms, my suggestion is use a free online program to file instead; I’ve used Wealthsimple for several years with no issues filing small business taxes; the T-2125 is part of the program.]

Etsy’s activist investor seems to think that the marketplace can “…add more buyers and increase the amount of money they spend on the platform”. But “monetization opportunities” were also mentioned.

Etsy is yet again called out for allowing AI-generated porn on the site. “Several of the available listings also appear to violate existing trademarks — TheStreet identified listings that sell NSFW (not safe for work) AI-generated, suggestive images that appear to mimic Rapunzel from Disney's "Tangled," Princess Jasmine from Disney's "Aladdin" and She-Hulk from Marvel's "She-Hulk."

Etsy has been talking a lot about "image quality" lately, but doesn't really define the term anywhere. While I agree with those that say it is more than image size - Etsy would not have humans curating images to train its AI if "quality" could simply be measured by pixels - note that Google Shopping Ads describe image quality as size. “The resolution of your product images determines its quality. Google considers images with more than 1024 pixels as high-resolution images.”

Apparently Etsy CEO Josh Silverman likes to make “unorthodox, downright risky career decisions” that often involve a ton of responsibility. [Link to podcast in article; I haven’t listened to it]

ECOMMERCE NEWS (minus social media)

General

Patreon’s live chats are now accessible on the web (instead of just the app). A creator can assign moderators, and have chats for different categories of members.

Canadians: beware that new tax rules requiring digital platform operators to report their users’ income to the Canada Revenue Agency are expected for 2025. These laws would make Canada similar to the United States and the United Kingdom, among others.

Amazon

Amazon is struggling to verify the VAT status of many UK sellers, and the fact the company holds all funds until the process is complete means many sellers are without income.

eBay

eBay is offering 3 free “express payouts” to select US sellers by email only, available until June 30th. Money is paid to seller debit cards and can take a half hour or more to receive. (The usual cost is 1.5%.)

If you use eBay For Charity, you may want to check to see if the charity is getting paid, as some apparently are not.

If you advertise on eBay, or just list inconsistently, you may be interested in the marketing trends calendar for 2024. It shows you when certain types of searches peak.

Michaels Makerplace

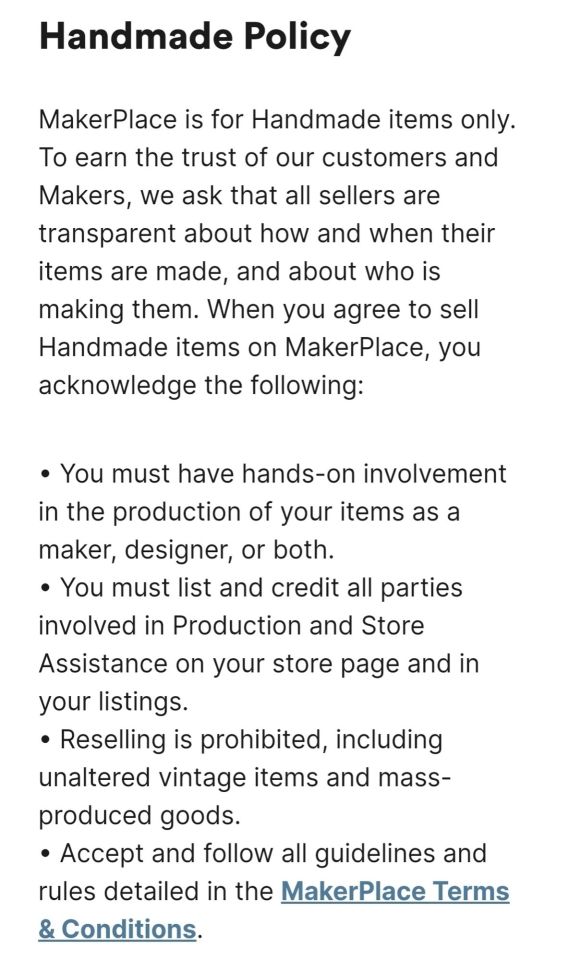

The landing page for Makerplace sellers doesn’t provide a lot of hard details; some of the actual policies appear once you begin to sign up. Here’s how they define handmade:

Thanks to Bluesky user Brushfeather for the info.

Shopify

Shopify is putting more effort into large businesses these days, despite its core offerings targeting small and medium-sized businesses for years. [soft paywall; Business Insider] The company “...has made a concerted effort over the last 18 months to introduce more software solutions to win over larger merchants. It has enhanced Shopify Plus, a higher-tier subscription with more features, and launched Hydrogen, a more custom framework geared toward retailers with more complex needs...Shopify introduced Commerce Components, an offering that allows merchants to integrate parts of Shopify's software into their existing tech stack. Mattel was its first retail partner for that product, and Everlane has since adopted Shop Pay as a stand-alone component.”

CEO Tobi Lutke recently received almost $200 million CAD in Shopify stock options, “one of the largest compensation packages in Canadian history.” As company founder, he now has around $8 billion worth of Shopify stock.

CIRRO Fulfillment now integrates with Shopify.

Squarespace

Squarespace is rolling out Squarespace Payments to sellers in the United States, and they expect to add more countries later this year. Fees are in line with other payment processors.

All Other Marketplaces

Mercari is following Depop and is ending seller transaction fees while adding a buyer fee. There is now a seller earnings withdrawal fee of $2, however, plus the pricing only applies to items listed after the announcement on March 27th, and sellers now have to accept returns for any reason, within 72 hours of receipt.

I suppose this fee might work for buyers if many are also sellers on Mercari or elsewhere, and are buying stock. If you see a good deal you know you can flip with a good margin, you might not mind paying a buyers fee on top of the listing price. The only other way I can see being willing to pay a buyers fee is if you are so enamoured with the platform and its culture that it is worth paying more for. Or maybe I am just out of touch…

The Mercari CEO basically calls out Etsy for raising seller fees too much [soft paywall; Modern Retail]: “I’m not going to mention them by name, but you have marketplaces that have a lot of makers, a lot of people that create things, and the fees around selling on those platforms have just been going up a lot very aggressively”. [my emphasis] Mercari wants fees to remain competitive while attracting better inventory. Another article on Mercari’s announcement mentions Etsy by name when discussing seller fees.

Mercari might want to consult lawyers the next time the site makes changes, though, as many sellers were furious that their existing balances were now subject to withdrawal fees without any warning, leading some to file complaints with the FTC. That led the company to announce that “On March 27, 2024, Mercari announced that it would begin charging a $2 fee(s) (“ACH Charge”) for all ACH direct deposit requests. Effective immediately through April 3, 2024 at 11:59 P.M. Pacific Daylight Time (“Waiver Period”), Mercari will waive the ACH Charge for ACH direct deposit requests made prior to the end of the Waiver Period for all eligible account holders.” Those who already incurred withdrawal charges will get refunds.

And because apparently you can never have enough Mercari news, they’ve introduced a listing importer for eBay and Depop. It uses AI.

AliExpress will now do livestream shopping events in the UK.

Payment Processing

PayPal users in the US will soon have only 30 days after delivery to file a significantly not described claim in most cases. Items not delivered by 180 days will still have the full 180 days.

Shipping

UPS is planning on closing about 200 facilities in the United States, and hopes to save money by instead using more automated hubs. Having fewer employees and consolidating locations is expected to save the company around $3 billion by the end of 2028.

FedEx is continuing to combine its Express and Ground pickups and deliveries, both to save money and to make pickups easier on customers.

2 notes

·

View notes

Text

Mumbai's Premier Accounting Services: Expert Financial Solutions Await!

In the bustling metropolis of Mumbai, where businesses thrive in the fast-paced environment, the need for reliable and expert accounting services is more critical than ever. As the financial hub of India, Mumbai's economic landscape demands precision, accuracy, and a deep understanding of the complex financial intricacies that businesses face. This is where Mumbai's premier accounting services come into play, offering expert financial solutions that cater to the diverse needs of businesses across various sectors.

Tailored Solutions for Every Business: Mumbai's premier accounting services understand that each business is unique, with its own set of challenges and opportunities. These expert financial professionals take a personalized approach, tailoring their services to meet the specific needs of each client. Whether you are a startup looking to establish solid financial foundations or an established corporation seeking to optimize your financial processes, these accounting services have the expertise to deliver customized solutions that align with your business goals.

Comprehensive Accounting Services: The premier accounting services in Mumbai offer a comprehensive range of financial solutions that go beyond traditional bookkeeping. From tax planning and compliance to financial forecasting and budgeting, these experts cover every aspect of accounting to ensure your business operates smoothly and efficiently. By outsourcing your accounting needs to these professionals, you can focus on what you do best – growing your business.

Navigating the Complex Tax Landscape: Tax laws and regulations in India are constantly evolving, making it challenging for businesses to stay compliant. Mumbai's premier accounting services stay abreast of these changes and have a deep understanding of the local tax landscape. Whether it's filing income tax returns, managing Goods and Services Tax (GST) compliance, or navigating other tax obligations, these experts ensure that your business remains in good standing with the authorities.

Technology-driven Efficiency: In a city that never sleeps, efficiency is paramount. Mumbai's top accounting services leverage cutting-edge technology to streamline their processes, ensuring accuracy and timeliness in all financial operations. Cloud-based accounting systems, automation tools, and secure online platforms are integrated seamlessly into their workflow, providing clients with real-time access to financial data and reports.

Professional Expertise You Can Trust: The premier accounting services in Mumbai boast a team of seasoned professionals with a wealth of experience in accounting and finance. These experts are not just number crunchers; they are strategic partners invested in the success of your business. By entrusting your financial management to these professionals, you gain access to a pool of knowledge and expertise that can drive your business forward.

Cost-effective Solutions for Every Budget: Contrary to the misconception that expert financial services come with a hefty price tag, Mumbai's premier accounting services offer cost-effective solutions tailored to businesses of all sizes. By outsourcing your accounting needs, you eliminate the need for an in-house finance team, reducing overhead costs and allowing you to allocate resources more efficiently.

In conclusion, Mumbai's premier accounting services are the cornerstone of financial success for businesses in this vibrant city. With tailored solutions, comprehensive services, and a commitment to professionalism, these experts are ready to navigate the intricate financial landscape, providing businesses with the peace of mind they need to thrive in the competitive Mumbai business environment. Whether you're a small startup or a large corporation, expert financial solutions await you in the heart of India's financial capital.

2 notes

·

View notes

Text

Demystifying the EIN: Your Guide to Obtaining EIN number

So, you've taken the exciting plunge into the world of business with your MAS Limited Liability Partnership (MAS LLP). Congratulations! Now, as you navigate the initial setup, one crucial milestone arises - Obtaining EIN number. But what exactly is an EIN, and how do you, as an MAS LLP, go about securing one? Worry not, fellow entrepreneur, for this blog is your one-stop guide to conquering the EIN conundrum!

What is an EIN?

Think of an EIN as your MAS LLP's social security number in the business world. It's a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. Essentially, it serves as the official stamp that grants your MAS LLP legitimacy in the eyes of the IRS and other financial institutions.

Do you need an EIN for your MAS LLP?

In most cases, the answer is a resounding yes! Here are some scenarios where an EIN is essential for your MAS LLP:

Filing tax returns: You'll need an EIN to report your business income and expenses to the IRS, even if you don't have employees.

Opening bank accounts and credit lines: Most banks and lenders require an EIN to set up business accounts and lines of credit for your MAS LLP.

Hiring employees: If you plan to have employees, you'll need an EIN to withhold and pay payroll taxes.

Filing certain business forms: Depending on your business activities, you may need an EIN to file specific forms with the IRS or other government agencies.

Obtaining EIN number:

The good news is Obtaining EIN number is a relatively straightforward process. Here are your options:

Online: The IRS website offers a quick and easy online application process. This is the fastest and most recommended method, with instant EIN issuance in most cases.

By phone: International applicants or those without a valid Social Security Number can call the IRS to apply for an EIN.

By mail or fax: While slower, you can also mail or fax Form SS-4, Application for Employer Identification Number, to the IRS.

What you need to know:

Applying for an EIN is free!

You'll need basic information about your MAS LLP, such as its legal name, address, and responsible party (typically, the managing partner).

Have your Social Security Number handy if applying online.

Once you receive your EIN, keep it safe and confidential, similar to your personal SSN.

Beyond the EIN:

Remember, Obtaining EIN number is just one step in establishing your MAS LLP. Consult with a business advisor or qualified accountant to ensure you're on the right track with all necessary tax filings, licenses, and legal compliance.

With the knowledge and resources now at your fingertips, Obtaining EIN number MAS LLP's EIN shouldn't be a source of stress. So, take a deep breath, conquer the EIN challenge, and focus on making your MAS LLP a resounding success!

Disclaimer: This blog is for informational purposes only and does not constitute legal or tax advice. Please consult with a qualified professional for guidance specific to your MAS LLP's needs.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

4 notes

·

View notes

Text

I have an idea New York State should really consider:

So New York has the NY.gov ID system that most state agencies that need to verify your state ID and/or state tax income tap into in order to unify everything (New York has an obsession about centralized control, which sometimes is actually beneficial).

This means if you have Medicaid/Essential Plan/Child Health Plus/Marketplace plan through NY State of Health and you have already filed your tax return, they are linked in the NY.gov ID system so NY State of Health just grabs your NYS tax return and renews your health insurance for you. It is immensely helpful. If you need to register for medical cannabis, that is also under the same system (also the DMV) so you provide your state issued ID number and they can verify your information with the same ID you used to establish your NY.gov ID account.

It has sped up so many things. But I think we can take this further.

The myBenefits applications and any other income based applications should also be under the NY.gov ID system. This would be so much more efficient since the application is already online anyway and a NY.gov ID account is practically required these days for New Yorkers anyway. The application process could be so much quicker and efficient and recertification wouldn’t be required in most cases as it would automatically be done.

Let it also give the person “Hey, based on your current NYS tax return and your demographics, you or your family may qualify for these programs”

I want the NY.gov ID system to tell our low and middle income seniors that they qualify for EPIC, which will prevent them from falling into the Medicare donut hole. I want it to tell low and middle income homeowners that they qualify for clean heat programs to cut down on the cost of making their homes more energy efficient and installing a clean heat source (and that you can stack those programs together). I want it to tell New Yorkers that qualify for HEAP that they actually do.

I don’t want to remove the current ways of applying for these programs because they will still be helpful for some people. I want to add in the option of applying through NY.gov ID to streamline the entire process and people could have a one stop place to go to find out about programs they qualify for and can instantly apply with their state ID and taxes already there for them.

13 notes

·

View notes

Text

Streamline Your Business with KVR TAX: Your Go-To Partner in Hyderabad

Starting and managing a business in Hyderabad involves several critical steps, from registration to tax filing. Navigating the complex regulatory landscape can be overwhelming, but with the right guidance, it becomes a seamless process. At KVR TAX, we specialize in offering comprehensive solutions for all your business needs, including gst registration certificate in hyderabad, income tax filing in Hyderabad, and much more.

Goods and Service Tax Registration in Hyderabad

One of the primary requirements for any business in India is the goods and service tax registration in hyderabad. GST is a crucial tax that every business dealing in goods or services must comply with. Our team at KVR TAX ensures a smooth and hassle-free firm gst registration process in hyderabad. From understanding the legal requirements to completing the paperwork, we assist you at every step.

Register Your Business Effortlessly

If you're planning to register a business in hyderabad, KVR TAX is your reliable partner. Whether you want to register a company in Hyderabad or set up a small firm, we provide end-to-end services. The registration of firm process in hyderabad can be daunting, but our experts make it simple and straightforward. We guide you through each phase, ensuring that your business complies with all necessary regulations.

Income Tax Filing Made Easy

Tax filing is another essential aspect of running a business. Whether you're an individual or a corporate entity, timely and accurate tax filing is crucial. KVR TAX offers expert services in income tax filing in hyderabad. Our professionals are well-versed in the latest tax laws and help you with incometax return filing in hyderabad, ensuring compliance and minimizing liabilities.

MSME Registration Consultants in Hyderabad

For small and medium enterprises, obtaining MSME registration is vital for availing various benefits. At

#gst registration certificate in hyderabad#goods and service tax registration in Hyderabad#register a business in hyderabad#register company in Hyderabad#firm gst registration process in Hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in Hyderabad#Msme Registration Consultants in Hyderabad#MSME Registration Online in hyderabad#iec code registration in Hyderabad#export and import registration in hyderabad

0 notes

Text

TRACES – Overview of e-TDS and e-TCS

Introduction

Welcome to the world of TDS, the traceability system for e-Commerce! In this blog post we'll discuss what e-TDS is and how it works.

e-TDS

e-TDS is a new system of tax collection introduced by the government of India. It is a part of the e-Nivaran project, an initiative to digitize all processes related to tax collection.

The main objective behind this system is to bring transparency and efficiency in government schemes by reducing manual work, avoiding corruption and ensuring better customer experience through online transactions at minimal cost.

e-TCS

e-TDS is the online version of TDS.

e-TCS is a web-based application used to submit income tax returns online, file income tax returns electronically, and receive updates on various things like income tax rates and deductions.

there are two parts of TDS traces.

There are two parts of TDS traces. One is e-TDS, which is done through the internet. The other one is e-TCS, which is done through a computer software.

The main purpose of using these two kinds of systems is to ensure that your money reaches its destination without any loss or delay in between; this way you can be sure that all your transactions are safe from frauds like card cloning and theft etc.,

Conclusion

From the above, you can conclude that e-TDS and e-TCS are two different technologies for creating digital time series data. Both have their own advantages and disadvantages, but both of them can be used together with any other technology to get the best results.

4 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat refund#vat registration#VAT Registration in Dubai#VAT Return Filing#vat registration uae#vat registration services in dubai

2 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat registration uae#VAT Registration in Dubai#uae vat registration#vat registration#vat registration services in dubai

3 notes

·

View notes

Text

Apply for a pan card online

A PAN (Permanent Account Number) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It serves as a vital document for financial transactions, tax filing, and identity verification. Applying for a PAN card has become easier, as you can now do it online. Here’s a step-by-step guide on Apply for a PAN card online.

Why Do You Need a PAN Card?

Before diving into the application process, it’s important to understand why a PAN card is essential:

Tax filing: It is mandatory to quote your PAN while filing income tax returns.

Financial transactions: PAN is necessary for opening a bank account, buying property, investments, or transactions above a certain threshold.

Identity verification: It acts as a valid identity proof for various official processes.

Applying for a PAN Card Online

If you want to apply for a pan card so you can contact us +1 (416) 996–1341 or [email protected] to apply for a pan card online.

1- Visit this site pancardcanada.com

2- And Go to application form of apply for pan card

3- fill the details

4- submit the application form.

Conclusion

Apply for a PAN card online is a simple and efficient process. With the availability of paperless Aadhaar-based e-KYC, you can receive your PAN in just a few days. Follow this guide to ensure a smooth and hassle-free application process, ensuring compliance with Indian tax regulations and seamless financial transactions.

Contact Us-

Phone- +1 (416) 996–1341

Email Us- [email protected]

0 notes

Text

Why Should One Enlist A Professional Property Management Service?

Owning a rental property can be financially rewarding. Besides generating a steady income, these real estate assets offer tax benefits and have significant potential for appreciation. However, rental properties also have several tasks such as maintenance, tenant management, and various financial and legal procedures. How to ensure your real estate business runs smoothly? Doing some investigation on property management services can be ideal. Let's explore why you should consider hiring a professional property management service in Benalmadena.

What is Property Management?

Let's understand what property management services are. It is a unique service that involves supervision of residential, industrial, or commercial real estate assets. Typically, landlords and developers hire third-party property management services to manage and administer the properties. With strong leadership and organizational skills, such property management services in Benalmadena handle multiple tasks on behalf of property owners or managers! From managing unruly tenants to maintaining the property they can do it all. Property management services in Benalmadena go beyond setting rents! Their work can be categorized into:

Rental and tenant management

Renovation and maintenance

Property sale and purchase

Accounts and finance

Marketing and advertising

Legal and insurance advisory

Benefits of Availing Property Management Services

Property management services involve numerous daily activities. From calculating taxes to filling vacancies it includes all. Multiple stakeholders need a reliable hand to address their needs and serious issues. Property management services offer a holistic approach to resolving the issues. They address three key demands: better return on investment, efficient rental management, and maintenance. They handle:

Setting rental prices after thorough market research

Ensuring vacancies are filled and rents are collected promptly

Conducting business transparently

Improving tenant retention rates

Grievance redressal and resolving tenant queries

Drafting and implementing lease and rental agreements.

Overseeing insurance and asset management

Tax planning and handling related documentation

Increasing property value

Hassle-free and quality maintenance

Handling vendors, pricing, and purchase management

Secrets of Efficient Property Management Companies

Communication Skills

Effective communication is crucial between clients and property management service providers. They keep you updated on property status and are responsive to tenant queries. They clearly describe rules and regulations to tenants and vendors. It will add extra value to your investment.

Knowledge of the Property

Every property has unique features. Researching and highlighting these, including neighborhood amenities like transportation, entertainment, shopping, business hubs, and educational institutes, is essential. A good Property management service in Benalmadena will gather all necessary data and inform clients about the project details.

Streamlining Work

Property management services in Benalmadena handle multiple tasks daily. From maintenance to financial transactions, they do it all. Efficient property management services set processes to streamline work. They are using online and offline tools or good file management systems.

Implementing Online Tools

Success today depends on technology. A professional property management service in Benalmadena upgrades or installs new systems and ensures employees are trained to use software, applications, or web-based programs effectively.

Long-term Strategy

Management services companies formulate long-term strategies to run a successful real estate business. They help clients stay focused and assess current strategies' shortcomings. They are offering comprehensive solutions based on performance in tenant retention and financial transactions.

Hundreds of property management services in Benalmadena cater to agents, developers, landlords, and tenants' needs. Sunshinehomes offers these services, to maximize your returns or earn high yields. They offer equal emphasis on implementing online tools. Taking assistance from Sunshinehomes enables you to handle multiple tasks efficiently. Call them today to learn more about their service in Benalmadena!

Know more about our affordable and quality products stay social with us on: Facebook & Instagram

0 notes