#inflación

Text

Nos hemos convertido en una sociedad donde solo importan los resultados a corto plazo y el enriquecimiento ilimitado. #Mercadona

13 notes

·

View notes

Text

Haveing them do a air inflation self-love quiz would be amazing.

Make a note of each time they do something cute, and ask them what they like about themselves and for every answer (and maybe a few for luck) give them a pump of air in to their belly.

Then see and hear them become a balloon of love!

#enby nsft#trans nsft#trans ns/fw#trans love#t4t nsft#nblnb#t4t love#trans4trans#soft nsft#chubby belly#inflated belly#inflatable#inflación#air inflation#fat and gassy#gassy guy#gassy boy#gassy stomach#gassy#gassy tummy#gassy girl#fart story#burp kink

22 notes

·

View notes

Text

Inflación

View On WordPress

6 notes

·

View notes

Text

Yves here. We’ve been warning for some time that the inflation we are suffering now is due to Covid-induced supply chain breakages, Russia sanctions blowback leading to high energy and commodity prices, and droughts and high heat wrecking crop yields. Labor does not have bargaining power, witness among other things falling real wages and continued record corporate profit share of GDP. But the Fed thinks its job is to break glass and kill demand, as in jobs.

By Jake Johnson. Originally published at Common Dreams

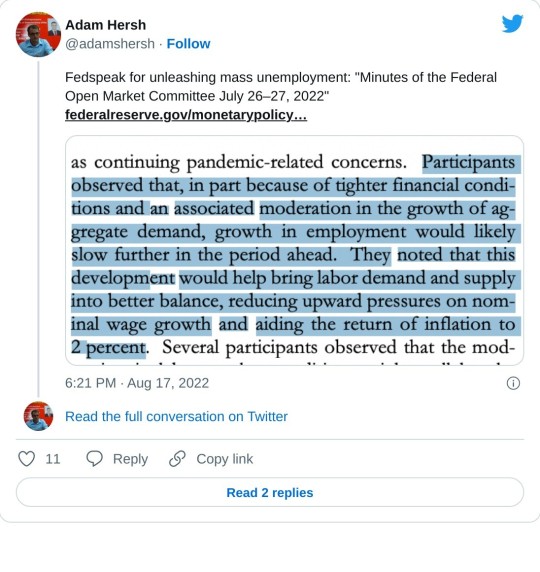

The newly released minutes of the Federal Reserve’s July meeting indicate that U.S. central bank officials have no plans to deviate from aggressive interest rate hikes as they attempt to tamp down high inflation, a policy response that one economist characterized as a commitment to “unleashing mass unemployment.”

“We have a supply-side problem, but rather than trying to restore or raise supply-side capacity the Fed is aiming to push demand down to the level where supply is currently constrained by pandemic, war, and climate crises,” noted Adam Hersh, a senior economist at the Economic Policy Institute.

Published Wednesday, the minutes of the Fed’s July 26-27 policy meeting show that the nation’s central bankers believed at the time that “there was little evidence to date that inflation pressures were subsiding,” reporting that “their business contacts remained concerned about persistently high inflation.”

Fed officials expressed their view on inflationary trends prior to the latest Consumer Price Index (CPI) reading, which suggested that price surges—a problem hardly limited to the U.S.—have cooled slightly while remaining near a four-decade high of 8.5% year over year.

“They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time,” the minutes read. “Participants also observed that in some product categories, the rate of price increase could well pick up further in the short run, with sizable additional increases in residential rental expenses being especially likely.”

While conceding that “supply bottlenecks were continuing to contribute to price pressures,” Fed officials signaled they will stay the course with rate increases aimed at suppressing economic demand, an approach they acknowledged would likely cause higher unemployment. The Fed’s next policy meeting is in September, when another large rate hike is expected even amid evidence of moderating prices as well as slowing economic and wage growth.

“Participants observed that, in part because of tighter financial conditions and an associated moderation in the growth of aggregate demand, growth in employment would likely slow further in the period ahead,” according to the minutes. “They noted that this development would help bring labor demand and supply into better balance, reducing upward pressures on nominal wage growth and aiding the return of inflation to 2%.”

“Participants remarked that a moderation in labor market conditions would likely involve a decline in the number of job openings as well as a moderate increase in unemployment from the current very low rate,” the minutes continue, noting that officials admitted the risk of hiking interest rates “by more than necessary to restore price stability.”

To progressive economists and other analysts, the Fed is flirting with disaster.

In an op-ed for The Guardian on Wednesday, Isabella Weber of the University of Massachusetts Amherst and Mark Paul of Rutgers University observed that “the current inflation situation hasn’t been about all goods in the economy getting more expensive at the same rate.”

“Specific goods—food, fuel, cars, and housing—have been experiencing massive price shocks, raising the general inflation level substantially,” they wrote. “Controlling these changes would require aggregate demand to shrink to unbearable levels for average Americans—essentially making people too poor to buy goods, and thus alleviating bottlenecks. Rate hikes are not only ill-suited to bring down these essential prices but risk a recession throwing millions out of work.”

As an alternative strategy for fighting inflation, Weber and Paul make the case for “targeted price stabilization measures including price controls to limit price increases in systemically significant goods and services: gas, housing, food, electricity, etc.”

“Contrary to conventional wisdom, price controls have a rather successful history in the U.S. when used right, and, while not a magic bullet, they are a powerful tool to tame inflation and protect low- and middle-income Americans,” they note. “This is particularly true when market power—be it from landlords, oil companies, or meat cartels—is at play.”

Weber and Paul specifically express support for Rep. Jamaal Bowman’s (D-N.Y.) recently introduced Emergency Price Stabilization Act, legislation that would establish a White House task force to “proactively investigate corporate profiteering” and propose “measures to ensure adequate supply of relevant goods and services, expand productive capacity, and meet climate and public health standards in the application of any price controls or regulations.”

In an August 4 statement unveiling his bill, Bowman said that “we cannot simply step back and allow the Federal Reserve, which hiked interest rates again last week, to address inflation on the backs of everyday people.”

“That approach means throwing people out of work and risking a recession,” Bowman warned. “Here is the question we must ask: do we have the resources and skills to reach our full productive capacity, make sure everyone in this country has a good job, and manage our economy in the interests of all people? I believe the answer is yes.”

“But we’ll need a new economic playbook to get there,” he added, “and passing my Emergency Price Stabilization Act would be a major step in the right direction.”

#federal reserve#inflazione#inflación#inflacja#economics#capitalism#unemployment#wages#class war#poverty#jobs#recession#economic depression

11 notes

·

View notes

Text

Cristiana bailando en Argentina

#cristina kirchner#argentina#noticias de el argentino#corrupción#kirchnerismo#cristina#kirchner#inflación#rosario#narcos

3 notes

·

View notes

Text

youtube

En Youtube: https://www.youtube.com/watch?v=h9cqWbH4nEs

En Twitch: https://www.twitch.tv/chicosanchez

En Facebook: https://www.facebook.com/chicosanchezphoto

Dona:

Bizum: 656288161

Cuenta Bancaria La CAIXA: ES09 2100 8506 6401 0009 4340 (España)

Cuenta Bancaria HSBC - CIVE 021180064600700425 (México)

Tarjeta HSBC/OXXO: 4213168052701489 (México)

Adquiere mis libros en estos enlaces:

(Papel y PDF)

(Papel y kindle)

#economía#política#tecnotrónica#tecnología#chico sánchez#chicosanchez#libros#noticias#euribor#inflación#autónomos#ciencias políticas#política internacional#Youtube

2 notes

·

View notes

Photo

El verdadero pasillo del terror es el del supermercado y sus precios terroríficos. #inflación #miedo #crisis #Viñeta @elkokoparrilla https://www.instagram.com/p/Ckc6TYAjBS2/?igshid=NGJjMDIxMWI=

6 notes

·

View notes

Text

💬 2147. Economía (no tan) competitiva

1 note

·

View note

Text

¿Puede la economía iraní permitirse una guerra?

Irán lleva años sufriendo una elevada inflación, la caída de su moneda y sanciones internacionales. Más restricciones de Occidente y un conflicto militar prolongado agravarían la crisis económica interna.

Por Thomas Kohlmann

.

Terminal de extracción de petróleo de Jask en Teherán, IránImagen: Iranian Presidency/ZUMA/picture alliance

Mientras Estados Unidos y la Unión Europea (UE) estudian…

View On WordPress

#Autor Thomas Kohlmann#Caida de moneda#Conflictos militares#DW.com#Economia iraní#Guerra#inflación#Iran#Sanciones internacionales

0 notes

Text

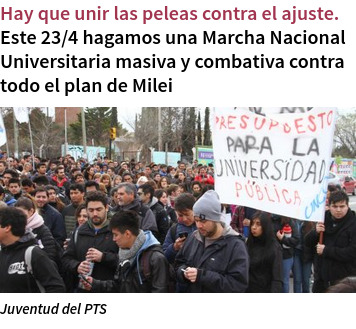

Resumen de Medios | Titulares 2024-04-16

View On WordPress

#argentina#capitalismo#caputo chorro#caputo preso#dólar#deuda#devaluación#economía#educación pública#fmi#fuera milei#gaza#genocidio#industria#inflación#irán#israel#jubilados#ley ómnibus#lla#milei#moyano#no hay plata#palestina#paritarias#política#Recesión#repreisón#represión#saqueo

0 notes

Text

Inflación en México subió a 4.42% en marzo de 2024

Continue reading Inflación en México subió a 4.42% en marzo de 2024

View On WordPress

0 notes