#market sentiment

Explore tagged Tumblr posts

Text

Google: Still the King of Search, Despite the Crown Tipping

#Google#Wall Street#Tech Stocks#Investing#Finance#Google Stock#Google Valuation#AIand Search#Market Sentiment#Tech Industry#Valuation#Supergirl#Batman#DC Official#Home of DCU#Kara Zor-El#Superman#Lois Lane#Clark Kent#Jimmy Olsen#My Adventures With Superman#Daily Planet

3 notes

·

View notes

Text

Trade Gaps in Forex Market

The forex market, known for its high volatility and liquidity, presents numerous opportunities for traders to capitalize on price movements. One such opportunity arises from trade gaps. Understanding and effectively trading these gaps can significantly enhance a trader’s profitability. This article delves into the concept of trade gaps, exploring their causes, types, and strategies for trading…

#Bollinger Bands#Entry and Exit Points#Forex#Forex Market#Geopolitical Events#Liquidity#Market Sentiment#Market Volatility#Moving Average#Price Movement#Price Movements#Profitability#Relative Strength#Risk Management#RSI#Stop-Loss#Trading Strategies#Trading Strategy#Trading Volume#Volatility

4 notes

·

View notes

Text

Importance of chart analysis for equity investments

Image by freepik Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial: Benefits of Chart Analysis in the Indian Stock Market 1.Trend Identification The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

Indian Equity Market Nears Lifetime Highs: Fundamentals Or FOMO? Market Expert Bhole Weighs In

Last Updated:June 01, 2025, 15:10 IST Indian equity market nears lifetime highs due to strong macro indicators, foreign inflows, and political stability. Atul Bhole of Kotak Mahindra AMC discusses market fundamentals. Patience, systematic investing, and the ability to exploit fear and greed cycles are essential to achieving long-term investing goals. The Indian equity market has rebounded after…

#corporate earnings#defence stocks#foreign inflows#Indian equity market#Indian stock market#market sentiment#political stability#retail investors

0 notes

Text

U.S. Consumer Confidence Surges in May Amid Renewed Trade Optimism

American consumers showed a sharp resurgence in optimism this month, buoyed by hopes of easing trade tensions between the United States and China, according to new data from The Conference Board.

The Consumer Confidence Index soared to 98.0 in May, marking a dramatic 12.3-point jump from April’s figure and easily surpassing economists’ expectations of 86.0, based on a Dow Jones consensus.

The rebound comes after months of declining sentiment and appears to be driven largely by renewed optimism around global trade. Analysts point to the U.S. administration’s decision to pause additional tariffs on Chinese imports earlier this month as a major factor fueling the improved outlook.

“The recovery in confidence had begun before the May 12 de-escalation in U.S.-China trade tensions, but that development clearly amplified the positive momentum,” said Stephanie Guichard, senior economist for global indicators at The Conference Board.

May’s surge marks a reversal after five consecutive months of declining sentiment, during which prolonged trade disputes — particularly with China — weighed heavily on consumer and investor outlooks. A temporary truce in early May between the two economic superpowers appears to have reassured many Americans about the near-term trajectory of the economy.

Other indicators in the report also reflected growing confidence:

The Present Situation Index climbed to 135.9, up 4.8 points.

The Expectations Index made an even more pronounced gain, rising to 72.8, a jump of 17.4 points.

Investor sentiment also turned more bullish, with 44% now expecting higher stock prices over the next year — up from 37.6% in April.

Improved views on the job market were another highlight. Some 19.2% of respondents now expect more job opportunities in the next six months, compared to just 13.9% last month. Meanwhile, the percentage expecting fewer jobs fell to 26.6%, down from 32.4%.

Still, current perceptions of the labor market remain mixed. While 31.8% of consumers say jobs are “plentiful,” a slight increase, those who feel jobs are “hard to get” also rose to 18.6%.

Sentiment gains were seen across demographic groups — including age, income, and political affiliation — but the most significant improvements came from Republican respondents, according to survey officials.

Analysts caution that while May’s surge is encouraging, future confidence will likely remain sensitive to developments on the trade front and other geopolitical risks. For now, however, consumers appear to be breathing a collective sigh of relief.

0 notes

Text

Stop Staring at Charts: How to Analyze the Market BEFORE You Trade (Like a Pro!)

Are you tired of feeling lost when you look at trading charts? Do you wish you had a clearer understanding of market movements before you even place a trade? What if I told you that some of the most successful traders make their crucial decisions before they ever analyze a price chart? It’s true! While technical analysis (reading charts) is a vital skill, understanding the bigger picture – the…

#Currency Strength Meter#Economic Insight#Forex Factory#Forex Trading#Fundamental Analysis#How to Trade#Market Analysis#Market Sentiment#Market Strength Chart#Risk Analysis#Trading Education#Trading for Beginners#Trading Strategy#Trading Tips

0 notes

Text

Overlooking Sentiment Analysis: Why Combining Sentiment with Technicals Can Provide Better Insights

When it comes to navigating the complex world of financial markets, traders and investors rely on a variety of tools to make informed decisions. Among these tools, Technical Analysis (TA) has long been a cornerstone, offering data-driven insights into price movements and trends. However, as markets become more dynamic and influenced by real-time events, incorporating Sentiment Analysis into your…

#Combining Sentiment and Technicals#Financial Analysis#forex trading#Investment Insights#Investment Strategies#Market Sentiment#Market Trends#Sentiment Analysis#Sentiment Trading#Stock Market Analysis#Stock Market Insights#technical analysis#Technical Indicators#Technical vs Sentiment Analysis#Trading Education#Trading Psychology#trading signals#Trading Strategies#trading tips

0 notes

Link

1 note

·

View note

Text

Market: Caution is advised due to persistent weak sentiment

The local stock market remains under pressure from weak sentiment caused by ongoing foreign fund outflows. However, local fund rotation into large-cap stocks provided a lift to the index yesterday. Key factors driving market focus include domestic corporate earnings and critical global events such as the U.S. Federal Reserve’s FOMC meeting, GDP data, and PCE releases. Market Highlights:…

0 notes

Text

youtube

Mastering Forex Charts: A Beginner's Guide to Candlesticks, Lines, and Bar Patterns

#Forex trading#Forex charts#candlestick charts#line charts#bar charts#trading tutorial#chart analysis#technical analysis#Forex market#bullish patterns#bearish patterns#price movements#market trends#OHLC#trading strategies#chart reading#price action#trading tips#beginner trading#advanced trading#Forex education#PipInfuse#trading insights#market sentiment#trend analysis#trading confidence#Youtube

1 note

·

View note

Video

youtube

The Ultimate Bitcoin Trading Strategy for BingX: Maximizing Profits in a Volatile Market

#BitcoinTrading #CryptocurrencyStrategy #BingXExchange #MaximizingProfits #VolatileMarket #CryptoGuru #GetRichQuick #MarketSentiment #RegulatoryChanges #BlockchainTechnology #AnalysisTools #PatternsAndTrends #UserFriendlyPlatform #LightningFastTrades #PortfolioGrowth #LifeChangingWealth #RightMindset #EmotionalControl #MarketUnderstanding #CalculatedRisks #TrustYourInstincts #StepByStepStrategy #PersonalizedPlan #ReferralCode911 #SecretWeapon #TakeAction

#youtube#bitcointrading#cryptocurrencystrategy#bingxexchange#maximizingprofits#volatilemarket#cryptoguru#getrichquick#get rich quick#marketsentiment#market sentiment#regulatorychanges#regulatory changes

0 notes

Text

Volume Trading: Forex Trading Strategy Explained

In the world of Forex trading, understanding market movements is crucial. One such method to gain insights into market behavior is through Volume Trading. This strategy involves analyzing the volume of trades to make informed decisions about buying or selling currency pairs. In this article, we will explore the concept of Volume Trading, its benefits, and how it can be effectively used in Forex…

#Currency Pairs#Forex#Forex Traders#Forex Trading#Geopolitical Events#Market Movements#Market Sentiment#OBV#On-Balance Volume#Price Movements#Technical Analysis#Trading Strategies#Trading Strategy#Trading Volume#Trend Following#Volume Analysis

2 notes

·

View notes

Text

Penny stock - Good or bad for investment??

Image by Mateus Andre on Freepik Choosing penny stocks for investment in the Indian equity market requires careful analysis and a strategic approach due to the high risks and potential for high rewards associated with these low-priced stocks. Here’s a step-by-step guide to help you make informed decisions: 1. Research and Analysis Fundamental Analysis: Financial Health: Check the company’s…

#financial research#high risk high reward#Indian stock market#Investment Strategy#investment tips#Market Sentiment#penny stocks#portfolio diversification#Risk Management#stock investment#stock market analysis#Stock Trading#Technical Analysis

3 notes

·

View notes

Text

Market Recap: Dow Jones Gains, S&P 500 Holds Steady, NASDAQ Edges Lower

In the ever-fluctuating landscape of the stock market, today's trading session saw a mixed bag of results, with the Dow Jones Industrial Average leading the charge with a 0.2% rise, marking a gain of 78 points. Meanwhile, the S&P 500 maintained relative stability, experiencing a marginal decline of 0.02%, and the NASDAQ Composite edged lower by 0.1%.

The Dow Jones, a benchmark index known for its representation of 30 significant stocks across various sectors, demonstrated resilience as it climbed modestly, buoyed by optimism in certain key industries. Investors found solace in the steady progress of companies within sectors such as industrials and financials, contributing to the index's upward trajectory.

Conversely, the broader market sentiment, as reflected by the S&P 500, exhibited a more subdued tone, hovering near its previous close. While certain sectors displayed strength, others faced headwinds, resulting in a balanced performance overall. This nuanced movement underscores the intricate interplay of factors influencing investor sentiment, ranging from economic data releases to geopolitical developments.

Amidst this backdrop, the NASDAQ Composite experienced a slight setback, dipping by 0.1% during today's trading session. This decline comes amidst ongoing concerns surrounding inflationary pressures and the potential impact on high-growth technology stocks, which often populate the NASDAQ index.

As investors navigate through a landscape marked by both opportunities and challenges, it becomes imperative to adopt a diversified approach and remain vigilant in assessing market dynamics. While certain sectors may outperform in the short term, maintaining a long-term perspective is essential in achieving sustainable investment outcomes.

Looking ahead, market participants will continue to monitor key economic indicators, corporate earnings reports, and geopolitical developments for insights into future market movements. In a market characterized by its dynamism and unpredictability, adaptability and informed decision-making remain paramount for investors seeking to navigate the ever-evolving landscape of the stock market.

#Stock Market Analysis#Dow Jones Industrial Average#S&P 500#NASDAQ Composite#Market Sentiment#Investor Sentiment#Economic Indicators#Geopolitical Developments#Market Dynamics#Investment Strategies#Diversified Portfolio#Long-term Investing#Economic Data Releases#Corporate Earnings#Inflationary Pressures#High-growth Technology Stocks#Market Volatility#Market Trends#Financial Markets#Investment Opportunities

0 notes

Text

Market Dynamics Shift as Whales Take Profits from Lido DAO, Signaling Changes

The Lido DAO (LDO) market is experiencing a strategic shift in large-scale investor behavior, notably among whales. On-chain data from Santiment reveals consistent profit-taking by whales since December 25, 2023, as evidenced by transactions exceeding $100,000 and a noticeable surge in the Network Realized Profit/Loss metric.

Moreover, the LDO supply on exchanges has increased from 5.09% to 5.69% since January 9. While a rise in exchange supply typically signals potential selling pressure, the market displays notable resilience in the face of these dynamics.

Transaction volumes in LDO have witnessed significant fluctuations, with recent days showing a spike in activity. The moving averages of transaction volume present a nuanced picture, with the longer-term trend (200-day moving average) remaining stable while the short-term trend (7-day moving average) reflects volatility.

A daily price chart analysis from TradingView provides additional insights. The closing price around $2.982, coupled with recent low trading volume, paints a complex picture of market sentiment. The Exponential Moving Average (EMA) suggests a slight uptrend, and the Relative Strength Index (RSI) stands at a neutral 50.08, indicating a balanced market.

CoinMarketCap data indicates a positive shift in Lido DAO, with a 6.51% increase to $3.02 in the last 24 hours. This uptick reflects investor confidence amidst observed whale activities.

Notably, recent actions by prominent investors, such as a whale withdrawing 361K LDO and accumulating over 1 million LDO in the past week, underscore a strategic approach to market movements. This blend of whale activities and market resilience makes the LDO market a fascinating study in current cryptocurrency trends.

0 notes

Text

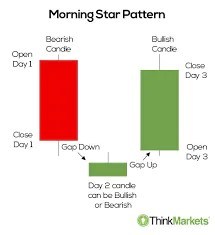

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes