#chart patterns with breakout

Explore tagged Tumblr posts

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

Nifty Forecast Tomorrow: Expert Predictions and Market Trends You Should Know

If you're looking for the most accurate Nifty forecast for tomorrow, you're not alone. Every day, thousands of traders and investors closely follow the Nifty 50 index, aiming to anticipate the next market move and get a step ahead of the volatility. In this post, we break down key technical levels, current sentiment, and expert-backed strategies to help you prepare for the trading session ahead.

📊 What Is the Nifty 50 and Why Its Forecast Matters

The Nifty 50 is India’s flagship stock market index, representing 50 of the largest and most liquid companies listed on the National Stock Exchange (NSE). It's a key barometer for market trends and investor confidence.

A well-researched forecast for Nifty 50 movement tomorrow can be highly valuable for:

Intraday traders planning entry and exit points.

Swing traders timing short-term opportunities.

Investors staying aligned with macroeconomic trends.

🔍 Nifty 50 Technical Analysis for Tomorrow

1. Key Support and Resistance Levels

Based on today’s market close and recent trading patterns:

Support zones: 22,300 and 22,180

Resistance zones: 22,500 and 22,640

If the index breaks above 22,500 with momentum, it may push higher. A drop below 22,180 could shift sentiment toward bearish.

2. Moving Averages

Nifty is trading above both 20-day and 50-day EMAs, suggesting the trend remains positive.

The Relative Strength Index (RSI) is around 58–60, reflecting healthy momentum without overbought conditions.

3. Candlestick Pattern

Today’s session showed indecision, forming a neutral candle. A breakout candle or a bullish engulfing pattern tomorrow would be a strong confirmation of upward momentum.

🗣️ Market Sentiment & Global Cues

Sentiment in the market remains cautiously optimistic. Some of the key global and domestic factors influencing the Nifty forecast tomorrow include:

U.S. Federal Reserve commentary on interest rates

Movement in crude oil prices

INR/USD exchange rate fluctuations

Institutional investor activity (FII/DII inflow/outflow)

FIIs were net buyers today, a signal that global appetite for Indian equities remains intact — at least for now.

📈 Expert Outlook: Nifty Forecast for Tomorrow

Analysts are leaning towards a mild bullish trend continuing into tomorrow’s session, assuming no sudden negative cues overnight. That said, volatility is likely to spike during the first hour of trade.

Here are some smart trading reminders:

Don’t chase early price gaps.

Stick to well-defined stop losses.

Wait for volume confirmation, especially near breakout zones.

💡 Tip: A breakout above 22,500 on strong volume could provide a high-probability setup for short-term trades.

🛠️ Action Plan for Traders

Intraday Traders

Observe the first 15–30 minute range for market direction.

Indicators like MACD, RSI, and volume spikes are crucial for timing entries.

Use a trailing stop-loss strategy once in profit.

Positional Traders

Consider adding long positions above 22,500 with upside targets around 22,800.

If Nifty dips below 22,180, reassess and wait for a base to form before entering.

🔗 Live Updates and Tools

Want more granular data? For real-time charts, key levels, and analyst videos, check out the full Nifty 50 forecast and live analysis page.

📬 Final Thoughts

A well-informed Nifty prediction for tomorrow helps traders cut through the noise and take calculated risks. No forecast is 100% guaranteed, but combining technical signals, market sentiment, and global cues can give you an edge.

Trade smart. Stay disciplined. And always have a plan.

#nifty forecast tomorrow#nifty 50 prediction#nifty 50 forecast#nifty technical analysis#nifty trend tomorrow#share market forecast#stock market prediction#nifty outlook#nifty analysis#nifty trading strategy#nifty support and resistance#nifty levels tomorrow#intraday trading tips#stock market india#nifty market trend#nifty tomorrow analysis#nifty movement prediction#NSE forecast#indian stock market forecast#market trend analysis#technical analysis nifty 50#nifty 50 chart#fii dii data analysis#stock market update today#trading view nifty#nifty live updates#nifty chart pattern#nifty stock tips#nifty breakout strategy#nifty candlestick analysis

0 notes

Text

Gold Surges Amid Geopolitical Tensions & Forex Market Shifts

GOLD

Gold has reached record highs as geopolitical risks escalate. Reports indicate Iran is accelerating its nuclear program, heightening investor uncertainty. Former President Donald Trump suggested potential U.S. intervention in Gaza, later moderated by aides, while talks on renegotiating the Iran nuclear deal add to market volatility. Washington’s proposal for a resolution in the Russia-Ukraine conflict further complicates global markets. Technically, forex chart patterns indicate a bullish structure. The RSI reflects strong momentum, while algorithmic trading signals suggest potential resistance levels. However, the MACD signals a possible pullback, and the EMA200 remains a key support level. Unless a clear reversal emerges, gold's overall outlook stays bullish.

SILVER

Silver struggles to break past the 32.5177 resistance level. The RSI reflects consolidation with bullish undertones, and the MACD highlights limited selling pressure. Breakout trading methods indicate continued bullish potential, provided the market sustains its gradual buildup in buying interest.

DXY

The worldwide economic indicators signal a shift as the Dollar Index (DXY) slides below 107.834, confirming a bearish momentum. The MACD shows weak buying volume, while RSI indicates overbought conditions. The upcoming Non-Farm Payroll (NFP) report will be a crucial factor, but expectations of a prolonged rate cut cycle weigh on the dollar’s strength.

FOREX PAIRS

GBPUSD

The Pound surged past resistance before retracing amid speculation of a 92% chance of a rate cut. The MACD suggests strong momentum, while the RSI indicates oversold conditions, supporting potential bullish attempts. However, market direction hinges on upcoming economic data and central bank policy.

AUDUSD

The Australian Dollar sees buying pressure as the U.S. dollar weakens. The MACD hints at bearish undertones, but the RSI signals oversold conditions, aligning with capital distribution strategies. A continued bullish outlook is expected unless key support levels break.

NZDUSD

The Kiwi consolidates near 0.56859 after surpassing key resistance. MACD indicates low volume, while RSI suggests oversold conditions, pointing to further upside potential. If consolidation continues, a breakout higher may be in store.

EURUSD

The Euro remains cautiously bullish, supported by the EMA200. RSI indicates buying interest, but resistance at swing highs restricts momentum. A potential breakout is likely, contingent on economic developments and market sentiment.

USDJPY

The Yen strengthens amid Bank of Japan rate hike expectations. The MACD recently crossed upward, signaling a short-term correction, while RSI reflects overbought dollar conditions. The downtrend holds as long as BOJ maintains a tightening stance.

USDCHF

The Swiss Franc maintains its downtrend. The MACD presents mixed signals, while RSI indicates overbought conditions, reinforcing bearish momentum. The EMA200 acts as a resistance level, capping potential upside.

USDCAD

The Canadian Dollar stabilizes near key support but remains in a broader bearish trend. The MACD suggests strong selling volume, while RSI signals overbought conditions, limiting upside potential. Consolidation may persist, but overall sentiment favors further downside.

COT REPORT ANALYSIS

AUD: WEAK (5/5) GBP: WEAK (4/5) CAD: WEAK (4/5) EUR: WEAK (4/5) JPY: WEAK (1/5) CHF: WEAK (5/5) USD: STRONG (4/5) NZD: WEAK (4/5) GOLD: STRONG (5/5) SILVER: STRONG (4/5)

These market movements align with forex chart patterns, breakout trading methods, and capital distribution strategies, helping traders navigate shifting economic conditions.

#Breakout trading methods#Algorithmic trading signals#Capital distribution strategy#Worldwide economic indicators#Forex chart patterns

0 notes

Text

GIFT Nifty Indicates Muted Opening; UCO Bank Hikes Lending Rates by 5bps for Certain Tenures

for more details click here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

So now she wants to be a popstar??!?!

So, theres now a new article from the Sun, and it’s honestly hilarious how bold they’re being. Like, they’re not even trying to sell us a love story any more. No “forever and always,” no “Louis has found The One.” Nope, it’s straight-up, “This is probably good for her career.”

I mean, at least they’re honest?

They’re literally hyping Zara for “dating up” and calling this relationship a “clever move” to help her focus on her “true passion”—music. Because apparently, being linked to Louis gives her a better shot at a chart-topping career than, you know, actual talent. They’re not even hiding that this is a PR chess move.

The funniest part? They’re not even trying to make this seem long-term. It’s all about short-term benefits: getting Zara back into music and boosting her profile. Louis is basically just a stepping stone, and they’re not even sugarcoating it.

Look, we don’t know why Louis agreed to this—maybe it’s tied to contracts, favors, or something bigger we don’t see yet. Remember how wild Holilva seemed until we figured out that A*off had financial stake in DWD and then we got My Policeman which seemed like some sort of tradeoff? Same chaotic vibes here.

So yeah, it’s messy. It’s obvious. But stunts like this are rarely random. Zara’s getting her career boost, the tabloids are eating it up, and Louis? Well, we’ll see what his angle is soon enough. Until then, let’s just laugh at how unsubtle this is and keep the Faith in the Future

OH AND DONT GIVE THE SUN CLICKS.

If you want to read an article, use https://12ft.io/proxy to get around the paywall.

ONE DIRECTION

The secret reason why Zara McDermott grew close to Louis Tomlinson and the clever way she always ‘dates up’

Zara's true passion has taken a back seat in recent years, insiders say

Dan Cain, Senior Showbiz Reporter

Published: 12:48, 18 Mar 2025

Updated: 12:48, 18 Mar 2025

LUCKY in love Zara McDermott has scored herself a pop prince after she was snapped on a date.

And we can reveal the secret reason she’s growing close to new man Louis Tomlinson, 33.

The Love Island beauty, who split from ex-boyfriend Sam Thompson over Christmas, was pictured with Louis at a hotel in Aldeburgh, Suffolk, just days after One Direction fans began speculating they were an item.

Though it’s still very early days, onlookers said they looked a happy couple as they giggled while drinking cocktails and eating fish and chips.

The pair stayed at the £315-a-night hotel before travelling to London the next day.

The stunning duo have all the attributes to become the new showbiz power couple, thanks to his huge global One Direction fanbase and her ties to the popular Love Island and reality TV market.

And a romance with Louis finally gives Zara, 28 - who has always dreamt of her own chart-topping music career - a firm footing in the music scene.

Not only that, but some say Zara has seriously upgraded - from love with an E4 reality favourite to a multi-millionaire global superstar.

Finding romance with Louis follows Zara’s pattern of "dating up" - a clever move of falling for ever more successful, high-profile men.

A source said: “Zara’s undoubtedly hot property in her own right and one of Love Island’s most successful breakout stars.

“She’s always done well to reinvent herself over the years and has been prepared to make the necessary changes to her career and personal life to take things to the next level.

“But while her modelling and TV work have progressed, her true passion - music - has taken a bit of a back seat.

“A relationship with Louis would allow her to submerge herself into music and let her focus on her passion that she has neglected in recent years.”

The former civil servant regularly showcases her impressive voice on social media, which is no surprise to those who tuned into Celebrity X Factor in 2019 and watched Zara perform as part of No Love Lost.

But she hasn’t been able to replicate the musical success of bandmates Wes Nelson and Samira Mighty, who are now fully focused on careers in the music business.

Wes is a bona fide solo star with a number three hit and a collaboration with Craig David, while Samira has had her music played by Radio 1 and reached the top five of the UK club chart.

Since her X Factor stint, Zara has turned her hand to making serious documentaries such as Uncovering Rape Culture and Inside Ibiza, the latter of which took a look at the dark side of the party island.

Though Louis previously stated that he wasn’t interested in anything to do with Love Island, he seems to have changed his mind after his siblings endorsed Zara.

Fans recently noticed how heartthrob Louis began following Zara - who was already Instagram friends with his twin sisters Daisy and Phoebe, 20, as well as his older sister Lottie who is a makeup artist to the stars.

There’s even been speculation Zara’s next TV project might involve the siblings and that this is how the pair met.

But regardless of their professional connection, the Tomlinson girls paved the way for Zara and Louis to begin dating by giving her a glowing review.

An insider said: “Louis is so famous that meeting a girl authentically on a dating app or down the local pub is practically impossible.

“He’s very close to his sisters and knows they have his best interests at heart.

“The fact they have actively given Zara their blessing says a lot about her character.

“It’s been a very difficult past few months following the death of Liam [Payne].

“He realises life is too short and Louis is determined to make 2025 a positive year for himself and live life to the full - and Zara could play a major part in that.”

Despite being worlds apart, it appears opposites do attract as Zara and Louis’ backgrounds couldn’t be more different.

Working class Doncaster lad Louis’ journey to superstardom began in 2010 when he applied to the X Factor as a solo artist.

During the process, show mogul Simon Cowell pieced together rejected hopefuls Louis, Harry Styles, Liam Payne, Niall Horan and Zayn Malik to create One Direction.

Though they didn’t win the series, they were its breakout stars and went on to become the biggest boyband in the world.

Just five years later, the shock departure of Zayn marked the beginning of the end of the group.

At the same time, Zara was embarking on a promising career in the civil service as Operational Officer and Correspondence Drafter for the Department of Energy and Climate Change.

Two years on, as Louis released a top 10 solo track with Bebe Rexha, Zara became a Policy Advisor for the Department for Education, before going on to find her first taste of fame in the Love Island villa the following year.

During her time in Majorca, Zara had a sizzling romance with tall, dark and handsome Adam Collard, widely considered the ultimate Love Island hunk.

The relationship was short-lived in the real world though, with Adam insisting it had naturally run its course while Zara said she would always hold a special place in her heart for him.

It didn’t take long for either to move on and just months later Zara started a relationship with Made In Chelsea’s Sam Thompson, with the pair posing for loved-up selfies on social media.

However, the romance was dealt a huge blow early on after it emerged Zara had cheated on Sam with top music executive Brahim Fouradi - an associate of Simon Cowell’s - while competing on X Factor.

Formerly an International A&R Manager for Cowell’s label Syco, Zara’s ill-judged tryst with Fouradi hinted at her desire to fall for the bright lights and trappings of the music biz.

25 notes

·

View notes

Text

HL FIC LIBRARY ✤ AUTHOR REC

AO3: juliusschmidt

Tumblr: @juliusschmidt

STATS:

✤ Number of fics: 67

✤ Posting Since: 2013

TOP 5 FICS:

1️⃣ Cameras Flashing {E, 81k}

With his breakout single platinum three times over and his second album still selling out in stores around the world, Louis Tomlinson has made it to the top. However, his position as Pop Heartthrob of the Decade is threatened by the edgier, more artistic Zayn, who happens to be releasing an album a week after Louis’ upcoming third. Louis needs something groundbreaking- scandalous, even- to push past him in the charts. Much to Louis’ dismay, his PR team calls in The Sexpert.

Consulting with PR firm Shady, Lane and Associates pays the bills so that Harry Styles can spend his down time doing what he really loves: poring over data. On weekends and late into the evenings, he researches gender, presentation, and sexual orientation, analysing the longitudinal study that is his father’s life’s work. That is, until his newest client, the popstar with the fascinating secret, drags him off his couch and frighteningly close to the spotlight.

As the album’s release date approaches, will Tomlinson and Styles be able to pull off the most risky PR scheme of the millennium and beat Zayn in sales or will the heat of their feelings for each other compromise everything?

2️⃣ Introduction to Dynamics {E, 29k}

Louis Tomlinson is the outspoken omega in the 'Introduction to Dynamics' course Harry wishes he didn't have to take. He's nearly certain to present as a beta, after all. Things will be simple for him.

3️⃣ I'll Fly Away {E, 122k}

Harry and Louis grew up together in Lake County, Harry with his mom and stepdad in a tiny cottage on Edward’s Lake and Louis in his family’s farmhouse a few minutes down the road. But after high school, Louis stuck around and Harry did not; Harry went to Chicago where he found a boyfriend and couple of college degrees. Six years later, Harry ends up back in Edwardsville for the summer and he and Louis fall into old patterns and discover new ones.

ft. One Direction, the local boyband; Horan’s Bar and Grill; families, most especially children and babies; Officer Liam Payne; many local festivals and fireworks displays; and Anne Cox, PFLAG President.

4️⃣ little wings on my shoes {M, 39k}

You have C Lunch?” Louis asks, peering over at Harry's work. The problem Harry’s just finished is printed neatly, the correct answer circled. Harry’s finger marks the next problem in his book as he copies it onto the page. It doesn’t look like he’s stealing the answers out of the back. Nice.

He’s dimpled and smart.

And probably gay.

[The American High School AU in which no one is cool (except Niall) and Harry wears a rainbow bracelet.]

5️⃣ The Worst Fucking Idea {M, 3k}

Liam suggests Harry and Louis do Seven Minutes in Heaven, just like they always used to in high school.

HIDDEN GEM:

💎 the bearded stranger {M, 1k}

Harry wakes up to a bearded stranger in his bed.

39 notes

·

View notes

Text

Forex Volatility Secrets: What the Top 1% of Traders Use to Dominate the Market

Forex volatility is often viewed as both a challenge and an opportunity in the fast-paced world of trading. For the majority of traders, volatility represents a threat—an unpredictable force that can quickly wipe out profits. However, for the top 1% of traders, volatility is an ally, an essential element they’ve learned to harness to their advantage. In this article, we’ll delve into the secrets behind how these elite traders master Forex volatility, with expert insights from Sangram Mohanta, a Forex trader with 15 years of experience. We’ll also share a real-life success story and discuss the importance of website security in Forex trading.

Understanding Forex Volatility

Forex volatility refers to the rapid price fluctuations that occur within the foreign exchange market. Volatile markets experience sharp, often unpredictable price movements, making them exciting for traders who know how to profit from these swings. However, volatility can also lead to substantial losses for those who aren’t prepared.

For top traders, volatility is not something to fear. Instead, it’s an opportunity to make substantial profits. By understanding the causes of volatility—such as economic data releases, political events, and central bank decisions—they can predict market movements and make informed trading decisions. Mastering this volatility is key to dominating the market.

Expert Insights: How Sangram Mohanta Dominates Forex Volatility

Sangram Mohanta, a Forex trading expert with over 15 years of experience, has been trading through various market conditions, including high-volatility periods. According to Mohanta, “The key to success in volatile markets isn’t to avoid the fluctuations but to embrace them and learn to read the signals the market is sending.”

He believes that the top 1% of traders use a combination of technical analysis, a deep understanding of economic fundamentals, and precise risk management strategies to profit from Forex volatility. Mohanta recommends staying informed about global economic events that can trigger volatility, such as GDP reports, central bank decisions, and geopolitical developments.

“Volatility is predictable if you understand the forces driving it, says Mohanta. By closely monitoring the economic calendar and using the right tools, traders can prepare for and capitalize on these movements rather than being caught off guard.

Insider Secrets to Mastering Forex Volatility

So, what are the specific secrets that top traders use to dominate the Forex market during volatile conditions? Here are a few key strategies that the elite traders rely on:

Leverage Advanced Technical Analysis: The top 1% of traders are masters of technical analysis. They use sophisticated chart patterns, candlestick formations, and indicators like the Average True Range (ATR) and Bollinger Bands to assess market volatility. By identifying patterns such as breakout or reversal signals, traders can time their entries and exits with high precision, capitalizing on price swings.

Use Fundamental Analysis to Anticipate Volatility: While technical analysis is vital, top traders also use fundamental analysis to anticipate volatility. For example, when a central bank is about to announce interest rate decisions, there is often heightened volatility. Traders who track economic data and geopolitical events can predict potential market reactions and position themselves accordingly.

Implement Smart Risk Management: The difference between a successful trader and an unsuccessful one is often the ability to manage risk. Top traders know that Forex volatility amplifies the potential for loss, so they never risk more than they can afford to lose. This is why they use techniques like setting tight stop-loss orders, scaling into positions, and employing position sizing strategies to protect their capital.

Trade with Smaller Time Frames: In volatile markets, large price movements can happen within short time frames. Many successful traders take advantage of this by trading on smaller time frames (such as 5-minute or 15-minute charts) to catch intraday price swings. This allows them to stay nimble and capitalize on short-term volatility.

Stay Disciplined and Patient: While volatility creates opportunities, it also leads to impulsive trading decisions for many. Top traders remain disciplined and patient, sticking to their strategies even when the market is chaotic. They understand that not every price movement needs to be acted upon, and waiting for high-probability setups is often more profitable than chasing every fluctuation.

Real-Life Trading Success Story: How John Turned Volatility into Profit

John, a novice trader, once struggled with the volatility of the Forex market. In the beginning, he was overwhelmed by rapid price changes and found himself losing money more often than winning. However, after following the strategies taught by Sangram Mohanta, John’s approach to trading transformed.

John began to pay close attention to economic calendars and the events that created market volatility, such as U.S. Federal Reserve announcements and European Central Bank policy meetings. Using technical tools like Bollinger Bands, John started to identify price breaks and volatility expansion, allowing him to catch high-reward trades during these periods of market movement.

One of John’s most successful trades came during a highly volatile week when the U.S. Dollar experienced significant fluctuations due to a surprise rate cut by the Federal Reserve. John positioned himself ahead of the news, using his technical analysis to predict the likely direction of the market after the announcement. As a result, he was able to capitalize on the initial price surge, closing out with a substantial profit. John’s success story exemplifies how understanding Forex volatility and applying strategic methods can lead to substantial gains.

Website Security Features: Trading Safely in a Volatile Market

In addition to mastering volatility, it’s crucial to prioritize the security of your funds and personal information when trading Forex. As volatility can attract cybercriminals, ensuring your trading platform is secure is paramount.

Top Forex brokers, recommended by Top Forex Brokers Review, implement advanced security measures to protect traders. Here are some key security features to look for:

SSL Encryption: A secure trading environment starts with SSL encryption, which ensures that any data exchanged between you and your broker is encrypted and cannot be intercepted by third parties. This protects your personal information and funds.

Two-Factor Authentication (2FA): Many trusted Forex brokers offer 2FA as an added layer of protection. This requires you to enter a unique code sent to your phone or email in addition to your password, making it harder for unauthorized users to access your account.

Regulation and Licensing: Reputable brokers are regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These regulatory bodies ensure brokers meet strict security standards and safeguard client funds.

Secure Trading Platforms: The best Forex brokers provide trading platforms with built-in security features, such as real-time monitoring of transactions, secure login systems, and encryption to prevent unauthorized access.

By choosing a broker with a strong security infrastructure, you can focus on your trading strategies without worrying about cyber threats or financial risks.

Why Choosing the Right Broker Matters

When navigating the volatile Forex market, your broker plays a pivotal role in your success. A trusted broker ensures that you have access to the right tools, market analysis, and a secure trading platform. Top Forex Brokers Review evaluates brokers based on key factors such as regulatory compliance, customer service, and platform reliability. Choosing the right broker is essential for capitalizing on market volatility and achieving long-term trading success.

Conclusion

Forex volatility doesn’t have to be a source of stress. By adopting the strategies used by the top 1% of traders, such as leveraging technical and fundamental analysis, implementing smart risk management, and staying disciplined, you can turn volatility into an opportunity for profit. Expert traders like Sangram Mohanta have built successful careers by mastering the art of trading during volatile periods—and you can too.

Additionally, don’t overlook the importance of website security. By choosing a trusted and regulated broker with robust security features, you can trade with peace of mind.

With the right knowledge, tools, and security measures, you can dominate the Forex market and join the ranks of successful traders in 2025. For expert broker recommendations and more insights into trading strategies, visit Top Forex Brokers Review—your go-to resource for Forex trading success.

3 notes

·

View notes

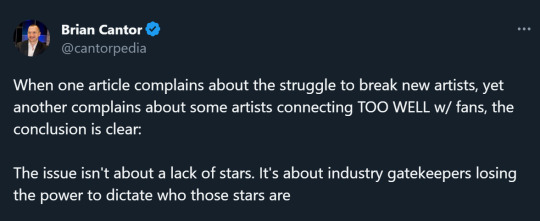

Note

Hi BPP,

I'm convinced Billboard has a spilt personality for real because how do you write an article about it being difficult to produce big stars right now, turm around a do a hit job on K-pop and Jimin specifically in order to quash his chances for any American noms and awards

***

Hi @ejassy

Lol Billboard doesn't have a split personality, you're just not really listening to all they're saying.

(Brian is something of a twat sometimes but even he has his moments)

Billboard's problem is not that it's difficult to produce big stars right now, it's that (1) the big stars that are being produced are doing so outside the legacy framework and direct influence of the American rainmakers - the American labels and middlemen who would demand their cut, and instead it's fans of various artists who can influence which artists rise to the top; and (2) that the big artists that are being produced (by fan engagement) are increasingly non-white, non-American, and non-English-speaking.

That's their conundrum.

It's a problem they've had since 2018 when BTS out of nowhere showed up in the top 10 on the Hot 100 with Fake Love after it not just went viral, but was sustained on the charts driven by demand from American pop listeners (this was the time many members of the Bey hive joined the ARMY fandom and BTS caught on with the pop-listener 'gp' in huge numbers). Since then, every award-season article Billboard has published (since 2019) has had the same tone as the one published yesterday, with each year Billboard getting more overt in their disdain, and the quiet part of what they actually mean to say, getting louder.

I've been writing on this blog for over a year about BTS, k-pop, fandoms, and the music industry, and if there's one thing I suggest people take from it, it's this: it's important to understand that everything about BTS represents a world in which the industry gatekeepers as they're currently structured, are rendered obsolete.

It's why the Korean music establishment had a similar reaction to BTS from 2013 - 2017. BTS should not have been as successful as they became, they didn't come from a Big 3 company with all their industry connections as most successful groups did, they didn't have the backing of an American conglomerate as more recent breakout groups like Fifty Fifty did, they didn't have the typical visuals, sound, vocals, styling, etc that the most popular and successful groups did.

All they had was their hunger, their talent, their hopes, and their pride, with Bang PD using every bit of streetsmarts he had to navigate the cutthroat competitive environment in the industry. And the fandom quickly realized, as early as 2014, that they could not possibly operate like every other k-pop fandom if they wanted BTS to ever have a fair chance.

It wasn't until BTS became too big to ignore both inside and outside Korea, that the Korean music establishment start giving them their dues. Personally, I expect the same pattern for Western recognition. BTS was well on pace to deliver on that promise in 2020 with their MOTS tour - it was planned to be bigger than Taylor Swift's tour is today, back then. It was rumoured to be bigger than anything anyone, even Beyonce, had done till that point.

...but we all know what happened. Dynamite was a huge hit but in comparison to what could've been, it was a pitiable substitute.

Cue the English trilogy and Grammy attempts, snubs, and hiatus. Now there's a vacuum left by BTS, that most k-pop groups are trying to use to establish themselves with the same toolbox ARMYs and Western stans are using, while leveraging BTS's reputation, and the American middlemen are watching to see which groups are most compatible for them to partner with so they too can get in on the action and not get left behind.

Because the reality is that the landscape has changed. Fan engagement is not going away and will have to become a key consideration for creating 'big stars'. Everybody recognizes this. Not everybody likes it, not everybody accepts it, but everyone understands that this is now how the cookie crumbles, and that BTS and ARMY are a big reason this is now the status quo.

And the fact is this has earned the group and fandom, more enemies than friends.

Jimin, by virtue of being a BTS member, is not exempt.

Like I said before, there are many types of people in fandom spaces and everyone has their own reasons for being here. Some trivial, some not. But anybody who actually considers themselves an ARMY should take the time to understand what it means to be a fan of BTS. In my opinion.

#I suspect the nominations we see for the Grammys will show how the industry is adapting with non-BTS k-pop players#It's going to be educational#bts#bangtan#jimin#park jimin#kpop#kpop music#music industry#kpop industry#hybe#bighit#grammys#grammys 2024

60 notes

·

View notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

Market Bounce After December Low Breach Encouraging

DJIA closed below its December closing low (page 36 STA 2025) on Friday, January 10, 2025 for the 39th time since 1950. Historically, this event has been associated with further market weakness. And with the Santa Claus Rally (SCR) failing to materialize this year our seasonal indicator antennae have been twitching. But S&P 500 did register a positive First Five Days (FFD) putting our January Indicator Trifecta at 1 for 2 so far with the full-month January Barometer (JB) holding the key. All three Trifecta components are based on the S&P 500 on a closing price basis.

This week’s softer inflation readings from PPI and CPI removed some of the market’s fears that sticky inflation would cause the Fed to hike rates. The 10-Year yield may have peaked here in the near term at least as stocks had their biggest one-day rally since the day after the election. Stocks appear to have found support around the election breakout gap around S&P 500 5775.

Reviewing the data associated with both the DJIA December Low indicator and the January Indicator Trifecta we found that there were only four other prior years that had a down Santa Claus Rally, a close below the prior DJIA December closing low and positive First Five Days and/or January Barometer: 1980 both FFD and JB up, S&P 25.8%, 1991 FFD down, JB up, S&P 26.3%, 1993 FFD down, JB up, S&P 7.1% and 1994 FFD and JB both up, S&P -1.5%.

In the above chart of the 30 trading days before and the 60 trading days after DJIA closed below its December closing low we have split the previous 38 DJIA December low crossings into four groups along with 2025 as of yesterday’s close (January 15) for comparison. With just four occurrences, years like 2025 have been second best on average with 1994 the big drag. The best performance was observed by the years that had the smallest decline after DJIA closed below its December low. Years with greater than a 10% decline after the cross had the weakest performance. Most importantly, it appears the quicker DJIA recovers after crossing below its December low, the better its performance was. DJIA’s quick rebound this year off the December low crossing is encouraging.

Using the same groupings to plot DJIA’s 1-year seasonal pattern we see nearly the same outcome. Full-year average performance is the best when one of the two remaining January Indicator Trifecta components is positive. Smaller declines and quick recoveries also lead to better full-year performance figures. Current readings are in line with our bullish forecast for 2025 with a base case of 8-12% and best case of 12-20%.

5 notes

·

View notes

Text

How to Trade the Three White Soldiers Pattern: Strategies and Examples

Technical analysis offers traders a wide range of candlestick patterns to predict price movements. One of the most reliable and bullish reversal patterns is the Three White Soldiers. This pattern, when used correctly, can signal a strong trend reversal and provide profitable trading opportunities. In this post, we’ll explore what the Three White Soldiers pattern is, how to identify it, and…

#Best strategies to trade the Three White Soldiers pattern#breakout trading patterns#Bullish candlestick pattern#Bullish Reversal Pattern#bullish trend reversal#candlestick chart patterns#Candlestick pattern confirmation#How reliable is the Three White Soldiers candlestick pattern#How to identify Three White Soldiers on a chart#How to trade Three White Soldiers#How to use RSI with Three White Soldiers pattern#Identifying Three White Soldiers#Intraday trading strategy using Three White Soldiers#Japanese candlestick patterns#learn technical analysis#Price Action Trading#Risk Reward Ratio#stock markets#stock trading#Stop Loss Strategy#successful trading#support and resistance zones#technical analysis#Technical analysis candlestick patterns#Three White Soldiers candlestick#Three White Soldiers candlestick pattern in stock trading#Three White Soldiers confirmation#Three White Soldiers pattern#Three White Soldiers pattern example#Three White Soldiers pattern with volume confirmation

0 notes

Text

Is Stellar (XLM) on the Verge of a Major Breakout? Here’s What You Need to Know.

Stellar is back in the spotlight. Known for its mission to connect financial institutions and unbanked communities, Stellar’s momentum is building. Key analysts predict potential gains of over 600%. Behind this is a mix of bullish chart patterns, some well-chosen partnerships, and a few strategic moves to improve security. Let’s dive into what’s driving this potential rally.

Bullish Patterns Signal a Potential Rally for XLM

Stellar (XLM) is trading between $0.09 and $0.10, with a market cap of $2.72 billion has shown some strong bullish signals. Popular crypto analyst Javon Marks recently pointed out multiple confirmed patterns that suggest XLM could be setting up for a breakout target of around $0.681. That’s a big leap from its current price of about $0.09149. If these patterns hold, it could mean more than 600% potential gains.

Stellar’s Partnerships with Financial Giants

Stellar has been quietly building partnerships that could make a real difference in its long-term success. Its most notable partnerships include Mastercard and Franklin Templeton, representing Stellar’s real-world impact and its growing credibility.

Mastercard and Stellar are exploring ways to use blockchain to improve the speed and security of financial transactions. Then there’s Franklin Templeton, a major player in asset management, which chose Stellar to support its OnChain U.S. Government Money Fund. This partnership says a lot about Stellar’s reliability and appeal.

Enhanced Security with Blockaid

Recently, Stellar partnered with Blockaid, a company specializing in security for decentralized applications (dApps). This is more than just an upgrade; it’s a way to attract developers and users who need a secure environment for their projects.

Key takeaways

Stellar’s current price, around $0.09149, may present an attractive entry point for investors. With a growing list of partnerships and a focus on security, it is a standout project in a sea of competitors. Crypto markets remain unpredictable, and competition from similar projects like XRP adds pressure. But with a strong focus on partnerships and security, Stellar might be on the verge of something big.

Is Stellar (XLM) worth watching? let us know in the comments.

2 notes

·

View notes

Text

That's Alright For Such a Night (Rewrite Chapter 6)

Word Count: 3,293

Writers Note: So far I'm enjoying rewriting this, and Now I'm adding and Rewriting my fanfic series Anyway you do into it to really solidify the timeline.

Warning: mostly fluff / Historic Language and Values

Pairing: POC OC x Elvis

Plot: During the Louisiana Hayride two breakout stars meet in a rush only to learn they've dealt their cards in the hands of fate.

Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8

Tennessee July 3rd, 1956

"How am I gonna cover this up, my boy."

"Any way you do." Elvis shrugged. Tom was nearly devastated, sitting in his office looking at Elvis like a parent would, "You are already in trouble for dancing like a colored man... Now this!" he slammed the newspaper on the table,

"Lightin' up, Colonel. It was just some fun." Elvis smiled, thinking about all the fun he had that night. He felt like Elvis again, not the Elvis that was available for everyone, but the small-town poor kid from Tupelo who was with the love of his life.

"We were just gettin our kicks," Cecelia said, putting on her pink sling-back heels.

"Some kicks!" Denise shouted, "Cecelia Shanel Valmos! Just on the other side of us in Alabama, there's the bus protest where we're getting beaten and slandered for having this skin color,"

"It's not that serious." she rolled her eyes, "I mean, the bus protest is, but Pres and I.."

"Pres and you doing what. You could lose fans over this."

"You could lose fans over this, Elvis." Tom slammed his fist on the table,

"Already lost 'em with that damn hound dog trick Colonel," he said, pushing his hair back.

"What's so special about him anyways..." Denise asked, sitting back in her chair.

"Mama..." Her mother glared at her when her Southern accent arrived,

"Mother, he's kind and sweet. He's crossing barriers. Maybe I could, too." Cecelia said as she looked love sick, her mother slash manager hating every inch of it,

"The only barriers you could cross is in music."

"Maybe that's what I wanna do," she mumbled,

"And besides, why not Chuck Berry or Little Richard." her mother kept listing artists. Cecelia was picking up a pattern here, but she wouldn't call her mother out on it.

"Mama Little Richard ain't exactly uh... well..a lady's man." she hinted as her mother rolled her eyes, "And besides, El is good people. We're neck and neck on the charts." she smiled, "And we toured together."

"Yeah, neck and neck on the charts with a colored woman who pretends to be you," Tom mentioned as Elvis groaned,

"She ain't pretending to be me. If anything, she's better than me."

"How's that, my boy..."

"Well, she's got stage presence. It's like she commands the crowd, and they listen."

"They do the same to you." Tom rolled his eyes, looking at contracts.

"Yeah, but when she does it... it's I can't explain it..." he sighed. He was lovesick. And he had it so bad it was like a fevering cold.

"She's..."

"Brave, mother, I mean, he goes up there coat tails looks like a butler still manages to look handsome and, Mornin Midge."

"Morning, Cece, talking about Mr. Presley again."

"When is she not." Denise sighed, "Lately, he's all she's got on her tongue." Midge nearly choked at her boss's words,

"Well, uh, You've got some memos and calls, Mrs. Valmos," Midge said as she was walking towards her desk in the office,

"From who?" Denise questioned,

"Frank Sinatra, Ella, Sammy, Dean, Sam," Midge sipped her coffee, "And an Elvis A Presley." she smiled as Denise took the card that had Elvis's number on it,

"Oh no, this is for Ms. Valmos only." Midge took the card from her hand,

"For me..." Midge gave her a nod,

"Tell him I'll call him back."

"Tell him to stop calling the studio so damn much..." Denise rolled her eyes.

"I'll handle it..." Midge smirked,

Cecelia dialed the number on the card. She could hear the phone ring as a lump in her throat appeared. It wasn't like they didn't talk all the time, but Cececlia had never been scared to have someone answer the phone,

"Hello, Elvis, darlin!"

"Who is this..."

"Cecelia Valmos and you are?"

"Mrs. Gladys Presely, his mother." she glared at her son, who was in the kitchen eating a quick lunch, covering the bottom half of the phone. She took a deep breath,

"Elvis Aaron Presley...How many times have I told you stop givin' those wayward girls the family phone number?"

"Mama, I-I..."

"There's one on the phone now, Booby. Says her name is Cecelia Valmos, which can't be right cause the only Valmos I know is the jazz singer and-"

Elvis took the phone from his mother as he cleared his throat from embarrassment.

"I-I uh uhm Cece, Hi!. Hey..." he tried to play it cool as she laughed,

"Hey El, I was, uhm, returning your call. My manager, Uh, well, she hung up on you." Cecelia laughed as she leaned against the wall, trying to act cool as Midge walked by and rolled her eyes, laughing at her.

"Figures... Hey, look, you doing anything tomorrow night,"

"I can't. I'm flying to New York for a performance taping."

"O-oh, I see." he had a tone of despair.

"Why, what's wrong?"

"Nothing."

"El...EP... Pres.. Sugar... Dumplin, Mr. Pretty Blue Eyes, tell me." she said as he blushed,

"Nothing Cece, uh, enjoy New York an bring me back one of them big hot dogs." he laughed.

"Thanks..." she sighed. Something had to be wrong, but what was it.

"You look sad, Booby.." Gladys sighed,

"I'm fine, mama."

"Looks like it's about a girl..." Vernon smirked,

"It seems like it always is with you." Gladys shook her head,

July 4th 1956 Memphis Tennessee, / New York City

The plane ride to New York was relaxing, but all she could think of was why in the world did Elvis sound so upset. Did she say something wrong, or did her mother say something wrong? Laying back in her seat as she was overthinking, Cecelia was rushed to NBC studios and her dressing room.

"Midge," Cecelia called out as she looked at the dresses picked for her to wear. They were all more modest and hardly even danceable, not that she had a problem with modesty, but she was known as the rock n roll pinup. The Risque roller. It was an image she was leaning into.

"What's wrong, Cece."

"It's about Pres," she sighed, dressed in the bright yellow detachable cumberbund skirt dress.

"Oh, tonights the Russwood Park Concert." Cecelia looked at her, confused,

"It's the biggest event in anyone's career," Midge smirked, "Your mother also booked you here so you wouldn't run into Elvis cause of your current scandal..."

"Can we still get back in time before he performs..." Cecelia asked, ignoring her last statement.

"I can arrange something."

After Cecelia performed, she sat in front of Ed Sullivan, in front of an America that didn't resemble her. But here she was on her best behavior.

"Lovely to have the daughter of the Legendary Valmos with us tonight. Tell us how you keep your nails so pretty while playing the guitar."

"A guitar pick and practice." she smiled.

"And those moves. Now I remember seeing you on another show dancing like a... ah, what's his name, the Elvis fellow." he laughed, "Tell me any inspiration from him?"She sighed, knowing what question was coming next, "How's it feel to be compared to him as the lady Elvis... or are you perhaps his lady..." she was asked as she was about to open her mouth.

"I'm joking. You might not even be Elvis's type." Ed laughed, "Since you two are kinda similar," as Cecelia laughed. Cecelia wanted to vomit,

"Actually, he and I are great friends..." she smiled, "We've been on tour from 54 to 55 together, and we learned a lot from each other."

"So when do you plan to settle down."

Thousands of screaming fans flooded the park as the cop cars and escorts drove into Russwood Park. Elvis was trembling like a leaf, with one person on his mind, and she wasn't there. He'd thought about what she'd say or a little joke she'd tell him, but it wasn't the same without her there.

"What are you gonna sing, my boy."

"I'll know it when I feel it." was all he had to say. He was all dressed in black. And he was ready to make a statement. Elvis wanted to be taken seriously. Sure, he was a singer. He was young. Elvis also wasn't a fool. And Elvis wanted his fans to know he wouldn't be some tails-wearing guy who would change for some lousy TV people from New York City. Elvis was a Tupelo, Mississippi, boy. And he was proud of it. And if anyone was looking for trouble, they came to the right place.

"Midge, can you drive any faster!" Cecelia shouted, the two nearly racing down the street in Midge's red Chevrolet Bel Air,

"And get a ticket and end up in jail and dead, fuck no!" she sighed, putting the pedal to the metal. Bobbing and weaving through traffic,

"You did it when we were on tour!"Cecelia smirked,

"Oh, what the hell, let's go!" Midge smirked back,

"You're gonna do great out there, Booby..." Gladys smiled, kissing his cheek,

"Just don't go wigglin a pinky, son," Vernon laughed. Both Gladys and Elvis shook their heads at his joke.

"Come on, come on, come on..." Cecelia sighed. The lines were atrocious, and the security was multiplied by 100. Getting an idea, Midge looked at Cecelia and groaned, "You're not ripping that dress... It's custom-made Dior."

"Don't care..." Detaching her skirt, Cecelia took her shoes off as she began to climb the hot metal gate, hoping security wouldn't notice her and her tree-climbing skills wouldn't fail her now.

"Hey, you in the yellow!"

"Shit..." she mumbled to herself,

"Me..." she pointed to herself.

"Yeah, you!" The guard pointed to her. Cecelia was at the top of the gate. The height from where she was was a tad too high, but either she jumped or missed the performance in total.

"Ain't you that jazz singin' colored woman's kid."

"Yeah, I am..."

"Then get yer ass down here!" Cecelia gulped and jumped. Now, she had to find a way to get closer to the stage. There was a straight line in the middle, but it was also the color barrier, and Cecelia couldn't risk breaking it. Or maybe she could,

Midge grumbled, looking through the gate. She could see Cecelia preparing to make a run for it via the segregation rope God. Did she hope Cecelia would do what she had in mind?

"Godspeed, Cece..."

"Those city folks ain't gonna change me none!" the music began to start, and so did her feet,

"Oh, her mother's gonna kill me." She was on the wrong side of the tracks, running as if her life depended on it. But at the same time, this was her boyfriend. Midge only hoped he'd be there for her the way she was for him. As the performance ended, Cecelia went to find him backstage, running like the flash to get to him, until Cecelia saw a beautiful blonde kissing him. Her heart sank, and suddenly, all she could think of was running towards the studio and recording her feelings.

How do you think I feel?

Well, I know your love's not real

The Boy I'm mad about is just a gadabout

How do you think I feel?

King Creole Premier Hollywood, California July 2nd, 1958

"Elvis, look at the camera!"

"No, look at this one!"

"Elvis over here!"

The crisp California air was no stranger to Mr. Presley, nor were the cameras and interviews. This had been his 4th movie premiere in the span of only 2 years, and the press and women loved him. But there was something still missing, or more like someone still missing. Elvis had taken The Colonel's advice to try to forget about Cecelia. But it was hard, especially since she hadn't talked to him much between her interviews, tours, and films. And he couldn't blame her. She wanted to go on a break with their relationship, but He'd been on numerous dates, some his mother didn't approve of, others that she did approve of too much. But they weren't her.

As he continued walking down the red carpet, he heard and saw the commotion coming from down the carpet. He could smell the scent of Femme de Rochas perfume, making him do a double take on the scent, and he could feel the ground shift from the switch in her walk.

"Cecelia tells about your tour!"

"Ms.Valmos, The Lucile Ball radio show? How's that going?"

"When are you gonna settle down?'

Cecelia had been the talk of every household. And now, on the red carpet, her once long locks of 1956 were now cut into a short bob, similar to Betty Boop. She was in a skin-tight lilac dress with a satin ribbon bow around her waist and black Dior gloves, walking further down as she smiled. Cecelia loved it, but she had to be honest. Cecelia missed Elvis. Sure, things had gotten rocky after Russwood Park, but he was her best friend.

"All the rumors are true," she said with her signature smile. Cecelia had been busy, now finding her footing in Rock n Roll and blues, becoming a heartthrob, and attending rallies with King since her debacle in 56. She was quite the cat's meow. There were still more questions, and she answered them all the best she could. As Cecelia kept walking, Midge saw, some friends of hers that she wanted to say hi to.

"Say there I've never seen you be..."

"Elvis..." her heart was pounding, he was more handsome than she remembered,

"Fore..." Elvis looked at her as she hugged him,

"Look at you and your hair..." he was mesmerized by her new look. Standing before him wasn't the same 21-year-old woman running him out of crowds. No, she was a beautiful bombshell, and he couldn't take his eyes off her when she hugged him. He wanted to hold her forever. He wanted. To apologize for all the stuff he'd done. Elvis wanted her back.

"Pres.." she kissed his cheek, red lipstick lingering,

"Oh, sorry, you probably got a girl now an-"

"Actually, I don't... I-I uh, I came here by myself minus The Colonel." he laughed, "Bet you got a ton of men following you."

Cecelia laughed, "Oh me, nah, came with Midge. You remember Midge, right?"

"Your mama's assistant,"

"Yeah." she blushed, her eyes lost in his own. Something about him in the suit was doing it for her. It was like she was back during the Hayride days, and she had first glanced at him,

"Would you maybe wanna be my date then?"

"Me your date?" she laughed,

"Oh, come on, doll, you know you're still in love with me." he laughed as she looked up at him. This was true, but she'd never admit it, so she'd hoped she wouldn't.

"Where'd you hear that Pres."

"One of those magazines." he laughed, taking her hand and walking into the theater. Midge wasn't too far away, but she gave them space.

Watching Elvis act had been one of her favorite things, especially when it came to his kiss scenes. She'd imagine herself instead of the actresses, which was how her mother caught her accidentally kissing a microphone.

She was on the edge of her seat the entire time, and he was loving every second of it. Raking his arm, he placed it over her shoulder as she leaned closer to him. He had been focused on her the entire time, almost like he wanted to see the world through her eyes, the way that she saw him. He had noticed that when he sang Trouble she was breathlessly mesmerized, in a trance even.

"Hey, Cece..."

"Shush... you're singing," she responded as he chuckled a little. When the movie finally came to an end. There was Cecelia and Elvis walking out together laughing, and joking like they used to do,

"I never asked why you stormed off during Russwood." She felt her heart sink again as she remembered that night.

"You saw me..."

"In bright yellow," he added,

"I had to leave early..."

"Cece..."

"An emergency..."

"Cecelia Shanel Valmos, don't lie to me..."

"I saw you kiss another girl and."

"You thought I was cheating on you..."

"Yeah, I did..." Stepping closer to her, Elvis took her hand on his cheek,

"Doll, I would never hurt you like that... But,"

"The Colonel made you do it." She took his hand away from his face as he nodded,

"Yeah, he did, actually..." Elvis sighed as Cecelia shook her head, "You gotta tell him what you're going to do, who you are, your Elvis Presley, Now Danny Fisher." she poked at him as he smiled, " Most importantly, A man I'd like to kiss again." the last part slipping out of her mouth.

"You wanna kiss me again?" he blushed,

"I wanna kiss Danny Fisher."

"Darlin, I am..."

"Are you, though?" Cecelia said as she winked at him. Elvis tilted her chin up as he leaned in and kissed her sweetly. A bit of need and longing. Her arm was around his neck, the other on his chest. When he pulled away, her knees nearly went weak, and she could hardly stand. "Darlin... I think there's somethin between us and... It's the most alive I've ever felt." Elvis said,

"Pres." She looked at him. "What do we do about this..."

"I don't know, but it's gotta be before September."

"Why's that?" She looked at him,

"Well... I leave for Germany." he sighed, kissing her hand. "Right, the draft." a sad look in her eyes,

"Hey, It's only July. We got time." he grinned, "

Guess we do." she smiled, "So let's make the most of it."

Memphis Tennessee July 4th, 1958,

"Wanna explain who's this girl you're kissin?" Gladys said as Elvis sunk down like a puppy dog. "Who we haven't met yet..." she smiled at him, both hands on her hips as Vernon smirked,

"Cecelia Valmos and it was just a kiss, nothing else." he blushed hard,

"Damn, you're just as red as the carpet," Vernon mentioned, "If you like her all that much... then let us meet her." he shrugged,

"Cecelia, you can't keep compromising yourself." Denise said, she sighed, "We cleaned your image, and now you're kissing him on red carpets!"

"What's so bad about that!"

"You're not of his kind!" she slammed her fist on the table,

"I KNOW THAT, MAMA!" she sighed, "But give him a chance." Cecelia tried to calm down. She took a deep breath."I'm 23 now, and I can make my own decisions."

"Baby, he'll only hurt you, like you know who. Hurt you! she shouted, watching her daughter leave out the door.

"DON'T YOU WALK AWAY FROM ME CECELIA... DAMN IT!"

"Where's she going, Midge,"

"I don't know."

Tears streamed down her face as she drove like a bat out of hell to Graceland. It was late, but she needed to see him. She needed to get away from the madness, away from feeling like a cooped-up songbird in a cage.

"Hold me close, hold me tight," she heard her radio start to play, " Make me thrill with delight." she took a deep breath, "Let me know where I stand from the start." she could see the gates sprinkled with fans waiting, " I want you, I need you, I-I love you..." pulling into the gate, she drove to the front of his house.

"With all my heart..."

"Cecelia..." she ran into his arms as she sobbed, " Won't you please be my own? " she looked up at him. As he wiped her tear-stained cheeks. "Never leave me alone.

'Cause I die every time we're apart..." he focused on her voice,

"I want you, I need you, I-I-I love you...With all my heart"

Taglist: If you wanna be tagged let me know!

@darkmoviesquotespizza

@sissylittlefeather

@richardslady121

@thegettingbyp2

@presleyenterprise

@sissylittlefeather

@dkayfixates

@rjmartin11

@thetaoofzoe

MORE IN CHAPTER 7

#oc#fanfiction#new stuff#new#romance#elvis presley#new series#elvis fanfiction#elvis x oc#elvis the pelvis#poc oc x elvis#Cecelia valmos#50s elvis#50s#fanfiction rewrite#Spotify

7 notes

·

View notes

Text

GIFT Nifty Indicates Positive Opening; Hindustan Petroleum to Invest Rs 2,212 Crore in Raipur Pipeline Project

More details visit here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

In futures trading, investors rely on a variety of factors to make buying or selling decisions. Here are some key factors for investors to consider

Raw Trading Ltd

Market Analysis: Investors analyze the market conditions, including supply and demand dynamics, price trends, and market sentiment. They use technical analysis tools, such as charts and indicators, to identify potential trading opportunities.

Fundamental Analysis: Investors assess the fundamental factors that can impact the price of the underlying asset. This includes analyzing economic indicators, geopolitical events, weather patterns, and government policies that can affect supply and demand.

News and Information: Investors stay updated with the latest news and information related to the underlying asset. They monitor news releases, industry reports, and expert opinions to gauge the potential impact on prices.

Risk Management: Investors use risk management techniques to determine their entry and exit points. They set stop-loss orders to limit potential losses and take-profit orders to secure profits. Risk management also involves determining the appropriate position size and leverage to use in each trade.

Technical Indicators: Investors use various technical indicators to identify potential entry and exit points. These indicators include moving averages, oscillators, and trend lines. Technical analysis helps investors identify patterns and trends in price movements.

Trading Strategies: Investors develop and implement trading strategies based on their analysis and risk tolerance. These strategies can be based on trend following, mean reversion, breakout, or other trading methodologies.

Market Orders: Investors can place market orders to buy or sell futures contracts at the prevailing market price. Market orders are executed immediately at the best available price.

Limit Orders: Investors can also place limit orders to buy or sell futures contracts at a specific price or better. These orders are not executed immediately but are placed in the order book until the specified price is reached.

Stop Orders: Investors use stop orders to limit potential losses or protect profits. A stop order becomes a market order when the specified price is reached, triggering the execution.

Electronic Trading Platforms: Investors can access futures markets through electronic trading platforms provided by brokerage firms. These platforms offer real-time market data, order placement, and trade execution facilities. IC Markets

It is important for investors to conduct thorough research, stay updated with market developments, and have a well-defined trading plan to make informed buying or selling decisions in futures trading.

1 note

·

View note