#payday loan leads

Text

Drive Business Success with Premium Auto Insurance Leads

In the competitive world of auto insurance, acquiring high-quality leads is crucial for sustained growth and success. Premium auto insurance leads offer a strategic advantage, providing businesses with targeted, motivated prospects. By investing in the best auto insurance leads, companies can optimize their marketing efforts, increase conversion rates, and ultimately boost revenue.

The Importance of Quality Auto Insurance Leads

Understanding the Value of Premium Leads

The auto insurance market is saturated with providers vying for customers' attention. To stand out, businesses need to focus on acquiring premium leads—prospects who are actively seeking auto insurance and are ready to make a purchase decision. These high-intent leads can significantly reduce the time and effort spent on cold calling and chasing uninterested prospects.

The Impact on Conversion Rates

Utilizing the Best Auto Insurance Leads ensures that your sales team spends their time and resources on prospects with a higher likelihood of conversion. This not only improves the efficiency of your sales process but also enhances the overall customer experience, leading to higher satisfaction rates and better retention.

Strategies to Acquire Premium Auto Insurance Leads

Leveraging Advanced Data Analytics

To acquire the best auto insurance leads, businesses must leverage advanced data analytics tools. These tools can analyze vast amounts of data to identify patterns and trends, helping you to target prospects more effectively. By understanding the demographics, behaviors, and preferences of your ideal customers, you can tailor your marketing strategies to attract high-quality leads.

Utilizing Multi-Channel Marketing

Diversifying your marketing efforts across multiple channels can increase your reach and visibility. Utilize digital marketing techniques such as search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and email campaigns. By maintaining a strong presence on various platforms, you can capture the attention of potential customers wherever they are.

Building Strategic Partnerships

Partnering with complementary businesses can also help in acquiring premium auto insurance leads. For instance, collaborating with car dealerships, repair shops, or financial advisors can provide access to a pool of potential customers who are already in need of auto insurance services. These partnerships can create a steady stream of high-quality leads.

Maximizing the Value of Your Leads

Implementing a Robust Lead Management System

To fully capitalize on the best auto insurance leads, it’s essential to have a robust lead management system in place. This system should track and manage leads throughout the sales funnel, ensuring that no opportunity is missed. Automated follow-ups, personalized communication, and detailed analytics can help in nurturing leads and converting them into loyal customers.

Training and Empowering Your Sales Team

A well-trained sales team is crucial for effectively handling premium auto insurance leads. Continuous training programs should focus on improving communication skills, product knowledge, and customer relationship management. Empower your team with the tools and resources they need to succeed, such as CRM software and sales automation tools.

Personalizing the Customer Experience

In today's market, personalization is key to winning over customers. Use the data collected from your leads to offer personalized solutions that meet their specific needs. Tailored quotes, customized policy options, and targeted marketing messages can enhance the customer experience and increase the likelihood of conversion.

Measuring Success and Adjusting Strategies

Analyzing Key Performance Indicators (KPIs)

Regularly analyze KPIs such as conversion rates, cost per lead, and customer acquisition costs to measure the success of your lead generation efforts. These metrics can provide valuable insights into the effectiveness of your strategies and highlight areas for improvement.

Adjusting Your Approach

The auto insurance market is dynamic, and consumer preferences can change rapidly. Stay agile by continuously reviewing and adjusting your lead generation strategies based on the latest market trends and customer feedback. This proactive approach ensures that you remain competitive and continue to attract the best auto insurance leads.

#Lead Generation for Health Insurance#Health Insurance Leads Generation#Ping Post Software#Health Insurance Leads#Lead Distribution Systems#Ping Post Lead#Ping and Post#Payday Loans Leads#Ping Tree System#Ping Tree Software#Ping Post Lead Distribution#Ping Post Lead Distribution Software#Lead Distribution System#Leads Distribution Software#Buy Health Insurance Lead#Leads For Payday Loan#Solar Industry Leads System#Best Auto Insurance Leads#Mortgage Loan Leads System#Workers Compensation Leads#Restaurants Lead Generation#Immigration Law Lead Generation#Estate Planning Lead Generation#Personal Injury Lead Generation#Buy Drug Injuries Lead#Social Security Disability Legal Leads#Family Law Lead Generation#Bankruptcy Leads for Attorneys

0 notes

Text

Thanks for the tag @theink-stainedfolk!

If I had to adopt one of my ocs...

I'd pick Ivander (as a child, obviously). I could save so much hassle by giving that man a better childhood. Surprisingly, having his mother/the only person he had an emotional bond with disappear without a trace at the tender age of eight had some negative consequences on his ability to make and keep close relationships. Also, the fact that his father wanted nothing to do with him, leading to him being tossed over for his twenty-year-old depressed uncle to raise, didn't help. I fully believe that if Ivander had been given a decent childhood with at least one loving parent, his entire story would've turned out differently.

(This is not to say Marius didn't try his best, but he was twenty, had just found out he was gay after being forced into an arranged marriage with a woman, and worked signing people onto unbreakable payday loan contracts. Neither him nor Ivander should've been in that position.)

Anyways, this has been an official Montane family hate post! I'll tag @kaylinalexanderbooks @seastarblue @rumeysawrites @writing-with-melon @writingamongther0ses and anyone else who wants to play :)

16 notes

·

View notes

Text

so, a couple of things:

this is very classic 'cyberpunk taking a real social ill to the extreme' kinda vibe to me in that it's basically a payday loan pawnshop where the thing you temporarily pawn to 'tide you over' is your own body, i've always thought. (and for context, such things as epidemic in the UK was having a media Moment arouuund the time this would have come out i think, so i wouldn't be surprised if it was a little bit on purpose tbh?)

the 'where it leads' thing is interesting because of course what happens, we later find out, is that the relinquishment clinics became assisted suicide facilities. but there's no obvious way to guess at that as a logical extreme endpoint, or to really connect the two even in the present day, imo? my little tinfoil hat theory has always been that 'the clinics are above Institute facilities' thing means that the later suicide clinics were actually known about and tolerated by the autobots as a source for body parts or something, which links them back a little better to the original 'body tourism' thing i think? anyway.

27 notes

·

View notes

Text

THINGS WE NEED TO GET OUT OF OUR ‘HOODS

The echoes of colonialism reverberate in the US, as the nation itself was built upon the colonisation of Indigenous lands and the enslavement of Africans. The lingering effects of these oppressive systems manifest in the form of social and economic disparities. Black communities, subjected to centuries of marginalisation, find themselves disproportionately burdened by extractive industries that exploit both their labour and natural resources.

As this TikToker points out, check-cashing centres and payday loan establishments disproportionately target Black communities, capitalising on financial vulnerabilities. The prevalence of fast-food chains such as McDonald's in African neighbourhoods, and limited access to healthier food options, leads to an over-reliance on junk food - contributing to health issues within our communities and reinforcing the cycle of systemic exploitation.

Liquor stores strategically placed in Black neighbourhoods contribute to a cycle of substance abuse and economic drain. The dominance of foreign-owned beauty supply stores in Black communities raises concerns about economic self-sufficiency and externally imposed standards of beauty.

These businesses, sometimes lacking local ownership and investment, extract profits from the community without necessarily reinvesting in its development. Understanding the connection between US imperialism, colonialism, and extractive practices in Black communities requires a nuanced look at these economic and environmental factors. Examining the tie between the five industries discussed in this clip is a great place to start!

17 notes

·

View notes

Text

On July 26, Russia’s Central Bank decided to raise the key interest rate from 16 to 18 percent. This decision was driven by unexpectedly high lending rates that previous regulatory measures had failed to curb. Russians are borrowing money and spending more, leading to a surge in prices. Inflation over the past year reached nine percent, far exceeding the government’s target of four percent. Meduza explains just how indebted Russians are and if this surge in lending is a serious issue for the authorities.

Why are Russians taking out loans?

According to Russia’s Central Bank, the volume of loans issued in the country has been steadily increasing since the spring of 2022. A few days after Russia launched its full-scale invasion of Ukraine, the bank raised its key rate to a prohibitive 20 percent, effectively halting all lending. However, it soon began bringing it back down. In April of that year, banks across the country issued loans totaling 859 billion rubles ($9.9 billion); by December, this figure had grown to two trillion ($23.1 billion).

In mid-2023, the Central Bank began raising the key rate again. Russians, realizing that loans were becoming more expensive, started applying for them sooner, causing overall loan volumes to jump to 2.4 trillion rubles ($27.8 billion) per month. This growth continued into 2024, driven by further government measures. Early this year, Russian authorities discussed curtailing preferential programs, primarily subsidized mortgages (a highly advantageous program for borrowers: while market rates were around 20 percent, the government offered loans at eight percent). Additionally, the Central Bank signaled a potential key rate increase. In response, Russians rushed to secure loans before rates increased. While the Central Bank has yet to release its official June report, analysts from Frank RG estimated that the volume of loans issued to individuals in that month increased by 13.74 percent (up 202.1 billion rubles, or $2.3 billion, compared to May 2024).

Another significant factor is income growth. Central Bank Head Elvira Nabiullina noted that people take out loans because “they’re confident in their future incomes” and feel they can “finance an improved life now.” According to Russia’s Federal State Statistics Service (Rosstat), real disposable incomes grew by more than five percent in 2023 and continued to grow in 2024. Independent analysts indirectly confirmed this, noting that consumer confidence indices are near historical highs.

The main driver of this income growth is the rapid increase in wages across many sectors of the Russian economy. As of April this year, nominal wages at large and medium-sized companies increased on average by 17 percent compared to April 2023, while real wages, adjusted for inflation, rose by 8.5 percent. Russian companies have to raise wages to attract employees as there’s a severe labor shortage in the job market.

Wages are growing fastest in industries fulfilling government defense orders. For example, in the production of “metal products” (as non-classified military goods are referred to in official statistics), wages increased by 24 percent in the span of a year. In the production of electronic products, which are also mainly supplied to the Russian army, wages rose by 28 percent.

As of May 2024, Russians owed banks more than 35.2 trillion rubles (over $408 billion). According to Meduza’s calculations, this represents an increase of nearly 22 percent in just one year. However, it’s not a record figure: in April, the amount owed was 36.6 trillion rubles ($423.6 billion). The payday loan segment grew even more rapidly, increasing by 28 percent in 2023, with Russians taking out 900 billion rubles ($10.4 billion) in loans. This growth continued into the first quarter of 2024, although the average loan amount remains around 10,000 rubles ($117).

Consumer lending has grown by 18 percent year-on-year, which economists attribute to the popularity of credit cards. Additionally, car loans have increased by 26 percent since the beginning of the year, which isn’t surprising given the record low availability of cars. Even pawnshops are showing positive trends: while there isn’t an increase in contracts, the average sum paid out gone up due to the rise in cost of precious metals.

As a result, the number of Russians with loans has reached 50 million. This is 40 percent of the country’s adult population. Over a quarter of these borrowers have more than three simultaneous loans, according to the Scoring Bureau credit history bureau. And that’s not the limit: 8.6 percent have taken out five or more loans, and the share of such debtors has doubled in two years.

One explanation is the popularity of mortgages. Eight out of 10 people with a mortgage also took out an additional loan, either for the down payment or for renovations. However, Scoring Bureau, attributes the increase to something else: the growing popularity of credit cards. In Russia, 27 million people have opened 91 million credit cards. Still, Central Bank representatives have expressed concern over the high level of indebtedness among Russians and mentioned “extreme cases,” including one person with 27 loans.

So Russians are saddled with debt?

Although more Russians are taking out loans, the average debt burden of the population — the share of household income spent on loan repayments — has remained relatively stable over the past few years. The Central Bank publishes data on this twice a year, and in the latest report from April, it noted that while the average debt burden has increased, it hovers around 11.2 percent. By comparison, in the first quarter of 2022, the average was even higher, peaking at 12.1 percent, and has since fluctuated within a two-percentage-point range. However, it’s important to note that this is an average, and some borrowers’ debt burden is significantly higher. Currently, 56 percent of borrowers in Russia have a debt burden of over 50 percent.

Another indicator of financial stability is the share of so-called bad debts — those with payments overdue by more than 90 days. In the consumer sector, this remains stable and doesn’t exceed eight percent, according to the Central Bank. According to a forecast from the ACRA rating agency, in 2024, the share of overdue debt in banks’ retail portfolios will not exceed three to four percent. The online lending service Moneyman calculated that Russians who take out payday loans actually repay their debts early in 43 percent of cases.

Frank RG analysts confirmed that the level of overdue debt and indebtedness indicators aren’t increasing. They pointed out that the ratio of the retail credit portfolio to GDP doesn’t exceed 30 percent, whereas in developed countries, the figure can reach up to 100 percent. Ivan Uklein, director of bank ratings at the Expert RA agency, believes that demographic factors alone may be driving the increase in the number of loans: in his opinion, Russia’s “boomer generation,” unaccustomed to living on credit, is starting to make way for bolder millennials

Of course, there are also skeptics. The Communist Party (KPRF) described the level of indebtedness as “catastrophic” and called for a credit amnesty for families with children. The Central Bank has identified problematic mortgage practices, with banks issuing loans to borrowers who already had a high debt burden. Kommersant reported that problematic credit card debt is at an all-time high in Russia, though the publication clarified that this growth is proportional to the increase in the number of credit cards issued. And RBC pointed to the slow but steady growth of debts involving bankrupt or deceased borrowers, where collection is impossible.

Indeed, personal bankruptcies have increased. The Center for Macroeconomic Analysis and Short-Term Forecasting predicts this trend will continue, as current rates prevent borrowers from taking out new loans to repay old ones. According to a survey by the Higher School of Economics, 70 percent of large families in Russia have loans, often can’t save money, and are sometimes forced to forgo essentials due to a lack of funds. The Federal Tax Service also reported issues, stating that 1.3 trillion rubles ($15 billion) in payments for 2023 were overdue.

Is the government worried?

The main risk lies with borrowers who have a high debt burden, those who spend 50 or even 80 percent of their salary on loan repayments. Elizaveta Danilova, the head of the Central Bank’s financial stability department, explained: “When the economy is doing well, [when] there’s work, and wages are rising, people with a high debt burden manage to cope. During crises, everything changes. We saw this during the pandemic. There were many requests for loan payment deferrals and those with the highest debt burdens and off-the-books incomes faced the greatest challenges.”

Last year, the Central Bank set limits on how much banks and payday loan organizations can lend to high-risk clients. Under the updated rules, that amount can be zero in some cases. As a result, the share of new contracts with high-risk borrowers fell to 14 percent in the first quarter of 2024, down from 36 percent in 2022. Additionally, banks must now inform such borrowers about potential risks and difficulties, even if they plan to take out less than 10,000 rubles ($117). For payday loans, the total cost of credit, including principle and interest, has been capped at 292 percent per annum.

The financial authorities claim that the current debt burden of Russians “looks acceptable.” The focus is on gradually slowing down lending: preferential mortgages ended on July 1, and market rates should deter borrowers. Developers have reported that demand for new apartments has already slowed by 14 to 30 percent. Egor Susin, the managing director at Gazprombank Private Banking, wrote that similar trends can be expected in other areas: construction plays an important role in business loans, and consumer loans were growing because people needed to cover down payments.

A survey conducted by Sravni showed that two-thirds of Russians have put off buying real estate due to the end of preferential programs. The United Credit Bureau noted a slowdown in car loans after a recent peak, which was also driven by government support measures. VTB Bank expects a decrease in demand for consumer loans, and Russian banks’ profits have been falling for the second month in a row. Meanwhile, the Russian State Duma is preparing for a possible crisis. Deputies have passed a bill that will safeguard a bankrupt individual’s only home from being seized, even if it’s mortgaged.

3 notes

·

View notes

Text

This day in history

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in BOSTON with Randall "XKCD" Munroe (Apr 11), then PROVIDENCE (Apr 12), and beyond!

#20yrsago Every copy of Reason customized with sat photos of subscribers’ homes https://web.archive.org/web/20100521071233/https://www.nytimes.com/2004/04/05/business/mediatalk-putting-40000-readers-one-by-one-on-a-cover.html

#15yrsago Congressman who’s giving payday loan companies legal 391% APR loans says he’s powerless to resist their lobbying https://consumerist.com/2009/04/05/house-preparing-to-legalize-payday-loans-with-391-aprs/

#5yrsago The New York Times’s chilling multimedia package on China’s use of “smart city” tech to create an open-air prison https://www.nytimes.com/interactive/2019/04/04/world/asia/xinjiang-china-surveillance-prison.html

#5yrsago Googler uprising leads to shut down of AI ethics committee that included the president of the Heritage Foundation https://www.vox.com/future-perfect/2019/4/4/18295933/google-cancels-ai-ethics-board

#5yrsago Most paint-spatters are valid perl programs https://docs.google.com/document/d/1ZGGNMfmfpWB-DzWS3Jr-YLcRNRjhp3FKS6v0KELxXK8/preview

#5yrsago The Internet Archive has recovered 500,000+ of the 50,000,000 songs Myspace “accidentally” deleted during a server migration https://www.techspot.com/news/79511-internet-archive-recovers-half-million-lost-myspace-songs.html

#5yrsago Ontario’s low-budget Trump-alike wants to eliminate sedation for people getting colonoscopies https://toronto.citynews.ca/2019/04/04/exclusive-changes-proposed-to-ohip-coverage/

#5yrsago Colorado’s net neutrality law will deny grant money to ISPs that engage in network discrimination https://coloradosun.com/2019/04/05/colorados-own-net-neutrality-bill-gets-some-teeth/

4 notes

·

View notes

Note

Please explain how to write out a personal ledger like I’m 5 (my budget is getting tighter and I always pay my bills before any other spending but I’m tired of passively spending and wondering where 50 bucks went at the end of the month)

OK

I have a five year old and if I explained this to you like you were five it would not be useful to you in your mid twenties

I do mine on the computer, I have a file in Microsoft Excel because I have Excel, but any spreadsheet program would work I'm sure, you could probably use Google sheets or whatever it’s called

warning: if you follow this method you will know how you spend your money

So what I do is this

I have a sheet set up as follows:

Column A is "Date," which is the date I spent the money

Column B is "Date Posted," which is the date the transaction actually clears my bank

Column C is "Amount," or the amount spent/moved/deposited. This will be a positive or negative number depending on whether you are adding or subtracting money from the account

Column D is "Category," which is very important for making this data useful for a budget. Categories will probably be subjective but the ones that I mainly use are:

Bill - this is for a regular monthly expense necessary to live, like car insurance, electricity, the mortgage, phone, etc.

Debt - this is for money I flush down the toilet. I used to have a separate category for "Medical Debt" but now it's all just Debt. Credit card payments and student loans. And medical debt.

Gas - when I buy gasoline it gets its own category

Groceries - as the name implies this is when I buy food from a grocery store, as distinct from:

Takeout - this is when I eat out, have delivery, fast food, etc., unhealthy sodium-saturated food prepared by someone else for immediate consumption

Misc - this is the useless category in which all other spending is absorbed, including my irresponsible purchases.

I also have the following categories:

Deposit - for when money goes in

Transfer - for when money is moved to or from another account

Withdrawal - for when I remove cash

Obviously you could have other categories for expenses you want to track more closely. Clothing might warrant its own category, or books, or snacks, which are sort of between takeout and groceries, or whatever.

Column E is "Location," which is where I spent the money. I usually try to write this how it appears on my ledger, which is not always where I remember physically spending it. For example, my wife's Old Navy card shows up as Barclay Card on the ledger, which has been the object of much confusion, leading to

Column F is "Notes," where I elaborate when Column E doesn't make very much sense. What is Barclay Card? Oh, the Old Navy card.

One place in which Columns E and F work together most regularly is on paydays, when E gives the name of the employer and F gives whose payday it is.

Column G just says "Balance," which I leave in cell G1 permanently, and then Column H / cell H1 is a running balance, which you can see above I let Excel calculate using a simple formula that takes the sum of all additions and subtractions in column C

Now, these features might be exclusive to Excel but I'm sure you could find equivalents in other spreadsheet programs. I have Row 1 / Top Row "Frozen" so that I can always see the column names and the balance as I scroll down. I also have columns A through F set to "filter," which is why they have the little drop-down arrow on the right-hand side, and this, as the name implies, lets me filter. So if you want to look at a specific category, or specific place, or something. I most often use this to filter out all but the current month in Column A, and to keep my transactions in the right chronological order.

Once its set up, and this is the painful part, you need to keep track of every single penny you spend. You can do this in the old-school way by keeping receipts or if you have online banking and they're pretty on top of things you can look at your bank ledger at the end of the day and add the day's transactions then. But if you let it sit more than a day or two you will have unpleasantness and it will only get worse the longer it sits. This is where having a Date and Date Posted column comes into play. There are some bills I have that take several days to post. My mortgage for example, which is my largest single bill, takes about four days to clear. My wife's student loans, the second largest bill, take about a week to go through. So I put those on my ledger the day I submit the payment and then they show up in the bank ledger a few days later and I note that as well. PayPal transactions also tend to take several days to go through. The other reason having a Date and a Date Posted column is nice is when you have to self-audit because there's a discrepancy between your balance and the bank’s, you can use the sort/filter function to sort your transactions by the date posted which makes it easier to compare your ledger to your bank.

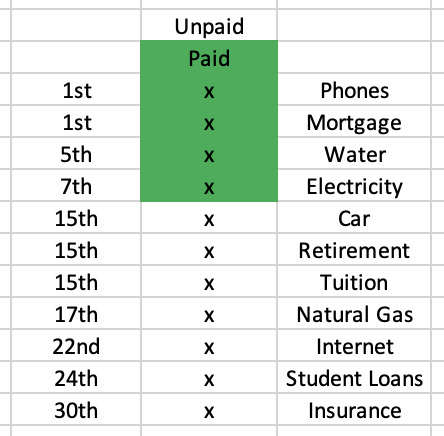

The other thing I do is I have a little portion of the spreadsheet off to the side where I keep all of my fixed bills and their due dates and keep track of when I pay them in a month. The Unpaid / Paid cells at the top are so I can copy and paste the format of those cells as the month goes on. As the months go on I have to cut and paste this to keep it close to the end of the ledger. You don't really need to have this but I do, it helps me decide which paycheck pays which bills and when every month.

The other thing is I have a different sheet for every year, because I don't want a spreadsheet with 10,000+ rows. You could have a different sheet for every month or whatever, I don't know. I did it by year.

If you keep on top of this you will know better than your bank how much money you have at all times.

30 notes

·

View notes

Note

for the ask meme: clovhous!! 🍀👻

Okay this is a admittedly hard one for me, I do like the ship in theory, they have things in common both being from rougher backgrounds who took to crime young and has been in some rough situations like being arrested or hunted by loan sharks. They're also both some of the few stealthy members of the Payday 2 gang.

But there is two issues, one I really don't know if they could get past the whole Hoxton vs Houston thing, Clover may be inclined to take Hoxton's side or her deciding to take Houston's instead could present some sort of weird and processive drama which I don't like near the Clover & Hoxton dynamic, in general it unfortunately leads itself to either portraying Hoxton as either a scorned love interest to Clover or a "disapproving father" to Clover, both just... Are not it for me.

And then second, I just haven't seen it done well yet, in general there isn't as much content for the woman members of the gang and what is out there is more for what I consider gameplay focused or casual fans which doesn't go as in depth with the characters as I enjoy.

So yeah I think I could enjoy it in theory but I haven't seen it in practice yet and I don't know if I'd be the one to write it in a interesting way.

2 notes

·

View notes

Text

youtube

Publisher Buyer Mapping Module | Ping Tree Systems | Lead Distribution Software

Publisher Buyer Mapping Module: Revolutionize Lead Distribution Software! Discover how the Publisher Buyer Mapping Module can transform your lead distribution process with cutting-edge Ping Tree Systems. Our comprehensive guide will walk you through the benefits, features, and implementation strategies that can significantly boost your revenue. Learn how to maximize your lead potential, streamline your operations, and achieve unmatched efficiency with this powerful software. Whether you're a publisher or a buyer, our expert insights will help you understand the full capabilities of the Publisher Buyer Mapping Module and how it can integrate seamlessly with your existing systems. Don't miss out on the opportunity to revolutionize your lead distribution strategy and stay ahead in the competitive market. Watch now and take the first step towards optimizing your business processes!

#business leads software#leads software#real estate leads software#customize lead distribution software#lead distribution software#sales leads software#leads for payday loan#payday loans leads#ping and post#youtube#Youtube

0 notes

Note

Just to stress again, the latter is my speculation and my gut instinct. I make that opinion based on my judgment of the character integrity of this group that operate within Sistah Space (it is very, very low).

However, as before the only true beneficiary in this instance is Sistah Space, not the domestic violence victims, not the service users, just the charity.

I strongly take a personal issue with the ethics on points like this, as I interpret this as the charity ultimately failing its charitable objective.

In reality, the charity operates as If it were a for-profit capitalistic obsessive business. It is the kind of behaviour and attitude that I would expect to see from the likes of a payday loan company, but certainly not a not-for-profit charity, under any circumstances.

Let's move onto grant number four. Rolling in with grant number four for £22'500, this was awarded on 27th April 2020, again from @London_cf (20 days after being awarded £4'300 for products).

This time, Sistah Space submitted a grant application stating that the funds were to be used to purchase x4 laptops, x4 mobile phones, and x1 administrative assistant (clearly a reference to a salary). The grant application also stated that this would allow the charity to operate a 24 hour service.

First things first, if at least half of this grant was used for a salaried assistant, then I'd be inclined to believe that the salary details in the financial report would need a closer look into.

I would also be incredibly interested to know if there is anyone at Sistah Space, outside of this family and the small key group, who have ever received any sort of Training that would lead to any sort of qualification at any level. I have read a lot about training for Djanomi (Ngozi's daughter) but nobody else.

Additionally, it would be interesting to discover whether this salaried assistant is a family member; nepotism is a noticeable Theme throughout every single aspect of this charity and its operations.

I also cannot help but notice from multimedia that very often members of the charity are plodding around with macbooks. For the avoidance of any doubt, to any person that may be unfamiliar with the Apple brand, it is a product that leans on the higher end scale in terms of price to value. For data entry and administrative tasks I wouldn't expect to see macbooks for a charity that supposedly struggles so much it submits an endless stream of applications for grants.

Also - and this is important - pay attention and remember that in this grant the charity stated in the application the laptops and mobile phones would allow it to operate a 24 hour service with an online presence, we will be reflecting back on this later, a number of times. Moving onto grant number five, which was for £9'800 from @TNLComFund and this was awarded on 22nd May 2020. In the application for this grant, Sistah Space stated that it would allow the charity to transition to an online service for victims of domestic violence.

Now the way This is worded would suggest that the charity does not have an online service prior to making this application. Perhaps the National Lottery Fund could have had more due diligence in vetting the information in the application, but if they were to trust it on face value then This cost is on the upper scale but it's not unreasonable *if* (big if) the transition to establishing an online presence and service was being done on a custom basis and from scratch. Now this is when we will be doing some hopping about, if you have been reading this from The very beginning (quick hello to you, because I've been sat for hours typing this lol), then you may recall earlier when we discussed the original Sistah Space website which is still accessible via Izabela Jelonek's github (as a reminder, if you google search 'sistah space github' then you will find it). Sistah Space already had an online presence, on a website with a customised code (I'll reflect on this point later too, so keep that in mind). It has had the website since at least 2016 if not earlier (as we can see from various notices on it)

So this grant for £9'800 has absolutely nothing to show for it. Not a single thing. So what I would very much like to know is what was this money used for.

Let's rewind back to the Trustee Annual Reports again for a moment, and within these reports there is typically a Statement of some sort to give a general idea of the charities future plans. Time and time again, this is dominated by the single subject of purchasing a London property. Sistah Space claims to have some money aside to purchase a property in London, after they spent even More effort once again harassing @hackneycouncil, with the assistance of @HackneyAbbott to lobby on their behalf, pushing for extremely favourable conditions that would be de facto exclusionary to every other domestic violence unit in the Hackney area.

My speculation is that Sistah Space has been ringfencing money from grants that have been awarded to the charity, on the grounds of purposefully misleading information to improve chances of securing more funding. I stress again that this is my speculation, based on what is available to my eyes but I very much suspect it is a very real possibility this is happening and the @ChtyCommission ought to be diving into the management and operations of Sistah Space to minimise, what in my opinion, is a recipe for disaster that will significantly damage confidence in both the Commission as the regulator, and confidence in charities in general with the public.

At this point I would also like to stress, in all the grants so far (remember we're doing them in chronological order on this thread), not once has there ever been mention of a property. Moving on to grant number six, and this is one that is highly relevant today. The sixth grant Sistah Space was awarded was for £32'948 on 11th August 2020. This grant was awarded by none other than our very own @DCMS, Department for Digital, Culture, Media and Sport. The purpose of this grant of course was to relieve pressure on public services (bless the NHS), and to ensure that charities and business has the financial resources to continue operating.

This grant in particular irks me up the wrong way, because it requires good faith on Part of the applicant that they are in genuine need of emergency funding to survive. Through a multitude of reasons and in light of the speed at which things were moving, we lost billions to fraud during the pandemic which we all, as taxpayers, have to make up the shortfall Now I am very much aware that this is not an isolated issue restricted to just one organisation, it was a widespread problem. However, I am reserving my right to treat them all with equal disdain and disgust; and I make no apology for that because this was committed by those Now I am very much aware that this is not an isolated issue restricted to just one organisation, it was a widespread problem.

However, I am reserving my right to treat them all with equal disdain and disgust; and I make no apology for that because this was committed by those A surplus (profit) that was larger than its liabilities (expenses). You would be forgiven for asking at this point why on earth Sistah Space was continuing to submit applications for grants:- I am asking the same question.

Some people may think that Sistah Space had a lot of Expenses to cover during the pandemic, but (for those that don't recall):

Sistah Space's premises was rent-free since December 2019; grants were provided for electronics, a new employee, food, hygiene products, skincare products, haircare products, etc.

So once again, I'm at A total loss as to what expenses this charity was supposedly having to deal with. Where did all this money go when so many freebies were provided?

Let's move onto grant number seven. This was for an award of £40'000 from Greater London Authority on 1st December 2020. This Grant does not have much information attached to it. Curiously, it is listed under a different name (Royal Dock) though the same charity registration number. I haven't fully explored this one yet, as it is an outlier, so I'm going to move on and not make any judgment here.

So, grant number eight. This time coming from @London_cf (yet again) for £12'000 awarded on 22nd December 2020. The application for this grant detailed how it would be used to purchase more essential products: food, hygiene products, skin care, hair care, etc.

Additionally Sistah Space stated that part of the grant would be used to cover the salary of another part-time domestic abuse advisor.

This will be the second time recruitment has been brought up in grant applications; as before, I am curious to know whether even just one of these Salaried positions is filled by anyone outside of the family or the key circle members. Still to this day the only advisors I have seen reference to other than Ngozi is Rosanne Lewis (of many names) and Djanomi (Ngozi's daughter, also of many names).

Next, we come onto my Personal favourite which I have been so annoyed by since I found out about it lol.

Grant number nine was awarded by @comicrelief (a charity that I very much like) and it was for the amount of a whopping £60'000 awarded on 8th September 2021.

This grant I am going to go into Quite a bit more detail because I want to demonstrate precisely how this was an utter and complete fraud and I hope that @ChtyCommission pays attention to this part if not anything else. I also hope that Comic Relief pay attention here, too.

Before I resume writing about This grant in particular, I need to bring up a lot of documents and tabs, because I will be tagging relevant persons due to the sizeable amount of money involved here. The details on this grant is so wild that I'm genuinely struggling where to even begin explaining it. Anyway, let's start with what the application to Comic Relief stated, as This application is one that we can see the submission by Sistah Space.

Sistah Space made a number of claims, and it splits into three areas:

(1) the charity claimed that its core user group is in the 40-86 age range and that part of the grant would be used to teach the To teach the people of an older age how to navigate around the internet, make use of online banking, etc.

(2) the charity claimed to Comic Relief that if it was awarded the grant for the sum of £60'000 then this would increase the outreach of Sistah Space by at least 60% However there is no citation to support such a claim; there are no details of any study commissioned by Sistah Space that even touched on the subject. Remember, Sistah Space utilises Survey Monkey (the free version) to conduct all its research thus far, and all of these are Still available online as you are reading this tweet. You can even complete the survey and submit your results, as they are all still live (despite being claimed on the website it ceased in 2020/2021).

I have looked long and hard for any evidence or even a mention of a study That focuses on outreach potential; at this point I am confident enough to state that it does not exist. I am also confident to state that this is a random number plucked out of thin air, as there is precedent for this to happen elsewhere. At the start of this thread I Explained how @CarolinePidgeon made the claim in the @LondonAssembly that Sistah Space saw a 300% increase in service demand. I also earlier wrote that this figure is present in a Trustee Annual Return.

During a @hackneycouncil virtual meeting on 27th January 2021, Ngozi Fulani attended this meeting and stated that Sistah Space has seen a 500% increase in service demand (that would mean a 200% jump in a single month).

Elsewhere in the Trustee Annual Reports, Sistah Space stated that its staff members halved and it's workload doubled. Given That Sistah Space has thus far opted to talk in percentiles, I shall translate: Sistah Space claimed that service demand increased 200%, and staff availability decreased 50%.

We have very different figures - 500%, 300%, 200% - all referencing service demand around the same Period, and coincidentally and strangely, they always seem to round off to perfectly whole figures. For that to happen on all three occasions, since we're on the topic of statistics, is nigh impossible.

But for a moment let's roll with it. Let's pretend that these figures Are correct and let's take the middle ground of 325%.

If you recall to earlier in this thread, I made a point on referencing the staggering increase in admin costs, which was a year on year increase of 4703% (note how I didn't land on a perfectly whole number lol).

Even if The service demand increase figures were true (to be clear, they are not but let's pretend so otherwise), then it would still not correlate anywhere near a 4703% increase in admin expenses.

Furthermore, Sistah Space expressly stated that they had to suspend taking on new Cases and only work with the existing cases. That is put on record by Sistah Space to the @ChtyCommission and I am glad that I clocked it.

If the charity was not taking on new cases, in what world is it possible for service demand to increase and expenses to soar?

The issue With lies and dirty accounts, is that if you're going to attempt to try and pull it off, you have to have every single last detail and digit absolutely pristine otherwise it all falls in on itself. That is what is happening here, unfortunately.

Now let's move onto the Third point.

(3) Sistah Space has put a high price tag on the cost of a new website. Once again, the application is written to imply that a website is not suitable, but I will come onto this in a moment because this is an area I am in a position to understand well.

Now before I go further here, I want to explain that I have previously reached out to a very small number of people that were involved, in some way or another, in anything Sistah Space could reasonably claim an expense on. This includes the new Sistah Space website which is Currently live right now.

On the footer on this website, you will see that it is credited to the work of a business called Lex Designs London Ltd. My understanding is that this is a sole director limited company, and I spent some time watching some of her social media videos Where she showed herself working on the PC and the applications. The reason I watched them is because I am extremely familiar with a lot of the Adobe Creative Commons apps.

I sent a private message to @AlexElissaaa over instagram, briefly explaining why I was contacting And presenting the question if her business was commissioned to the tune of £60'000 or around that figure to build a website.

I explained to Alexandra that the reason I was asking was to source more information for a better understanding, and the business that put its name Against the work seemed like a sensible route to take.

Alexandra declined to comment, which is fine as it doesn't necessarily alter the detail I will go into next. In the world of website creation, for a custom built website with some fancy features to a personalised Specification, you're probably talking upwards of around £4'000 depending on the complexity of the work involved and amount of code required.

However Alexandra is a graphic artist - from what I have seen she is at an amateur level of digital art (I'm making that opinion on The basis of professional work). In videos Alexandra has posted, I can see that she uses AI (adobe illustrator) and PS (adobe photoshop). Both very common run of the mill applications for any graphic designer, as expected.

However, her knowledge is somewhat limited as she Relies on licenced templates. The idea is that you purchase the licence, you then download the template, open it up in the application and all the layers are pre-set where you can then edit the graphic to suit your need. There's nothing wrong with this, but it is typically A method employed by those who are at an amateur level which is rather common in those that are self-taught. (props for being self-taught in the first place though - I wanted to say something positive because it feels like I'm being negative when that's not the point).

Anyway, so we've established that Alexandra can tamper with graphic design to a satisfactory level, but I would not regard it at a high end professional level (keep going Alexandra, you'll eventually get there). However, Alexandra is most certainly not a coder. That I can Outright demonstrate by pointing any one of you in the direction of pulling up the page source code on the Sistah Space website, and you will see the assets (multimedia files, pictures, etc) are all stored on Square Space servers.

What is Square Space? Well, if you've seen TV adverts for 'Wix' where it shows you how you can easily build your own website utilising the *extremely* beginner-friendly templates, then Square Space is in effect the same thing. Similar to that of Wordpress templates, it is website creation for those with zero coding Experience or knowledge.

I just want to reiterate that there's not actually anything wrong with these platforms, they are fantastic options for those who are not positioned to write their own code, but hell will freeze over before anyone sells a Square Space website for £60k More so, just to reiterate my point, Lex Designs London's own website is built on the Wix platform.

If you are a website creator/coder however you fashion it, your website, particularly your landing page, is by far your biggest sales tool. It is your chance to brag with With every trick you know. Getting the right colour palette, balance of text and infographics, user interface, UX, platform responsiveness (mobile, laptop, tablet, etc). So much goes into that advertisement in of itself.

I can categorically tell you, nobody pitching custom Built websites would be seen alive with a freebie template. It just doesn't happen.😂

Now there is a cost for Square Space, for the hosting, however you can navigate to Square Space's website and see the prices for yourself. It is very cheap and very reasonable, especially If you are utilising a package that comes with e-commerce solutions (online payments) as that saves you the trouble of having to set up an account with a merchant bank and payment processing company, so on so forth.

Sistah Space's new website is in fact actually a technical Downgrade on what they had originally.

Though I will secede, that the new website is more aesthetically pleasing. But on technical input, the original website wins hands down. To put this into perspective, you could go onto Fiverr and easily find anyone who would do the The exact same job for $5. It is super quick, super easy, does not take a lot of time at all and that's why people price it so cheaply because it is easy money. Consequentially, it is also why so many offer template installation services.

So I'm rewinding back a little to This grant for £60'000.

Where did this money go and what has it been used for?

To get an answer to that question, we would really need the @ChtyCommission to do what any responsible regulator would do and investigate it.

I would have liked to been able to trust Sistah Space However, with all that I have chosen to share thus far, I believe I've explained in a concise and clear manner (as far as I reasonably could) why that option is untenable.

I also want to take a moment to express that I am not in favour of hurling abuse at anyone. I started My investigation into Sistah Space as a stranger, and I intend to complete it as a stranger.

BUT there is one thing I would *greatly* appreciate, is if you would take a moment to report concerns to the @ChtyCommission, because these concerns are valid and need addressed.

- JustPikachoo on Twitter

This may be the longest ask I have ever received.

Based on what I have seen so far, it's a matter for the charity commission to investigate.

26 notes

·

View notes

Text

Short Term Loans UK Direct Lender the Trump Card That Meets Your Needs

You keep failing to get a loan to pay off debts before your next payday. In that scenario, it is advised that you apply for short term loans UK direct lender. You can obtain funds in modest sums, such as £100 to £1000, with a flexible 14- to 31-day payback time. After taking out this loan, you can make the different payments stated below:

Child’s education or tuition,

Payments with credit cards,

Light or phone bills, health care costs, and even other essential payments

You must adhere to a few simple terms and conditions in order to pledge collateral against the lender. You can now easily and stress-free take advantage of short term loans UK direct lender. These include being a permanent resident of the United Kingdom, being at least eighteen years old, working a permanent job for the past twelve months, and having an open checking account.

You must complete a brief online application and submit it online with all necessary details, including your name, address, bank account information, email address, and other details, in order for your money to be approved quickly. On the same day that your submission is made, the money is securely put into your bank account following information verification.

Why am I unable to obtain a UK short term loans?

This could be for a few reasons.

The first and most crucial factor is affordability. You will provide information about your income source, amount, and average monthly expenses when filling out a form. For your personal interest, it is crucial that you tell the truth about these specifics. Direct lenders may run checks to confirm that you have a steady source of income. They will reject your request if they are unable to verify your income or if it is not consistent. They must be certain that you can pay back the short term loans UK. The quantity of existing credit obligations you have is another important factor in determining your affordability. You are probably going to be turned down if you already have a number of short term loans UK direct lender that you are repaying. Lenders don't want to take advantage of you and increase your already substantial debt.

You may already be aware of the other factor, which is your credit record and score. The score alone doesn't really matter, but you might not be approved if you have recent missed payments or defaulted credit history on your record, or if you are enrolled in any debt management programs (like IVAs). These could be interpreted by lenders as an indication that you will probably struggle to repay your short term cash loans to them on time, leading them to deny your request.

You must first complete an online application. This is done in a matter of minutes. Your personal information, address, proof of income, monthly spending information, and bank account information (where you want the loan deposited to) will all need to be provided.

After submitting your application through a broker like Classic Quid, you will be contacted by a lender and directed to their website to complete it. The short term loans direct lenders agreement, which includes information about your loan amount, repayment schedule, installment amounts, and due dates, must be read. If you're pleased with the offer, you confirm the request. The bank account you designated will receive the balance of your loan. This can occur in a matter of minutes, contingent upon your lender and bank.

https://classicquid.co.uk/

4 notes

·

View notes

Text

The Ultimate Guide to Navigating Payday Loans in Canada Like a Pro

Payday loans have become a common financial tool for many Canadians, providing a way to access quick cash when needed. However, understanding how to navigate payday loans like a pro is essential to avoid pitfalls and make the most of this financial option. In this comprehensive guide, we'll walk you through everything you need to know about payday loans in Canada.

What Are Payday Loans?

Before delving into the nuances of payday loans, it's essential to understand what they are. A payday loan is a short-term, small-dollar loan designed to provide immediate funds to borrowers who are facing unexpected expenses or financial emergencies. These loans typically need to be repaid on the borrower's next payday.

The Pros of Payday Loans

Payday loans can offer several advantages, making them an attractive option for many Canadians:

1. Quick Access to Funds

One of the primary benefits of payday loans is the speed at which you can access the funds. In many cases, you can apply for a payday loan online or in person and receive the money within hours.

2. No Credit Check

Payday lenders often do not perform a traditional credit check, making payday loans accessible to individuals with poor credit or no credit history.

3. Simple Application Process

The application process for payday loans is straightforward and typically requires minimal documentation. This simplicity is especially helpful during financial emergencies.

4. No Collateral Required

Unlike some other types of loans, payday loans do not require collateral. You won't need to risk your assets to secure the funds.

The Cons of Payday Loans

While payday loans have their advantages, they also come with some disadvantages to consider:

1. High Interest Rates

Payday loans are associated with high interest rates and fees. The annual percentage rate (APR) for payday loans in Canada can be extremely high, making them an expensive form of borrowing.

2. Short Repayment Terms

Payday loans typically have very short repayment terms, often requiring full repayment within two weeks. This can lead to financial strain for some borrowers.

3. Risk of Debt Cycle

Due to the high cost and short repayment terms, some borrowers may find themselves trapped in a cycle of borrowing to repay previous loans, leading to a debt spiral.

How to Navigate Payday Loans Like a Pro

Now that you understand the pros and cons of payday loans, here's how to navigate them like a pro:

1. Assess Your Needs

Before applying for a payday loan, carefully assess your financial needs. Ensure that taking out a payday loan is the best solution for your situation.

2. Borrow Responsibly

Only borrow what you can comfortably repay on your next payday. Avoid the temptation to borrow more than you need, as this can lead to financial difficulties.

3. Compare Lenders

Shop around and compare different payday lenders. Look for lenders with transparent terms and reasonable fees. Read online reviews and ask for recommendations if necessary.

4. Understand the Terms

Thoroughly read and understand the terms and conditions of the loan agreement. Pay attention to interest rates, fees, and the repayment schedule.

5. Have a Repayment Plan

Before taking out a payday loan, have a clear plan for repaying it. Make sure you'll have the necessary funds available when the loan comes due.

6. Seek Financial Counseling

If you find yourself repeatedly relying on payday loans, consider seeking financial counseling or advice. A financial counselor can help you create a budget and explore other financial options.

In Conclusion

Payday loans can be a valuable resource during financial emergencies, but they come with risks. Navigating payday loans like a pro means understanding their advantages and disadvantages, borrowing responsibly, and having a clear repayment plan. By following these guidelines, you can make informed decisions regarding payday loans and avoid the potential pitfalls associated with this form of borrowing.

2 notes

·

View notes

Text

Brief Term Loans Leading Cash Assistance from Direct Lenders

Have you already spent all of your time completing the loan paperwork in order to obtain the money in the UK? Do not fret! It is recommended that you apply for short term loans UK here. The ideal way to handle a variety of financial necessities, like paying for groceries, utilities, medical expenses, kid tuition, school fees, auto repairs, and so on, is to avoid using debit cards.

Despite your bad credit history, you can always obtain cash support with short term loans direct lenders. Many lenders are willing to give you the money without requiring credit verification. You therefore have unfavorable credit factors, such as bankruptcy, insolvency, foreclosure, arrears, late payments, CCJs, and so on.

There are short term loans UK that range in size from £100 to £2,500. The incredible thing is that you may take advantage of the loan mentioned here without having to worry about having to pledge assets as security. This makes it possible for tenants and non-homeowners alike to benefit greatly from the loan. With this money in your possession, you can promptly and simply handle unforeseen expenses. This must be returned within two to four weeks.

Remember that you must meet certain requirements, like being at least eighteen years old, a resident of the United Kingdom, working a regular job that pays at least £1000, and having an open bank account. You can apply for a short term loans UK as soon as feasible, 24/7. To get your application verified, you must fill out the online form and submit it. On the day of application, the loan is approved and deposited into your account.

Possible Right Away Same Day Loans UK Benefits

A same day loans UK, in contrast to other loan kinds, gives you the flexibility to select flexible repayment terms in addition to giving you access to the money you need quickly. We provide new clients up to 8 months to return their loans, and we extend this period to 12 months for those who have previously borrowed money and paid it back in full. This way, you don't have to settle your loan in full on your next payday. You can select a loan period that is sustainable for you thanks to this flexibility.

The other advantage is that you can get the money fast. Some lenders might make you wait many hours or even days before deciding and transferring the money. A short term loans UK direct lender aims to complete all of this within the same day, as fast as feasible, and in accordance with responsible lending criteria. You will still be subject to a credit check and have your affordability evaluated. This means that a same day loan could be approved and deposited into your bank account minutes after you sign your agreement.

Apply online at Payday Quid to quickly receive a same day loans direct lenders. We can assist you with our easy application if you require a loan immediately to pay for an emergency or unforeseen expense, regardless of your credit history.

4 notes

·

View notes

Text

Helsinki Mayor Juhana Vartiainen (NCP) told Helsingin Sanomat (siirryt toiseen palveluun) that Helsinki—like other parts of Finland—is home to too few working age people in relation to general "welfare promises" made.

Boosting productivity among city workers is one way to stretch funds, according to Vartiainen, who told HS that he favoured a performance pay system.

The mayor also suggested the city should also stop producing its own school and hospital meals, outsourcing the food instead.

"It's generally acknowledged that the motive to turn a profit in a privately-owned business raises productivity," he told the paper.

Borrowing power

Business daily Kauppalehti (siirryt toiseen palveluun) reports that the value of energy imports in Finland grew by 141 percent during the first half of this year. Statistics Finland's data indicates that energy imports between January and June were valued at 9.1 billion euros, representing a 141 percent increase over the same period last year.

More than half of Finns meanwhile say they worry about the rising price of electricity. That said, many people, particularly those living in electrically heated homes, are adjusting their habits ahead of winter.

Riina and Uffe, who live in an electrically heated home in Espoo, told Hufvudstadsbladet (siirryt toiseen palveluun) that they've made several changes to keep electricity costs down.

The couple said they run their dishwasher at 10pm and recently installed a geothermal heat pump. Their row-house co-op is also adding more roof insulation to all of its units to prevent heat from escaping.

The leading daily Helsingin Sanomat (HS (siirryt toiseen palveluun)) meanwhile talked to Juha Koskinen, a retiree, living in a 110m2 house in Lieto, near Turku, who said that just the price increase in his electricity bill exceeded his pension.

While Koskinen's solar panels cover around half of his home's electricity needs, he said solar output diminishes as summer turns to autumn, dropping to zero by November.

Koskinen said he may have to seek a consumer loan to cover his electricity bills.

"It's very likely I'll need to go to the bank and ask for a loan. At least I'm in a good position in the sense that I have enough collateral to get a loan. There's also people who will have to resort to payday loans," he said.

3 notes

·

View notes

Text

Payday Loan Scenarios: What Halifax Residents Should Avoid

Payday loans can be tempting for those in financial distress,debts consolidation in newfoudnland especially when unexpected expenses arise. However, Halifax residents should be aware of the potential pitfalls associated with these loans. Understanding common scenarios can help individuals make informed decisions and avoid falling into debt traps.

1. Rollover Loans

One of the most common scenarios to avoid is the rollover loan. When borrowers cannot repay their payday loan on the due date, they might be offered the option to roll over the loan into a new one, often with added fees and interest. This can lead to a cycle of debt that becomes increasingly difficult to escape.

Tip: Always plan to repay your loan on time or seek alternatives if you anticipate difficulty.

2. Multiple Loans from Different Lenders

Some residents may think they can manage multiple payday loans from different lenders simultaneously. This often leads to overwhelming debt, as individuals struggle to keep track of various repayment schedules and interest rates.

Tip: Limit your borrowing to one loan at a time and consider consolidating any existing debts before taking on new loans.

3. High-Pressure Sales Tactics

Be wary of lenders who use high-pressure sales tactics. If a lender is pushing you to take out a loan quickly without allowing you to read the terms or consider your options, it’s a red flag. Responsible lenders will provide clear information and give you time to make a decision.

Tip: Take your time to review loan terms and conditions before signing any agreements.

4. Hidden Fees and Charges

Many payday lenders advertise low-interest rates but fail to disclose hidden fees that can dramatically increase the total cost of borrowing. Halifax residents should always ask about any additional charges that may apply.

Tip: Read the fine print and ask for a full breakdown of all potential costs before proceeding.

5. Ignoring Alternative Options

In times of financial need, residents might overlook alternative options such as credit unions, community assistance programs, or personal loans from banks. These alternatives often come with lower interest rates and more favorable repayment terms.

Tip: Explore all options available to you, including speaking with a financial advisor or community organization for assistance.

6. Loan Amounts Exceeding Your Repayment Ability

Taking out a loan that exceeds your ability to repay it can lead to a cycle of borrowing and increased debt. It’s crucial to assess your financial situation realistically.

Tip: Only borrow what you can afford to repay within the loan term, considering your other financial obligations.

While payday loans may seem like a quick fix for financial issues, Halifax residents should approach them with caution. By avoiding these common pitfalls, individuals can protect themselves from falling into a cycle of debt. Always consider alternatives and emergency loan in british columbia make informed decisions to secure your financial well-being.

0 notes

Text

CashWalle: The Leading Loan Provider in Delhi

When it comes to finding a reliable loan provider in Delhi, CashWalle stands out as a top choice for many residents. Known for its customer-centric approach and comprehensive loan solutions, CashWalle has made a name for itself in the bustling financial landscape of the city.

Why Choose CashWalle?

CashWalle is not just any loan provider in Delhi; it’s a trusted partner that understands the diverse needs of its clients. Whether you're looking for a personal loan or any other type of financing, CashWalle offers tailored solutions designed to meet your specific requirements.

Speed and Convenience: CashWalle understands that when you need payday loans, time is of the essence. Their streamlined application process ensures that you can apply for a loan quickly and receive approval in record time. This efficiency helps you get the cash you need without unnecessary delays.

Quick and Easy Process: One of the standout features of CashWalle is their streamlined loan application process. Unlike traditional banks, CashWalle simplifies the application procedure, making it faster and more convenient for you. With minimal paperwork and quick approval times, accessing the funds you need has never been easier.

Customer Support: CashWalle prides itself on offering exceptional customer service. The team of specialists is always ready to help with any inquiries or problems you may have. As a leading loan provider in Delhi, they emphasize clear communication and transparency throughout the loan process.

Competitive Rates: CashWalle understands that cost is a crucial factor when choosing a loan provider. They offer competitive interest rates and flexible repayment options, ensuring that you get the best value.

How to Get Started

Getting a loan from CashWalle is simple. You can start by visiting their website or making contact with their office. Their team will guide you through the process, helping you understand your options and choose the best loan for your situation.

Characteristics of Loan

Quick Access: Borrowers can often receive funds within a few hours or on the same day.

Small Amounts: Loans can range from Rs 10,000 to Rs 1,00,000. It depends on the lender.

High Interest Rates: As they are short-term, they often come with higher-than-average interest rates, which is a key factor to consider.

Benefits of Loan Provider in Delhi

Loans in India provide several advantages for individuals needing urgent financial assistance:

Speed and Convenience: The application process is usually straightforward; many providers allow you to apply online.

No Collateral Required: Most loans are unsecured, meaning you don’t have to risk your property or assets.

Accessible to Many: Borrowers with poor credit might still qualify, as lenders consider your income rather than credit history.

Pre-closure: There is No Pre-closure charges on the loans.

Eligibility Criteria for Loans in India

To apply for Loan, you generally need to meet certain basic criteria:

Age Requirement: You must be at least 21 years old and not more than 60 years old.

Income Proof: You must be a Salaried Employee and you'll need to provide proof of income, such as salary slips or bank statements.

Identification: Valid identity proof such as an Aadhar card, voter ID, or passport.

Bank Account: You must possess an operational bank account where the funds can be deposited.

It’s always wise to check with the particular lender for their specific eligibility requirements.

Conclusion

If you’re in Delhi and looking for a dependable loan provider in Delhi, CashWalle is a name you can trust. With their diverse loan options, quick processing times, and excellent customer support, they are dedicated to helping you achieve your financial goals. Explore CashWalle today and take the first step towards a brighter financial future.

0 notes