#mortgage lenders arizona

Text

0 notes

Text

Arizona Homes For Sale

With the recent mortgage interest rates falling, now is the perfect time to purchase that dream home you’ve been wanting! Arizona Homes for sale can be found on my new App!

Click on the photo and download my App (Loving AZ Homes) to view more in-depth detail of each of the below Arizona homes for sale.

“Appy” hunting! Enjoy a hassle-free home search without having 30 agents calling, texting, or…

View On WordPress

#app#appy#Arizona#arizona homes for sale#AZ#chat#download#first time home buyer#first-time buyers#for sale#home buyer#homes for sale#lender#mortgage rate#pre-qualification#search for homes

0 notes

Text

The Navajo Nation has received a $55 million grant to help Navajo homeowners with mortgage payments and home repairs.

Navajo Nation President Buu Nygren said as many as 901 homeowners should qualify for the funds.

The money comes from the American Rescue Plan Act, which provides nearly $10 billion to support homeowners throughout the country who face financial hardships due to the COVID-19 pandemic.

The program is open to Navajo homeowners of all income levels within the Four Corner states who live on both tribal lands and in urban areas.

The funds must be used within three years.

PHOENIX — Urban Navajos who own homes off the Navajo Nation will soon receive some unexpected help they’ll want but didn’t need to ask for.

On Sept. 11, Navajo Nation President Buu Nygren told 250 Phoenix metro area Navajo homeowners that the Nation received a $55 million federal grant to provide financial assistance to Navajo homeowners under various Homeowner Assistance Fund programs.

This includes mortgage payments and home repair assistance.

As many as 901 Navajo homeowners should qualify for the money for their homes, he said.

“Make sure we tell everybody,” Nygren told an overflow crowd in the shade outside the historic Phoenix Indian School Visitor Center, one of the remaining buildings from the 100-year-old Indian boarding school.

They were outside because a capacity crowd was already indoors awaiting the same announcement, and Nygren wanted to address those in the 105-degree F heat first.

The Homeowner Assistance Fund was authorized through the American Rescue Plan Act to provide $9.9 billion nationwide to support homeowners who face financial hardships associated with COVID-19, the Nygren said yesterday.

The funds were distributed to states, U.S. territories, and tribes. The Navajo Nation was awarded $55,420,097.

Most federally funded programs are restricted to low- and very-low-income households.

This program allows higher-income Navajo homeowners to receive financial relief from the economic effects of COVID-19, as well.

“Tell your relatives,” Nygren said. “Say the $55 million that came from our government was specifically for Navajo people who are homeowners.”

To launch the process, Nygren signed an agreement with Native Community Capital. The group is a Native-led and operated non-profit corporation that was selected as the sub-recipient to administer the Homeowner Assistance Fund Project activities on behalf of the Navajo Nation.

Native Community Capital is certified by the U.S. Department of the Treasury as a Native Community Development Financial Institution and is a licensed mortgage lender in Arizona and New Mexico.

The program is designed for both higher-income and medium-income homeowners, Native Community Capital CFO Todd Francis said.

As an example, a family of four in Maricopa County in Arizona earning as much as $132,450 a year may be eligible for the tax-free, non-repayable funds to pay their mortgage or repair their homes, he said.

The program will benefit Navajo relatives and their families who reside in both rural remote locations and those in the urban areas of Phoenix, Albuquerque, Denver, Salt Lake City, surrounding smaller cities and towns, and wherever Navajo homeowners live off-reservation, said NCC CEO Dave Castillo.

A significant lack of investment in tribal communities compared to non-Indian communities has resulted in a critical absence of homeownership on tribal lands, particularly for higher-income Native households, he said.

As a result, Navajos with higher incomes tend to purchase or build homes off the Navajo Nation where they can qualify for loans and mortgages to build equity and wealth.

The Center for Indian Country Development reports that 78% of Native people live outside of tribal trust land in counties surrounding their homelands. It is these families the HAF Project will seek to support, Castillo said.

Nygren said the Navajo HAF Project will provide financial assistance to 901 eligible Navajo homeowners to use for qualified expenses in five activities for the next 36 months.

The program will provide financial assistance to eligible Navajo homeowners in the four-state region of Arizona, New Mexico, Utah and Colorado.

Each eligible applicant could receive a maximum amount of $125,000 of combined assistance under various programs.

These include:

Monthly mortgage payment assistance to a maximum assistance level of $72,000 per participant. This is for Navajo homeowners who are delinquent in mortgage payments or at risk of foreclosure due to a loss of household income.

Mortgage reinstatement assistance would give a maximum assistance of $50,000 per participant to those who are in active forbearance, delinquency default status, or are at risk of losing a home.

Mortgage principal reduction assistance that would assist up to $100,000 for those who find the fair market value of their home is now less than the price they paid for it and now may result in a loss when it is sold.

Home repair assistance that would give $100,000 to those who need significant home repairs.

Clear title assistance of up to $30,000 for grant assistance to receive a clear title of their primary residence.

In his 2022 presidential campaign, Nygren committed to helping urban Navajos who have said for years that they felt underserved by the tribal government. He said this grant addresses that.

He said one of his administration’s next goals is to buy or construct a building owned by the Navajo Nation in the metro area to serve urban Navajo Phoenicians.

“Wouldn’t it be nice if we used the entire $55 million this year?” Nygren asked. “I know you committed to live here and to take care of your family. I see a lot of familiar faces and I understand this is where your jobs are. We want you to have access to resources.”

Castillo urged applicants to be sure their applications were complete and submitted early.

“One thing we want to emphasize is to be ready when the information is being requested on the checklist,” he said. “Make sure you have your documents prepared and you get it to our licensed professionals that will be working with you. If you do not, the application will expire in 30 days.”

He said the program has just three years to deploy the $55 million.

“It seems like we could do that quickly but we can only do it quickly if you help us, if you’re ready, and if you submit the information that’s necessary.”

Debbie Nez-Manuel, executive director of the Navajo Nation Division of Human Resources, said visits to other urban areas will be planned, scheduled, and announced by Native Community Capital.

The funds must be used within three years.

So does any of this money go to the Black Indians Tribes? @militantinremission

maybe y'all should start asking for your cut right now cause they got it

#Navajo#Navajo Nation#First Nation#Chief Buu Nygren#Nygren reveals $55 mil for Diné homeowners#HAF#The Center for Indian Country Development#Navajo Nation has received a $55 million grant to help Navajo homeowners with mortgage payments and home repair#@MilitantinRemission

19 notes

·

View notes

Text

Reason doesn't often flatter my biases this blatantly, but, goodness, I am flattered. Blaming the Great Recession on zoning!

The conventional view of the Great Recession is that excess demand for housing—caused by some combination of loose monetary policy, government-subsidized credit, and unscrupulous lenders—inflated a bubble that inevitably had to pop. Leftists, liberals, libertarians, and conservatives can all find something to agree with in this theory.

But it's wrong, according to Kevin Erdmann, a senior affiliated scholar at George Mason University's Mercatus Center. Erdmann has advanced a heterodox theory that this century's most serious economic contraction before the pandemic can be traced back to zoning laws in the most in-demand cities.

In a 2020 paper on the origins of the recession, Erdmann and economist Scott Sumner argue that monetary policy was not exceptionally loose in the lead-up to the financial crisis and that new residential investment was not high by historic standards. Most of the toxic assets and bad mortgages originated after housing prices had already started to decline.

Erdmann and Sumner also point out that prices were increasing fastest in coastal "closed access" cities like New York and San Francisco, where the economy was booming but restrictive zoning regulations prevented much new housing from being built. The result was an out-migration of lower-income people to "contagion cities" in Nevada, Florida, Arizona, and other places where home building was less regulated. Erdmann and Sumner lay the housing crisis directly at the feet of NIMBYs—"not in my backyard" activists who opposed the construction of new housing.

"The NIMBY phenomenon that led to housing scarcity in closed-access cities induced households to migrate from large multi-unit buildings in dense coastal cities to single-family homes in cheaper cities," write Erdmann and Sumner. "The primary source of demand was households looking to economize on housing consumption by moving out of the expensive coastal cities."

Think of Mark and Patricia McCloskey as a class of activist. The McCloskeys of San Francisco, Los Angeles, and New York City tried to protect their views, their property values, and their relatively low-traffic streets with zoning laws that banned apartments across whole swaths of the city. Lack of supply met huge demand, hiking prices in the process. Middle-class people were effectively priced out of urban apartments because those apartments were simply never built.

So instead of living in Los Angeles and New York City, middle- and lower-income people moved to Las Vegas and Phoenix. That influx of demand saw prices spike and builders respond by throwing up lots of new homes. The glut of new homes in inexpensive Sun Belt cities wasn't just the result of an overinflated financial system. It was a response to real demand from cost-burdened coastal emigrants.

All this had massive macroeconomic consequences. Erdmann and Sumner argue the Great Recession was ultimately caused by federal officials misinterpreting rising home prices as a bubble rather than the result of a real shortage. So they tightened monetary and lending policy, and that tipped a rational building boom into an artificially induced recession.

It's an out-of-the-box theory that deemphasizes or disputes many common libertarian diagnoses of the Great Recession that center on an overly profligate Federal Reserve or on reckless financial institutions banking on an inevitable federal bailout. But it does explain how the country was able to go from a supposed glut of housing oversupply to a shortage of somewhere between 4 million and 20 million homes. The glut was overinterpreted—and the shortage never went away.

When economic growth did come back in the 2010s, in the form of a "return to the city" movement, zoning restrictions that were already tight became positively strangling.

And:

If you take seriously the idea that politics is primarily downstream of material factors, you might blame zoning for a lot of the sheer craziness of American politics in the last decade too.

15 notes

·

View notes

Text

NV Mortgage Lenders

NV Mortgage Lenders, like Superior Mortgage Lending, provide diverse loan options across Nevada, California, and Arizona. They offer competitive rates, no fee choices, and specialize in conventional, FHA, VA, jumbo loans, and more. Their focus on tailored solutions and efficient processing ensures clients find the right mortgage for their needs. Contact them today for expert guidance in residential and commercial lending.

0 notes

Text

Are You Looking for the Best Real Estate Properties in Sedona?

Sedona, Arizona, renowned for its stunning red rock landscapes, vibrant arts community, and spiritual energy, is not just a tourist destination; it's also a prime location for Real Estate Investment. Whether you're seeking a vacation home, a retirement retreat, or a lucrative investment opportunity, Sedona offers a diverse range of properties to suit every taste and budget. In this comprehensive guide, we'll explore why Sedona is an attractive real estate market, what factors to consider when searching for properties, and how to navigate the process effectively.

Why Choose Sedona?

Sedona's appeal as a real estate destination stems from its unique blend of natural beauty, cultural richness, and recreational opportunities. The city's iconic red rock formations, surrounded by the Coconino National Forest, create a picturesque backdrop for residential neighborhoods, making it a magnet for outdoor enthusiasts and nature lovers alike. Additionally, Sedona's thriving arts scene, with galleries, festivals, and cultural events year-round, adds to its allure as a vibrant community.

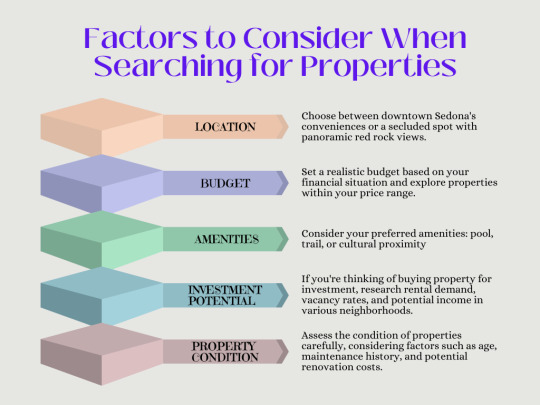

Factors to Consider When Searching for Properties:

Location: Determine whether you prefer to be close to downtown Sedona with its shops, restaurants, and amenities, or if you prefer a more secluded location with panoramic views of the red rocks.

Budget: Set a realistic budget based on your financial situation and explore properties within your price range. Keep in mind that prices can vary significantly depending on factors such as location, size, and amenities.

Amenities: Consider what amenities are important to you, whether it's a swimming pool, a hiking trail, or proximity to cultural attractions. Make a list of must-have features and prioritize them during your search.

Investment Potential: If you're considering purchasing property as an investment, research rental demand, vacancy rates, and potential rental income in different neighborhoods. Consult with local real estate agents or property managers for expert advice.

Property Condition: Assess the condition of properties carefully, considering factors such as age, maintenance history, and potential renovation costs. A thorough inspection can help you avoid unexpected expenses down the line.

Navigating the Real Estate Process in Sedona:

Research: Begin your search by exploring online listings, attending open houses, and consulting with local real estate agents who specialize in the Sedona market. Take the time to familiarize yourself with the different neighborhoods and property types available.

Financing: Determine your financing options early in the process, whether it's through a conventional mortgage, a home equity loan, or cash purchase. Get pre-approved for a loan to strengthen your offer when you find the right property.

Tour Properties: Schedule tours of properties that meet your criteria, paying attention to details such as layout, condition, and views. Take notes and ask questions to gather as much information as possible.

Make an Offer: When you find a property that ticks all the boxes, work with your real estate agent to craft a competitive offer. Consider factors such as market conditions, comparable sales, and seller motivations when negotiating price and terms.

Due Diligence: Once your offer is accepted, conduct due diligence to ensure there are no hidden issues with the property. Hire a qualified inspector to assess the home's condition, review documents such as title reports and HOA disclosures, and address any concerns before closing.

Closing: Work with your lender, real estate agent, and attorney to finalize the closing process, including signing paperwork, transferring funds, and obtaining insurance. Celebrate your new home or investment property and begin enjoying all that Sedona has to offer.

Whether you're drawn to Sedona for its natural beauty, cultural richness, or investment potential, finding the Best Real Estate Properties requires careful research, planning, and execution. By considering factors such as location, budget, amenities, and investment potential, and navigating the real estate process effectively, you can find the perfect property to suit your needs and goals in this enchanting desert oasis. With its breathtaking landscapes and vibrant community spirit, Sedona offers not just a place to live, but a lifestyle to treasure for years to come.

0 notes

Text

Ranking the Best Mortgage Brokers in the State

Arizona's real estate market is booming, with more people looking to buy homes than ever before. However, navigating the complex world of mortgages can be daunting. That's where mortgage brokers come in. These professionals act as intermediaries between borrowers and lenders, helping you find the best loan options for your needs. In this article, we'll explore the role of mortgage brokers in Arizona and highlight some of the best brokers in the state.

Understanding the Role of Mortgage Brokers

The Best Mortgage Brokers Arizona are professionals who help borrowers find the right mortgage products and lenders for their needs. These brokers work with a variety of lenders to offer borrowers a range of options and help them navigate the mortgage process from application to closing. Mortgage brokers play a crucial role in the home buying process. Unlike loan officers who work for a specific lender, brokers work independently and have access to a wide range of lenders and loan products. This means they can shop around on your behalf to find the best loan terms and interest rates. Additionally, brokers can help you navigate the often complex mortgage application process, ensuring you meet all the necessary requirements.

Read more - Mortgage and Refinance Rates in Arizona

Criteria for Selecting the Best Mortgage Brokers

When choosing a mortgage broker, it's essential to consider several key factors:

Experience and Reputation: Look for brokers with a proven track record of success and positive reviews from past clients. Experience matters when it comes to navigating the intricacies of the mortgage market.

Range of Lenders and Loan Options: The best mortgage brokers in Arizona will have access to a diverse array of lenders and loan products, ensuring that you have options tailored to your specific needs.

Customer Service: A broker's level of customer service can make a significant difference in your mortgage experience. Seek out brokers who prioritize communication, transparency, and responsiveness.

Fees and Costs: Understand the fee structure of any broker you're considering. While some brokers charge upfront fees, others earn their commission from lenders. This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans. Make sure you're comfortable with the costs involved before committing to a broker.

Tips for Working with a Mortgage Broker

When working with a mortgage broker, it's important to be prepared. Have all your financial documents ready, including pay stubs, tax returns, and bank statements. Additionally, be honest about your financial situation and goals. This will help your broker find the best loan options for you.This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans.

Finally, stay in communication with your broker throughout the process. This will ensure that everything goes smoothly and that you're able to close on your loan on time.

Finding the right mortgage broker in Arizona can make all the difference when buying a home. By following the tips outlined in this article and choosing one of the top brokers in the state, you can streamline the home buying process and secure the best loan terms possible. Contact a reputable broker today to start your journey towards homeownership in Arizona.

Frequently Asked Questions

1. What is a mortgage broker, and how do they differ from lenders?

A mortgage broker is a licensed professional who acts as an intermediary between borrowers and lenders. Unlike lenders, who provide loans directly to borrowers, mortgage brokers work with multiple lenders to find the best loan options for their clients.

3. Why should I use a mortgage broker instead of going directly to a bank?

Mortgage brokers can shop around on your behalf to find the best loan terms and interest rates from multiple lenders, saving you time and potentially money.

4. What criteria should I consider when choosing a mortgage broker?

Look for a broker with experience in the Arizona real estate market, a strong network of lenders, positive client testimonials, and all necessary licensing and certification.

5. How do mortgage brokers get paid?

Mortgage brokers typically receive a commission from the lender once the loan is closed. This commission is usually a percentage of the loan amount.

6. How long does the mortgage process typically take when working with a broker?

The timeline for the mortgage process can vary depending on factors such as the complexity of your financial situation and the lender's requirements. A mortgage broker can provide a more accurate estimate based on your specific circumstances.

7. Are there any advantages to using a local mortgage broker in Arizona?

Working with a local mortgage broker can offer several benefits, including their familiarity with the local market and regulations, personalized service, and the ability to meet face-to-face if desired.

8. Can I use a mortgage broker for refinancing my existing mortgage?

Yes, mortgage brokers can assist with refinancing your existing mortgage. They can help you explore refinancing options to potentially secure a lower interest rate, reduce your monthly payments, or change the terms of your loan.

9. What should I expect during the mortgage application process with a broker?

Your broker will help you gather all necessary documents, submit your application to lenders, and communicate with you throughout the process to ensure everything goes smoothly.

10. How can I find the best mortgage broker in Arizona for my needs?

Research brokers online, ask for recommendations from friends or family, and schedule consultations with potential brokers to discuss your needs and goals.

Get in touch

Website – https://homeloansproviders.com/

Mobile – +91 9212306116

Whatsapp – https://call.whatsapp.com/voice/9rqVJyqSNMhpdFkKPZGYKj

Skype – shalabh.mishra

Telegram – shalabhmishra

Email – [email protected]

#home mortgage company in Arizona#best mortgage refi company in Arizona#online mortgage company in Arizona

0 notes

Text

[ad_1]

Gamers and dealmakers are transferring up the ladder within the newest roundup of South Florida actual property hiring information.

Stantec is forming a brand new principal-led group in its Miami workplace with a sequence of promotions, in accordance with a press launch. Gustavo Alberti and Aida Sanchez-Gomez have been elevated from senior architect roles to principals. They be a part of principals Arturo Vasquez and Elvira Freire-Santamaria in helming the group, the discharge reveals. Previous to becoming a member of Stantec, each Alberti and Sanchez-Gomez held roles with Miami-based Arquitectonica, in accordance with LinkedIn.

in palm seaside, Forman Capital promoted Ty Regnier to vice chairman, a press launch reveals. He joined the lender final 12 months as an affiliate vice chairman, in accordance with the discharge. In his new position, Regnier will oversee new mortgage originations and underwriting.

It is a reunion of kinds. Previous to becoming a member of Forman, Regnier was a senior affiliate with Trez Capital, the true property funding agency primarily based in Vancouver. Brett Forman and Ben Jacobson relaunched Forman Capital final 12 monthsafter a six-year stint at Trez Capital.

In Davie, ANF Group introduced a brand new CEO, together with a number of different management promotions. The agency's longtime president, Alberto Fernandez, is taking the reins as CEO, in accordance with a press launch. His father, Alberto Fernandez, Sr. launched the agency in 1981.

Nelson Fernandez, who has been with the corporate for greater than 40 years, is assuming the position of president of ANF Growth, the discharge reveals. He was beforehand government vice chairman. Alberto Gil, who joined the corporate in 1986, is taking on as president of ANF Development. He was previously senior vice chairman.

Construct-to-rent developer Christopher Todd is increasing, opening an workplace in Boca Raton, in accordance with a launch. Headquartered in Mesa, Arizona, the agency makes a speciality of constructing single-family rental communities. It employed Jeffrey Gersh, one other Trez Capital alum, as Florida regional president, and Matthew Paul as Florida regional vice chairman, the discharge reveals.

Of their new roles, Gersh and Paul will deal with growth and growth alternatives in Tampa, St. Petersburg, Orlando, Sarasota, southwest Florida, Jacksonville, the Treasure Coast and the House Coast.

Moreover, Christopher Todd can be opening workplaces in Texas and Utah.

Learn extra

[ad_2]

Supply hyperlink

0 notes

Text

1 note

·

View note

Text

Equity Loans in Phoenix Arizona

Ashlee Tietgen - Mortgage Advisor at Local Mortgage, LLC is offers mortgage lender, loan agency, mortgage broker, residential mortgages and Equity Loans in Phoenix Arizona. Call on (602) 301-5577. Your satisfaction matters. Ashlee ensures personalized service tailored to your unique needs.

#Mortgage Lender in Phoenix Arizona#Loan Agency in Phoenix Arizona#Mortgage Broker in Phoenix Arizona#Equity Loans in Phoenix Arizona#Residential Mortgages in Phoenix Arizona

1 note

·

View note

Text

Are Mortgage Rates Making You A Little "Fraidy-Cat"?

Sellers: Don’t Let These Two Things Hold You Back

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles. Don’t be a…

View On WordPress

#Arizona#AZ#buying a house#Casa Grande#Chandler AZ#dream home#first-time homeowner#home loan#homeowners#lender#loving az homes#mortgage rates#mortgages#Scottsdale#sellers#selling a house

0 notes

Text

Reverse Mortgage Lenders in Arizona

Are you searching for trustworthy reverse mortgage lenders in Arizona to help you unlock the equity in your home and secure your financial future? Look no further than Sun American Mortgage, your premier destination for reliable and professional reverse mortgage services in the Grand Canyon State.

0 notes

Text

What I do as a Buyers Agent might surprise you. #RLS8GUY

In Arizona, builders are everywhere, finding the right home for you, is what I do. I have access to every single home listed for Sale. I've been selling houses for nearly 1/2 my life. So when I get asked what I do as a Buyers agent, I am more than happy to share.

Regardless if its a new home, resale, REO, HUD Home, Short Sale, Foreclosure, Pre-Foreclosure, Estate, Probate, Divorce Sell, I have come across every single type of scenario you can imagine as a buyers agent.

So when I am asked the question, "why would do I need a buyers agent representing them" on any home for sale, here is a list of what I do as a buyers agent that most don't realize:

1. Schedule Time To Meet Buyers

2. Prepare Buyers Guide & Presentation

3. Meet Buyers and Discuss Their Goals

4. Explain Buyer & Seller Agency Relationships

5. Discuss Different Types of Financing Options

6. Help Buyers Find a Mortgage Lender

7. Obtain Pre-Approval Letter from Their Lender

8. Explain What You Do For Buyers As A Realtor

9. Provide Overview of Current Market Conditions

10. Explain Your Company’s Value to Buyers

11. Discuss Earnest Money Deposits

12. Explain Home Inspection Process

13. Educate Buyers About Local Neighborhoods

14. Discuss Foreclosures & Short Sales

15. Gather Needs & Wants Of Their Next Home

16. Explain School Districts Effect on Home Values

17. Explain Recording Devices During Showings

18. Learn All Buyer Goals & Make A Plan

19. Create Internal File for Buyers Records

20. Send Buyers Homes Within Their Criteria

21. Start Showing Buyers Home That They Request

22. Schedule & Organize All Showings

23. Gather Showing Instructions for Each Listing

24. Send Showing Schedule to Buyers

25. Show Up Early and Prepare First Showing

26. Look For Possible Repair Issues While Showing

27. Gather Buyer Feedback After Each Showing

28. Update Buyers When New Homes Hit the Market

29. Share Knowledge & Insight About Homes

30. Guide Buyers Through Their Emotional Journey

31. Listen & Learn From Buyers At Each Showing

32. Keep Records of All Showings

33. Update Listing Agents with Buyer’s Feedback

34. Discuss Home Owner’s Associations

35. Estimate Expected Utility Usage Costs

36. Confirm Water Source and Status

37. Discuss Transferable Warranties

38. Explain Property Appraisal Process

39. Discuss Multiple Offer Situations

40. Create Practice Offer To Help Buyers Prepare

41. Provide Updated Housing Market Data to Buyers

42. Inform Buyers of Their Showing Activity Weekly

43. Update Buyers On Any Price Drops

44. Discuss MLS Data With Buyers At Showings

45. Find the Right Home for Buyers

46. Determine Property Inclusions & Exclusions

47. Prepare Purchase Contract When Buyers are Ready

48. Educate Buyer’s On Sales Contract Options

49. Determine Need for Lead-Based Paint Disclosure

50. Explain Home Warranty Options

youtube

0 notes

Text

Superior Loan Service

Superior Mortgage Lending delivers outstanding Superior Loan Service across Nevada, California, and Arizona. They offer a variety of loan products, such as conventional, FHA, VA, and jumbo loans, with competitive rates and no fee options. As both a lender and broker, they ensure efficient processing and a seamless borrowing experience. Superior Mortgage Lending is dedicated to providing professional guidance and personalized loan solutions to meet diverse client needs. to contact us

0 notes

Text

Albuquerque Actual Property Homes For Sale $600k $700k

A 10% down fee would wish a qualifying income of $74,000 to afford a house in the metropolis of simply over forty six,000.The median sale price for homes within the Duke City was just over $248,000 in 2020. But one other price increase would observe.In 2022, that median worth was as a lot as $336,600 in Albuquerque. That was slightly behind Q3 2022, which noticed the median sale price for Albuquerque at $339,500.Over those two years of gross sales, median home sale prices have went up 32.8%. Those trying homes for sale albuquerque to purchase a house at a 5% or 10% down fee would want to meet a qualifying income normal.An Albuquerque worker would want to earn slightly above six-figures to afford a 5% down cost. However, Albuquerque isn't the only New Mexico city that has seen home value elevated.This vital increase in pricing dates again to the beginnings of the COVID-19 pandemic in March 2020. Nothing can kill the house sale like an overpriced, inflated quantity.

Located just half-hour from Albuquerque, this luxurious community is nestled in the security, convenience, and ambiance of Rio Rancho. To see all the homes you’ve saved, go to the My Favorites section of your account. – Buying a house is an investment—and an more and more costly one. The median worth of a house within the United States reached $295,300 in June 2020, according to the National Association of REALTORS. Needs to evaluation the security of your connection before proceeding.

States are sometimes ranked as either tenant-friendly or landlord-friendly. New Mexico is extra landlord-friendly than Arizona, although it isn’t as landlord-friendly as Texas or Colorado. Landlords can require affordable homes for sale in albuquerque nm deposits, although that is limited to 1 month’s hire if the lease is lower than one year.

Ethan says someone recently shot at him while he was inside his automobile, just driving to get groceries for his household. Home Partners' Lease Purchase and Choice Lease packages are offered and administered by Home Partners Holdings LLC. Resident and property must meet eligibility criteria, which are topic to alter. Resident must qualify for a mortgage from a third-party lender or pay the acquisition worth in money to exercise the proper to buy a home. Home Partners isn't a mortgage firm, does not present financing for a resident to purchase a house, and cannot assure that a resident will be ready to acquire a mortgage loan. ©2022 Home Partners Holdings LLC. All rights reserved.

Check out trending color palettes and paint rooms accordingly. This inexpensive replace can work wonders for the image of the house. You can request cash provides without any danger or obligation — should you're not proud of an offer, you are free to walk away. Selling to a New Mexico money new home builders in albuquerque home buyer might put money in your checking account in as little as 7 days. Keep in thoughts that these are annual averages and the numbers will differ by month and/or season. Stacker provides its articles as-is and as-available, and makes no representations or warranties of any sort.

Families will recognize the abundance of terrific colleges and the quiet neighborhood streets. A little over seventy p.c of residents own their homes. However, the local financial system will stop nearly all of these renters from shopping for homes. The lower than the average earnings in the Albuquerque housing market combined with the higher than average home worth means a big minority of the inhabitants is priced out of the housing market.

The median record worth of Condos/Townhomes in Albuquerque, NM was $238,000 in May 2022, in comparison with $263,000 in 2021. The average sale worth per sq. foot in Albuquerque is $190, up 20.3% since last yr. The common sale worth of a house in Albuquerque was $327,000 last month, up 21.1% since last 12 months.

This coverage covers how MHVillage, Inc. treats personal information that MHVillage collects and receives, including info related to your past use of MHVillage products and services. Personal information is information about you and is particular to you like your name, address, e-mail tackle, telephone number, website actions, and so forth, but just isn't new homes albuquerque in any other case publicly obtainable. As a useful resource to traders, Roofstock could provide contact data or hyperlinks to lending, insurance, property management, or other monetary or skilled service providers. In offering this info, Roofstock does not advocate or endorse any third-party provider nor assure their providers.

Home patrons have lots to contemplate when house-hunting or seeking to spend money on rental properties, from the state of the housing market itself to taxes and potential resale worth. The housing market grew robust and pricey within the last decade following the 2008 recession, however the market might be slowed by rising rates of homes for sale in albuquerque new mexico interest. Such a downturn can be excellent news for potential home-buyers, as you’re extra probably to have the power to wager a deal on an otherwise overpriced home. Then there's the home itself to consider, together with what sort of repairs it requires .

0 notes