#instant online account opening

Text

Top Tips for Secure Online Banking: Safeguard Your Transactions - itechfy

In today’s digital age, online banking offers unparalleled convenience for managing your finances. However, ensuring the safety of your online transactions is paramount. While online banking platforms come equipped with built-in security features, it’s essential to take proactive measures to protect your sensitive information.

#zero bank account open#online instant bank account opening#open savings bank account online#instant online account opening#payment bank account opening

0 notes

Text

Quick and Easy Instant BharatPe Account Opening | Digi Khata

Digi Khata simplifies the process to open an instant BharatPe account online, providing a fast and efficient solution for managing your business finances. Our platform ensures a seamless experience with quick approval and setup, allowing you to start using your BharatPe account almost immediately. With Digi Khata, you can effortlessly handle transactions, payments, and financial management from the comfort of your home. Experience the convenience of instant BharatPe account opening and enhance your financial operations with our user-friendly online services.

#open an instant BharatPe account online#instant BharatPe account opening#open an instant BharatPe account

0 notes

Text

How to Choose Online Business Bank Accounts

When you first start your business, personal and business funds and expenses may mix and mingle. However, as your business expands, it becomes increasingly crucial to keep those finances separate.

Source :

Download App :

#fd account transfer application#fd account yearly#fd account app#quick fd account#fd transfer account#create fd#Fd transfer status#instant fd account setup#open fd#quick fd account creation#online fd#fd deposit

1 note

·

View note

Text

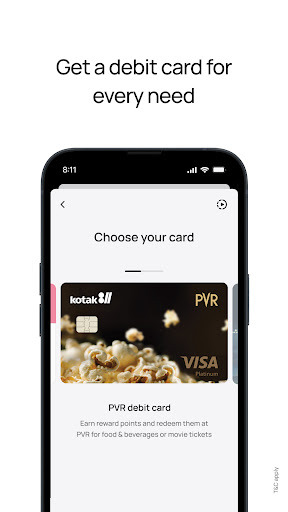

Kotak Mahindra Bank’s official mobile banking application for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

If you are an existing Kotak customer, you can use the 250+ features of the app to Bank, Pay bills, Invest, Shop and access services.

One of our recent additions to the 250+ features is our new Pay Your Contact feature, where you can now send money to anyone using just their mobile Number

#credit card on upi#instant fd account setup#open fd online#fund transfer status#transfer payment bank#money transfer bank account#emi card to bank transfer#fd account#upi money transfer app#fixed deposit account#highest fd rates in bank#digital banking india

0 notes

Text

Unlock the world of seamless trading with Integrated Enterprises (India) Pvt. Ltd. by taking advantage of our 0 AMC Demat Account. It's never been easier to Open a Free Demat Account Online and begin your investment journey without compromise. Our service ensures that you can manage your securities digitally with ease, providing a secure and efficient way to trade. Whether you're a seasoned trader or a newcomer, aligning with Integrated Enterprises (India) Pvt. Ltd. means opening a new trading cum demat account with zero annual maintenance charges, giving you the freedom to focus on your financial growth. Experience unparalleled convenience, robust customer support, and a feature-rich platform designed for investors of all levels. Don’t miss out on this opportunity to simplify your investing process. Open your DigiTrade account now and take the first step towards smarter, hassle-free trading.

#new demat account#instant demat account opening#apply for free demat#open free demat account online#0 amc demat account

0 notes

Text

Mobile banking app for Iphone.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#apply for instant loan#instant money loan#bank balance check#instant personal loan#instant account opening bank#apply for credit cards#book train tickets#book flights and hotels

0 notes

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

Features to look for when opening a digital savings account

It can be tricky to open a bank account for savings because many banks offer similar interest rates and features. Since most people use savings bank accounts for simple financial operations, most don't offer much more than essential banking services. It is the account that receives your monthly wage and is used to make regular payments for the majority of you.

But what happens if you want to open a digital savings account? It should provide a lot more benefits than a standard savings account. So, in this article, you can read about the benefits of a digital account opening compared to a regular savings account.

Easy to open and operate

Documentation and in-person trips to the bank are usually required when creating a savings bank account. The procedure can be laborious because you need to fill out paper paperwork and submit copies of your identity documents. Here's where an online savings account comes in handy.

Opening a modern digital savings account is simple when you make use of techniques like video-KYC and e-verification of electronic papers. If you have a smartphone and good internet access, opening an online savings account is very simple.

Quick activation of linked services

A digital savings account has significantly shorter service activation times than a traditional savings account. You don't have to wait to get a lot of features because you can do everything online.

Beyond purchases, the virtual debit card in a digital account app offers additional features. Furthermore, it enables you to promptly initiate Internet and mobile banking as soon as you receive the card. This means that as soon as you finish the account application, you can begin using more than 250 financial services.

Access to a wide range of digital services

A digital savings account should offer all of the banking services you need, be conveniently accessible from anywhere else, and be simple to set up and quickly activate.

You should be able to transfer money, pay bills, create statements, and more through services like Internet and mobile banking. Your personal finance needs should also be accessible through a single portal. This covers long-term savings, investments, and much more.

Added benefits and offers

Doing daily transactions isn't the only thing a modern digital savings account should be used for. Along with providing transaction benefits and reward points, it should compensate you for your usage. You should also be able to readily access all of the information whenever and whenever you want it.

For example, several banks offer you a variety of offers on the virtual debit card you receive right away after activating your digital savings account. They also offer cashback for online purchases for making specific purchases at a specific time. This feature in credit cards helps you enjoy offers while increasing your credit score.

Final thoughts

It could be time to switch to a new digital बचत खाता if your current savings account doesn't meet all of the requirements listed above. Not only is opening a digital savings account quick and easy, but it also moves you one step closer to the banking of the future.

#digital account opening app#online digital account opening#digital account opening#instant account opening bank#बचत खाता#bank khata kholna#best banking app#online bank account opening app#open bank account online app#bank online account#open online bank account

0 notes

Text

Internet merchant accounts for High risk Business?

Internet merchant accounts for High risk Business?

Internet merchant accounts are essential for "high-risk businesses" to conduct online transactions smoothly and efficiently. As the world continues to embrace digitalization, it is becoming increasingly important for businesses to establish an online presence and cater to the needs of their customers. However, certain industries are deemed high-risk due to various factors such as chargeback rates, fraud potential, or legal and regulatory concerns. To navigate these challenges and ensure a "secure payment process", high-risk businesses must obtain "internet merchant accounts" that provide the necessary tools and protection.

High-risk businesses encompass a wide range of industries, including online pharmacies, adult entertainment platforms, and online gambling websites. These industries are considered high-risk due to the potential for fraudulent activities, strict legal and regulatory oversight, or customers disputing charges and demanding chargebacks. Thus, "acquiring an internet merchant account" specifically designed for high-risk businesses is crucial for their survival and growth.

An internet "merchant account for high-risk businesses" offers several advantages. Firstly, it provides businesses with a secure payment gateway that enables credit card transactions and protects sensitive customer information. Given the nature of high-risk businesses, security measures must be in place to prevent unauthorized access, data breaches, and fraudulent activities. Consequently, an internet merchant account with robust security features promotes trust between the business and its customers, increasing customer satisfaction and loyalty.

Another significant benefit of internet "merchant accounts for high-risk businesses" is the ability to manage chargebacks effectively. Chargebacks occur when customers dispute transactions and request a refund directly from their issuing banks. High-risk businesses often experience a higher rate of chargebacks due to factors such as dissatisfied customers, fraud, or illegal activities. Therefore, an effective chargeback management system provided by an internet "merchant Bank account" allows businesses to resolve and mitigate chargeback disputes efficiently, minimizing financial losses and maintaining a positive reputation.

Furthermore, internet merchant accounts cater specifically to the unique needs and legal compliance requirements of "high-risk businesses". Each industry has its regulations and restrictions that necessitate careful attention and adherence. For instance, pharmaceutical businesses must comply with strict FDA guidelines, while online gambling platforms must follow local and international gambling laws. By partnering with a "merchant account provider specializing in high-risk businesses", these organizations can ensure compliance and avoid penalties, legal issues, and potential shutdowns.

In conclusion, "high-risk businesses require internet merchant accounts" to facilitate secure and efficient online transactions. These accounts provide crucial benefits such as secure payment gateways, effective chargeback management systems, and compliance with industry-specific regulations. By obtaining an internet merchant account designed for high-risk businesses, organizations can navigate the challenges associated with their industries, protect their customers' sensitive information, and ensure a smooth payment process. Embracing the digital era and establishing a strong online presence are crucial for high-risk businesses to remain competitive and thrive in today's market.

Offshore Gateways merchant accounts |

Merchant accounts |

Merchant accounts online |

Internet merchant accounts |

Set up merchant accounts |

Merchant account fees in USA |

Merchant account fees in UK |

Open merchant account online |

Merchant accounts credit card |

Merchant Bank Account |

Merchant account providers |

High risk merchant account instant approval |

High Risk merchant account in USA |

High Risk merchant account in UK |

High Risk payment Gateway |

Forex merchant account |

Gambling Merchant Account |

Best merchant account services |

Online casino merchant account providers |

#Offshore Gateways merchant accounts#Merchant accounts#Merchant accounts online#Internet merchant accounts#Set up merchant accounts#Merchant account fees in USA#Merchant account fees in UK#Open merchant account online#Merchant accounts credit card#Merchant Bank Account#Merchant account providers#High risk merchant account instant approval#High Risk merchant account in USA#High Risk merchant account in UK#High Risk payment Gateway#Forex merchant account#Gambling Merchant Account#Best merchant account services#Online casino merchant account providers#offhsoregateways

0 notes

Text

THINGS TO CONSIDER WHILE OPENING A TRADING ACCOUNT ONLINE!

Discover Key Factors When Opening a Trading Account Online! Evaluate the Online Broker, Check Trading Leverage, Market Analytics, Digital Support, and Open a Trading Account Online in India With Instant Demat Account. Start Your Trading Journey With Confidence and Make Informed Decisions Today!

#open trading account online India#online demat account#trading brokerage charges in india#instant demat account#best broker in india for share market#best online Demat Account opening#0 brokerage demat account

0 notes

Text

How is using an online bank account helpful for you?

Most individuals have been using online banking for the last few years. There are many wonderful advantages to using an app or website for banking. Digital banking is any banking done online through a mobile application or website. It eliminates the need for clients to physically visit a branch by enabling them to conduct banking transactions and access banking services remotely. Because digital banking is so convenient and useful, it has grown in popularity recently. In today's fast-paced world, most people prefer instant bank account opening online. This post explains how using an online bank account is helpful for you:

Bank on your phone or tablet

Starting an online banking account does not require sitting at a computer; you can do it from your phone or tablet. Most bank websites are mobile-friendly, making accessing the internet on your preferred device simple. Furthermore, assistance is typically well-marked and offers live chat or a phone line to the department you require, so you don't have to worry about losing out on the in-person interaction.

Pay bills and make payments

The days of filling out long papers and sending checks to pay bills are long gone. You may use your bank's website to pay all your bills and make payments, which is one of the main advantages of online banking. In addition to sending money to friends and family, you can set up standing orders and direct debits. That is as convenient as it gets.

Minimize unnecessary costs with low-fee online accounts

More customers choose to new bank accounts open online because of their fee-friendly approach, which typically offers accounts with lower costs compared to traditional banks. Access to accounts with few or no fees is one advantage of using an online bank, including several high-yield savings accounts.

However, while comparing accounts from different online banks, thoroughly review the charge schedules like any other bank account. To save money, look for accounts with low or no fees for services like overdrafts, ATM usage, and monthly maintenance. You should also fulfill any other account requirements.

Control

Real-time access to managing and transferring money as needed and having self-serve control over your funds are two other important advantages of digital banking. There are typically no time limits on when you can carry out banking operations, such as depositing checks or transferring money between accounts, with mobile banking apps and websites, in contrast to traditional banking establishments. Also, navigating daily transactions is becoming simpler.

Keep on top of your finances

You will find it much easier to stay on top of your finances if you use online banking. In addition to checking your balance and seeing your transactions easily, you will also be able to view past payments to ensure they were made on time. You may also flag any unauthorized purchases more easily, allowing you to act quickly if you become aware of them.

Wrapping it up As a result, the above detailed are about how using online bank account helpful for you. Banks employ various technologies to guarantee that online banking is secure. Online and mobile banking systems can assist you with everyday banking duties, improve your financial management, and, in certain situations, link you to a group of like-minded people after new bank accounts open.

#best savings account#ebanking#instant online bank account opening#safe mobile banking#instant open bank account#manage bank account online#digital banking

0 notes

Text

Create UPI ID Online Effortlessly with Digi Khata

Digi Khata simplifies the process to create UPI ID online, allowing you to quickly and securely manage your transactions. With our platform, you can open an instant UPI account in just a few easy steps. Our service ensures instant UPI account activation, enabling you to start making payments and transfers immediately. Experience the convenience of hassle-free UPI account setup with Digi Khata, designed to provide fast, secure, and efficient banking solutions right at your fingertips.

0 notes

Text

#open fd online#fd mobile app#instant bank account online transfer#fd transfer account#upi bank app#phone banking#online bank#bank account#banking app#bank online

1 note

·

View note

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#account opening form online#bank online open account#best online account opening#account open online#bank account open online app#instant account opening app#open bank account online#online open bank account#bank accounts to open online

0 notes