#investment management company

Text

Investing wisely means understanding the risks involved. This blog from Yoj Investment breaks down the concept of risk, detailing the different types and how they can impact your investment strategy. Whether you're a beginner or an experienced investor, this guide will help you navigate the complexities of risk management.

#Here are some hashtags for the blog:#InvestmentRisk#RiskManagement#InvestmentTips#FinancialPlanning#YojInvestment#UnderstandingRisk#InvestSmart#RiskTypes#WealthManagement#InvestmentGuide#SmartInvesting#InvestmentKnowledge#FinancialLiteracy#RiskAwareness#Investing101#investment company#investment management company#investing

0 notes

Text

Alliance Investments Management

Explore the journey from beginner to pro in investment management, covering strategies, market analysis, and technological innovations, with insights on building a diversified portfolio for long-term success.

0 notes

Text

Unlocking the Aspects of Financial Prosperity

In the ever-evolving space of personal finance, financial prosperity can be paved successfully with informed decisions, strategic planning and a personalised approach to wealth management. Two essential players in this journey are financial advisory services and portfolio management services. These services are crafted by the finance experts in an investment management company. In this article, we will narrow down the essence of these services, shedding light on how they collaborate to guide individuals towards financial success.

Financial advisory services are like storytellers in the world of finance. They help individuals script their financial narratives by weaving together aspirations, goals, and a secured approach to wealth.

At the core of these advisory services is the strategic goal setting. The professionals in this domain work closely with clients to chart out clear and achievable financial objectives. Whether it's buying a home, funding education, or retiring comfortably, financial advisors create a roadmap that aligns personal ambitions with fiscal realities.

Our life is a journey filled with financial crossroads, and these advisory services act as a trustworthy compass. These services provide insights and strategies to travel through challenges such as changing employment, unexpected expenses, or shifts in personal circumstances. Advisors become reliable partners in the financial journey, offering support and expertise at every turn.

Complementary to the advisory services, portfolio management services delve into the field of tangible investments, creating a sketch that reflects the unique financial personality of each client.

They go beyond cookie-cutter solutions, focusing on the creation of customised investment portfolios. The professionals collaborate with clients to understand the risk tolerance, investment preferences, and time horizons.

The synergy between financial advisory and portfolio management services creates a synchronised mix in the financial sector. Financial advisors and portfolio managers work together, ensuring that the financial narrative is not only well-constructed but also dynamically responsive to market fluctuations. This commitment distinguishes an investment management company that prioritises the enduring financial wellness of their clients.

In essence, the financial advisory services and portfolio management services are vital components of a holistic approach to gain financial prosperity. Woven together by the skilled hands within an investment management company, these services empower individuals to go through life's financial journey with confidence, resilience, and a customised strategy that reflects their own financial story.

0 notes

Text

Selecting Wisely: Factors for Choosing an Investment Management Company

In today's complex financial landscape, individuals and businesses alike seek efficient ways to manage their investments and secure their financial future. An Investment Management Company plays a pivotal role in navigating this terrain. Understanding their functions, benefits, and essential considerations is crucial for those seeking expert financial guidance.

The Role of an Investment Management Company

An Investment Company (IMC) operates as a financial institution that handles investments on behalf of its clients. These firms offer a spectrum of services, including asset management, portfolio diversification, and financial planning. Their primary objective is to maximise client wealth by employing various investment strategies tailored to individual goals and risk tolerance.

The services offered by an IMC encompass a wide array of financial instruments, such as stocks, bonds, real estate, and commodities. Their expertise lies in analysing market trends, conducting risk assessments, and executing trades to generate optimal returns. By leveraging their industry knowledge and resources, these companies assist clients in making informed investment decisions that align with their financial objectives.

Benefits of Partnering with an Investment Management Firm

Partnering with an Investment Company provides several benefits that can significantly impact an investor's financial well-being. One of the key advantages is access to professional expertise. These firms are equipped with skilled financial advisors and analysts who possess extensive knowledge in the investment landscape. This expertise allows for personalised investment strategies, keeping in mind the client's specific goals and risk appetite.

Furthermore, IMCs often offer diversified investment portfolios. Through a diverse range of investment options, they help in spreading risk and potentially increasing returns. This diversity reduces the impact of market volatility on a single asset, promoting a more stable investment journey.

Another significant advantage of collaborating with an IMC is the time-saving aspect. Managing investments requires continuous monitoring, research, and timely decision-making. Delegating this responsibility to a proficient management company frees up time for clients, allowing them to focus on their core interests without compromising on their financial growth.

Factors to Consider When Choosing an Investment Management Company

Selecting the right Investment Company is crucial for a successful financial journey. Several factors should be considered before entrusting an IMC with your investments.

Firstly, understanding the fee structure and transparency is vital. It's essential to comprehend how fees are charged and the services included in the package. Transparency in these financial dealings is crucial for a healthy client-company relationship.

Secondly, assessing the company's track record and reputation is key. Researching their past performance, client reviews, and the company's adherence to regulatory standards provides insights into their reliability and credibility.

Additionally, aligning the investment objectives with the company's expertise is crucial. An IMC specialising in a particular market or investment type might be more suitable for specific investment goals.

Wrapping Up

Partnering with an Investment Management Company can significantly impact one's financial well-being. Understanding their role, the benefits they offer, and the factors to consider before choosing one are vital steps towards achieving financial goals. By making informed decisions and selecting the right IMC, individuals and businesses can secure a more prosperous financial future.

Remember, a well-chosen Investment Company can be a reliable partner in your financial journey, offering expertise, diversified options, and time-saving solutions to help achieve your investment goals.

0 notes

Link

Discover the benefits of choosing a financial intermediation investment management company, from expertise and diversification to personalized strategies.

0 notes

Text

i am insane someone please talk to me about them

#gregor limbus company#gregor samsa#dante limbus company#dante alighieri#limbus company#g corp manager corporal gregor#my art#gregante#gregor x dante#im so invested in those two you have no idea there is just a loop of gregor saying manager bud in my head

579 notes

·

View notes

Text

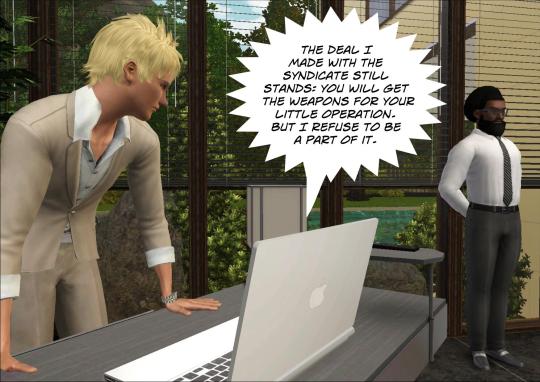

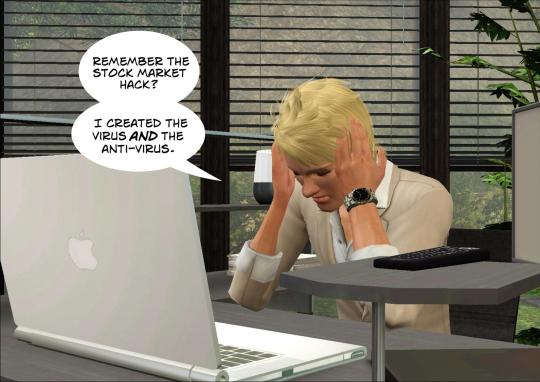

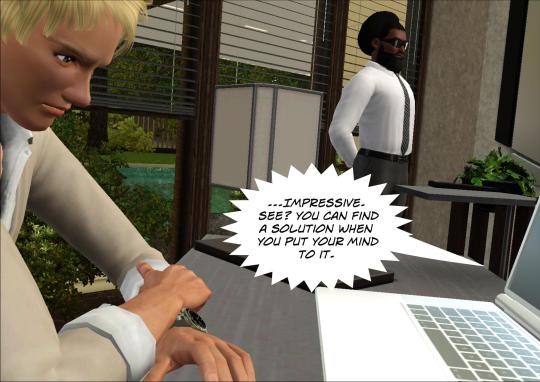

Author's note: Reference is made to the following scenes: (1), (2), (3)

#ts3#sims 3#sims 3 story#sims stories#tteot story#laurie golzine#omar ayad#muhammad al-saud#i'm sorry for going into details#i hate doing that#look i work in investment but imposter syndrome is kicking me hard#plus it's kind of difficult to make a plot look seamless when there is so much time between updates#in summary: laurie is managing a conglomerate including an investment fund of which noah is a partner#so laurie is a shareholder of a small tech company through that fund#he sold the antivirus via noah to that company as a solution to the virus he developed himself#when the stock market got hacked (by laurie) all companies rushed to get an anti-virus#but it also contained a spyware (also by laurie)#and this is how laurie's main business is now stealing data#laurie arc

70 notes

·

View notes

Text

GUESS WHO GOT THE FREAKING JOB

#augh my aeons of waiting and torment and inane bureaucratic crucibles are OVER#I don't start for a couple weeks but I will HAVE IT. hhh relief#it's interesting bc this experience is so much more formal than getting my old job... this company seems a lot more invested in due process#which is not a bad thing. I hope it means they're more reliable than my old manager was#but it is. augh. just glad it's all sorted out now#I'll get to hang out with my best friends the small children again !!

7 notes

·

View notes

Text

Turns out it wasn't just Bank Chanwut who left M.Flow but Willi Arawill, Frame Noraphat, Float Nattawut, Poom Soravis and Phuri Phuwanon as well (so basically their whole boygroup project that was showcased in Beyond the Star the series).

I wonder if this is a sign of another production company running into financial trouble or just a case of contracts not being renewed.

#bl industry#m.flow#thai bl#i think what we're seeeing here might indicate that the thai bl bubble is about to burst#not for creatives but for bl as a quick investment#the market must be saturated now#lots of previously announced projects are in limbo presumably due to a lack of funding#and compared to last year fewer projects are announced esp by smaller companies#add to that that big companies like gmm are dividing up the cake among themselves#there's not much room past the pandemic boom for even established smaller companies to stay afloat#this might not be a bad thing#but much like in the gaming industry it could be largely mitigated by good management and union-like structures

8 notes

·

View notes

Text

Simplifying Website Design and Development: Your Ultimate Guide

Simplifying Website Design and Development: Your Ultimate Guide

In today's digital age, having a strong online presence is essential for businesses of all sizes. A well-designed and developed website not only enhances your brand image but also serves as a powerful marketing tool to attract and engage customers. In this comprehensive guide, we'll explore everything you need to know about website design and development, including services, companies, and agencies in the USA and Canada.

Understanding Website Design and Development

Website design and development encompass the process of creating and building a website from scratch or redesigning an existing one. It involves various elements such as layout design, user interface (UI) and user experience (UX) design, coding, content creation, and optimization for search engines.

Website Design and Development Services

Professional website design and development services cater to the diverse needs of businesses seeking to establish or enhance their online presence. These services typically include:

Custom Website Design: Tailored design solutions to reflect your brand identity and meet specific business objectives.

Responsive Web Development: Building websites that adapt seamlessly to different devices and screen sizes for optimal user experience.

E-commerce Development: Creating online stores with secure payment gateways, product catalogs, and shopping cart functionality.

Content Management Systems (CMS): Integration of user-friendly CMS platforms like WordPress, Joomla, or Drupal for easy website management.

Search Engine Optimization (SEO): Implementing strategies to improve website visibility and rankings on search engine results pages (SERPs).

Website Maintenance and Support: Ongoing support, updates, and maintenance services to ensure website performance and security.

Website Design and Development Companies and Agencies

In the USA and Canada, numerous companies and agencies specialize in website design and development. These firms offer expertise in creating high-quality websites tailored to clients' unique needs and preferences. Some key characteristics to look for in a reputable website design and development company or agency include:

Experience and Expertise: Choose a company with a proven track record of delivering successful projects across various industries.

Portfolio: Review their portfolio of past work to gauge the quality and diversity of their designs and developments.

Client Reviews and Testimonials: Read reviews and testimonials from previous clients to assess their satisfaction and experiences.

Communication and Collaboration: Look for a company that emphasizes clear communication and collaboration throughout the project lifecycle.

Affordability and Value: Consider companies that offer competitive pricing without compromising on quality and value-added services.

Website Design and Development Companies in the USA and Canada

In the USA, reputable website design and development companies include:

ABC Web Solutions: A leading web development firm specializing in custom website design, e-commerce solutions, and digital marketing services.

XYZ Creative Agency: Known for innovative web design, responsive development, and SEO optimization strategies tailored to clients' specific needs.

123 Digital Studio: Providing comprehensive website design and development services, including UI/UX design, CMS integration, and ongoing support.

In Canada, notable website design and development companies include:

Maple Leaf Web Design: Offering professional website design, e-commerce development, and SEO services for businesses across Canada.

Great White North Digital: Specializing in responsive web design, custom development, and online marketing solutions to help Canadian businesses thrive online.

True North Web Solutions: A full-service web agency providing creative design, robust development, and strategic digital solutions tailored to clients' goals.

Conclusion

Investing in professional website design and development is crucial for businesses looking to establish a strong online presence and attract customers. By understanding the services offered and choosing reputable companies or agencies, you can create a visually appealing, functional, and user-friendly website that drives business growth and success.

Whether you're based in the USA or Canada, there are numerous options available to help you achieve your website design and development goals. Take the time to research, compare, and select the right partner to bring your vision to life and propel your business forward in the digital landscape.

#mobilepayment#ed teach#fintech startup#website#web development#web developing company#webcore#website development#smm services#seo services#webdesign#fintechindustry#investment#google ads#google adwords#google ad manager#google ad agency

15 notes

·

View notes

Text

Not Musk being right next to Nikola Tesla in the science section

My man is rotating in his grave right now

#nikola tesla#elongated muskrat#elon musk#Musk isn't even an engineer#he just invested in a few companies and managed to keep himself from ruining a few of them#do we thank Clarence William Nelson II whenever NASA does something cool

4 notes

·

View notes

Text

Overview Of Return On Investment Rates On Indonesia Property In 2023

Over the past few years, Indonesia has significantly improved its structural guidelines and macroeconomics. Indonesia’s economy is consistently growing and as a result, Indonesia is able to concentrate on its development strategies and processes.

There is a constant rise in property values and demand due to high levels of urbanization and rapid expansion of population in Indonesia. This has made the real estate market of Indonesia one of the most dynamic markets in the region.

Also, the pandemic crisis did not affect the Indonesian real estate market much. Hence, in terms of making investments, the Indonesian market is one of the most profitable choices.

There are many property investment opportunities in Indonesia for you to create another successful and profitable source of income. So, let us give you more detailed information about investment and ROI rates in Indonesia before you make your decision.

Necessary Information About ROI of Property Investment in Indonesia

Nowadays, both locals and foreigners buy property in Indonesia due to the high “ROI — Return on Investment” rate in Indonesia. Generally, property investment in Indonesia yields up to 20% to 30% ROI annually. However, the ROI rate may differ depending on the location of the property.

One of the reasons why property investment in Indonesia is offering such a high ROI rate is that this country is all set to become one of the most powerful global economic hubs in the coming years.

As a result, you will be able to recover your capital investment in the initial 10 to 12 years if you have purchased the property with a 25-year lease. You will gain good profits until your property lease expires. Also, you can always renew the lease at any time you wish.

Read more: Overview Of Return On Investment Rates On Indonesia Property In 2023

#apartment management service#across the spiderverse#property investment in indonesia#buy property indonesia#propertymanagement#property management company in indonesia#property management indonesia#real estate in indonesia#property rentals indonesia#real estate investment#property auction in indonesia#property management company indonesia#indonesia real estate#buy property in indonesia#property maintenance services#short-term rental property

2 notes

·

View notes

Text

Trends and Innovations in Investment Portfolio Management

Investing has come a long way, and the methods of managing investment portfolios are evolving at a rapid pace. The world of finance, including investment management companies, is embracing trends and innovations that are reshaping how we grow and safeguard our wealth. In this article, we'll delve into some of the latest developments in investment portfolio management, and fund accounting, and how it's all being facilitated by forward-thinking investment management companies.

Diving into Data-Driven Decisions

One of the significant trends is the increased reliance on data-driven decision-making. An investment management company now harnesses the power of big data and advanced analytics to make informed choices. They scrutinize vast amounts of financial data to identify trends, assess risk, and optimize portfolio performance. For instance, by examining historical data and real-time market indicators, investment managers can spot opportunities and make timely adjustments to investment portfolios.

AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning have also found a home in the world of investment portfolio management. These technologies allow investment management companies to create intelligent algorithms that can learn from historical data and adapt to changing market conditions. For example, AI-driven systems can assess a portfolio's risk exposure and automatically rebalance assets to align with the investor's goals.

Incorporating Sustainable Investing

Another major shift is the emphasis on sustainable investing, often referred to as Environmental, Social, and Governance (ESG) investing. Investors are increasingly conscious of the environmental and social impact of their investments. Investment management companies are responding by offering ESG-focused portfolios, allowing investors to align their financial goals with their ethical values.

Personalized Investment Solutions

Investment portfolio management is moving away from the one-size-fits-all approach. Today, it's all about personalization. Investment management companies recognize that every investor is unique, with specific financial goals and risk tolerances. By leveraging technology, they can create personalized investment solutions that cater to individual needs, ensuring clients get the most from their investments.

The Role of Fund Accounting

Fund accounting, the financial backbone of investment management, is also evolving. It's no longer a mere bookkeeping function. Modern fund accounting systems provide real-time insights into the financial health of investment portfolios. They facilitate accurate reporting and help investment managers make informed decisions about asset allocation.

Keeping It Secure

Innovations in security are crucial to protect investments. An investment management company employs advanced cybersecurity measures to safeguard sensitive financial data. They continuously monitor for potential threats, ensuring that your investments are kept safe from cyberattacks and fraud.

Global Investment Opportunities

Technology has made it easier for investors to explore global markets. Investment management companies now offer diversified investment portfolios that include international assets. This diversification helps spread risk and seize opportunities in different regions.

So, as you embark on your investment journey, consider the exciting opportunities and advancements that lie ahead in investment portfolio management.

0 notes

Text

Unleash your dreams with us at "universal vault investment management LTD".If you're interested in the future, check out our firm at Universal-vaultinvestments.com

2 notes

·

View notes

Link

The investment management company will help you find the best place for investment & you can accomplish the life goals & many more.

0 notes