#noteinvesting

Text

Selling defaulted mortgage notes

0 notes

Video

youtube

Note Investing w/ Guest: Jorie Aulston | Roughneck 2 Real Estate

1 note

·

View note

Text

Learning the latest from the best.

0 notes

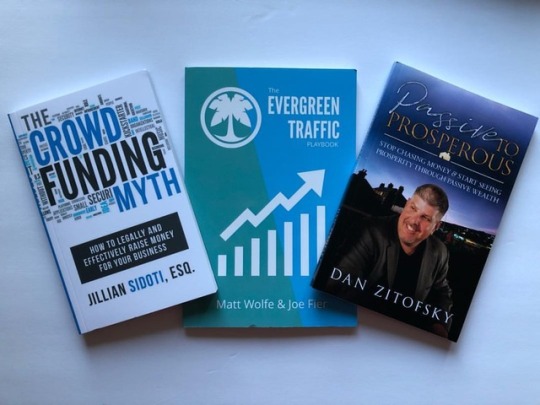

Photo

Some ‘light’ reading to start the year off. Latest Swag Bag. #wcncrew #swagbag #mattwolfe #joefier #notes #noteinvesting #danzitofsky #jilliansidoti https://www.instagram.com/p/BsY6DEZHKVBZkIc2Sx3Br4GitC0V83oJDfsSs00/?utm_source=ig_tumblr_share&igshid=1apujj0ciazrq

0 notes

Photo

Benefits To Being the Bank: An Introduction To Note Investing ✔✔✔#newblogpost ✔✔✔ Follow @gentrifanatic and Click the Link in the Bio for Wealth, Health, and Wellness #gentrifanatic #noteinvesting #noteinvestor #passiveincome #passiondriven #bethebank #bethebanknotthebanker #wealthbuilding #wealthcoach #wealthconsultant #miamifl #indianapolisindiana #wealthhealthwellness #baltimoremd #districtofcolumbia #hamptonroads #hamptonroadsrealestate #fallschurchva #norfolkva #denverco #slcutah #dallastexas #dfwtx #pensacolaflorida #virginiabeachva #fayettevillenc #montgomeryal #memphistn #nyc

#slcutah#hamptonroadsrealestate#dfwtx#denverco#passiveincome#noteinvestor#wealthhealthwellness#fallschurchva#nyc#bethebanknotthebanker#hamptonroads#fayettevillenc#virginiabeachva#gentrifanatic#newblogpost#wealthbuilding#districtofcolumbia#pensacolaflorida#memphistn#noteinvesting#wealthconsultant#passiondriven#dallastexas#indianapolisindiana#miamifl#montgomeryal#bethebank#wealthcoach#baltimoremd#norfolkva

0 notes

Text

Worried about the risk of holding a mortgage note? Here's how to mitigate your risk and earn a steady return on your investment.

0 notes

Text

Promissory Note Vurdering og værdiansættelse

Undgå IRA Investering faldgruber-gør det rigtigt

Definition: faldgruber plural of pit · fall (Noun)

En skjult eller usandsynlig fare eller vanskelighed.

Merriam-Webster

Promissory notes kan være et godt investeringsvalg til din selvstyrede IRA-konto, hvis du undgår faldgruberne og strukturerer dem rigtigt.

Styr risikoen

Du kan styre mængden af risiko, du tager ved omhyggeligt at lave din egen due diligence. Hvis en promille note investeringsmulighed virker for kompliceret, kan du afvise det; hvis en investeringsmulighed er i et ubehageligt kvarter, eller hvis det er for langt væk fra din egen placering, kan du afvise det; hvis du ikke er fortrolig med låntagerens karakter, kan du afvise det; Hvis du er ubehagelig med typen og / eller sikkerhedsstillelsen, kan du afvise det.

I det væsentlige kan du og dig alene bestemme, hvor meget risiko og hvilken risiko du skal acceptere.

Drage fordel af sammensætningen

Sammensætning indebærer geninvestering af indtjening over tid. Hvis din noteinvestering er i en udskudt skat eller en skattefri selvreguleret IRA-konto, beskattes den månedlige eller kvartalsvise renteindtægt, der indsamles, ikke, når den er modtaget. Derefter kan det geninvesteres igen for at tjene renter, og så bliver den nye renteindtægt ikke beskattet, og den kan geninvesteres igen – igen og igen.

For eksempel: En investering på $ 10.000, der tjener 5%, vil generere 500 dollar af renteindtægter i løbet af det første år, hvilket resulterer i en balance på $ 10.500. Forudsat at $ 500.00 geninvesteres til 5%, så i andet år beregnes renteindtægten på 5% på dette større antal – $ 10.500. Investeringen på $ 10.500,00 vil tjene $ 525 dollars og være værd $ 11.025 efter andet år. Som du kan se, er sammensætningen mest vellykket over tid; Jo længere renteindtægterne geninvesteres og forøges, desto større vil være den endelige værdi af investeringen.

Beskyt med diversificering

“Sæt ikke alle dine æg i en kurv” beskriver bedst den grundlæggende teori bag diversificering. Du må ikke investere alle dine selvstyrede IRA-konti i en enkelt pengeseddel. Du kan enten finde mindre noter til at investere i eller investere hos partnere, der kan sprede deres egen konto og din konto ved at tage dele af større pengesedler. At dele en stor note i portioner blandt flere investorer gavner alle. At have en velafbalanceret og diversificeret IRA-pengemarkedsportefølje antages af mange at være den vigtigste faktor i opnåelsen af langsigtede finansielle mål, da det begrænser den samlede risiko.

Visdomsord

I gårens vurderede værdi bør ikke forveksles med dagens markedsværdi.

I dag er din sikkerhedsstillelse kun værd, hvad den rent faktisk vil sælge til.

Dagens markedsværdi af din pengeseddel bestemmes primært af

markedsværdien af sikkerhedsstillelsen.

Ej ej mest, men det bedste.

from WordPress http://bit.ly/2K7sDuL

via IFTTT

0 notes

Link

0 notes

Photo

Fri-Sunday learning the latest on commercial real estate notes #1scottcarson #commercialnotecamp #lifeofanoteinvestor #real estate #paradiseproperties.net #money #business #invest #investments #sdira #cashflow #profits #fixnflip #privatemoney #investor #assets #realestate #investor #retirement #mortgagebanking #noteinvesting (at Huntington Beach, California) https://www.instagram.com/p/B0eYWwjlR9t/?igshid=1w8uijxcure49

#1scottcarson#commercialnotecamp#lifeofanoteinvestor#real#paradiseproperties#money#business#invest#investments#sdira#cashflow#profits#fixnflip#privatemoney#investor#assets#realestate#retirement#mortgagebanking#noteinvesting

0 notes

Text

Interested in the secondary mortgage market? Here's what you need to know about buying and selling mortgage notes on the secondary market.

0 notes

Text

Want to invest in mortgage notes but don't have a lot of cash?

Here's how to get started with little to no money down.

0 notes

Text

Looking to sell your mortgage note?

Let us help you get the best value for your investment.

0 notes

Text

Note Investing

Note investing refers to the process of buying and selling promissory notes, which are legal documents that outline the terms of a loan agreement. Note investors can either buy notes directly from the borrower or purchase them on the secondary market, where they are sold by banks, mortgage companies, and other lenders.

The goal of note investing is to earn a return on investment by collecting interest payments and eventually receiving the full amount of the loan principal. Note investors can also earn a profit by purchasing distressed notes at a discount and then working with the borrower to restructure the loan and get it back on track.

Note investing can provide a number of benefits for investors, including:

Passive income: Note investing can provide a passive income stream, as investors receive regular interest payments from the borrower.

Diversification: Investing in notes can provide diversification for an investment portfolio, as notes are not directly tied to the stock market or real estate values.

Control: Note investors have a greater degree of control over their investments, as they can negotiate the terms of the note with the borrower and have greater flexibility in managing the investment.

Potential for higher returns: Depending on the terms of the note and the creditworthiness of the borrower, note investing can provide higher returns than other investment options.

However, note investing also carries certain risks, such as the risk of default by the borrower, the risk of changes in interest rates, and the risk of changes in the value of the underlying collateral. It's important for note investors to carefully evaluate the risks and potential rewards before investing in a note.

0 notes

Text

The Benefits of Selling Your Property Privately: A Guide to Sell Private Mortgage

Selling a property can be a complex and time-consuming process, especially if you are looking to sell quickly or want to avoid the fees and commissions associated with traditional real estate agents. Enter Sell Private Mortgage, a platform that allows you to sell your property privately, quickly, and easily.

What is Sell Private Mortgage?

Sell Private Mortgage is an online platform that connects homeowners with a network of private lenders who are looking to purchase properties directly from the owners. This platform offers a simple and streamlined process for selling your property, without the need for a traditional real estate agent or the associated fees.

Benefits of Selling Your Property Privately with Sell Private Mortgage

Quick and Efficient: The Sell Private Mortgage process is quick and efficient, allowing you to sell your property in a matter of weeks, rather than months.

Avoid Commission Fees: By selling your property privately, you can avoid the commission fees associated with traditional real estate agents, which can be as high as 5-6% of the sale price.

No Repairs or Renovations Required: Sell Private Mortgage purchases properties in their current condition, so you don't have to worry about costly repairs or renovations before you sell.

Flexible Payment Options: Sell Private Mortgage offers flexible payment options, including lump sum payments or monthly instalments, to help meet your specific needs and financial goals.

Transparent Process: Sell Private Mortgage provides a transparent and straightforward process for selling your property, with clear and easy-to-understand terms and conditions.

How to Sell Your Property with Sell Private Mortgage

Submit Your Property Information: To get started, simply submit your property information, including the address, size, and estimated value, on the Sell Private Mortgage website.

Receive an Offer: Once your property information has been submitted, you will receive an offer from one of Sell Private Mortgage's private lenders within 24 hours.

Accept the Offer: If you are happy with the offer, simply accept it, and Sell Private Mortgage will handle the rest of the process, including closing and payment.

Conclusion

In conclusion, Sell Private Mortgage is a unique platform that offers homeowners a quick and efficient way to sell their property, without the need for a traditional real estate agent or the associated fees. Whether you are looking to sell quickly, avoid costly repairs and renovations, or simply want a transparent and straightforward process, Sell Private Mortgage has you covered.

By submitting your property information, receiving an offer, and accepting the offer, you can sell your property privately and efficiently, allowing you to achieve your financial goals and move on to your next adventure.

#sellprivatemortage#Sellmortgages#noteinvesting#mortgagenotes#passiveincome#debtportfoliosale#investing#realestatefinance#owner financing

0 notes

Text

Note Investing

To summarize, buying real estate notes is a common investment activity where a buyer acquires a legally binding document from a lender specifying the terms of repayment for a property purchase. It's important to know the homeowner and their key negotiating points to ensure a successful investment.

0 notes

Text

Are you looking to diversify your investment portfolio with a high-yielding asset?

Have you considered buying mortgage notes?

Mortgage notes are a type of investment that can offer steady income in the form of interest payments and the potential for capital gains if the underlying property appreciates.

But where can you find mortgage notes to buy?

One option is to work with a commercial note broker, who can help you find and evaluate mortgage notes that meet your investment criteria. Another option is to search for mortgage notes online, through platforms that specialize in connecting investors with note sellers.

It's important to do your due diligence when buying mortgage notes, including evaluating the creditworthiness of the borrower, the value of the collateral, and the terms of the note.

Take advantage of the opportunity to add mortgage notes to your investment portfolio! Start your search today and see the potential returns that this unique asset class can offer.

0 notes