#managingfinances

Text

5 Money Tips to Secure Your Future: Budget, Debt, Savings, Retirement, Insurance

#budgeting #emergencysavings #financialadvisor #financialtips #highinterestdebt #insurancecoverage #longterminvestmentstrategy #managingfinances #retirementsavings #savings

#Business#budgeting#emergencysavings#financialadvisor#financialtips#highinterestdebt#insurancecoverage#longterminvestmentstrategy#managingfinances#retirementsavings#savings

0 notes

Text

Understanding the Average Cost of Living in Indiana

Indiana, nestled in the heartland of America, offers a desirable blend of affordability and quality of life. If you're considering relocating to Indiana, it's essential to understand the average cost of living. This blog post will delve into various factors contributing to Indiana's cost of living, providing valuable insights to help you plan your finances effectively.

Housing Costs

Housing expenses are a significant component of the cost of living. Indiana boasts a relatively affordable housing market compared to many other states. The median home price in Indiana tends to be lower than the national average, making homeownership more attainable. Additionally, the state offers a variety of housing options, including apartments, townhomes, and single-family homes, catering to various budgets and lifestyles.

Transportation

Transportation costs play a vital role in determining the overall cost of living. Indiana has a well-developed transportation infrastructure, including an extensive road network and public transit systems. The price of gasoline in Indiana is generally lower than the national average, providing relief to motorists. Public transportation options, such as buses and trains, offer affordable commuting alternatives in significant cities.

Healthcare

Access to quality healthcare is essential for maintaining a high standard of living. Indiana is home to numerous hospitals, medical centers, and healthcare providers. Indiana's healthcare service costs are typically lower than the national average, helping residents manage their medical expenses effectively. The state also offers a range of healthcare insurance options to suit different needs and budgets.

Groceries and Utilities

Day-to-day expenses, including groceries and utilities, significantly impact the cost of living. Indiana's worth of groceries is generally on par with or slightly below the national average. Residents can access various grocery stores, from budget-friendly chains to specialty markets, accommodating different budgets and dietary preferences.

Indiana's utility costs, including electricity, water, and heating, are typically reasonable. The state benefits from efficient infrastructure and competitive utility rates. As a result, residents can expect their utility bills to align with or be slightly below the national average, contributing to overall affordability.

Taxes

Understanding the tax structure is crucial when evaluating the cost of living. Indiana has a relatively low state income tax rate compared to many other states. Therefore, individuals and families can retain more of their earnings. Additionally, property taxes in Indiana tend to be lower than the national average, offering potential savings for homeowners.

Entertainment and Recreation

Indiana offers many entertainment and recreational opportunities that contribute to a well-rounded lifestyle. The state has beautiful parks, historic sites, cultural events, and sports activities. Many of these attractions are accessible at affordable prices, making it easier for residents to enjoy a vibrant social life without straining their budgets.

Conclusion

Indiana's average cost of living presents an appealing proposition with its affordable housing options, reasonable transportation expenses, accessible healthcare, and manageable grocery and utility costs. The state's favorable tax structure and diverse entertainment options further enhance its affordability and quality of life.

Considering the factors discussed in this comprehensive analysis, you can make informed decisions about living in Indiana. The state's balance of affordability and amenities makes it an attractive destination for individuals and families looking to build a comfortable and fulfilling life.

For more detailed information, please visit this page https://indianapolisrealestateguide.com/indianapolis-cost-of-living/

#IndianaCostOfLiving#AffordableLiving#IndianaHousingMarket#BudgetingInIndiana#FinancialPlanning#IndianaExpenses#QualityOfLife#IndianaAffordability#ManagingFinances#LivingInIndiana

0 notes

Photo

#ProfessionalDevelopment 💚➡️ @mdp_info 💚➡️ https://linktr.ee/MDP_info ⬅️ 👞 Get your your practice in order, make sure your budgets balance and you pay yourself what you deserve. Figuring Out… Making a Budget is a new online workshop looking at the complexities of budget making, negotiation and the management of finances 💰 📆 Wednesday 1 March ⏰ 10am - 12pm 📍 Online (Zoom) 💷 £21 - £39 🎟 Book your place via our website (link in bio) 📷 1. Fleeting Flights, David Bethell, 2019 . . . #MakingABudget #FiguringOut #MarkDevereuxProjects #MDP #Budget #Budgeting #ArtsBudget #ArtsBudgets #ManagingFinances #Finances #ArtBudget #ArtistBudget #ArtistFee #ArtistsFee #ExhibitionBudget #CommissionBudget #ProjectBudget #SupportingArtists #ArtistMentor #ArtistMentoring #ArtistsMentor #ArtistsMentoring #Art #Artists #Artwork #ArtistDevelopment (at Mark Devereux Projects) https://www.instagram.com/p/Co9laWpona0/?igshid=NGJjMDIxMWI=

#professionaldevelopment#makingabudget#figuringout#markdevereuxprojects#mdp#budget#budgeting#artsbudget#artsbudgets#managingfinances#finances#artbudget#artistbudget#artistfee#artistsfee#exhibitionbudget#commissionbudget#projectbudget#supportingartists#artistmentor#artistmentoring#artistsmentor#artistsmentoring#art#artists#artwork#artistdevelopment

0 notes

Photo

(via Aging Wisely and Managing Finances)

Key Steps for Every Stage of Life! #managingfinances #aging #ruralmoney #rural #money #ruralareas

0 notes

Photo

Application Fee Waiver for US universities

1. DePaul University

2. Pace University

3. Saint Leo University

and more...

#study#studyblr#studyabroad#studyspo#studystudystudy#student#students#college#university#college life#finance#managingfinances

8 notes

·

View notes

Photo

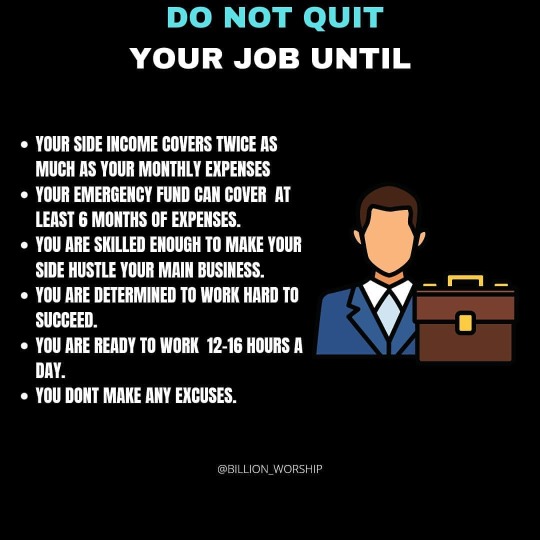

Like ❤️ Comment 💬 Share ⏩ Save 📩 For more amazing posts Follow @billion_worship👈 Follow @billion_worship👈 Follow @billion_worship👈 #joblisting #jobdiel #jobopportunities #jobhunting #jobperks #jobless #managingfinances #joblessus #joblessme #entrepreneursrock #billion_worship #joboffer #entrepreneurmindmap #entrepreneurminds #jobsearching #jobopenings #entrepreneurships #managingchronicpain #jobdodia #jobhunter #entrepreneurher (at Chennai, India) https://www.instagram.com/p/CUCHRWslO9M/?utm_medium=tumblr

#joblisting#jobdiel#jobopportunities#jobhunting#jobperks#jobless#managingfinances#joblessus#joblessme#entrepreneursrock#billion_worship#joboffer#entrepreneurmindmap#entrepreneurminds#jobsearching#jobopenings#entrepreneurships#managingchronicpain#jobdodia#jobhunter#entrepreneurher

0 notes

Photo

🏆 Top 8 Personal Finance Apps for iOS Free & Paid [2021] Who doesn’t want to save money and who says no to an app that helps them do so? It does not matter what we call them, personal finance app, budgeting app, or expense tracker, they are a must for people who want to have control over their money and finances. It is the necessary step you have to take in order to achieve financial health and strength. In an ocean of applications and gadgets, (not considering websites), it might become a little tricky to get our hands on the most useful and the best financing app for ios. Therefore, Topwonk has handpicked the top 8 applications for you. Stick around to be offered an in-depth review of top budgeting app. No longer will you have to wander in App Store looking for a good financing app. And No longer will you have to wonder what happens to your hard-earned money at the end of the month. What does a finance app do after all? Think of it as a personal accountant or a clever bot who lends you a hand in taking charge of your money. You t... 🖇 See full list in 👇 https://www.topwonk.com/top-personal-finance-app-ios/?feed_id=61&_unique_id=5ffc3be886d33

0 notes

Photo

Yusafali Adukurussi Valiyaparambil suggests you to establish an emergency fund which will help you out if any damage or threat happens. You should determine your financial situation and go ahead according to a financial planning. This will help you for financial management.

0 notes

Link

Managing Finance and Property with Kate Browne https://propertyinvestory.com/managing-finance/

0 notes

Text

Get Paid Now: The Future of Work and Your Money

#affordablefinancialtools #cycleofdebt #earnedwageaccess #earnedwageaccessapp #employeeturnover #financialdifficulties #financialwellness #futureofwork #gigeconomyworkers #highfees #immediateaccesstoearnings #managingfinances #paydaylending #predatorypractices #Productivity #revolutionizeworkandcompensation #risksofearnedwageaccess #transparentfinancialtools

#Business#affordablefinancialtools#cycleofdebt#earnedwageaccess#earnedwageaccessapp#employeeturnover#financialdifficulties#financialwellness#futureofwork#gigeconomyworkers#highfees#immediateaccesstoearnings#managingfinances#paydaylending#predatorypractices#Productivity#revolutionizeworkandcompensation#risksofearnedwageaccess#transparentfinancialtools

0 notes

Photo

Always wanted to travel in business class? Want to know how to ask for an upgrade? Get tips from experts about when is the right time to ask for an upgrade.

0 notes

Text

5 Money Tips to Secure Your Future: Budget, Debt, Savings, Retirement, Insurance

#budgeting #emergencysavings #financialadvisor #financialtips #highinterestdebt #insurancecoverage #longterminvestmentstrategy #managingfinances #retirementsavings #savings

#Business#budgeting#emergencysavings#financialadvisor#financialtips#highinterestdebt#insurancecoverage#longterminvestmentstrategy#managingfinances#retirementsavings#savings

0 notes

Photo

Want to apply for scholarships but don't know how many you can apply for, at a time? Ask our study abroad experts.

0 notes

Photo

Looking at managing your living expenses while studying abroad? Check out our Instagram page for getting details about the types of job that you can take up!

0 notes

Photo

Looking at managing your living expenses while studying abroad? Check out our Instagram page for getting details about the types of job that you can take up!

0 notes