#payroll and bookkeeping

Explore tagged Tumblr posts

Text

Payroll and Bookkeeping Services Simplify Your Business Finances

Running a business involves managing many tasks. Payroll and bookkeeping are two important aspects that help businesses stay organized. These services simplify financial management and allow business owners to focus on growth.

What Are Payroll and Bookkeeping Services?

Payroll services manage employee wages, taxes, and benefits. Bookkeeping services track income, expenses, and financial records. Together, they keep business finances accurate and up to date.

Benefits of Payroll Services

Payroll services ensure employees are paid on time. They calculate wages, deductions, and taxes correctly. This helps avoid mistakes and legal issues. Payroll services also handle tax filings and generate pay stubs.

Benefits of Bookkeeping Services

Bookkeeping services track daily transactions. They create financial reports and manage invoices. These services help businesses understand their cash flow and make better financial decisions.

Why Outsource Payroll and Bookkeeping?

Outsourcing these services saves time and reduces errors. Professionals use advanced software to handle finances efficiently. It also ensures businesses follow tax laws and regulations.

Conclusion

Payroll and bookkeeping services simplify business finances. They help businesses stay organized, save time, and avoid costly mistakes. Outsourcing these tasks allows business owners to focus on what matters most growing their business.

#payroll and bookkeeping services#human resources and accounting#accounts payable and receivable#Small Business Bookkeeping Northern Virginia#Northern VA Bookkeeping for Small Businesses#payable and receivable management#bookkeeping for dispensaries#payroll and bookkeeping#payroll companies in florida#Bookkeeping Services Northern VA#Accounting Services Ashburn VA#Small Business Accounting Northern VA#Bookkeeping for Professional Services in Northern VA#Local Small Business Bookkeeping Services#payroll and hr services for small business

1 note

·

View note

Text

GST Registration Consultants Madhapur

Get expert GST Registration services in Madhapur with Tirumalesh & Co | Chartered Accountants. Fast, hassle-free registration and compliance support. " Call: +91 84998 05550.

Visit link: https://www.catirumalesh.in/

Location: https://bit.ly/42ljdS4

#Small business accountants near me Hyderabad#best car for audit services near me#LLP Registration Madhapur#PVT LTD Registration Madhapur#Compliance Services Madhapur#Accounting and bookkeeping services Hyderabad#Payroll Services Madhapur

2 notes

·

View notes

Text

Accounting Services for US Small Businesses

Managing your business finances doesn’t have to be overwhelming. At Counto, we provide professional accounting services tailored to the needs of small businesses in the US.

Whether you're a startup, freelancer, or growing company, we help you:

✅ Stay compliant with tax laws ✅ Keep accurate financial records ✅ Understand your numbers to make smarter decisions

We combine intelligent automation with real human experts—so you get accuracy, speed, and support you can trust.

🔗 Learn more:

#accounting#smallbusiness#bookkeeping#payroll#taxes#counto#ustax#smallbizsupport#business#small business#united states

2 notes

·

View notes

Text

Accounting Services in Los Angeles

Chhokar & Co Global has been a trusted partner for businesses in Los Angeles since 2019, working with reputable CPAs and managing over hundreds of clients across various industries. We provide best Accounting services in Los Angeles, CFO, and consulting services tailored to help businesses thrive.

Backed by over 30 years of industry experience, our firm delivers high-quality financial and management solutions to a diverse clientele. Including multinational corporations, private enterprises, emerging firms, startups, and high-net-worth individuals.

Recognized by Los Angeles businesses for our exceptional accounting services, we take pride in delivering strategic financial insights and operational guidance that drive business success. Our team specializes in financial advisory, bookkeeping, and audit support, ensuring accuracy and compliance at every step.

#accounting#bookkeeping#catch-up bookkeeping#cpaservices#payroll#taxpreparation#virtual cfo services

2 notes

·

View notes

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

Locally Owned Bookkeeping Service in Omaha

Newland Bookkeeping & Tax Services is a locally owned bookkeeping service in Omaha, Nebraska, specializing in accurate financial management and tax solutions. We offer tailored bookkeeping, payroll, and tax preparation services to help businesses stay financially organized. Trust our local bookkeeping experts in Omaha for reliable and professional support.

#Locally Owned Bookkeeping Service in Omaha#Payroll Services Providers in Nebraska#Bookkeeping Services in Nebraska#Newland Bookkeeping Small Business Services

2 notes

·

View notes

Text

Taxulo

As an established CFO and Tax firm, Taxulo provides quality tax and accounting services that maximize the value of your money. While headquartered in Santa Clara, Our company provides services to clients throughout the US. We offer convenient locations to visit or provide services on-site to meet your needs.

Contact Info:

Taxulo

Address: 3031 Tisch Way #10, San Jose, CA 95128

Phone: 888-316-2990

Website: https://taxulo.com/

Business Email: [email protected]

Influencer marketing services

Business Hours: Mon – Fri: 9 AM–5 PM

Follow us on: Facebook: https://www.facebook.com/TaxuloUSA Instagram: https://www.instagram.com/taxulousa/ Google Maps CID: https://www.google.com/maps?cid=14264812699456281482

#accounting services#tax preparation#tax planning#bookkeeping services#QuickBooks ProAdvisor#fractional CFO#small business accounting#tax compliance#financial consulting#payroll management#business growth strategies#San Jose CA

3 notes

·

View notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

NSI Accounting: Reliable Financial Reporting You Can Trust

Ensure your financial statements are accurate and compliant with NSI Accounting. We deliver detailed financial reporting that provides a clear picture of your business’s financial health.

3 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

3 notes

·

View notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

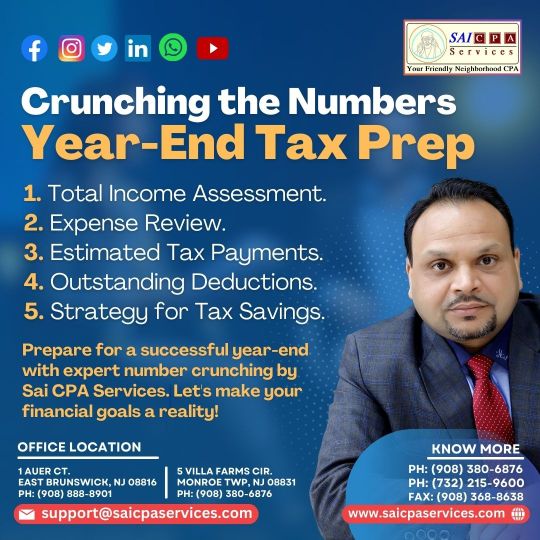

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

Afford Books Tax Offers Affordable, Expert-Led Xero Bookkeeping for Small Businesses Across Adelaide, Brisbane, and Melbourne

Afford Books Tax serves clients across a wide range of industries including retail, hospitality, trades, professional services, eCommerce, and health. The company’s tailored approach means that whether you’re a café owner in Melbourne, a plumber in Brisbane, or a freelance designer in Adelaide, you’ll receive bookkeeping support that’s aligned with your specific needs. For more Information: https://pressnews.biz/@affordbookstax/afford-books-tax-offers-affordable-expert-led-xero-bookkeeping-for-small-businesses-across-adelaide-brisbane-and-melbourne-jhy7rklnwnn3

#affordable bookkeeping service#bookkeeper in brisbane#bookkeeping services in australia#affordable payroll services#bookkeeper in melbourne#bookkeeping service melbourne#bookkeepers in brisbane

0 notes

Text

Billing Software in Navi Mumbai

Managing finances in today’s fast-paced business environment can be overwhelming without the right tools. That’s where TSP Group comes in with its advanced Billing Software in Navi Mumbai, designed to meet the evolving needs of businesses of all sizes and industries.

Our billing software offers an intuitive interface and smart automation features, enabling you to generate accurate invoices, track payments, and maintain clear financial records. Whether you're a startup, retailer, wholesaler, or service provider, TSP Group’s billing solutions simplify your operations by reducing manual errors and improving efficiency.

The Billing Software in Navi Mumbai by TSP Group supports multiple billing formats, customizable templates, tax compliance (including GST), and seamless integration with accounting systems. Businesses benefit from real-time data access, enabling better decision-making and enhanced cash flow management.

In a competitive market like Navi Mumbai, staying ahead means embracing technology that saves time and money. With TSP Group’s billing software, you eliminate paperwork, streamline inventory tracking, and get detailed financial reports—all in a few clicks.

Security and reliability are at the core of our solution. Your financial data is encrypted and stored securely, giving you peace of mind. Additionally, TSP Group provides ongoing support and updates to ensure that your billing system runs smoothly and stays compliant with the latest regulations.

What sets us apart is our local expertise and commitment to customer satisfaction. We understand the specific needs of Navi Mumbai businesses and offer tailored billing solutions that deliver real value. Our team works closely with clients to customize the software as per their workflow, ensuring smooth onboarding and maximum usability.

If you're looking for reliable and feature-rich Billing Software in Navi Mumbai, TSP Group is your trusted partner. We help you transform your billing process into a streamlined, error-free, and fully automated experience, so you can focus more on growth and less on paperwork.

Get in touch with TSP Group today and take a step toward smarter financial management. Our scalable billing software is ready to grow with your business and empower you to achieve operational excellence.

0 notes