#intraday breakout and retest setup

Explore tagged Tumblr posts

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

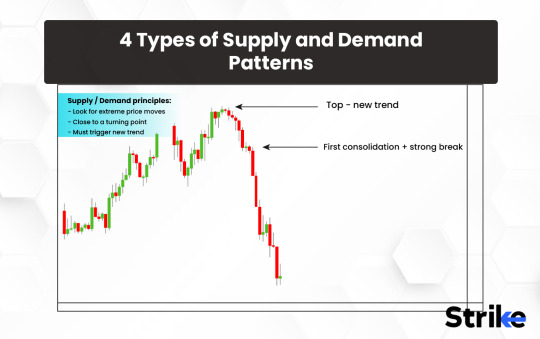

Complete Guide to 4 Types of Supply and Demand Patterns That Actually Move Markets

Supply and demand aren’t just textbook concepts. They are the core of price movement in every market—from Nifty 50 to global commodities. Most traders chase indicators. The smart ones? They trade zones.

In this guide, we’ll break down the 4 real-world supply and demand patterns you need to know, how they work, and how they show up in the Indian stock market. No fluff. No theory dumps. Just practical setups that work.

Why Supply and Demand Is More Than Just a Concept

Price doesn’t move randomly. It moves because of imbalances between buying and selling pressure.

Demand zones = Where institutional buyers stack orders

Supply zones = Where heavy selling appears

This is the Law of Supply and Demand, straight from economics—but traders use it visually on charts. Smart traders don’t react to indicators. They react to order imbalances.

A 2023 study by NSE India found that over 68% of large intraday moves occurred after price touched previous high-volume demand/supply zones. This isn’t coincidence. It’s a pattern.

Reversal Zones – Spot Where the Market Turns Before It Happens

This is the classic “V-shape” bounce or rejection. Reversal zones are where price hits a wall, then sharply reverses.

Real Indian Example – Reliance Industries

In July 2023, Reliance hit ₹2,850—a previous supply zone from April 2022. Price immediately reversed. Sellers who were trapped earlier came back hard. Volume spiked. A textbook reversal.

How to Spot It:

Price touches a clean zone

Volume spikes

Reversal candle (pin bar, engulfing)

Strong push away from zone

Use charting platforms like Strike Money to mark previous reversal zones. Its liquidity heatmaps make it easy to see where heavy buyers or sellers lie.

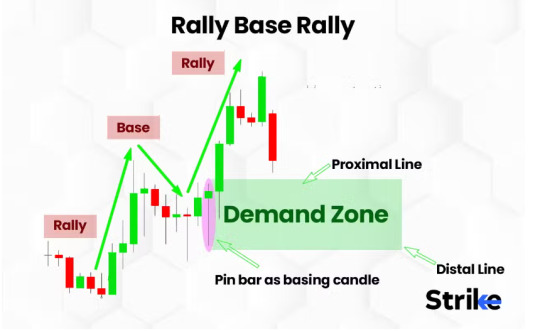

Continuation Zones – The Smart Way to Trade With the Trend

Not all zones reverse price. Some act as a launchpad—where a trend pauses and continues. These are continuation zones.

Real Indian Example – ICICI Bank’s 2021 Uptrend

ICICI Bank had a sharp bull run in 2021. Price would rally, pause at a zone, then break out again. These pauses were accumulation areas, not reversals.

Watch For:

Small consolidations

Inside candles or tight ranges

Continuation after retest

Increasing volume after breakout

This is where Smart Money Concepts (SMC) come in. Big players don’t chase—they build positions inside these zones. With Strike Money, you can track how volume flows before and after breakouts.

Compression Zones – When the Market Goes Silent Before the Storm

This is one of the most explosive patterns. Price gets compressed in a tight range. Volume dries up. No big candles. Traders lose patience. And then—boom.

Real Indian Example – Nifty 50 Before Budget 2024

Two weeks before the Union Budget 2024, Nifty traded sideways between 21,700–21,900. No volume. No direction. Then came the Budget speech—and a 400-point breakout. Classic compression.

Look For:

Low volatility

Tight candle ranges

Low volume (volume spread analysis)

Breakout with conviction

These setups are ideal for breakout traders. Use Strike Money’s real-time order flow to see when compression is about to explode.

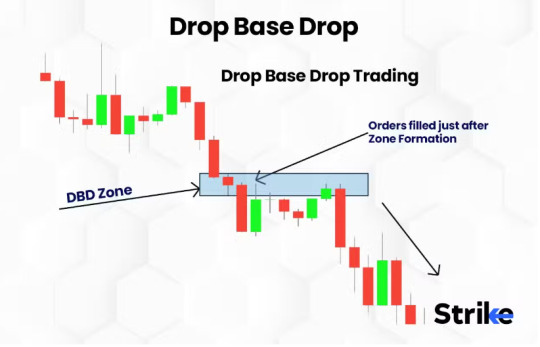

Flip Zones – Where Support Becomes Resistance (And Vice Versa)

This one flips the script. Price breaks through a level and then retests it from the other side. Support becomes resistance. Resistance becomes support. Known as Flip Zones or Breaker Blocks.

Real Indian Example – Infosys Break of ₹1,550

Infosys fell below ₹1,550 in Q4 2022. Price later returned to test that same level. It rejected hard. That level flipped from support to resistance. Bearish continuation followed.

How to Trade It:

Identify broken support/resistance

Wait for retest

Confirm with price rejection or wick

Enter with tight risk

Smart money traders love these zones because they offer low-risk, high-reward entries. Combine it with liquidity zone tracking on Strike Money for confirmation.

Why Supply and Demand Patterns Beat Indicators

Indicators are reactive. They follow price. But supply and demand? They anticipate it.

RSI, MACD, Bollinger Bands = All lagging

Supply/Demand = Based on actual price reaction and volume

Research from SEBI’s algorithmic trading desk shows that volume spikes near demand/supply zones consistently precede large moves in index derivatives. That’s alpha.

Think about it. Warren Buffett doesn’t use RSI. He buys when there’s value—aka high-demand zones. Ray Dalio builds positions during price inefficiencies. These are modern forms of supply/demand strategies.

Tools That Help You Trade These Patterns Like Institutions

You don’t need 10 indicators. You need the right tools to spot zones, understand reactions, and track liquidity.

Top Tools:

Strike Money – Zone recognition, liquidity mapping, real-time charting

TradingView – Chart markup, alerts, multi-timeframe analysis

Strike Money is especially useful for spotting institutional order clusters, which helps validate whether a zone is likely to hold or break.

What Most Traders Get Wrong About Supply and Demand

Just drawing boxes won’t make you profitable. Here's where most go wrong:

Ignoring Volume Zones without volume confirmation are weak. Use volume spread analysis (VSA) to filter noise.

Marking Zones Inconsistently Always mark from the origin of the move—not just where price paused. Use last engulfing candle or base structure.

Forcing Trades at Every Zone Not every zone matters. Look for confluence—price structure, liquidity, and market context.

Lack of Patience Wait for price to react. Don’t predict. Watch for confirmation signals like wicks, rejection candles, or order flow changes.

How Indian Markets React Around Supply and Demand

This isn’t theory—it plays out daily in Indian stocks.

HDFC Bank: Repeated reactions at ₹1,500–1,520 as a long-term demand zone

Bank Nifty: Strong rejections at psychological zones like 40,000

Tata Motors: Breakouts above ₹650 often retest the zone before flying

Even FII activity data, published daily by NSE, shows how institutions load up near these levels—confirming their relevance.

Volume: The Missing Link to Confirming Your Zones

Volume is the fuel behind price. Without it, a zone is just a line.

At demand: Look for rising volume as price enters

At supply: Look for exhaustion or trap candles

Volume Spread Analysis (VSA) is your best friend here. When price moves out of a zone with wide range candles and high volume, that’s confirmation. Strike Money offers zone-volume overlays to help you see this clearly.

The Psychology Behind These Patterns

Every pattern is driven by trader psychology.

Reversal: Fear and panic create overreactions

Continuation: Confidence grows during trend

Compression: Uncertainty builds before a major event

Flip: Traders trapped on the wrong side look to exit

Understanding this helps you trade the pattern, not just the shape. Trading isn't about shapes—it's about human behavior.

Final Thoughts: Learn the Zones, Respect the Zones

If you’re serious about trading, stop chasing indicators. Start mapping zones. Supply and demand are where the real money trades.

Use platforms like Strike Money to:

Visualize key zones

Track real-time liquidity

Confirm setups with volume

These aren’t magical boxes—they’re battle zones between buyers and sellers. Learning to read them will change your trading forever.

What You Should Do Next

Go back and mark 3 supply/demand zones on Nifty or your favorite stock

Use Strike Money or TradingView to track price behavior at those zones

Log every reaction: bounce, break, or rejection

Combine with volume and structure

Build your own zone playbook

Once you do this consistently, you won’t need 20 indicators. You’ll start trading like institutions do—with price, volume, and intent.

Want a strategy checklist or zone-mapping PDF? Just let me know—I’ll send it right over.

Let’s make your charts speak the language of real money.

0 notes

Text

Amgen Inc. (AMGN) stock price broke out from the falling wedge pattern and has gained strength over the past sessions. Moreover, the price action shows that AMGN stock has retested the 100-day EMA near $250 and again started to rise. Furthermore, the chart structure shows that buyers are gaining traction and are looking strong, which suggests that follow-on buying may persist and AMGN stock will chase the swings of $300 soon. Moreover, the chart shows that after breaking out of the trendline at $230, AMGN stock persisted in forming higher highs and looked stronger. Amgen stock price is trading in the bull trajectory and indicates bullishness, and the price action suggests that AMGN share price is targeting $300 and will skyrocket soon. AMGN stock is in the bull trajectory, and follow-on buying continues in the upcoming sessions. Moreover, investors are gaining attention in the pharma stocks, having accumulated over the past sessions. Furthermore, AMGN stock shows the long buildup and buying activity witnessed in the past sessions. At press time, AMGN stock price was $267.70, with an intraday drop of 0.63%, showing bullishness on the charts. Moreover, the trading volume increased by 0.44% to 2.909 Million; the market cap is $143.193 Billion. Furthermore, analysts maintained a neutral rating with a yearly target price of $260.76, suggesting mutant growth aspects. Amgen, Inc. is a biotechnology company that engages in the discovery, development, manufacture, and marketing of human therapeutics. It operates through the Human Therapeutics segment. The company was founded by William K. Bowes, Jr., Franklin Pitcher Johnson, Jr., George B. Rathmann, and Joseph Rubinfeld on April 8, 1980, and is headquartered in Thousand Oaks, CA. AMGN Stock Shows Bullish Cues on Daily Charts Source: AMGN Stock Price Chart At TradingView On the daily charts, AMGN stock price is in the bull territory, highlighting the bullish cues. Furthermore, the chart setup suggests that AMGN share price will reach $300 in the upcoming sessions. Moreover, the price persists in forming higher highs, and trading volume above average shows investors’ interest in the stock. Furthermore, AMGN stock price is trading above the 61.8% Fib zone and is heading toward the immediate hurdle of $275. Moreover, it is near the breakout zone and the upper Bollinger band where a significant upside can be anticipated. The RSI curve stayed in the overbought zone, and forming a positive crossover suggests that AMGN stock price will skyrocket soon. The MACD indicator showed a bullish crossover forming green bars on the histogram which suggests a positive outlook for the upcoming sessions. Summary AMGN stock price shows bullish cues and is trading in the bull territory, suggesting that buyers are looking strong and trying to exceed the buying momentum to reach $300. Furthermore, the buying conviction came from the breakout of the falling wedge pattern, and the stock persisted in gaining traction, forming higher highs over the past number of sessions. Technical Levels Support Levels:$260 and $240 Resistance Levels: $280 and $300 Source

0 notes

Text

Price analysis 11/11: BTC, ETH, XRP, LINK, BCH, BNB, DOT, LTC, ADA, BSV

https://ift.tt/3pfz1S1

Price analysis 11/11: BTC, ETH, XRP, LINK, BCH, BNB, DOT, LTC, ADA, BSV

Billionaire investor Stanley Druckenmiller became the latest famous name to disclose a Bitcoin position. Although Druckenmiller did not specify the quantity he had purchased, he did say that Bitcoin will outperform gold a lot more “because it’s thinner, more illiquid, and has a lot more beta to it.”

Paul Tudor Jones, Stanley Druckenmiller, and Bill Miller are some of the most successful traders and investors on Wall Street. A stamp of approval from them is likely to attract several other investors who may want to diversify their portfolio and outperform the markets.

Daily cryptocurrency market performance. Source: Coin360

In further validation for the crypto space, controversial Australian politician Cory Bernardi has called Bitcoin (BTC) “the millennial’s version of gold.” Even though Bernardi said that risks remain, he believes they are similar to that of any other asset class.

Alex Saunders, founder of the crypto education site Nuggets News, views the endorsements for cryptocurrencies by high-profile figures as a sign of changing times and earlier this week the analyst predicted that Bitcoin price will reach $1 million by 2030.

These fundamental points are long-term positives for cryptocurrency prices. However, let’s analyze the charts of the top-10 cryptocurrencies to find out the path of least resistance in the short-term.

BTC/USD

Bitcoin (BTC) had formed an inside day candlestick pattern on Nov. 10, which showed indecision among the bulls and the bears. The uncertainty has been resolved to the upside today with the bulls attempting to push the price above the $16,000 resistance.

BTC/USD daily chart. Source: TradingView

If the bulls succeed, the BTC/USD pair could start the journey towards the next target objective at $17,200. This level is likely to be the last stop before the pair retests the all-time highs.

The rising moving averages and the relative strength index in the overbought zone suggest that bulls are in command.

Contrary to this assumption, if the price fails to sustain above $16,000, then the pair could remain range-bound between $14,000 and $16,000 for a few more days. A break below the 20-day exponential moving average ($14,242) will be the first sign of weakness.

ETH/USD

Ether (ETH) formed inside day candlestick patterns for three consecutive days from Nov. 8 to 10. This uncertainty has today resolved to the upside, which suggests that the bulls have absorbed the selling and have established their supremacy.

ETH/USD daily chart. Source: TradingView

If the bulls can sustain the price above the resistance line of the wedge, it will invalidate the bearish setup. That will open the gates for a retest of the critical overhead resistance at $488.134. A breakout and close above this level could resume the up-move.

The first target on the upside is $520 and if the ETH/USD pair can ascend this level, a move to $550 is possible. The upsloping moving averages and the RSI in the positive territory suggest that bulls are in command.

Contrary to this assumption, if the price turns down from the current levels and breaks below the 20-day EMA ($418), it will signal that the bears are aggressively defending the wedge. They will then try to pull the price down to the 50-day simple moving average at $382.

XRP/USD

The bulls pushed XRP above the overhead resistance at $0.26 on Nov.10 but failed to sustain the breakout. This suggests selling at higher levels, but the positive thing is that the bulls have not allowed the price to break below the moving averages on the downside.

XRP/USD daily chart. Source: TradingView

Repeated jumps above a resistance level tend to weaken it. The bulls are currently again attempting to propel the XRP/USD pair above $0.26. If they succeed in sustaining the price above this level, a new uptrend is likely.

The first target on the upside is $0.30. The RSI in the positive territory and the gradually upsloping 20-day EMA ($0.248) suggest that bulls have the upper hand.

This positive view will be invalidated if the price turns down from the current levels and breaks below the moving averages. Such a move could drag the pair down to the support at $0.2295.

LINK/USD

Chainlink (LINK) has been trading close to the overhead resistance at $13.28 for the past few days. A tight consolidation near a resistance usually ends with a breakout favoring the bulls.

LINK/USD daily chart. Source: TradingView

If the price closes above $13.28, it will complete an inverse head and shoulders pattern that may signal the start of a new up-move. The target objective of this setup is $19.2731.

The upsloping moving averages and the RSI in the positive territory suggest that bulls are in control.

This bullish view will be invalidated if the price turns down sharply from the current levels. Such a move could result in profit-booking by short-term traders. A break below $9.7665 will signal a possible deeper correction to $7.30.

BCH/USD

Bitcoin Cash (BCH) is struggling to rebound off the 20-day EMA ($257). This suggests a lack of urgency among the bulls to buy at these levels as they may not be confident that the altcoin will rise above $280.

BCH/USD daily chart. Source: TradingView

The bearish divergence on the RSI also suggests that the momentum may be weakening. If the 20-day EMA support cracks, the BCH/USD pair could drop to the 50-day SMA ($245) and then to $231.

This negative view will be invalidated if the pair rebounds off the current levels and breaks above the $272 to $280 resistance zone. The flattish 20-day EMA and the RSI close to the midpoint suggest a range-bound action in the short-term.

BNB/USD

The intraday range in Binance Coin (BNB) is narrowing, which suggests indecision among the bulls and the bears. The flat moving averages and the RSI just below the midpoint also suggests a balance between the bulls and the bears.

BNB/USD daily chart. Source: TradingView

If the range expands to the upside and the bulls push the price above the moving averages and the overhead resistance at $30, the BNB/USD pair could rally to the $32 to $33.3888 zone.

Conversely, if the range expansion happens to the downside, the bears will try to sink the pair below the $25.6652 support.

The next trending move could start after the bulls push the price above $33.3888 or the bears sink the price below $25.6652.

DOT/USD

Polkadot (DOT) is currently stuck close to the midpoint of the $3.80 to $4.95 range. However, as long as the price sustains above the moving averages, the bulls will try to push the price to the resistance of the range.

DOT/USD daily chart. Source: TradingView

The gradually upsloping 20-day EMA ($4.29) and the RSI in the positive zone suggest a marginal advantage to the bulls. A break above $4.95 could push the price to the next resistance at $5.5899.

Conversely, if the price again turns down from $4.95, the DOT/USD pair may remain range-bound for a few more days. A break below the moving averages will be the first sign that the bulls have surrendered the advantage to the bears.

LTC/USD

Litecoin (LTC) has bounced off the 20-day EMA ($56.75), which suggests that the sentiment remains positive and the bulls are buying on dips. The bulls will now try to push the price to the overhead resistance at $64.

LTC/USD daily chart. Source: TradingView

Traders can keep an eye on the RSI as it has formed a symmetrical triangle. A breakout of the triangle will increase the possibility of a break above $64 while a break below the triangle could pull the price below the 20-day EMA.

Currently, the upsloping moving averages and the RSI in the positive zone suggest that bulls have the upper hand. This advantage could shift in favor of the bears if the support at $56.50 gives way. Such a move could drag the LTC/USD pair to $51.

ADA/USD

Cardano (ADA) has been sustaining above the moving averages for the past few days. The bulls are now likely to attempt to push the price above the overhead resistance at $0.1142241.

ADA/USD daily chart. Source: TradingView

If they succeed, the ADA/USD pair will complete a double bottom pattern that has a target objective of $0.1391. The upsloping moving averages and the RSI in the positive territory suggest an advantage to the bulls.

Contrary to this assumption, if the price turns down from $0.1142241, the pair may remain range-bound for a few more days.

The advantage will tilt in favor of the bears if the price reverses direction and breaks below the moving averages. If that happens, the pair could drop to the critical support at $0.0893.

BSV/USD

Bitcoin SV (BSV) remains range-bound but the failure of the bulls to push the price above the moving averages suggests a lack of demand at higher levels. The bears will now try to sink the price to the critical support at $146.

BSV/USD daily chart. Source: TradingView

Both the moving averages are flat and the RSI is just below the midpoint, which suggests a balance between supply and demand. Even if the BSV/USD pair dips to $146, the bulls are likely to defend this level.

A strong bounce off the support of the range could extend the stay inside the range. Contrary to this assumption, if the BSV/USD pair turns up from the current levels and breaks above the downtrend line, then it can move up to $181.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

https://ift.tt/36tGYdA Altcoin News Price analysis 11/11: BTC, ETH, XRP, LINK, BCH, BNB, DOT, LTC, ADA, BSV

Wanna Win Some Free Crypto?

This is our favorite crypto casino... Check it out and get a free sign up bonus and daily crypto rewards!

The post Price analysis 11/11: BTC, ETH, XRP, LINK, BCH, BNB, DOT, LTC, ADA, BSV appeared first on ESA Token.

from WordPress https://ift.tt/3lqthlX via IFTTT https://ift.tt/3oqtis8 https://ift.tt/3dTdjOi

0 notes

Text

Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar, Litecoin, Cardano, Monero, TRON: Price Analysis, October 17

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Market data is provided by the HitBTC exchange.

While crypto markets have given up much of their Oct. 15 gains, they are still trading well above the recent lows, which is a positive sign. A knee-jerk reaction to a news event can propel the markets only to a certain level, after which fundamentals take over. The next leg of the up move will be based on strong fundamental news flows.

Crypto markets have been waiting for institutional investors to take it to the next level. Mike Novogratz, CEO and Founder of Galaxy Investment Partners believes that larger players might enter the markets in Q1 or Q2 of next year, pushing it to new highs.

The launch of Fidelity Digital Asset Services, by leading U.S. investment firm Fidelity, is a step in the right direction, providing institutional players a “secure, compliant, and institutional-grade omnibus storage solution for Bitcoin, [Ethereum] and other digital assets.”

However, larger players are likely to test the waters before jumping in, which may take some time. Until then, is it worthwhile to buy and hold or is there a risk of a further fall? Are any of the top cryptocurrencies showing a reliable buy setup? Let’s find out.

BTC/USD

After the spurt on Oct. 15, Bitcoin has been consolidating just below the overhead resistance at $6,831.99. Ideally, after invalidating a bearish pattern, the price should have rallied, but that has not happened.

Now, if the bulls fail to scale the resistance levels quickly, it will invite selling by the bears. A drop below the moving averages will retest the critical support zone of $6,075.04–$5,900.

Though the BTC/USD pair has broken out of the downtrend line of the descending triangle, it has not picked up momentum. The moving averages remain flat, which shows equilibrium between the bears and the bulls.

The balance will tilt in favor of the bulls if the virtual currency sustains above $6,831.99. The upside targets to watch are $7,400 and $8,400. Traders holding long positions can maintain the stop loss at $5,900.

The next few days are critical and will provide an insight on the next direction of the digital currency.

ETH/USD

Though Ethereum continues to consolidate, the bears have pushed it down towards the lower half of the range. The price is trading below both the moving averages and the RSI is also in negative territory.

If the bulls fail to scale the moving averages within the next few days, the ETH/USD pair might retest the support at $192.50, below which a drop to the Sept. 12 low of $167.32 is probable.

Contrarily, a rally above the overhead resistance will indicate strength and can carry the digital currency to the next resistance at $322.57. Therefore,traders should wait for a close (UTC time frame) above $249.93 before initiating any long positions.

XRP/USD

Among all the top 10 cryptocurrencies, Ripple is the only one that has risen above its Oct. 15 intraday high. It is also trading above the moving averages, which is a positive sign.

The XRP/USD pair is on track to move up to $0.50 where it might face some resistance. Above this level, a rally to $0.55 and $0.625 is probable.

If the digital currency turns down from $0.50, it can decline to the 50-day SMA, which should act as a support. Both the moving averages are flat and the RSI is close to the midpoint. This points to a consolidation in the short-term.

BCH/USD

Bitcoin Cash continues to trade inside the symmetrical triangle as a breakout or a breakdown evades it.

The BCH/USD pair is trading below the moving averages and the 20-day EMA is turning down. The RSI is also in negative territory; which shows that the bears have an upper hand.

A breakdown of the triangle will resume the downtrend, with minor support at the Sept. 11 low of $408.0182. The digital currency will show strength if it breaks out of the triangle. The traders can keep the stop loss on their existing long positions at $400.

EOS/USD

EOS is currently trading close to the midpoint of the $6.8299–$4.4930 range. Both the moving averages are flat and the RSI is also in neutral territory. This shows that neither party has an upper hand.

A new uptrend will start on a breakout and close above the overhead resistance of $6.8299. Such a move can carry the EOS/USD pair to $9 and higher.

On the downside, if the bears break below the immediate support of $5, a fall to the lower levels of $4.49 and $3.8723 is possible. Therefore, traders can protect their long positions with a stop loss of $4.90.

XLM/USD

Stellar has been trading above the moving averages, which is a bullish sign. It is currently trying to break out of the downtrend line and the overhead resistance at $0.24987525.

If successful, it will invalidate the bearish descending triangle pattern and rally to $0.36, with a minor resistance at $0.30 probable. Traders can initiate a long position on the XLM/USD pair if it closes (UTC time frame) above $0.27.

On the downside, the digital currency has support at the moving averages and below that in the $0.204–$0.2148 zone. If this zone breaks, a retest of the critical support at $0.184 will be in the cards.

LTC/USD

After the surge on Oct. 15, Litecoin has again fallen to the bottom half of the range. Both the moving averages are flat and the RSI is in the negative zone.

If the LTC/USD pair trades below the moving averages for a few more days, the bears might attempt a breakdown of the range once again. Any breakdown of the $47 level will resume the downtrend and push prices to the next support at $40.

The digital currency will form a reversal pattern if the bulls breakout and sustain above $69.279. We don’t find any trade as long as the price remains inside the range.

ADA/USD

Cardano is struggling to climb above the moving averages. Currently, it is trading between the 20-day EMA and $0.073531.

Both the moving averages are flat and the RSI is close to the 50 level, which shows a neutral sentiment. If the bears break below the intraday low of Oct. 15, the ADA/USD pair can retest the low at $0.060105.

The digital currency will show signs of strength if it breaks out of the overhead resistance at $0.094256. We suggest traders remain on the sidelines until a new buy setup forms.

XMR/USD

Monero has broken below both the moving averages. It is currently trying to stay above $107.80, below which it can slide to the $100 level once again.

Failure of the bulls to keep prices above the moving averages shows weakness. If the bears break below $100, a retest of $81 is probable.

The XMR/USD pair will gain strength above $128.65. Currently, we don’t find any buy setups, hence, we are not suggesting any trade.

TRX/USD

After failing to sustain above the overhead resistance on Oct. 15, TRON is currently back in the range. The bulls are trying to keep the price above the moving averages, below which the digital currency can drop to the bottom of the range.

We don’t find any buy setups as long as the TRX/USD pair remains stuck inside the $0.02815521–$0.0183 range. Its next move will start either on a breakout of the range or a breakdown from it.

There have been two intraday breakouts of the range that failed to sustain. Therefore, traders should wait for a close (UTC time frame) above the range before establishing any long positions.

Market data is provided by the HitBTC exchange. Charts for analysis are provided by TradingView.

source: https://ift.tt/2Cothzc

The post Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar, Litecoin, Cardano, Monero, TRON: Price Analysis, October 17 appeared first on BTC News Today.

from WordPress https://ift.tt/2Cnfysy via IFTTT

0 notes

Text

London Box Retest Forex Trading Strategy

London Box Retest Strategy is a strategy that makes use of and profits from the directional hints that occurs during the London trading session. Knowledge and understanding of intraday cycles in forex is a very powerful tool. It gives traders an idea as to the reasons behind certain sudden spikes in volume which often lead to directional moves.

The forex market is composed of three big market sessions, Tokyo, London and New York session. While there are other markets that open up at different times during the day such as Australia and Frankfurt, these three are the biggest. These three markets also have different characteristics unique to it due to the location and the size of the market.

Tokyo is the first among the three markets to open during a trading week. It has about 8 hours of lead time from the London session. It is characterized by a relatively small volume with less volatility. London session, the second market to open is a total opposite. It is the biggest market and with such size comes big trading volumes and more volatility. New York session is somewhat in the middle. It is the second largest market. As such, it also has a relatively high trading volume and volatility.

Given the characteristics of the Tokyo and London sessions, which are polar opposites, there is an opportunity which could be exploited based on these market cycles. Tokyo session, having less volume and volatility often has a fairly tight trading range. Add to it the fact that it has about eight hours of lead time prior to the open of the London session, this allows the Tokyo session to create a well-defined range. Then comes the open of the London market. During this time, there is an overlap between Tokyo and London, which is about an hour, depending on the daylight-saving time. As the London market opens, a sudden influx of volume and volatility occurs. This is due to the pent-up trades that Londoners and the European market have pending as the market opens. As the volatility and volume explodes, the market tends to find itself breaking out of the range created during the Tokyo session. Although it is not a rule of thumb, but often times these breakouts of the Tokyo range would become the theme of the day for the London session.

Forex Breakout Box

Given this knowledge about the characteristics of different sessions, many traders have programmed an indicator which clearly marks the range created during the Tokyo session and the time when the different trading sessions starts and ends. The Forex Breakout Box is one of these indicators.

The Forex Breakout Box conveniently marks the range of the Tokyo session with a crimson colored rectangle. Then, it also marks the start of the London session with an orange and blue line.

Trading Strategy Concept

This strategy makes use of the Forex Breakout Box custom indicator in order to exploit the occurrence of breakouts during the London session.

First, we would have to wait for price to breakout of the box. Price should close above the blue line. Then, we wait for price to retrace to the edge of the box on the side where it breaks out. Then, we wait for price action to create a pin bar indicating the rejection of price on the extreme of the Tokyo session. As soon as a pin bar candlestick pattern closes, we place a pending stop entry order beyond the pin bar to enter the market if indeed the market direction does resume in our direction.

Indicator

forex-breakout-box

Template: 5-minute chart only

Trading Session: London session only

Currency Pair: EURUSD, GBPUSD, EURJPY and GBPJPY pairs; other EUR and GBP pairs may work but may need wider stops due to wider spreads

Buy (Long) Trade Setup

Entry

Wait for price to breakout above the high of the Tokyo session based on the blue box

Wait for price to retrace and touch the blue line

Wait for a bullish pin bar pattern to close

Place a buy stop order above the high of the pin bar candle

Stop Loss

Set the stop loss below the entry candle and below the top orange line

Exit

Close the trade as soon as the London session ends

Sell (Short) Trade Setup

Entry

Wait for price to breakout below the low of the Tokyo session based on the blue box

Wait for price to retrace and touch the blue line

Wait for a bearish pin bar pattern to close

Place a sell stop order below the low of the pin bar candle

Stop Loss

Set the stop loss above the entry candle and above the bottom orange line

Exit

Close the trade as soon as the London session ends

Conclusion

This is a profitable trading strategy that many traders use. However, there are many different variations of this strategy. This a type of a London Breakout strategy. This version however is the aggressive option. It has tighter stop losses which allows it to have bigger reward-risk ratios. It is not uncommon for this type of strategy to have a reward-risk ratio of around 4:1, which is quite high on any standard.

There are other factors which you should also be looking at prior to trading this in a trading day. Some of which are news releases, momentum behind a breakout and the bigger picture trend. Having these filters would allow you to have better win ratios but may also cause you to have lesser trades in a week.

Forex Trading Strategies Installation Instructions

London Box Retest Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

London Box Retest Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

youtube

Recommended Forex Metatrader 4 Trading Platform

Free $30 To Start Trading Instantly

Deposit Bonus up to $5,000

Unlimited Loyalty Program

Awards-Winning Forex Broker

Click Here for Step By Step XM Trading Account Opening Guide

How to install London Box Retest Forex Trading Strategy?

Download London Box Retest Forex Trading Strategy.zip

*Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

Copy tpl file (Template) to your Metatrader Directory / templates /

Start or restart your Metatrader Client

Select Chart and Timeframe where you want to test your forex strategy

Right click on your trading chart and hover on “Template”

Move right to select London Box Retest Forex Trading Strategy

You will see London Box Retest Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Save

Save

Get Download Access

La entrada London Box Retest Forex Trading Strategy se publicó primero en Forex MT4 Indicators.

London Box Retest Forex Trading Strategy published first on https://alphaex-capital.blogspot.com/

0 notes

Text

Rising & Falling Wedge Patterns: Your Ultimate 2020 Guide

Of all the reversal patterns we can use in the Forex market, the rising and falling wedge patterns are two of my favorite. They can offer massive profits along with precise entries for the trader who uses patience to their advantage.

One of the great things about this type of wedge pattern is that it typically carves out levels that are easy to identify. This makes our job as price action traders that much easier not to mention profitable.

Let’s start by defining the characteristics.

Characteristics of a Wedge

The rising and falling wedge patterns are similar in nature to that of the pattern that we use with our breakout strategy. However because these wedges are directional and thus carry a bullish or bearish connotation, I figured them worthy of their own lesson.

The first thing to know about these wedges is that they often hint at a reversal in the market. Just like other wedge patterns they are formed by a period of consolidation where the bulls and bears jockey for position.

While both patterns can span any number of days, months or even years, the general rule is that the longer it takes to form, the more explosive the ensuing breakout is likely to be.

As the name implies, a rising wedge slopes upward and is most often viewed as a topping pattern where the market eventually breaks to the downside.

The illustration below shows the characteristics of the rising wedge.

Get Instant Access to the Same “New York Close” Forex Charts Used by Justin Bennett!

Notice how the rising wedge is formed when the market begins making higher highs and higher lows. All of the highs must be in-line so that they can be connected by a trend line. The same goes for the lows. It cannot be considered a valid rising wedge if the highs and lows are not in-line.

Because the two levels are not parallel it’s considered a terminal pattern. This implies that it must eventually come to an end.

The falling wedge is the inverse of the rising wedge where the bears are in control, making lower highs and lower lows. This also means that the pattern is likely to break to the upside.

The illustration below shows the characteristics of a falling wedge.

In the illustration above, we have a consolidation period where the bears are clearly in control. We know this to be true because the market is making lower highs and lower lows.

Notice how all of the highs are in-line with one another just as the lows are in-line. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid.

Lastly, when identifying a valid pattern to trade, it’s imperative that both sides of the wedge have three touches. In other words, the market needs to have tested support three times and resistance three times prior to breaking out. Otherwise, it cannot be considered tradable.

Trading the Breakout

Similar to the breakout strategy we use here at Daily Price Action, the trade opportunity comes when the market breaks below or above wedge support or resistance respectively.

A common question when it comes to trading breakouts is which time frame is best to use. Should we wait for a 4 hour close beyond the level or should we only consider an entry on a daily close?

The answer depends on the setup in question. It all comes down to the time frame that is respecting the levels the best.

More on that later. For now, let’s focus on how to trade the breakout. First up is the rising wedge.

Notice in the image above we are waiting for the market to close below the support level. This close confirms the pattern but only a retest of former wedge support will trigger a short entry.

Why a retest?

Put simply, waiting for a retest of the broken level will give you a more favorable risk to reward ratio.

The same holds true for a falling wedge, only this time we wait for the market to close above resistance and then watch for a retest of the level as new support.

Notice how we are once again waiting for a close beyond the pattern before considering an entry. That entry in the case of the falling wedge is on a retest of the broken resistance level which subsequently begins acting as new support.

Although the illustrations above show more of a rounded retest, there are many times when the retest of the broken level will occur immediately following the break.

Before we move on, also consider that waiting for bullish or bearish price action in the form of a pin bar adds confluence to the setup. That said, if you have an extremely well-defined pattern a simple retest of the broken level will suffice.

Stop Loss Strategies

Up to this point, we have covered how to identify the two patterns, how to confirm the breakout as well as where to look for an entry. Now let’s discuss how to manage your risk using two stop loss strategies.

Finding an appropriate place for the stop loss is a little trickier than identifying a favorable entry. This is because every wedge is unique and will, therefore, be marked by different highs and lows than that of the last pattern.

However, the golden rule still applies – always place your stop loss in an area where the setup can be considered invalidated if hit.

Let’s take a look at the most common stop loss placement when trading wedges. Below is a closeup of the rising wedge following a breakout.

Notice how the stop loss is placed above the last swing high. If our stop loss is hit at this level it means the market just made a new high and we therefore no longer want to be in this short position.

As you may have guessed, the approach to placing a stop loss for a falling wedge is very similar.

Once again our stop loss has been strategically placed. If the market hits our stop loss in the image above it means a new low has been made which would invalidate the setup.

There is one caveat here, and that is if we get bullish or bearish price action on the retest. In which case, we can place the stop loss beyond the tail of the pin bar as illustrated in the example below.

In the illustration above we have a bearish pin bar that formed after retesting former support as new resistance. This provides us with a new swing high which we can use to “hide” our stop loss.

Regardless of which stop loss strategy you choose, just remember to always place your stop at a level that would invalidate the setup if hit.

Taking Profit: It’s Easier Than You Think

Now for the really fun part – taking profit. Both the rising and falling wedge make it relatively easy to identify areas of support or resistance. This is because the pattern itself is formed by a “stair step” configuration of higher highs and higher lows or lower highs and lower lows.

Let’s take a look at the rising wedge first.

Notice how we simply use the lows of each swing to identify potential areas of support. These levels provide an excellent starting point to begin identifying possible areas to take profit on a short setup.

Of course, we can use the same concept with the falling wedge where the swing highs become areas of potential resistance.

It’s important to keep in mind that although the swing lows and swing highs make for ideal places to look for support and resistance, every pattern will be different. Some key levels may line up perfectly with these lows and highs while others may deviate somewhat.

This is why learning how to draw key support and resistance levels is so important, regardless of the pattern or strategy you are trading.

A Pattern Within a Pattern

I’m going to let you in on a little secret. Both the rising and falling wedge will often lead to the formation of another common reversal pattern. You can even see the structure in the illustrations above.

Care to guess what it is?

The pattern I’m referring to is the head and shoulders. Or in the case of the example below, the inverse head and shoulders.

More often than not a break of wedge support or resistance will contribute to the formation of this second reversal pattern. This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement.

See the lesson on the head and shoulders pattern as well as the inverse head and shoulders for detailed instruction.

Taking a Page From EURUSD

To wrap up this lesson, let’s take a look at a rising wedge that formed on EURUSD. The break of this wedge eventually lead to a massive loss of more than 3,000 pips for the most heavily-traded currency pair.

The chart above shows a large rising wedge that had formed on the EURUSD daily time frame over the course of ten months. There are two things I want to point out about this particular pattern.

1) Time Frame Matters

Remember how I mentioned that the time frame you should use depends on the time frame that is respecting both levels the best?

The 4-hour chart above illustrates why we need to trade this on the daily time frame. Notice how the market had broken above resistance intraday, but on the daily time frame this break simply appears as a wick.

This proves that the daily time frame is the best candidate for trading this particular wedge.

2) Immediate Retest of the Broken Level

Nine times out of ten a market will retest the broken level. However, that doesn’t always mean we will get a rounded retest.

Notice in the chart above, EURUSD immediately tested former wedge support as new resistance. This is common in a market with immense selling pressure, where the bears take control the moment support is broken.

The inverse is true for a falling wedge in a market with immense buying pressure.

In Summary

As you can see, there is no “one size fits all” when it comes to trading rising and falling wedges.

As you can see, there is no “one size fits all” when it comes to trading rising and falling wedges. However, by applying the rules and concepts above, these breakouts can be quite lucrative.

Both of these patterns can be a great way to spot reversals in the market. Like the strategies and patterns we trade, there are certain confluence factors that must be respected. The rising and falling wedge are no exception.

Below are some of the more important points to keep in mind as you begin trading these patterns on your own.

A rising wedge is often seen as a topping pattern while a falling wedge is more often than not a bottoming pattern

The wedge must have three touches on each side in order to be considered tradable

The time frame used depends on the time frame that is respecting both levels the best

The breakout is confirmed on a close below support for a rising wedge and above resistance for a falling wedge

The entry comes on a retest of the broken level and can sometimes occur immediately without a rounded retest

A typical stop loss strategy is to place the stop loss beyond the last swing high or low of the pattern

Potential take profit areas are defined by the recent swing highs or lows

Rising and falling wedges will often contribute to the formation the head and shoulders or inverse head and shoulders pattern

Frequently Asked Questions

What is a falling or descending wedge?

A falling or descending wedge is a technical pattern that narrows as price moves lower. It often signals the bottom or swing low in a market that has been trending lower.

What is a rising or ascending wedge?

A rising or ascending wedge is a technical pattern that narrows as price moves higher. It often signals the top or swing high in a market that has been trending higher.

Are wedges in Forex profitable?

Yes, wedges can be incredibly reliable and profitable in Forex if traded correctly as I explain in this blog post.

How can I trade rising and falling wedges?

First, move to the 4-hour or daily time frame. Second, find a market that has been trending higher or lower. Third, see if you can identify a wedge pattern as discussed in this post.

Your Turn

Do you currently trade rising and falling wedge patterns? If not, do you think you will start trading them having read this lesson?

Leave your comment, question or general feedback in the comments section below. I look forward to hearing from you.

The post Rising & Falling Wedge Patterns: Your Ultimate 2020 Guide appeared first on Forex Trader Post.

from WordPress https://ift.tt/33bjPN4 via IFTTT

0 notes

Photo

New Post has been published here https://is.gd/PQOHfu

Top 5 Crypto Performers Overview: BSV, XEM, TRX, BNB, BTC

This post was originally published here

In a bear market, the sentiment is most bearish right at the bottom of the trend. The entire heard says to sell. Short sellers laugh away to the bank and many analysts call for a further fall. With majority of the news being negative, it sounds logically correct.

However, when the downtrend enters a capitulation, it usually signals a bottom. Going against the trend, at such times, turns out to be a profitable decision. A prolonged downtrend is also a good time to sell out the positions that don’t have sound fundamentals and shift into cryptocurrencies that have a bright future.

Though the total market capitalization of cryptocurrencies has plunged about 87 percent from its highs, Bitcoin has managed to maintain its dominance above the 50 mark throughout the fall. This shows that its leadership position remains intact and we have to watch its price action closely to forecast direction for the entire crypto markets.

BSV/USD

Bitcoin SV, born out of the Bitcoin Cash hard fork, is the only one among the top virtual currencies that has been in the green in the past seven days. Its outperformance helped it to overtake Bitcoin Cash in terms of market capitalization for a short period of time on Dec. 7.

Currently, both the cryptocurrencies are trading with market capitalizations that are relatively close to each other.

The BSV/USD pair has seen wild swings in its short trading history. From a high of $254.13 on Nov. 14, it plunged 84.83 percent to an intraday low of $38.528 on Nov. 23. From the lows, it pulled back 221.79 percent to reach an intraday high of $123.98 on Nov. 26.

The recovery stalled at the 38.2 percent Fibonacci retracement level of the fall. Since Nov. 26, the digital currency has been trading in a range of $123.98-$80.352. A breakout of the range can result in a rally to $167.608, which is close to the 61.8 percent Fibonacci retracement level.

On the contrary, if the price breaks down of the range, a retest of the lows is probable. Trading inside the range can be volatile; therefore, we suggest waiting for a breakout of the range for initiating any long positions.

XEM/USD

NEM and three other blockchain firms have come together to form a lobbying group in Europe to “create a unified voice for the blockchain industry at the European level.” NEM has been one of the stronger performers in this fall. Let’s see if it is showing any bottoming formations.

While most other top digital currencies are making new year-to-date lows, the XEM/USD pair has not declined much in the past few days. Even after breaking down of the range $0.13125258-$0.07790717, the bears have not been able to push prices lower. This suggests demand on dips.

If the price climbs back into the range and sustains it for three days, it will confirm that the markets have rejected the lower levels. Traders can initiate long positions above the 50-day SMA and expect a move back towards the top of the range.

On the other hand, if the digital currency turns down from the 20-day EMA and breaks down of $0.06155741, the fall can extend to $0.05. We expect a decisive breakout or breakdown within the next few days.

TRX/USD

TRON CEO Justin Sun announced that Tron has joined Blockfolio Signal beta, which is a popular mobile cryptocurrency portfolio tracking and management network. Justin Sun’s war of words with its competitors, Ethereum and EOS, also continues. He said that his company will create a fund to “rescue” the developers of Ethereum and EOS, following a “collapse” of their platforms.

For the past few days, the bulls are facing a stiff resistance at the 20-day EMA, which is sloping down. The price has gradually drifted close to the Nov. 25 low of $0.01089965. A break of the low will resume the downtrend that can stretch to $0.00844479.

If the bulls scale the overhead resistance of the 20-day EMA, a rally to $0.0183 is probable. We expect the TRX/USD pair to remain range bound for a few days before making the next decisive move.

A breakout above $0.0183 will signal strength and can be traded on the long side.

BNB/USD

Binance Coin made a large move during the week on the back of the announcement regarding upcoming release of Binance Chain. Binance CEO Changpeng Zhao (CZ) hopes to host millions of coins and thousands of blockchains on the platform in the future.

The upcoming launch of Binance’s decentralized exchange (DEX) also boosted sentiment. The constant complain of the naysayers has been a lack of mainstream usability. However, with a partnership with Tripio, Binance has offered the opportunity of using BNB at 450,000 hotel locations. Though the fundamentals are improving, let’s see what the chart forecasts.

The BNB/USD pair gave up a lot of ground between Nov. 14 to Nov. 25. During this period, the price dropped by about 53 percent. Thereafter, the bulls attempted to bounce from the critical support zone of $4.8355125-$4.5200621. The pullback broke out of the 20-day EMA, which was trending down but the bulls could not sustain the higher levels.

The digital currency turned around and slumped sharply on Dec. 6 and 7, resulting in a new low. The bears are attempting to resume the downtrend, while the bulls are trying to pull back from the current levels. The RSI is showing a positive divergence, which is a bullish sign. We anticipate a trend change if the price breaks out of $7 levels. Traders should wait for a new buy setup to form before investing.

BTC/USD

Though Bitcoin is the fifth best performer in the past seven days, it has continued to make new year-to-date lows. The SEC postponing the decision on the Bitcoin ETF did not go well with investors. The experts are divided whether the digital currency will slip further or will it bounce off the current levels. Let’s see what the charts forecast.

The BTC/USD pair gathered momentum on the downside after it broke below the critical support of $5,900. The RSI on the weekly chart has slipped into the oversold territory for the first time since early 2015. The previous dip into the oversold zone had proven to be a good buying point, as the markets then entered a prolonged bull phase.

The $3,000-$3,500 zone had previously acted as a support in mid-September 2017. Therefore, we anticipate a bounce from this zone this time too. If successful, we expect a retest of the breakdown levels of $5,900. Hence, we have been on the lookout to buy.

On the other hand, if the bears break below the support zone, the next major support is way lower at $2,000.

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/PQOHfu

0 notes

Text

Bitcoin, Ripple, Ethereum, Bitcoin Cash, Stellar, EOS, Litecoin, Cardano, Monero, TRON: Price Analysis, Dec. 3

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Market data is provided by the HitBTC exchange.

Over-the-counter (OTC) trading desks usually cater to institutional or large individual traders. While retail traders are dumping their holdings in cryptocurrencies, institutional traders are using the opportunity to buy. Higher demand from large traders has encouraged U.S. cryptocurrency exchange Coinbase to start an OTC desk for its selected customers. This shows that it is only a matter of time before the tide turns from down to up.

After a crushing bear market, one expects the volume to dry up due to the lack of buying interest. However, the notional volume of Bitcoin traded this year has already touched the $2.2 trillion mark, according to Satoshi Capital Research. The growth clocked this year is more than 61 percent over the previous year’s total volume of $870 billion. The numbers will soar after the markets turn bullish in 2019.

Global funds network Calastone, which processes mutual fund trades for over 1,700 financial companies, will use blockchain for its entire system of fund trade clearing services. Deloitte, one of the “Big Four” audit firms, estimates that the use of blockchain will save $4.3 billion to the global fund industry, excluding the U.S. market.

Even after the fall, cryptocurrencies continue to figure into the discussions of world leaders and policy makers. Recently, the G20 countries called for a tax on all cross-border cryptocurrency payment services and regulation to prevent money laundering.

BTC/USD

Bitcoin has formed a pennant, which is a continuation pattern. A breakdown and close (UTC time frame) below the trendline of the pennant will resume the downtrend and has a pattern target of $2,416.52.

The support levels that can stall the fall are $3,620.26 and below that the critical support of $3,000. The moving averages continue to trend down and the RSI is close to the oversold zone, which shows that the bears have an upper hand.

Failure of the BTC/USD pair to even reach the 38.2 percent Fibonacci retracement level of the recent fall shows the kind of selling on every pullback. Considering the bearish pattern and the negative sentiment, traders can raise the stops on half of the position to $3,800 and keep the rest at $3,500.

The bearish view will be invalid if the bulls buy the breakdown and the virtual currency reverses direction, breaking out of $4,500. Until then, the path of least resistance is to the downside.

XRP/USD

Ripple is struggling to pull back. The 20-day EMA has turned down and the RSI is close to the oversold levels. This shows that the bears are overpowering the bulls in the short term.

The first level to watch on the downside is $0.33108. Below this, the next support is at the Nov. 25 intraday low of $0.31123. A break of this level will result in a retest of the critical support at $0.24508. Traders can watch the $0.30 level closely and liquidate positions if the bears sustain the price below the support line of the descending channel.

If the XRP/USD pair attracts buyers at one of the above-mentioned support levels, it will move up to $0.40, which will act as a major resistance, as the 20-day EMA is located at this level. After this level is crossed, we expect the bulls to pick up momentum.

ETH/USD

Ethereum has been trading inside the tight range of $130.50–$102.20 for the past ten days. A breakdown of the range will resume the downtrend. The first target on the downside is $83.

Contrarily, if the bulls succeed in defending the bottom of the range, the ETH/USD pair might extend its consolidation for a few more days.

Both the down-trending moving averages will act as a resistance on any pullback. A breakout of the range and the 20-day EMA can result in a rally to $167.32. Traders can remain on the sidelines until a trend reversal is signaled.

BCH/USD

Bitcoin Cash has drifted closer to the bottom of the $204.76–$148.27 range. A breakdown of this range will resume the downtrend that has a lower target of $100.

Though the RSI is in oversold territory, there is still no sign of buying by the bulls. We shall turn bullish on the BCH/USD pair if it breaks out and closes (UTC time frame) above the top of the range. The trend is clearly down and supply is much greater than demand.

XLM/USD

After failing to break out of the overhead resistance of $0.184, Stellar has turned down, which shows a lack of buying at higher levels.

There is a minor support closer to the current levels, below which a retest of $0.13427050 will be in the cards. A breakdown of this level will resume the downtrend and can sink the price to $0.08.

On the upside, the XLM/USD pair will face a stiff resistance at $0.184. The 20-day EMA is also located just above this level. Hence, if the bulls scale these resistances, it will signal strength. Until then, traders should avoid any positive setting.

EOS/USD

EOS has been making new year-to-date lows on a regular basis. This shows that the bulls are not showing any interest in buying. Every pullback in the past few days has hit a roadblock after a day of recovery.

The next support on the downside is $2.40, below which, the fall can extend to $2. Both the moving averages are sloping down and the RSI continues to languish in the oversold territory.

A breakout of the downtrend line and the 20-day EMA will be the first sign of a change in trend. The traders should wait for a new buy setup to form before initiating a long position in the EOS/USD pair.

LTC/USD

Litecoin failed to break out of the 20-day EMA in the past few days, which shows that the bears are not waiting for higher prices to sell. On the other hand, the buying also dries up at higher levels.

Therefore, the LTC/USD pair is likely to retest the support at $28. A break of this level will resume the downtrend and can drag prices lower to $20.

If the bulls bounce off the supports and break out of the 20-day EMA, the virtual currency can rally to the next overhead resistance at $47.246. Both the moving averages are sloping down and the RSI is in the negative territory. This suggests that the bears have an advantage.

ADA/USD

Cardano has been trading in a tight range for the past few days. One small positive is that it has been trading in the top half of the range, which shows some buying pressure.

Any breakout of the range will face a minor resistance at the 20-day EMA, which is currently at $0.048. If the bulls break out of this, the next resistance is at $0.060105. Short-term traders can wait for a close above the range and then ride the move higher. However, as this is a high risk trade, please keep the position size small.

Contrary to our expectation, if the ADA/USD pair plunges below the range, it can resume its downtrend to the next target of $0.025954. Position traders should wait for a new uptrend to begin before initiating any long positions.

TRX/USD

After bouncing off the lows of $0.01089965, TRON has been facing a stiff resistance from the 20-day EMA, that is sloping down. Just above the 20-day EMA is the previous support-turned-resistance of $0.183. If the price turns down from either of the resistance levels, a retest of the lows is likely. If the lows are breached, the fall can extend to $0.00844479.

However, if the bulls succeed in scaling above $0.183, it will be a positive move. It will indicate that the recent breakdown was a bear trap.

Another possibility is that the TRX/USD pair consolidates below $0.183 for a few days. Either way, it is best to wait for a new buy setup to form before jumping in.

XMR/USD

Monero is in a downtrend. Both the downtrending moving averages and the RSI point to a further fall.

If the bears break down of the recent lows of $53, a fall to the next lower level of $40 is probable. On the upside, the bulls will face stiff resistance in the $66–$70 zone.

The XMR/USD pair is yet to form a bottoming pattern. Hence, traders should wait until the trend reverses for establishing any fresh positions.

Market data is provided by the HitBTC exchange. Charts for analysis are provided by TradingView.

window.fbAsyncInit = function() { FB.init({ appId : '1922752334671725', xfbml : true, version : 'v2.9' }); FB.AppEvents.logPageView(); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; js.async = true; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1922752334671725'); fbq('track', 'PageView'); This news post is collected from Cointelegraph

Recommended Read

New & Hot

The Calloway Software – Secret Weapon To Make Money From Crypto Trading (Proofs Inside)

The modern world is inextricably linked to the internet. We spend a lot of time in virtual reality, and we're no longer ...

User rating:

9.6

Free Spots are Limited Get It Now Hurry!

Read full review

Editors' Picks 2

BinBot Pro – Its Like Printing Money On Autopilot (Proofs Inside)

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

The post Bitcoin, Ripple, Ethereum, Bitcoin Cash, Stellar, EOS, Litecoin, Cardano, Monero, TRON: Price Analysis, Dec. 3 appeared first on Review: Legit or Scam?.

Read more from → https://legit-scam.review/bitcoin-ripple-ethereum-bitcoin-cash-stellar-eos-litecoin-cardano-monero-tron-price-analysis-dec-3

0 notes

Text

Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, March 23

http://cryptobully.com/bitcoin-ethereum-bitcoin-cash-ripple-stellar-litecoin-cardano-neo-eos-price-analysis-march-23/

Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, March 23

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

The pullback in cryptocurrencies could not sustain as fears of a clampdown by the regulators again sent them crashing down. The latest news came from the Japan Financial Services Agency, as it issued a warning for Binance, the largest cryptocurrency exchange by volume, for operating in Japan without a license.

Binance, which was founded in Hong Kong said that it is “in conversation” with the FSA to seek a license. Additionally, it is examining the possibility of opening an office in Malta, according to the founder Zhao Changpeng.

Such obstacles are to be expected in any new asset class, more so, if it has a reputation of being preferred by tax hoarders and money launderers. However, for every avenue that closes, another new one opens. Cryptocurrencies are here to stay and grow in value in the future.

So, let’s see if we find any buying opportunities.

BTC/USD

We had suggested traders buying 50 percent of the desired allocation if Bitcoin dips to $8,800. The levels were reached today, March 23, and the trade is active. The initial stop loss is $7,600, which should be trailed higher once the price breaks out of $9,300.

For the past two days, the bulls have managed to keep prices above the descending channel, which is a positive sign.

The BTC/USD pair will gain momentum once it sustains above the 50-day SMA and $10,000. Once these two levels are crossed, a rally to $12,172 is likely.

On the other hand, if prices fall into the descending channel and break below the March 18 lows of $7,715, a retest of the February 06 lows of $6,075.04 is possible.

ETH/USD

On March 19, though the intraday high was $590.11, the closing (UTC) was at $558.78. Our proposed long positions were not filled because Ethereum could not close above $575.

Currently, the bulls are trying to push prices back above the descending channel. If successful, we can expect a move to the 20-day EMA at $641.

On the contrary, if the bears push prices back into the channel, a retest of the March 18th lows of $452.32 might take place.

We don’t find any setup that has a good risk to reward ratio, hence, we don’t recommend a trade on the ETH/USD pair at the moment.

BCH/USD

Bitcoin Cash could not break out of the 20-day EMA but is holding above the downtrend line, which is a positive sign.

If the BCH/USD pair fails to hold the $980 levels, it can slide to $940 and then to the March 18th lows of $884.7951.

On the upside, the 20-day EMA and the 50-day SMA will act as a strong resistance. Once the price sustains above $1,200, it will indicate the start of a new trend. Until then, we shall remain on the sidelines.

XRP/USD

We went long on Ripple at $0.71, on March 19. Our suggested stop loss is $0.52, just below the March 18th lows. We took this trade because we anticipated a range bound action on the cryptocurrency.

However, for the past four days, the XRP/USD pair has been correcting back towards the critical support of $0.5627.

If the bulls are unable to recover prices within a day or two, a breakdown of the March 18th lows is possible. If the $0.5375 level breaks, the next support is only at $0.22.

On the upside, the cryptocurrency will pick up momentum above $0.75.

XLM/USD

In our previous analysis, we had suggested long positions in Stellar if the bulls buy the dip at $0.23. Currently, the price is struggling to hold above the downtrend line.

If prices dip back below the downtrend line, a retest of the $0.2 level is possible. If this level breaks, the next support is way lower at the support line of the descending channel.

Therefore, we suggest buying the XLM/USD pair on a close (UTC) at $0.25, which will confirm a successful retest of the downtrend line. The target objective on the upside is $0.32 followed by a move to $0.35.

The initial stop loss can be kept at $0.19, on a closing basis (UTC), which can subsequently be trailed higher.

LTC/USD

We had recommended buying Litecoin on dips to $165. Traders who have initiated long positions today should keep the stop loss at $142.

The LTC/USD pair turned down from the 20-day EMA on March 21 and broke below the downtrend line. Unless the bulls recover prices quickly, the cryptocurrency will retest the March 18th lows. If the retest fails, a slide to $128 will be on the cards.

The first sign of strength will be when the price sustains above $180. Please use only 50 percent of the usual position size. If you have purchased the normal size, please sell half at the current levels. Let’s keep our risk to the minimum.

ADA/BTC

Cardano did not trigger our buy levels of 0.000025. It turned down from 0.00002449 on March 21. We expect it to find buying support above the downtrend line, around the 0.00002 mark.

We continue to be bullish on the ADA/BTC pair, providing it breaks out and closes (UTC) above 0.000025. The target objective is 0.000035 and the stop loss can be kept just below the recent lows.

Critical supports on the downside are at 0.00002 and 0.00001690.

NEO/USD

In our previous analysis, we had recommended long positions in NEO if it holds the $65 mark. Right now, we don’t see any significant buying support at this level. If the support breaks, a fall to the March 18th lows of $49.04 is likely.

Therefore, traders should wait for a bounce and initiate long positions after the NEO/USD pair breaks out $82. The stop loss can be kept just below the recent lows, and the target objective is a rally to the downtrend line of the descending triangle at $110.

Our bullish view will be invalidated if the cryptocurrency continues to slide below $65 levels.

EOS/USD

EOS has risen close to the resistance line of the descending channel, which is a major hurdle to cross because the price has turned down from this line on two previous occasions.

For the past two days, the EOS/USD pair has been trading close to the resistance line, but to its credit, it has not given up much ground. It continues to trade above the 20-day EMA; it is a positive sign.

A breakout and close (UTC) above the resistance line of the channel and the 50-day SMA gives a pattern target of $11.5. Aggressive traders can initiate a long position around $8 with a stop loss of $6.

This is a risky trade because the cryptocurrency has resistances at $8.6 and $10. Therefore, traders should close the position if they find that one of the above-mentioned levels is proving difficult to cross.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

Ethereum

0 notes

Text

Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar, Litecoin, Cardano, Monero, IOTA: Price Analysis, October 5

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Market data is provided by the HitBTC exchange.

2017 was about large range days and superlative returns in cryptocurrencies. 2018 is about a crushing bear market and a sharp drop in volatility. Bitcoin’s volatility is at year-to-date lows and most altcoins have followed suit. While flat markets are despised by speculative traders, it is a good time to make an investment for the long term.

A small range trading period with low volatility will be followed by range expansion and increased volatility. However, we believe that the rise from current levels will face a number of hurdles on the way up. A large number of retail investors stuck at higher prices will bail out when the price of Bitcoin starts a new uptrend. Mike Novogratz, CEO of crypto investment firm Galaxy Digital Capital Management, does not see Bitcoin scaling above $9,000 in 2018.

So, has Bitcoin bottomed or can it fall further?

Fundstrat managing partner and head of research Tom Lee asked this question to institutions and Twitter users. The results of the poll were interesting. A majority of 25 Wall Street institutions believed that the Bitcoin price had “already bottomed”, whereas the majority of 9,500 Twitter poll respondents think that it is likely to fall further.

57 percent of institutions have a minimum target of $15,000 on Bitcoin by the end of 2019, which is about 127 percent higher than the current price of the leading digital currency.

BTC/USD

The bears did not take advantage of the breakdown below the trendline and Bitcoin has bounced back above the 20-day EMA. The important level to watch on the upside is the downtrend line of the descending triangle and $6,832. If the bulls scale above these two levels, it will invalidate the bearish pattern, which is a bullish sign.

The first level to watch on the upside is the intraday high of Sept. 4 at $7,413.46. If this level is crossed, the BTC/USD pair could rally to the next level of $8,500. The bears might launch a strong defense of this level.

On the downside, a break below the $6,341–$6,435 support zone can sink the digital currency to the critical zone of $6,075.04–$5,900. A break of this level will trigger a number of stop losses that can result in a sharp fall. Therefore, traders holding long positions should keep a stop loss of $5,900.

ETH/USD