#learnwithraj

Explore tagged Tumblr posts

Text

New tribes of the Metaverse — Community-owned economies

The gaming ecosystem is set to become more community-driven with the help of decentralized tech, empowering creators and coders.

People have talked in glowing tones about the transformative properties of blockchain since Satoshi Nakamoto launched Bitcoin (BTC) back in 2009 — books have been written, thousands of panels and presentations have complemented its prospects, costumed Bitcoin maximalists have flaunted their newfound wealth. Despite these commendations, the transformation has been slow.

However, whether the delay was due to the global COVID-19 pandemic, or just the time needed to create innovation, we are now on the cusp of change that is creating new economies and ways of human interaction. The Metaverse, with the powerful combination of game theory and blockchain, is creating tokenized incentivization in virtual worlds. Decentraland has already started to revolutionize people’s lives and interaction, and many similar platforms are being built. The Metaverse will grow to include multiple cross-chain possibilities as the virtual economy grows in importance.

NFTs and the gaming industry

GameFi, a term used to describe the burgeoning intersection between decentralized tech and the video game industry, is where the real value is being created. Nonfungible tokens (NFTs) allow players to own assets with tangible, real-world value and incentivise gamers to participate for longer periods of time, as well as allowing developers to create in-game economies which are based on the creativity and interactions of players as creators and owners.

Blockchain offers numerous advantages to GameFi:

Transparency: Making the gamification mechanisms clear, transparent and perhaps codified through a smart contract, users tend to trust more and therefore to invest more resources in terms of money and time.

Interoperability: The blockchain allows for the possibility of creating portability of virtual resources outside the limits imposed so far.

Liquidity: It is now possible to buy, sell and exchange assets outside of individual games.

Autonomous automation with smart contracts, which may enable multiple parties to interact with each other, even without human intervention.

NFTs can increase player engagement and create better gameplay experiences which, ultimately, increases the value of in-game NFTs and tokens. Players can now have agency within the games they want to play, and as to how these games evolve.

Axie Infinity came to prominence, in part, because of its social impact in keeping families out of poverty during the pandemic, and its player-created “scholar” program, which encourages community development, is growing fast. It's now a multi-billion-dollar, player-controlled game ecosystem.

BlackPool is another example of an early decentralized autonomous organisation (DAO) built for NFT gaming and trading. This platform is very much community-driven; it combines a passion for gaming and art with data analytics and machine learning to provide returns for users. BlackPool has also deployed Axie-like scholarship programs, opening up new income streams for the excluded. Blockchain enables participation, voting rights and monetization within an economy. It is also possible through interoperability to foresee the creation of networks of online communities, with exchanges and interactions among them.

Community first

The big story here is that we are seeing a move from “corporation first” to “community first.” The community forms around an idea or interest through engagement and collaboration with the community, and concepts emerge out of the community. It’s “community first” and “community fast!”

These communities are decentralized and community-governed — designs can be put to vote, and the artwork with the highest number of votes from the community can ultimately get accepted for the final design. Every time someone mints an NFT, the artists who worked on the asset earn royalties from it for each transaction. This will open up unexplored terrains of monetizing creative knowledge and skills.

The create-to-earn model allows creators to take complete control of the game studios and directly participate in developing the game. This provides the community the opportunity to make in-game assets, create NFTs and sell them on secondary marketplaces. This is a powerful new creator economy that is emerging, in which players and coders can liberate their ideas, improve the in-game experience and monetize their intellectual capital. This makes the gaming ecosystem more community-driven, with content creators getting incentivized to enhance the overall playing experience. Anyone with basic coding skills can contribute to the game.

This will also drive new social networks to emerge between creators and fans. The attention economy will be replaced through social tokens in the Metaverse to bring a new immersive fan-run economy. Social tokens based around a brand, community or influencer will allow communities or celebrities to further monetize themselves. They will create bi-directional relationships between creators and consumers, with benefits on both sides. These Web 3.0 communities are collaborating, evangelizing and creating tribal network effects, all helping each other drive the value of their platform.

Digital communities are forming networks through token economies. The more players use or promote the community, the stronger the game and underlying blockchain become. The players are the stakeholders.

This creates the data infrastructure to enable a harmonized, interconnected Metaverse that further enables tokenized NFTs to include digital data rights, and to store, track and enforce those data rights. We are still in the early days of this transformation, and the future is in the hands of innovators and creators, and the community who support them. These communities are the new tribes of the Metaverse, and the only limit to what is possible is your imagination!

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

#blockchain#digitalcommunity#creators#tradewithraj#learnwithraj#brainmasscommunity#gamesmarket#socialtokens#NFT#metaverse#gamingecosystem#web3.0community#token#influencer#platform#mobilegames#pcgames#consolegames#GameFi#coders#brainmasscoders#brainmasseducation#brainmasstutors#brainmassfinance#brainmasstraders

0 notes

Quote

Don't invest in what you don't know. Learn first then invest. #richdad

Robert Kiyosaki

#inspiration#inspirationwithraj#trade#investing#learn#brainmasstraders#brainmassfinance#brainmass#tradewithraj#learnwithraj#chartbyraj#rkmotivation

1 note

·

View note

Text

Timeless trading lessons from reclusive market wizard Ed Seykota

While the names of market gurus like Benjamin Graham, Warren Buffett and Peter Lynch are known by nearly everyone in the investing community, there are several traders who generate exceptional returns but do not want to come in the limelight. One such name is Ed Seykota, who may be one of the only traders who also wrote and starred in musical performance of his trading strategy " The Whipsaw Song".

Although almost completely unknown to the investment world, Seykota’s achievements rank him as one of the best trend followers and traders of his time. Seykota believes a trader’s psychology is the most important part of operating any trading system.

As a trend follower and money manager, he amassed millions in the 1970s and 1980s for his investors. He is basically a mechanical trend following trader who built the majority of his systems around exponential moving averages, with some reliance on pattern recognition. Seykota has always kept a low profile and caught the public eye only after his interview in Jack Schwager’s 'Market Wizards' books. He began his trading career in the 1970s, when he was hired by a major brokerage firm. It was in that brokerage firm that Seykota developed one of the first commercialized trading systems for managing money in the futures market.

After a few disagreements regarding the way management was interfering with his system, Seykota decided to part ways with them. Investors over the years have learnt many invaluable lessons by following his trading philosophy. Let's look at some of the trading rules that he mentioned in an interview with Jack Schwager.

Cut your losses Seykota believes that the most important trading rule is to cut losses because protecting one's capital is the primary job of a trader. He feels making money should be the secondary goal in the priority list of traders and they should embrace trading losses. He believes to stay ahead in the trading business, traders need to learn to lose like winners which means accepting losses the moment the market refutes their trade idea.

"If you make the mistake of hoping for the market to turn around in your favor, you’ve already lost. The best way to embrace trading losses is to have a plan. Combine that with small bets and you’ll be lightyears ahead of other traders. If you can’t take a small loss, sooner or later you will take the mother of all losses," he said in an interview in Jack Schwager’s 'Market Wizards' book series.

Seykota also believes that losing a trading position is aggravating, whereas losing one's nerve is devastating for a trading portfolio.

"The best way to ensure you never lose your nerve is to cut losses early. It’s one of the simplest ways to maintain your discipline and avoid emotional decision-making," he said.

Ride your winners

Seykota is of the view that trading isn’t about having a win rate of 70% or 80% but it comes down to how much investors make when they’re right and how much they lose when they’re wrong.

He feels the only way to achieve asymmetrical returns is to ride one's winners. Seykota feels trends tend to persist in all parts of life, and they also exist in the stock market.

"Successful trend following is buying when you recognize a trend, and holding on until that trend has finally come to fruition and begins to change. Of course, once in a while, a trader is going to end up buying nearly the exact top in a market, but that's where risk management and stop losses come into play. The key to enjoying enormous returns in the stock market is riding out your winners, and being stubborn enough to hold onto positions to capture as much of the trend as possible," he said.

Seykota believes that investors make the mistake of holding on to their losers as it's uncomfortable to sell them. On the other hand, they sell their winners before they ever get big as they don't want those gains to erode.

Seykota is of the view that investors shouldn't get influenced by soothsayers and prognosticators as they provide fanatical calls that are often way out in the future and turn out to be eventually wrong.

"I usually ignore advice from other traders, especially the ones who believe they are on to a “sure thing”. The old timers, who talk about 'maybe there is a chance of so and so,' are often right and early," he said.

Keep bets small

Seykota feels that one of the best ways to keep emotions at bay while trading is to keep bets small by speculating with less than 10% of one's liquid net worth.

"Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth. Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. The solution is to risk just enough that a profitable outcome is meaningful but not so much that a loss forces you to lose your nerve," he said.

Follow your trading rules

According to Seykota trading rules are vital and are critical to one's success. He feels when traders sit down to place a trade, nobody tells them how much to risk or whether to buy or sell.

Seykota is also a huge believer in rules and everything he does is based on strict trading rules he’s outlined for himself which helps him stay calm even when things aren’t going his way.

"It’s a rule that defines how much you’re allowed to risk or what you’re supposed to do during a losing streak. They help keep you disciplined in a world without many boundaries," he said.

Know when to break the rules

Seykota is of the view that a balance between following rules and breaking them is very important.

"Sometimes I trade entirely off the mechanical part, sometimes I override the signals based on strong feelings, and sometimes I just quit altogether. If I didn’t allow myself the freedom to discharge my creative side, it might build up to some kind of blowout. Striking a workable ecology seems to promote trading longevity, which is one key to success," he said.

Seykota believes that the win rate for any trader is insignificant and what really matters is having an asymmetrical profit to loss ratio.

He feels finding a trading approach that fits one's personality is vital and sometimes intuition and “gut feel” can become one's most useful assets.

"I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader," he says.

Reduce your trading risk

Seykota is of the view that the three primary components of trading are (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell.

"Trading requires skill at reading the markets and at managing your own anxieties. Risk is the uncertain possibility of loss. If you could quantify risk exactly, it would no longer be a risk. Risk control has to do with your willingness to allow your stop to do its job," he said.

Have a winning mindset

Seykota believes a losing trader can do little to transform himself into a winning trader as a losing trader is not going to want to transform himself.

But a winning trader will always be wanting to learn and would like to transform every bet into a profitable one.

Seykota is of the view that in the recipe for success investors shouldn't forget commitment and a deep belief in the inevitability of success.

Leave emotions aside while trading

Seykota feels investors shouldn't get emotionally attached to their trading bets as it may lead to huge losses.

“Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions,” he said.

Seykota is of the view that the market is always right and investors should make their trading bets without letting their emotions get the better of them.

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right,” he said.

(Disclaimer: This article is based on Ed Seykota's interview with Jack Schwager in the Market Wizards books series)

#trade#investing#brainmasstraders#brainmassfinance#tradewithraj#learnwithraj#investinglessons#tradingquotes#marketwizard#edseykota#greed#psychology#bet#emotions#cutloss#ridewinners#benjamingraham#warrenbuffet#peterlynch

0 notes

Text

Free #Forecast Friday!

Asia-Pacific Short Term Update:

"Prices are breaking lower in the #Nifty index... We are short-term #bearish on the Nifty with a break of 17,500 expected in the coming days."

#nifty#brainmassacademy#brainmassfinance#brainmasstraders#tradewithraj#learnwithraj#brainmasscommunity#brainmassgroup#banknifty#stock market#Indian stock#trader#investors#nifty50

0 notes

Photo

Brainmass Academy :

#tradewithraj#brainmasstraders#brainmassacademy#vwap#vwma#supertrend#learnwithraj#indicators#pricechart#bollingerband#stochastic#macd#adx#ichimokucloud#tradingindicators

0 notes

Text

How to trade volatility?

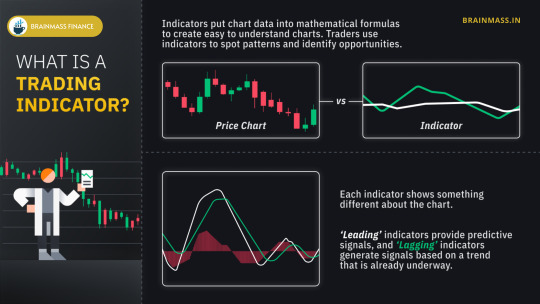

While volatility in stocks provide opportunities, the risk involved in the trade is uncertain. To avoid risky trades and minimize losses, today’s Technical Funda introduces a few technical indicators that can help amplify the real picture. Technical indicators that can help traders navigate volatility Trading in a volatile stock is difficult as the movement is often sharp and uncertain. Volatility, in simplest terms, defines the change in stock price over daily average change. This means that if a stock is swinging in the 5 per cent range and suddenly begins to trade over 5 per cent -- the average swing -- then it looks to have entered a volatile phase. These uncertain moves are highly attractive, but trading in one is, in fact, risky. Volatility may trigger stop loss and show certain unexpected moves. Such a scenario disrupts trading morale, leaving traders anxious. To avoid risky trades and minimize losses, here are a few technical indicators that can help amplify the real picture.

Keltner Channel Keltner channel is a moving average band indicator comprising three bands -- upper, middle, and lower bands -- that assist in identifying and protecting from volatile price moves with the use of average true range. This indicator is very useful in a strong trend, either upward or downward. As the stock starts to show the weakness at the upper band, one can view this as an opportunity to enter a trade around the middle band. While doing so, the stop loss can be considered as the difference of middle and lower band. As said earlier, in a trending market, the stock is expected to rebound on the back of follow-up buying. The same philosophy can be applied when the stock is in a downtrend. The Keltner channel encourages one to enter a trade within a specific range of volatility. This can diminish the greater volatility as one always waits for better levels of middle band. Normally, the stock price moves within the band, which primarily defines the expected volatility. When the stock breaches the Keltner channel, it may lead to extreme rally with wild swings wherein sentiments may change unexpectedly.

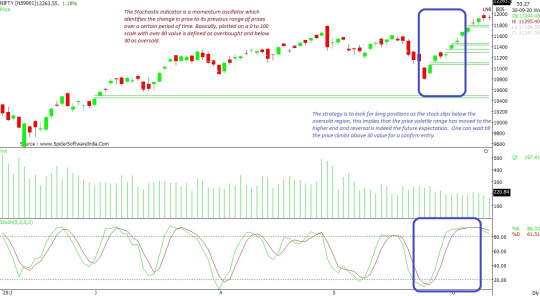

Stochastic Oscillator The Stochastic indicator is a momentum oscillator which identifies the change in price as compared to its previous range of prices over a certain period of time. Basically, this indicator is plotted on a 0 to 100 scale, with over 80 value being defined as 'overbought' and below 30 as 'oversold'. Although, there can be exceptions where a stock shows strong momentum over 80 value. This does not mean the volatility is low, it can even show stronger volatile moves in the price. The strategy is to look for long positions as the stock slips below the oversold region, since this implies that a reversal is indeed the future expectation. One can wait till the price climbs above 30 value for a confirmed entry. Similarly, when the price touches the roof of 80 value, the range seems to have reached a far end and one can expect a fall when the indicator slips below 80. And, although these rules may not always be true; however, one can get a fair idea about the volatility and maximum swings that are supposed to occur in any given fair trade. Volatility does provide opportunities, yet the risk involved in the trade is uncertain. In order to manage a volatile stock, one needs to have a strong hold on certain technical parameters that one has learnt and experimented with over the years.

#learnwithraj#tradewithraj#brainmassfinance#brainmasscommunity#brainmasstraders#brainmassgroup#stochastic#keltner#volatility

0 notes