#index calculation

Explore tagged Tumblr posts

Text

Indxx is a leading global index provider, offering end-to-end indexing solutions, including index calculation, maintenance, and development.

0 notes

Text

unless I'm searching wrong. Outer Wilds has barely more fics on Ao3 than Goncharov

#they're both in the 800's. with I think like 50 fics difference??#not good at math rn enough to calculate OW's Gonch index

2 notes

·

View notes

Text

(with a corkboard behind me, red strings all around it) no okay listen there are so many similarities between nameless bard and amos,

#im always stuck on the fact that they were the two to have died out of the crew#why THEM !!#bc like !!!#they were both probably very good mediators#bard not only bc of the bard thing . to battle people with your words instead#but amos probably . had access to meetings with others . the queen standing at the king’s side#hell i wouldnt be surprised if in the beginning deca told her of some of it#she’s gotten used to how people try to alter their words. how careful they are speaking with her. what they try to say without fully#speaking of it. hidden#AND !#they are probably the kinds of people to finish something even if it comes at the detriment of themselves#phoenixes#they will do everything they can. they will sink their claws in and dig until this is over. because it has to.#someone has to be the one to bear the burden’s#>> frosted exterior but i think it’s telling they never got to fully leave it#they never got the chance to melt ……. to warmth :(#bard and staining his hands bc it’s all for the greater good#amos and leaving behind everything she once knew. tearing it to shreds with her own hands#it’s this way they can only make the future better#a silent calculating of how much is there to lose#a silent understanding that theyve made their graves#a silent understanding that maybe . they got in over their heads#DOES THIS MAKE SENSE im#(holds my hands out with my index extended) im making connections#bard masks so hard with people’ing also I fear /lh#so does amos#to Me#they who are more familiar with that of otherworldly than their own…. yknow#bards Good with people don’t get me wrong but he needs a minute afterwards….#lantern says stuff

4 notes

·

View notes

Text

it's interesting to view other classically "evil traits" through a more sympathetic lens.

for example, if someone is described as "calculating"... this indicates that they lack tolerance for the consequences of a spontaneous life. they can't accept risks, so they behave in restricted ways to only allow for their desired outcome. they're at odds with reality. isn't this actually a deep form of suffering?

#sorry for one last post while the water heats up#indexed post#Also The key idea that follows is that suffering is not proportional to rightness#And also that a lot of risk aversion would be ungenerously described as 'calculating' -- the same mindset can be framed different ways#This is why nobody understands Makima like I do BTW.

13 notes

·

View notes

Text

"I'm your arch's nemesis"

Normal people: what? that doesn't sound right, don't you mean-

Architects: HAVE AT THEE, FUCKING BUTTRESS

#tumblr wants me to add tags#uuuh#architecture#here you go#I guess the actual nemesis of arches would be orthogonal horizontal pressure though?#since then an arch would (I presume) be less stable to that than a wall of similar length#that's just what I expect though I know literally nothing about architecture#At least if the arch doesn't support anything#If it does support something good luck felling it#I know that much#because obviously it's hard to push stuff out if there's stable weight on it#I wonder how that holds up to an architect's expertise#do architects do whole calculations of materials like how ductile they are and friction index and tensile strength and lots of stuff like#that so nothing bad happens#or do we have that stuff figured out and they just pull out a table with all the data and they just know by heart the important stuff#like 'don't use stucco as your foundation; it is brittle and sad'

4 notes

·

View notes

Text

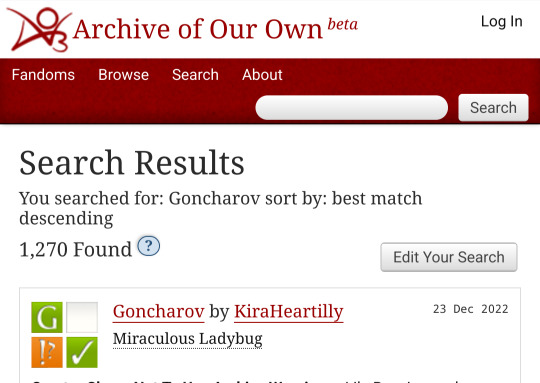

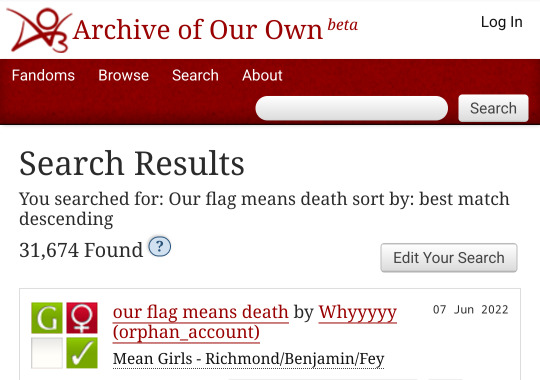

Here we have three screenshots for three different search queries, I'm not a judge of whether that is an adequate measure of the size of the fandom, but it's what I have.

So Goncharov being our measuring basis sits at 1270

Then we have our flag means death at 31674

Which means their relative impact when using the Goncharov index is 31674/1270 which is about 24.9, or for every fic under Goncharov tags are 24.9 for Our flag means death. So we can deduce that their market position is greater but not necessarily a time to invest, we'd need to look at trends for that.

Now we have another, more controversial query. By searching for the Onceler (Lorax was much higher, at 1480) we get a result for 335. So their value for Goncharov index is merely 335/1270 or 0.26. Stagnant and frowned upon fandom, do not invest.

people trying to insist a fandom is tiny when it /only/ has a few thousand works on ao3 meanwhile my current fandom is a sixteen book series and has several hundred fewer works than goncharov, a movie that, and i cannot stress this enough, doesn’t even exist

#Not a financial advisor#Not a writing consultant#Not a fic writer#An avid lover of numbers#goncharov#onceler#our flag means death#Index calculations#normalization#uniformity

57K notes

·

View notes

Text

Rental Index Calculator Dubai by Propwise

Understanding the Dubai rental market just got easier with the Propwise Rental Index Calculator. No more guessing— get instant insights based on location, unit type, and market trends. Save time, make informed decisions, and stay compliant with Dubai’s rental laws. Simplify your renting journey and protect your rights with confidence. Visit our website now to use the Rental Index Calculator Dubai.

0 notes

Text

Key Factors in Accurate Index Calculation

Financial indices play a crucial role in tracking market trends, guiding investment decisions, and serving as benchmarks for various asset classes. The accuracy of index calculation is essential for ensuring transparency, reliability, and consistency in financial markets. Any errors or biases in index computation can lead to misleading market signals, incorrect portfolio allocations, and flawed economic assessments.

This article explores the key factors that contribute to accurate index calculation and their impact on financial markets.

1. Selection of Index Constituents

The accuracy of an index depends on the careful selection of its constituent assets. The methodology used to include or exclude stocks, bonds, or commodities affects the index’s relevance and reliability.

Market Representation: The index should accurately reflect the market segment it is designed to track. For example, a large-cap index should include well-established companies with high market capitalization.

Liquidity Considerations: Highly liquid stocks should be prioritized to ensure that price fluctuations are based on actual market activity rather than illiquid trades.

Sector and Industry Balance: A well-diversified index provides a realistic picture of overall market trends rather than being skewed by a single sector.

A poor selection process can result in an index that does not truly represent its intended market, leading to misleading conclusions for investors and analysts.

2. Weighting Methodology

The way individual securities are weighted in an index significantly impacts its calculation. There are several weighting methodologies, each with its own advantages and limitations:

Price-Weighted Index: Assigns higher importance to stocks with higher prices, regardless of company size. Used in the Dow Jones Industrial Average (DJIA).

Market Capitalization-Weighted Index: Weighs stocks based on their total market value, giving larger companies more influence. Used in the S&P 500 and NASDAQ Composite.

Equal-Weighted Index: Assigns equal weight to all securities, regardless of price or market cap. Used in the S&P 500 Equal-Weight Index.

Fundamentally Weighted Index: Uses fundamental financial metrics like revenue, earnings, or dividends to determine weightings. Used in the FTSE RAFI Index Series.

Choosing the right weighting methodology ensures that the index accurately represents market trends and is not overly influenced by a few large or high-priced stocks.

3. Accurate Price and Data Collection

Index calculation relies on real-time and historical price data, which must be accurate and timely to prevent errors in computation.

Reliable Data Sources: Stock prices, volume, and market capitalization data must come from reputable exchanges and data providers.

Handling of Market Anomalies: Mechanisms should be in place to address sudden price fluctuations, stock splits, or trading halts.

Corporate Actions Adjustments: Events such as mergers, acquisitions, stock splits, and dividend payouts must be properly accounted for to avoid artificial distortions in index values.

Without accurate price data, an index may reflect misleading market trends, impacting investment strategies and financial analysis.

4. Regular Rebalancing and Maintenance

Indices must be regularly rebalanced and maintained to ensure they remain representative of the market over time.

Periodic Review of Constituents: Stocks that no longer meet the index criteria should be removed and replaced with better-suited alternatives.

Reweighting Adjustments: Changes in market capitalization, sector composition, or economic conditions may require adjustments in weighting.

Dividend and Corporate Action Adjustments: If a company issues stock splits or dividends, the index must be adjusted to reflect these changes without affecting its overall value.

A lack of regular updates can lead to outdated indices that no longer provide meaningful insights into market performance.

5. Transparency in Calculation Methodology

An index's credibility depends on its transparency and adherence to standardized calculation methodologies. Investors and analysts should clearly understand:

How constituent stocks are selected

How weightings are assigned

How adjustments are made for corporate actions

How frequently the index is rebalanced

Financial indices managed by reputable organizations, such as S&P Dow Jones Indices, MSCI, and FTSE Russell, publish clear guidelines on their calculation methods, ensuring trust and consistency in the financial markets.

6. Handling of Market Volatility and Outliers

Market fluctuations can impact index values significantly. Effective index calculation accounts for volatility and unexpected price swings by:

Using Moving Averages: Helps smooth out short-term fluctuations and provides a more stable index value.

Applying Circuit Breakers: Protects against extreme market crashes that may temporarily distort index calculations.

Accounting for Economic Events: Major economic reports, geopolitical events, and interest rate changes can impact stock prices, requiring careful adjustment to avoid misleading trends.

Ignoring volatility factors can result in an index that is too reactive to short-term movements, leading to inaccurate market assessments.

7. Governance and Compliance

Strong governance structures ensure that index calculation follows ethical standards, regulatory compliance, and best practices.

Independent Oversight Committees: Ensures unbiased index management and prevents conflicts of interest.

Regulatory Compliance: Indices must adhere to financial regulations, such as EU Benchmark Regulation (BMR) and SEC guidelines.

Fair and Equal Treatment of Securities: No single stock or sector should have an unfair advantage in index composition.

A well-governed index enhances investor confidence and prevents market manipulation risks.

Conclusion

Accurate index calculation is essential for maintaining transparency, fairness, and reliability in financial markets. Key factors such as constituent selection, weighting methodology, price data accuracy, regular rebalancing, transparency, volatility adjustments, and governance all play a critical role in ensuring an index’s effectiveness.

As financial markets evolve, advancements in index construction and computational techniques will continue to enhance accuracy, making indices more reflective of real-world market conditions. By understanding these key factors, investors and analysts can make informed decisions and use indices effectively for benchmarking, risk assessment, and investment strategy formulation.

#Index Calculation Agent#Index Calculation#Index Administration#Index Management#Equity Basket Calculation#index management stock market

1 note

·

View note

Text

Navigating Complexity: Challenges in Index Calculation

Index calculation, while fundamental to the functioning of financial markets, is not without its complexities and challenges. As investors increasingly rely on indices as benchmarks for performance evaluation and portfolio management, understanding the intricacies of index calculation becomes paramount. In this article, we explore the challenges inherent in index calculation and how they impact investors and market participants.

1. Data Quality and Availability:

One of the primary challenges in index calculation is ensuring the quality and availability of data. Index providers rely on accurate and timely data sources, including pricing data, corporate actions, and other relevant information, to calculate index values. However, discrepancies or delays in data availability can impact the accuracy and reliability of index calculations, leading to potential errors or distortions in index performance.

2. Methodological Complexity:

Index calculation methodologies can be inherently complex, especially for indices with intricate weighting schemes or specialized selection criteria. Determining the appropriate weighting methodology, rebalancing frequency, and inclusion/exclusion criteria requires careful consideration and may vary depending on the objectives of the index. Complexity in methodology can pose challenges for investors in understanding how index values are derived and how they should be interpreted.

3. Treatment of Corporate Actions:

Corporate actions, such as stock splits, mergers, acquisitions, and dividend payments, can pose challenges for index calculation. These events may require adjustments to constituent weights or changes in index composition to maintain the integrity and continuity of the index. However, the treatment of corporate actions can be complex and may vary depending on the methodology employed by the index provider, leading to potential discrepancies in index values across providers.

4. Rebalancing and Maintenance:

Periodic rebalancing and maintenance are necessary to ensure that the index remains representative of its target market segment. However, the process of rebalancing can be complex and may involve significant transaction costs, especially for indices with large numbers of constituents or frequent turnover. Additionally, changes in index composition may impact market liquidity and trading dynamics, potentially affecting index performance and tracking error.

5. Transparency and Disclosure:

Transparency in index calculation processes is essential for maintaining investor confidence and market integrity. However, achieving transparency can be challenging, especially for proprietary indices or those with complex methodologies. Index providers may face constraints in disclosing certain aspects of their methodologies or data sources due to intellectual property considerations or competitive pressures. As a result, investors may have limited visibility into how index values are derived and how they should be interpreted.

Conclusion:

In conclusion, navigating the complexities of index calculation requires careful consideration of data quality, methodological complexity, treatment of corporate actions, rebalancing and maintenance, and transparency and disclosure. While these challenges pose significant hurdles for investors and market participants, they also underscore the importance of robust governance, rigorous oversight, and transparent reporting practices in ensuring the accuracy, reliability, and integrity of financial market indices. By understanding and addressing these challenges, investors can make more informed decisions and navigate the complexities of the investment landscape with confidence.

0 notes

Text

Mastering the Sliding Puzzle Game: A Timeless Blend of Logic and Fun

Sliding puzzle games have been a staple of intellectual entertainment for generations, challenging players with grids of numbered or image-based tiles that need to be arranged correctly. Whether you're a seasoned puzzle solver or a beginner looking for a brain-boosting challenge, mastering the sliding puzzle game requires patience, logical thinking, and strategic moves. Just like maintaining an optimal Body Mass Index (BMI) for good health or using an Age Calculator to track personal milestones, sharpening your cognitive abilities through puzzles is a rewarding experience.

The Fundamentals of Sliding Puzzle Games

At the heart of sliding puzzles is a simple yet engaging mechanism—one empty space that allows you to move adjacent tiles. Players must visualize the final arrangement and strategically shift pieces to achieve the correct order. Much like analyzing health metrics such as BMI, success in sliding puzzles hinges on observation and thoughtful decision-making. These games offer a mental workout comparable to solving complex equations or strategizing moves in online mobile games.

Strategic Approaches to Solving

One common method for tackling sliding puzzles is solving row by row, ensuring that each piece aligns correctly before moving on to the next section. Another strategy is to recognize patterns within the puzzle and make informed moves rather than random shifts. Just as using an Age Calculator helps plan life events, approaching puzzles with a structured mindset enhances problem-solving efficiency.

Benefits Beyond Entertainment

Sliding puzzles are more than just games; they improve cognitive skills such as memory, spatial awareness, and logical reasoning. Research suggests that engaging in brain-stimulating activities—whether it’s solving puzzles or playing online mobile games—can boost mental agility. Likewise, understanding health-related metrics like BMI fosters better lifestyle choices, highlighting the interconnectedness of mental and physical well-being.

The Everlasting Appeal of Sliding Puzzles

In a world dominated by fast-paced digital entertainment, classic sliding puzzles remain relevant. Whether competing against friends in an online mobile game or fine-tuning problem-solving skills, puzzle enthusiasts continue to find enjoyment in this timeless challenge. Just as tracking your Body Mass Index or using an Age Calculator serves practical purposes, mastering the sliding puzzle game adds a valuable dimension to cognitive development.

0 notes

Text

Group Housing FSI Available for Sale in Lucknow – Unlock Prime Development Potential

Lucknow, the capital city of Uttar Pradesh, is emerging as one of India's fastest-growing real estate hubs. With its expanding infrastructure, strategic location, and increasing demand for modern housing solutions, group housing FSI (Floor Space Index) available for sale in Lucknow presents a golden opportunity for real estate developers. Investors and builders looking to capitalize on the city's booming real estate market should not miss the chance to acquire FSI for group housing projects in key locations of Lucknow.

Understanding FSI and Its Significance in Group Housing Projects

Floor Space Index (FSI), also known as Floor Area Ratio (FAR), is the ratio of the total built-up area of a building to the total plot area. This metric determines how much construction is permissible on a given plot of land. Higher FSI availability allows developers to build high-density residential projects, maximizing their return on investment while catering to the growing demand for urban housing.

With the rapid urbanization of Lucknow, acquiring FSI for group housing projects enables developers to create well-planned, high-rise residential communities that offer modern amenities, green spaces, and excellent connectivity.

Prime Locations Offering Group Housing FSI in Lucknow

Several prime locations in Lucknow offer lucrative opportunities for group housing development. Some of the best areas for investment in FSI for group housing include:

1. Gomti Nagar Extension

One of the most sought-after localities in Lucknow, Gomti Nagar Extension, is a prime residential and commercial hub. With excellent connectivity via Shaheed Path, proximity to IT parks, shopping malls, and educational institutions, investing in group housing FSI in this area guarantees high demand and excellent returns.

2. Amar Shaheed Path

This developing corridor is an ideal choice for high-rise residential projects. The area boasts seamless connectivity to Lucknow Airport, major expressways, and commercial centers, making it a perfect location for luxury and affordable housing developments.

3. Sultanpur Road

With the Lucknow-Sultanpur highway expansion, this region is witnessing tremendous growth in residential projects. The availability of group housing FSI in Sultanpur Road ensures developers can cater to the rising demand for affordable and mid-segment housing.

4. Raebareli Road

A fast-growing locality with multiple educational institutions, hospitals, and commercial developments, Raebareli Road presents an excellent opportunity for developers looking to launch large-scale residential projects with modern amenities.

5. Faizabad Road

Known for its strategic location and upcoming metro connectivity, Faizabad Road is another hotspot for group housing FSI investment. The region offers an ideal mix of affordability and luxury, making it a prime area for large-scale development.

Advantages of Investing in Group Housing FSI in Lucknow

1. High Demand for Residential Projects

Lucknow's growing population, coupled with increasing urbanization, has led to a significant rise in demand for quality housing projects. Group housing developments are ideal for catering to this demand, offering well-planned apartments with modern amenities.

2. Strong Connectivity and Infrastructure Development

The city's rapid infrastructure development, including metro expansion, new expressways, and better road networks, ensures seamless connectivity across major localities, enhancing the appeal of group housing projects.

3. Affordable Land Prices with High ROI Potential

Compared to other metropolitan cities, Lucknow offers relatively affordable land prices, allowing developers to maximize their investments. The rising property rates ensure high returns on investment (ROI) in the long run.

4. Government Incentives and Policies

With the Uttar Pradesh Real Estate Regulatory Authority (UP-RERA) promoting planned urbanization, various government policies encourage group housing projects. Incentives such as tax benefits, ease of approvals, and development schemes make FSI investments highly attractive.

5. Rising Demand for Gated Communities and Luxury Apartments

The demand for gated communities, high-rise apartments, and integrated townships is growing among homebuyers in Lucknow. Investing in group housing FSI ensures developers can cater to the rising expectations of homebuyers seeking modern lifestyle amenities.

Factors to Consider Before Purchasing Group Housing FSI in Lucknow

While investing in group housing FSI in Lucknow offers multiple benefits, developers must consider the following factors:

Zoning and Regulatory Approvals: Ensure compliance with local municipal regulations, FSI norms, and RERA guidelines before purchasing land or FSI.

Market Demand Analysis: Conduct thorough market research to identify the right segment—affordable, mid-segment, or luxury housing.

Infrastructure and Connectivity: Choose a location with existing or upcoming infrastructure projects to ensure high demand.

Amenities and Project Planning: Focus on offering modern amenities such as clubhouses, green spaces, security systems, and recreational facilities.

Budget and Financial Planning: Factor in the cost of land acquisition, construction, approvals, and marketing to ensure a profitable venture.

How to Acquire Group Housing FSI in Lucknow?

Developers and investors looking to acquire group housing FSI in Lucknow can follow these steps:

Identify Prime Locations – Research high-growth areas with excellent connectivity and infrastructure.

Engage with Real Estate Consultants – Work with property experts to find the best deals on FSI sales.

Verify Legal Documentation – Ensure all FSI approvals, land titles, and municipal clearances are in place.

Plan and Design the Project – Collaborate with architects and planners to create an optimized housing project.

Get RERA Registration – Ensure compliance with Uttar Pradesh RERA for smooth project execution.

Market the Project Effectively – Use digital marketing, real estate listings, and offline promotions to attract homebuyers.

Conclusion: Invest in Lucknow’s Booming Group Housing Market Today

Lucknow’s real estate market is witnessing unprecedented growth, making it the perfect time to invest in group housing FSI. With prime locations, affordable land rates, and increasing demand for modern residential communities, developers can unlock massive potential in this thriving city.

For real estate developers, acquiring FSI for group housing projects in Lucknow ensures long-term profitability, sustainable urban development, and enhanced lifestyle experiences for homebuyers.

#Group Housing FSI for Sale#Group Housing FSI in Lucknow#FSI Available for Sale in Lucknow#Floor Space Index for Group Housing#Group Housing Development in Lucknow#FSI Rules for Group Housing#Real estate investment in Lucknow#Affordable Housing FSI in Lucknow#FSI Calculation for Housing Projects#Lucknow Property Development FSI

0 notes

Text

Body Mass Index Calculator India | BMI Chart by PNB MetLife

Check your health status with PNB MetLife's BMI Calculator. Easily calculate your Body Mass Index (BMI) and understand your ideal weight range. Access a comprehensive BMI chart tailored for India, helping you maintain a healthy lifestyle. Try it now for accurate results!

0 notes

Text

Calculate your living expenditures with the Living Wage Expenditure Index from DOSM

The Department of Statistics Malaysia (DOSM) has released its 2023 Cost of Living Indicator (KSH) report in conjunction with its 75th-anniversary celebration. The report introduces the Living Wage Expenditure (PAKW) Index, designed to reflect essential living costs for households. Chief Statistician Datuk Seri Dr. Mohd Uzir Mahidin highlighted that PAKW, initiated in 2018, factors in household…

0 notes

Link

In the complex world of Life Insurance, index universal life (IUL) policies have gained popularity. These policies offer both death benefit protection and cash value growth potential. However, determining the right policy and understanding its long-term implications can be challenging. As a result, the Index Universal Life insurance Calculator has become essential tools. In this article, we’ll explore these calculators in depth.

#lifeinsurance#Life Insurance#indexuniversallife#index universal life#IUL#cashvalue#cash value#growth#insurance#insurance Calculator

0 notes

Text

Index Calculation Agents vs. Index Providers: Understanding the Differences

Introduction

Financial markets rely on indices to measure performance, track trends, and guide investment strategies. These indices—such as the S&P 500, NASDAQ Composite, and MSCI Emerging Markets Index—play a crucial role in asset management, exchange-traded funds (ETFs), and financial benchmarking. However, their creation and management involve two distinct entities: Index Calculation Agents and Index Providers.

Although these terms are often used interchangeably, they represent different functions within the financial ecosystem. Understanding the differences between Index Calculation Agents and Index Providers is essential for investors, asset managers, and financial professionals.

1. What Is an Index Provider?

An Index Provider is an organization that creates, owns, and maintains financial indices. These firms define the methodology for index construction and ensure the index remains representative of the intended market or sector.

Key Responsibilities of Index Providers

Designing Index Methodology:

Establish rules for security selection, weighting, and rebalancing.

Define whether an index is price-weighted, market-cap-weighted, or equal-weighted.

Developing Benchmark Indices:

Create indices that serve as benchmarks for ETFs, mutual funds, and institutional portfolios.

Managing Index Licensing:

License index data to financial institutions, ETFs, and derivatives markets.

Adjusting Indices Based on Market Evolution:

Modify criteria based on market conditions, industry trends, and regulatory changes.

Examples of Index Providers

Some of the most well-known index providers include:

S&P Dow Jones Indices (S&P 500, Dow Jones Industrial Average)

MSCI (MSCI World Index, MSCI Emerging Markets)

FTSE Russell (FTSE 100, Russell 2000)

Bloomberg (Bloomberg Barclays Bond Indices)

2. What Is an Index Calculation Agent?

An Index Calculation Agent is responsible for computing and maintaining index values. These entities perform complex calculations to ensure index accuracy and integrity based on real-time market data.

Key Responsibilities of Index Calculation Agents

Index Value Computation:

Collect and process market data to calculate real-time and end-of-day index values.

Applying Corporate Actions:

Adjust for stock splits, mergers, dividends, and spin-offs.

Ensuring Data Accuracy:

Validate price feeds and eliminate discrepancies in index calculations.

Publishing and Disseminating Index Data:

Provide real-time index values to exchanges, financial platforms, and investors.

Examples of Index Calculation Agents

Many financial institutions offer index calculation services, including:

S&P Dow Jones Indices

FTSE Russell

Bloomberg Index Services

Solactive

Some index providers also act as calculation agents, while others outsource the function to third-party firms for independent and unbiased calculations.

3. Key Differences Between Index Providers and Index Calculation Agents

While both roles contribute to index management, their responsibilities differ significantly:

Index Providers focus on methodology, licensing, and market representation.

Index Calculation Agents ensure real-time computation, accuracy, and data integrity.

Why This Distinction Matters

Understanding the difference between these roles is crucial for:

Investors: Ensuring that indices they track are accurately calculated.

Asset Managers: Choosing reliable index providers for fund benchmarking.

Regulators: Maintaining market transparency and preventing manipulation.

Conclusion

While Index Providers create and maintain index methodologies, Index Calculation Agents handle the technical task of computing and disseminating index values. Both entities work together to ensure that financial indices are reliable, transparent, and valuable to the investment community. As global financial markets grow, the importance of accurate index calculations and unbiased methodologies continues to increase.

0 notes