#it cost me like. 5 usd per volume

Text

Me, not obsessed at all.

#Yes; these are the 18 japanese volumes#it cost me like. 5 usd per volume#with shipping included#considering to post the extras not yet available in English hsjshs#undead unluck#shut up cat

24 notes

·

View notes

Text

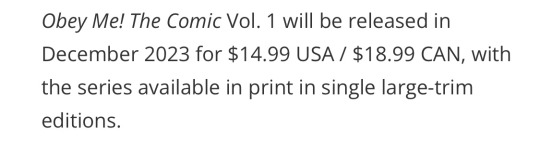

3 months late on this news but apparently Seven Seas has been given license to translate the physical Obey Me! Manga which I was actually excited about.

Then I saw they're selling volume one for $15USD, which is usually what light novels sell for which this is not(manga are usually priced at $5-7 USD per volume).

Like no thank you, byeeeee 👋🏻

Though, if it's priced that way as a result of the unionizing that went on last year then actually I am fine with that, pay your translators.

I'm not excited to potentially pay what will round up to about $45 USD without shipping or tax for three volumes of manga, but if it's priced like that because manga should already be more expensive to cover the cost of paying your people a living wage then fine, whatever.

Unless they're only releasing the large trim editions; which are always more expensive, then the $15 price point actually makes sense.

Undecided on buying the physical manga rn but at least I know it's being translated by a reputable source this time and not... whatever the heck mangaplaza has going on.

#screaming into my personal void#obey me comic#we'll just have to wait and see honestly#apologies if this is all over i have trouble organizing my thoughts sometimes#also if you're curious about the union from what I understand they're formally recognised#and still in talks about finalizing agreements according to their twitter#solmares recent decisions are also making it hard to justify spending money on the game despite how much I like it

2 notes

·

View notes

Text

Google Search Result Scraper | Scrape Google SERP Result Data

+

Google Search Result Scraper - Scrape Google SERP Result Data

RealdataAPI / google-search-scraper

This tool allows you to extract the Google search result pages and compile all the details shown for a particular query, like organic and paid results, questions, and prices; people also asked for reviews, ads, etc. Choose your language or country, extract custom attributes, and save the data without coding. Our Google Search Result Scraper is available in the USA, UK, Canada, France, Spain, Germany, Australia, Singapore, and other countries worldwide.

Customize me! Report an issue SEO tools Marketing

Readme

API

Input

Related actors

What is a Google Search Result Scraper, and How Does It Work?

The Google SERP Data Scraping Tool On Our Platform Crawls Search Results On The Largest Search Engine In The World And Extracts Data From Crawled Web Pages In Usable Formats Like CSV, JSON, Excel, Or XML. Using Google SERP Scraper, You Can Scrape The Following Data From The Google Search Engine.

Organic results

People also ask

Related queries

Product ads

Paid results

Ratings and reviews

Other customized attributes

Why Use Google Search Result Scraper for Data Extraction?

For The Last 13 Years, Google Hasn't Had Any Official Search Result API To Show You How Your Competitors And You Perform On Google. Therefore, You Must Find An Alternative Tool To Monitor Your And Your Competitor's SERP. Web Scraping Tools Like Google SERP Scraper For SERP Analysis Help Fulfill Your Needs.

Our Google Search Result Scraper Gives You A Customizable Google Scraper With RESTful SERP API That Gives You Optimized Outputs From Google Search In Real-Time That You Can Download And In A Usable Format. After Collecting And Exporting The Data From Google Search Results, You Can Import It Into Your Projects Or Integrate It With Other Platforms Like Airbyte, Google Sheets, Google Drive, Etc.

How to use collected data from Google search results?

Track how often people search a specific search term on Google and its comparison with the total tentative search volume.

Track the performance of your website on the Google search engine for specific keywords and use the scraped data to optimize your website on the search engine.

Study display advertisements for selected keyword sets.

Study Google algorithms and discover essential trends.

Track competition for your website in paid and organic search results.

Compile a list of URLs for specific search queries. You can use it to find starting points while scraping required search result pages from Google.

How to use Google Search Result Scraper?

In A Stepwise Tutorial, We Have Shared The Process To Set Up And Execute This Scraper. Explore It To Understand Various Aspects Of Google SERP Data Collection API.

What is the cost of using Google Search Result Scraper?

The Cost Of Using This Scraper Varies Depending On Your Requirements For Google Search Result Data. Using The Trial Plan Of 5 USD, You Will Get Up To Five Thousand Results Monthly. If You Want More Data Often, You Can Use Our Starter Plan And Scrape Over One And A Half Million Results Monthly. You Can Contact Us For Custom Requirements If You Still Need More Data.

To Check Your Platform Credits And Balance, Visit The Pricing Page.

Is it mandatory to use proxy servers to scrape search results from Google?

You Must Use A Proxy Server To Set Up Enough To Run The Scraper Successfully. You Have The Option To Use Our Proxies From Your Console Account.

But The Scraper Consumes One SERP Proxy Server For Each Request. Using The Trial Plan, You Can Use Five Hundred Proxy Requests From Our Platform Regardless Of The Results You Extract Using The Scraper. You Can Optimize The Proxy Usage By Customizing The Per-Page Outputs Of The Scraper.

Input to Google Search Result Scraper

The SERP API Allows You To Customize It For Specific Outputs. For This, You Can Mention The Following Input Settings:

Search domain or country

Search language

Raw URL for Google search or keyword phrases

The resulting count for each page

Device version outputs

The exact location of the user.

Check Out The Input Tab For A Detailed Explanation Of Every Input Setting.

How to extract Google SERP using keywords or URLs?

There Are Two Methods To Scrape Google SERP: Search Keyword And URL.

Crawling the Google SERP will help you get data from the result pages. You can add unlimited search queries according to your requirements.

If you crawl the SERP using a URL to collect the data, the scraper will give you data from any domain or copy-pasted link. You can add unlimited URLs according to your needs.

Both Alternatives To Scraping The Google Search Engine Are Suitable For This Scraper.

How to extract search results from Google using URLs?

It Is Straightforward To Scrape Google Search Engines Using URLs. You Only Need To Copy And Paste The URL For The Required Data And Mention The Pages From The Platform You Want To Extract.

Check Out The Below JSON Example To Scrape Google SERP Using URLs.

How to extract Google SERP using search keywords?

Likewise, Scraping Google Search Engine Pages Using Search Keywords Is Also Very Simple. You Only Needed To Mention The Search Queries And Required Pages From SERP You Want To Extract. You Have Multiple Options To Use Keywords For Scraping Google.

Those Options Are:

Mention domain or country location and language as a location parameter.

Mention the result count you want to collect for each page of Google.

Extract the SERP using a single search query.

Extract the SERP using multiple search queries parallelly.

Check Out The Below JSON Example To Scrape Google SERP Using Search Queries.

Output Example of Google Search Result Scraper

It Saves Its Output In A Default Output Dataset Related To The Scraper Execution. The Scraper Lets You Download The Data From A Dataset In Multiple Formats Like CSV, JSON, Excel, Or XML.

You Can Export These Outputs Directly From The API Endpoint From Get Dataset Details. < Https://Api.RealdataAPI.Com/V2/Datasets/[DATASET_ID]/Items?Format=[FORMAT] >

The Datasets Formats Are Available As [FORMAT], Like Xlsx, Xml, Html, Json, Or Rss With [DATASET_ID] As A Dataset ID.

Search Query-based Output Example

The Output Dataset Will Have A Single Record For Every Google Search Engine Result Page In The Following JSON Format. Remember That You Will Find Sample Values In A Few Fields.

How to collect a single search output in a row?

We Have A Toggle Button For CSV-Based Output For This Condition. However, If You Want To Do It Using Code, Follow The Below Guide.

Built-in Approach

If You Need Output For Google Searches, With Different Results For Paid And Organic Results For Each Row, You Have To Set The Input Field CsvFriendlyOutput To True. It Is Switched Off By Default, Ignoring Each Extra Field Besides PaidResults, OrganicResults, And SearchQuery To Store In A CSV Format. It Also Stringifies The Array EmphasizedKeywords And Deletes The SiteLinks Data Array From Paid And Organic Outputs. You'll See The Output Datasets In Paid And Organic Output Arrays.

You'll See The Organic Search Result Output Representation In The Below Format:

Check The Paid Result To Note The Difference In AdPosition Fields With The Position And Value Of The Type Field. The Scraper Computes The Position Of Paid Outputs Compared To Organic Results Separately And Stores It In The AdPosition Field.

Optional Approach Using API Call

You Can Pass Search Term Parameters Unwind=OrganicResults And Fields=SearchQuery,OrganicResults To The Link Of The API Endpoint:< https://api.RealdataAPI.com/v2/datasets/[DATASET_ID]/items?format=[FORMAT]&fields=searchQuery,organicResults&unwind=organicResults >

The API Will Reflect The Output In The Following JSON Data Format:

While Using CSV, Excel, Or Other Tabular Data Formats, You Will Get A Table With A Single Organic Output In Every Row. Explore The Documentation To Learn More About Formatting And Exporting The Recorded Datasets.

Bits of Advice

You Can Extract Many Results Effectively Using A Single Search Term With A Set Of A Hundred Search Outputs For Every Page To Get A Hundred Outputs On Each Page Instead Of Getting Ten Search Results On Ten Google Pages.

If You Need To Clarify The Quality And Efficiency Of Search Results, The Scraper Stores The Complete HTML Page In The Key-Value Store For Every Execution. You Can Read It And Compare Outputs. Our Dedicated Team Continuously Tracks The Resulting Quality. However, We Are Happy To Resolve Your Issues.

Disclaimers

How to extract Google search results in millions?

Please Remember That, Though The Largest Search Engine Displays Millions Of Search Results Available For Specific Keywords, It Will Not Show You Over A Hundred Or Thousand Results For A Search Query. If You Want More Results, You Can Create Similar Search Queries Combining Various Locations And Parameters And Get Results.

How to extract data from Google ads?

Scraping Google Search Results Is The Option To Collect Required Data For Specific Search Terms Using Search Results And Paid Advertising Results From Google SERP. These Results Depend On Browser History And The Location Of Users. Further, It Relies On Google Algorithms On Which Ads It Wants To Display To Which Users. You May Not Get The Expected Results Due To Google's Accurate And Ever-Changing Algorithms.

Can I Legally Use Google Search Result Scraper?

If You Scrape Public Data From Google, Web Data Collection Is Legal. However, You Should Check Personal Data And Property Regulations. Remember To Extract Only Public Data. Luckily, You Can Extract Private Data If You Have A Legitimate Purpose And Follow Google's Terms And Conditions Effectively. You Can Consult Your Advocate To Clarify Whether Your Reason For Scraping Google Search Results Is Genuine.

Google SERP Scraper with Integrations

Lastly, You Can Integrate Google SERP Scraping Tool Into Any Web Application Or Cloud Service With The Help Of Integrations On Our Platform. Connecting The Scraper With Airbyte, Zapier, Make, Google Drive, Google Sheets, Slack, And Other Platforms Is Possible. Further, Use Webhooks To Set Up If Any Event Occurs, Like A Successful Run Of The Scraper.

Using Google SERP Scraping Tool with Real Data API Actor

Our Actor Allows You To Access Real Data API Programmatically. We Have Organized It Around RESTful HTTP Endpoints To Allow You To Schedule, Manage, And Run Our Actors. It Also Allows You To Track Performance, Extract Results, Access Scraped Datasets, Update And Create Scraper Versions, And More.

You Can Use Our Client PyPl And Client NPM Package To Access The API Using Python And Node.Js, Respectively.

What are the other Google data scrapers?

Google Maps Scraper

Google Trends Scraper

Google Play Reviews Scraper

Google Shopping Scraper

Google Datasets Translator

Google Maps Reviews Scraper

Google Trending Searches

Google Maps with Contact Details

Know More : https://www.realdataapi.com/google-search-scraper.php

#GoogleSearchResultScraper#ScrapeGoogleSERPResultData#GoogleSERPDataScraping#GoogleSearchDataExtraction#ExtractGoogleSERP

0 notes

Photo

I... I don’t often call out anyone specifically using social media before, but... I saw this among the reblogs in my first post about MXTX novels English release announcement and I feel that this is just too much...

I’m not going to tag this with the fandom tags because this is literally just my personal rant, and I don’t want unpleasant things to appear when people are happily browsing the tags.

I also censored the person’s blog name. It’s not like I want people to mass attack them.

But I do have some things I want to say about this kind of mindset.

And this is gonna be a long post, so I’ll cut it with "Read More” later below as not to disturb anyone’s browsing experience.

Why do they have to split the books into multiple volumes?

First, you do realize that the original Chinese version and other languages versions are also in multiple volumes that don’t always be published on the same date, right?

SVSSS has 3 volumes, MDZS has 4 volumes, TGCF has 5 volumes.

With the English release, both SVSSS and MDZS get +1 volume while TGCF gets +3 volumes.

Why you ask?

Have you ever considered how long a single Chinese word would be if written in alphabets?

The word “人” in Chinese only needs 1 (one) character, while in English it would translate to “P E O P L E” = 5 (five) characters.

The word “知己” in Chinese only needs 2 (two) characters, while in English it would translate to “C O N F I D A N T E” = 10 characters, or “S O U L M A T E” = 8 characters.

Now apply this to an entire novel. FYI, TGCF has more than 1 million word count in Chinese, so you can do the math by yourself.

I mean, just go watch the donghua or live action in YouTube. One single sentence in the Chinese sub is often translated to two or more lines in the English subtitle.

And have I mentioned that the English release will have:

Glossary

Footnotes

Character Guides

And I’m going to repeat this once again: In China and other countries that already get their official releases, it is also NOT always all released on the same date as a single set/box.

So yes, (not) surprise! For the Chinese release and official releases in other countries, you also often need to purchase multiple times, pay shipping fee multiple times, and wait for certain period of times until all volumes are released.

It doesn’t only happen to MXTX novels, it happens to almost all novels, be it danmei or not.

Why don’t they just wait for translations to finish and release it all at the same time/as a box set? Why the span of two years?

On my part, I already say above that in China and other countries that already get their official release, it’s also not always published all on the same date.

Other than that, I’m not an expert at book publishing, much less when the publisher is not from my own country. But maybe consider the following:

They’re releasing 3 (three) hugely popular IPs all at the same time. Maybe the preparations take more time and effort to ensure everything is flawless?

Since it is very rare (or maybe never, cmiiw) for danmei novels to be published in English, maybe the publisher is testing the market first? Because if they already release them as a huge bundle from the start and it somehow flops, the loss would be very big. If it works well, then good! Maybe for future danmei release, they will consider making a box set or releasing them within shorter timeframe.

In terms of marketing, if they wait another 2 years to release it all at once, will the momentum still be there? You can say “so in the end it’s all about money”, but if not sales number and money, what else should the publisher expect to receive for their work? They’re already putting a lot of effort buying all three IPs from the Chinese publishers, proofread or even translate some from scratch, pay translators, editors, illustrators, printing companies, etc. If it’s not selling well simply because they release it at the wrong time, aren’t all these efforts going to be wasted? And you can bet there will be no more danmei published in English if their first try already flops merely because of losing the momentum.

Are there any other rules or regulations they need to comply that prevents them from releasing everything in one go? But once again, even in China and other countries, it is also not always all released in one go, so this argument is already invalid from the start.

But they make it so expensive like this!

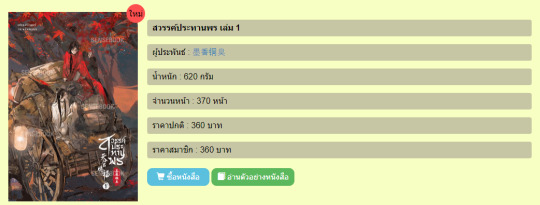

I’m sorry to break it to you, but I’ve compared the prices to MDZS Japanese release + TGCF Thai release and... The price isn’t really that much different.

Btw, I’m using Google’s currency converter, in case anyone wants to know where does my calculation comes from.

Okay, so here’s MDZS Japanese version from CD Japan:

One volume of MDZS Regular ver. cost 1760 yen. This is 15,96 USD before shipping. There’s only like $4 difference.

There’s also the Exclusive ver. that cost 3660 yen (32,92 USD) but we’re not gonna talk about that because they’re basically making you pay for the bonus, which is some acrylic panels and illustration cards.

Now here’s TGCF Thai version from Sense Book:

Translation using Google Chrome page translate:

One volume of TGCF costs 360 baht. This is 10.77 USD before shipping. So there’s about $9.22 difference.

Again, notice the difference of word/sentence length in the Thai words and English alphabet.

"But there’s still difference in price and other releases usually gets merchandise!” - Correct me if I’m wrong, but the US is probably one of the most expensive countries in the world. Do you think the materials, printings, and manpower cost is the same with other countries? Especially compared to one in Southeast Asia.

“But it’s xxxx times more expensive than the original Chinese version!” - Excuse me, the original Chinese version doesn’t need to pay for translators, proofreaders and editors with multilingual skills, and purchase the IPs? If you think it’s more worth buying the Chinese version, then by all means go ahead.

------------

Some last words...

I’m not looking down on those in difficult financial situation, but hey, I’m not filthy rich either? I come from a third world country and even if I’m a working adult, I’m still in working middle class + I got my parents to take care of. My country’s currency is literally just a tiny 0.000069 USD per 1 Indonesian Rupiah.

Every single fandom merchandise that you see me bought, either I’ve saved up for that or I sacrificed other things to buy that. I just don’t show the struggle to you guys because why should I? I’m just here to have fun about the fandom I love, not to flex my struggling financial condition.

These official English release of MXTX novels? All 17 books are going to cost me almost HALF of my monthly salary. But hey, I think it’s a good thing that they didn’t release it all at once, so that I can save up between months to purchase them all and plan my spending better.

If you feel the price is expensive, especially if you have to ship from outside North America, consider the following:

Book Depository provide free worldwide shipping

The books’ ISBN numbers are all available in the publisher’s website, just show it to you local bookstore and ask if they can order it for you

Plus, there are already hundreds of generous fans doing free giveaways in Twitter, even the publishers are helping to signal boost this. You can go and try your luck if you’re really desperate.

Lastly, I know how much love we all have for our favorite fandoms, but remember that fandom merchandise is NOT your primary needs.

You are NOT obliged to purchase any fandom merchandise if you can’t afford it and you should ALWAYS prioritize your primary needs.

Also, if you still want to read the fan-translations that are still available, alright go ahead. But remember that the translators themselves already said fan translations in English are now illegal. You can read it. We all consume pirated contents at one point. But don’t flex about it and diss the official release just because you can’t afford it.

I don’t know if the person who made that reblog tags are going to come at me or not, but even if they do, I literally don’t care. I’m not gonna waste my time arguing with someone with that kind of mindset and will block them right on the spot.

Also Idgaf if they call me out or talk behind my back, I literally don’t know them, so I don’t care.

End of rant.

53 notes

·

View notes

Text

Emi’s Icon Commission Rates

As well as important info you need to read if you want to commission me.

1 USD for 10 icons (10 cents for 1 icon in essence).

20% of payment is due upfront, the rest of the payment is due after all iconing has been completed.

Anime icons will cost anywhere between 25% to 50% more than normal depending on the length of the series and the amount of icons requested (if you do not want me to icon the whole series, then I require a list of episodes you want me to cover).

Icons of Visual Novel sprite portraits will cost 5% more if the files require me to construct the portraits manually. If you want me to make combinations of different elements (i.e. a happy face’s eyes plus every mouth variation and so forth), this will cost more depending on how many icons you want me to make.

R18+ anime is not on the table. R18+ manga will be discussable depending on the contents but will cost double if particularly heavy on sexual content

All icons are posted onto this blog by default, but if you wish for some not to be then you can just tell me. Posts will also not be labeled as commissions unless you want me to credit you for commissioning me.

There may be some series I am not willing to icon and I apologize for this. A list of such can be found on the main page of the blog.

I also will be taking a few smaller commissions on my ko-fi. Limited slots per option.

Information required to submit a commission

The full name of the character (or characters) you wish for me to icon, as well as the series they are from.

If the series has an adaptation in another medium, I need to know what version of the material you want me to icon (i.e. Manga or Anime).

Start the message with “Jackpot!".

A general amount of icons desired or as much as you’re willing to pay. The former is more ideal but if you provide the latter I can at least get an idea of what to prioritize in terms of expressions and the like. It would also be ideal if you let me know what chapters/volumes to go through or what episodes you want me to cover for the commission. If you simply want an entire series iconed and will pay as much as needed, I’ll give you a discount for being a fantastic support!

Not an actual step, but related to the above: If you know what chapters/volumes and episodes your character appears in, I’m willing to negotiate a small discount if you happen to have a list of the pages or general timestamps of the character’s appearance!

#manga rp#anime rp#anime icons#manga icons#roleplay icons#rp icons#manga rp icons#anime rp icons#icon commissions#a sword rambles | mod emi

4 notes

·

View notes

Text

Letter from our CEO

I would like to begin by saying thank you to the many people who have written in via email, through our DMs, or on social media expressing their support, understanding, and compassion as KnitCrate navigates this situation. Whenever we receive one of those messages, we share it internally with the rest of the team, and it helps boost morale and remind us why we enjoy being a part of this community. So again, THANK YOU.

The situation over the past year has been, well…to say it has been messy would be an understatement. The lack of inventory being in stock (particularly in the last 3 months), delayed shipments, and customers understandably being more budget-conscious with the uncertainties of the pandemic have all strongly impacted our sales as a company. We have been doing whatever we can to overcome it. One of the biggest challenges we’ve dealt with as a company during COVID-19 has been our supply chain, both with getting the yarn to our warehouse for kit assembly and for production of the yarn in the first place.

Issue 1: Logistics of receiving the yarn

There are two main problems affecting companies who rely on importing/exporting goods these days.

The first is that, due to COVID, there are less commercial flights. Almost all commercial flights carry the passengers up top and cargo down below. With less commercial flights, there is less opportunity to transport cargo. This causes a backlog of cargo sitting at the airports. For example, we paid our mill in mid-March to try to get what should have been the April yarn now in March (paying it a month ahead of what was planned in our budget), at which point they sent the cargo to the airport in Lima. The cargo sat there for over a week because of the backlog of other cargo waiting to be put on a plane. The airline finally delivered 3 pallets to the US on March 30th. The remaining 9 pallets arrived today on March 31st. Customs wouldn’t let us pick up the first 3 pallets until the other 9 arrived, because they wanted us to pick up the order in its entirety. We finally got clearance to pick it up earlier today.

The second issue companies are facing are capacity constraints at the ports, whether airports or ocean. All ports worldwide are working with far less employees than they were before the pandemic, which causes massive delays in being able to process shipments. This affects us with our large inbound orders but also with shipments to our international customers, as packages sometimes sit at customs in your countries for what may seem to be an eternity.

Issue 2: Production of yarn at the mills

Because of the volume of yarn we are now ordering monthly, we have to contract with our mills 12+ months in advance. For example, as of today, all yarn orders through March 2022 are already contracted. Why the long 12-month lead time? The mills need this amount of lead time to plan their own raw materials purchases and production schedules, not just for our orders, but the orders of all their clients. Every month, we pay our mill at the time of shipment, they proceed to ship the yarn to us. Under normal circumstances, it takes a shipment by air only 1-3 business days to arrive, clear customs, and be delivered to our warehouse. Outside of a worldwide pandemic, this is not usually an issue. The mills have plenty of time to produce yarn and deliver it the first week of each month when we need to assemble your kits and ship to you.

However, the COVID pandemic has complicated things. Both of our main mills in Peru and Italy have had periods of time where they outright closed due to government restrictions on non-essential businesses to help combat the spread of COVID in their respective countries. For example, in April/May of 2020, our Peruvian mill was closed for two months and that left us without yarn to send out in May. Due to the lead times required and the fact that most mills worldwide were (and still are) facing similar issues, looking for alternate yarn was nearly impossible. Thankfully, our team was quick on their feet and we put together a fun dye-it-yourself project using undyed yarn from our Dyer Supplier business.

During this first quarter of 2021, our Italian mill, who was originally supplying yarn from December through February, has been facing stringent lockdowns and closures in response to the recent increase in COVID cases in Italy. This disrupted their ability to produce yarn and has resulted in part of the January yarn and all of the planned February yarn not being delivered. We were horribly disappointed about this, but despite our best efforts as well as the mill’s, the production needs could not be met. Thankfully, our Peruvian mill has been able to come back online with a more regular schedule in the past few months, and we have been working with them to get yarn delivered now that was originally meant for a later month.

While this is a solution to the inventory needed for crate shipment, it presented the company with a new problem. We had to fund the purchase for this yarn outside of our budget and available funding, which has been difficult during a challenging and financially straining year. This is why we have been forced to issue a credit, as opposed to an outright refund, on those purchases. It would be impossible for the company to do both - issue a refund for all those orders at one time while allocating funds to pay for yarn ahead of time.

***

Does this situation absolutely suck? Yes. It absolutely sucks. Am I sorry that this is happening? Of course. Business owners who give a damn about their business, customers, and employees do not set out on a mission to disappoint customers or give a less-than-exceptional experience. It is more heartbreaking to me than I can explain. But we aren’t dealing with normal times. We are doing what we need to do to get the company through this temporary situation to keep delivering yarn each month, keep our team members employed, and continue to be the business so many of you have grown to love.

Unfortunately, this also means streamlining how we offer products to you as well as increasing prices. When we took over KnitCrate in mid-2016, the kits ranged in price between $45 to $65 USD. We lowered those prices significantly to $24.99, including shipping & handling, that same year. We have kept prices there since then, even though shipping costs and wool prices have skyrocketed over the past 4-5 year period. Keeping our prices that low could not continue indefinitely. We had plans to introduce these price increases later in the year, but this situation has forced us to accelerate those changes. However, even at the new prices, we still feel there is superb value for the yarn you are receiving. Moreover, you still have access to the member discounts in the shop which gives you even more value.

I am hoping that most customers know us well enough to understand that we aren’t trying to pull a fast one or go Dr. Jekyll/Mr. Hyde on you. We would never turn into a completely different company who is out to take advantage of you. However, we recognize that these sudden changes and issues have understandably raised concerns. Among them, there have been concerns raised about the products and website that we would like to clarify:

Our Terms and Conditions have not changed since 2019 and our Privacy Policy hasn’t changed since 2017.

We will continue to include 2 skeins per crate for the traditional membership and 1 for the sock membership. The “1+ skeins” wording previously seen on the website was updated back in 2019 when we tested featuring 1 skein of ultra-luxury base in the months we featured Citrus Squeeze and Titmouse. We subsequently sent a survey to our customers asking how they would like us to approach this in the future. The answer was that the majority preferred two skeins, and so we have featured at least two skeins ever since and will continue to do so.

We had seen some comments regarding extras no longer being included in kits. Please rest assured that extras will continue being a part of your kits.

Member Central discounts, Double Down discounts, etc. will continue. These are some of the key benefits of being a member and will continue to be so.

I have come across some hard-to-read comments about how KnitCrate is going out of business or won’t be around in 2 months. Are we going through a tough situation? Yes. That is no secret. Are we disappearing in 2 months? No. Like I said above, the yarn is contracted out through March 2022 with our Peruvian mill. This mill has already come back online and is working with us to push every month contract up by 30 days. We are working overtime and making the necessary changes to get things back on track and get the shipping schedule normalized again.

Ultimately, whether KnitCrate, or any company for that matter, stays in business or not is always in the hands of the customers. Companies can die for many reasons, but there are two overarching reasons.

The company cannot deliver a product the customer wants. The company created a product the customer wants and is willing to pay for, but the company cannot access or deliver it to the customer.

The company cannot get customers. The company developed a product a customer doesn’t care for and isn’t willing to pay for and they go out of business.

As a company, we have predominantly been battling Reason #1 during the pandemic and are actively working on solutions within our team and with our partner mills to address the supply chain issues. Given that our Peruvian mill was able to finish the April yarn by mid-March and ship to us early, we are looking forward to working with them on the future orders already contracted as we bump up each of those months. Going forward, we will not be pre-selling yarn on the shop. Yarn will only be listed for sale once it has been received into our warehouse, quality controlled, and counted. We understand that this may upset some customers who liked the ability to reserve the yarn by pre-buying it, but it is a necessary action.

That leaves us with Reason #2, and this is entirely in your hands as a customer. We offer great products, great value, and fair prices not available in most places. In fact, I encourage anyone who has been a member with us for a long time to look at the yarn they have purchased through us over their lifetime as a customer, either through the kits or in Member Central, and tally up the savings they have earned. I don’t know many other places that can enable you to save on quality yarn as much as KnitCrate.

When it comes to business, the customer is always in charge. You vote with your dollars whether any company you buy from, including KnitCrate, stays in business or not. This is not new, though. This has always been the case, ever since we took over the company in 2016, and will always be the case. We have had to make some tough decisions during a temporarily very sh!tty situation. We made those decisions in order to stay alive and keep delivering yarn to you at affordable prices long into the future. If you will have us, we will be here working to bring you yarn with great projects at great prices.

Thank you for your support. We hope you stay well and keep stitchin’!

- Rob and the KnitCrate Team

9 notes

·

View notes

Text

RECENT NEWS, RESOURCES & STUDIES, September 2019

Welcome to my latest summary of recent news, resources & studies including search, analytics, content marketing, social media & ecommerce! This covers articles I came across in the past 5 weeks, although some may be older than that.

I am still working on scheduling enough time to post these every 10 days or so, but lately luck is just not on my side. Writing this elsewhere then cutting & pasting it here is creating some significant formatting issues, so if you find any errors or broken links, please let me know.

Are there types of news you would like to see here? Leave a comment below, email me through my website, or send me a message on Twitter.

TOP NEWS & ARTICLES

Etsy introduced Etsy Ads at the end of August; I covered it on my blog. Some people are seeing decent returns, but many are not. I started a forum thread here for continuing discussion.

A day later, Amazon announced it has waived their $40 a month shop fee for Handmade by Amazon shops. See the pinned post on their Facebook page.

A large study of click-through-rates (CTR) on Google reveals that the top link gets over 30% of the clicks, titles with questions get 14% more clicks than those without, and moving up one slot in the results leads to more clicks, unless you move from 10th to 9th. They cite Etsy’s study of titles & CTR (which showed that shorter titles get more clicks, something that this study also found).

Trend watch: a suggestion that Americans can avoid most of the tariff pain in the pocketbook by buying used clothing & other items. “Secondhand and vintage is no longer synonymous with a dusty pile of outdated sweaters in the corner of a church basement, or a yearly rummage sale. Online resale, including high-end designer items, is booming, thanks to start-ups like The RealReal, Depop, Poshmark, eBay, and Etsy. It’s possible to fill your entire closet this way”. Pre-owned & rented clothing also makes fans of sustainability happy.

Also, “grandmillennials” are a thing.

ETSY NEWS

Etsy US searches often now have a full first page of items that ship free or have the $35 free shipping guarantee, as of September 6 (although they were testing it earlier than that.) I was seeing the rare exception, beyond searches that have fewer than 48 items shipping free, but it wasn’t clear if these are tests or personalization. Then on September 21, we started seeing many items with shipping charges on the first page of even very large results, & most smaller results didn’t give much if any priority to free shipping at all. There has been no statement from Etsy, so your guess is as good as mine ...

In the meantime, they’ve begun promoting free shipping to buyers, which has led to some media coverage. Some note that the timing is good, since most US holiday purchases online in the past several years have included free shipping.

There is a new chapter in the Ultimate Guide To Etsy Search, involving attributes. The accompanying podcast with Etsy’s head taxonomist [transcript with links to the podcast] is quite interesting. She says that one of the reasons that some attributes haven’t shown up yet as search filters is that not enough sellers have applied them to listings. “If we have 100,000 items in the search results and a buyer uses a filter, and that filter causes the results to return just 20 items, that makes it seem broken. The buyer no longer trusts the results. If only 20% of sellers fill out an attribute, showing a filter based on that attribute to buyers isn’t going to be helpful because such a drastic reduction in results makes them lose confidence in those search results. We have to wait until a large number of sellers fill out that data to show it to buyers as a filter. When we do, sellers who have filled out that attribute show in those filtered search results. Sellers who haven’t, don’t.”

Also, “[w]e know that shoppers who interact with these filters tend to buy more expensive items.” And, there aren’t separate jewellery attributes for “gold”, “gold-filled” & “gold-plated” because “[m]any jewelry buyers don’t have your experience and don’t know the huge difference between these things.”

The new commercials were launched earlier this month; you can check them all out here, and here is some media coverage. Some analysts think this is a good thing for the stock.

Vox published a review of Etsy’s latest free shipping push, in contrast with its history. [I am sure most of you have seen that, but if not, it is a good read!] “Silverman doesn’t like the words “handmade” or “craft” because they “don’t communicate anything to buyers about when to think of Etsy.” he says now. Nobody wakes up thinking, “Gosh, I need to buy something handmade today,” he tells me, which may be true but I rarely wake up thinking I need to buy anything at all, and more commonly wake up in horror because I’ve already bought way too much.

“You need to furnish your apartment. You need to prepare for a party. You need to find a gift for a friend. You need a dress. Handmade is not the value proposition — unique, personalized, expresses your sense of identity, those are things that speak to buyers.” [emphasis added] Also, apparently Etsy founder Rob Kalin “didn’t know what seed funding was when he took it” 😮

The new tool for creating country-specific sales is finally out. You still can’t create the equivalent of the $35 free shipping guarantee for countries other than the US, however, which makes this pretty useless for people wanting to offer free shipping in the US and to their own country. The only way to come close is to set a 30 day free shipping sale to your own country, but it won’t show up in search (unless people filter for free shipping) or get the Canadian search boost for items that ship free, and you still need to renew it every 30 days. In short, Etsy is telling us to overcharge our customers in other countries with no way to offer them the same deals Americans are getting.

Sellers can now use Etsy Labels for USPS First Class letters & flats.

Holiday tips continue to roll out: here are some ideas for running holiday sales and promotions on Etsy.

Advanced content on machine learning: Etsy is employing its data on styles to serve up personalized recommendations, including the “Our Picks for You” section on the home page. The purchase and favouriting rates are part of what gets shown. They’ve discovered that some styles are more popular are different times of the year.

For those of you who think Etsy doesn’t spend enough on advertising, they are actually buying spots on tv shows now, including this Las Vegas morning show. [video]

SEO: GOOGLE & OTHER SEARCH ENGINES

Sad to report that Keywords Everywhere is becoming a paid tool starting October 1st (although it may take longer to roll out to your account). https://keywordseverywhere.com/news.html They need to do this because they were being scraped by bots, which was affecting user experience & costing them a lot of time and money.

Fortunately, it is still going to be very cheap - 10,000 keywords for $1 USD, purchased ahead of time as credits. They say that the average user will spend less than $2 a month, & I suspect that the average Etsy user will spend less. Once your account moves to a paid one, you will no longer see the search volume, cost per click & competition numbers under search terms until you buy credits, although the "related keywords" & "people also search" sections will still show up on the right side of Google search.

I usually do not recommend any paid tools, but I do think this will still be worth every penny, especially if you remember to turn it off when shopping instead of researching! Every comparable paid tool costs way more than this. And despite the rush of attention since their announcement, I still received a personal reply to my email within 24 hours.

You know how I always talk about nofollow links? They still exist, but Google has expanded their link attribution codes to include “sponsored” & "ugc" (user generated content), and all might be crawled at any point after March 1, 2020. Moz did a top level explanation, and here is Google’s (shorter) summary. But it may not really matter much to the average site.

Want to rank well on Google and other search engines? Create “complete content.”

A followup on last edition’s discussion of canonical URLs - Google gets the final say. [video]

Google is now releasing monthly videos of their search news; first one is here.

Some of you will remember Moz’s Whiteboard Friday series on learning SEO in one hour. They’ve now compiled all 6 videos in one place.

And if you want to learn the basics of link building quickly, Moz has a short version of that chapter from their Beginner’s Guide to SEO.

If you are afraid you are missing some SEO rules on your top pages, check out this complete checklist for on-page SEO.

There are tons of SEO tools for Wordpress; here are 15 of the best.

Many people will find your blog through search engines, so make sure you use keywords in your blog posts.

If you have a website, check out 16 things that can harm your search engine rankings [semi-advanced in part, some points are discussing coding]

Success on YouTube involves SEO, something I find many users forget.

Mostly advanced: reminder that as of September 1, you can’t use robots.txt to tell Google not to index pages or sites.

Advanced content for website developers: you need to make sure the site is ready for SEO work.

There are always more Google updates; this one is still rolling out, and was confirmed by Google, but very few details were given. Sistrix did the first comprehensive analysis, although it is still early, and health and media sites seem to be the most dramatically affected.

CONTENT MARKETING & SOCIAL MEDIA (includes blogging & emails)

Marketing emails need to be carefully designed for success. Everything from the layout to the “preheader” matters.

If you have content on one medium that is doing well for you, it’s time to “repurpose” it for different platforms.

Infographics are very popular in content marketing; here’s how to make one, with 15 free templates.

Some Instagram posts do better than others; here’s why. Among other study findings, “smaller profiles which use more hashtags actually do see better engagement rates per post.”

If you aren’t getting much interaction on Instagram, you could be “shadowbanned.” There are ways to avoid that happening, and ways to fix it when it does.

“Content factories” are a big part of Instagram traffic. Maybe Facebook should crack down on this?

Pinterest is combining image recognition visual search with Shoppable Pins.

Facebook is considering hiding the like counts on News Feed posts, as Instagram is testing in 7 countries right now. “The idea is to prevent users from destructively comparing themselves to others and possibly feeling inadequate if their posts don’t get as many Likes. It could also stop users from deleting posts they think aren’t getting enough Likes or not sharing in the first place.”

Video app TikTok can be confusing, so here is a step-by-step guide for beginners. And here’s a podcast [with text] on the basics.

Twitter chats are a great way to attract interest in your business.

ONLINE ADVERTISING (SEARCH ENGINES, SOCIAL MEDIA, & OTHERS)

Facebook is testing new shopping ads, but they are only available to small groups at the moment: checkout from the Facebook app, and turning Instagram shopping posts into ads. Here’s more on the latter.

Snapchat now has longer ads and different formats.

I see a lot of questions on what you can advertise on various platforms; here’s a good summary of items/topics prohibited on major sites.

Since so many sellers are interested in other types of advertising right now, here are a few primers, most of which I have posted here before:

Setting up Google Shopping for your website

Instagram Sponsored Posts

How to beat Facebook’s ad algorithm

Setting up Pinterest ads

STATS, DATA, OTHER TRACKING

Have Google Analytics set up on your website but don’t know how to use it? Here are some common features [text and video] you may want to take advantage of. Note that the part about setting it up doesn’t apply to most marketplaces and many website builders, which have a more simplified set up, as Etsy does.

The old Google Search Console (formerly Google Webmaster Tools) is now almost entirely converted to the new version. Expect all of the old reports to be moved to the new version soon.

ECOMMERCE NEWS, IDEAS, TRENDS

There’s new evidence that Amazon has skewed its search algorithm to favour its own products & third-party products that make Amazon the most money. ”Executives from Amazon’s retail divisions have frequently pressured the engineers at A9 to surface their products higher in search results, people familiar with the discussions said.” In case that WSJ article goes back behind a paywall, here is some news coverage of it. “Instead of adding profitability into the algorithm itself, Amazon changed the algorithm to prioritize factors that correlate with profitability, the article said.” Amazon denies this, of course.

Despite the legal agreement in Germany, Amazon is still suspending accounts without 30 days notice.

Want to use cash to pay for online purchases? Amazon is now offering that option in the US.

eBay listings now default to 1-day handling; if you ship slower than that, make sure to remember to change the default on each new listing you make.

eBay managed payments (the equivalent of Etsy Payments) are now available in Germany.

A review of major shipping trends in ecommerce notes that “[t]he accelerated supply chain is putting small sellers at a crossroads regarding if they can afford to take a hit on margins” when discussing Etsy’s free shipping push.

BUSINESS & CONSUMER STUDIES, STATS & REPORTS; SOCIOLOGY & PSYCHOLOGY, CUSTOMER SERVICE

Over ⅓ of US adults have bought something on social media, over 50% of 18-34 year olds are in that group. Far fewer had used visual search or virtual reality.

More people are shopping online late at night; women are more likely to do it, but men spend more when they do. [I’ve noticed this trend on my site and Etsy shop for a few years now,compared to when I first started selling in 2008.]

The majority of shoppers worldwide who are online use videos to make some purchase decisions, as shopping lists, how-to research, and to check reviews.

Gen Z (the generation after millennials) is more concerned about their health than the the previous 2 generations, and sometimes avoid the stresses of social media by shopping in brick & mortar stores. “About two-thirds (67%) of Gen Z prefer products made with ingredients they can understand, and tend to buy products in health and wellness categories more frequently than other generations. On environmental issues, 65% said they prefer simple packaging and 58% said they want eco-friendly packaging. Half of the group seeks products that are locally sourced or made, and 57% are seeking products that are environmentally sustainable, but fewer are willing to pay a premium price for them.”

For the 2019 holiday season, “65% of holiday shoppers will use a mobile device to shop, and 65% will make an online purchase via mobile.”

How do different industries get their online traffic? Google sends sites 8 times more traffic than all social media sites combined, and Facebook drives nearly ⅔ of all visits from social media. Instagram is responsible for less than 1%, while Twitter tops 10%. The author notes that “faster-growing social networks like Instagram, Snapchat and TikTok are designed from the ground up in a way that makes it difficult to drive traffic to external sites.”

MISCELLANEOUS (including humour)

Google is working on letting you search your Google Photos for text; it seems to be using AI to identify & store the text in your screenshots and other images. It’s interesting technology that will likely be used in many ways, including search engines, if it works well.

If you like convo snippets on Etsy, here’s a tool that will make them possible in many more places.

Need a photo editor that works on mobile? Here’s a list of 12, most of which are free or cost only $1 USD.

This one simple trick makes everything faster and easier.

Stuff that probably shouldn’t taste like pumpkin spice. [humour]

#seo#search engine optimization#search engine marketing#etsynews#analytics#stats#social media#contentmarketing#content marketing#Ecommerce#smallbiz#CindyLouWho2NewsUpdates

3 notes

·

View notes

Photo

LAST MINUTE SALE BEFORE THE HOLIDAYS 3D Printers will be inaccessible after this week, until roughly mid-Janurary. 50% off the cost of 3D printing services for ALL who DM me until both 3D printers are booked to Thu, 12th Dec* (AEDT +11:00)! Pricing described further below... ⦁*[CST = Thu, 12 Dec, 6:00am]. Negotiable. ⦁Provide 3D files or DM me to discuss what you have in mind! Links below. (Custom modelling work currently unavailable until after the holidays) ⦁There is still time to guarantee Christmas delivery if extra is provided for Express shipping (Express not required within Victoria, Australia). ⦁Does not include any sanding or paint work unless print time is short. Materials such as elastic and velcro negotiable (included in the box, not assembled). 3D printers: ⦁Zortrax M200 build volume: 200mm x 200mm x 180mm ⦁Zortrax M300 build volume: 300mm x 300mm x 300mm Price varies per design and it's size. Here are some rough examples, to give a better idea (These are all the original prices, in USD according to conversion from AUD, NOT discounted)... ⦁28mm miniatures: 1-2 hours (about $5 per miniature) ⦁Small masquerade mask: roughly 7 hours (roughly $27) ⦁Full face-covering mask: ranging between 18-40 hours (depending on size): Between $62-$140 I take PayPal through DM here, or order through Etsy custom request (Preferable!). Contact me via this page or on my Etsy store here: https://etsy.me/351Gz05 (you can also see more items through this link to compare prices (check raw prints, not painted ones, for more accuracy pertaining to this sale) Examples of design options (Pick something you like and DM me the link!) : ⦁ Thingiverse: https://www.thingiverse.com/ (3D printing dedicated site) ⦁ Sketchfab: https://bit.ly/2PnITI0 (This site tends to include more interesting models, depending on your tastes. Use the search bar to find what you're looking for.) #art #artist #artwork #3D #3Dart #3Dprintedart #3Dmodel #3dprint #3dprinting #3dprintingservice #3dprinted #zortrax #zortraxm200 #zortraxm300 #Christmassale #holidays #masks #butreallyanythingyouwant (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B537Q9cDvJa/?igshid=kousjm4u7nl5

#art#artist#artwork#3d#3dart#3dprintedart#3dmodel#3dprint#3dprinting#3dprintingservice#3dprinted#zortrax#zortraxm200#zortraxm300#christmassale#holidays#masks#butreallyanythingyouwant

1 note

·

View note

Text

My Report of Top 10 Economical Impacts of COVID-19

Top 10 Effects and Changes due to COVID-19 Impacts.

1. Collectable Trading Cards have seen significant inflation. About 5 years worth condensed over a few months.

https://articles.starcitygames.com/2020/05/04/reserved-list-commander-staples-are-spiking-its-time-to-take-action/

Reasons:

> US Market Dependent or Influence. Other countries base prices on US websites and ebay for fair market value.

> US Government stimulus checks. People having excess weekly to spend money. Use the money to target and buyout multiple copies of a card to inflate their prices.

> Overhype in the Pokemon community - Jake Paul unboxing 1st edition Pokemon Card Booster Box on a charity stream at the end of last year. Graded cards up 25%-200% depending on print, condition and rarity. Young nostalgic adults now has disposable income to re-connect with their childhood and invest in an appreciating asset.

> MTG Reserve list cards, (non-reprintable cards) all it takes is one buy out of a desierable reserve list card and boom, people get FOMO. Significant influence comes from Youtubers, Streamers and Podcasts that talk about the buyouts. This advertises a potential to make money of cards, consequently making other reserve list cards a target.

My Relationship.

I bought reserve list cards from the start of 2020 till the end of december. I’ve even bought some as late as March after the boom.

I spent and traded about $9,200-$9,600 on MTG Reserve List Cards. I estimate that I’ve spent about 7,000 in Cash and the other $2200-$2,600 as trades. Todays market value’s my collection of reserve list cards at approx $14,351 USD or $20534.87 NZD. I plan on holding at least for another 5 years to gain a 100-200% increase.

2. Steam, Xbox, PS4-5, Nintendo online co-current online player bases explodes over lockdown.

Reasons:

> People are self-isolating at home, nothing to do, limited education. More inclined to get distracted by playing games to pass the time.

> Game Publishers and other services promoting deals and sales for people to buy new games. Opportunity to make more from accessibility and user pool.

> Sheep in the crowd are more likely to hop online to play with friends since social distancing is in place. Keeps people connected and sane. Boosts optimism and friendships.

My Relationship.

I was playing CSGO and other games over the course of lockdown. There was no certainty about Uni. No one knew what to do as Universities and Schools prepair and co-ordinate for online learning. I noticed more people on networks, servers and streaming services that connected people from playing games to a form of communicating media. Steam database suggests a large increase to co-current players playing CSGO, Dota and PUBG.

3. In home entertainment sales for consoles, desktop PC’s and TV systems increase in demand and price

Reasons:

> Again, people in lockdown, to busy themselves and pass the time, consumers will opt to a form of rewarding entertainment.

> Prices for parts went out of stock.

> Families with younger people are constantly bored and will bother parents as they work.

> Limited supply of consoles released, as a result, high volume for

buy orders.

> Shares for streaming services like Netflix, Disney, Amazone Prime, HBO, Lightbox and Quickflix

My Relationship.

Parent’s used Netflix religiously, best way to kill a TV series was in Lockdown with all the free time on our hands. I personally sought to buy a custom pc, however there was no stock for the parts and second hand markets for parts was over valued. Bad time to buy unless you were a month out from the first lockdown.

4. Small and Large Buisnesses transition online for a click and collect or deliver service.

Reasons:

> Keep people with retail jobs busy and earning

> Better making something than nothing, It effects the way buisnesses calculate their quarterly budgets.

> Essential for small buisnesses to make ends meet.

> Great for people who are stuck at home and need products to help with their day to day lives. People can have that accessibility.

My Relationship.

Working part-time for a retail store. In the first lock down, we were not working but the leadership team were apllying for the government buisness subsidy. We did not get it, so bunnings cut it’s losses by closing several stores that did not make much. For us, eventually all our services were online for customers to participate in click and collect. We never made the smae back on a normal day but at least it was something.

5. Essential goods become high demand and are bought out for price gouging.

Reasons:

> People will buy out common sanitary goods, masks, hand sanitiser, toiilet paper.

> Buisnesses will start to limit purchases per person.

> Smart individuals or teams will buy in bulk and then sell else where for a a 100-200% mark up.

> Opportunity to try new recipes for fun or testing.

My Relationship.

Working in retail, the team is the highest priority to make sure we have enough essential sanitary goods. The rest we can sell at a limit. However during the first lockdown, we sold out and we caught people selling for a rediculous mark up just down the road or even outside the store.

6. Social media marketing increases sevenfold

Reasons:

> People are spending more time on their devices.

> More exposure for online marketing and trade.

> Most buisnessess can only operate online.

My Relationship.

Started to notice more adds on FB and Instagram with people pushing ideas or products from lockdown. Most servicess were pushing the click and collect service online so you could still recieve your goods face to face.

7. General population make large asset purchases within New Zealand instead of spending the money on travel and overseas spending.

Reasons:

> People are stuck inside NZ and can’t travel as freely as planned.

> Funds saved will go towards other desired luxuries.

> Shortage of cars and higher second hand market on trade me.

My Realtionship

Both parents bought new cars to replace old ones. Parents also planned trips to go down south. At the same time, prices were a premium and no sales of the sort, except for travel which was dying for people to spend money on their service to come and use.

8. Global Share Markets enter a 4-6 month depression at the height of the first and second lockdowns.

Reasons:

> Cashing out, flooding quanity buy orders.

> No confidence in some brands and markets as COVID-19 ma

> Cover living expenses, people have uncertainty if you don’t make as much as the average earner in NZ

My Realtionship

Following stocks and learning more about investing in them. This was a great time to invest, however, no one quite knew where the bottom was.

9. Government relief checks for Small and medium sized buisnesses.

Reasons:

> Keep people’s jobs alive

> Keep confidence in the government.

> Provide assistance for those who are suffering from hardships.

My Relationship.

Bunnings did apply for the stimulus relief fund over the first lockdown but was not successful to recieve the fund

10. Industries dependant on Travel, Immigration, Location based entertainment, forced to reduce workforce.

Reasons:

> No one can travel

> No airflights, or travel into country unless you are a resident.

My Relationship.

I’ve met new people who have left the travel and travel entertainment industry as a consequence of covid. This has also shriveled up cost of running the buisnessess.

0 notes

Text

Free Forex Training - The Ultimate Basics 2020

Course Prerequisite

Forex Demo Broker Account (See below if you do not already have one)

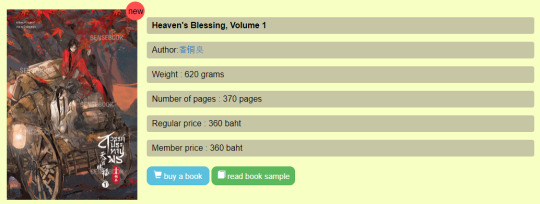

Passport or Identity Document and Proof of address not older than 90 days (You will need these documents for verification purposes)

Your full attention

Practice, practice practice!!!

Forex Broker Demo Account

In order to be able to practice the exercises in this course, you will need to open a demo account. A demo account is a practice account where you are able to trade live using fake money and not your own money.

Once you are comfortable with a demo account, you can then deposit real money and apply what you learned while using a demo account.

Here are the steps to follow when opening a demo account:

Click on this link (Non-US learners):

Recommended broker.

For the United States learners, follow this guide:

Recommended US broker

For the rest, let us continue.

Click on the “Open Account” button at the top of the screen.

Fill in your details

First name(s) – As per your Identity document

Last Name – As per your Identity Document

Country of residence – Should be chosen automatically if you are not using any proxy or VPN

Mobile phone – Enter the correct number as this will be verified

E-mail - Enter the correct e-mail address as this will also be verified

Password – Choose a strong password with Letters, Numbers and Symbols (This will be your broker password on ForexTime.com)

Click on “Send Pin” – A PIN will be sent to your cellphone and E-mail address. You may use any of the two PINs for verification.

Enter the pin, accept the marketing consent and then click on “Register Now”.

On the next page, enter all the necessary details to the best of your ability, Accept the agreements and click “Submit”

On the next page, select as follows:

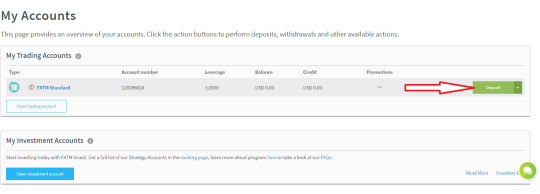

Account type – FXTM Standard

Account currency – Any that you prefer

Account leverage – 1:2000

Trading Account Password – Enter a strong password twice (This is different from your ForexTime portal login account that you set earlier. It will be your password to your MetaTrader account, more on this later)

Click “Open Account”

Next: Click on “Download platform”

Select the “Metatrader 4 Trading Terminal for PC” or “Metatrader 4 Trading Terminal for MAC” depending on your Operating system. Download and install the application.

Go to your Desktop, you will see a ForexTime (FXTM) MT4 icon (Windows). Double click the icon and login. To find your login details, go to the e-mail that says “Congratulations! Your new trading account is now open”. Metatrader login (at the bottom of the e-mail) and use the Trading Account Password that you entered above.

Should you need to install one for your phone, hover your mouse over the QR code, scan the QR code with your phone to download the platform.

Go to your e-mail account that you used for registration. Open the e-mail that says “action required with regard to your verification” – see below!

Click “upload”

Upload your Identity document as per the e-mail and your proof of address.

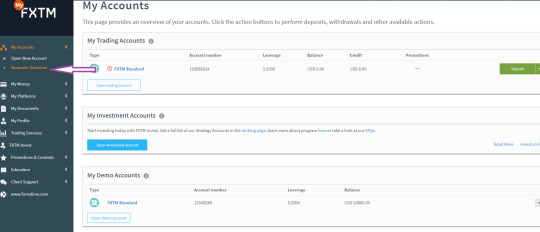

Open a Demo account

Click on “My Accounts” on the left-hand side, then select “Open New Account”

Select Demo Account.

Account type – FXTM Standard

Choose currency

Account Leverage 1:2000

Complete the passwords fields

Initial balance – any amount, I suggest 20000 USD

Click “Open Account”

Your Metatrader Login details will be displayed

Download the Platform just as you did above and login using the details given.

You are now ready to continue with the course content.

Chapter 1

Welcome to the World of Forex Trading with Free Forex training

So you have heard about Forex Trading and you are now curious to check it out, but really don't know where to start. We offer free forex training that is comprehensive and complete.

Well, you have come to the right place, as this book will take you through the basics, explain Forex in a plain and simple manner and give you enough information to get started sooner rather than later, in the exciting world of Forex Trading.

What is Forex?

Forex is the common term used to describe Foreign Exchange. It is also called currency trading, or just FX trading, and every now and then you may see it referred to as Spot FX.

It is essentially the trading of the world's various currencies. Trading currencies is a little different from trading shares or stocks, as currencies are traded against each other. What I mean by this is that you are comparing one country's currency to another country's currency. It is not as confusing as it sounds, so bear with me. Before you embark on a forex trading journey, you need to understand what you are getting yourself into.

Why would I want to trade Forex?

Good question! Most people have heard about trading stocks, maybe even futures and options. They have been around for years and your grandparents may have even traded them. But I guarantee you that they wouldn't have traded Forex unless they were exceptionally wealthy individuals or worked for a major bank.

It is only in the last 15 or so years that the retail Forex industry has opened up to the likes of you and me, where you can start trading with a very small deposit into a brokerage account. Obviously the popularity of the internet has helped create this boom as about 99.9% of all transactions are carried out online.

Why Forex?

For a start, it is by far the most liquid market in the world that runs 24hrs a day for 5 1/2 days of the week. Just to give you an idea of what I mean, in early 2014 and according to the Bank for International Settlements, Forex trading increased to an average of $5.3 trillion dollars a day. To put this in perspective, this averages out to be $220 billion per hour. In fact, it would take 30 days of trading on the New York Stock Exchange to equal one day of Forex trading.

These figures are huge! There is no other way to put it. But obviously that doesn't really affect the average trader other than giving that trader very good liquidity,

which means if you want to buy or sell any of the top 10 currency pairs, there is never an issue of that pair not being available to trade. Also with this much volume on a daily basis, the average trader like you and I have absolutely zero chance of influencing market direction.

Advantages to Trading Forex

Because the Forex market is running continuously for 24 hours during the week, there is very little gapping, which can be a common problem with stock trading. For example, you may have bought XYZ stock at $24.20 on Tuesday just before the market close with a stop loss set at $23.50 to protect you against any major losses.

During the night, when the market is closed, there is a major announcement that affects the company trading as XYZ, and the market opens on Wednesday morning, with XYZ trading at $22.10. Not only has it gapped down $3.10 overnight, but it has also opened $1.40 below your stop loss giving you a much bigger loss than you ever anticipated.

This rarely happens in Forex trading, but having said that it can happen, especially over the weekend as this is the only time the Forex market is closed. But it is rare! I can give you one example where I was caught out on a weekend. Late 2003 I was in open positions over the weekend where I was basically going against the US dollar, and then US troops captured Saddam Hussein.

This was very positive for the US dollar, which then opened much higher on Monday inflicting some financial pain my way. I have learned my lesson and I am rarely in open positions over the weekend.

As you will soon see, with regards to Forex trading, you only have a small number of currency pairs to choose from. This is a very small basket compared to the number of stock choices you have. On the US stock exchanges, there are literally thousands of stocks to choose from.

Here you have the problem of finding a needle in a haystack. You will see that your Forex choices are much, much narrower, hence there is certainly a lot less searching and analyzing required. All of your efforts and concentration can be targeted in a very narrow field, so you can get on with the trading sooner than later.

Once you have a look at a few different Forex charts, which I discuss later, you will see some very nice smooth trends that seem to occur quite often.

Now, this is something that you may not understand if you have never traded a financial instrument before, especially if you have never looked at charts. For those stock traders out there, you would be very aware of stocks that just get stuck in a range for what seems forever, or stock charts that show plenty of gaps and a general ugly sort of look. I am not saying that Forex doesn't range.

It does, trust me, but when it breaks out it is normally something very good. You will understand this once you start looking at the charts.

The low cost of trading is also important. Most trading is conducted electronically over the internet on your nominated broker's online account. The cost is minimal for each trade as there is normally no commission involved, however, you do have to cover the spread. This will be explained shortly, but it can be very cheap to trade considering some pairs now have less than one pip spread.

Further to the low cost, you can open an account with a broker for a very small amount, and in some cases, just a couple of hundred dollars. Granted you are not going to make millions from this, but it is a start. I will cover brokers later.

Some Further Advantages of Forex Trading

So we need somewhere to trade and as stated earlier, this is all done online via the internet. The good thing about this is that most brokers offer unlimited demonstration platforms where you can practice trading for as long as you like without risking any of your own money.

This is brilliant if you want to try out different trading methods and ideas. Commonly referred to as 'demo trading,' there is no reason that you can't have both a 'live' and 'demo' account with the same Broker. Just ensure you don't get them confused.

Demo trading is quite a useful tool where you can try out different things etc, but please be warned, trading on a 'demo' account is nothing like trading on a 'live' account as there is zero risks with a 'demo' account and therefore your emotions do not come into play at all.

It is like walking across a plank of wood 6 inches above the ground, compared to walking across the exact same plank of wood ten stories up in the air. I'm sure your emotions would be different, and the same goes for trading. When there is real money on the line, you will think and act differently! Trust me on this.

And to take this one step further, Forex data is live and it is free. Unlike a lot of stock data where you have to pay a monthly data subscription fee or stuck with 15 minute delayed data, your Forex data is all freely provided to you by your chosen broker's trading platform. I’ll have more on brokers and their platforms later.

When is the Forex Market Open?

Here I will discuss the trading times and as you will see, there is ample time to trade Forex. As stated earlier, it is a market that is open longer than it is closed. As most people would be aware if you were trading stocks then you would trade these through an exchange, whether it was the New York Stock Exchange or the Australian Stock Exchange.

Forex trading does not have any central exchange as such. All trading is done through the banks or market makers, which are basically the brokers that traders like you and I would use.

Forex trading follows the world's time zones and is broken down into three major time zones.

The first to open in Asia, which includes New Zealand, Australia, Singapore, Japan, etc. This is called the Asian session and is normally the quietest of the sessions with regards to trading volume.

This is then followed by the European session. In the meantime, traders in the Middle East are kicking in, and then all the major European centers, where eventually London opens. The European session is the main session as it normally has the greatest volume traded. You have to remember also that London is the financial capital of the world, even though most people think it is Wall Street in the US.

The last session to open is the US session, and this session can also be very frantic, especially early in the day where there can at times, be major news releases that have a big effect on the US dollar itself. So we have the three trading sessions, which do overlap each other. There are no set times, just when banks open for business in each major financial city and volume picks up.

For me living in Australia, I know that during the day here, it is the Asian session, followed by the European session which kicks off at about 5 pm, followed by the US session at 11 pm. I am normally in bed by 2 am at the latest, which would be getting close to lunchtime in the US.

In a nutshell, you can trade at any time, but if you intended on trading the London open and you lived in the US, you may have to set your alarm clock and get up very early in the morning. Every time zone has its advantages and disadvantages.

There are plenty of free online time zone clocks available that relate to the different session times, so it is quite easy to find a session or sessions that suit your lifestyle. You can also find free custom indicators that clearly put the different session times on your trading charts. This is a great visual tool for some.

Chapter 2

What Do We Trade in the Forex Market?

Let's get into it! Our free forex training will give you a very broad idea to get you started.

There are several currency pairs that can be traded, but the majority of traders just stick with a group of about 8 to 10 pairs. That is more than enough choice.

First up, we have what they call the 'majors'. These are by far the most heavily traded currency pairs, and a lot of traders are just happy trading one or two of these. The majors include:

EUR/USD

Euro against the US dollar

USD/JPY

Japanese yen against the US dollar

GBP/USD

Great Britain pound against the US dollar

USD/CHF

US dollar against the Swiss franc

Notice how they are all against the US dollar, therefore when traders discuss these pairs, they simply just refer to them as the Euro, Yen, Pound (or Cable) and the Swissy.

Then we have what we call the '2nd tier pairs' and these include the following:

AUD/USD

Australian dollar against the US dollar

USD/CAD

US dollar against the Canadian dollar

NZD/USD

New Zealand dollar against the US dollar

Again, these pairs are all against the US dollar, so they are simply referred to as the Aussie, Loonie, and Kiwi. The term Loonie actually comes from the first Canadian dollar coin.

Then there are currency pairs that are simply called the 'crosses', and these involve non-US dollar pairs. Some of the more popular crosses include:

EUR/JPY

Euro against the Japanese yen

GBP/JPY

Great Britain pound against the Japanese yen

EUR/GBP

Euro against the Great Britain pound

There are quite a few others, but these three are probably the most popular traded. A lot of traders prefer to trade their home currency as they feel they have a better understanding of it. Personally, I'm Australian, but I rarely trade the Aussie as I am very comfortable trading the majors for the majority of my trades.