#Invoice Processing

Explore tagged Tumblr posts

Text

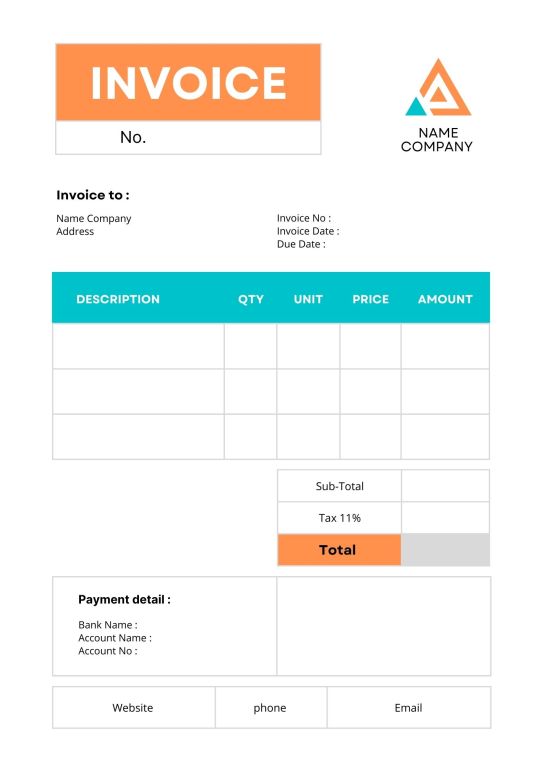

Orange Blue Minimalist Business Invoice A4 Document

Orange Blue Minimalist Business Invoice A4 Document is a vibrant and modern template designed for businesses that value clarity and style. Featuring a clean layout with orange and blue accents, it balances professionalism with a touch of creativity.

Buy this

#free invoice software#invoice software development bd#money transfer#finance#money#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

2 notes

·

View notes

Text

Understanding Invoices, Billing, and Payment Terms: A Simple Guide to Getting Paid Right

If you’ve ever sold a product or service, you already know how important it is to get paid on time. But when money is involved, there’s more than just sending a bill and hoping it gets paid. Behind every successful business transaction, there’s a system that keeps things organized, clear, and traceable. This system lives in a world full of terms like invoices, credit memos, remittance advice,…

#accounting terms#Accounts Receivable#accounts receivable management#applied payments#billing#billing process#business payments#cash application#credit memo#customer billing#customer payment#debit memo#financial documents#financial recordkeeping#invoice#invoice accuracy#invoice management#invoice matching#invoice processing#invoice terms#invoice tracking#Net 30#Net 60#payment collection#payment due#payment reconciliation#Payment Terms#remittance advice#remittance processing#unapplied cash

0 notes

Text

Beyond Words: Unveiling the True ROI of Intelligent Document Processing (IDP)

Across industries—from manufacturing to insurance—businesses are under pressure to streamline operations, enhance customer experiences, and boost employee productivity, all while keeping costs in check. Intelligent Document Processing (IDP) is transforming how organizations handle documents by leveraging AI to automate data extraction and processing. But with any new technology, the big question remains: Is it worth the investment?

The Growing Importance of IDP

Traditional document handling is often plagued by delays, errors, and inefficiencies that frustrate employees and slow down critical business functions. IDP eliminates these bottlenecks by using AI to classify, extract, and validate information with speed and accuracy. Despite its advantages, some enterprises remain hesitant, uncertain about the true return on investment (ROI).

A structured approach to evaluating IDP’s financial and operational impact can help decision-makers build a solid business case for adoption. Understanding both the direct cost savings and broader benefits—like improved compliance, reduced risk, and enhanced decision-making—is key.

Measuring IDP’s ROI: A Data-Driven Approach

To bridge this knowledge gap, experts have developed a comprehensive framework that outlines key cost and benefit categories associated with IDP adoption. This approach enables businesses to estimate potential ROI through real-world applications, such as:

Invoice Processing – Faster, more accurate processing that reduces manual effort.

Insurance Claims Handling – Quicker claim settlements with fewer errors.

Customer Onboarding – Smoother, automated workflows that enhance user experience.

For organizations looking to maximize their IDP investments, understanding market trends and success factors is essential. Explore the latest insights and a proven ROI assessment framework to see how businesses are leveraging IDP for measurable gains.

About Us

IntentTech Insights™: Your Tech World Navigator

Uncharted waters demand a seasoned guide. We excel in providing intent-based technology intelligence to navigate complex technology landscapes, such as IT, cybersecurity, data storage and networks, SaaS, Cloud, Edge, IoT, AI, HR technologies, Contact Center software, Fintech, Martech, and 150+ other domains.

IntentTech Insights™ is your compass through the ever-evolving tech landscape. We are more than just a publication; we are your strategic partner in navigating the complexities of the digital world.

Our mission is to deliver unparalleled insights and actionable intelligence to tech professionals and enthusiasts alike. We delve deep into the latest trends, technologies, and innovations, providing comprehensive coverage that goes beyond surface-level reporting.

#Intelligent Document Processing#automate data extraction#Invoice Processing#Insurance Claims Handling#Customer Onboarding

0 notes

Text

How AR Automation transforms financial operations

Accounts Receivable (AR) automation is revolutionizing financial operations. By automating tasks like invoicing, payment processing, and reconciliation, businesses can streamline their processes, improve cash flow, and reduce errors. With AR automation, finance teams can focus on more strategic initiatives, such as analyzing customer data and identifying opportunities for growth.

ARAutomation #FinancialOperations #CashFlow #Efficiency #BusinessGrowth

0 notes

Text

0 notes

Text

Online Invoice generation

To generate and send an invoice online, one can follow these steps using various tools and platforms:

1. Use an Invoicing Software or Tool

Popular Tools: FreshBooks, Billsarathi, QuickBooks, Zoho Invoice, Wave, PayPal, etc.

Steps:

Sign Up for an account on any of these platforms.

Create a New Invoice:

Add your business details (name, address, logo, etc.).

Add client details (name, address, email, etc.).

Enter the products/services you are billing for (description, quantity, rate, etc.).

Set due dates, taxes, discounts if applicable.

Preview the invoice to ensure all details are correct.

Send the Invoice directly to the client via email through the platform.

2. Using Google Docs or Word Processors (Manual)

Steps:

Open Google Docs or Microsoft Word and select an Invoice Template.

Customize the template with your business details, client details, itemized services/products, and total amount.

Save the document as a PDF.

Send the PDF invoice via email to the client.

3. Using Excel or Google Sheets

Steps:

Use Excel or Google Sheets to create an invoice.

Add your company and client details, product/service details, prices, and totals.

Use built-in formulas to calculate totals and taxes.

Download the completed sheet as a PDF.

Send the PDF via email.

4. Send Invoice via Email

After creating the invoice:

Draft an email explaining the details of the invoice.

Attach the invoice PDF.

Include any payment instructions (bank transfer, PayPal, etc.).

Send to the client's email address.

5. Payment Integration

Some platforms like FreshBooks or PayPal allow you to integrate payment gateways directly into the invoice. Clients can click a link to pay directly, making the process easier.

Choose a method based on your needs for tracking, payment integration, and design.

0 notes

Text

How Invoice Processing is useful in Business

Automatic Expense Tracking

The main advantage of TRIRID-Billing software provides automation expense tracking gives you the control and wisdom of spending your resources wisely. You can make generate report automatically and easily as your invoices can quickly and easily be organised by TRIRID-Billing software including date, type or any other fields you choose.

Less Paperwork

The main benefits of choosing TRIRID-Billing software are to manually manage the data in a spread sheet format. With TRIRID-Billing software you can store your invoices in the form of data files on your Computer/Mobile/Tablet etc. Now you have rights to access to them without use of any paper. You can manage invoice once you have enter proper time so it is easy to move your data in a proper way. The TRIRID-Billing software is easy to use and take less time to generate receipt.

Reducing Mistakes

Manual data entry is open to errors because multiple layers of communication are involved. Invoices can be lost, a chance to miscalculation can happen any time, especially when there are too many items to process. Because of an invoice processing system, you do not need to worry about at all.

Regular Updates

Whenever you’re recording your transactions in TRIRID-Billing software you will get regular update of those records. Use a password for your organizations in order that the records are not accessed by unauthorized personnel.

Business Intelligence

If you are using the old conventional methods like spreadsheets and other tools for optimizing business transactions, there is a high possibility occurring of human errors from your side and other side. To overcome all these problems, choosing a right billing software for your business is the best solution.

For More Information:

Call @ +91 8980010210

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Benefits of Billing Software#Custom Billing Software#Invoice Processing#TRIRID-Billing in Bopal-Ambli road-ahmedabad#TRIRID-Billing in ISCON-Ambli road-ahmedabad

0 notes

Text

Manage your financial and accounting operations with Billing Applications

Automate daily tasks for your finance team with Tecnolynx billing software. Our powerful application allows you to create professional invoices, generate payment reminders, and maintain accurate accounting records. With Tecnolynx, you can easily track the products and services used by your clients, produce and send invoices, and efficiently collect payments. Streamline your financial processes and enhance productivity with our advanced billing solution.

#Billing applications#Invoice software#Billing solutions#Invoice management#Billing system#Invoice generation#Billing software#Invoice processing#Business invoicing#Free demo

0 notes

Text

https://www.automatrix-innovation.com/blog/invoice-processing-automation-in-india

#Invoice Processing Automation#Invoice Automation Solution#invoice processing#Invoice Processing platform

0 notes

Text

Efficient invoice processing is crucial for maintaining timely payments and ensuring vendor satisfaction. Utilizing professional invoice processing services can streamline your financial operations, reduce errors, and enhance your overall business productivity. These services offer automation, accuracy, and reliability, allowing businesses to focus on core activities while ensuring that vendors are paid promptly and accurately. Embrace the benefits of modern invoice processing to improve your company's financial health and vendor relationships.

#invoice processing#invoice processing services#outsource invoice processing services#invoice processing company

0 notes

Text

The Ultimate Guide to Vendor Management Strategies

The core of each organisation's procurement process is its vendors. Nonetheless, a lot of businesses sometimes undervalue the significance of building strong bonds with their vendors. Due to this, they sometimes deteriorate the relationship with their vendors and do not receive materials or goods from them. That is why these companies are getting interested in vendor management systems.

#accounts payable management#accounts payable outsourcing services#Invoice Processing#invoice processing services#vendor management software#Vendor Management Strategies#vendor management system#MYND Solution

0 notes

Text

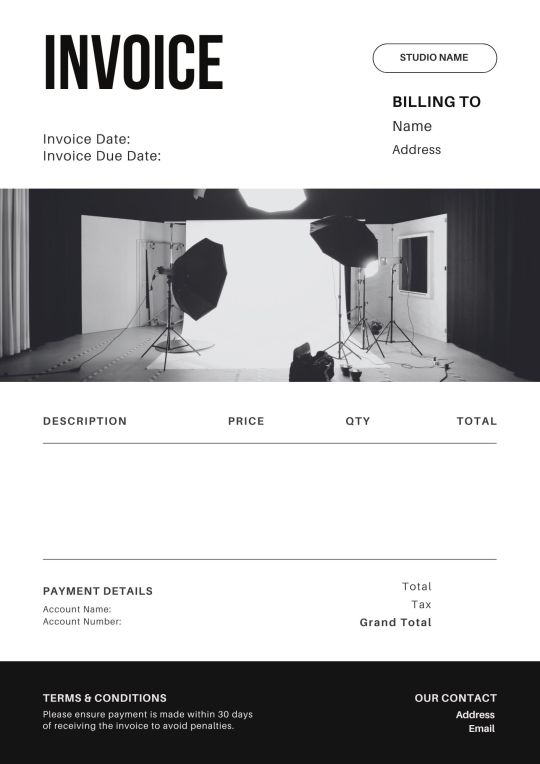

Black White Bold Simple Photography Studio Invoice

Black White Bold Simple Photography Studio Invoice is a sleek and modern template tailored for photography professionals. Featuring a clean white background with bold black accents, it exudes sophistication and clarity.

Buy this

#free invoice software#invoice software development bd#money transfer#money#finance#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

0 notes

Text

In-House vs. Outsourced Accounts Receivable: Making the Right Choice

Managing accounts receivable (AR) effectively is crucial for maintaining cash flow and business health. Businesses often debate whether to handle AR in-house or outsource it. In-house AR management offers control and direct oversight but can be time-consuming and costly. Outsourcing AR to specialized firms can save time and reduce costs, leveraging experts and advanced technology. However, it may result in less direct control and potential communication gaps. The decision hinges on balancing control with efficiency. Small businesses might benefit more from outsourcing due to resource constraints, while larger enterprises might prefer the control of in-house management. Choose the strategy that aligns with your business needs and goals.

Contact us Now!

#Account Receivable#Accounting Services#Invoice Processing#Outsourced Accounting#Small Business#Technology#Cost Saver#sage accounting#Quickbooks Bookkeeping

0 notes

Text

Tired of manual invoice processing slowing down your organization's digital transformation journey? 𝗦𝘁𝗿𝗲𝗮𝗺𝗹𝗶𝗻𝗲 𝗬𝗼𝘂𝗿 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗣𝗮𝘆𝗮𝗯𝗹𝗲 𝘄𝗶𝘁𝗵 iKapture! We offer a best-in-class solution for Accounts Payable automation that eliminates manual data entry, streamlines workflows and unlocks valuable insights for your business. Here's how iKapture empowers your invoice processing: 👉Automated Invoice Processing 👉Enhanced Efficiency 👉Improved Accuracy 👉Real-Time Visibility 👉Seamless Integration Let iKapture transform your AP processes! Contact us today to learn more! #digitaltransformation #automation #documentprocessing #ai #accountspayable #invoiceprocessing

#ikapture#ai#ap automation#accounts payable#invoice management system#free invoice software#invoice processing

0 notes

Video

youtube

Supplier Invoice Processing with iKapture

0 notes