#mortgagebanking

Text

How to Get Mortgage Pre-Approval in United Arab Emirates (U.A.E.)

Getting mortgage pre-approval is the first step towards realizing your homeownership goals.

Start your mortgage journey today & take the first step toward owning your dream home!

Read the article to know everything you need to know about getting mortgage pre-approval in U.A.E.

#mortgage#preapproval#UAE#homeownership#realestate#mortgageloans#financialplanning#homebuying#mortgagebrokers#property#homebuyers#mortgageadvisor#mortgagebanking#UAErealestate#homefinance#homeowners#UAEproperty#UAEfinance#UAEbanking#homebuyingtips#realestatetips#UAEhomebuying#homebuyingprocess#UAEpropertymarket#UAEhousingmarket#business#realtor#finance

1 note

·

View note

Text

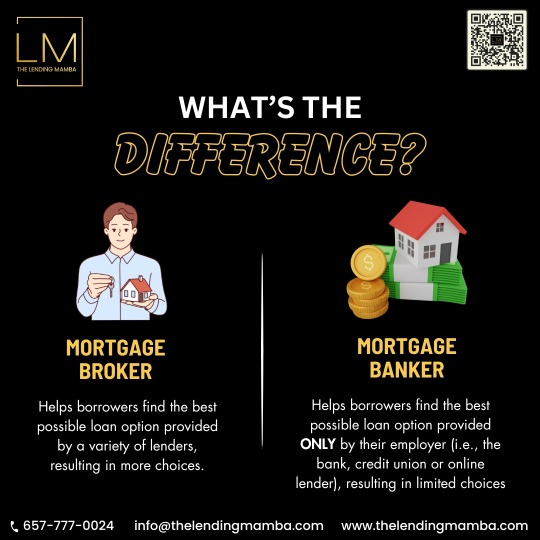

Understanding the Differences Between Mortgage Brokers and Mortgage Lenders

In the journey of securing a mortgage for your dream home, you'll inevitably encounter the terms "mortgage brokers" and "mortgage lenders." While both play crucial roles in the homebuying process, they serve distinct functions. Understanding the differences between them is essential for making informed decisions regarding your mortgage. Let's delve into the nuances of mortgage brokers and mortgage lenders.

Mortgage Brokers:

Middlemen in the Mortgage Market

Mortgage brokers act as intermediaries between borrowers and lenders. Their primary role is to connect prospective homebuyers with mortgage products that best suit their financial needs. Unlike lenders who directly provide loans, brokers work independently and collaborate with various lending institutions, including banks, credit unions, and private lenders.

Personalized Guidance

One of the key advantages of working with a mortgage broker is the personalized guidance they offer throughout the mortgage application process. Brokers assess your financial situation, including credit history, income, and debt, to match you with suitable loan options. Their expertise can be invaluable, especially for individuals with complex financial circumstances or those seeking specialized mortgage products.

Access to Multiple Lenders

Unlike traditional lenders who offer in-house loan products, mortgage brokers have access to a wide array of mortgage options from different lenders. This diversity allows brokers to offer borrowers competitive interest rates, terms, and conditions tailored to their specific needs. By shopping around on your behalf, brokers strive to secure the most favorable mortgage terms available in the market.

Fee Structure

While mortgage brokers provide valuable services, it's essential to understand their fee structure. Brokers typically earn commissions from lenders for originating loans. In some cases, they may also charge borrowers origination fees or application fees. However, these costs are often offset by the potential savings brokers can negotiate on your behalf.

Mortgage Lenders:

Direct Providers of Mortgage Loans

Mortgage lenders are financial institutions or entities that directly offer mortgage loans to borrowers. These may include banks, credit unions, mortgage companies, or online lenders. When you obtain a mortgage directly from a lender, you're entering into a contractual agreement with that specific institution.

In-House Mortgage Products

Unlike brokers who offer loans from multiple sources, mortgage lenders typically provide their own in-house mortgage products. These may include conventional mortgages, government-backed loans (such as FHA or VA loans), jumbo loans, or specialized programs tailored to the lender's target market.

Streamlined Process

Working directly with a mortgage lender can streamline the mortgage application and approval process. Since you're dealing with one entity, communication and documentation requirements may be more straightforward compared to working with a broker who interfaces with multiple lenders.

Personalized Customer Service

Mortgage lenders often prioritize customer service and may assign dedicated loan officers or mortgage specialists to guide you through the entire loan process. This personalized approach can be reassuring, especially for first-time homebuyers or those navigating complex financial situations.

Conclusion:

In summary, mortgage brokers and mortgage lenders each play distinct roles in the mortgage market. While brokers serve as intermediaries, connecting borrowers with a range of loan options from different lenders, mortgage lenders directly offer mortgage products and manage the loan process in-house. Both have their advantages, and the choice between them depends on your individual preferences, financial situation, and the level of guidance you seek. By understanding the differences between mortgage brokers and mortgage lenders, you can make informed decisions that align with your homeownership goals.

#MortgageBroker#HomeBuying#FinancialFreedom#mortgagebanker#mortgagelenders#homeownership#HomeownershipDreams#homeownershipgoals#MortgageinCalifornia#homeloan#propertytips#finance#personalfinance#realestate#mortgage#interestrates#loan#investment#home#house#homesweethome#homesforheroes#google#reviews#customerservice

0 notes

Text

Unlocking Homeownership: Solutions for Self-Employed Individuals

The dream of homeownership is not out of reach for the self-employed. At ReRx Mortgage, we understand the unique challenges faced by entrepreneurs and freelancers in securing home loans. Our bank statement loans are designed specifically for the self-employed, offering a flexible alternative to traditional mortgage requirements. In addition to our specialized mortgages, we also offer competitive FHA loan options and low mortgage rates to ensure that you find a loan that fits your financial situation. Whether you're a first-time buyer or looking to refinance, our team is dedicated to providing personalized solutions and expert guidance.

Discover how ReRx Mortgage can help you achieve your homeownership goals. Visit ReRx Mortgage today to learn more about our tailored loan options for the self-employed.

0 notes

Photo

Are you a loan officer sick of losing out on business? Tired of being trapped in the middle, never knowing what your competition is offer? There's a better way! BankerMatch.com has relationships with the top brokers, so you can get raw pricing information and take control of your business. With the fastest underwriting turn time and great support, you can win more deals and make more money. Sign-on bonuses and recoverable salaries are available for the right candidates. So don't wait any longer, click here to learn more and take control of your career! #loanofficer #bankermatch #loanofficers #mortgage #mortgagebankers https://www.instagram.com/p/Cow6nOyLWhV/?igshid=NGJjMDIxMWI=

0 notes

Text

Everyone wants his or her wealth to multiply with each passing day. So, Loans Paradise has come up to help you meet your financial needs and brings the best deals on loans against property. Now, get a loan and plan your investment wisely for a guaranteed return.

Visit: https://www.loansparadise.com/mortgage-loans

#mortgageloans#mortgagespecialist#mortgagebanker#mortgage loans#mortgage#loans#loan#easyloans#easy loans#quickloans#fastloans#fast approval loan#fastapproval#interestrates#lowrateloans#lowerinterest#lowinterestrates#loansparadise

0 notes

Link

Which is better for you?

www.1stChoiceBHL.com

0 notes

Text

The Financial Fortune That Comes With Owning a Home!

The past should teach us that buying a property is a great investment in your future financial stability. Part of being free is being able to put aside money so you can do the things you want to do in life, and the sooner you achieve this, the more likely you are to be able to do so.

Let's take a look at some of the ways that home ownership might lead to financial success:

Most homes increase in value over time.

There is no way to predict whether the value of your new home will rise, but the odds are in your favor. According to the Federal Housing Finance Agency's House Price Index, home prices have climbed by 3.6% on average during the last twenty-seven years. For example, if you invested $200,000 on a house in 1991, it could be worth around $350,000 now. This increase in value contributes to your equity, increasing your net worth even more than the principal you would have paid down had you kept up with your mortgage payments during that time.

Buying a home is a good method of pushing yourself to save money.

Experts say that the best way to be financially independent is to have a savings cushion, but most people don't do a good job of putting money away each month. Making a monthly mortgage payment could be a good way for a homeowner to save money every month. If you have a mortgage and make payments on the principal, you will increase your total value because the loan balance will go down.

Your mortgage payment can be fixed, but your rent can fluctuate.

Renters are at the mercy of the market, which typically results in annual increases. However, mortgage rates can be locked in at the beginning, guaranteeing a consistent monthly housing expense throughout the loan's duration. Because of this, you'll be able to reduce your outgoings and redirect more funds toward wealth-creating activities, such as saving, investing, or expanding your business.

The Bottom Line

Owning a home is a must if you wish to be independent financially. As a long-term investment, purchasing a home is among the most intelligent decisions you can make. Innovative Mortgage Tech wants to guide you throughout the process. Give Us A Call (281) 842-3842 to get started!

#mortgage#MortgageBroker#mortgages#mortgagebrokers#MortgageLoans#mortgagelife#mortgagelender#mortgagebanker#mortgagerates#mortgagepro#MortgageAgent#MortgageLady#mortgagelenders#mortgagebroking#mortgageexpert#mortgageloan#mortgageloanoriginator#mortgagefree#houston#houstontx#houstonastros#houstonstrong#houstonhair#houstonhairstylist#HoustonTexas#houstonblogger#houstonphotographer#houstonstylist#HoustonMua#HOUSTONROCKETS

1 note

·

View note

Photo

Hi There! Are you looking for flyer or social media post design? Kindly inbox me. #socialmediapost #neville #book #success #publish #motivation #guide #amazon #kindle #bestseller #global #speaker #education #coach #realestate #mortgage #mortgagebroker #mortgagebanker #realtor #broker #property #consultant #wealth #ceo #owner #flyer #graphicdesign #usa #canada #uk https://www.instagram.com/p/CingcS5vFtw/?igshid=NGJjMDIxMWI=

#socialmediapost#neville#book#success#publish#motivation#guide#amazon#kindle#bestseller#global#speaker#education#coach#realestate#mortgage#mortgagebroker#mortgagebanker#realtor#broker#property#consultant#wealth#ceo#owner#flyer#graphicdesign#usa#canada#uk

0 notes

Photo

Fri-Sunday learning the latest on commercial real estate notes #1scottcarson #commercialnotecamp #lifeofanoteinvestor #real estate #paradiseproperties.net #money #business #invest #investments #sdira #cashflow #profits #fixnflip #privatemoney #investor #assets #realestate #investor #retirement #mortgagebanking #noteinvesting (at Huntington Beach, California) https://www.instagram.com/p/B0eYWwjlR9t/?igshid=1w8uijxcure49

#1scottcarson#commercialnotecamp#lifeofanoteinvestor#real#paradiseproperties#money#business#invest#investments#sdira#cashflow#profits#fixnflip#privatemoney#investor#assets#realestate#retirement#mortgagebanking#noteinvesting

0 notes

Photo

CLOSED!!!! 3 months ago, The Villanueva’s inquired about First Time Home Buyer programs in CA. After preparing their approval, we connected them with one of our preferred Agents who get them into escrow after ONLY 2 weeks of searching 🤜🏼🤛🏼 @george.abrego Our clients DID NOT pay above appraised value & we were able to close sooner than expected, accommodating the sellers next move Who you work with matters 😏 @_integrityhomefinance -The Mike Berrios Team #firsttimehomebuyer #firsttimebuyers #homesweethome #homeowners #homeowner #californiarealestate #californiarealtor #californiarealtors #southerncaliforniarealestate #realestate #realestateagent #realtor #realestatetips #mortgage #mortgageloanofficer #mortgagebanker #mortgagetips #loanofficer #lancaster #lancasterca 2 weeks to get into escrow (at Lancaster, California) https://www.instagram.com/p/CSM1rB-nwUw/?utm_medium=tumblr

#firsttimehomebuyer#firsttimebuyers#homesweethome#homeowners#homeowner#californiarealestate#californiarealtor#californiarealtors#southerncaliforniarealestate#realestate#realestateagent#realtor#realestatetips#mortgage#mortgageloanofficer#mortgagebanker#mortgagetips#loanofficer#lancaster#lancasterca

1 note

·

View note

Text

Confused about Mortgages? Let's Clear the Air!

Looking for a mortgage solution? Here's why you should consider a Mortgage Broker over a Mortgage Banker:

Ready to secure your dream home? Let's chat! at 657-777-0024.

#MortgageBroker#HomeBuying#FinancialFreedom#mortgagebanker#mortgagelenders#homeownership#HomeownershipDreams#homeownershipgoals#MortgageinCalifornia#homeloan#propertytips#finance#personalfinance#realestate#mortgage#interestrates#loan#investment#home#house#homesweethome#homesforheroes#google#reviews#customerservice

0 notes

Photo

With the many guideline changes when purchasing and refinancing we're here to answer all of your questions. Give Our Team A Call (888) 931-9444 or (702) 696-9900 www.valleywestmortgage.com #guidelines #policies #purchasing #refinancing #questions #valleywestmortgage #creditscore #downpayment #mortgagelenders #mortgagebroker #mortgagebanker #lasvegas https://www.instagram.com/p/B-7o1-KDjbT/?igshid=lf2nofj273c7

#guidelines#policies#purchasing#refinancing#questions#valleywestmortgage#creditscore#downpayment#mortgagelenders#mortgagebroker#mortgagebanker#lasvegas

1 note

·

View note

Photo

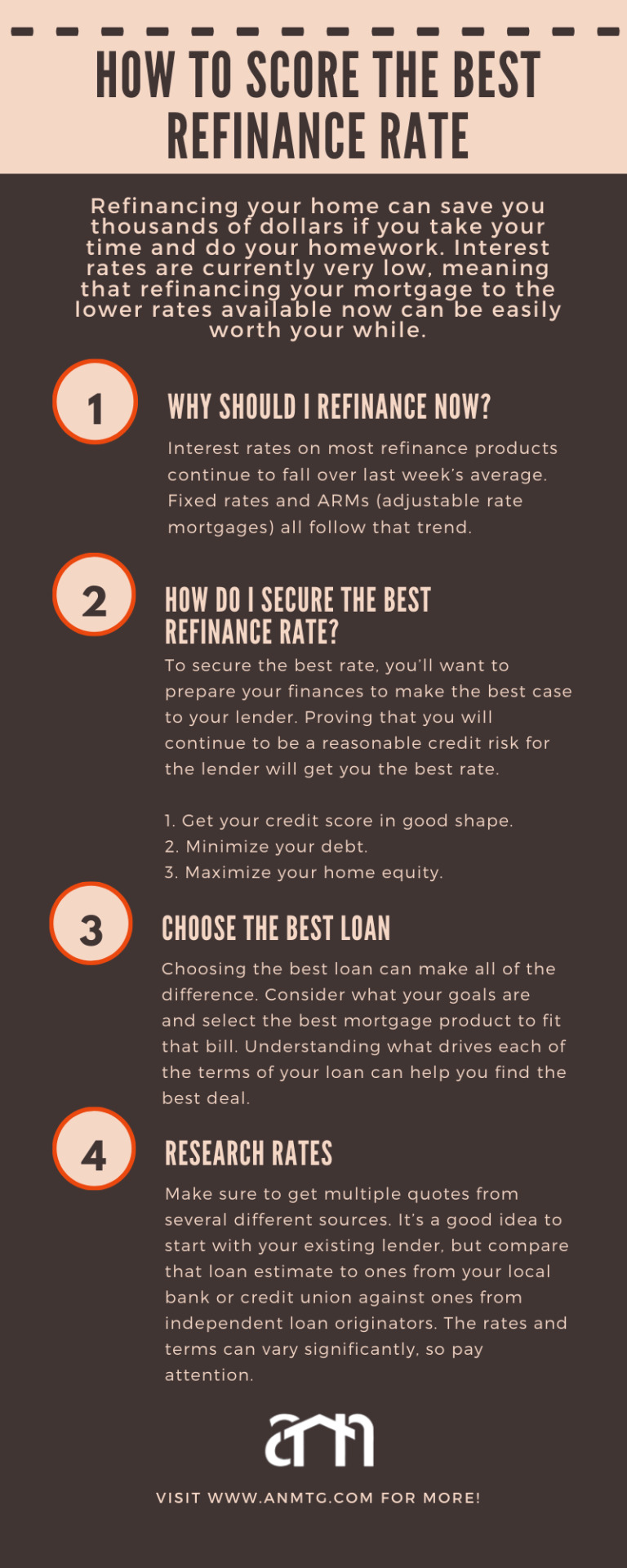

How To Score The Best Refinance Rate

Refinancing your home can save you thousands of dollars if you take your time and do your homework. Interest rates are currently very low, meaning that refinancing your mortgage to the lower rates available now can be easily worth your while. Read more how to score the best refinance rate.

1 note

·

View note

Photo

BankerMatch.com is a platform that helps loan officers and branch managers find the best mortgage company to meet their needs through AI technology and a team of experienced planners. By spending just 10 minutes on the site, users can find a company with higher compensation, better pricing, more support, and a sign-on bonus. Sign up today to take advantage of this valuable service. #mortgage #mortgagelending #mortgagebanker #loanofficer https://www.instagram.com/p/CnU3O9xvMyR/?igshid=NGJjMDIxMWI=

1 note

·

View note

Photo

First things first. Your specific monthly payment would be based on exactly how much you borrow to buy your $1 million property, as well as the interest rate and term for your loan. You'd have to take out a jumbo loan to buy a $1 million home. A jumbo loan exceeds the limits set by government-sponsored agencies, while regular, conforming loans do not. Jumbo loans can be harder to qualify for than conforming loans. And the jumbo mortgage rates are often higher. Plus, most jumbo lenders require at least a 20% down payment. So if you bought a $1 million home, you'd probably take out a mortgage for around $800,000 and put at least $200,000 down. It could take a long time to come up with such a large down payment. Let's assume you have your $200,000 down payment and you qualify for a jumbo loan for the remaining $800,000. You're ready to buy your million-dollar place. You'd need to get a personalized rate quote, as different borrowers qualify for different rates. But these examples can give you a good idea of what you'd end up paying per month. Don't forget, your mortgage principal and interest aren't the only payments you need to make. You'll have to pay taxes and insurance too. These can vary dramatically depending on where you live. Here are some approximate monthly payments for a 30 year amortization. . . . #mortgage #MortgageBroker #mortgages #mortgagebrokers #MortgageLoans #mortgagelife #mortgagelender #mortgagebanker #mortgagerates #mortgagepro #MortgageAgent #MortgageLady #mortgagelenders #mortgagebroking #mortgageexpert #mortgageloan #mortgageloanoriginator #mortgagefree #mortgagespecialist #mortgagetips #mortgageblog #mortgageadvisor #mortgagecompany #MortgageInsurance #MortgageLending #MortgageAlliance #mortgageconsultant #mortgagepayments #mortgageprofessional #mortgageadvice (at Burlington, Ontario) https://www.instagram.com/p/Cch_GLzPxnZ/?igshid=NGJjMDIxMWI=

#mortgage#mortgagebroker#mortgages#mortgagebrokers#mortgageloans#mortgagelife#mortgagelender#mortgagebanker#mortgagerates#mortgagepro#mortgageagent#mortgagelady#mortgagelenders#mortgagebroking#mortgageexpert#mortgageloan#mortgageloanoriginator#mortgagefree#mortgagespecialist#mortgagetips#mortgageblog#mortgageadvisor#mortgagecompany#mortgageinsurance#mortgagelending#mortgagealliance#mortgageconsultant#mortgagepayments#mortgageprofessional#mortgageadvice

0 notes

Link

When someone applies for a mortgage, they may not be aware of how many professions are involved in their application. Occasionally, different people with different jobs can deal with their applications. This includes mortgage bankers and loan officers. But what is the difference between- these two jobs? ContentsWhat is the Difference?Mortgage BankerLoan OfficerWhats the Difference?Qualities of a Good Mortgage BankerA good mortgage banker is willing to walk you through the entire mortgage processA good mortgage banker is replying to youA good mortgage banker is willing

0 notes