#most active developers crypto

Explore tagged Tumblr posts

Text

Unveiling the Powerhouse: Crypto Ecosystems with the Most Active Developers in 2023

Introduction:

In the ever-evolving landscape of cryptocurrency, the heartbeat of innovation is driven by the talented developers who contribute their skills to various blockchain projects. As we step into 2023, it's crucial to shine a spotlight on the crypto developer ecosystem, identifying the hubs of activity and innovation. In this article, we delve into the dynamic world of crypto development, highlighting the crypto ecosystems that boast the most active developers crypto.

Exploring the Crypto Developer Ecosystem:

The crypto developer ecosystem is the lifeblood of the blockchain industry, encompassing a diverse range of projects, platforms, and protocols. Developers play a pivotal role in shaping the future of decentralized finance (DeFi), non-fungible tokens (NFTs), smart contracts, and more. Identifying the most active developers provides valuable insights into the vibrancy and potential of different crypto ecosystems.

Ethereum: The Pioneer Continues to Lead

Ethereum, often hailed as the pioneer of smart contracts and decentralized applications (DApps), continues to maintain its status as a leading crypto development hub. With a robust community and a track record of hosting a myriad of successful projects, Ethereum attracts developers eager to contribute to the next wave of blockchain innovation.

Binance Smart Chain: Nurturing Innovation and Speed

Binance Smart Chain (BSC) has rapidly risen through the ranks, offering developers a fast and cost-effective alternative to Ethereum. With a focus on fostering innovation and scalability, BSC has become a hotspot for developers looking to build decentralized applications without compromising on speed.

Solana: Riding the Wave of High-Performance Blockchain

Solana's high-performance blockchain has captured the attention of developers seeking scalability and low transaction costs. As the ecosystem continues to grow, Solana has emerged as a playground for developers exploring cutting-edge technologies and pushing the boundaries of what is possible in the crypto space.

Polygon: Enhancing Ethereum's Scalability

Polygon, formerly known as Matic, has positioned itself as a scaling solution for Ethereum, offering developers the opportunity to build on a layer 2 solution that enhances scalability without sacrificing security. This approach has attracted a vibrant community of developers looking to contribute to Ethereum's ecosystem while enjoying the benefits of faster and cheaper transactions.

Cardano: Aiming for Sustainability and Innovation

Cardano's focus on sustainability and academic rigor has drawn developers who are committed to building robust and secure blockchain solutions. With a strong emphasis on research and development, Cardano's ecosystem provides a platform for developers to contribute to the evolution of blockchain technology.

Conclusion:

In the fast-paced world of cryptocurrency, developers are the driving force behind innovation and progress. The crypto ecosystems mentioned above are thriving hubs of activity, attracting some of the most talented developers in the industry. As we navigate the complexities of blockchain technology in 2023, these ecosystems stand out as beacons of creativity, collaboration, and continuous advancement.

Explore more about the crypto ecosystems with the most active developers in 2023 on https://coinscreed.com/. Stay tuned for updates on the pulse of crypto development and witness the transformative power of blockchain technology in the hands of these visionary developers.

0 notes

Note

literally what is the good in reporting "scammers". if it actually was a scammer great job they'll make another account and go on with their day. some probably wont notice if they're running multiple scams but if you managed to get an actual persons account deleted they have to make a new account prove that they're in an active war site go through the vetting process write a new fucking paragraph about their trauma (if they don't have it on hand already with how many accounts are scamjacketed and deactivated constantly) and regain their meager ass place in the algorithm. for daring to mildly inconvenience a tumblr user. i'm going insane

pls read all the way thru!!

~

is it weird that what makes me the most certain that they’re actually scam bots the fact that they would choose tumblr in the first place. like let me go to emo faggot land, a site that is believed to be dead by most people and is lowkey infamous for its bot problem, to get help. it makes more sense to post something like that on tiktok, instagram, xiaohongshu, etc. or at least imo.

in the event that families are actually flocking here in an attempt to receive help, someone should tell them that they’re likely to be ignored and assumed to be a bot. if you’re gonna support a scam, tell these accounts to catfish people on sugar daddy apps to get donations. there are lonely rich dudes willing to pay to just talk to people. or shit, asking a findom to get their subs to donate could work too.

~

but on a more serious note, it’s generally safer, and better for everyone involved, to help people through legit organizations (like pcrf, map, unicef, unwra, wfp, wck, rescue, etc.) anyways, as these are actual nonprofits and welfare programs and they have potential to reach more than just one family at a time, which is ultimately more effective and efficient when it comes to saving palestine as a whole. it’s secure and safer to trust.

not all people are moral, a lot of humans use whatever they can to their advantage. if someone wants money, even if they don’t remotely need it, they will find a way to get it.

the internet has been littered with scams since its conception.

do not trust strangers with your account information, do not trust strangers with your money, do not trust strangers on the internet, do not trust strangers. full stop.

remember, dead internet theory isn’t a theory anymore. bots have already begun to reign supreme.

~

anyways,

here’s more links to some helpful resources in regards to being confident in your efforts to support palestine.

protect palestine - essentially a palestinian support masterlist

palestinian solidarity campaign

the blop - big list of protests, not just for palestine but still useful and relevant

click to help /li ‼️- this one is great for my fellow broke and/or depressed bitches that lack the funds or energy to contribute more significantly but still want to help out. you best believe that activism burnout is real and prevalent, which is another thing this is good for

is it legit? - read charity reviews and ratings

us campaign for palestinian rights

decolonize palestine - learn about palestine and its culture! history, literature, myth busting, and more

palestine legal - if you need lawful help in your support efforts. this is especially important with the kidnappings of activists that’s been occurring as of late

heal palestine

build palestine’s list of trusted orgs

muslims around the world - they’re international but i linked their palestinian donation page specifically

un crisis relief for gaza

donate stock or crypto to project hope

wear the peace - clothes as activism. all profits go to gazan aid

penny appeal

doctors without borders - helps over 70 different countries, including palestine, ukraine, sudan, and the democratic republic of congo

sign up to volunteer at helping hand for relief and development

impactive - app for organizing and volunteering

turn up activism - app for youth activism

BDS movement

apps and sites to help with your boycotting: no thanks, boycott for peace, goods unite us, uplift

aweea’s list of palestinian owned businesses in USA, CANADA, UK, and AU

shop palestine

actions you can take to help

#this is not meant to be rude btw!!! i’m just very firm in my beliefs 💔#this is a certified shrimpothy post#activism#free palestine#save palestine#resources for palestine#palestinian aid#scammers#scam bots#guys i am BEGGING you; be skeptical be critical be wary be untrusting#it will save you#it will help you#the internet is a hellscape#humans suck#stay safe and be careful#shrimp is a misanthrope#never fully let your guard down guys PLEASE#shrimp has trust issues#shrimp lore drop#(lore in tags)#i hope this helps /gen nbr#it also bothers me because i specifically state the reasons i’m unable to donate hence why i assume these are all bots#cuz otherwise theyd know i’m a broke disabled and chronically ill unemployed student brah#i quite literally cannot donate anything (see that one post about getting a 1¢ payment declined lmfao)#and i usually don’t like to rb these sorts of posts (at least on here) just in case it is a scam#i spent a couple hours putting this all together because i care#stay vigilant y’all#and stop the occupation#shrimp answers asks#tw f slur

12 notes

·

View notes

Text

Hardly a new thought, but I'm constantly frustrated by even centrist Democrats' seeming inability to put 2 and 2 together on economic issues. They'll get tantalizingly close and then stall out, rhetorically, right at the finish line.

My charitable read on the situation is that explaining why capitalism and economic growth are so vital to human flourishing is sufficiently difficult that most people gloss over it. The less charitable take is that it's risky to openly advocate for profit, business, and the free market in progressive circles—even those who fully understand their value will be hesitant to actually come out and argue for it, lest they be attacked by their own "team".

It'll come as no surprise that I think the left-liberal divorce is long overdue. Liberalism and leftism are only contingently related; leftists are quite vocal about this fact. All too many self-identified liberals fail to understand the historical reasons for that coalition (and, thus, why leftists should have always remained the junior member). The various reasons why that happened are a story for another post. Suffice to say, liberals sanewashing leftist ideas was an electoral own-goal.

I bring this all up, of course, because the abundance agenda is back in the discourse thanks to Ezra Klein's new book. I haven't read the book yet, but I've been following the development of the idea since co-author Derek Thompson's piece in the Atlantic three years ago. The basic idea is sound, and compatible with all the ideologies I've explored seriously since starting my intellectual journey half a lifetime ago. Achieving material abundance, broadly defined, is my goal for economic and social policy. The important question is how to get it (and history really isn't very ambiguous in its answer).

Freedom from want is a core prerequisite of human flourishing. So I find myself confused that liberals are so hesitant, generally, to come out in favor of that. Perhaps part of the problem is that almost no one has actually gone to bat for economic liberalism in...150 years? Most advocates are either libertarian extremists who scare the normies, or crypto-Republicans really just trying to justify tax cuts. (Or both.) I suppose, then, the abundance crowd represents one of the only serious attempts to argue for economic liberalism in modern times.

A short note on terminology—the term economic liberalism refers to the policy and ideology of private property and a market economy. Protectionism, redistribution, onerous regulation, and other forms of central planning are not economically liberal. The vernacular meaning of the word "liberal" has shifted so far, at least in America, that most so-called liberals are only lukewarm on capitalism, and downright eager to regulate and tax economic activity.

The abundance agenda crowd is largely not that allergic to certain economically illiberal policies (Ezra Klein is openly on-board with plenty of big government programs), but they are critically motivated by a desire to get the goods. They can be reasoned with when it comes to the exact methods, because we can study empirically how to get more housing and more healthcare and so on. There will be plenty of debate on the specific strategies and tradeoffs to achieve abundance, but the conversation won't break down over a hatred of big business and millionaires.

The problem is that even many advocates of abundance are too timid to come out and say the obvious conclusions of their arguments—or, at least, say them loudly. Liberals need to once again embrace economic liberalism (as a means to the end of human flourishing!) and make that a core part of their message. It complements the socially liberal agenda, and appeals to what the public actually supports. The median voter and marginal voter care a whole lot about rent and the price of groceries, and they aren't wrong to do so.

If Democrats can actually start to deliver on this agenda in blue states (there's some signs of this, e.g. Gov. Josh Shapiro openly plugging his efforts to reduce the regulatory requirements to start a business in Pennsylvania), then perhaps the party can actually build credibility on economic issues. Economics isn't the only sphere in which Democrats need to reform, but if they can, then, just maybe, Trumpism will finally die.

The abundance conversation is the start of that process, not the end. But we won't get to that end so long as centrist Democrats are too afraid of the (electorally useless) left flank to court persuadable voters. And Democrats are not going to deliver the benefits of social and economic liberalism to the masses if they can't win elections. Even if their hearts are in the right place, that won't matter until they can clearly and confidently make the case for real material prosperity.

13 notes

·

View notes

Text

If you drive outside the city of Campton, population less than 400, the low industrial noise of crypto mining rises from the trees. Step closer, and the source comes into view: squat metal buildings that look like shipping containers arrayed in a semicircle, thrumming with fans and processors. There’s chain-link fencing, security cameras, and two guards sitting in pickup trucks just beyond the wire.

There are steel shipping containers like this all over these hills, right where the old coal mines once stood. And inside, specialized computers race to solve complex math problems—competing to verify bitcoin transactions and earn slivers of digital currency as a reward.

For a brief moment, in 2021, it felt like the region had found its next boom—and it had Bitcoin written all over it. At its peak, Kentucky accounted for some 20 percent of the collective computing power dedicated to proof-of-work cryptocurrency mining in the US.

But booms, here, have a history. And so do busts. Local officials say it is hard to pin down the exact number of crypto mines still active in eastern Kentucky because state regulations are light and there’s a general lack of transparency in the industry. But what is clear, locals say, is that the boom has begun to recede.

“ They'd constructed on someone else's land, or they would be paying a host company to provide the physical plant,” alleges Anna Whites, a lawyer who represented a roster of crypto mining clients. “So they'd pay the down payment or they would convince the landowner to pay the down payment, and then they would mine the first three months and then they'd go into the next billing set cycle, go almost to the end of it and then disappear.”

In early 2022, when Mohawk Energy initiated a crypto mining project in Jenkins, Kentucky, local officials said this time it would be different. Cofounded by Kentucky senator Brandon Smith, Mohawk purchased a sprawling 41,000-square-foot building and the 8 acres around it. It leased most of it to a Chinese crypto mining company, and the rest of the building included classrooms and hands-on training centers that were supposed to teach locals how to repair iPads, maintain Bitcoin rigs, and build skills for a digital economy. It was a big deal for Jenkins. A local PBS station ran a story about the launch. The images showed tool kits, workers, and smiling officials.

“The plan with Mohawk was to employ retired coal miners and disabled veterans who were back in eastern Kentucky and couldn’t find work, and train them,” said Whites, who counts Mohawk as one of her clients. Among other things, the project promised near-six-figure salaries and a vow to put some of the mining proceeds into the training program, to help grow it. And for a time, it worked.

Whites said that for a brief moment—about 18 months—things looked promising. Twenty-eight families saw real gains: One person from each family landed a permanent job, and about 30 more relatives found work nearby. But when we asked where things stood now, she paused. “I believe most of them are unemployed again.”

The unraveling came quickly. The Chinese partner sued for breach of contract. Mohawk counter-sued. And the shared crypto profits never materialized. Now, as some Kentucky residents have soured on bitcoin mining, they’ve started to speak about AI data centers in the same way they used to talk about coal seams and hash rates: with a kind of cautious hope. AI, they say, could bring jobs, fiber optics, and permanence.

Colby Kirk runs a nonprofit called One East Kentucky, focused on bringing economic development to the region. He remembers the moment the conversation shifted, back in April when he was in Paducah for the Kentucky Association for Economic Development’s spring conference.

“They had some site selection consultants that were on the panel, and they were talking about data centers,” he recalls. “And they talked about this I-81 corridor up through Pennsylvania where there’s all kinds of these big data centers. And they talked about whether our communities could prepare for some of these kinds of investments? And the consultant was like, here’s kind of what it takes.”

What it takes, it turns out, is no small feat: flat land, lots of power, fiber connectivity, and a workforce that can wire and weld. As fate would have it, the number of welders in the area, according to regional economic development organization One East Kentucky, is about twice the national average, which stands to reason, because wherever there’s metal and stress—and there’s a lot of both in coal mines—welders are the people who keep it all from falling apart.

The old infrastructure is still there too; substations, hardened ground, cooling systems, and power-hungry hardware just waiting to be switched back on. “Maybe a data center or something is a part of the puzzle,” Kirk said.

So, at the conference, when the panel ended and the floor opened to questions, Kirk says he asked the one he couldn’t stop thinking about.

“You know, 50, 60 years ago it would take a room bigger than my office to power a computer, and now I've got a computer I carry around in my pocket that's more advanced than what we sent astronauts to the moon with,” he recalls asking. “Are these data centers going to keep taking up million-square-feet buildings with 30- and 40-foot ceilings, or are we gonna be left with an abundance of warehouse or industrial-scale buildings that we won't be able to keep up?”

The consultant, he claims, didn’t have a good answer. “And that’s the thing,” Kirk says. “We don’t know what the future’s going to hold when it comes to this stuff.”

That kind of ambiguity doesn’t sit well with Nina McCoy. She’s a former high school biology teacher from Inez, a coal town made famous in 1964 when President Lyndon Johnson used it to generate support for his War on Poverty.

“This is going to sound awful,” she says, “but if they're putting it here, then that means it's bad. We've lived here long enough to see that that is how it works. You put those things that you don't want in your neighborhood in a place like this.”

Her skepticism is rooted in lived experience: In October 2000, a massive coal slurry spill from a mine site upstream poisoned the Coldwater Fork stream, which runs behind her house. People in Inez couldn’t drink water from the tap for months.

“Those of us living downstream didn't hear about it for a while, but the school system had to close down for about a week until they got an alternate water source,” she says.

To this day, many in Inez still don’t trust the tap water.

So when McCoy hears the hype about AI, she hears something else: another promise that comes with a cost. “We’ve allowed these people to be called job creators,” she said. “And I don’t care if it’s AI or crypto or whatever, we bow down to them and let them tell us what they are going to do to our community because they are job creators. They’re not job creators, they’re profit makers.”

And the profit leaves a footprint.

AI data centers demand staggering amounts of energy—a ChatGPT search uses up to 10 times more energy than a regular Google one—and they run hot. To keep them cool, these facilities consume billions of gallons of water every year. Most of that evaporates, but residents are wary because they have had problems with facilities and their runoff in the past, so they worry these new facilities could affect fish and disrupt the land. The very things the residents of Kentucky hope to preserve.

Still, some locals see potential, even progress.

“AI is in everything that we do,” said Wes Hamilton, a local entrepreneur who did his fair share of crypto mining in Kentucky in its heyday. “Siri, ChatGPT, robotics—everything you can imagine has to have AI,” he said. “Bitcoin is a one-trick pony. You create it. The only person that gets paid is the owner of the machines.”

Hamilton claims there is a path forward where data centers bring in investors, engineers, maybe even companies willing to stay. All the AI people in the world would be steaming into Kentucky, Hamilton says. And while he admits to losing a fortune in crypto ventures in the past, he claims this is different.

When Bitcoin first arrived, lawmakers offered generous tax breaks to lure miners. Companies investing more than $1 million were exempted from paying sales taxes on hardware and electricity. And then, in March 2025, Kentucky governor Andy Beshear took all that and went a step further by signing a “Bitcoin Rights” bill into law.

The legislation, cast as a defense of personal financial freedom, is designed to enshrine the right to use digital assets in Kentucky. An earlier draft went further, aiming to bar local governments from using zoning laws to restrict crypto mining operations—a provision that drew resistance from environmental groups. That language was eventually tempered, but the intent remains: to signal that, in Kentucky, digital extraction can keep humming.

Which is why we found ourselves outside this facility in Campton, staring at this semicircle of metal buildings nestled in the trees. The mines run all night and all day, even Sundays. And the question some are asking now, with bitcoin hovering around $100,000 and big miners talking about pivoting to AI, is whether bitcoin mining gets a second wind in Kentucky.

Mohawk’s bitcoin mining may even make a comeback. Anna Whites said the parties are supposed to go into arbitration May 12th. “I’m hopeful,” she told us. “I’m very hopeful that they sit down and say, ‘Mighty nice plant you have there. Let’s just go ahead and turn it on.’”

5 notes

·

View notes

Text

In 2024, Donald Trump won the popular vote by 1.5 points. Trump and Democrats alike treated this result as an overwhelming repudiation of the left and a broad mandate for the MAGA movement. But by any historical measure, it was a squeaker. [...] Down-ballot, Republicans’ 2024 performance was, if anything, less impressive. In the House, the Republicans’ five-seat lead is the smallest since the Great Depression; in the Senate, Republicans lost half of 2024’s competitive Senate races, including in four states Trump won; among the 11 governor’s races, not a single one led to a change in partisan control. If you handed an alien these election results, they would not read like a tectonic shift. And yet, they’ve felt like one. Trump’s cultural victory has lapped his political victory. The election was close, but the vibes have been a rout. This is partially because he’s surrounded by some of America’s most influential futurists. Silicon Valley and crypto culture’s embrace of Trump has changed his cultural meaning more than Democrats have recognized. In 2016, Trump felt like an emissary of the past; in 2025, he’s being greeted as a harbinger of the future. [...] Reading Cowen’s list with the benefit of hindsight, four factors converged to turn Trump’s narrow victory in votes into an overwhelming victory in vibes. The first is the very different relationship (most) Democrats and Republicans have to social media. To Democrats, mastering social media means having a good team of social media content producers; Kamala Harris’s capably snarky team was just hired more or less en masse by the D.N.C. To the Trumpian right, mastering social media — and attention, generally — means being, yourself, a dominant and relentless presence on social media and YouTube and podcasts, as Trump and JD Vance and Elon Musk all are. It’s the politician-as-influencer, not the politician-as-press-shop. There are Democrats who do this too, like A.O.C., but they are rare. [...] I won’t make any claims about the future, but the present feels decidedly male. Trump’s campaign in 2024 was gaudily masculine. Hulk Hogan and Dana White, the chief executive of UFC, spoke on the night of Trump’s speech at the Republican convention. The campaign fanned out to the podcasters young men listened to and embraced crypto culture. It connected to a larger anger building among men — a sense that there was no recognized masculinity aside from toxic masculinity, that there wasn’t much room for them in that female future. Trump’s win, in turn, has been felt as a victory for a particular type of man in the gender wars. In the hours after his victory, the taunt “your body, my choice,” filled social media. Attention has focused on the spaces in culture that embraced Trump, from Rogan to crypto to UFC, deepening the sense — or recognition — of their power. [...] Partly this reflected the limitations of Biden’s age. But it was also a strategy. Democrats came to believe their coalition was an “anti-MAGA majority” that stretched from Bernie Sanders to Liz Cheney. Their relatively strong performance in the 2022 elections — despite Biden’s dismal favorability ratings — seemed to vindicate this view. But the anti-MAGA majority would only activate if the threat of Trump felt real. And so a sort of attentional détente developed between Biden and Trump: Both agreed that the public’s attention should be on Trump. There was no attempt to dislodge Trump from being the center of American politics. [...] Perhaps the cultural momentum of Trumpism will give Trump’s presidency added force. But it is at least as likely that it lures Trump and his team into overreach. It is always dangerous to experience a narrow victory as an overwhelming mandate. Voters — angry about the cost of living and disappointed by Biden — still barely handed Trump the White House. There is little in the election results to suggest the public wants a sharp rightward lurch. But Trump and his team are jacked into the online vibes-machine and they want to meet the moment they sense.

Ezra Klein at The New York Times on why Donald Trump's narrow popular vote win and slim House and Senate majorities feel like a "mandate" when it really isn't. (01.19.2024)

Ezra Klein wrote in The New York Times that Trump’s very narrow election win feels like the "mandate” it is not.

#Ezra Klein#The New York Times#Masculinity#Opinions#Opinion#Donald Trump#Mark Zuckerberg#Elon Musk#2024 Presidential Election#Culture

9 notes

·

View notes

Text

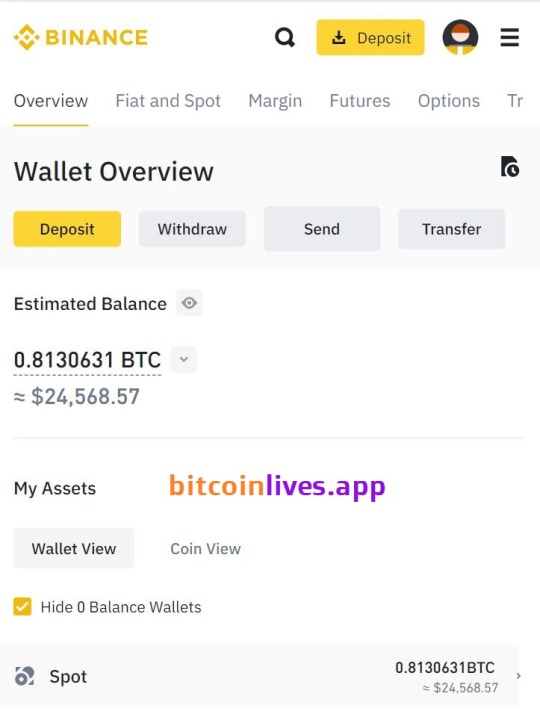

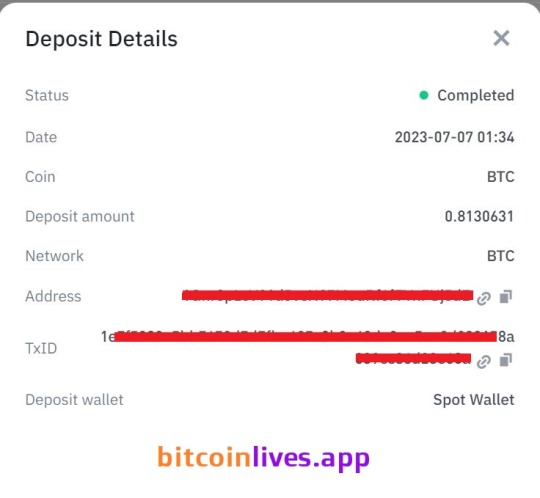

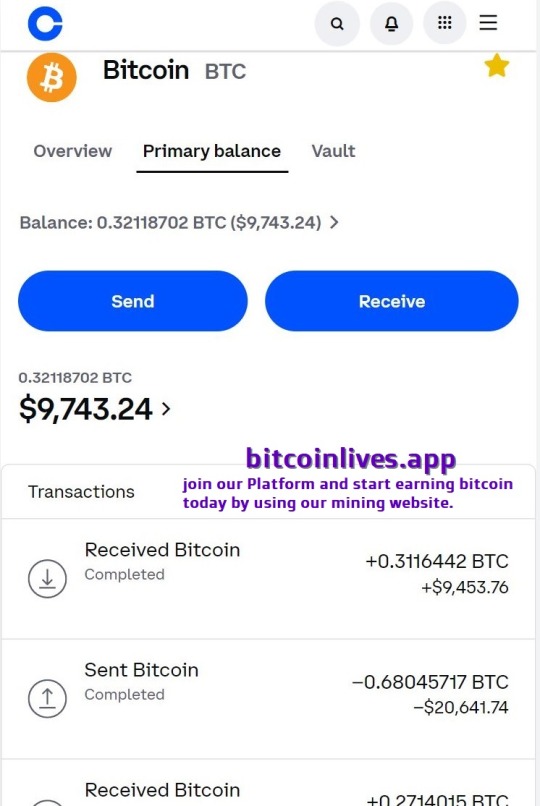

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

138 notes

·

View notes

Text

The Role of NFTs & Blockchain in MMORPGs: A Fad or the Future?

I've been gaming since I was a kid, and I've watched MMORPGs evolve from text-based MUDs to today's sprawling 3D worlds. But lately, there's been a ton of buzz around blockchain and NFTs in MMORPG game development. Everyone seems to have strong opinions, so I wanted to take a moment to cut through the hype and think about what this might really mean for the games we love.

What's Actually Happening Here?

If you haven't been keeping up with crypto gaming news, here's the simple version: NFTs are unique digital tokens that prove ownership of digital items. In MMORPGs, this could mean your epic sword, your character skin, or even your virtual land actually belongs to you—not just the game company.

Several games are already testing these waters. Axie Infinity let players earn real money through gameplay. The Sandbox and Decentraland sell virtual land as NFTs. New titles like Guild of Guardians are trying to create more traditional MMO experiences with player-owned assets.

The Exciting Possibilities

When I think about blockchain in MMORPG game development, I get genuinely excited about a few things:

We might finally solve the ownership problem. How many times have you spent countless hours grinding for gear, only to lose it all when a game shuts down or bans your account? True ownership could change that forever.

Player economies could get way more interesting. EVE Online and Runescape already have fascinating economies, but imagine if the rarity of items was verifiably limited and players had real stakes in the game's success.

Crafters could become legends. In a blockchain MMORPG, a master blacksmith could literally sign their creations, building reputation across the game—or potentially even across multiple games.

The Real Challenges

But let's be honest—there are some serious hurdles that aren't going away soon:

Game balance becomes a nightmare. When items have real-world value, how do you prevent pay-to-win? How do you add new content without crashing the value of existing items? These aren't easy questions for MMORPG game development teams.

The tech isn't quite there yet. Most blockchains still struggle with transaction speed and fees. An active MMORPG needs to process thousands of actions per second—something current blockchain tech isn't built for.

Gamers are (rightfully) skeptical. Many of us have seen companies try to cash in on trends without adding real value to gameplay. The backlash against NFT announcements from major studios wasn't just internet drama—it reflects genuine concern about the future of our hobby.

Finding a Balance

I think the most promising path forward isn't about going all-in on blockchain or rejecting it entirely. It's about thoughtful integration that actually makes games better:

Make ownership optional. Why not have both traditional and blockchain servers? Let players choose what model works for them.

Focus on fun first. The most successful blockchain MMOs will be great games first, investment platforms second. If the game isn't fun without the earning potential, it won't last.

Be transparent about the economy. Players need to understand how items enter the game, what controls inflation, and how the developers make money. Without this transparency, trust breaks down quickly.

So... Fad or Future?

After diving into this topic, I don't think it's either-or. Some elements of blockchain will likely find their way into mainstream MMORPG game development over time, while the more speculative aspects might fade away.

What excites me most isn't NFTs themselves, but the conversations they're sparking about ownership, value, and community in virtual worlds. These are questions worth exploring whether or not a particular technology ends up being the answer.

For developers building new MMORPGs, my advice is simple: if blockchain elements enhance your game experience, consider them—but never at the expense of what makes MMORPGs special in the first place: community, adventure, and that magical sense of being part of something bigger than yourself.

What do you think? Are you excited about owning your virtual gear, or do you think this is just another tech bubble? I'd love to hear your thoughts in the comments!

#game#mobile game development#multiplayer games#metaverse#nft#blockchain#unity game development#vr games#gaming

3 notes

·

View notes

Text

The future of crypto: The delicate dance between innovation and regulation

The major crypto technologies we are now seeing touch on a range of areas affecting our everyday lives. Blockchain technology is allowing us to record and transport financial data far more securely, transparently and efficiently than before. This new way of financial recordkeeping is being used in areas ranging from supply chain management to healthcare.

Blockchain is the basis of many other crypto technologies such as smart contracts. They are making contractual obligations stronger and more automatized across industries. Similarly, tokenization is changing how we securely move and store sensitive data such as credit card numbers by using ‘tokens’ to represent data and information. We’re seeing these used even in the world of arts and collectibles where a new digital dimension of non-fungible tokens (NFTs) are certifying ownership and authenticity.

Decentralized financial systems are also changing how we are dealing with money. By using peer-to-peer lending and decentralized exchanges, these systems are breaking down barriers, particularly for marginalized groups including women.

But not far behind each of these advances are security risks and challenges. While decentralization might provide some advantages to marginalized groups, the gender gap remains an issue in the world of virtual assets and cryptocurrency. Indeed, women continue to be underrepresented in the crypto space. This disparity is evident not only in the number of female investors and developers but also in leadership roles within blockchain projects. The crypto industry has the potential to reshape traditional financial systems, and fostering gender diversity is crucial for ensuring a more equitable and innovative future. Efforts to close the gender gap in crypto involve initiatives to educate and empower women in blockchain technology, providing mentorship opportunities, and advocating for a more inclusive and diverse community.

And gender inequality isn’t the only challenge facing the world of crypto. The irreversible nature of most crypto transactions means hacking and exploiting vulnerabilities can have major, lasting consequences. And anonymity makes these technologies potential hotbeds for illegal activities by criminals and terrorists. Robust cybersecurity measures are crucial for addressing this.

But how?

Regulatory uncertainty is one of the foremost challenges in the crypto landscape. Authorities have to carefully consider a range of questions: How do you create a system that simultaneously protects innovation and people? Whose jurisdiction are these borderless technologies under? How do we standardize their regulation without overregulating? And many more.

If you look at the regulatory framework around Virtual Assets Service Providers, which are the bridges between crypto and government-issued currencies, regulation is helping to mitigate major risks such as money laundering, terrorism financing, and other illicit activities. Such a framework gives these digital entities clear legal boundaries that help safeguard the integrity of financial systems as well as adds an important layer of consumer protection for any transactions involving virtual assets.

Clear guidelines and oversight mechanisms help prevent fraud and ensure the security and integrity of digital transactions. This builds confidence in investors, businesses, and the public that these assets are subject to transparent and accountable practices, which, ultimately, helps to foster a healthy and sustainable digital asset ecosystem.

Here at the OSCE we are actively engaged in helping participating States forge solid regulatory frameworks that strike a delicate balance between oversight and fostering innovation. We advocate for regulations created in consultation with industry stakeholders and that set clear guidelines without imposing unnecessary restrictions.

We also recognize that regulations should be adaptable and not overwrought. The rapidly evolving nature of virtual assets will quickly outpace a framework that is too rigid, overregulated or static, which not only hinders progress but also creates new vulnerabilities.

Our project, ‘Innovative policy solutions to mitigate money laundering risks of virtual assets’, is a key driving force of our support to States. Along with raising awareness among public officials about crypto-related risks, we are also building law enforcement and supervisory bodies’ capacities in crypto-related investigations.

By working together using a careful and balanced approach, we can create an agile crypto regulation system that mitigates risks, protects consumers and fosters innovation. This is key to tapping into the world of possibilities crypto offers and paving the way for a brighter and better future for us all.

2 notes

·

View notes

Text

Best Play-to-Earn Crypto Games 2025: Level Up Your Earnings While You Play

Introduction

Gaming isn’t just a pastime anymore, it’s a way to earn real money. In 2025, play-to-earn crypto games are changing lives. Players are collecting cryptocurrencies, trading NFTs, and joining thriving online communities, all while having fun. If you’re curious about the best play-to-earn crypto games 2025 has to offer, you’re in the right place.

What Are Play-to-Earn Crypto Games?

Play-to-earn (P2E) crypto games are digital games built on blockchain technology. Instead of just scoring points, you earn real crypto, tokens, or NFTs for your achievements. These rewards can often be traded or sold for actual money.

Unlike traditional games, your in-game items belong to you, not the developer. This means you can use, sell, or trade them however you like. The idea is simple: the more you play, the more you can potentially earn.

If you want to understand the basics, great guide on play to earn games.

Why Are Play-to-Earn Games So Popular in 2025?

There are a few big reasons. First, the crypto market is more mature and accessible than ever. More people have wallets, and blockchain games are easier to join. Second, the rewards are real. Players are earning tokens that can be swapped for dollars, euros, or other cryptocurrencies.

Finally, these games are social. Communities form around them, and players often help each other succeed. The best play-to-earn crypto games 2025 are more than games — they’re economies.

Top 7 Best Play-to-Earn Crypto Games 2025

Let’s look at the hottest games this year. Each one stands out for its gameplay, earning potential, and community.

1. The Sandbox

The Sandbox is a virtual world where you can build, own, and monetize your gaming experiences. You earn SAND tokens by creating assets, hosting games, or trading land. It’s creative, social, and perfect for builders.

2. Axie Infinity

Axie Infinity remains a favorite. Breed, battle, and trade cute creatures called Axies. Earn SLP and AXS tokens by winning battles and completing quests. The game’s economy is robust, and the community is huge.

3. Gods Unchained

If you love strategy, try Gods Unchained. This trading card game lets you earn GODS tokens and rare NFT cards by playing and winning matches. Cards can be sold on open markets for real value.

4. Decentraland

Decentraland is a 3D virtual world where you can buy land, create experiences, and join events. Earn MANA tokens by developing content or hosting activities. It’s a place where creativity meets opportunity.

5. Valhalla

Valhalla is a tactical RPG with NFT integration and chess-like battles. Players earn FLOKI tokens and collect tradable NFT items. The game is fun, strategic, and offers plenty of ways to earn.

6. Blast Royale

Blast Royale is a fast-paced battle game with NFT characters and equipment. Compete in quick matches and earn crypto rewards. It’s perfect for players who love action and want quick payouts.

7. RavenQuest

RavenQuest is an MMORPG where you own land, complete quests, and trade resources. The in-game economy is decentralized, and players can earn real crypto by participating in the world.

For more game ideas, check out the list of trending blockchain games.

How to Start Earning with Play-to-Earn Crypto Games?

Getting started is easier than you might think. Here’s a quick roadmap:

Choose a Game: Pick one that fits your interests and budget. Some games are free to start, while others may require a small investment.

Set Up a Wallet: Most games need a crypto wallet like MetaMask. This is where you’ll store your tokens and NFTs.

Learn the Rules: Each game has its own economy and rules. Take time to understand how you can earn and what the best strategies are.

Join the Community: Most games have Discord or Telegram groups. Here, you’ll find tips, updates, and other players to team up with.

Play and Earn: Dive in, complete quests, win battles, and start collecting rewards.

Trends to Watch in 2025

Mobile Gaming: More P2E games are launching mobile versions, making it easier to play anywhere.

NFT Integration: In-game items as NFTs are now standard, giving players more control and value.

Cross-Chain Gaming: Games are supporting multiple blockchains, so you can use your assets in different games.

Community Governance: Players are voting on updates and helping shape the future of their favorite games.

For more on trends, the latest in blockchain gaming.

Frequently Asked Questions

1. Are play-to-earn games free? Ans: Some are, but many require an initial investment or NFT purchase. Always check before you start.

2. How do I cash out my rewards? Ans: Transfer your tokens or NFTs to your wallet, then sell them on supported exchanges or marketplaces.

3. Is it risky? Ans: Like any investment, there are risks. Only play with what you can afford to lose, and stick to reputable games.

Conclusion

The best play-to-earn crypto games 2025 are more than just entertainment — they’re a way to earn, connect, and be part of a new digital economy. Whether you’re a casual player or a crypto enthusiast, there’s never been a better time to jump in. Explore, play, and start earning today!

2 notes

·

View notes

Text

KikoTheCat: The Upcoming Memecoin Revolution on MultiversX

In the ever-evolving world of cryptocurrency, there’s always room for innovation, fun, and community. From the rise of Dogecoin as the pioneer of memecoins to the global explosion of Shiba Inu, it’s clear that people love projects that bring personality and passion to the blockchain. But there’s one glaring omission in the current memecoin landscape: a cat-themed coin that truly represents the internet’s favorite animal.

That’s where KikoTheCat comes in. As the first significant cat-themed memecoin on MultiversX, KikoTheCat aims to fill this gap and capture the hearts of crypto enthusiasts and cat lovers alike.

Who Are We?

We’re a team of three dedicated crypto enthusiasts who have been active participants in the MultiversX ecosystem for over three years. Our journey within this space has been transformative, as we’ve witnessed the unmatched potential of MultiversX as a blockchain.

After years of experience and a deep understanding of the crypto space, we decided to take the leap and create something fun, innovative, and impactful. Following long discussions and brainstorming sessions, we realized there was one glaring opportunity waiting to be seized: a cat-themed memecoin.

The result? KikoTheCat, a coin designed to bring joy to the community, harness the power of memes, and provide a meaningful use case for one of the most scalable blockchains in the world.

Why a Cat-Themed Meme Coin?

Memecoins are more than just tokens; they are movements powered by communities. And when you think of the internet, cats are everywhere — from viral videos to beloved memes. Cats have dominated social media for years, but they’ve been underrepresented in the crypto world.

That’s not fair to the millions of cat lovers out there. Dogs have had their moment in the spotlight, but now it’s time for the internet’s true rulers to step up: the cats. KikoTheCat is here to give cats the recognition they deserve in the memecoin world.

Why MultiversX?

When building KikoTheCat, the choice of blockchain was crucial. We wanted a platform that was secure, scalable, and future-proof. That’s why we chose MultiversX (formerly Elrond) as the home for our project. Here are the reasons why MultiversX is the perfect fit:

1. Unparalleled Scalability

MultiversX’s Adaptive State Sharding Technology can handle up to 15,000 transactions per second. This makes it one of the fastest and most efficient blockchains in the world, ensuring smooth and low-cost transactions for KikoTheCat holders.

2. Top-Tier Security

MultiversX is built on a highly secure infrastructure, making it a trusted choice for projects that prioritize safety and reliability. KikoTheCat’s community can rest assured knowing their investments are protected.

3. Eco-Friendly Blockchain

As concerns about crypto’s energy consumption grow, MultiversX has positioned itself as an energy-efficient blockchain. This aligns with our vision of sustainability and responsibility.

4. Vibrant Ecosystem

The MultiversX ecosystem is thriving, with innovative projects and a strong developer community. With tools like the xPortal wallet (formerly Maiar), it’s easier than ever to onboard new users and make crypto accessible to all.

5. Global Recognition and Growth

MultiversX is rapidly gaining recognition as one of the top Layer 1 blockchains. By building KikoTheCat on this platform, we’re contributing to its growth while leveraging its technology and reputation.

Our Vision and Goals

At KikoTheCat, we have a clear mission: to become one of the top memecoins in the world while supporting the growth of the MultiversX ecosystem. Here’s how we plan to achieve it:

1. Building a Strong Community

Community is the backbone of any memecoin. We’ll focus on creating a welcoming space for cat lovers, crypto enthusiasts, and everyone in between. Through social media campaigns, giveaways, and fun challenges, we’ll foster a vibrant and engaged community.

2. Transparent Tokenomics

Trust is earned through transparency. Our tokenomics are designed to be fair, with clear allocations and no hidden agendas. We believe in empowering our community by keeping everything open and above board.

3. Bringing Exposure to MultiversX

KikoTheCat isn’t just about our project. It’s about helping the MultiversX ecosystem grow by increasing trading volume and bringing more users to the blockchain.

4. Creating a Global Brand

With the power of memes and the appeal of cats, we’ll build KikoTheCat into a globally recognized brand. From merchandise to partnerships, the possibilities are endless.

Tokenomics: The Foundation of KikoTheCat

KikoTheCat’s tokenomics are designed to ensure sustainability, fairness, and growth. Here’s the breakdown:

Allocation

Percentage

Tokens (out of 7,000,000,000,000)

Team

10%

700,000,000,000

Marketing

10%

700,000,000,000

Private Sale

45%

3,150,000,000,000

Liquidity Listing

35%

2,450,000,000,000

Key Details:

Private Sale Revenue: We aim to raise 50 EGLD through the private sale, all of which will be added to the liquidity pool.

Listing Price: The listing price will be 50% higher than the private sale price to incentivize early participation.

Vesting and Unlocks

Team Tokens: Locked for 10 months, with 10% unlocking each month after the lock-up period.

Marketing Tokens: Available immediately after listing to support airdrops, social media campaigns, and partnerships.

The Roadmap

We have a clear plan to take KikoTheCat to the top:

Phase 1:

Launch social media campaigns.

Build a strong community.

Begin the private sale.

Phase 2:

Token listing and liquidity pool setup.

Execute marketing campaigns.

Collaborate with MultiversX ecosystem projects.

Phase 3:

Introduce new utilities and partnerships.

Expand global recognition through influencers and media.

Conclusion: Join Us on This Journey!

KikoTheCat is more than just a memecoin. It’s a community-driven project built on one of the best blockchain platforms in the world. Whether you’re a cat lover, a crypto enthusiast, or someone who believes in the potential of MultiversX, we invite you to join us on this exciting journey.

Our vision is clear: to bring KikoTheCat to the forefront of the global memecoin movement while shining a spotlight on the incredible capabilities of MultiversX. With a strong community, transparent tokenomics, and a team dedicated to innovation and growth, we’re confident that KikoTheCat will become a force to be reckoned with in the crypto space.

The future is bright, and KikoTheCat is ready to lead the way. Together, we can create something truly extraordinary — a project that not only brings joy and excitement to the crypto world but also helps pave the way for the broader adoption of MultiversX.

So, whether you’re a seasoned investor or someone new to crypto, KikoTheCat welcomes you. Join us as we unleash the power of memes, cats, and blockchain technology to create something unforgettable.

Let’s take KikoTheCat to the moon — or, in true cat style, to the very top of the scratching post of success!

3 notes

·

View notes

Text

STON Gains Institutional-Grade Security with Zodia Custody

Security and trust are the backbone of any thriving digital asset ecosystem. STON has taken a major step forward by becoming the first token on The Open Network (TON) to integrate with Zodia Custody, a leading provider of institutional-grade asset protection. This partnership reshapes how digital assets on TON are secured, bringing a new level of credibility and accessibility to investors.

For years, institutional investors have faced a major roadblock in the blockchain space: the lack of reliable custody solutions. Without secure storage, even the most promising assets remain out of reach for major financial players. Zodia Custody changes the game by offering a secure and compliant environment for institutional holdings. With 24/7 availability and robust infrastructure, it ensures that large-scale investors can confidently store, manage, and interact with STON without operational risks.

What This Means for Institutional Investors

Institutional investors operate under strict regulatory and security requirements. Unlike retail traders, they cannot afford to engage with assets that lack proper custodial solutions. Now that STON is secured within Zodia Custody’s infrastructure, it becomes accessible to a broader class of investors who require institutional-grade security before making large-scale investments.

One of the biggest validations of this integration comes from CoinFund, a highly regarded crypto-native investment firm and lead investor in STON. CoinFund’s decision to hold STON within Zodia Custody signals trust in the token’s long-term viability and positions it as a more attractive asset for other institutional players.

The Impact on STON and the TON Ecosystem

STON’s integration with Zodia Custody is not just about security—it’s a catalyst for long-term growth. Institutional accessibility means more liquidity, broader adoption, and stronger market confidence. With a secure custody solution now in place, STON is no longer just a token for retail investors; it is now positioned as a high-value digital asset within the TON blockchain.

Beyond STON, this move also elevates the entire TON ecosystem. A reliable custody solution attracts institutional capital, making TON a more appealing blockchain for developers, investors, and projects looking for a secure environment to operate in. This sets the stage for larger partnerships, increased DeFi activity, and long-term sustainability.

A Defining Moment for STON’s Future

The integration with Zodia Custody is a strategic leap forward. It strengthens STON’s position in the market, reassures investors, and opens the door to more institutional participation in the TON ecosystem. As blockchain technology continues to mature, security and compliance will play a central role in determining which assets gain mainstream adoption.

STON is now ahead of the curve. With a solid foundation of security, credibility, and institutional backing, the token is well-positioned for future growth, adoption, and market expansion.

4 notes

·

View notes

Text

STON.fi’s Grant Program: Fueling Innovation on TON

The world of Web3 is constantly evolving, with new ideas shaping the future of decentralized finance, gaming, and blockchain applications. But turning ideas into reality requires more than just passion—it requires resources, funding, and the right ecosystem to thrive.

That’s where STON.fi’s Grant Program comes in. As the most active decentralized exchange (DEX) on The Open Network (TON), STON.fi isn’t just facilitating seamless crypto trading—it’s actively investing in builders who are pushing the boundaries of what’s possible in Web3.

With grants of up to $10,000, developers, founders, and teams working on DeFi, GameFi, and blockchain applications now have a chance to bring their ideas to life with the support of a strong, high-utility ecosystem.

Why STON.fi

STON.fi has established itself as the leading DEX on TON, and the numbers speak for themselves:

$5.2 billion+ total trading volume (the highest among DEXs on TON)

4 million+ unique wallets (representing 81% of all DEX users on TON)

25,800+ daily active users, with 16,000 making multiple transactions daily

8,000+ new users joining each day, making it the fastest-growing DEX on TON

700+ trading pairs active daily, ensuring a dynamic, liquid market

STON.fi isn’t just growing—it’s setting the standard for DeFi activity on TON. The strength of its ecosystem makes it the perfect launchpad for new projects that need exposure, funding, and a strong technical backbone.

What Does the Grant Program Offer

The STON.fi Grant Program is more than just financial support. It’s a strategic boost that provides:

✅ Funding up to $10,000 to build and expand projects

✅ Technical integration support for leveraging STON.fi’s ecosystem

✅ Ecosystem access, ensuring collaboration and visibility

✅ Growth opportunities, including exposure to STON.fi’s vast user base

This isn’t just for DeFi protocols—NFT platforms, Web3 games, and blockchain tools that enhance the TON ecosystem are all eligible. The goal is impactful innovation, with projects that contribute to user growth, activity, and adoption on TON.

Meet the Latest Grant Winners

STON.fi has already begun funding promising projects that align with its mission. Two standout teams recently received grants:

Farmix – Leveraged Yield Farming

Farmix is redefining yield farming by offering leveraged positions on STON.fi’s liquidity pools. This allows users to optimize their farming strategies, maximize returns, and strengthen the liquidity of key pairs, including:

STON/USDt

PX/TON

STORM/TON

The project directly contributes to the growth of STON.fi’s ecosystem, increasing total value locked (TVL) and transaction volume while giving users more ways to earn.

TonTickets – Web3 Prize Gaming

TonTickets is bringing a fresh gamification model to blockchain. Players lock tokens, earn tickets, and redeem them for rewards—adding an interactive layer to Web3 engagement.

By integrating STON.fi’s swap technology, winners can instantly convert rewards into TON, creating real utility and seamless transactions. This initiative doesn’t just benefit TonTickets—it enhances the entire STON.fi ecosystem by increasing activity and liquidity.

Who Can Apply

STON.fi is looking for projects that bring real utility and innovation to the TON ecosystem. Ideal applicants include:

🚀 DeFi builders creating financial tools and liquidity solutions

🎮 GameFi projects integrating blockchain with gaming mechanics

🔗 Web3 infrastructure developers focused on trading tools, NFT utilities, and more

💡 Innovators with unique blockchain applications that strengthen TON’s adoption

STON.fi isn’t just looking for ideas—it’s looking for scalable projects with a clear roadmap and impact potential.

How to Apply

The application process is straightforward:

1️⃣ Submit your proposal, detailing the project’s goal and impact on TON

2️⃣ Show technical feasibility and explain how it integrates with STON.fi

3️⃣ Outline a roadmap that highlights your growth and development strategy

Successful applicants receive not just funding, but also technical and ecosystem support, ensuring their project can thrive within the TON blockchain.

Final Thoughts

STON.fi isn’t just a DEX—it’s a catalyst for Web3 innovation. By supporting builders with funding, infrastructure, and an active user base, it’s ensuring that TON becomes a hub for next-gen blockchain applications.

For developers, founders, and teams looking to launch, scale, and grow, this grant program offers a unique opportunity to gain funding, technical backing, and immediate exposure within a high-utility ecosystem.

The next wave of Web3 innovation is happening now. Will your project be part of it?

4 notes

·

View notes

Text

The young developers are having the time of their lives. They pop open bottles of sparkling wine, eat steak dinners, play soccer together, and lounge around in a luxurious private swimming pool, all of their activity captured in photos that were later exposed online. In one picture, a man poses in front of a life-size Minions cardboard cutout. But despite their exuberance, these are not successful Silicon Valley entrepreneurs; they’re IT workers from the Hermit Kingdom of North Korea, who infiltrate Western companies and send their wages back home.

Two members of a cluster of North Korean developers, who allegedly operated out of Southeast Asian country Laos before being relocated to Russia by the beginning of 2024, are today being identified by researchers at cybersecurity company DTEX. The men, who DTEX believes have used the personas “Naoki Murano” and “Jenson Collins,” are alleged to have been involved in raising money for the brutal North Korean regime as part of the widespread IT worker epidemic, with Murano alleged to have previously been linked to a $6 million heist at crypto firm DeltaPrime last year.

For years, Kim Jong Un’s North Korea has posed one of the most sophisticated and dangerous cyber threats to Western countries and businesses, with its hackers stealing the intellectual property needed to develop its own technology, plus looting billions in crypto to evade sanctions and create nuclear weapons. In February, the FBI announced that North Korea had pulled off the biggest ever crypto heist, stealing $1.5 billion from crypto exchange Bybit. Alongside its skilled hackers, Pyongyang’s IT workers, who often are based in China or Russia, trick companies into employing them as remote workers and have become an increasing menace.

“What we’re doing isn’t working, and if it is working, it’s not working fast enough,” says Michael “Barni” Barnhart, a leading North Korean cyber researcher and principal investigator at DTEX. As well as identifying Murano and Collins, DTEX, in a detailed report about North Korean cyber activity, is also publishing more than 1,000 email addresses that it alleges to have been identified as linked to North Korean IT worker activity. The move is one of the largest disclosures of North Korean IT worker activity to date.

North Korea’s broad cyber operations can’t be compared with those of other hostile nations, such as Russia and China, Barnhart explains in the DTEX report, as Pyongyang operates like a “state-sanctioned crime syndicate” rather than more traditional military or intelligence operations. Everything is driven by funding the regime, developing weaponry, and gathering information, Barnhart says. “Everything is tied together in some way, shape, or form.”

The Misfits Move In

Around 2022 and 2023, DTEX claims both Naoki Murano and Jenson Collins—their real names are not known—were based in Laos and also travelled between Vladivostok, in Russia. The pair appeared among a wider group of possible North Koreans in Laos, and a cache of their photos were first exposed in an open Dropbox folder. The photos were discovered by a collective of North Korean researchers who often collaborate with Barnhart and call themselves a “Misfit” alliance. In recent weeks, they’ve posted numerous images of purported North Korean IT workers online.

North Korea’s IT workers are prolific in their activities, often trying to infiltrate multiple companies simultaneously by using stolen identities or creating false personas to try to appear legitimate. Some use freelance platforms; others try to recruit international facilitators to run laptop farms. While their online personas may be fake, the country—where millions do not have basic human rights or access to the internet—steers talented children into its education pipeline where they can become skilled developers and hackers. That means many of the IT workers and hackers are likely to know each other, potentially since they were children. Despite being technically adept, they often leave a trail of digital breadcrumbs in their wake.

Murano was first linked to North Korean operations publicly by cryptocurrency investigator ZachXBT, who published the names, cryptocurrency wallet details, and email addresses of more than 20 North Korean IT workers last year. Murano was then linked to the DeltaPrime heist in reporting by Coinbase in October. Members of the Misfits collective have shared photos of Murano looking pleased with himself while eating steak and a picture of an alleged Japanese passport.

Meanwhile, Collins, who DTEX included in its report and who was featured in swimming pool photos included in the Dropbox folder, was most commonly involved in IT work that generated revenue for Pyongyang, says narcass3, a member of the Misfits who asked to be identified by their online handle. “He seems to have mainly just worked on crypto/blockchain projects, including one which seems to be completely DPRK-backed or primarily made up of IT workers,” narcass3 says.

Evan Gordenker, a consulting senior manager at the Unit 42 threat intelligence team of cybersecurity company Palo Alto Networks, says he is familiar with the two personas identified by DTEX and other outlets and the cluster of North Korean workers that were based in Laos. The group were putting out a lot of job applications, creating fake personas, and searching for potential accomplices, the researcher says. “It seemed to me like they also enjoyed a level of autonomy that I don't think you tend to see for some of the [IT worker] groups,” Gordenker says. “I don't know if that’s because they generated more money and earned more privileges or just because they happened to have a group lead that operated in that way.”

An email address in Murano’s name bounced back when contacted by WIRED. Meanwhile an email address in Collins’ name did not respond to a request for comment.

Hiding in Plain Sight

Pyongyang’s IT workers have been operating for the best part of a decade, but attention on their activities has intensified in the past 12 months as Fortune 500 companies realized they have inadvertently hired North Koreans. Teams of hackers and IT workers are set “earnings quotas” by Kim Jong Un’s regime, Barnhart says, with IT workers operating from multiple North Korean military and intelligence organizations. One IT worker that made $5,000 per month could keep $200 of it, the investigator says.

Malicious IT workers, who may be likely to steal as well as earning money, are a part of the country’s recently revealed AI organization called 227 Research Center, which is part of the the primary intelligence agency the Reconnaissance General Bureau, while others are part of teams at the Ministry of National Defense, according to a cyber organization chart published by Barnhart in the DTEX report. IT workers that solely try to generate revenue from their jobs may be part of the Munitions Industry Department, the research says.

The relatively recent uptick in scrutiny around IT workers has come amid a growing US government crackdown: In May 2023 it sanctioned North Korean company Chinyong Information Technology Cooperation Company for employing IT workers in Laos and Russia, while at the start of this year two North Korean front companies and their China- and Laos-based bosses were sanctioned by the US Treasury Department. The Treasury said IT worker groups earn “hundreds of millions of dollars” for the regime, and thousands of IT workers are dispatched around the world.

“IT workers play the numbers game and are applying for remote roles in volume,” says Rafe Pilling, director of threat intelligence, at Sophos’ Counter Threat Unit. That means they often make errors. “They seem to operate at such a pace that they can make mistakes like leaving Github repositories of CVs and tools publicly accessible, leaving comments in code and scripts, making mistakes across CV’s that make them easier to spot as fakes, and slip-ups on camera during interviews that can reveal subterfuge.”

Alongside identifying Murano and Collins, DTEX also published more than 1,000 email addresses allegedly linked to North Korean IT worker operations that have been gathered through investigations and collaboration with researchers. Each email address has been provided by multiple sources, Barnhart says. A WIRED analysis of almost two dozen of the emails, using open-source intelligence tools and a database of material leaked online, shows few of them appear to have any signs of authentic online behavior; some email addresses are linked to online developer tools or freelancing websites, with others having very little online presence.

“There’s quite a bit of reuse of personas and some of them last years and years,” Unit 42’s Gordenker says. Others might be used just once, Gordenker says, but the scammers can quickly create new personas if needed. “You’ll see a persona that works, for instance, can sometimes have four or five, six different jobs across the lifespan.”

As more IT workers are identified, they are increasingly adopting their tactics to try to make themselves harder to spot. Multiple cybersecurity researchers have found North Koreans using face-changing software during video interviews or using AI assistants to help answer questions in real-time.

Changing Faces

The IT worker stands in the middle of the cramped room and poses for his photo. A clock on the wall reads 11:30. In the background, three other men wearing military uniforms hunch over computers. A rack of laundry appears at the back of the room in the photo, which was first published by DTEX. “There’s a lot to unpack in that one image,” Barnhart says.

Barnhart explains that while much is unknown about the photo, it reveals some details about how the group of IT workers operate. One of the men, in the far right corner of the photograph, appears to have WhatsApp messages open on his computer screen, with multiple chats ongoing. Attached to the wall above him is a surveillance camera.

“The MSS watches them so they don’t become defectors,” Barnhart says, referring to North Korea’s counterintelligence agency and secret police, the Ministry of State Security. As the men are based out of a small work space, they are likely to be lower down the pecking order of IT workers and will, like their compatriots, also face digital surveillance when they use their computers, he says. Barnhart says software he has seen monitors what the IT workers type and send on their devices. “They hate it,” he says. “It sends flags out to external servers whenever sexual imagery or sexual content is talked about or if Kim Jong Un [is mentioned].” Other researchers have spotted suspected IT workers ending job interviews when asked a variation on the question: “How fat is Kim Jong Un?”

While it’s unclear where the men in the room may be physically located, there are signs that the portrait photograph of the central subject has been used to create a false persona. Subsequent images obtained by Barnhart show the man edited into different clothes and turned into a cartoon-style illustration of his face.

“It shows him messing with the hairline. It shows him altering features, it shows him basically getting his profiles ready,” Barnhart says. One of these photos—of him edited into a leather jacket—appears on the website of “Benjamin Martin,” a self-styled web3 and full-stack developer.

Aside from appearing to be the North Korean from the IT worker photo, two of the companies listed on Martin’s online CV tell WIRED they have not heard of the persona, let alone employed him. One of the firms said it was not fully incorporated during most of the time the Martin persona listed he was working there. Martin did not respond to messages sent to the email listed on the developer webpage, while a Telegram account linked to a phone number on Martin’s website responded “yes” in a limited Chinese-language exchange when asked if they were a North Korean IT worker.

Ultimately, Barnhart says, people need to understand how North Korean hackers and IT workers are operating, with fluidity between groups and approaches, before significant disruption of their efforts can take place. “We need to refocus, we need to reshape,” Barnhart says. “North Korea has already moved on to their next point and now they're subcontracting and creating another layer of obfuscation there, too.”

5 notes

·

View notes

Text

Coke Meme (COKE): The Fast-Rising Solana Meme Coin Redefining Community Engagement and Growth

The world of meme coins is constantly evolving, and few projects have captured attention as rapidly as Coke Meme (COKE) on Solana. With a strong and committed community, a strategic roadmap, and a unique incentive system, COKE is setting new standards for engagement and longevity in the meme coin space.

A Resilient Beginning & Community-Driven Success

The COKE team had been planning this launch for a month, preparing a robust strategy to ensure sustainable growth. However, due to early challenges, they made the bold move to launch COKE V2, implementing better supply control and locking a significant portion of tokens to boost confidence among holders.

The results speak for themselves. The COKE community is now 3,800 holders strong, with an astounding 2,000 new holders joining in just the last two hours. Backed by a dedicated team of 45 active community members, the project is quickly proving itself as a dominant force in the space.

Explosive Growth and Strategic Positioning

One of the most impressive aspects of COKE’s journey is its fast-tracked listings on CoinMarketCap (CMC) and CoinGecko, a rare achievement that speaks to its momentum and legitimacy. Additionally, the project has developed a range of engaging strategies to fuel organic growth and increase adoption, including:

Celebrating Major Market Cap Milestones — Each milestone (e.g., $2M → $5M → $10M) is marked with spin wheels, token airdrops, and token burns, ensuring continuous engagement and excitement.

Rewarding Social Engagement & New Holders — The project incentivizes users to spread the word on X (formerly Twitter) and Telegram, rewarding those who bring in new holders.

Consistent Buybacks & Supply Locks — The team ensures a stable price chart by conducting regular buybacks and has also relocked supply, reducing fears of rug pulls.

Strategic Partnerships & Marketing Pushes — COKE is actively collaborating with well-known crypto promoters and plans to launch aggressive marketing campaigns.

Meme Raids & X Spaces — The community frequently engages in meme-driven marketing through social media raids and X Spaces, keeping the brand in the spotlight.

Unique Lock & Reward Mechanism

One of the most innovative features of COKE is its token locking incentive. If a holder locks 100% of their tokens, they can send proof and receive an airdrop of 5% of their locked amount. This system not only encourages long-term holding but also strengthens trust within the ecosystem.

The Roadmap — Clear Vision for the Future

The COKE team has outlined a structured and transparent roadmap, focusing on:

Short-Term (Phases 1–3) — Aggressive marketing, token burns, and CEX listings.

Community Engagement — More rewards, social campaigns, and interactive features.

Expansion & Utility — New exchange listings and further strategic partnerships.

With a rapidly growing user base and a well-planned vision, COKE is not just another meme coin — it’s a movement. Backed by a dedicated team, strategic growth mechanics, and an engaged community, COKE has positioned itself as one of the most promising projects on Solana.

For more information, visit:

🔗 Website: OfficialCokeMeme.fun

🔗 Twitter/X: @Coke_On_Sol

🔗 Telegram: Join the Community

🔗 Chart: Dexscreener

2 notes

·

View notes

Text

Staking STON Tokens: How It Works and Why You Should Care

If you’re holding STON tokens, you’re probably asking: “How can I make the most out of them?” The answer is simple—staking. In this article, I’m going to break down exactly what staking is, how it works with STON tokens, and why it’s something you should seriously consider.

Let’s dive right in.

What is Staking

Staking is like putting your savings into a high-interest account. You lock your crypto in a smart contract, and in return, you earn rewards. It’s a way to actively participate in the network’s growth while also making your crypto work for you.

In a traditional savings account, your money is just sitting there, and the bank uses it to fund loans and other activities. With staking, your crypto is helping to support the blockchain network, ensuring it runs smoothly and securely. And as a thank-you, you earn rewards.

Why Should You Stake STON Tokens

Now that you get the basics of staking, let's talk about why it’s a good move to stake your STON tokens specifically. There are two major benefits you get when you stake with STON.fi that you won’t find everywhere.

1. ARKENSTON: Your Personal NFT Membership

When you stake your STON tokens, you get something special—a soulbound NFT called ARKENSTON. This NFT is permanently linked to your wallet, and it’s more than just a digital collectible.

ARKENSTON is your key to the STON.fi DAO (Decentralized Autonomous Organization). Think of it like an exclusive VIP pass that gives you a say in how the STON.fi platform evolves. It’s not transferable or sellable, which means it’s yours for life, and it gives you a unique position within the STON.fi community.

Being part of the DAO means you’ll have a voice in shaping the future of STON.fi. You’ll help make decisions about how the platform develops, and your input directly influences its direction.

2. GEMSTON: Earn Real Rewards

Along with ARKENSTON, staking your STON tokens rewards you with GEMSTON—a community token that has real value.

Here’s how GEMSTON benefits you:

You can trade GEMSTON on the STON.fi platform and other exchanges.

The token’s future will be decided by the STON.fi DAO, which means it has the potential to grow in value as the community develops it.

What makes GEMSTON stand out is its flexibility. It’s not just a placeholder token; it has genuine utility and is a valuable asset within the STON.fi ecosystem.

STON.fi even makes it easy to see exactly how much GEMSTON you’ll earn before you stake, thanks to the platform’s reward calculator. It’s as if you can predict your interest before depositing it into a bank.

How to Stake STON Tokens

Getting started with staking is straightforward, and you don’t need to be a crypto expert to do it. Here’s how:

1. Go to STON.fi: First, head over to the ‘Stake’ section on the platform.