#breakout and retest confirmation

Explore tagged Tumblr posts

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

Dogecoin (DOGE) has dropped below the critical $0.12 support level, now trading at $0.1079 with a 24-hour volume of $949,738,368. Despite an 8.02% increase in the last 24 hours, it has fallen 12.65% over the past week. DOGE's market cap is $15.6 billion, with a supply of 140 billion DOGE.

After reversing from the $0.22 resistance mark, DOGE lost over 54% in three months, forming a descending triangle. Bears drove the price below $0.129, confirming a bearish breakout. Attempts by bulls to reclaim $0.129 failed at the 20 EMA, continuing the downtrend.

DOGE now approaches the $0.01-$0.096 support range, a crucial high liquidity zone for halting further declines. A reversal here could push DOGE to retest $0.11-$0.12. The RSI in the oversold territory hints at a potential bullish reversal. If support fails, DOGE may fall towards $0.08.

2 notes

·

View notes

Text

First few trades of '24

Tata Motors 5 min time frame:

The chart made a flag and gave a solid resistance trend line. The flag eventually had a breakout followed by a retest. The retest can be identified through the long downside wick along the trendline showing it as a zone of support and the buyers force being stronger than the sellers, which led to the price going up.

EUR/AUD 1 hour time frame:

The price had been trading in a range for quite a while and eventually broke out of the range. After getting a confirmation to enter through a retest as in the same manner above, i took the call and the price rocketed to the take profit mark set just below the liquidity zone.

CAD/JPY 5 min time frame:

The setup is practically the same as the one above, price was trading in a range, saw a breakout, confirmation to enter through a retest and the price shot up. XAU/USD 5 min time frame:

The price broke a resistance zone and came back down to give a retest, only before to - yup, you guessed it, rise and reach the take profit, and actually go way above the take profit zone.

3 notes

·

View notes

Text

11 Strategic Forex Trade Setups Amid Market Volatility

Market Analysis

GOLD

GOLD remains below recent highs as traders reassess after the surprising decline that followed bullish geopolitical developments. Despite expectations for a rally—given Middle East tensions and a weakening U.S. Dollar—larger profit-taking likely drove prices down temporarily. For strategic forex trade planning, this presents a key area for reassessing long positions. While the MACD indicates bearish growth and RSI shows overbought signals, a normalization may provide a better re-entry point.

SILVER

SILVER is holding firm near support at 36.7308 following its retreat from recent highs. Metals seem to be consolidating, partly due to shifting safe-haven demand into Oil. However, we anticipate further bullish follow-through. These levels remain important for traders applying multi-pair forex strategies or looking at commodity-currency correlations.

DXY

The Dollar surged following the Fed’s rate hold and Powell’s comments on tariff-driven inflation. With traders recalibrating rate cut expectations, the MACD and RSI both confirm bullish momentum. The DXY’s move above the EMA200 supports near-term strength. However, forex analysis and predictions suggest this may be temporary. Price action traders should monitor whether this move continues or corrects after the FOMC fallout.

GBPUSD

The Pound broke key structure levels, continuing its bearish trend. The MACD and RSI both show heavy selling volume and momentum. As part of a broader EUR/USD trend analysis, GBPUSD shows how political divergence and inflation fears impact currency flows. We are now actively looking for sell opportunities.

AUDUSD

The Australian Dollar is consolidating, showing relative resilience compared to the Pound. In light of global risk-off sentiment, this move is surprising. We wait for a break of structure before applying strategic forex trade planning to AUD setups.

NZDUSD

The Kiwi is pressing against the lower edge of its range. A sustained move below this level could lead to new selling opportunities. Traders using multi-pair forex strategies should closely track NZD correlation with commodity trends and overall market sentiment.

EURUSD

EUR/USD is under pressure but still structurally bullish. Currently, the pair is retesting the upper band of its previous consolidation zone. RSI and MACD show bearish volume and momentum, while EMA200 acts as resistance. We’re on watch for a bullish breakout or further confirmation of a trend shift. Price action trading for EUR/USD remains central to current forex positioning strategies.

USDJPY

USDJPY shows signs of bullish continuation but remains in consolidation. Despite risk-off flows, JPY isn’t gaining as expected, possibly due to domestic policy hesitations. We'll stay on hold until structure gives way in either direction—essential for high-confidence forex analysis and predictions.

USDCHF

USDCHF has re-entered consolidation and broken the EMA200. Although MACD and RSI show bullish signals, we remain cautious. Strategic forex trade planning suggests waiting for structure confirmation before shifting our bias from bearish to bullish.

USDCAD

USDCAD shows strong bullish momentum after bouncing off the EMA200. RSI and MACD confirm follow-through to the 1.37261 level. With no immediate rejection, we maintain a bullish bias. However, as with all multi-pair forex strategies, we remain alert for rapid shifts tied to oil and Fed sentiment.

Final Thoughts

This week's volatility underscores the importance of strategic forex trade planning. With inflation outlooks, geopolitical escalation, and central bank divergence shaping currency flows, a methodical approach to multi-pair forex strategies and EUR/USD trend analysis is essential. Stick to the technicals, follow the price action trading for EUR/USD, and remain responsive to macro news for optimal trade execution.

0 notes

Text

Critical Juncture: Gold Eyes Breakout, USD Teeters at Support Amid Inflation Countdown

Critical Juncture: Gold Eyes Breakout, USD Teeters at Support Amid Inflation Countdown

This past week has seen strong movement across key markets, particularly in gold and the US dollar, both reacting sharply to shifting interest rate expectations and geopolitical unease. Gold pushed to new highs while the US Dollar Index (DXY) extended its recent downward trend despite bouts of intraday volatility. The broader narrative continues to revolve around Fed policy re-pricing, sticky inflation, and rising geopolitical risk, themes that will remain front and center heading into a critical macro week. Looking ahead, traders will be laser-focused on next week’s US inflation releases, including CPI and PPI, which may recalibrate expectations on rate cuts. The dollar’s reaction to these prints will likely steer risk appetite, commodity flows, and cross-asset volatility into mid-June. All times mentioned in this report are in UST. XAUUSD Gold has extended its rally this week, reaching as high as $3,446.60 and now trading just below at $3,432.80. The metal found strong buying interest around $3,294.40, staging two notable rallies from that zone. Momentum accelerated sharply between June 12–13, with price action pointing to aggressive dip-buying and institutional flows. This performance reflects the persistent safe-haven demand as geopolitical risk and macro uncertainty deepen.

XAUUSD M5 Tensions in the Middle East, particularly the growing conflict between Israel and Hezbollah along the Lebanese border, have reignited market concerns around a broader regional escalation. This, combined with uncertainty around the US rate path, is fuelling gold’s role as a defensive asset. In times of geopolitical stress, gold historically benefits from inflows as traders seek insulation from currency and equity volatility. From a technical perspective, the structure remains clearly bullish. On the short-term chart, gold is carving a clean sequence of higher highs and higher lows, with impulsive legs followed by shallow consolidations. The break and successful retest of the $3,400 level confirms bullish strength, while the ongoing consolidation beneath $3,445 appears more like a pause than a rejection. A breakout above $3,446.60 opens the door to price discovery and could attract further momentum-driven buying. Fundamentally, gold’s upside is supported by a trio of macro drivers: expectations of a dovish Fed, sticky inflation, and ongoing central bank accumulation. With no hike priced in for the next two meetings, markets are increasingly leaning toward policy easing later this year. Meanwhile, real yields remain relatively subdued, a favorable environment for gold, which yields nothing, but tend to gain value in low-opportunity cost conditions. It’s also worth noting that demand from emerging market central banks continues to build quietly in the background, reflecting a broader move away from USD-based reserves, a long-term structural tailwind for bullion. Despite the bullish trend, price action remains highly reactive. Gold has moved over $150 within days, with sharp intraday swings common around data releases or geopolitical headlines. This kind of volatility can amplify both gains and drawdowns, so traders should remain cautious with sizing, particularly around key levels like $3,400 and $3,446.60. A clean breakout could spark fast continuation, but failed attempts may invite sharp pullbacks into prior demand zones. DXY The US Dollar Index has faced heavy pressure this week, currently trading around 98.10, well off the recent swing high of 99.30, and just above the week’s low at 97.60. The chart shows a series of lower highs and lower lows, indicating persistent downside momentum despite a brief bounce early on the 13th.

DXY M5 After peaking near 99.30 on June 10, DXY broke down sharply, losing nearly 1.7% into the weekly low at 97.60. A strong intraday rally early Thursday reversed most of that loss, but price failed to hold above 98.40, showing lingering bearish pressure. The lower-high structure remains intact. Short-term support is at 97.60- a key inflection point, while resistance is now reinforced at 98.50. Fundamentally, the dollar’s softness may reflect market confidence that the Fed won’t hike again in 2025, with cuts later this year. However, ongoing Middle East tensions have provided some counterbalance, with occasional USD inflows during headline-driven risk-off moves, though gold appears to be the primary beneficiary. Next week’s CPI and PPI figures will be critical for sentiment and policy expectations. Volatility Note: The DXY’s roughly 170-point swing from peak to trough in just a few days highlights reactive positioning, sensitive to both macro data and geopolitical flow. Key Levels to Watch Asset Bias Key Support Key Resistance XAUUSD Bullish 3400 3446.6 DXY Bearish 97.6 98.5

Forward-Looking Considerations The coming week could prove pivotal for both gold and the US dollar, with market focus shifting squarely to key US inflation prints, CPI (Wednesday) and PPI (Thursday). These will act as the next major catalysts for USD direction and, by extension, gold and commodity volatility. Despite recent softness, the USD remains at the heart of global macro flows, and any upside inflation surprise could reignite hawkish Fed repricing, triggering a sharp short-covering rally in the dollar and putting gold's recent breakout under pressure. Conversely, if inflation data continues to soften, expect renewed dollar weakness and another leg higher in gold, potentially through the $3,450 resistance zone. Technically, both gold and DXY sit at critical junctures: · For gold, a sustained hold above $3,400 keeps the bullish structure intact, but failure to break $3,446.60 could lead to short-term exhaustion. · For the dollar, 97.60 is now the line in the sand, a break could usher in broader USD weakness against major pairs. Beyond inflation, geopolitical uncertainty and global central bank divergence remain persistent tailwinds for gold. Market participants will also be watching for Fed speakers’ post-CPI for tone confirmation. With volatility elevated and both assets near technical inflection points, next week offers a high-risk, high-opportunity environment. Traders should remain nimble, size appropriately, and be prepared to adapt quickly as macro catalysts and geopolitical developments collide in the days ahead.

0 notes

Text

Bitcoin Battles Key Resistance – $106,600 Retest Could Confirm Trend Shift

Bitcoin is preparing for a decisive move as price action tightens near key resistance levels. After weeks of sideways movement and lower highs, bulls are now attempting to flip the script by reclaiming control and confirming the start of a new bullish phase. A successful breakout above short-term resistance could open the door for a rally back toward all-time highs, but the path forward remains

Read More: You won't believe what happens next... Click here!

0 notes

Text

Top Strategies for Successfully Trading Breakouts and Pullbacks

Trading breakouts and pullbacks are two of the most powerful strategies in technical analysis. When executed correctly, they can offer high-probability setups and consistent returns. At AtlasFunded, we help traders sharpen their edge by understanding market structure, timing, and risk management. In this guide, we’ll break down the top strategies for successfully trading breakouts and pullbacks.

What Are Breakouts and Pullbacks?

A breakout occurs when the price moves beyond a defined support or resistance level with increased volume. This often signals the start of a new trend. A pullback, on the other hand, is a temporary reversal within an existing trend—a chance for traders to enter at a better price before the trend resumes.

Both strategies are used by day traders, swing traders, and even long-term investors.

Strategy 1: Identify Key Support and Resistance Levels

The foundation of breakout and pullback trading lies in accurately identifying support and resistance zones. These levels are where price has historically reversed or paused, making them critical decision points.

Tip: Use tools like horizontal lines, Fibonacci retracements, and pivot points to mark these areas. Volume analysis can also confirm the strength of a breakout.

Strategy 2: Use Volume to Confirm Breakouts

Volume plays a crucial role in confirming the validity of a breakout. A breakout with high volume indicates strong market interest and a higher chance of follow-through.

AtlasFunded Insight: Low-volume breakouts are more likely to fail or reverse, trapping traders in poor entries. Always wait for volume confirmation before jumping in.

Strategy 3: Wait for the Retest (Breakout-Pullback Combo)

One of the most effective breakout trading methods is to wait for the retest. After the initial breakout, price often returns to test the previous resistance (now support) or support (now resistance) before continuing.

This gives traders a chance to enter with a lower risk and higher reward setup.

Strategy 4: Trendline and Moving Average Pullbacks

When trading pullbacks, using a trendline or moving average (like the 20 EMA) helps identify dynamic support or resistance. These indicators can act as reliable zones for pullback entries during a trend.

Tip: Enter on a bullish or bearish candlestick pattern near the trendline or moving average for added confirmation.

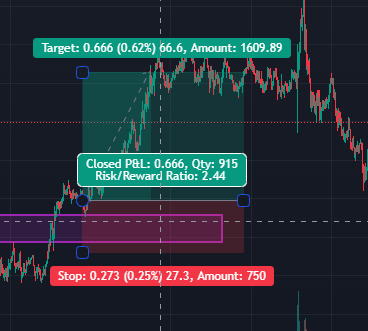

Strategy 5: Set Clear Entry, Stop, and Target Levels

Whether trading a breakout or pullback, never skip proper risk management. Define:

Entry: Above the breakout point or at the pullback support/resistance

Stop-loss: Below the breakout level or under recent swing low/high

Take-profit: Based on risk/reward ratio (e.g., 1:2 or 1:3)

At AtlasFunded, we emphasize disciplined trade planning to help traders scale with confidence.

Conclusion

Trading breakouts and pullbacks can be incredibly rewarding, but success comes from preparation, not prediction. Focus on structure, confirmation, and discipline.

Join AtlasFunded and gain access to educational resources, funding opportunities, and a community that empowers you to trade smarter, not harder.

0 notes

Text

High Win Rate Trading Strategies for Traders Tired of Market Chaos

High Win Rate Trading Strategies for Traders Tired of Market Chaos

Struggling with inconsistent results? Discover high win rate trading strategies designed for traders who crave clarity, reliability, and a proven edge—even in volatile markets.

The Power of Simplicity in High Win Rate Trading

Complex setups often lead to confusion. Data shows that simple, rule-based high win rate trading strategies outperform discretionary methods by up to 34%. Focus on clean, mechanical entries and exits to remove doubt and stay disciplined. This sets the stage for consistent results, no matter the market’s mood swings.

Backtested Systems: Your Statistical Advantage

Research proves that strategies with at least a 60% win rate, verified by 10+ years of backtesting, dramatically outperform random trading. For instance, a moving average crossover with robust risk controls can yield stable profits. Let’s explore how you can implement backtested systems for peace of mind in every trade.

Risk Management: The Hidden Win Rate Multiplier

Even the best high win rate trading strategies fail without proper risk controls. Professional traders risk just 1–2% of capital per trade, ensuring small losses and letting winners run. This approach protects your edge and keeps you in the game for the long term, compounding your gains.

Trade Only the Highest Probability Setups

Quality over quantity: studies reveal that filtering trades for only the top 20% probability setups can boost win rates above 70%. Use clear criteria—like RSI divergences or volume spikes—to avoid overtrading and maximize each opportunity. Mastery comes from patience and selectivity.

Real-World Example: The Breakout Pullback Play

Consider the breakout pullback: entering after a confirmed breakout and waiting for a retest increases win rates to 68% historically. This pattern is simple, repeatable, and easy to spot. Integrate it into your playbook for reliable, actionable trades—even when the market seems unpredictable.

Simple systems boost confidence and consistency

Backtesting proves edge and builds trust in your strategy

Risk controls are essential to protect your win rate

Ready to reclaim control? Apply these high win rate trading strategies and transform market chaos into consistent gains. Start refining your approach today!

What is a high win rate trading strategy?

It’s a rules-based method that delivers more winning trades than losing ones—typically 60% or higher—proven by historical data and backtesting for reliability.

How do I know if my strategy has a high win rate?

Backtest your strategy over several years of historical data. If it regularly wins 60%+ of trades and maintains positive returns after costs, it qualifies as high win rate.

Have you found a strategy that finally boosted your win rate? Share your experiences or reblog! What’s the biggest challenge you face in achieving consistency?

0 notes

Text

Ethereum: The Underdog That Could Still Lead the Next Crypto Rally

The world outside crypto looks like a slow-motion train wreck right now. Trade wars. Recession alarms. Sentiment at rock-bottom. And yet, Ethereum — bloodied but unbowed after its worst quarterly performance since 2018 — is showing its first real signs of life.

Here’s the thing: most people are looking at Ethereum and seeing damage. Smart investors are looking and seeing opportunity.

Let's not sugarcoat it. Ethereum had a brutal Q1 2025. Down nearly 44%. $1.5 billion hacked from Bybit. Pectra upgrade delays. ETH ETF outflows. It’s been one hit after another. And compared to Bitcoin’s relatively mild 10% dip, Ethereum looked weak, fragile — even outdated to some.

But history doesn’t reward the safe, it rewards the resilient. And Ethereum's resilience is exactly why I'm betting on it leading the next crypto recovery.

Ethereum's Bullish Structure: A Foundation, Not a Fluke

Ethereum’s price action over the past week isn't just noise — it’s a meaningful signal.

Top analyst Daan highlights that ETH has reclaimed its local range against Bitcoin, pulling a wave of altcoins higher along with it. That’s not just "good vibes" — that’s classic early-stage rotation behavior. In crypto, Bitcoin moves first, Ethereum follows, and then the altcoin herd stampedes. We’re in phase two.

Price is currently holding above the 4-hour 200 MA and EMA — key technical levels that often separate flash-in-the-pan rallies from real, sustained trend shifts. As of today, ETH trades around $1,800, flirting with the critical $1,850 resistance. A close above that level could ignite a powerful altcoin season — something the market hasn’t seen since late 2023.

The technicals are whispering: accumulation is happening. The fundamentals are shouting: the worst may be behind us.

Fear Is High, But So Is the Risk/Reward

CoinMarketCap’s latest research confirms the setup: extreme fear dominates the market. Their Fear & Greed Index hit a low of 15 in March — a level not seen since the COVID crash of 2020.

Historically, Ethereum thrives when fear peaks. Q2 has been a historically strong quarter for ETH, with a median return of +15.29%.

Contrarians make their money when others are too scared to act.

We are at a pivotal psychological moment: the crowd is licking its wounds, while smart money is preparing for the next move.

The Bitcoin Effect: Ethereum’s Hidden Lever

Let’s be clear: Ethereum’s short-term fate still hinges partly on Bitcoin’s next big move.

Credible Crypto laid it out cleanly: if Bitcoin manages to confirm its breakout with another push above $95,000, Ethereum is poised to skyrocket. ETH has already shown an impulsive move off its $1,533 lows — if Bitcoin holds up, it’s likely we’ll never see sub-$1,500 ETH again in this cycle.

But there’s a catch: Bitcoin needs to maintain momentum. If BTC fails to seal its breakout and retraces below ~$89,000, expect turbulence. Ethereum could retest lower ranges ($1,725-$1,600) before the final push.

In simple terms: Bitcoin sets the tempo, but Ethereum could outperform in the dance that follows.

Why Ethereum Still Matters in 2025 — More Than Ever

There’s a dangerous narrative floating around right now: that Ethereum’s best days are behind it. That newer L1s and rollups will cannibalize it. That Solana’s speed or L2s like Base and zkSync will make Ethereum obsolete.

It’s lazy thinking.

Ethereum isn’t just a blockchain. It’s the infrastructure layer of Web3. DeFi, NFTs, tokenized RWAs, decentralized identity — they all still fundamentally depend on Ethereum’s security model, its settlement assurances, and, yes, its global liquidity.

The Layer-2 explosion (which is about to accelerate) benefits Ethereum more than it threatens it. Every successful L2 scaling solution — Optimism, Arbitrum, Base — settles back onto Ethereum’s base layer. More usage = more demand for ETH gas fees = more ETH burned = more value accrual for ETH holders.

Ethereum is not dead tech. It's foundational tech.

And the upcoming catalysts — pending ETH spot ETF flows, Ethereum Improvement Proposals (EIPs) aimed at fee reductions, and growing institutional experiments with tokenization — all favor Ethereum’s long-term dominance.

Ethereum Leads The Q2 Comeback

Here's the call: Ethereum will outperform Bitcoin in Q2 2025.

It won’t be easy. The macroeconomic headwinds are real. Trade wars and shaky global growth will keep risk appetite low. But that’s precisely why Ethereum’s next move will catch most off guard.

I’m looking for:

A decisive ETH close above $1,850 this week.

A monthly close above $1,870.

An altcoin rally led by ETH/BTC strength.

If we get it, we’re staring down a summer where Ethereum reasserts itself not just as a survivor, but as a leader.

And if you think you’ll have time to "wait for confirmation" before it moves? Think again. Crypto doesn’t reward the patient. It rewards the prepared.

Scar Tissue Builds Strength

Ethereum today is battle-tested. It’s survived multiple bear markets, a regulatory onslaught, internal wars over scaling, and the relentless emergence of so-called "Ethereum killers."

It’s easy to bet against the battered. It’s harder — but smarter — to bet on the survivor.

Ethereum doesn’t need your belief. It will continue building with or without you.

But history has shown: those who bought despair, who bought when "ETH was dead," walked away with life-changing returns.

Enjoy Our Content? Support Us!

We don’t run subscriptions. We don't lock articles behind paywalls. Everything we write is free — because we believe crypto knowledge should be free.

If you found value in this piece, consider buying us a coffee at our Ko-Fi page! Every donation, big or small, helps us keep writing, analyzing, and delivering sharp crypto insights straight to you.

Thank you for reading — and remember: fortune favors the bold.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. This article may not be reproduced, distributed, or transmitted in any form without prior written permission.

0 notes

Text

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu…

0 notes

Text

New record low for Bitcoin’s realized volatility – What’s the future?

Key Points

Bitcoin’s one-week realized volatility has dropped to 23.42%, nearing historical lows.

This low volatility has historically indicated significant market moves, often leading to breakouts.

Bitcoin’s one-week realized volatility has decreased to 23.42%, nearing its historical lows. Over the past four years, this level has only been breached a few times, specifically in October 2024 and November 2023.

These instances of low volatility have often been a precursor to major market moves, making it a significant metric to monitor.

Bitcoin’s Volatility Compression

The realized volatility chart shows a steady decline in Bitcoin’s volatility since late 2024. The current reading is around the 23% zone.

Sharp decreases in volatility have historically led to significant price swings, often setting the stage for breakouts. When volatility is suppressed, it tends to build up pressure in the market, leading to strong moves in either direction. This is particularly true when Bitcoin is trading near key technical levels.

Bitcoin’s Current Market Trends

Bitcoin’s current trading price is $96,450, showing a slight increase from its previous levels. However, Bitcoin is struggling to stay above its 50-day moving average of $98,186, but it remains above the 200-day moving average of $97,764.

The Bollinger Bands are tightening, indicating a possible price move. The Choppiness Index is at 48.53, suggesting that the market is not in a strong trending phase but is nearing the end of its consolidation period.

With realized volatility nearing historical lows, the market may be gearing up for a decisive move. If Bitcoin maintains support around the $96,000 – $97,000 range, a breakout above $98,500 could trigger further upward momentum. Conversely, if Bitcoin fails to sustain its current levels, it may retest support around $94,000 before any significant recovery.

Investors and traders should look out for signals of volatility expansion, such as widening Bollinger Bands and increased trading volume, to confirm the direction of the next significant move.

0 notes

Text

Trading Strategies for the Broadening Top Pattern

Understanding the Broadening Top Pattern The Broadening Top Pattern, also referred to as the megaphone pattern, is a classic chart formation that signifies increasing volatility and indecision in the market. This pattern is characterized by a series of higher highs and lower lows, creating a structure that resembles an expanding triangle or a megaphone. Traders often observe this formation…

#Bearish Broadening Top#Breakout Trading Strategy#Broadening Top Examples#Broadening Top Pattern#Broadening Top Reversal#Bullish Broadening Top#Chart Patterns for Trading#How to Trade Broadening Top#learn technical analysis#Megaphone Chart Pattern#Stock Market Chart Analysis#Stock market trading strategies#stock markets#stock trading#successful trading#technical analysis#Technical Analysis Patterns#Trading Risk Management#Trendline Retest Strategy#Volume confirmation in trading

0 notes

Text

Bitcoin Plummets Under $97,000, Triggering Liquidation of 105K Traders: ADA, AI Tokens Skyrocket

Key Points

Over 110K traders were liquidated as Bitcoin dropped below $97,000, wiping off around $182 million.

AI tokens AI16Z and ARC, and ADA saw significant gains amid massive whale purchases.

In the last 24 hours, more than 110,000 traders faced liquidation as Bitcoin’s price fell below $97,000. This resulted in approximately $182 million being wiped off. The 20-day EMA, currently at $98,800, is posing resistance for Bitcoin. AI tokens AI16Z and ARC experienced substantial growth in the same period due to large whale purchases.

Bitcoin, the market leader in digital currency, lost the $97,000 price mark following a 1.15% price drop in the last 24 hours. Despite efforts by bulls to push above the $100,000 resistance, bears brought the price down to $96,000, a level that is barely holding on. Amid this uncertainty, over 110,923 traders were liquidated in the past day.

Liquidation Data

According to data from Coinglass, a significant $182.34 million was wiped off from the digital asset space in the past 24 hours. This includes $105.61 million in longs and $77.01 million in shorts. The largest liquidation event of $1.97 million occurred on Bybit, a leading exchange, for the BTCUSDT pair. It is conceivable that Bitcoin could retest lower levels before attempting a breakout above $100,000.

The Coinglass Liquidation Map confirms that if Bitcoin turns bullish and claims the $99,100 price level, an astonishing $1.25 billion in BTC shorts will be wiped off from the digital asset space. If the $100,000 price level is reclaimed, it would result in $1.80 billion worth of short liquidations for Bitcoin.

The 20-day Exponential Moving Average (EMA) is currently presenting a significant resistance for the Bitcoin price action. The 20-day EMA stands at 98,800, and reclaiming this level with substantial volumes could lead to a bullish reversal for BTC.

ADA, AI Tokens Gain Amid Bitcoin Dip

While Bitcoin’s price action remained uncertain, the altcoin sector turned bullish. ADA skyrocketed 9.73% in the last 24 hours and is currently trading at $0.7699, according to CoinMarketCap data. This price surge is the result of digital asset management firm Grayscale including ADA in the exchange-traded fund (ETF) race.

On the other hand, artificial intelligence tokens, including Bittensor, also turned bullish with a 5% increase in the past day. Kaspa also jumped about 5%, AI Rig Complex (ARC) soared more than 41%, and ai16z shot up close to 30% in the past 24 hours. The price surge of ARC and ai16z was due to a new whale, “8u6u3,” purchasing 12.511 million ARC and 6.508 million AI16Z tokens.

Destra Network (DSYNC) and Qubic (QUBIC) also turned bullish, shooting up around 7% and 9%, respectively. The total market cap of the AI sector stood at a monumental $34.73 billion but is expected to grow further.

0 notes

Text

7 Forex Market Setups: EUR/USD Trends & Trade Strategies

Market Analysis

GOLD

Gold prices remain consolidated, currently positioned near the EMA200 and the lower boundary of a key consolidation zone. Both MACD and RSI indicators support this consolidation phase. We're waiting for a decisive move to signal the next trend direction. Among the 7 Forex Market Setups this week, gold stands out as a prime example of how geopolitical risk—such as President Trump’s recent tariff threats—can create safe-haven demand. As the market reacts, this setup demands careful monitoring for breakout opportunities. For deeper insights into gold and forex strategies, visit RichSmart FX.

SILVER

Silver continues to show signs of consolidation. Until a definitive breakout or breakdown occurs, we maintain a neutral stance. As part of the 7 Forex Market Setups worth tracking, silver's technical structure reflects hesitation amid broader market uncertainty. This setup is important for traders waiting to catch a momentum shift. See additional silver trade resources from RichSmart.net.

DXY

The U.S. Dollar Index (DXY) is trading sideways, hinting at a potential bearish continuation. Momentum indicators like MACD and RSI suggest further selling pressure may emerge. Within the 7 Forex Market Setups featured this week, the DXY’s indecisiveness mirrors broader uncertainty in USD performance. Its movement is critical in shaping direction across multiple forex pairs. For DXY and USD correlation analysis, explore Axel Private Market.

GBPUSD

GBP/USD finds support at the EMA200, with RSI indicating bullish momentum nearing overbought territory. A minor pullback is possible near the 1.34998 resistance zone. However, MACD suggests sustained bullish momentum. As one of the 7 Forex Market Setups, GBP/USD presents an opportunity aligned with positive sentiment for the Pound. It’s a key chart to watch for continuation or potential reversal signs. Learn more from GFS Markets.

AUDUSD

AUD/USD is bouncing off the 0.64086 support level with growing bullish volume. Momentum indicators are aligned with further upward movement. Included in this week's 7 Forex Market Setups, the Australian Dollar offers a clear trend structure for strategic forex trade planning. Follow up with analysis at DBGMFX.

NZDUSD

NZD/USD shows a strong bullish rejection from recent support levels. MACD confirms increased buying pressure, although the RSI is nearing overbought levels. Among the 7 Forex Market Setups, NZD/USD stands out with its momentum-rich environment, presenting a solid candidate for tactical price action trading. Get NZD insights at TopMax Global.

EURUSD

EUR/USD remains trapped in a consolidation zone, retesting its upper boundary. While MACD hints at bullish momentum, the RSI’s approach toward overbought conditions urges caution. This pair is central to the 7 Forex Market Setups due to its high relevance and potential for breakout. EUR/USD trend analysis remains essential here. For expert perspectives, check WorldQuest FX.

USDJPY

USD/JPY has failed multiple attempts to break above the EMA200, suggesting bearish potential. Despite this, long-term trend structure still supports bullish continuation. As part of the 7 Forex Market Setups, USD/JPY highlights a dual narrative—short-term bearish signals versus longer-term bullish structure.

USDCHF

USD/CHF has weakened following a recent retreat from highs. Prices are consolidating under resistance, with bearish signals from MACD and RSI. Included in the 7 Forex Market Setups, USD/CHF shows potential for further decline, pending confirmation through key support levels.

USDCAD

USD/CAD continues to slide as CAD strengthens, driven by a strong Q1 2025 GDP report (2.2% annualized) and reduced likelihood of an immediate rate cut by the BoC. This pair rounds out the 7 Forex Market Setups, offering a bearish bias that aligns with current macroeconomic fundamentals favoring the Canadian dollar.

COT Market Analysis

AUD - WEAK (5/5)

GBP - STRONG (5/5)

CAD - WEAK (5/5)

EUR - STRONG (3/5)

JPY - STRONG (3/5)

CHF - WEAK (4/5)

USD - MIXED

NZD - WEAK (4/5)

GOLD - STRONG (3/5)

SILVER - STRONG (5/5)

Final Thoughts

This week’s 7 Forex Market Setups showcase a range of opportunities across metals and major currency pairs. Strategic forex trade planning and consistent application of price action trading remain critical, especially with EUR/USD and related setups in consolidation or reversal zones. As geopolitical and economic developments evolve, being selective and disciplined in execution will help traders capitalize on the most favorable market conditions.

0 notes

Text

Global Markets Update: Gold, Oil, and USD/THB Trends Lower

Financial markets have experienced significant volatility over the past week, influenced by shifting economic policies, geopolitical uncertainties, and fluctuating risk sentiment. Traders have been closely monitoring central bank decisions, particularly the Federal Reserve’s stance on interest rates, as well as broader macroeconomic developments that continue to shape market direction. Gold, crude oil, and the U.S. dollar have been at the center of recent price action, reflecting both technical and fundamental drivers. While gold has struggled to sustain gains near key resistance levels, crude oil has witnessed a sharp decline as supply-demand concerns weigh on sentiment. The U.S. dollar remains a key focus, especially in emerging markets where shifting risk sentiment has driven currency fluctuations, including the Thai Baht.

The U.S. dollar has maintained strong momentum amid shifting rate expectations and economic data. As a safe-haven asset, its movement has influenced commodity prices and emerging market currencies. A stronger dollar tends to pressure gold and crude oil, while also impacting the performance of currencies like the Thai Baht. Upcoming inflation data and Federal Reserve commentary will be pivotal in shaping the next moves for the dollar, commodities, and emerging market currencies. All times mentioned in this report are in BST.

Gold (XAU/USD) Analysis

Gold prices have seen heightened volatility, reaching a high near $2051 before encountering resistance and pulling back. The rejection at this level led to a period of consolidation, with buyers stepping in around $2025–$2030 to establish short-term support. The formation of an upward trendline has helped stabilize price action, but gold remains at a pivotal level as traders weigh technical patterns against fundamental drivers.

XAUUSD H1

On the fundamental side, the Federal Reserve’s monetary policy outlook remains a key catalyst. Traders are closely watching the Fed’s future rate decisions, with any signs of a more dovish stance likely to support gold. Additionally, broader risk sentiment, ongoing geopolitical tensions, and movements in the U.S. dollar remain critical. A weaker dollar could provide renewed upside momentum, whereas continued USD strength may cap gold’s gains.

From a technical perspective, gold needs to hold above $2040 to sustain upward momentum and potentially retest $2051. A breakout beyond this level could pave the way for further upside. On the downside, $2025 serves as key short-term support, with a break below increasing the risk of a deeper retracement toward $2010–$2000.

CFTC data indicates strong speculative interest in gold, though a breakout above $2051 is needed to confirm bullish momentum. Looking ahead, traders should closely monitor macroeconomic data, particularly inflation reports, Federal Reserve commentary, and any shifts in risk appetite, as these will likely dictate gold’s next move.

Crude Oil (WTI) Analysis

Crude oil prices have experienced a sharp decline, reversing from a peak near $72.80 and entering a steep downtrend. The chart highlights a clear downtrend line, with prices repeatedly failing to break above resistance before accelerating downward. Currently trading around $70.30, oil has broken multiple support levels, and increased selling pressure, as indicated by rising volume, suggests that bearish sentiment is in control.

USOILRoll H1

The selloff may be attributed to a combination of fundamental and technical factors. On the macroeconomic front, concerns over slowing global demand and uncertainty regarding OPEC+ production policies have weighed on crude prices. Additionally, the stronger U.S. dollar has placed further pressure on oil, making it more expensive for foreign buyers. China’s crude demand remains uncertain, with mixed economic signals on industrial output adding to market caution. Any slowdown in demand from the world’s largest importer could exert further downside pressure on prices.

From a technical standpoint, the failure to hold above the $71.50–$72.00 zone triggered an increase in selling, leading to further downside momentum. For key levels to watch, $71.50–$72.00 now acts as resistance, as it aligns with the trendline and represents the previous breakdown area. On the downside, $70.00 serves as a psychological support level, with a further decline potentially opening the door to $69.50 as the next downside target. If the price stabilizes near $70.00, a relief bounce could occur, but continued weakness may signal further declines.

Fundamental catalysts, including U.S. inventory reports, OPEC+ production outlooks, and global economic data, will remain crucial for crude oil’s trajectory. Traders should remain cautious and assess macroeconomic indicators alongside technical signals to navigate potential price movements.

USD/THB Analysis

The USD/THB pair has exhibited significant volatility in recent sessions, with a sharp reversal from its high of 36.73 leading to an extended decline toward the 35.50 region. The chart highlights a clear rejection at the recent peak, followed by sustained selling pressure, which suggests that traders have been capitalizing on the dollar’s earlier strength by taking profits. Despite some stabilization, the broader trend remains uncertain as both fundamental and technical factors continue to influence price action.

USDTHB H1

One key driver behind the Thai Baht’s recent resilience has been improving sentiment in emerging markets. With risk appetite fluctuating, investors may be positioning themselves in Asian currencies amid expectations of steadier regional economic growth. Thailand’s trade performance, particularly its export sector, also plays a crucial role in determining the Baht’s strength. A strong recovery in tourism, a key pillar of Thailand’s economy, could provide further support for the currency in the medium term.

The Thai Baht, along with other Asian currencies, has strengthened due to shifting investor sentiment toward emerging markets. However, any resurgence in U.S. rate hike expectations could challenge this trend.

On the U.S. side, the dollar’s performance remains highly dependent on Federal Reserve policy expectations. While the Fed has maintained a cautious approach, any shifts in inflation data or labor market conditions could influence the dollar’s direction. A more hawkish stance from the Fed would likely drive USD/THB higher, while softer inflation data could lead to further dollar weakness.

From a technical perspective, 36.73 remains a key resistance level, marking the recent high before the strong reversal. A breakout above this level could indicate renewed bullish momentum, with potential upside toward 37.00. On the downside, 35.50 is acting as an important support zone, and a confirmed breakdown below this level could expose the pair to further losses, potentially targeting 35.30 or even lower.

Key Technical Levels to Watch and Forward-Looking Considerations

Gold, crude oil, and USD/THB are at key technical levels, with upcoming macroeconomic events likely to determine their next moves.

· Gold (XAU/USD): $2051 remains a significant resistance level. A sustained breakout above this level could pave the way for further upside. On the downside, $2025 serves as an important support zone, with a break below increasing the risk of a decline toward $2010–$2000.

· Crude Oil (WTI): $71.50–$72.00 is a critical resistance zone, while $70.00 remains key support. If breached, the next downside target is $69.50.

· USD/THB: 36.73 acts as a key resistance level, while 35.50 serves as important support. A break lower could signal further downside toward 35.30.

With volatility persisting, traders should stay focused on upcoming macroeconomic releases, Federal Reserve policy expectations, and broader geopolitical developments. Risk management remains crucial in positioning for the next major market move.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

🧭 What Are Support & Resistance? Your Trading Decisions Depend on These Levels

Support and resistance are foundational pillars in technical analysis. Support refers to a price level where a stock tends to find buying interest—demand outweighs supply. Resistance is the opposite—supply overwhelms demand, halting price advances.

These levels aren't just numbers on a chart. They represent mass psychology. When a stock like Reliance Industries falls to ₹2,400 and repeatedly bounces, that level becomes a psychological floor for buyers. Similarly, if Tata Motors repeatedly stalls around ₹1,000, traders see it as a ceiling.

🔍 According to a CME Group study, more than 65% of professional traders use support and resistance in combination with price action or volume indicators.

🧠 Why Do These Levels Work? It’s All About Market Psychology

Support and resistance work because market participants remember pain and reward. When retail and institutional traders see prices stall or bounce at certain zones, they mentally anchor around them.

👉 Imagine Infosys falls from ₹1,600 to ₹1,400, then rebounds. Traders who missed buying now wait at ₹1,400, expecting another bounce. That demand creates support.

💡 Resistance forms when people who bought high and suffered losses rush to sell when prices bounce back to their breakeven, limiting upside.

📈 In markets like NIFTY 50 or Bank NIFTY, institutional flows amplify these levels. FIIs and DIIs (Foreign and Domestic Institutional Investors) create large order clusters that reinforce support/resistance.

📊 How to Spot Support and Resistance on Any Chart

Start by opening a clean candlestick chart on Strike Money, TradingView. Remove indicators and zoom out to see the bigger picture.

🔎 Look for: ✨ Recent swing highs and lows ✨ Multiple price touches at the same level ✨ Reversal candles (like hammer or shooting star) at key zones ✨ Gaps or consolidation ranges

🎯 Example from the Indian market: In March 2024, HDFC Bank repeatedly bounced from ₹1,370, creating a clear support zone. Meanwhile, ₹1,540 acted as resistance during multiple retests before a breakout.

🔄 Dynamic vs Static: Not All Support/Resistance Are Equal

Most new traders focus only on horizontal levels. But seasoned pros watch dynamic levels too. These are constantly evolving based on price action and trend.

📍 Static Support/Resistance: ➡ Based on historical highs/lows (e.g. NIFTY pausing near 22,000 repeatedly)

📍 Dynamic Support/Resistance: ➡ Based on indicators like moving averages or trendlines ➡ Example: A 50-day EMA often acts as support in trending markets

🔁 Tools like Strike Money let you apply SMA, EMA, and Fibonacci retracements to spot these moving levels in real time.

🚨 Breakouts, Fakeouts & Trap Zones: What Every Trader Must Know

Support and resistance don’t last forever. When price breaks through, it signals one of two things: strength or deception.

💥 Breakout: When price breaks resistance (like ICICI Bank surging past ₹1,100), it's a bullish sign—often supported by volume.

💣 Fakeout: When price briefly crosses a level then reverses, it's a trap. Retail traders get caught. This happens often in low-volume environments or during news events.

🎯 In Jan 2025, Adani Enterprises faked out above ₹3,200 only to drop below ₹2,900. Those who didn't wait for confirmation lost big.

🧪 Research from John Murphy’s Technical Analysis of the Financial Markets reveals that false breakouts happen in over 40% of resistance test cases—especially without volume confirmation.

💹 Proven Strategies That Actually Work with Support & Resistance

Support and resistance aren’t just theoretical—they form the backbone of profitable setups. Here’s how to turn levels into entries 👇

🎯 Bounce Trade: Buy near support with a clear stop-loss just below it. Sell near resistance. Classic in range-bound markets.

💡 Example: L&T trading between ₹3,000 and ₹3,200. Every bounce near ₹3,000 with a reversal candle was a clean entry.

🚀 Breakout Entry: Wait for a close above resistance. Enter on confirmation with volume. Works best with momentum names like Zomato or IRCTC.

↩ Pullback to Broken Resistance: When resistance breaks and becomes new support, that’s your entry zone. Called support-resistance flip.

✅ Tip: Use RSI and volume to confirm your entry. Strike Money provides visual cues for both.

🌏 How Support & Resistance Varies in Stocks, Forex, and Crypto

Support and resistance is a universal concept, but how it behaves differs across asset classes.

📈 Stock Market (India): Clear levels due to business cycles, earnings, and institutional flows. Weekly charts for Infosys, Reliance, and HDFC often show textbook zones.

💱 Forex: More fluid. Currency pairs like USD/INR respond to macro news, making S&R less sticky unless supported by volume clusters or economic zones.

🪙 Crypto: Levels are often respected on a shorter timeframe due to 24/7 volatility. For example, BTC/INR showed strong resistance around ₹50L in 2024, flipped to support in early 2025.

⚠️ Support and resistance in crypto often breaks more violently due to lack of circuit limits and liquidity traps.

🔍 What Makes a Level Strong? It's Not Just the Price

Not all support/resistance levels are created equal. Strength depends on:

⏳ Time Spent: More candles = stronger level 🧱 Number of Touches: Repeated bounces reinforce the zone 📊 Volume at the Level: High volume = institutional interest 🧠 Psychological Levels: Whole numbers like ₹1,000, ₹10,000 often act as magnets

👀 Strike Money’s volume profile tool helps you identify volume-based support and resistance zones visually.

⚠️ Common Mistakes Traders Make with Support and Resistance

Let’s be honest—everyone makes these early on:

❌ Drawing Lines Instead of Zones: Price reacts in zones, not exact levels ❌ Chasing Breakouts Without Confirmation: Breakouts need volume ❌ Ignoring Timeframes: A support on 1-min chart is noise on a daily chart ❌ Placing Stop-Loss Right at the Level: Always place it below/above the zone, not within

🚫 In March 2025, Zee Entertainment triggered many stop-losses at ₹180 before bouncing hard from ₹177. Lesson: respect zones, not exact levels.

🛠️ Smart Tools to Level Up Your S&R Game

The right tools can dramatically boost accuracy. Here’s how to automate and simplify your support-resistance workflow:

🧭 Strike Money: ✓ Auto-zones with adjustable sensitivity ✓ RSI, MACD and Fibonacci overlays ✓ India-centric stock universe (NSE, BSE) ✓ AI alerts for fakeouts and breakouts

📈 TradingView: Great for multi-timeframe analysis Custom S&R indicators and alert systems

⚙️ MetaTrader: Used heavily in forex markets Supports expert advisors for zone-based trading

❓ Frequently Asked Questions About Support and Resistance

❓ Can support become resistance? ✅ Absolutely. This is called a flip zone. When TCS broke ₹3,800 in Jan 2025, it later found support at the same level after a retest.

❓ What timeframe is best for S&R? ✅ Depends on your style. Swing traders prefer daily/weekly, scalpers go to 5-min. Combine at least two timeframes for confirmation.

❓ Is support/resistance reliable in the Indian market? ✅ Yes. With NSE’s retail and institutional activity, S&R is highly respected. Tools like Strike Money even track how many times a level has been tested.

❓ How often do fakeouts happen? 📊 Around 40-50% of breakouts in low volume zones result in false moves, especially during opening hours or pre-budget sessions.

🏁 Final Thoughts: Master the Market by Mastering the Levels

Support and resistance aren’t magic—they’re price memory. They reflect where buyers and sellers are likely to act again. Mastering them gives you the edge over impulsive, emotional traders.

Whether you're trading NIFTY Futures, Bank NIFTY options, or mid-cap stocks like BHEL or BEL, respecting support and resistance can transform your win rate.

💡 Platforms like Strike Money are making it easier than ever to visualize and trade these levels with precision, especially in the Indian stock market context.

0 notes