#kyc for low risk customers

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

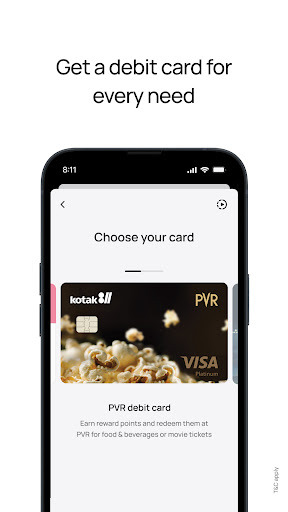

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

Sec Alivia Regulación Para 12 Criptomonedas En Binance

Understanding SEC's New Regulations on Cryptocurrencies in Binance

The world of cryptocurrency has always been a wild ride, full of highs and lows. With the recent news about the U.S. SEC's decision to regulate twelve specific cryptocurrencies on Binance, it’s essential for both seasoned investors and newcomers to grasp what this means for them.

What's the Big Deal?

The United States Securities and Exchange Commission (SEC) has taken recognition of the rapid growth and popularity of cryptocurrencies. With that, they’ve set their eye on a dozen cryptocurrencies available for trading on Binance, a major cryptocurrency exchange. This decision is aimed at overseeing the market, protecting investors, and maintaining fair trading practices.

Impacted Cryptocurrencies

According to the announcement, here is a list of cryptocurrencies that are most affected:

Ethereum Classic (ETC)

Neo (NEO)

Cardano (ADA)

Tron (TRX)

Dash (DASH)

Monero (XMR)

Bitcoin Cash (BCH)

Litecoin (LTC)

Algorand (ALGO)

Stellar (XLM)

Quant (QNT)

VeChain (VET)

These coins have been noted for potential risks and regulatory issues, creating a stir among traders who either hold or are considering investing in them.

Why Regulation Matters

Regulation is a double-edged sword. On one side, it can enhance investor confidence by ensuring that trading platforms comply with certain rules. This can lead to more people entering the market, which could normalize cryptocurrency as a legitimate form of investment. On the other hand, stringent regulations may deter smaller investors who fear hefty compliance costs, or who find the landscape too complicated to navigate.

Binance's Position

Binance has long been in a grey area regarding compliance and regulations. The exchange has made efforts to adapt, such as enforcing KYC (Know Your Customer) policies and striving for greater transparency. The recent SEC regulations may enforce Binance to revise its offerings, potentially delisting certain cryptocurrencies or increasing its compliance investments.

How Should Investors React?

For investors, it’s vital to stay informed. Here are some steps you might consider:

Educate yourself about the specific cryptocurrencies you hold.

Monitor news regarding SEC regulations closely.

Consult with a financial advisor, particularly if you’re projected to invest in any of the affected cryptocurrencies.

Diversify your portfolio to mitigate potential risks.

In Conclusion

The SEC's regulation of these twelve cryptocurrencies marks a significant milestone in the world of digital assets. While change is daunting, understanding regulations and trends can empower investors to make informed decisions. Whether this leads to a more robust crypto market or creates further complications remains to be seen, but one thing's for sure: the evolution of cryptocurrencies is ongoing.

Stay tuned to our blog for more insights into the ever-changing landscape of finance and investment technology!

Sec Alivia Regulación Para 12 Criptomonedas En Binance

0 notes

Text

"Beyond Passwords: The Evolution of Digital Identity Solutions"

Introduction

The Digital Identity Solutions Market is on the rise, driven by the increasing need for secure and efficient identity management systems. As our world becomes more digital, businesses, governments, and individuals face growing concerns about security, privacy, and identity theft.

Read More - https://market.us/report/digital-identity-solutions-market/

Digital identity solutions offer a way to verify and protect personal information online, which is crucial in today's environment where cyber threats are more sophisticated than ever. This growth is fueled by factors such as the widespread adoption of smartphones and the internet, rising cybercrime, and stringent regulations mandating secure identity verification.

However, challenges remain, including high implementation costs, complex integration with existing systems, and concerns about data privacy. For new entrants, the market presents opportunities in offering cost-effective solutions, focusing on emerging markets, and developing technologies that enhance user convenience and security.

Emerging Trends

Biometric Authentication: Increasing use of biometric methods like fingerprint, facial recognition, and iris scanning, providing higher security levels and reducing fraud.

Decentralized Identity Systems: Moving away from centralized identity systems to decentralized models, where individuals have more control over their personal data.

AI and Machine Learning: Leveraging AI and ML to detect and prevent identity fraud in real-time, making systems more adaptive and intelligent.

Blockchain for Identity Verification: Utilizing blockchain technology for secure, transparent, and tamper-proof identity verification processes.

Mobile-First Identity Solutions: The growing focus on mobile-friendly identity solutions, ensuring that users can easily verify their identities on smartphones.

Top Use Cases

Financial Services: Banks and financial institutions use digital identity solutions to comply with KYC (Know Your Customer) regulations and prevent fraud.

Government Services: Governments are adopting digital identity systems to offer citizens seamless access to public services like voting, tax filing, and social benefits.

Healthcare: Ensuring the accurate identification of patients, securing medical records, and enabling telemedicine services.

E-commerce: Online retailers use digital identity solutions to secure transactions, reduce fraud, and offer personalized shopping experiences.

Travel and Hospitality: Digital identities streamline airport security checks, hotel check-ins, and other travel-related processes, enhancing customer experiences.

Major Challenges

Privacy Concerns: Users are increasingly concerned about how their personal information is collected, stored, and used by digital identity systems.

High Implementation Costs: Deploying digital identity solutions can be expensive, especially for small and medium-sized businesses.

Data Breaches: The risk of data breaches is a significant challenge, as any compromise in a digital identity system can lead to widespread fraud.

Regulatory Compliance: Navigating the complex landscape of global regulations related to digital identity can be daunting for businesses.

User Adoption: Convincing users to adopt and trust digital identity solutions, especially in regions with low digital literacy, remains a hurdle.

Market Opportunity

Expanding into Emerging Markets: There is a significant opportunity to introduce digital identity solutions in emerging markets where digital infrastructure is still developing.

Affordable Solutions for SMEs: Developing cost-effective digital identity solutions tailored for small and medium-sized enterprises (SMEs).

Innovation in Biometric Technology: Continued innovation in biometric technology can offer more secure and user-friendly solutions.

Integration with IoT Devices: Opportunities lie in integrating digital identity solutions with IoT devices for seamless and secure identity verification.

Partnerships and Collaborations: Companies can explore partnerships with government agencies and other organizations to expand their reach and enhance their offerings.

Conclusion

The Digital Identity Solutions Market is growing rapidly, driven by the increasing demand for secure and efficient identity management. While challenges like high costs and privacy concerns persist, the market offers numerous opportunities for innovation and growth.

For new entrants, focusing on affordable, user-friendly solutions and exploring emerging markets could provide a competitive edge. As technology evolves, so too will the ways in which we verify and protect our identities, making digital identity solutions an essential part of our increasingly digital world.

0 notes

Text

How is automation AI transforming the financial services industry?

Automation and AI are revolutionizing the financial services industry in several impactful ways. Here’s a closer look at how these technologies are transforming the sector:

1. Enhanced Customer Service:

Chatbots & Virtual Assistants: AI-driven chatbots offer round-the-clock customer service, promptly and effectively managing standard questions and transactions. As a result, wait times are shorter and customer satisfaction is higher.

Personalized Recommendations: AI uses consumer data analysis to provide tailored investment advice, financial guidance, and product recommendations. This allows services to be catered to the needs and tastes of each individual user.

2. Improved Risk Management:

Fraud Detection: Artificial intelligence (AI) systems are able to identify potentially fraudulent actions faster and more precisely than traditional approaches by recognizing anomalous patterns and behaviors in real-time.

Credit Scoring: By adding new data sources and advanced analytics, artificial intelligence (AI) improves credit scoring models and offers a more thorough and equitable evaluation of creditworthiness.

3. Operational Efficiency:

Robotic Process Automation (RPA): RPA automates repetitive, rule-based tasks such as data entry, account reconciliation, and compliance reporting. This minimizes human mistakes and lowers operating costs.

Document Processing: Artificial intelligence (AI)-driven optical character recognition (OCR) technology expedites procedures like loan approvals and account opening by automating the extraction and processing of information from documents.

4. Investment Management:

Algorithmic trading: AI systems analyze enormous volumes of data to make well-informed decisions, executing deals at the best speeds and prices. This results in trading techniques that are more successful and efficient.

Robo-Advisors: These automated systems offer low-cost portfolio management and investment advice, opening up financial planning to a wider audience.

5. Compliance and Regulatory Adherence:

RegTech Solutions: By automating monitoring, reporting, and audit procedures, artificial intelligence (AI) assists financial firms in adhering to complicated rules. This lowers the cost of compliance while guaranteeing conformity to legal standards.

AML and KYC Procedures: By swiftly confirming identities and highlighting questionable activity, artificial intelligence (AI) improves anti-money laundering (AML) and know-your-customer (KYC) protocols, thereby enhancing security and compliance.

6. Data-Based Perspectives:

Predictive analytics: AI uses past data to estimate consumer behavior, market trends, and economic conditions. This helps businesses make more informed strategic decisions.

Sentiment Analysis: AI tools scan news, social media, and other sources to gauge public sentiment about financial markets, influencing investment strategies and risk assessments.

7. Enhanced Protection:

Cybersecurity: Sensitive financial data and infrastructure are shielded from attacks by AI-powered systems that recognize and react to cybersecurity threats instantly.

Biometric Authentication: Artificial Intelligence augments security by means of biometric techniques such as fingerprint scanning and facial recognition, guaranteeing safe and easy access to financial services.

Overall, automation and AI are driving significant advancements in the financial services industry, enhancing efficiency, security, and customer experiences while enabling more informed decision-making. In addition to streamlining current procedures, these technologies are opening the door for cutting-edge services and business concepts that will influence the financial industry going forward.

#AIinFinance#FinancialServicesAI#AutomationInFinance#FintechInnovation#AITransformation#FinanceTech#AutomatedFinance#SmartBanking

0 notes

Text

Mastering Solana: The Ultimate Guide to Going from 1 to Millionaire

Introduction

Solana is a high-performance blockchain platform known for its ability to process over 65,000 transactions per second. This capability positions it as a strong alternative to Ethereum, often referred to as an “Ethereum killer.”

Key Highlights:

Significance in the Crypto Space: Solana’s innovative architecture combines Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus mechanisms, ensuring scalability and low transaction fees.

Investment Potential: For beginners, investing in Solana presents a unique opportunity for substantial returns. The growing adoption and robust ecosystem enhance its appeal.

Understanding the potential rewards is crucial. Equally important is recognizing the inherent risks associated with cryptocurrency investments. Approach with caution and informed decision-making to navigate this exciting yet volatile market.

Understanding the Solana Blockchain

Solana stands out as a high-performance blockchain due to its unique architecture and consensus mechanisms. At the heart of its innovation is Proof-of-History (PoH), which allows for efficient transaction verification by creating a historical record that proves an event occurred at a specific time. This technology enhances scalability, enabling Solana to process over 65,000 transactions per second (TPS) with minimal fees.

When comparing Solana to Ethereum and other blockchains, several advantages become evident:

Transaction Speed: Solana’s ability to handle thousands of TPS far exceeds Ethereum’s current capabilities.

Lower Fees: Transaction costs on Solana are significantly lower, making it more accessible for users and developers alike.

These features position Solana as an attractive option for both new investors and seasoned professionals seeking opportunities in the evolving crypto landscape.

The SOL Token: Key Insights for Investors

The SOL token is the native cryptocurrency of the Solana network and plays a crucial role in its ecosystem. Here are the main uses of SOL:

1. Transaction Fees

Users pay fees in SOL for executing transactions and smart contracts on the Solana network.

2. Staking

By staking SOL, you contribute to network security while earning passive income through staking rewards.

The potential for price appreciation is significant. As adoption of Solana grows, demand for SOL may increase, driven by its limited supply of approximately 489 million tokens. This scarcity can enhance its value over time, making it an attractive option for investors.

Staking SOL not only strengthens the network but also allows you to earn rewards, a compelling feature that adds another layer of incentive for holding the token. Engaging with the SOL token opens opportunities for both participation in governance and financial growth within the Solana ecosystem.

Investing in Solana: A Step-by-Step Guide

Investing in Solana involves a straightforward process, starting with selecting a reputable cryptocurrency exchange. Popular options include:

Coinbase

Binance

These platforms provide user-friendly interfaces and robust security measures. However, it’s crucial to be aware of potential risks and the existence of crypto scams, which can occur if one is not careful.

Setting Up Your Account

Create an Account: Visit the chosen exchange and sign up with your email address and a secure password.

Identity Verification: Complete the KYC (Know Your Customer) process by providing personal information and uploading identification documents.

Funding Your Account: Link your bank account or credit card to deposit funds. Some exchanges allow funding through other cryptocurrencies as well.

Buying SOL Tokens

After funding your account, you can proceed to buy SOL:

Navigate to the trading section of the platform.

Select SOL from the list of available cryptocurrencies.

Enter the amount you wish to purchase.

Review and confirm your order.

Understanding this process is essential for successfully acquiring SOL tokens and entering the vibrant Solana ecosystem.

Ensuring the Security of Your SOL Tokens

Securing your investment in SOL tokens is crucial to protect against potential hacks or thefts. Cybersecurity threats are prevalent in the crypto space, making it essential to choose the right wallets for storing your assets.

Types of Wallets

1. Hardware Wallets

Physical devices that store your private keys offline.

Highly secure and less vulnerable to online attacks.

Recommended options:

Ledger Nano S/X: Popular choices known for their solid security features.

Trezor Model T: Offers a user-friendly interface with robust protection.

2. Software Wallets

Applications that can be installed on computers or mobile devices.

More convenient but exposed to potential online threats.

Recommended options:

Phantom Wallet: A widely used wallet for Solana with an intuitive design.

Sollet Wallet: A browser-based wallet that provides flexibility and ease of use.

Choosing the right wallet is vital for safeguarding your SOL tokens while participating in the evolving cryptocurrency landscape. For a more comprehensive understanding on how to choose the right crypto wallet, or exploring some of the best crypto wallets in 2024, you may find these resources helpful. If you’re considering choosing the right Bitcoin wallet for your business, there’s valuable information available as well.

Exploring Solana Memecoins: Risks and Rewards

Memecoins are a unique segment of the cryptocurrency market, often created as a joke or inspired by internet meme culture. They typically gain traction through community engagement and social media buzz rather than technical superiority or utility. Their significance lies in their ability to attract a dedicated following, leading to notable price fluctuations and investment opportunities.

Popular Solana Memecoins

Samoyedcoin (SAMO): A playful nod to the beloved Samoyed dog breed, SAMO has gained popularity within the Solana ecosystem. Its community-driven approach and fun branding have attracted many investors. Recent price performance shows considerable growth, making it a notable player in the memecoin space.

Doge Capital (DogeCap): This memecoin draws inspiration from the iconic Doge meme. With an emphasis on community involvement and engagement, DogeCap has also seen significant interest from investors. Its price movements reflect the volatility typical of memecoins, offering both risks and rewards for potential investors.

Investing in Solana memecoins can be enticing due to their potential for quick gains; however, it is crucial to understand the inherent risks associated with such speculative assets.

Utilizing the Solana Token Generator: A Beginner’s Guide to Creating Custom Tokens on Solana Blockchain

Creating custom tokens on the Solana blockchain is a straightforward process, especially with tools like Metaplex. This token generator simplifies token creation by allowing users to define key parameters such as:

Token Name: The unique name for your token.

Symbol: A short code to represent your token in transactions.

Supply: The total number of tokens you wish to create.

Once these details are set, Metaplex handles the underlying complexities of smart contracts and deployment.

Custom tokens have diverse applications across various industries, such as:

Gaming: In-game currencies or assets that enhance user experience.

Art: Non-fungible tokens (NFTs) representing ownership of digital artwork.

This versatility makes token generation on the Solana blockchain an attractive option for developers and entrepreneurs looking to explore innovative solutions within their markets. To gain a deeper understanding of how to leverage such opportunities, consider exploring this comprehensive guide on building on the Solana platform.

Launching Projects on Solana: Opportunities for Developers

Launching projects on the Solana blockchain offers developers a unique opportunity to create high-performance decentralized applications (dApps). Utilizing tools provided by platforms like Serum DEX and Raydium AMM, developers can build robust solutions tailored to various industries.

Key Benefits of Using Solana for Development:

High Transaction Speed: Solana can process over 65,000 transactions per second (TPS), enabling seamless user experiences for dApps.

Low Transaction Fees: Affordable fees encourage frequent transactions, making it ideal for applications that require microtransactions or high volumes of activity.

Scalability: The architecture allows projects to scale without compromising performance, accommodating growth and increased user demand.

Developers can leverage the Solana launcher platform to simplify project deployment. This platform streamlines the creation and management of dApps, reducing technical barriers and speeding up time-to-market. The vibrant Solana ecosystem also fosters collaboration. Engaging with other developers through community forums and resources enhances innovation and knowledge sharing.

By choosing Solana, developers position themselves at the forefront of blockchain technology, ready to capitalize on emerging trends in the crypto space.

Understanding Risks When Investing in Cryptocurrencies Like Solana

Investing in cryptocurrencies like Solana comes with risks that every investor should know about. Here are the main concerns:

Key Concerns

Market Volatility: Prices can change dramatically in a short time, leading to potential losses.

Regulatory Uncertainties: Changes in government regulations can affect the legality and usability of cryptocurrencies.

Strategies to Mitigate Risks

To reduce these risks, consider the following strategies:

Diversify Your Portfolio: Spread investments across various assets to reduce reliance on any single investment.

Stay Informed: Regularly follow news related to cryptocurrency markets and regulatory developments.

Set Realistic Goals: Establish clear investment objectives and understand your risk tolerance.

Use Stop-Loss Orders: These can help limit losses by automatically selling assets at predetermined prices.

Understanding these factors will help you make better decisions in this exciting yet unpredictable market.

Mastering Your Journey as an Investor in The World’s Fastest Blockchain Platform

Continuous learning is crucial in the ever-evolving cryptocurrency landscape. As you navigate your investment journey, consider the following strategies to enhance your knowledge and skills:

Follow reputable news sources: Websites like CoinDesk, CoinTelegraph, and The Block provide timely updates and analyses.

Join online communities: Engage with forums and social media groups on platforms like Reddit or Twitter to share insights and trends.

Participate in webinars and courses: Educational platforms like Coursera or Udemy offer courses on blockchain technology and investment strategies.

The potential for growth extends beyond Solana. The entire cryptocurrency ecosystem shows promise, driven by innovation and increased adoption. Emerging technologies such as decentralized finance (DeFi) and non-fungible tokens (NFTs) are reshaping the market.

Thanks For Reading blop, At the end we must Suggest for You Begginer Guys, We Strongly Recommeded you about Create your own memecoins tokens on solana in just less than three seconds without any programming knowledge only on This Solan Token Generator Tool, Just Click Here to Go Official Website : Solanalauncher

Investing in cryptocurrencies requires diligence, but with ongoing education, you can make informed decisions. By staying updated on trends, understanding market dynamics, and embracing new opportunities, you position yourself for success in this dynamic space. Embrace the journey ahead; it holds immense possibilities for you as an investor.

0 notes

Text

Collaboration Between FinTech and RBIs: A New Era of Lending

The Collaboration

In recent years, India's financial outlook has witnessed a radical shift. The finance industry is driven by the collaborative partnership between financial technology (FinTech) companies and the Reserve Bank of India (RBI), which has modified the entire lending sector. As FinTech firms bring innovation, depth, and tech-driven solutions to the table, the RBI matches these advances with powerful regulatory frameworks, ensuring a symmetrical ecosystem that promotes both development and stability in the finTech Industry.

Earlier, many of India's population, particularly in rural and semi-urban areas, remained underserved by traditional financial institutions. The advent of FinTech, supported by the RBI's inclusive policies, has bridged this gap, promoting financial introduction at an exceptional scale.

The Need of the Alliance

The idea of this partnership crops up to address and simplify the complexity of traditional banking systems. With traditional banking systems' extensive paperwork, slow processing times, and inflexible credit requirements, they often fail to meet the changing needs of consumers. In contrast, FinTech companies, portrayed by providing tech-driven solutions, have disturbed this status quo by offering faster, more accessible financial services. This is where the RBI plays its role. RBI implements forward-thinking regulations and guidelines that encourage and regulate FinTech operations, ensuring they remain secure for the end consumer.

The Role of RBI

RBI regulations encouraging digital transactions and a secure trading environment have created fertile ground for FinTech growth. This surreal act is evident through initiatives like the Unified Payments Interface (UPI), the promotion of digital currencies, and the establishment of norms for digital banking. These strategies nurture innovation and plant trust among end-consumers.

The Role of Fintech Industries

FinTech firms, with their innovative approaches and tech-driven solutions, are breaking down the traditional barriers. By leveraging Data Analytics(DA), Artificial Intelligence(AI), and Machine Learning(ML), they can assess credit risk more accurately than traditional banks.

The Impact

The collaboration between RBI and FinTech companies has led to the creation of more user-friendly lending solutions. Consumers can now enjoy seamless online interfaces, minimal paperwork, and faster loan approval processes. For instance, digital KYC (Know Your Customer) and e-signatures, supported by RBI regulations, have significantly reduced the time it takes to onboard new customers.

Micro-lending

Traditional banks have often overlooked small loans due to their high operational costs. However, FinTechs, with their low digital costs, are uniquely positioned by RBI to offer these services profitably. This collaboration boosts micro-lending. FinTech firms, through mobile platforms, extend small credit to underserved sectors of the economy. Farmers, small entrepreneurs, and individuals in remote areas can now enjoy banking facilities and receive micro-loans quickly on their mobile devices.

Risk Management and Fraud Prevention

Combining FinTech with RBI has supported lending risk management and fraud prevention. FinTech's advanced algorithms enable quick monitoring and assessment of loan transactions, which helps in the early detection of fraud.

Financial Accessibility

Digital platforms now enable instant loan approvals and disbursements powered by algorithms that assess the creditworthiness of the individual using digital footprints and transaction history. This capability was essential in India, where many potential borrowers need a formal credit history. The RBI made it easy by encouraging digital verification methods, thus speeding up the loan process.

They Have Bridged The Digital Gap

The partnership between FinTech companies and the RBI is undoubtedly transforming the lending landscape in India. As we move forward, this collaboration is expected to deepen, driven by a goal of making financial services more accessible to all. It's about creating a more financially inclusive India where everyone can access and benefit from formal financial services.

Conclusion

In this context, it's important to spotlight companies like Lenditt, a FinTech company providing platforms to individuals to access digital loans across various demographics. Specializing in personal loans, including personal loans, mobile loans, bike loans, emergency loans, medical loans, travel loans, and consumer durable loans, Lenditt leverages a simplified borrowing process.

As we look to the future, companies like Lenditt will play an increasingly significant role in bridging the digital divide. With continuous support from regulatory bodies like the RBI, FinTech companies are well-positioned to drive a new financial era.

Source Link: Collaboration Between FinTech and RBI

0 notes

Text

What Are the Challenges in Implementing Stablecoin Development Solutions?

Stablecoins have emerged as a critical component of the cryptocurrency ecosystem, offering a stable value compared to the volatility of traditional cryptocurrencies like Bitcoin and Ethereum. These digital assets are pegged to stable assets like fiat currencies, commodities, or other cryptocurrencies, providing users with a reliable medium of exchange and store of value. However, despite their potential benefits, stablecoin development and implementation are not without challenges. In this blog post, we'll explore some of the key challenges faced in implementing stablecoin development solutions.

Regulatory Compliance: One of the primary challenges in implementing stablecoin development solutions is regulatory compliance. Due to the potential for stablecoins to be used in money laundering, terrorism financing, or other illicit activities, regulators around the world have taken a keen interest in stablecoin projects. Developers must navigate a complex regulatory landscape, ensuring that their stablecoins comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, securities laws, and other relevant regulations.

Scalability: Another challenge in stablecoin development is scalability. As the popularity of stablecoins grows, developers must ensure that their stablecoin solutions can handle increasing transaction volumes without compromising on speed or security. Scalability issues can lead to network congestion, slow transaction times, and increased fees, which can undermine the utility of stablecoins as a means of payment.

Volatility of Collateral: The stability of stablecoins is contingent on the collateral backing them. If the value of the collateral used to back stablecoins fluctuates significantly, it can undermine the stability of the stablecoin itself. Developers must carefully manage the collateral reserves to ensure that they are sufficient to maintain the stablecoin's peg to the underlying asset.

Centralization vs. Decentralization: There is an ongoing debate in the cryptocurrency community about the degree of centralization in stablecoin development. While some argue that a degree of centralization is necessary to ensure stability and regulatory compliance, others advocate for a more decentralized approach to avoid single points of failure and enhance security.

Interoperability: Interoperability is another challenge in stablecoin development. As the number of stablecoins and blockchain platforms increases, developers must ensure that their stablecoin solutions can seamlessly interact with other stablecoins and blockchain networks. This requires the development of interoperable standards and protocols, which can be complex and time-consuming.

Security: Security is a paramount concern in stablecoin development, as any vulnerabilities in the stablecoin's smart contract or underlying blockchain network can lead to the loss of user funds. Developers must employ rigorous security practices, such as code audits, penetration testing, and bug bounties, to mitigate the risk of security breaches.

Market Adoption: Finally, market adoption is a key challenge in stablecoin development. While stablecoins offer many benefits, including fast and low-cost transactions, widespread adoption will depend on factors such as ease of use, liquidity, and trustworthiness. Developers must work to overcome these barriers to adoption to realize the full potential of stablecoins.

Conclusion

While stablecoins offer many benefits, including stability and fast, low-cost transactions, they also face several challenges in development and implementation. By addressing these challenges, developers can help to ensure that stablecoins continue to play a crucial role in the cryptocurrency ecosystem.

#stablecoin development#stablecoin development solutions#stablecoin development services#stablecoin development Solutions#stablecoin development company

0 notes

Text

Sailing: A Guide to Offshore Company Setup

Embarking on the journey of offshore company setup can be both exciting and daunting. While the allure of international business opportunities and tax benefits beckons, navigating the intricate waters of offshore incorporation requires careful planning and adherence to legal requirements. In this guide, we'll navigate the process of offshore company setup, charting a course towards success in the realm of global entrepreneurship.

Choosing the Right Jurisdiction: The first step in offshore company setup is selecting the right jurisdiction for your business. Offshore jurisdictions vary in terms of tax regulations, political stability, and privacy laws. Popular offshore destinations such as the British Virgin Islands, Seychelles, and Cayman Islands offer favorable tax regimes and business-friendly environments. Conducting thorough research and seeking expert advice can help you identify the jurisdiction that aligns with your business goals and preferences.

Understanding Legal Requirements: Once you've chosen a jurisdiction, it's essential to understand the legal requirements for incorporating an offshore company. These may include drafting and filing articles of incorporation, appointing directors and shareholders, and obtaining relevant licenses or permits. Additionally, offshore companies are subject to anti-money laundering (AML) and know-your-customer (KYC) regulations, necessitating due diligence in verifying the identity of beneficial owners and stakeholders. Seeking guidance from legal professionals or offshore company formation specialists can ensure compliance with local laws and regulations.

Navigating Tax Implications: One of the primary motivations for setting up an offshore company is tax optimization. Offshore jurisdictions often offer favorable tax regimes, including low or zero corporate tax rates, tax exemptions for certain types of income, and access to double taxation treaties. However, it's crucial to understand the tax implications in both the offshore jurisdiction and your home country to ensure compliance with international tax laws and regulations. Consulting with tax advisors or consultants can help you develop a tax-efficient structure tailored to your specific circumstances.

Maintaining Compliance: Once your offshore company is established, it's essential to maintain compliance with ongoing regulatory and reporting requirements. This may include filing annual returns, maintaining accurate accounting records, and adhering to corporate governance standards. Failure to comply with these obligations can result in penalties, fines, or even the dissolution of your offshore company. Implementing robust compliance and risk management practices is essential to safeguarding the integrity and reputation of your offshore business.

Managing Risks and Challenges: Offshore company setup comes with its share of risks and challenges, including regulatory scrutiny, reputational risk, and political instability. Conducting thorough due diligence and risk assessments before proceeding with offshore incorporation can help mitigate these risks effectively. Additionally, implementing robust compliance and risk management practices can enhance transparency and accountability, instilling confidence in stakeholders and regulatory authorities alike.

In conclusion, offshore company setup offers an array of opportunities for businesses seeking to expand their horizons and optimize their operations. By understanding the process of offshore incorporation and navigating the complexities of international business, entrepreneurs can set sail towards new horizons of success and prosperity.

0 notes

Text

Offshore Company Formation Cheap

Offshore company formation has become an attractive option for businesses seeking cost-effective solutions and strategic advantages. This guide explores the process, benefits, and key considerations of forming an Offshore Company Formation Cheap.

Benefits

Cost Savings

Offshore company formation offers significant cost savings compared to establishing a company in high-tax jurisdictions. Reduced registration fees, lower operational expenses, and tax incentives contribute to substantial cost efficiencies.

Tax Advantages

One of the primary benefits of offshore company formation is the favorable tax environment. Many offshore jurisdictions offer tax exemptions or minimal taxation on foreign income, leading to enhanced profitability for businesses.

Asset Protection

Offshore companies provide robust asset protection mechanisms, shielding assets from legal liabilities and potential risks. This safeguarding of assets is crucial for businesses operating in volatile or litigious environments.

Process

The process of offshore company formation involves several key steps:

Choose Jurisdiction: Select a suitable offshore jurisdiction based on your business needs and regulatory requirements.

Name Reservation: Reserve a unique name for your company, ensuring compliance with local naming conventions.

Submit Documentation: Prepare and submit necessary documents, including articles of incorporation and director/shareholder details.

Pay Fees: Fulfill registration fees and other financial requirements as per the chosen jurisdiction's regulations.

Obtain Approval: Await approval from regulatory authorities, following which your offshore company is officially registered.

Jurisdiction Options

Popular offshore jurisdictions for cost-effective company formation include:

Seychelles

Belize

Mauritius

Panama

Cyprus

Legal Requirements

Compliance with legal requirements is essential for offshore company formation, including:

Anti-money laundering (AML) regulations

Know Your Customer (KYC) procedures

Annual reporting and tax filings

Cost Breakdown

A detailed breakdown of costs for offshore company formation typically includes:

Incorporation fees

Registered agent services

Annual renewal fees

Compliance and legal expenses

Tax Implications

Offshore companies often benefit from:

Zero or low corporate taxes

Tax exemptions on foreign income

VAT advantages in certain jurisdictions

Asset Protection

Offshore companies offer comprehensive asset protection through:

Separation of personal and business assets

Limited liability protection for shareholders/directors

Confidentiality and privacy provisions

Compliance and Regulation

Maintaining compliance with local and international regulations is crucial for offshore companies. Key areas of focus include:

Reporting requirements

Corporate governance standards

Regulatory updates and changes

Common Mistakes

Avoid these common pitfalls during offshore company formation:

Neglecting due diligence on jurisdictional requirements

Non-compliance with tax regulations

Lack of clarity on legal obligations and reporting timelines

Success Stories

Case studies of successful offshore company setups demonstrate:

Strategic tax planning leading to cost savings

Enhanced asset protection and wealth management

Global expansion opportunities and market diversification

Comparison

Comparing different offshore jurisdiction options based on:

Cost-effectiveness

Tax benefits

Regulatory environment

Reputation and stability

Conclusion

Offshore Company Formation Cheap offers a cost-effective and strategic solution for businesses seeking tax advantages, asset protection, and international expansion opportunities. By understanding the process, benefits, and compliance requirements, businesses can leverage offshore structures to optimize their financial and operational strategies.

#OffshoreCompanyFormation#CostEffectiveSolutions#TaxAdvantages#AssetProtection#GlobalExpansion#BusinessStrategies#FinancialOptimization#OffshoreJurisdictions#LegalCompliance#SuccessStories#TaxPlanning#WealthManagement#InternationalBusiness#CorporateGovernance#MarketDiversification

0 notes

Text

Navigating the Crypto Landscape: The Best Websites to Buy Cryptocurrency

Introduction: As interest in cryptocurrency continues to soar, choosing the right platform to buy and trade digital assets has become increasingly important. In this comprehensive guide, we'll explore the top websites for buying cryptocurrency, examining factors such as security, fees, user experience, and available features to help you make informed decisions and navigate the crypto landscape with confidence.

Understanding Cryptocurrency Exchanges: a. Overview of cryptocurrency exchanges and their role in facilitating the buying, selling, and trading of digital assets. b. Types of exchanges: Comparison of centralized exchanges (CEXs) and decentralized exchanges (DEXs) and their respective advantages and disadvantages. c. Factors to consider: Introduction to key factors to consider when choosing a cryptocurrency exchange, including security, liquidity, fees, and supported assets.

Top Cryptocurrency Exchanges: a. Binance: Review of Binance, one of the largest and most popular cryptocurrency exchanges globally, known for its wide range of supported assets, low fees, and robust security features. b. Coinbase: Analysis of Coinbase, a user-friendly platform favored by beginners, offering a simple interface, regulatory compliance, and a diverse selection of cryptocurrencies. c. Kraken: Examination of Kraken, a reputable exchange known for its advanced trading features, high liquidity, and strong security measures. d. Gemini: Overview of Gemini, a regulated exchange offering a secure and compliant platform for buying, selling, and storing cryptocurrencies, backed by the Winklevoss twins.

Factors to Consider When Choosing a Cryptocurrency Exchange: a. Security: Importance of choosing exchanges with robust security measures, such as cold storage, two-factor authentication (2FA), and insurance coverage. b. Fees: Comparison of trading fees, withdrawal fees, and deposit fees across different exchanges, as well as the impact of fee structures on trading costs. c. User Experience: Evaluation of user interfaces, mobile apps, and customer support options to assess ease of use and accessibility. d. Regulatory Compliance: Consideration of regulatory compliance measures, including Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, to ensure legal compliance and protect against fraud.

Additional Considerations: a. Payment Methods: Analysis of supported payment methods, such as bank transfers, credit/debit cards, and cryptocurrency deposits, and their availability in different regions. b. Customer Support: Importance of responsive customer support channels, including live chat, email, and phone support, for resolving issues and addressing inquiries promptly. c. Reputation and Trustworthiness: Researching the reputation and track record of exchanges, including user reviews, security incidents, and regulatory compliance history. d. Advanced Features: Exploration of advanced trading features, such as margin trading, futures trading, and cryptocurrency derivatives, for experienced traders seeking sophisticated tools and strategies.

Diversification and Portfolio Management: a. Importance of diversifying cryptocurrency holdings across multiple exchanges and assets to mitigate risk and optimize portfolio performance. b. Portfolio tracking: Overview of portfolio tracking tools and services to monitor asset allocation, performance, and market trends. c. Risk Management: Implementation of risk management strategies, including position sizing, stop-loss orders, and portfolio rebalancing, to protect against losses and maximize returns.

Conclusion: a. Recap of the best websites to buy cryptocurrency, including Binance, Coinbase, Kraken, and Gemini, based on factors such as security, fees, user experience, and available features. b. Encouragement for investors to conduct thorough research, consider their individual needs and preferences, and choose exchanges that align with their trading goals and risk tolerance. c. Outlook for the future: Optimism for continued innovation and growth in the cryptocurrency industry, driven by increasing adoption, regulatory clarity, and technological advancements.

In conclusion, selecting the best website to buy cryptocurrency is a crucial decision that can significantly impact your investment experience and outcomes. By carefully evaluating factors such as security, fees, user experience, and available features, investors can choose exchanges that meet their needs and help them navigate the complex and evolving crypto landscape with confidence.

0 notes

Text

How to Choose the Right Crypto Exchange for Your Needs

Cryptocurrencies have emerged as a significant player in the world of finance. For business people looking to venture into this realm, choosing the right crypto exchange is crucial. With a plethora of options available, each offering various features and services, selecting the ideal platform can be daunting. However, by considering key factors tailored to your business needs, you can navigate through the maze of choices and find the perfect match.

Security: As a business person, safeguarding your assets is paramount. Look for exchanges that prioritize security measures such as two-factor authentication, cold storage for funds, and encryption protocols. Additionally, investigate the exchange's track record regarding past security breaches and how they handled them. Opt for platforms with a solid reputation for security to mitigate the risk of hacks and theft.

Regulatory Compliance: Compliance with regulatory standards is vital to ensure legality and transparency in your crypto transactions. Choose exchanges that adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Regulatory compliance not only protects your business from legal ramifications but also fosters trust and credibility among your clientele.

Liquidity: Liquidity is crucial for executing trades swiftly and at optimal prices. Evaluate the trading volume and liquidity of the exchange, as higher liquidity means tighter spreads and better trade execution. A liquid market also provides flexibility for large transactions, essential for businesses with significant capital investments.

Supported Cryptocurrencies: Different businesses may have diverse needs when it comes to cryptocurrencies. Ensure that the exchange supports a wide range of digital assets relevant to your business operations. Whether you're dealing with Bitcoin, Ethereum, or niche altcoins, having access to a variety of cryptocurrencies allows for greater flexibility in your investment strategies.

Fees and Charges: Examine the fee structure of the exchange, including trading fees, withdrawal fees, and deposit fees. While low fees are attractive, be wary of platforms offering excessively low rates, as they may compensate through hidden charges or compromised services. Strike a balance between cost-effectiveness and quality of service to maximize your returns.

User Experience and Interface: A user-friendly interface and intuitive trading platform can significantly enhance your crypto trading experience. Look for exchanges with sleek interfaces, robust trading tools, and responsive customer support. Smooth navigation and efficient order execution streamline your operations, saving time and effort for your business endeavors.

Customer Support: Prompt and reliable customer support is indispensable, especially in the dynamic world of cryptocurrencies. Prioritize exchanges with dedicated support channels, including live chat, email, and phone assistance. A responsive support team can address your concerns swiftly, troubleshoot any issues, and provide valuable guidance when needed.

Reputation and Reviews: Conduct thorough research on the reputation and reviews of potential exchanges within the crypto community. Seek feedback from other business professionals and reputable sources to gauge the reliability and credibility of the platform. Steer clear of exchanges with a history of malpractices or unresolved customer complaints.

Conclusion Selecting the right crypto exchange tailored to your business needs requires careful consideration of various factors, including security, regulatory compliance, liquidity, supported cryptocurrencies, fees, user experience, customer support, and reputation. By prioritizing these aspects and conducting diligent research, you can make an informed decision that aligns with your business objectives and facilitates seamless crypto transactions. Remember, investing time and effort into choosing the right exchange is a worthwhile endeavor that can pave the way for success in the burgeoning world of cryptocurrencies.

0 notes

Text

Top Reasons to invest in Mutual funds in 2024

If you're considering to invest in mutual funds, it can offer a straightforward and flexible way to begin or refine your investment journey. With options like index funds, equity funds, debt funds, and passive choices, there's something for everyone. Whether you're new to investing or seeking a refresher, this guide aims to simplify the process of how to invest in mutual funds and navigate online investment platforms in 2024.

What are Mutual funds?

Mutual funds are investment options managed by Asset Management Companies (AMCs) with predefined goals and risk levels. When you invest in mutual funds, your money is pooled and invested in various securities like stocks, bonds, and commodities. Fund managers oversee the investments to maximize returns while managing risk. Earnings from securities, such as dividends from stocks or interest from bonds, are distributed to investors. Shareholders can choose to withdraw these earnings or reinvest them by buying more units of the fund.

Why Should You Invest in Mutual Funds in 2024

Here are several compelling reasons why investing in mutual funds in 2024 could be advantageous:

Expert Management at a Low Cost

Mutual funds are managed by skilled professionals who work to maximize returns, making them ideal for investors who prefer not to manage investments directly.

Diversification to Reduce Risk

Through options like hybrid or multi-asset funds, mutual funds allow you to spread your investment across different asset classes, lowering overall risk.

Market Monitoring for Smart Decisions

Fund managers continuously track market movements, adjusting asset allocation accordingly to ensure your investment is well-managed.

High Liquidity and Accessibility

Mutual funds offer easy buying and selling options, with no lock-in period or exit load in many cases. You can review scheme details before investing for peace of mind.

How to Invest in Mutual Funds in 2024?

To invest in mutual funds in 2024, here are the available options that you can explore for initiating your investment journey:

Online Investment

Begin by selecting your desired mutual fund scheme and visiting the respective Asset Management Company's (AMC) website. Create an account and follow the provided instructions to input your details. Complete the e-KYC (Know Your Customer) process by submitting your Aadhar and PAN card details. After verification, you'll receive confirmation, allowing you to start investing conveniently from your computer or smartphone.

Stock-Broking Platforms and Apps

Another option is to use stock-broking platforms and apps specifically designed for investing in mutual funds. If you have a Demat account with a platform, simply login to the website or app. From there, you can easily navigate to the desired mutual fund scheme and place your order with just a few clicks.

Offline Methods

For those who prefer traditional methods, visiting the nearest branch of the scheme's AMC, Registrar & Transfer Agents (RTAs), or Investor Service Centres (ISCs) is an option. Simply fill out an application form, provide the necessary documents, and make payment via cheque or bank draft.

Conclusion

In conclusion, investing in mutual funds in 2024 offers a multitude of benefits, including expert management, portfolio diversification, and accessibility. Whether you choose online platforms, a mutual fund app, or traditional offline methods, the process has become more convenient and user-friendly than ever before.

0 notes

Text

How To Start Trading On Some Of The Top Crypto Exchanges

Starting crypto trading on platforms like Binance and Kraken involves a straightforward process. After registering and completing KYC requirements, deposit funds in either crypto or fiat currency. Select a desired crypto trading pair and choose between market or limit orders. Market orders execute instantly, while limit orders execute at set prices. Confirm the order and wait for execution. Binance, known for its vast coin offerings and low fees, caters to global traders but requires U.S. customers to use Binance.US. Kraken, based in San Francisco, facilitates trading with various fiat currencies. Both platforms prioritize security measures like two-factor authentication (2FA). However, due to crypto's volatility and regulatory uncertainty, traders should exercise caution, conduct thorough research, and employ risk management strategies to navigate the market effectively and mitigate potential losses.

0 notes

Text

Dogwifhat Coin : The Future of Memecoins and Why You Should Invest

Introduction

In the world of cryptocurrencies, memecoins have carved out a unique niche, capturing the imagination of investors and enthusiasts alike. One such emerging star is DogWifHat Coin, a memecoin that’s quickly gaining traction for its fun concept and strong community backing. This blog will explore what DogWifHat Coin is, why it’s a good investment, and how you can invest in it from India.

What is DogWifHat Coin?

Why Invest in DogWifHat Coin?

Strong Community Support

DogWifHat Coin has quickly built a vibrant and active community. This strong community support is essential for the success of any memecoin, as it drives awareness, adoption, and engagement. A committed community can significantly influence the coin’s value through collective efforts in promotion and development.

Viral Potential

The meme-based nature of DogWifHat Coin makes it highly shareable and marketable. Memecoins often experience rapid growth due to viral marketing campaigns on social media platforms like Twitter, Reddit, and TikTok. DogWifHat Coin’s humorous and relatable branding gives it the potential to go viral, attracting a broad audience of investors and enthusiasts.

Low Entry Barrier

Investing in DogWifHat Coin is accessible to everyone. You don’t need to invest a large amount to get started. This low entry barrier allows more people to participate, contributing to the coin’s widespread adoption and growth.

Innovative Features

DogWifHat Coin is not just about the meme. The development team is working on integrating innovative features and applications that add real value to the coin. These could include decentralized finance (DeFi) applications, NFTs, or other utility features that enhance the coin’s functionality and attractiveness.

Potential for High Returns

Early adopters of successful memecoins have historically seen significant returns on their investments. DogWifHat Coin, with its strong community and viral potential, offers a promising opportunity for high returns. While all investments carry risks, the potential upside with DogWifHat Coin makes it an attractive option.

How to Invest in DogWifHat Coin from India

Step 1: Choose a Cryptocurrency Exchange

To invest in DogWifHat Coin, you first need to choose a cryptocurrency exchange that supports it. Popular exchanges like Binance, Coinbase, and WazirX often list new and emerging coins. Ensure that the exchange you choose allows you to trade DogWifHat Coin.

Step 2: Create an Account

Sign up for an account on your chosen cryptocurrency exchange. You’ll need to provide some personal information and verify your identity. This process typically involves submitting a government-issued ID and completing KYC (Know Your Customer) procedures.

Step 3: Deposit Funds

Once your account is set up and verified, deposit funds into your account. Most exchanges accept deposits in INR (Indian Rupee) via bank transfer, UPI, or other payment methods. You can also deposit other cryptocurrencies like Bitcoin or Ethereum and trade them for DogWifHat Coin.

Step 4: Buy DogWifHat Coin

With funds in your account, you can now buy DogWifHat Coin. Navigate to the trading section of the exchange, search for DogWifHat Coin (typically listed as $WIF), and place your buy order. You can choose to buy at the current market price or set a limit order if you prefer to buy at a specific price.

Step 5: Secure Your Investment

After purchasing DogWifHat Coin, it’s essential to secure your investment. Transfer your coins to a secure wallet. Hardware wallets like Ledger or Trezor are considered very secure, but software wallets and mobile wallets are also options for shorter-term storage.

Is It Good to Invest in DogWifHat Coin?

Positive Outlook

DogWifHat Coin has several factors in its favor, including strong community support, viral potential, and innovative features. These elements contribute to a positive outlook for the coin’s future. The low entry barrier and potential for high returns make it an attractive investment opportunity for both new and experienced investors.

Risk Management

As with any investment, it’s essential to manage risks. Memecoins can be highly volatile, and their value can fluctuate significantly. It’s wise to invest only what you can afford to lose and to diversify your investment portfolio. Keeping up with news and community updates can also help you make informed decisions.

Growing Market

The market for memecoins and cryptocurrencies continues to grow, with increasing mainstream acceptance and interest. This growth trend bodes well for DogWifHat Coin, as more people are likely to explore and invest in new and exciting digital assets.

You Don’t Have Any Programming or coding knowledge while you want to create Dogwifhat tokens on solana.

Don’t Worry we have solution of your problems, we have amazing platform where you can create your Dogwifhat tokens in just less than three seconds without any coding knowledge.

It’s Mobile friendly platform , Out team is ready to assist you

The Platform is : solanalauncher | Solana Token Creation & Deployment

Conclusion

DogWifHat Coin represents an exciting opportunity in the world of memecoins. With its strong community, viral potential, and innovative features, it stands out as a promising investment. For investors in India, the process of buying and securing DogWifHat Coin is straightforward, making it accessible to a broad audience.

While all investments carry risks, the potential rewards with DogWifHat Coin make it worth considering. By managing your investments wisely and staying informed, you can take advantage of this exciting opportunity and potentially see significant returns.

Start your investment journey with DogWifHat Coin today and join a growing community that’s shaping the future of memecoins!

#solana#defi#dogecoin#bitcoin#token creation#blockchain#investment#crypto#currency#token generator#memecoin#dogwifhat

1 note

·

View note

Text

Explore the Popular Token Standards to Create a Feature-Rich Crypto Token

In the ever-evolving landscape of blockchain technology and cryptocurrency, the creation and utilization of tokens have become integral components of various ecosystems. From Ethereum to Binance Smart Chain, Tron to Solana, and Polygon, each blockchain network has its own set of token standards that govern the creation, issuance, and functionality of tokens. In this guide, we'll delve into some of the most popular token standards across different blockchain platforms.

Ethereum Token Standards:

ERC-20:

ERC-20 is perhaps the most well-known token standard on the Ethereum blockchain. It defines a set of rules that all Ethereum-based tokens must follow to ensure compatibility with the Ethereum ecosystem. ERC-20 tokens are fungible, meaning they can be exchanged on a one-to-one basis.

ERC-721:

Unlike ERC-20, ERC-721 tokens are non-fungible tokens (NFTs). Each ERC-721 token is unique and cannot be replaced by another token. This standard has found extensive use cases in digital collectibles, gaming assets, and real-world asset representation on the blockchain.

ERC-1155:

ERC-1155 is a multi-token standard that supports both fungible and non-fungible tokens within the same contract. This standard is highly efficient in terms of gas costs and has gained popularity in blockchain-based gaming and decentralized finance (DeFi) applications.

ERC-777:

ERC-777 is an extension of the ERC-20 standard with additional features such as sending tokens in a single transaction and the ability to reject incoming token transfers. This standard aims to enhance token functionality and simplify token interactions.

ERC-23:

ERC-23 is an improvement over ERC-20 that aims to address some of its shortcomings, particularly the issue of lost tokens due to incorrect transactions. ERC-23 allows tokens to be transferred without triggering a smart contract execution, thus reducing the risk of lost tokens.

ERC-827:

ERC-827 extends the functionality of ERC-20 tokens by adding support for token approvals with additional data. This allows users to delegate token transfer approvals to third parties, enabling more complex token interactions.

ERC-1400:

ERC-1400 is a security token standard designed to facilitate compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. It provides features for issuing, transferring, and redeeming security tokens while ensuring regulatory compliance.

ERC-998:

ERC-998 introduces the concept of composable tokens, which are tokens that can own other tokens or contracts. This standard enables the creation of complex token structures where tokens can represent ownership in multiple assets or entities.

Binance Smart Chain Token Standards:

BEP-20:

BEP-20 is the token standard for the Binance Smart Chain, similar to ERC-20 on Ethereum. It defines the basic rules for creating fungible tokens on the Binance Smart Chain.

BEP-721:

BEP-721 is the non-fungible token standard on the Binance Smart Chain, equivalent to ERC-721 on Ethereum. It allows for the creation and management of unique digital assets.

BEP-1155:

BEP-1155 is a multi-token standard on the Binance Smart Chain, similar to ERC-1155 on Ethereum. It supports both fungible and non-fungible tokens within the same contract.

BEP-2:

BEP-2 is the native token standard for the Binance Chain, focusing on simplicity and compatibility with the Binance ecosystem.

Tron Token Standards:

TRC-10:

TRC-10 is the native token standard on the Tron blockchain, similar to ERC-20 on Ethereum. It is optimized for high throughput and low transaction fees.

TRC-20:

TRC-20 is a more advanced token standard on the Tron blockchain, supporting additional features compared to TRC-10.

TRC-721:

TRC-721 is the non-fungible token standard on the Tron blockchain, equivalent to ERC-721 on Ethereum.

TRC-1155:

TRC-1155 is a multi-token standard on the Tron blockchain, similar to ERC-1155 on Ethereum.

Solana Token Standards:

SPL:

SPL (Solana Program Library) is a collection of on-chain program libraries and standards, including token standards, on the Solana blockchain.

Polygon Token Standards:

MATIC:

MATIC is the native token of the Polygon network, used for transactions, staking, and participating in the network's governance.

ERC-20, ERC-721, ERC-1155:

In addition to its native token, Polygon supports various Ethereum token standards, including ERC-20, ERC-721, and ERC-1155, facilitating interoperability with the Ethereum ecosystem.

In conclusion, the diversity of token standards across different blockchain platforms reflects the evolving needs and use cases within the crypto space. Whether it's creating fungible tokens for DeFi applications, unique digital assets for gaming, or security tokens for regulated markets, there's a token standard tailored to meet every requirement. As blockchain technology continues to mature, these standards will play a crucial role in shaping the future of digital asset creation and management.

Plurance, a leading Token Development Company, specializes in assisting projects in navigating the complexities of crypto token development and choosing the most suitable token standards for their specific use cases. With expertise across multiple blockchain platforms, Plurance empowers businesses to harness the full potential of tokenization and blockchain technology. And we help you to create and launch your crypto token in 1 day!

#Crypto Token Development#Crypto Token Development Company#Token Development Company#Token Development Services

0 notes