#invoice data digitization

Explore tagged Tumblr posts

Text

Invoice Digitization Benefits for Healthcare, Retail & Logistics Sector

Invoices are a crucial part of any business, having sensitive data, It is evident to store and organize massive invoices accurately by invoice data entry services. Here's what invoice digitization has to offer for the healthcare, retail and logistics sector.

#invoice data digitization#Invoice data entry services#invoice data entry#data entry of invoices#digitizing invoices#digital invoice management#data digitization

1 note

·

View note

Text

Why Germany Is Still Struggling with Digitalization – A Real-Life Look from Finance

Working in Germany, especially in a field like Finance, often feels like stepping into a strange paradox. On one hand, you’re in one of the most advanced economies in the world—known for its precision, engineering, and efficiency. On the other hand, daily tasks can feel like they belong in the 1990s. If you’ve ever had to send invoices to customers who insist they be mailed physically—yes, by…

#automation#business digitalization#business modernization#cash payments#change management#Clinics#cloud services#communication barriers#cultural habits#data privacy#digital future#digital mindset#digital natives#digital platforms#digital resistance#digital tools#digital transformation#digitalization#Distributors#document digitization#EDI#education system#electronic invoicing#email invoices#fax orders#filing cabinets#finance automation#finance department#future of work#generational gap

0 notes

Text

How to Automate Document Processing for Your Business: A Step-by-Step Guide

Managing documents manually is one of the biggest time drains in business today. From processing invoices and contracts to organizing customer forms, these repetitive tasks eat up hours every week. The good news? Automating document processing is simpler (and more affordable) than you might think.

In this easy-to-follow guide, we’ll show you step-by-step how to automate document processing in your business—saving you time, reducing errors, and boosting productivity.

What You’ll Need

A scanner (if you still have paper documents)

A document processing software (like AppleTechSoft’s Document Processing Solution)

Access to your business’s document workflows (invoices, forms, receipts, etc.)

Step 1: Identify Documents You Want to Automate

Start by making a list of documents that take up the most time to process. Common examples include:

Invoices and bills

Purchase orders

Customer application forms

Contracts and agreements

Expense receipts

Tip: Prioritize documents that are repetitive and high volume.

Step 2: Digitize Your Paper Documents

If you’re still handling paper, scan your documents into digital formats (PDF, JPEG, etc.). Most modern document processing tools work best with digital files.

Quick Tip: Use high-resolution scans (300 DPI or more) for accurate data extraction.

Step 3: Choose a Document Processing Tool

Look for a platform that offers:

OCR (Optical Character Recognition) to extract text from scanned images

AI-powered data extraction to capture key fields like dates, names, and totals

Integration with your accounting software, CRM, or database

Security and compliance features to protect sensitive data

AppleTechSoft’s Document Processing Solution ticks all these boxes and more.

Step 4: Define Your Workflow Rules

Tell your software what you want it to do with your documents. For example:

Extract vendor name, date, and amount from invoices

Automatically save contracts to a shared folder

Send expense reports directly to accounting

Most tools offer an easy drag-and-drop interface or templates to set these rules up.

Step 5: Test Your Automation

Before going live, test the workflow with sample documents. Check if:

Data is extracted accurately

Documents are routed to the right folders or apps

Any errors or mismatches are flagged

Tweak your settings as needed.

Step 6: Go Live and Monitor

Once you’re confident in your workflow, deploy it for daily use. Monitor the automation for the first few weeks to ensure it works as expected.

Pro Tip: Set up alerts for any failed extractions or mismatches so you can quickly correct issues.

Bonus Tips for Success

Regularly update your templates as your document formats change

Train your team on how to upload and manage documents in the system

Schedule periodic reviews to optimize and improve your workflows

Conclusion

Automating document processing can transform your business operations—from faster invoicing to smoother customer onboarding. With the right tools and a clear plan, you can streamline your paperwork and focus on what matters most: growing your business.

Ready to get started? Contact AppleTechSoft today to explore our Document Processing solutions.

#document processing#business automation#workflow automation#AI tools#paperless office#small business tips#productivity hacks#digital transformation#AppleTechSoft#business technology#OCR software#data extraction#invoicing automation#business growth#time saving tips

1 note

·

View note

Text

Streamlining Trucking Finances with Digital Invoice Management

Let’s talk invoices. I know, it might not be the most exciting topic when you’re out on the road, but stick with me for a minute—it’s actually smart for your business. Tired of handling stacks of paper invoices? It’s like trying to navigate rush hour traffic with a broken GPS. Papers get lost, numbers get messed up, and chasing down payments can feel like an endless loop. But here’s some good…

View On WordPress

#AI for trucking operations#AI invoice processing#automated invoicing systems#blockchain in trucking#business#cash flow management#cloud computing in trucking#cloud-based invoicing#digital invoicing for truckers#digital solutions for trucking#factoring services for truckers#Freight#freight industry#Freight Revenue Consultants#invoice automation in trucking#invoice factoring for truckers#invoice management software for truckers#logistics#real-time invoice tracking#scalable invoicing solutions#secure invoicing for truckers#small carriers#streamline trucking operations#Transportation#Trucking#trucking business efficiency#trucking cash flow solutions#trucking data insights#Trucking Financial Management#trucking financial tools

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

Simplifying OCR Data Collection: A Comprehensive Guide -

Globose Technology Solutions, we are committed to providing state-of-the-art OCR solutions to meet the specific needs of our customers. Contact us today to learn more about how OCR can transform your data collection workflow.

#OCR data collection#Optical Character Recognition (OCR)#Data Extraction#Document Digitization#Text Recognition#Automated Data Entry#Data Capture#OCR Technology#Document Processing#Image to Text Conversion#Data Accuracy#Text Analytics#Invoice Processing#Form Recognition#Natural Language Processing (NLP)#Data Management#Document Scanning#Data Automation#Data Quality#Compliance Reporting#Business Efficiency#data collection#data collection company

0 notes

Text

Different Art Commission Scams

Since more people might be curious about this, I'm gonna put it all in a post instead of replying as a comment. The art commission discord I'm in explains several scams linked to a commission in some way.

=> In short, the goal is usually either: private data, phishing, free art, or selling art as NFT.

You can find screenshots of these scams in action in the Art Commission server (too many images to upload here). I'm copying the explanation directly:

Fake paypal scam / Phishing via Invoice link

These scammers will message people asking for a commission, specifically for a commission of their daughter/son/pet for 500$. After successfully baiting their victim, they will ask for paypal email just to send a fake invoice that has a phishing link attached to it. Usually the email will be put in "Spam" section.

Digital check scam / Personal Info Scam

These scammers will message people for a commission but when asked for payment will ask to pay with a digital check. They will proceed asking for confidential information, such as name, surname and bank information.

"Actually, I am a… scammer" / Fake artist scam (?)

These scammers message people out of the blue using small talk phrases, such as "Hi!" "hey how are you?" or "hi, can i ask you something?". After exchanging a couple of messages with a user they waste no time and send this kind of message: "Actually I am a digital artist and I am looking for commissions, I can do 3D Models, Digital Art, Paintings, Banners, Graphic Design,... [the list goes on and on] ... lmk if you are interested so I can share my portfolio?"

"I want you to draw XYZ.."/ False Payment Screenshot

These scammer approach you with the lure of false hope that they'll commission you and accept any rate you offer them. They'll ask for your email and try to pay you via friends-and-family and send you a false screenshot that they've sent the money. If you receive an e-mail from Paypal informing you've received payment, please watch more closely as it's not from the official Paypal e-mail.

NFT Scam / Enquiry via Art Station / "Is this piece for sale?"

These are scammers who will email or message artists looking to buy an already existing artwork from their gallery. The artworks these scammers receive are forwarded/sold to NFT projects. These are not legitimate buyers but rather huge scam businesses. It is best not to interact with such messages, especially from unknown users even if you are doing it as a joke. Your information will be marked and they will keep flooding your DMs/email box. We advice everyone to just block these accounts and move on with their day. These scams usually happen on social media, like Twitter/X and Art Station.

Art Theft / Personal Info Scam

Anyone who gives away too much personal info unwarranted is likely a scammer looking to get personal info or art out of you for NFTs/AI/posters/etc. - similar to the ‘draw my child/pet’ (not my child/pet) scam where scammers bomb artists with photos and don't pay. To state the obvious, watch out for strangers online and don't doxx yourself by accident.

"Commission of my [family/pet/etc]" / Alternative Payment & Phishin scam

These scammers will DM you asking for commission information/ask for the commission straight away. They will specify that they are willing to spend the whole budget on just one commission of their relative/close person/pet. Usually the budget exceeds your own prices to easily manipulate people into agreeing to this request. However, they don't need the art, as they will ask you to sign up for their alternative payment method. The link is either a phishing link or an actual website that is hosted by these scammers to get a hold of your personal information information. This scam is more common for Instagram, Facebook and Twitter/X but Discord is no stranger to these scammers either.

54 notes

·

View notes

Text

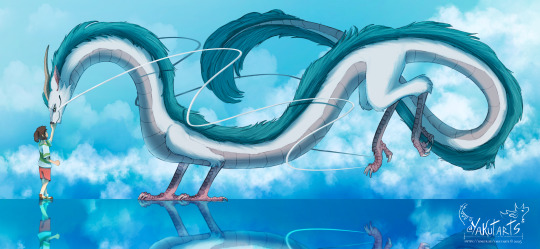

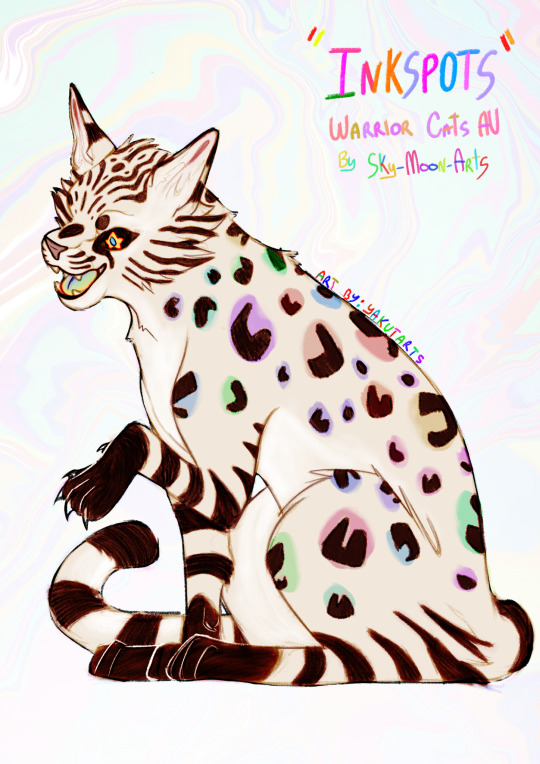

Yakut’s Commission Sheet 2025

[OPEN]

Finally made a brand new commission sheet!! I really like the way it turned out, and if I spot any mistake now I Will cry myself to sleep, because GODAMN it took fucking 12 hours to make this.

Transcript, T.o.S., and other important information under the cut!!

Yakut Arts Commission Sheet

Sketch

Headshot - $5

Bust - $7

Half body - $10

Full body - 15

Line Art

Headshot - $17

Bust - $22

Half body - $28

Full body - $36

Flat Color

Headshot - $20

Bust - $26

Half body - $32

Full body - 45

No line art: + $5,50

Cel Shaded

Headshot - $30

Bust - $36

Half body - $42

Full body - $55

No line art: + $15,50

Soft shaded

Headshot - $46

Bust - $52

Half body - $64

Full body - $76

No line art: + 25,50

Detailed

Headshot - $60

Bust - $70

Half body - $90

Full body - $130

Other stuff:

More characters: + %50 of the price per character

Background: + %70 of the price

Complex design: + %15 - %30 of the price

Hard to draw: + %10 - %40 of the price

Currencies that I accept:

$ - United States Dollar (USD)

€ - Euro

R$ - Brazilian Real (BRL)

Payment via:

PayPal

Stripe

PIX

* All the prices are the same, no matter the currency. If you want a $20 Flat Color Headshot but only use euro, then you will pay €20;

* If you are american or european, you CANNOT pay in BRL;

* While PayPal is the most popular and most used option, I highly recommend Stripe, because you don’t need an account to pay and I can safely send you an invoice via e-mail.

Prices before and after comparison:

I will draw:

Furry, Anthro, Feral, Animals, Creatures, Fanart, Fruit/Candy/Regular gore, NSFW, kinks, suggestive art, Complex designs, Partially mecha, Horror, Weapons/Armor, Cosplay, Magic, Skeletons/bones, Latex, Copyrighted characters, and others.

I won’t draw:

Humans, Extremely heavy gore, Fully mecha (Synths are an exception), Offensive art, Some fetishes, Watersports, Scat, Things that make me really uncomfortable, Commercial commissions, Things I can't draw because it's above my current level.

Terms of Service

1. Commercial Commissions:

- I do not work with commercial commissions. Any use of your commissioned artwork is for personal, non-profit purposes only.

- It is not permitted to use the commissioned artwork for commercial purposes, such as resale, mass reproduction, or any other form of profit.

2. Usage Restrictions:

- The commissioned artwork is not allowed to be used for artificial intelligence training or any form of data analysis.

- Reselling the commissioned artwork, especially as an NFT (non-fungible token) or any other form of tradable digital asset, is strictly prohibited.

3. Copyright and Intellectual Property:

- I retain all copyrights and intellectual property rights to the commissioned artwork, even after delivery.

- The client does not have the right to claim authorship of the artwork or use it in any way that infringes upon the artist's rights.

4. Use of Images and Promotion:

- I reserve the right to use images and information about the commissioned artwork, including the final product, for promotional and marketing purposes, unless specifically agreed otherwise.

- When reposting the images, it is highly recommended that you repost the version that is watermarked and/or glazed/nightsahded, which will also be delivered to you along with the "clean" version of the image, to prevent stealing and it being fed to A.I. models.

5. Custom Designs:

- Custom designs created by the artist are not to be resold or used for commercial purposes without explicit permission from the artist.

- If reselling is permitted, the price of the resold design must be equal to or lower than the original price set by the artist, but never higher.

6. Payments and Refunds:

- Payments for commissions must be made as agreed between the client and the artist before the start of the work. All transactions must be conducted in United States Dollars (USD), unless otherwise agreed upon.

- No refunds will be granted after the commencement of the creative process unless there are exceptional circumstances agreed upon by both parties. In that scenario, if the client does not want to continue the project, a partial refund will be granted based on how far I have completed the commission, but if for any reason I am the one who cannot work on your project anymore, I will give you a full refund.

- If you are Brazillian, you will have the special option to use the currency Brazillian, Real R$ (BRL) and pay via PIX.

7. Privacy:

- During the payment and commissioning process, both parties may have access to private information such as full legal names, addresses, and contact details. Both parties agree to respect each other's privacy and refrain from disclosing or doxxing any private information shared during the transaction. Breach of this clause may result in legal action.

8. Limited Liability:

- The artist will make every effort to provide high-quality work and meet the client's expectations. However, the artist is not liable for any damages arising from the use or interpretation of the commissioned artwork. [Example: The infamous YouTuber Verbablaze commissioned a $50,000.00 animation of him and the Hazbin Hotel character, Charlie, where they were being shown in a suggestive situation. Verbablaze posted the animation and got criticized and made fun of because of it. If you were to commission me, and then get into a controversy because of what you commissioned, I would not be held responsible and I will reserve the right to rather or not make a statement on the situation and/or get involved.]

9. Delivery Timeframe:

- While I do not work with strict deadlines, it is generally expected that the commission will be completed within a timeframe of 1-2 weeks to 1 month. However, please note that the actual delivery time may vary depending on the complexity and workload of the project.

10. Revisions:

- I understand that clients may have specific requirements or preferences. I am open to accommodate up to 10 major changes to the commissioned artwork. Please note that these revisions must be requested and finalized before the rendering process begins. Once the rendering process has started, I can accept up to 5 additional minor revisions, but major changes may not be feasible at that stage. Any revisions beyond these limits may be subject to additional charges or renegotiation.

11. Modifications to the Terms of Service:

- The artist reserves the right to modify these terms of service at any time, with prior notice to clients.

By proceeding with an art commission from me, Yakut, the client acknowledges that they have read and agree to these terms of service. Any violation of these terms may result in appropriate legal actions.

Here are some artwork quality examples:

Commission sheet creation Timelapse:

To make a commission request, you can send me a direct message (DM) to me on Tumblr, Bluesky, Twitter, or Instagram. I am not active on Discord so there’s a 90% I won’t see your message.

#commission#commissions are open#commission sheet#furry commissions#comms#art comms open#furry comms open#commission art#commissioned art#commissioned work#comms are open#artist comms#comms info#YakutArts Commissions#Yakut Commissions#commissions#art#artists on tumblr#artwork#drawing#digital artwork#digital art#furryart#design#furry#sfw furry#yakutarts#yakut arts#furry artwork#furry artist

19 notes

·

View notes

Text

✨ ✨ ✨ COMMISSIONS ARE OPEN!! ✨ ✨ ✨

i'm offering portrait commissions!

lineart 60 $ / 57 €

color 85 $ / 81 €

HOW TO GET ONE

fill out the google form (please have references ready!)

you'll get an email to confirm

i'll send a paypal invoice for the full price

once paid, i start drawing!

you'll get a sketch stage update + can request minor changes

you get the finished commission (watermarked, web-friendly JPG + full-size PNG file without watermark)

i'm allotting about 2 weeks for the turnaround time.

if you'd like more examples of the kinds of characters i can draw, check out my art tag

if you have any questions, feel free to dm me!

(i also have a ko-fi if you'd like to support me financially, but can't/don't want to get a commission. in any case, reblogs are deeply appreciated <3)

ToS under the cut:

Terms of Service

I may reject the commission for any reason.

You may not use these commissions for commercial purposes (merch design, resale, NFTs, etc) or as training data for generative AI. You may not redistribute these commissions without attribution and link back to edda-grenade.tumblr.com.

Commissions are digital; no shipping is required. The client receives 1 watermarked, web-friendly JPG, and 1 full-size PNG file.

Payment is to be made in full and up-front through Paypal invoice. Work on the commission begins once the invoice is paid.

Clients may request small (!) changes after the sketch stage.

If I am unable to complete the commission for whatever reason, the client will receive a file with the work completed up to that point. From the money that has been paid by the client, I will deduct what covers the work that I have already done, and return the rest.

#artists on tumblr#art commisions#commissions#commission info#open commissions#portrait commissions#pinned post

14 notes

·

View notes

Text

How to Ensure the Quality of Data Entry Services

Data entry services demand high quality and accuracy for professionals to gain the right information at the right time. Partnering with an outsourcing data entry company maintains this quality and accuracy level, allowing organizations to have an organized database. Here are some tips that can help enhance the accuracy of the data entry process and streamline business operations.

#data entry services#data entry company#outsource data entry#data digitalization#data entry for real estate#invoice data entry service#document data entry services#ecommerce data entry services#outsource data entry services#medical data entry

2 notes

·

View notes

Text

How ERP Software for Engineering Companies Improves Operational Efficiency

In today's competitive market, engineering companies are under immense pressure to deliver innovative solutions, maintain cost-efficiency, and meet tight deadlines—all while ensuring the highest standards of quality. As the engineering industry becomes more complex and digitally driven, operational efficiency has become a key metric for success. One of the most transformative tools driving this change is ERP (Enterprise Resource Planning) software.

For companies seeking to streamline their operations, ERP software for engineering companies provides a centralized platform that integrates every function—ranging from procurement, design, production, finance, HR, and project management. In India, especially in industrial hubs like Delhi, the demand for such software is growing rapidly. Let us explore how ERP systems significantly enhance operational efficiency and why choosing the right ERP software company in India is vital for engineering enterprises.

Centralized Data Management: The Foundation of Efficiency

One of the major challenges engineering companies face is managing vast amounts of data across departments. Manual entries and siloed systems often lead to redundancies, errors, and miscommunication. With ERP software for engineering companies in India, organizations gain access to a unified database that connects all operational areas.

Real-time data availability ensures that everyone, from the design team to procurement and finance, is working with the latest information. This reduces rework, improves collaboration, and speeds up decision-making, thereby increasing efficiency.

Streamlined Project Management

Engineering projects involve numerous stages—from planning and design to execution and maintenance. Tracking timelines, resources, costs, and deliverables manually or via disparate systems often results in delays and budget overruns.

Modern engineering ERP software companies in Delhi provide robust project management modules that allow firms to plan, schedule, and monitor projects in real time. This includes milestone tracking, Gantt charts, resource allocation, and budget forecasting. Managers can gain visibility into bottlenecks early on and reallocate resources efficiently, ensuring timely delivery.

Automation of Core Processes

Automating routine tasks is one of the key advantages of implementing ERP software. From generating purchase orders and invoices to managing payroll and inventory, ERP eliminates the need for repetitive manual work. This not only saves time but also minimizes human error.

The best ERP software provider in India will offer customizable automation workflows tailored to the specific needs of engineering companies. For instance, when a material stock reaches a minimum threshold, the ERP system can automatically generate a requisition and notify the purchasing team. This ensures zero downtime due to material shortages.

Enhanced Resource Planning and Allocation

Resource planning is crucial in engineering projects where labour, materials, and machinery must be utilized efficiently. A good ERP software for engineering companies provides detailed insights into resource availability, utilization rates, and project requirements.

By analysing this data, companies can better allocate resources, avoid overbooking, and reduce idle time. This leads to significant cost savings and ensures optimal productivity across the board.

youtube

Integration with CAD and Design Tools

Many ERP solution providers in Delhi now offer integration with design and CAD software. This is particularly useful for engineering firms where design data is often needed for procurement, costing, and production.

When ERP is integrated with CAD, design changes automatically reflect across related departments. This seamless flow of information eliminates miscommunication and ensures that downstream processes such as procurement and manufacturing are aligned with the latest design specifications.

Real-time Cost and Budget Management

Keeping engineering projects within budget is a continuous challenge. Unexpected costs can arise at any stage, and without proper monitoring, they can spiral out of control. ERP software providers in India equip engineering companies with real-time budget tracking tools.

From initial cost estimation to actual expenditure, companies can monitor every aspect of the financials. Alerts can be configured for budget deviations, helping management take corrective action promptly. This financial control is a cornerstone of operational efficiency and long-term profitability.

Improved Compliance and Documentation

Engineering companies must adhere to various compliance standards, certifications, and audit requirements. Maintaining accurate documentation and audit trails is critical. ERP systems automate compliance tracking and generate necessary documentation on demand.

By partnering with trusted ERP software companies in Delhi, engineering firms can ensure they meet industry standards with minimal administrative overhead. Features like document versioning, digital signatures, and compliance checklists help organizations stay audit-ready at all times.

Scalable and Future-ready Solutions

One of the biggest advantages of working with a reputed engineering ERP software company in Delhi is access to scalable solutions. As engineering businesses grow, their operational complexities increase. Modern ERP systems are modular and scalable, allowing businesses to add new functionalities as needed without disrupting existing operations.

Moreover, cloud-based ERP solutions offer flexibility, remote access, and lower infrastructure costs. These are especially beneficial for engineering companies that operate across multiple locations or work on-site with clients.

Enhanced Customer Satisfaction

Efficient operations lead to improved delivery timelines, better quality products, and faster customer service—all of which directly impact customer satisfaction. With ERP, engineering companies can maintain accurate production schedules, meet delivery deadlines, and respond to customer queries with real-time information.

By choosing the right ERP software for engineering companies in India, firms not only improve internal operations but also build a strong reputation for reliability and professionalism among their clients.

Choosing the Right ERP Partner

With the growing number of ERP solution providers in India, selecting the right partner is crucial. Here are a few factors to consider:

Domain Expertise: Choose a vendor with experience in the engineering sector.

Customization: The software should be tailored to suit your specific workflows.

Scalability: Ensure the ERP solution grows with your business.

Support & Training: Opt for companies that provide ongoing support and employee training.

Integration Capabilities: Check whether the ERP can integrate with your existing systems, including CAD tools, financial software, etc.

Trusted ERP software companies in Delhi like Shantitechnology (STERP) stand out because they offer deep industry knowledge, scalable platforms, and dedicated customer support—making them ideal partners for engineering businesses seeking to transform operations.

youtube

Final Thoughts

In a rapidly evolving business landscape, engineering companies must adopt smart technologies to stay ahead. ERP software is not just an IT solution—it is a strategic tool that can redefine how engineering firms manage their projects, people, and performance.

From streamlining project workflows and automating routine tasks to enhancing collaboration and boosting resource efficiency, ERP solutions deliver measurable gains across the organization. For those looking to make a digital leap, partnering with a top-rated ERP software company in India can be the difference between stagnation and scalable success.

Looking for a reliable ERP partner? Shantitechnology (STERP) is among the leading ERP solution providers in Delhi, offering tailored ERP software for engineering companies to help you boost productivity, reduce costs, and grow sustainably. Contact us today to learn more!

#Engineering ERP software company#ERP software for engineering companies in India#ERP solution providers#ERP software for engineering companies#ERP software companies#ERP software providers in India#Gujarat#Maharashtra#Madhyapradesh#ERP solution providers in India#ERP for manufacturing company#Delhi#Hyderabad#ERP Software#Custom ERP#ERP software company#Manufacturing enterprise resource planning software#Bengaluru#ERP software company in India#Engineering ERP Software Company#Best ERP software provider in India#Manufacturing ERP software company#Manufacturing enterprise resource planning#ERP modules for manufacturing industry#Best ERP for manufacturing industry#India#Youtube

2 notes

·

View notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional — it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes

Text

How to Ensure Compliance with ZATCA Phase 2 Requirements

As Saudi Arabia pushes toward a more digitized and transparent tax system, the Zakat, Tax and Customs Authority (ZATCA) continues to roll out significant reforms. One of the most transformative changes has been the implementation of the electronic invoicing system. While Phase 1 marked the beginning of this journey, ZATCA Phase 2 brings a deeper level of integration and regulatory expectations.

If you’re a VAT-registered business in the Kingdom, this guide will help you understand exactly what’s required in Phase 2 and how to stay compliant without unnecessary complications. From understanding core mandates to implementing the right technology and training your staff, we’ll break down everything you need to know.

What Is ZATCA Phase 2?

ZATCA Phase 2 is the second stage of Saudi Arabia’s e-invoicing initiative. While Phase 1, which began in December 2021, focused on the generation of electronic invoices in a standard format, Phase 2 introduces integration with ZATCA’s system through its FATOORA platform.

Under Phase 2, businesses are expected to:

Generate invoices in a predefined XML format

Digitally sign them with a ZATCA-issued cryptographic stamp

Integrate their invoicing systems with ZATCA to transmit and validate invoices in real-time

The primary goal of Phase 2 is to enhance the transparency of commercial transactions, streamline tax enforcement, and reduce instances of fraud.

Who Must Comply?

Phase 2 requirements apply to all VAT-registered businesses operating in Saudi Arabia. However, the implementation is being rolled out in waves. Businesses are notified by ZATCA of their required compliance deadlines, typically with at least six months' notice.

Even if your business hasn't been selected for immediate implementation, it's crucial to prepare ahead of time. Early planning ensures a smoother transition and helps avoid last-minute issues.

Key Requirements for Compliance

Here’s a breakdown of the main technical and operational requirements under Phase 2.

1. Electronic Invoicing Format

Invoices must now be generated in XML format that adheres to ZATCA's technical specifications. These specifications cover:

Mandatory fields (buyer/seller details, invoice items, tax breakdown, etc.)

Invoice types (standard tax invoice for B2B, simplified for B2C)

Structure and tags required in the XML file

2. Digital Signature

Every invoice must be digitally signed using a cryptographic stamp. This stamp must be issued and registered through ZATCA’s portal. The digital signature ensures authenticity and protects against tampering.

3. Integration with ZATCA’s System

You must integrate your e-invoicing software with the FATOORA platform to submit invoices in real-time for validation and clearance. For standard invoices, clearance must be obtained before sharing them with your customers.

4. QR Code and UUID

Simplified invoices must include a QR code to facilitate easy validation, while all invoices should carry a UUID (Universally Unique Identifier) to ensure traceability.

5. Data Archiving

You must retain and archive your e-invoices in a secure digital format for at least six years, in accordance with Saudi tax law. These records must be accessible for audits or verification by ZATCA.

Step-by-Step Guide to Compliance

Meeting the requirements of ZATCA Phase 2 doesn’t have to be overwhelming. Follow these steps to ensure your business stays on track:

Step 1: Assess Your Current System

Evaluate whether your current accounting or invoicing solution can support XML invoice generation, digital signatures, and API integration. If not, consider:

Upgrading your system

Partnering with a ZATCA-certified solution provider

Using cloud-based software with built-in compliance features

Step 2: Understand Your Implementation Timeline

Once ZATCA notifies your business of its compliance date, mark it down and create a preparation plan. Typically, businesses receive at least six months’ notice.

During this time, you’ll need to:

Register with ZATCA’s e-invoicing platform

Complete cryptographic identity requests

Test your system integration

Step 3: Apply for Cryptographic Identity

To digitally sign your invoices, you'll need to register your system with ZATCA and obtain a cryptographic stamp identity. Your software provider or IT team should initiate this via ZATCA's portal.

Once registered, the digital certificate will allow your system to sign every outgoing invoice.

Step 4: Integrate with FATOORA

Using ZATCA’s provided API documentation, integrate your invoicing system with the FATOORA platform. This step enables real-time transmission and validation of e-invoices. Depending on your technical capacity, this may require support from a solution provider.

Make sure the system can:

Communicate securely over APIs

Handle rejected invoices

Log validation feedback

Step 5: Conduct Internal Testing

Use ZATCA’s sandbox environment to simulate invoice generation and transmission. This lets you identify and resolve:

Formatting issues

Signature errors

Connectivity problems

Testing ensures that when you go live, everything operates smoothly.

Step 6: Train Your Team

Compliance isn’t just about systems—it’s also about people. Train your finance, IT, and sales teams on how to:

Create compliant invoices

Troubleshoot validation errors

Understand QR codes and UUIDs

Respond to ZATCA notifications

Clear communication helps avoid user errors that could lead to non-compliance.

Step 7: Monitor and Improve

After implementation, continue to monitor your systems and processes. Track metrics like:

Invoice clearance success rates

Error logs

Feedback from ZATCA

This will help you make ongoing improvements and stay aligned with future regulatory updates.

Choosing the Right Solution Provider

If you don’t have in-house resources to build your own e-invoicing system, consider working with a ZATCA-approved provider. Look for partners that offer:

Pre-certified e-invoicing software

Full API integration with FATOORA

Support for cryptographic signatures

Real-time monitoring dashboards

Technical support and onboarding services

A reliable provider will save time, reduce costs, and minimize the risk of non-compliance.

Penalties for Non-Compliance

Failure to comply with ZATCA Phase 2 can result in financial penalties, legal action, or suspension of business activities. Penalties may include:

Fines for missing or incorrect invoice details

Penalties for not transmitting invoices in real-time

Legal scrutiny during audits

Being proactive is the best way to avoid these consequences.

Final Thoughts

As Saudi Arabia advances toward a fully digital economy, ZATCA Phase 2 is a significant milestone. It promotes tax fairness, increases transparency, and helps modernize the way businesses operate.

While the technical requirements may seem complex at first, a step-by-step approach—combined with the right technology and training—can make compliance straightforward. Whether you're preparing now or waiting for your official notification, don’t delay. Start planning early, choose a reliable system, and make sure your entire team is ready.

With proper preparation, compliance isn’t just possible—it’s an opportunity to modernize your business and build lasting trust with your customers and the government.

2 notes

·

View notes

Text

Benefits of Fast Online Payments — Quick Pay

In today’s digital economy, fast online payments are no longer just a convenience—they are a necessity. From e-commerce stores to freelancers and service providers, everyone is shifting toward quicker, safer, and smarter payment solutions. Among the many options available, Quick Pay has emerged as a leading platform offering seamless online payment experiences for both businesses and customers.

If you're a business owner or entrepreneur looking to scale your operations and improve customer satisfaction, understanding the benefits of fast online payments is crucial. And when it comes to delivering these benefits efficiently, Quick Pay stands out with its cutting-edge features and reliable service.

1. Enhanced Customer Experience

The first and most obvious benefit of fast online payments is an improved customer experience. Today’s consumers expect instant transactions. A slow or complicated checkout process can lead to cart abandonment and loss of revenue.

With Quick Pay, customers can complete payments in just a few clicks. The user-friendly interface, minimal redirects, and fast processing ensure that your clients enjoy a hassle-free payment journey, increasing the chances of repeat business.

Quick Pay Advantage:

One-click checkout

Mobile-optimized experience

Multiple payment options: UPI, cards, wallets, net banking

2. Faster Cash Flow for Businesses

One of the major benefits of fast online payments is accelerated cash flow. Unlike traditional bank transfers that may take days, fast payment systems like Quick Pay ensure that your money reaches you quickly—often on the same day.

For small businesses and startups, this is a game-changer. You no longer have to wait endlessly for payments, allowing better cash management, investment in growth, and operational efficiency.

Quick Pay Benefit:

Same-day settlements (T+0 and T+1 options)

Instant payment notifications

Transparent tracking of incoming funds

3. Higher Conversion Rates

Online businesses thrive on conversion rates. A complicated or slow payment process can discourage potential customers right at the final step. By offering a quick and secure payment gateway like Quick Pay, businesses can increase their checkout success rate dramatically.

Speed combined with security builds trust and reduces the bounce rate.

Quick Pay Features That Help:

Secure payment environment (PCI DSS compliant)

Optimized checkout for mobile and desktop

Auto-fill and tokenized payments for returning users

4. Increased Trust and Credibility

When customers notice that your website or app uses a reputed and fast payment solution like Quick Pay, it instantly boosts your brand’s credibility. Shoppers feel more secure transacting on your platform, knowing that their personal and financial data is in safe hands.

This trust translates into higher engagement, more referrals, and long-term brand loyalty.

Quick Pay Security Standards:

End-to-end encryption

Two-factor authentication

Fraud detection and chargeback control

5. Support for Recurring Payments

Many businesses today rely on subscription models—whether it's digital services, SaaS platforms, or fitness memberships. A major benefit of fast online payments is the ability to automate recurring billing.

Quick Pay makes recurring payments smooth and effortless. Customers don’t need to re-enter their details every time, and businesses enjoy predictable revenue without delays.

With Quick Pay, You Get:

Automated recurring billing setup

Smart invoicing and reminders

Custom billing cycles

6. Lower Operational Costs

Handling cash or bank transfers manually involves time, risk, and additional staff. Online payments automate this entire process, reducing overhead costs. Quick Pay’s all-in-one dashboard helps manage your transactions, analytics, and customer data in one place.

Over time, businesses save money on labor, reconciliation, and administrative tasks.

Quick Pay’s Business Dashboard Offers:

Real-time transaction tracking

Sales reports and analytics

Easy refund and dispute management

7. Wider Customer Reach

Fast online payments open up a global customer base. Whether you're selling in your local city or shipping products across the world, a payment gateway like Quick Pay ensures that you never miss a sale due to geographical or banking limitations.

Quick Pay supports multi-currency payments and international cards, making it easier to scale your business globally.

Quick Pay Global Features:

Support for major global currencies

Acceptance of Visa, Mastercard, AmEx, and more

Integration with international platforms like Shopify, WooCommerce, and others

8. Seamless Integrations with Online Platforms

The benefits of fast online payments are amplified when your payment gateway easily integrates with your website, mobile app, or POS system. Quick Pay offers ready-made plugins and robust APIs for smooth integration.

This reduces developer time, lowers setup costs, and gets you live faster.

Quick Pay Integration Highlights:

Easy plugins for WordPress, Shopify, Magento

Android/iOS SDKs for mobile apps

API documentation and 24/7 tech support

9. Better Customer Retention

A smooth payment experience not only helps you close a sale but also encourages customers to return. Fast refunds, saved payment options, and friendly interfaces make users feel valued.

Quick Pay includes customer retention features like:

Smart retry on failed transactions

Branded payment pages

Custom thank-you messages and emails

10. Real-Time Analytics and Insights

Understanding how your customers pay can guide better business decisions. Quick Pay’s powerful analytics tools offer deep insights into payment trends, user behavior, and settlement reports—all in real time.

This data can be used to optimize your marketing campaigns, identify high-value customers, and plan inventory.

What Quick Pay Analytics Offers:

Dashboard with payment trends and patterns

Conversion rate tracking

Refund and dispute summary

Why Choose Quick Pay?

When it comes to maximizing the benefits of fast online payments, Quick Pay checks all the boxes:

✅ Fast and secure transactions ✅ Same-day settlements ✅ Easy integrations ✅ Scalable for small to enterprise businesses ✅ Exceptional customer support

Whether you're a growing startup, a large enterprise, or a freelancer, Quick Pay empowers your business to accept payments quickly, securely, and with minimal friction.

Final Thoughts

The world is moving fast, and so should your payments. Embracing the benefits of fast online payments can revolutionize your business operations, boost customer satisfaction, and drive consistent revenue.

With its reliable technology, business-friendly features, and unmatched customer support, Quick Pay is the ideal partner for modern businesses looking to thrive in the digital age.

Ready to Get Started?

Visit www.usequickpay.com to create your free account and start accepting payments within minutes.

#finance#online payments#payments#branding#economy#quickpay#bestpaymentgateway#FastOnlinePayments#QuickPayIndia#DigitalPaymentsSolution

2 notes

·

View notes

Text

VAT Data Processing in ALZERP Cloud ERP Software

Key Features of ALZERP’s VAT Data Processing:

ZATCA Server Integration: ALZERP seamlessly connects with the ZATCA server using the business identification number, enabling real-time data exchange and synchronization.

Data Synchronization: The software automatically synchronizes various data points, including opening balances, purchase and LC details, VAT sales, item returns, expenses, voucher data, and data corrections.

VAT Return and Zakat Return Calculation: ALZERP accurately calculates VAT and Zakat return amounts based on the synchronized data, ensuring compliance with tax regulations.

Separate Invoice Management: Invoices from sales are created in a separate table, allowing for efficient tracking and management.

Non-VAT Invoice Processing: ALZERP automatically processes non-VAT invoices with the applicable 15% VAT amount.

Invoice Item Synchronization: Any changes made to items in VAT invoices are reflected in the corresponding non-VAT invoices, maintaining consistency.

Opening Balance Synchronization: ALZERP synchronizes opening balances for products, stock, parties, and accounts heads as of December 31, 2022.

Purchase and LC Synchronization: The software synchronizes purchase and LC data within specified date ranges, capturing all relevant transactions.

VAT Sales Synchronization: VAT sales data is synchronized, including the option to enable automatic ZATCA submission.

Sold Item Returns Synchronization: Returned items are recorded in a separate table, and existing data within the same date range is replaced.

Voucher Data Processing: ALZERP processes expenses and bookkeeping vouchers, excluding non-VATable items and focusing on relevant payment, receipt, and journal vouchers.

Data Correction and Reprocessing: The software allows for rechecking and correcting synced data, processing bank statements, and reprocessing sales as needed.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

What Are the Benefits of Adopting Latest Fintech Technologies?

The financial industry is witnessing a rapid transformation driven by the adoption of the latest fintech technologies. These technologies are revolutionizing how financial services are delivered, enhancing efficiency, improving security, and fostering innovation across banks, insurance companies, investment firms, and payment platforms. By integrating advanced fintech software into their operations, businesses are unlocking numerous benefits that enable them to stay competitive in an increasingly digital world. In this article, we will explore the key advantages of adopting the latest fintech technologies and how they are reshaping the financial landscape.

1. Enhanced Efficiency and Automation

One of the primary benefits of adopting the latest fintech technologies is the significant boost in efficiency. Traditional financial systems often rely on manual processes, which can be time-consuming, prone to errors, and costly. With the integration of fintech software solutions, businesses can automate a wide range of processes, from payment processing to data analysis.

For example, AI-powered algorithms can automate tasks like credit scoring, fraud detection, and risk assessment, enabling financial institutions to make faster and more accurate decisions. Additionally, blockchain technology enables automated, transparent transactions, reducing the need for intermediaries and speeding up processes like cross-border payments. The efficiency gained through automation allows businesses to handle a larger volume of transactions and deliver services more swiftly, benefiting both the institutions and their customers.

2. Improved Customer Experience

The latest fintech technologies also play a crucial role in enhancing customer experiences. Consumers today demand convenience, speed, and personalized services. Fintech software solutions enable businesses to meet these demands by offering innovative and user-friendly platforms for managing finances.

Digital wallets, mobile banking apps, and AI-powered chatbots are just a few examples of how fintech technologies are transforming customer interactions. Mobile payment systems like Apple Pay and Google Pay allow users to make secure transactions with just a tap of their phone, while robo-advisors provide tailored financial advice based on individual needs. AI-driven chatbots can respond to customer inquiries instantly, providing 24/7 support and delivering personalized responses. These innovations make financial services more accessible, faster, and tailored to the unique needs of each customer.

Additionally, by leveraging the latest fintech technologies, businesses can offer cross-channel experiences, where customers can seamlessly transition between online platforms, mobile apps, and physical locations without interruption. This level of convenience significantly improves customer satisfaction and loyalty.

3. Cost Savings and Reduced Operational Expenses

Adopting fintech technologies can result in significant cost savings for businesses. Traditional banking systems often involve high overhead costs related to maintaining physical branches, processing manual transactions, and managing large teams. By embracing fintech software, financial institutions can streamline their operations, reducing the need for human intervention in routine tasks.

For example, cloud computing solutions allow businesses to store and process large amounts of data without the need for expensive in-house infrastructure. This can lead to significant savings in terms of hardware and maintenance costs. Additionally, automated systems for customer service, fraud detection, and compliance reduce the reliance on human resources, leading to further cost reductions.

For small businesses and startups, fintech solutions offer an affordable way to access sophisticated financial tools that were previously out of reach. Cloud-based accounting, invoicing, and payment solutions enable these companies to operate more efficiently without the need for large investments in infrastructure or personnel.

4. Improved Security and Fraud Prevention

As the financial industry becomes more digital, security has become a top priority. The latest fintech technologies offer advanced security features that help protect businesses and their customers from cyber threats and fraud. Blockchain technology, for example, provides a decentralized and immutable ledger, ensuring the integrity and transparency of transactions. This makes it nearly impossible for malicious actors to alter or tamper with transaction records, reducing the risk of fraud.

Additionally, fintech software solutions integrate cutting-edge encryption methods and biometric authentication, such as facial recognition and fingerprint scanning, to safeguard sensitive data. AI-powered fraud detection systems can monitor transactions in real-time, flagging suspicious activities and preventing fraudulent transactions before they occur. These security measures help businesses build trust with their customers and ensure that sensitive financial information is protected.

By adopting the latest fintech technologies, financial institutions can also ensure compliance with stringent data protection regulations, such as the GDPR (General Data Protection Regulation), further reducing the risk of penalties and reputational damage.

5. Greater Accessibility and Financial Inclusion

Fintech technologies are making financial services more accessible to underserved and unbanked populations around the world. In developing regions, where access to traditional banking services may be limited, mobile phones and fintech apps are enabling individuals to manage their finances, make payments, and even access credit.

Digital wallets and mobile banking apps allow users to store, send, and receive money without the need for a physical bank account. Peer-to-peer (P2P) lending platforms are helping individuals and small businesses access credit that they might otherwise not be able to obtain from traditional banks. Additionally, fintech software solutions are allowing micro-lending institutions to assess creditworthiness more accurately using alternative data, such as mobile usage and payment history, making it easier for individuals without formal credit histories to secure loans.

By adopting fintech technologies, businesses can contribute to financial inclusion, helping to bridge the gap between the banked and unbanked populations and enabling more people to participate in the global economy.

6. Better Decision-Making and Data Analytics

Data is at the heart of fintech innovation. The latest fintech technologies, such as AI and big data analytics, enable businesses to gather, process, and analyze vast amounts of information in real-time. This allows financial institutions to make data-driven decisions, improve risk management, and offer more personalized services to their customers.

For example, AI algorithms can analyze a customer's spending habits, credit history, and financial goals to offer personalized financial advice and recommend investment opportunities. Similarly, advanced analytics tools can identify emerging trends in the market, allowing businesses to adjust their strategies accordingly. The ability to harness the power of data leads to more informed decision-making and better outcomes for both businesses and their customers.

7. Scalability and Flexibility

Fintech software solutions offer unmatched scalability, allowing businesses to grow without the constraints of traditional systems. Whether it’s increasing transaction volumes, expanding to new markets, or offering additional services, fintech technologies can easily adapt to changing business needs. Cloud-based platforms, for instance, allow businesses to scale up or down quickly without incurring significant costs or requiring significant infrastructure investments.

Xettle Technologies, for example, provides scalable fintech solutions that help businesses manage their growth seamlessly, offering flexibility and adaptability in a fast-evolving digital landscape.

Conclusion

The adoption of the latest fintech technologies offers a wide range of benefits for businesses in the financial sector. From enhanced efficiency and automation to improved customer experiences, cost savings, and better security, fintech solutions are revolutionizing the way financial services are delivered. By embracing these innovations, businesses can stay competitive, drive growth, and provide more personalized and accessible services to their customers. The future of finance is digital, and those who adopt the latest fintech technologies today will be better equipped to succeed in tomorrow’s rapidly evolving market.

3 notes

·

View notes