#invoice data solutions

Explore tagged Tumblr posts

Text

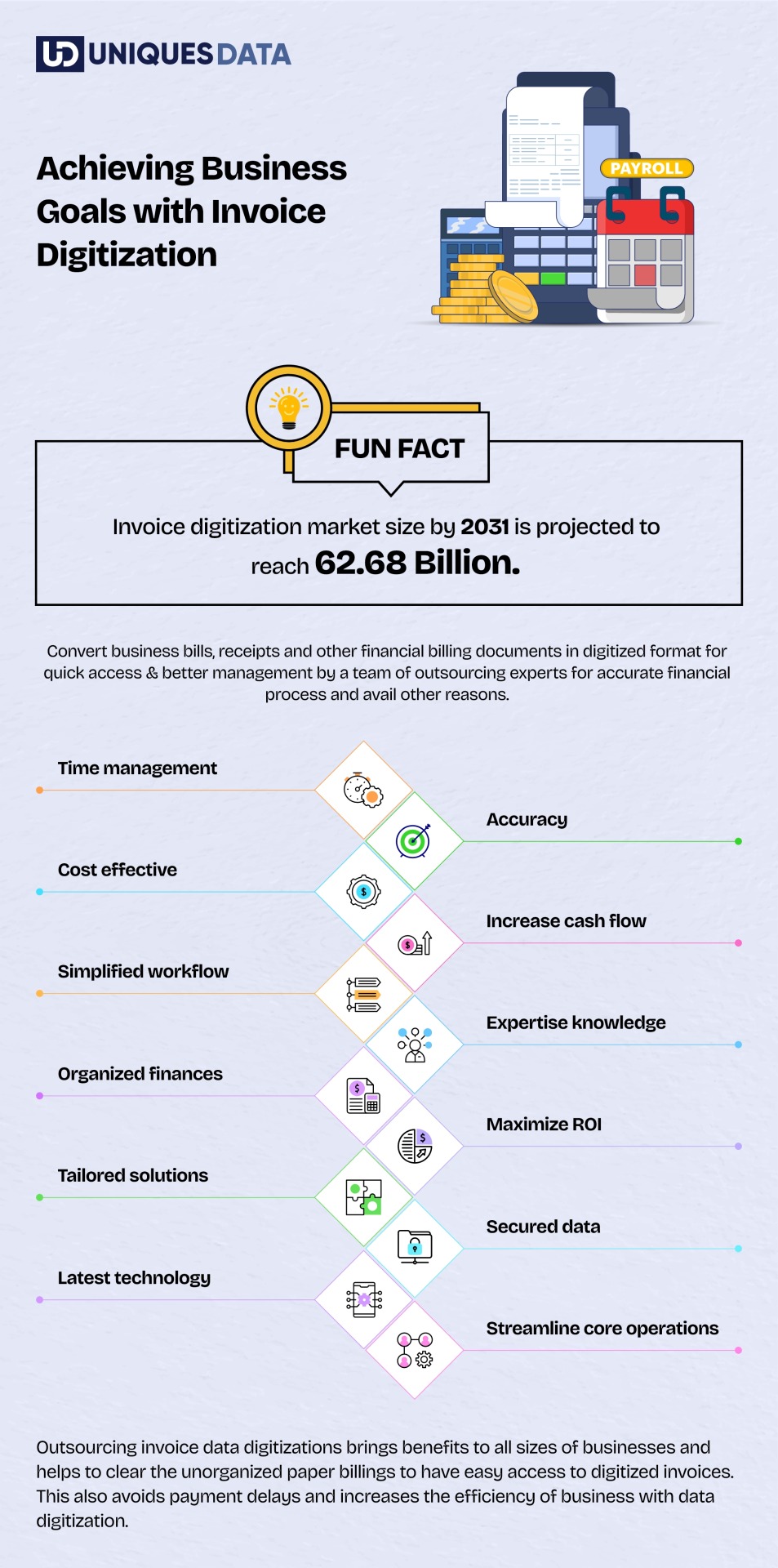

Achieving Business Goals with Invoice Digitization

Outsourcing invoice digitization is profitable for businesses as it allows them to manage their financial documents while streamlining business operations. Uniquesdata is a renowned outsourcing data entry partner with a team of professionals and years of experience.

#invoice data entry service#outsource invoice data entry service#invoice data solutions#invoice form data entry service#invoice data service#data entry invoices#data entry of invoices#invoice data entry#data digitization service

4 notes

·

View notes

Text

Streamlining Trucking Finances with Digital Invoice Management

Let’s talk invoices. I know, it might not be the most exciting topic when you’re out on the road, but stick with me for a minute—it’s actually smart for your business. Tired of handling stacks of paper invoices? It’s like trying to navigate rush hour traffic with a broken GPS. Papers get lost, numbers get messed up, and chasing down payments can feel like an endless loop. But here’s some good…

View On WordPress

#AI for trucking operations#AI invoice processing#automated invoicing systems#blockchain in trucking#business#cash flow management#cloud computing in trucking#cloud-based invoicing#digital invoicing for truckers#digital solutions for trucking#factoring services for truckers#Freight#freight industry#Freight Revenue Consultants#invoice automation in trucking#invoice factoring for truckers#invoice management software for truckers#logistics#real-time invoice tracking#scalable invoicing solutions#secure invoicing for truckers#small carriers#streamline trucking operations#Transportation#Trucking#trucking business efficiency#trucking cash flow solutions#trucking data insights#Trucking Financial Management#trucking financial tools

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

Here is how you can Choose the Right Tools for Data Transformation

For those who are running a business, data management is an art. Choosing the right data transformation tools is a critical decision that can significantly impact the quality and efficiency of your processes. This informative guide explores vital considerations and insights to help you navigate the landscape and make informed decisions.

Understanding Data Quality:

The foundation of any data transformation lies in ensuring data quality. Before probing into the selection of tools, assessing the quality of your existing datasets is crucial. Look for tools that offer robust data quality features, including validation checks, anomaly detection, and cleansing capabilities. A device that addresses data quality concerns ensures the accuracy and reliability of your transformed data.

Validation:

An essential aspect of data transformation is validating the input and output data sets. Effective validation mechanisms within a tool help identify and rectify errors, ensuring that the transformed data adheres to standards that have already been laid out to set the course. Look for tools with comprehensive validation features to guarantee the integrity of your data throughout the transformation process.

Combining Data Sets and Aggregation:

Many data transformation tasks involve merging or combining dissimilar data sets to derive meaningful insights. Choose tools that offer seamless integration capabilities, enabling you to combine data from various sources effortlessly. Additionally, look for tools with robust aggregation functionalities that help summarize and analyze data at different granularities to meet specific business requirements.

Compatibility with Existing Systems:

Ensuring compatibility with your existing systems should be a priority for a smooth integration process. Evaluate data transformation tools that seamlessly integrate with your current infrastructure, databases, and analytics platforms. A software tool that aligns with your existing ecosystem minimizes disruptions, streamlines the adoption process, and optimizes your overall data transformation workflow. Trust use when we tell you that optimizing the data so that it fits in well with the new version of the software tool that you plan on using can be a task, hence use the one with possible integration.

Scalability for Future Growth:

As your organization grows, so does the volume and complexity of your data. Opt for tools that offer scalability, allowing you to handle increasing data loads and evolving business needs. A scalable data transformation tool ensures that your processes remain efficient and effective even as your data requirements expand. It should be able to get in data silos and integrate them together so as to make meaningful insights that can help in the business growth.

Making Informed Decisions:

Choosing the right tools is a strategic decision that influences the success of your data initiatives. By prioritizing data quality, validation capabilities, the ability to combine and aggregate data, compatibility with existing systems, and scalability, you empower your organization to harness the full potential of your data. As you begin to select data transformation tools, keep these considerations in mind. By making informed decisions at this stage, you lay the groundwork for a robust and agile data transformation process that aligns seamlessly with your business objectives. With the right tools and partners like HubBroker, your organization can unlock the true value of its data assets.

#datamanagement#datasecurity#data transformation#automation#erpsoftware#erp solution#ecommerce integration#invoice software development bd#supplychain#healthcare

1 note

·

View note

Text

Financial accounting is the process of recording, summarizing, and reporting a company's financial transactions to external users. These users include investors, creditors, and other stakeholders who need to make informed decisions about the company. There are a number of basic financial accounting concepts that are essential for understanding how financial statements are prepared and interpreted. These concepts provide the foundation for financial reporting and help to ensure that financial statements are accurate and reliable.

#e invoice in tally#tally automation#accounting automation software#excel to tally import#auto entry in tally#data entry automation#automation for accountants#tally solutions#tally on cloud#automated bank statement processing

0 notes

Text

One such solution is the implementation of an Electronic Invoice Management System

In the digital age, businesses are constantly seeking ways to streamline their operations and improve efficiency. One such solution is the implementation of an Electronic Invoice Management System. This system allows businesses to manage their invoicing process online, reducing the need for physical paperwork and improving accuracy.

An Online Invoice Management System is a tool that automates the invoicing process, from order capture to payment receipt. It eliminates manual errors, speeds up the billing cycle, and improves customer satisfaction.

Order Capture Management is another crucial aspect of business operations. It involves recording customer orders accurately and efficiently, ensuring that the right products or services are delivered on time.

For businesses using SAP software, integrating these systems can be a complex task. This is where SAP Data Integration Services come into play. These services help businesses integrate their various systems and processes, allowing for seamless data flow and improved operational efficiency.

There are several SAP Data Integration Solutions available in the market today. These solutions provide a range of tools for integrating data from different sources, including databases, applications, and services.

One such tool is the SAP Data Integration Tool, which provides a comprehensive platform for data integration tasks. It supports a wide range of data sources and targets, allowing businesses to integrate their data seamlessly.

For businesses that rely heavily on order management, SAP for Order Management is an ideal solution. This system provides a comprehensive set of tools for managing orders, from capture to fulfillment.

SAP Integration Services are essential for businesses that want to integrate their SAP systems with other software or services. These services provide the necessary tools and expertise to ensure seamless integration.

Many businesses prefer to work with an SAP Integration Services Company Online. These companies offer a range of SAP integration services, including software development, consulting, and support.

SAP Integration Software is a key component of any SAP integration project. This software provides the necessary tools for integrating SAP systems with other software or services.

Similarly, SAP Integration Solutions provide a comprehensive set of tools and services for integrating SAP systems. These solutions include software, consulting services, and support.

The SAP Interface Tool is another important tool for SAP integration projects. This tool allows businesses to create custom interfaces for their SAP systems, enabling them to integrate with other software or services more easily.

For businesses that need to manage large volumes of orders, the SAP Order Management System is an ideal solution. This system provides a comprehensive set of tools for managing orders, from capture to fulfillment.

If you’re looking for an SAP Services Solutions Company Online, there are many options available. These companies offer a range of SAP services, including software development, consulting, and support.

The SAP BTP Cloud, or Business Technology Platform Cloud, is a comprehensive platform for building and running business applications. It provides a range of services and capabilities, including data management, analytics, application development, and integration.

The SAP BTP Cockpit is a web-based interface that provides a centralized location for managing all aspects of your SAP BTP environment.

For businesses using SAP S/4HANA, the SAP S4 interface provides a user-friendly way to access and manage your SAP systems.

E-Invoicing in SAP is a feature that allows businesses to send electronic invoices directly from their SAP system. This feature simplifies the invoicing process and improves accuracy.

Finally, Pre Sales Activities in SAP involve using SAP tools to manage and track pre-sales activities such as lead generation and customer engagement.

In conclusion, whether you’re looking for an online invoice management system or an SAP integration tool, there are many solutions available to help streamline your business operations.

For More Info: -

SAP btp cloud

SAP btp cockpit

SAP s4

0 notes

Text

Your One-Stop for Transcription, Translation, Tax Automation, and Appeals Management

Datagain transcription - Datagain offers services in the areas of transcription, translation, tax automation, and appeal management.

We offer services in transcription, translation, coding, and analysis, as well as solutions for the criminal justice system, tax administration, and custom software, amongst many others.

#data management systems#datagain inc#datagain transcription#spotify invoices#datagain login#justice solutions case#case management lab#solutions case management#property tax bill#industries clients contact#legal transcriptions#property tax

1 note

·

View note

Text

How ERP Software for Engineering Companies Improves Operational Efficiency

In today's competitive market, engineering companies are under immense pressure to deliver innovative solutions, maintain cost-efficiency, and meet tight deadlines—all while ensuring the highest standards of quality. As the engineering industry becomes more complex and digitally driven, operational efficiency has become a key metric for success. One of the most transformative tools driving this change is ERP (Enterprise Resource Planning) software.

For companies seeking to streamline their operations, ERP software for engineering companies provides a centralized platform that integrates every function—ranging from procurement, design, production, finance, HR, and project management. In India, especially in industrial hubs like Delhi, the demand for such software is growing rapidly. Let us explore how ERP systems significantly enhance operational efficiency and why choosing the right ERP software company in India is vital for engineering enterprises.

Centralized Data Management: The Foundation of Efficiency

One of the major challenges engineering companies face is managing vast amounts of data across departments. Manual entries and siloed systems often lead to redundancies, errors, and miscommunication. With ERP software for engineering companies in India, organizations gain access to a unified database that connects all operational areas.

Real-time data availability ensures that everyone, from the design team to procurement and finance, is working with the latest information. This reduces rework, improves collaboration, and speeds up decision-making, thereby increasing efficiency.

Streamlined Project Management

Engineering projects involve numerous stages—from planning and design to execution and maintenance. Tracking timelines, resources, costs, and deliverables manually or via disparate systems often results in delays and budget overruns.

Modern engineering ERP software companies in Delhi provide robust project management modules that allow firms to plan, schedule, and monitor projects in real time. This includes milestone tracking, Gantt charts, resource allocation, and budget forecasting. Managers can gain visibility into bottlenecks early on and reallocate resources efficiently, ensuring timely delivery.

Automation of Core Processes

Automating routine tasks is one of the key advantages of implementing ERP software. From generating purchase orders and invoices to managing payroll and inventory, ERP eliminates the need for repetitive manual work. This not only saves time but also minimizes human error.

The best ERP software provider in India will offer customizable automation workflows tailored to the specific needs of engineering companies. For instance, when a material stock reaches a minimum threshold, the ERP system can automatically generate a requisition and notify the purchasing team. This ensures zero downtime due to material shortages.

Enhanced Resource Planning and Allocation

Resource planning is crucial in engineering projects where labour, materials, and machinery must be utilized efficiently. A good ERP software for engineering companies provides detailed insights into resource availability, utilization rates, and project requirements.

By analysing this data, companies can better allocate resources, avoid overbooking, and reduce idle time. This leads to significant cost savings and ensures optimal productivity across the board.

youtube

Integration with CAD and Design Tools

Many ERP solution providers in Delhi now offer integration with design and CAD software. This is particularly useful for engineering firms where design data is often needed for procurement, costing, and production.

When ERP is integrated with CAD, design changes automatically reflect across related departments. This seamless flow of information eliminates miscommunication and ensures that downstream processes such as procurement and manufacturing are aligned with the latest design specifications.

Real-time Cost and Budget Management

Keeping engineering projects within budget is a continuous challenge. Unexpected costs can arise at any stage, and without proper monitoring, they can spiral out of control. ERP software providers in India equip engineering companies with real-time budget tracking tools.

From initial cost estimation to actual expenditure, companies can monitor every aspect of the financials. Alerts can be configured for budget deviations, helping management take corrective action promptly. This financial control is a cornerstone of operational efficiency and long-term profitability.

Improved Compliance and Documentation

Engineering companies must adhere to various compliance standards, certifications, and audit requirements. Maintaining accurate documentation and audit trails is critical. ERP systems automate compliance tracking and generate necessary documentation on demand.

By partnering with trusted ERP software companies in Delhi, engineering firms can ensure they meet industry standards with minimal administrative overhead. Features like document versioning, digital signatures, and compliance checklists help organizations stay audit-ready at all times.

Scalable and Future-ready Solutions

One of the biggest advantages of working with a reputed engineering ERP software company in Delhi is access to scalable solutions. As engineering businesses grow, their operational complexities increase. Modern ERP systems are modular and scalable, allowing businesses to add new functionalities as needed without disrupting existing operations.

Moreover, cloud-based ERP solutions offer flexibility, remote access, and lower infrastructure costs. These are especially beneficial for engineering companies that operate across multiple locations or work on-site with clients.

Enhanced Customer Satisfaction

Efficient operations lead to improved delivery timelines, better quality products, and faster customer service—all of which directly impact customer satisfaction. With ERP, engineering companies can maintain accurate production schedules, meet delivery deadlines, and respond to customer queries with real-time information.

By choosing the right ERP software for engineering companies in India, firms not only improve internal operations but also build a strong reputation for reliability and professionalism among their clients.

Choosing the Right ERP Partner

With the growing number of ERP solution providers in India, selecting the right partner is crucial. Here are a few factors to consider:

Domain Expertise: Choose a vendor with experience in the engineering sector.

Customization: The software should be tailored to suit your specific workflows.

Scalability: Ensure the ERP solution grows with your business.

Support & Training: Opt for companies that provide ongoing support and employee training.

Integration Capabilities: Check whether the ERP can integrate with your existing systems, including CAD tools, financial software, etc.

Trusted ERP software companies in Delhi like Shantitechnology (STERP) stand out because they offer deep industry knowledge, scalable platforms, and dedicated customer support—making them ideal partners for engineering businesses seeking to transform operations.

youtube

Final Thoughts

In a rapidly evolving business landscape, engineering companies must adopt smart technologies to stay ahead. ERP software is not just an IT solution—it is a strategic tool that can redefine how engineering firms manage their projects, people, and performance.

From streamlining project workflows and automating routine tasks to enhancing collaboration and boosting resource efficiency, ERP solutions deliver measurable gains across the organization. For those looking to make a digital leap, partnering with a top-rated ERP software company in India can be the difference between stagnation and scalable success.

Looking for a reliable ERP partner? Shantitechnology (STERP) is among the leading ERP solution providers in Delhi, offering tailored ERP software for engineering companies to help you boost productivity, reduce costs, and grow sustainably. Contact us today to learn more!

#Engineering ERP software company#ERP software for engineering companies in India#ERP solution providers#ERP software for engineering companies#ERP software companies#ERP software providers in India#Gujarat#Maharashtra#Madhyapradesh#ERP solution providers in India#ERP for manufacturing company#Delhi#Hyderabad#ERP Software#Custom ERP#ERP software company#Manufacturing enterprise resource planning software#Bengaluru#ERP software company in India#Engineering ERP Software Company#Best ERP software provider in India#Manufacturing ERP software company#Manufacturing enterprise resource planning#ERP modules for manufacturing industry#Best ERP for manufacturing industry#India#Youtube

2 notes

·

View notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Everything you need to know about Outsourcing Invoice Data Entry Services

Invoices are a significant part of any organization which is generated in massive volume. Managing each bill is tedious which calls for invoice data digitization for precise management and easy access. UniquesData brings comprehensive solutions for multiple industries to manage their bulk invoices.

#invoice data entry service#outsource invoice data entry service#invoice data solutions#invoice form data entry service#invoice data service#data entry invoices#data entry of invoices#invoice data entry#data digitization service

1 note

·

View note

Text

How to Ensure Compliance with ZATCA Phase 2 Requirements

As Saudi Arabia pushes toward a more digitized and transparent tax system, the Zakat, Tax and Customs Authority (ZATCA) continues to roll out significant reforms. One of the most transformative changes has been the implementation of the electronic invoicing system. While Phase 1 marked the beginning of this journey, ZATCA Phase 2 brings a deeper level of integration and regulatory expectations.

If you’re a VAT-registered business in the Kingdom, this guide will help you understand exactly what’s required in Phase 2 and how to stay compliant without unnecessary complications. From understanding core mandates to implementing the right technology and training your staff, we’ll break down everything you need to know.

What Is ZATCA Phase 2?

ZATCA Phase 2 is the second stage of Saudi Arabia’s e-invoicing initiative. While Phase 1, which began in December 2021, focused on the generation of electronic invoices in a standard format, Phase 2 introduces integration with ZATCA’s system through its FATOORA platform.

Under Phase 2, businesses are expected to:

Generate invoices in a predefined XML format

Digitally sign them with a ZATCA-issued cryptographic stamp

Integrate their invoicing systems with ZATCA to transmit and validate invoices in real-time

The primary goal of Phase 2 is to enhance the transparency of commercial transactions, streamline tax enforcement, and reduce instances of fraud.

Who Must Comply?

Phase 2 requirements apply to all VAT-registered businesses operating in Saudi Arabia. However, the implementation is being rolled out in waves. Businesses are notified by ZATCA of their required compliance deadlines, typically with at least six months' notice.

Even if your business hasn't been selected for immediate implementation, it's crucial to prepare ahead of time. Early planning ensures a smoother transition and helps avoid last-minute issues.

Key Requirements for Compliance

Here’s a breakdown of the main technical and operational requirements under Phase 2.

1. Electronic Invoicing Format

Invoices must now be generated in XML format that adheres to ZATCA's technical specifications. These specifications cover:

Mandatory fields (buyer/seller details, invoice items, tax breakdown, etc.)

Invoice types (standard tax invoice for B2B, simplified for B2C)

Structure and tags required in the XML file

2. Digital Signature

Every invoice must be digitally signed using a cryptographic stamp. This stamp must be issued and registered through ZATCA’s portal. The digital signature ensures authenticity and protects against tampering.

3. Integration with ZATCA’s System

You must integrate your e-invoicing software with the FATOORA platform to submit invoices in real-time for validation and clearance. For standard invoices, clearance must be obtained before sharing them with your customers.

4. QR Code and UUID

Simplified invoices must include a QR code to facilitate easy validation, while all invoices should carry a UUID (Universally Unique Identifier) to ensure traceability.

5. Data Archiving

You must retain and archive your e-invoices in a secure digital format for at least six years, in accordance with Saudi tax law. These records must be accessible for audits or verification by ZATCA.

Step-by-Step Guide to Compliance

Meeting the requirements of ZATCA Phase 2 doesn’t have to be overwhelming. Follow these steps to ensure your business stays on track:

Step 1: Assess Your Current System

Evaluate whether your current accounting or invoicing solution can support XML invoice generation, digital signatures, and API integration. If not, consider:

Upgrading your system

Partnering with a ZATCA-certified solution provider

Using cloud-based software with built-in compliance features

Step 2: Understand Your Implementation Timeline

Once ZATCA notifies your business of its compliance date, mark it down and create a preparation plan. Typically, businesses receive at least six months’ notice.

During this time, you’ll need to:

Register with ZATCA’s e-invoicing platform

Complete cryptographic identity requests

Test your system integration

Step 3: Apply for Cryptographic Identity

To digitally sign your invoices, you'll need to register your system with ZATCA and obtain a cryptographic stamp identity. Your software provider or IT team should initiate this via ZATCA's portal.

Once registered, the digital certificate will allow your system to sign every outgoing invoice.

Step 4: Integrate with FATOORA

Using ZATCA’s provided API documentation, integrate your invoicing system with the FATOORA platform. This step enables real-time transmission and validation of e-invoices. Depending on your technical capacity, this may require support from a solution provider.

Make sure the system can:

Communicate securely over APIs

Handle rejected invoices

Log validation feedback

Step 5: Conduct Internal Testing

Use ZATCA’s sandbox environment to simulate invoice generation and transmission. This lets you identify and resolve:

Formatting issues

Signature errors

Connectivity problems

Testing ensures that when you go live, everything operates smoothly.

Step 6: Train Your Team

Compliance isn’t just about systems—it’s also about people. Train your finance, IT, and sales teams on how to:

Create compliant invoices

Troubleshoot validation errors

Understand QR codes and UUIDs

Respond to ZATCA notifications

Clear communication helps avoid user errors that could lead to non-compliance.

Step 7: Monitor and Improve

After implementation, continue to monitor your systems and processes. Track metrics like:

Invoice clearance success rates

Error logs

Feedback from ZATCA

This will help you make ongoing improvements and stay aligned with future regulatory updates.

Choosing the Right Solution Provider

If you don’t have in-house resources to build your own e-invoicing system, consider working with a ZATCA-approved provider. Look for partners that offer:

Pre-certified e-invoicing software

Full API integration with FATOORA

Support for cryptographic signatures

Real-time monitoring dashboards

Technical support and onboarding services

A reliable provider will save time, reduce costs, and minimize the risk of non-compliance.

Penalties for Non-Compliance

Failure to comply with ZATCA Phase 2 can result in financial penalties, legal action, or suspension of business activities. Penalties may include:

Fines for missing or incorrect invoice details

Penalties for not transmitting invoices in real-time

Legal scrutiny during audits

Being proactive is the best way to avoid these consequences.

Final Thoughts

As Saudi Arabia advances toward a fully digital economy, ZATCA Phase 2 is a significant milestone. It promotes tax fairness, increases transparency, and helps modernize the way businesses operate.

While the technical requirements may seem complex at first, a step-by-step approach—combined with the right technology and training—can make compliance straightforward. Whether you're preparing now or waiting for your official notification, don’t delay. Start planning early, choose a reliable system, and make sure your entire team is ready.

With proper preparation, compliance isn’t just possible—it’s an opportunity to modernize your business and build lasting trust with your customers and the government.

2 notes

·

View notes

Text

VAT Data Processing in ALZERP Cloud ERP Software

Key Features of ALZERP’s VAT Data Processing:

ZATCA Server Integration: ALZERP seamlessly connects with the ZATCA server using the business identification number, enabling real-time data exchange and synchronization.

Data Synchronization: The software automatically synchronizes various data points, including opening balances, purchase and LC details, VAT sales, item returns, expenses, voucher data, and data corrections.

VAT Return and Zakat Return Calculation: ALZERP accurately calculates VAT and Zakat return amounts based on the synchronized data, ensuring compliance with tax regulations.

Separate Invoice Management: Invoices from sales are created in a separate table, allowing for efficient tracking and management.

Non-VAT Invoice Processing: ALZERP automatically processes non-VAT invoices with the applicable 15% VAT amount.

Invoice Item Synchronization: Any changes made to items in VAT invoices are reflected in the corresponding non-VAT invoices, maintaining consistency.

Opening Balance Synchronization: ALZERP synchronizes opening balances for products, stock, parties, and accounts heads as of December 31, 2022.

Purchase and LC Synchronization: The software synchronizes purchase and LC data within specified date ranges, capturing all relevant transactions.

VAT Sales Synchronization: VAT sales data is synchronized, including the option to enable automatic ZATCA submission.

Sold Item Returns Synchronization: Returned items are recorded in a separate table, and existing data within the same date range is replaced.

Voucher Data Processing: ALZERP processes expenses and bookkeeping vouchers, excluding non-VATable items and focusing on relevant payment, receipt, and journal vouchers.

Data Correction and Reprocessing: The software allows for rechecking and correcting synced data, processing bank statements, and reprocessing sales as needed.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

Integrating Third-Party Tools into Your CRM System: Best Practices

A modern CRM is rarely a standalone tool — it works best when integrated with your business's key platforms like email services, accounting software, marketing tools, and more. But improper integration can lead to data errors, system lags, and security risks.

Here are the best practices developers should follow when integrating third-party tools into CRM systems:

1. Define Clear Integration Objectives

Identify business goals for each integration (e.g., marketing automation, lead capture, billing sync)

Choose tools that align with your CRM’s data model and workflows

Avoid unnecessary integrations that create maintenance overhead

2. Use APIs Wherever Possible

Rely on RESTful or GraphQL APIs for secure, scalable communication

Avoid direct database-level integrations that break during updates

Choose platforms with well-documented and stable APIs

Custom CRM solutions can be built with flexible API gateways

3. Data Mapping and Standardization

Map data fields between systems to prevent mismatches

Use a unified format for customer records, tags, timestamps, and IDs

Normalize values like currencies, time zones, and languages

Maintain a consistent data schema across all tools

4. Authentication and Security

Use OAuth2.0 or token-based authentication for third-party access

Set role-based permissions for which apps access which CRM modules

Monitor access logs for unauthorized activity

Encrypt data during transfer and storage

5. Error Handling and Logging

Create retry logic for API failures and rate limits

Set up alert systems for integration breakdowns

Maintain detailed logs for debugging sync issues

Keep version control of integration scripts and middleware

6. Real-Time vs Batch Syncing

Use real-time sync for critical customer events (e.g., purchases, support tickets)

Use batch syncing for bulk data like marketing lists or invoices

Balance sync frequency to optimize server load

Choose integration frequency based on business impact

7. Scalability and Maintenance

Build integrations as microservices or middleware, not monolithic code

Use message queues (like Kafka or RabbitMQ) for heavy data flow

Design integrations that can evolve with CRM upgrades

Partner with CRM developers for long-term integration strategy

CRM integration experts can future-proof your ecosystem

#CRMIntegration#CRMBestPractices#APIIntegration#CustomCRM#TechStack#ThirdPartyTools#CRMDevelopment#DataSync#SecureIntegration#WorkflowAutomation

2 notes

·

View notes

Text

Fintech is rapidly transforming the financial services industry, and the accounting profession is no exception. Accounting technology is automating tasks, improving efficiency, and providing accountants with new insights to help businesses make better decisions. The impact of fintech innovations on the accounting industry. We will discuss how technology is changing the roles of accountants and bookkeepers, and we will highlight five technologies that are transforming the accounting profession.

#accounting automation software#tally automation#tally solutions#automated bank statement processing#tally on cloud#e invoice in tally#excel to tally import#auto entry in tally#automation for accountants#data entry automation

1 note

·

View note

Text

Why Shipease is the Smartest Choice for E-Commerce Shipping in 2025

Why Shipease is the Smartest Choice for E-Commerce Shipping in 2025

In the ever-evolving world of e-commerce, efficient and reliable shipping isn’t just a feature — it’s the backbone of customer satisfaction and business growth. As we step into 2025, one platform continues to stand out for e-commerce businesses looking for a smarter, smoother, and more scalable shipping solution: Shipease.

Here’s why Shipease is the smartest choice for e-commerce shipping in 2025:

1. All-in-One Shipping Dashboard

Shipease eliminates the hassle of juggling multiple courier partners. With its centralized dashboard, you can compare rates, generate labels, schedule pickups, and track shipments — all in one place. It’s designed to save time, cut manual errors, and improve operational efficiency.

2. AI-Powered Courier Recommendations

Thanks to its smart algorithm, Shipease automatically suggests the best courier based on delivery location, cost, and performance history. This means faster deliveries, lower return rates, and happier customers.

3. Real-Time Tracking and Notifications

Today’s customers expect to know exactly where their order is. Shipease provides real-time tracking updates to both you and your buyers, reducing WISMO ("Where is my order?") queries and improving customer experience.

4. Seamless Integration with Major Marketplaces

Whether you're selling on Amazon, Shopify, WooCommerce, or your own website, Shipease easily integrates with major e-commerce platforms. Sync your orders effortlessly and manage your shipping in a streamlined workflow.

5. Flexible Shipping Options

From same-day delivery to cash on delivery (COD) and reverse logistics, Shipease offers a wide range of shipping options. This flexibility allows you to cater to diverse customer preferences and boost your overall conversion rates.

6. Affordable Pricing and Transparent Billing

Shipease offers competitive shipping rates with no hidden charges. With clear invoicing and billing insights, e-commerce sellers get complete visibility over shipping expenses, making budgeting and forecasting a breeze.

7. Automated NDR and RTO Management

Non-delivery reports (NDRs) and return-to-origin (RTO) shipments can be a nightmare for online sellers. Shipease automates the process of addressing delivery failures, communicates with customers, and helps minimize return costs.

8. Dedicated Support and Account Management

Need help fast? Shipease offers responsive customer support along with dedicated account managers who understand your business goals and help optimize your shipping strategy.

9. Data-Driven Insights for Smarter Decisions

With in-depth analytics and shipping performance reports, you can track KPIs, optimize courier selection, and uncover areas to improve logistics and customer experience.

10. Future-Ready Technology

In 2025, speed and adaptability are key. Shipease stays ahead of the curve by continuously upgrading its tech infrastructure, ensuring faster processing, enhanced security, and new features that support your e-commerce growth.

Conclusion

E-commerce success in 2025 hinges on delivering orders quickly, reliably, and affordably — and Shipease is built to help you do just that. Whether you’re a small seller or a large-scale brand, Shipease offers the tools, tech, and support you need to ship smarter, scale faster, and deliver better.

Switch to Shipease today — because smart businesses deserve smart shipping.

2 notes

·

View notes

Text

Benefits of Fast Online Payments — Quick Pay

In today’s digital economy, fast online payments are no longer just a convenience—they are a necessity. From e-commerce stores to freelancers and service providers, everyone is shifting toward quicker, safer, and smarter payment solutions. Among the many options available, Quick Pay has emerged as a leading platform offering seamless online payment experiences for both businesses and customers.

If you're a business owner or entrepreneur looking to scale your operations and improve customer satisfaction, understanding the benefits of fast online payments is crucial. And when it comes to delivering these benefits efficiently, Quick Pay stands out with its cutting-edge features and reliable service.

1. Enhanced Customer Experience

The first and most obvious benefit of fast online payments is an improved customer experience. Today’s consumers expect instant transactions. A slow or complicated checkout process can lead to cart abandonment and loss of revenue.

With Quick Pay, customers can complete payments in just a few clicks. The user-friendly interface, minimal redirects, and fast processing ensure that your clients enjoy a hassle-free payment journey, increasing the chances of repeat business.

Quick Pay Advantage:

One-click checkout

Mobile-optimized experience

Multiple payment options: UPI, cards, wallets, net banking

2. Faster Cash Flow for Businesses

One of the major benefits of fast online payments is accelerated cash flow. Unlike traditional bank transfers that may take days, fast payment systems like Quick Pay ensure that your money reaches you quickly—often on the same day.

For small businesses and startups, this is a game-changer. You no longer have to wait endlessly for payments, allowing better cash management, investment in growth, and operational efficiency.

Quick Pay Benefit:

Same-day settlements (T+0 and T+1 options)

Instant payment notifications

Transparent tracking of incoming funds

3. Higher Conversion Rates

Online businesses thrive on conversion rates. A complicated or slow payment process can discourage potential customers right at the final step. By offering a quick and secure payment gateway like Quick Pay, businesses can increase their checkout success rate dramatically.

Speed combined with security builds trust and reduces the bounce rate.

Quick Pay Features That Help:

Secure payment environment (PCI DSS compliant)

Optimized checkout for mobile and desktop

Auto-fill and tokenized payments for returning users

4. Increased Trust and Credibility

When customers notice that your website or app uses a reputed and fast payment solution like Quick Pay, it instantly boosts your brand’s credibility. Shoppers feel more secure transacting on your platform, knowing that their personal and financial data is in safe hands.

This trust translates into higher engagement, more referrals, and long-term brand loyalty.

Quick Pay Security Standards:

End-to-end encryption

Two-factor authentication

Fraud detection and chargeback control

5. Support for Recurring Payments

Many businesses today rely on subscription models—whether it's digital services, SaaS platforms, or fitness memberships. A major benefit of fast online payments is the ability to automate recurring billing.

Quick Pay makes recurring payments smooth and effortless. Customers don’t need to re-enter their details every time, and businesses enjoy predictable revenue without delays.

With Quick Pay, You Get:

Automated recurring billing setup

Smart invoicing and reminders

Custom billing cycles

6. Lower Operational Costs

Handling cash or bank transfers manually involves time, risk, and additional staff. Online payments automate this entire process, reducing overhead costs. Quick Pay’s all-in-one dashboard helps manage your transactions, analytics, and customer data in one place.

Over time, businesses save money on labor, reconciliation, and administrative tasks.

Quick Pay’s Business Dashboard Offers:

Real-time transaction tracking

Sales reports and analytics

Easy refund and dispute management

7. Wider Customer Reach

Fast online payments open up a global customer base. Whether you're selling in your local city or shipping products across the world, a payment gateway like Quick Pay ensures that you never miss a sale due to geographical or banking limitations.

Quick Pay supports multi-currency payments and international cards, making it easier to scale your business globally.

Quick Pay Global Features:

Support for major global currencies

Acceptance of Visa, Mastercard, AmEx, and more

Integration with international platforms like Shopify, WooCommerce, and others

8. Seamless Integrations with Online Platforms

The benefits of fast online payments are amplified when your payment gateway easily integrates with your website, mobile app, or POS system. Quick Pay offers ready-made plugins and robust APIs for smooth integration.

This reduces developer time, lowers setup costs, and gets you live faster.

Quick Pay Integration Highlights:

Easy plugins for WordPress, Shopify, Magento

Android/iOS SDKs for mobile apps

API documentation and 24/7 tech support

9. Better Customer Retention

A smooth payment experience not only helps you close a sale but also encourages customers to return. Fast refunds, saved payment options, and friendly interfaces make users feel valued.

Quick Pay includes customer retention features like:

Smart retry on failed transactions

Branded payment pages

Custom thank-you messages and emails

10. Real-Time Analytics and Insights

Understanding how your customers pay can guide better business decisions. Quick Pay’s powerful analytics tools offer deep insights into payment trends, user behavior, and settlement reports—all in real time.

This data can be used to optimize your marketing campaigns, identify high-value customers, and plan inventory.

What Quick Pay Analytics Offers:

Dashboard with payment trends and patterns

Conversion rate tracking

Refund and dispute summary

Why Choose Quick Pay?

When it comes to maximizing the benefits of fast online payments, Quick Pay checks all the boxes:

✅ Fast and secure transactions ✅ Same-day settlements ✅ Easy integrations ✅ Scalable for small to enterprise businesses ✅ Exceptional customer support

Whether you're a growing startup, a large enterprise, or a freelancer, Quick Pay empowers your business to accept payments quickly, securely, and with minimal friction.

Final Thoughts

The world is moving fast, and so should your payments. Embracing the benefits of fast online payments can revolutionize your business operations, boost customer satisfaction, and drive consistent revenue.

With its reliable technology, business-friendly features, and unmatched customer support, Quick Pay is the ideal partner for modern businesses looking to thrive in the digital age.

Ready to Get Started?

Visit www.usequickpay.com to create your free account and start accepting payments within minutes.

#finance#online payments#payments#branding#economy#quickpay#bestpaymentgateway#FastOnlinePayments#QuickPayIndia#DigitalPaymentsSolution

2 notes

·

View notes