#payrollprocessing

Explore tagged Tumblr posts

Text

#bandcamp#music#hip hop#rap#Kanye west#yzy#yeezy#baltimore#payrollgiovanni#payrollprocessing#payrollsupport#payrollservices#payrollsolutions#payrollspecialist#payrollmanagement#vamshiandco#payrollservice#esi#pf#serviceprovider#vamshiandcohyderabad#vamshiandcopayroll#statutoryaudit#statutorycompliance#statutorylaw#businessservice#providentfund#businessgrowth#esic#labourlawadvisor

4 notes

·

View notes

Text

Vendor Mangement Solution

3 notes

·

View notes

Text

HR Services | Payroll Outsourcing Companies | RPO | EHRS

We are specialized in recruitment process outsourcing and HR Services. Our services range from Payroll outsourcing, RPO, Document Scanning & Digitization, and many more. Find out more here.

#RecruitmentProcessOutsourcing#HRServices#HRSolutions#HRO#PayrollOutsourcingCompanies#RPO#PayrollProcessing#HumanResourcesServices#HROutsourcing#GlobalPayrollProcessing#HR#Payroll

2 notes

·

View notes

Text

What Is Payroll? A Simple Guide for Businesses

Payroll might seem like just another back-office task, but it's one of the most critical functions in any organization. Whether you're running a small startup or managing hundreds of employees, getting payroll right is essential—not just for compliance, but also for keeping your team happy and motivated.

In this guide, we’ll break down what payroll is, why it matters, and how you can manage it more efficiently.

What Is Payroll?

At its core, payroll is the process of calculating and distributing wages to employees. But it's not just writing checks or direct deposits—it includes:

Tracking hours worked

Calculating gross pay

Withholding taxes and deductions

Issuing pay stubs

Filing payroll taxes with the government

Maintaining payroll records

Why Payroll Matters

Legal Compliance: Incorrect payroll can lead to penalties from the IRS or local agencies. Staying compliant means avoiding costly fines.

Employee Trust: Late or inaccurate paychecks can seriously damage morale. A reliable payroll process shows professionalism and respect.

Financial Planning: Payroll is often the largest expense for a business. Accurate payroll supports better budgeting and forecasting.

Common Payroll Challenges

Misclassifying employees vs. contractors

Forgetting tax deadlines

Using outdated software or manual spreadsheets

Navigating multi-state or remote worker laws

Managing benefits and deductions accurately

How to Simplify Payroll

Use Payroll Software: Tools like Gusto, QuickBooks Payroll, or ADP automate much of the work and help reduce errors.

Set a Clear Payroll Schedule: Whether weekly, bi-weekly, or monthly—consistency is key.

Stay Updated on Tax Laws: Federal, state, and local tax rules change regularly. Make sure you or your provider keeps up.

Outsource if Needed: If payroll is taking too much time or causing stress, consider using a payroll service provider.

Conclusion

Payroll may not be the flashiest part of your business, but it's one of the most vital. A solid payroll system helps you stay compliant, improve cash flow, and foster employee satisfaction. Whether you choose to manage it in-house or outsource it, make payroll a priority—it pays off.

How to find Payroll service providers?

Clue- You are already on their website. Futurex Management Solutions does their best research and customizes payroll services that are best for your company. With a growing number of businesses in India and digitalization taking over Payroll service providers are also growing. But, invest time in researching and outsource the assistance that will understand and add value to your company’s goal. Different companies, Departments, roles need to have a different set of customizations for their payrolls, the compliances need to be stated differently depending on the company and the objective of the company. Some roles allow lesser leaves than others, some roles require leaving policies customized for them. The payroll services available in India are many, but you need to make a choice based on your requirements. It is a time-investing process initially where you will have to explain your company goals, size, sales, etc, to the payroll service provider, and then they can form their customized solution for you. Because the legal compliances and tax rules etc. change you also need a payroll service provider that keeps up with the changes and suggests changes from time to time.

Need Help With Payroll? Contact Futurex Management Solutions today to learn how we can simplify and strengthen your payroll processes.

#Payroll#PayrollTips#PayrollManagement#PayrollSolutions#PayrollServices#PayrollProcessing#HRandPayroll#SmallBusiness#HumanResources#BusinessTips#HRTech#EmployeeManagement#WorkplaceWellness#TaxCompliance#FinanceTips#Accounting#BusinessCompliance#PayrollTax#Futurexsolutions

1 note

·

View note

Text

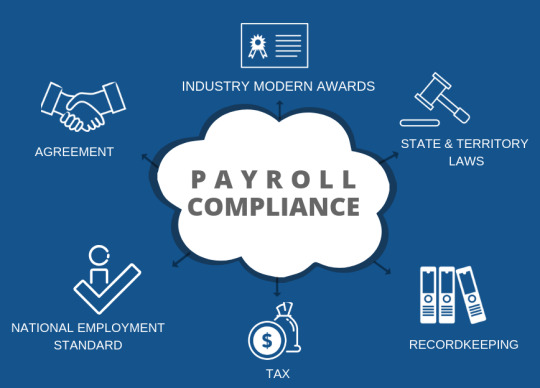

Ensure error-free and compliant payroll processing with Karma Management's expert payroll compliance services. Stay ahead of regulations and streamline operations.

#PayrollCompliance#PayrollServices#ComplianceManagement#KarmaManagement#HRCompliance#PayrollSolutions#PayrollProcessing

0 notes

Text

Struggling with HR & payroll processes? 😓

Say goodbye to manual work and hello to automation with #ScriptzolHRMS! 🚀

Optimize your business operations today. Read more 👉 www.scriptzol.com/blog/streamline-business-operations-scriptzol-hrms-payroll-script

#Scriptzol#HRMS#PayrollSoftware#HRTech#BusinessAutomation#HRSolutions#WorkplaceEfficiency#HRManagement#PayrollProcessing#HRAutomation#BestHRSoftware#HRMSBenefits#BusinessEfficiency#HRMSforSmallBusiness#SimplifyHRTasks#HRMSKeyFeatures

0 notes

Text

Automate Payroll & Taxes in Minutes – Try HivePayroll for Free!

Payroll made easy, accurate, and stress-free! 💻✨ Discover HivePayroll – the smart way to manage your team’s payments. Sign up for a free trial!

✅ Access payroll data anytime, anywhere ✅ Cost-effective – No need to maintain expensive servers ✅ Scalable – Grows with your business needs ✅ Secure – Your data is safely stored on the cloud

💡 Try HivePayroll FREE for 15 days! Sign up now 👉 https://www.hivepayroll.co.in/

#HivePayroll #PayrollSoftware #CloudPayroll #HRTech #PayrollManagement #SmallBusinessSolutions #AutomatedPayroll #PayrollProcessing #HRSoftware #BusinessGrowth

#HivePayroll#PayrollSoftware#CloudPayroll#HRTech#PayrollManagement#SmallBusinessSolutions#AutomatedPayroll#PayrollProcessing#HRSoftware#BusinessGrowth

0 notes

Text

How to Choose the Right Payroll Service Provider?

In today’s fast-paced business environment, managing payroll efficiently is essential for maintaining employee satisfaction and regulatory compliance. Payroll service providers (PSPs) are specialized companies that assist businesses in handling their payroll processes, ensuring that employees are paid accurately and on time. Here’s a closer look at the benefits and features of payroll service providers.

What Do Payroll Service Providers Do?

Payroll service providers take on the responsibility of calculating employee wages, withholding taxes, and submitting necessary tax forms. They often offer services that include direct deposit options, payroll reporting, and time tracking. By outsourcing payroll, businesses can save valuable time and resources, allowing them to focus on core operations.

Benefits of Using Payroll Service Providers

The main advantage of using a payroll service provider is the potential cost savings it offers. By automating payroll tasks, businesses can reduce the risk of errors that could lead to costly penalties. Additionally, PSPs stay up-to-date with tax regulations, ensuring compliance and reducing the burden on internal teams.

Choosing the Right Payroll Service Provider

When selecting a payroll service provider, businesses should evaluate the specific needs of their organization. Factors to consider include the provider’s reputation, the range of services offered, and customer support. A reliable PSP will provide not only payroll processing but also additional services such as HR support and compliance assistance.

Payroll service providers play a critical role in helping businesses manage their payroll effectively. By leveraging their expertise, companies can ensure timely and accurate payroll processing while minimizing compliance worries. Integrating a reliable PSP into your operations may just be the investment needed to streamline your payroll system.

0 notes

Text

Best Payroll and Leave Management Software: Streamline Your HR Operations with Mun-C Software

Managing payroll and leave records manually can be a daunting and time-consuming task for HR teams. Errors in salary calculations, tax deductions, and leave tracking can lead to dissatisfaction among employees and compliance issues. This is where the best payroll and leave management software comes into play, automating processes and ensuring accuracy.

At Mun-C Software, we provide a top-notch payroll and leave management solution that simplifies HR operations, improves efficiency, and ensures compliance with labor laws. In this blog, we will explore the key features, benefits, and reasons why Mun-C Software is the best choice for businesses of all sizes.

Why Do Businesses Need Payroll and Leave Management Software?

Before diving into the best features of Mun-C Software, let's understand why businesses need a robust payroll and leave management system.

Error-Free Payroll Processing: Manual payroll calculations are prone to errors, leading to incorrect salary disbursement and compliance risks.

Automated Leave Tracking: Keeping track of employee leaves manually can result in discrepancies and miscalculations.

Legal Compliance: Ensures adherence to tax laws, labor regulations, and company policies.

Time and Cost Savings: Reduces administrative workload, freeing up HR professionals to focus on strategic tasks.

Enhanced Employee Satisfaction: Employees appreciate accurate payroll processing and transparent leave tracking.

Key Features of Mun-C Software

Mun-C Software is designed to handle all aspects of payroll and leave management efficiently. Here are some of its standout features:

1. Automated Payroll Processing

Automatically calculates salaries, taxes, deductions, and bonuses.

Integrates with accounting software to ensure seamless transactions.

Generates detailed payslips and reports for employees.

2. Comprehensive Leave Management

Allows employees to request leave through an easy-to-use portal.

HR can approve, reject, or modify leave requests instantly.

Tracks leave balances and ensures proper compliance with leave policies.

3. Tax Compliance and Deductions

Automates tax deductions such as income tax, provident fund, and other statutory deductions.

Generates tax reports to help businesses comply with local tax laws.

Reduces risks of non-compliance and penalties.

4. Employee Self-Service Portal

Employees can access payslips, tax documents, and leave records.

Improves transparency and reduces HR workload.

Ensures employees have access to their financial information at any time.

5. Integration with Attendance Systems

Syncs with biometric and attendance tracking systems.

Automatically calculates worked hours and overtime.

Reduces errors and improves payroll accuracy.

6. Multi-Currency and Multi-Country Support

Ideal for global businesses with multiple locations.

Supports different tax laws, currencies, and regional payroll regulations.

7. Data Security and Compliance

Ensures data encryption and secure storage of employee records.

Complies with GDPR, SOC 2, and other data protection regulations.

Reduces risks of payroll fraud and unauthorized access.

Benefits of Using Mun-C Software

Adopting Mun-C Software as your payroll and leave management solution brings numerous advantages:

1. Accuracy and Efficiency

Eliminates manual errors in salary processing and leave tracking.

Reduces payroll processing time significantly.

2. Improved Compliance

Automatically updates with tax laws and labor regulations.

Ensures adherence to company policies and labor laws.

3. Cost Savings

Reduces administrative costs associated with manual payroll management.

Minimizes penalties due to compliance issues.

4. Employee Satisfaction

Transparent payroll and leave tracking improve trust and morale.

Provides instant access to salary and leave records.

5. Scalability

Suitable for small businesses, startups, and large enterprises.

Easily adaptable to changing business needs.

Why Choose Mun-C Software?

Mun-C Software stands out as the best payroll and leave management software due to its user-friendly interface, robust features, and commitment to accuracy and compliance. Here’s why businesses trust us:

✅ User-Friendly Interface

Simple and intuitive dashboard for easy navigation.

No technical expertise required to use the system.

✅ Customizable Solutions

Tailor-made payroll and leave policies as per company needs.

Flexible integration with existing HR and accounting software.

✅ 24/7 Customer Support

Dedicated support team available for any queries and assistance.

Comprehensive training and onboarding for new users.

✅ Cloud-Based System

Accessible from anywhere, ensuring remote work compatibility.

Automatic data backups to prevent loss of information.

Conclusion

Investing in a reliable payroll and leave management software is crucial for businesses that want to streamline HR processes and ensure compliance. Mun-C Software offers a powerful, efficient, and user-friendly solution designed to meet the diverse needs of businesses.

By choosing Mun-C Software, businesses can eliminate payroll errors, automate leave tracking, ensure compliance, and improve overall employee satisfaction.

Are you ready to enhance your HR efficiency?

Read More

0 notes

Text

#accounting#business#finance#accountants#bookkeeping#financial growth#BookkeepingServices#AccountingSolutions#SmallBusinessFinances#ExpenseManagement#PayrollProcessing#BusinessGrowth#BrushmableBookkeeping

0 notes

Text

MY DEEPEST DISCOVERY: an album by JHarry

digital edition: $5.99 https://www.gettothecorner.com/welcome/mydeepestdiscovery

@soundcloud : https://soundcloud.com/gettothecorner/sets/mydeepestdiscovery

@spotify : https://open.spotify.com/album/5l9hOZPCTf6g9y45M2QULG?si=mDXXZgS_RS-kyb8LMIXB8A

@deezer : https://www.deezer.com/us/album/740319751

@tidal:https://tidal.com/browse/album/429172924?u

#payrollgiovanni#payrollprocessing#payrollsupport#payrollservices#payrollsolutions#payrollspecialist#payrollmanagement#vamshiandco#payrollservice#esi#pf#serviceprovider#vamshiandcohyderabad#vamshiandcopayroll#statutoryaudit#statutorycompliance#statutorylaw#businessservice#providentfund#businessgrowth#esic#labourlawadvisor#detroit#bylug#sadababy#explore#indiantaxation#foodlicense#typebeat#teegrizzley

0 notes

Text

Automated Payroll Services: Save Time and Cut Errors Today

In today’s fast-paced business world, efficiency and accuracy are crucial for success. Managing payroll manually can be time-consuming and prone to errors, which may lead to unhappy employees and costly penalties. That’s where automated payroll services come to the rescue. They offer a seamless way to handle employee compensation, tax calculations, and compliance, all while saving time and reducing errors.

Here’s why businesses of all sizes should consider adopting automated payroll services and how they can revolutionize your operations.

What Are Automated Payroll Services?

Automated payroll services use software to streamline the payroll process. From calculating salaries and deductions to generating payslips and filing taxes, these tools handle repetitive tasks efficiently. They integrate with accounting software, track employee work hours, and ensure compliance with local tax laws.

Unlike manual processes, where errors in calculations or missed deadlines can disrupt operations, automation ensures accuracy and timely processing.

Key Benefits of Automated Payroll Services

1. Saves Time

Payroll involves a myriad of tasks — calculating wages, tracking hours, managing deductions, and ensuring compliance with tax regulations. Automated payroll systems handle these tasks quickly, allowing HR teams and business owners to focus on strategic goals instead of administrative chores.

2. Reduces Errors

Human errors in payroll processing can lead to underpaid employees or hefty fines for non-compliance. Automated systems minimize mistakes by relying on predefined formulas and real-time data integration. This ensures that calculations are accurate and deductions are properly applied.

3. Ensures Compliance

Tax laws and labor regulations are constantly changing. Keeping up with these updates manually is challenging. Automated payroll services come with built-in compliance features that update tax rates, generate tax forms, and ensure filings meet government deadlines.

4. Enhances Security

Manual payroll systems often involve paper-based records or spreadsheets, which are susceptible to theft and misuse. Automated systems store data securely in encrypted formats, protecting sensitive employee information from unauthorized access.

5. Improves Employee Satisfaction

Employees expect timely and accurate pay. Automated payroll ensures salaries are processed on time, contributing to better employee morale and trust. It also provides employees with access to digital pay stubs and tax forms for added transparency.

Features to Look for in an Automated Payroll Service

When choosing an automated payroll service, it’s essential to select a tool that fits your business needs. Here are some key features to consider:

Integration Capabilities: Ensure the system integrates with your accounting and HR software.

Customizable Reports: Look for detailed reports on payroll expenses, taxes, and employee benefits.

Cloud-Based Access: A cloud-based system allows you to access payroll data anytime, anywhere.

Employee Self-Service Portals: These portals enable employees to view pay stubs, update information, and download tax forms.

Scalability: Choose a system that can grow with your business and adapt to increasing workforce needs.

How Automated Payroll Saves Time and Money

Streamlining Processes

Automated payroll eliminates manual data entry, ensuring that employee details are correctly recorded and calculations are automated. This drastically cuts down the hours spent on payroll each month.

Reducing Administrative Costs

By automating tasks like tax filing, record keeping, and generating payslips, businesses can reduce the need for additional staff or outsourcing payroll, resulting in significant cost savings.

Minimizing Compliance Risks

Failure to comply with payroll regulations can lead to penalties. Automated systems stay updated on the latest laws, ensuring compliance without requiring constant monitoring.

Real-Life Example: Small Business Success

Consider a small e-commerce business with 15 employees. Before switching to automated payroll, the owner spent several hours each week calculating wages, managing overtime, and filing taxes. After adopting an automated payroll system, the business reduced payroll processing time by 80%, improved accuracy, and avoided late tax penalties.

The owner could now focus on growing the business instead of worrying about payroll, leading to higher revenue and happier employees.

Is Automated Payroll Right for Your Business?

Automated payroll services are ideal for businesses of all sizes. Whether you’re a startup with a handful of employees or an established company with a large workforce, automation simplifies payroll management.

If you’re currently spending too much time on payroll tasks or struggling with errors and compliance issues, it’s time to consider switching to an automated system. The initial investment is minimal compared to the long-term savings and benefits.

Choosing the Best Automated Payroll Service

Research and compare different providers to find a solution that suits your business. Popular options include:

1. Pumpkin Tax: Pumpkin Tax is an excellent choice for startups because it automates payroll, tax filings, and employee management, saving you time and reducing

2.Gusto: Offers a user-friendly interface and comprehensive payroll features.

3. QuickBooks Payroll: Ideal for small businesses looking for seamless integration with accounting software.

Make sure to read reviews, take advantage of free trials, and assess the level of customer support provided.

Conclusion

Automated payroll services are more than just a convenience — they are a necessity for modern businesses. By saving time, reducing errors, and ensuring compliance, these tools empower you to focus on growing your business while keeping your employees satisfied.

Don’t let manual processes hold you back. Embrace automated payroll services today and experience the difference they can make in your business operations.

0 notes

Text

👩💼 Streamline Your Workforce Management with SAP HCM! 💼

From personnel administration to payroll processing, this cheat sheet covers the essentials for mastering HR tasks and boosting efficiency! 🚀

📊 Key Modules | Important T-Codes | Time & Payroll Insights

Make your HR processes smarter, faster, and more effective with SAP HCM. ✅

✨ Manage your workforce with confidence and precision!

📞 Call Now: +91 8282824781 / 8282826381

🌐 Visit us: www.mentortechsystems.com

🔑

#SAPHCM#WorkforceManagement#HRTech#PayrollProcessing#EmployeeManagement#TimeTracking#HRTransformation#ERPSoftware#HRInnovation#SAPforBusiness

0 notes

Text

Accurate and informative payroll data is crucial for businesses to understand employee pay, manage tax obligations, and calculate total payroll costs

0 notes

Text

Simplify Payroll Management with AI Technology

Payroll processing can be complex, but Zbrain AI’s Payroll Management AI Agent automates tasks such as payroll auditing, employee benefits tracking, and payroll reporting. This tool reduces errors, ensures compliance, and saves time for HR and finance teams alike.

🕒 Save time and improve accuracy in payroll with AI.

0 notes

Text

🛡️ Ensure Smooth Business Operations with Expert Labor Law Compliance! 🛡️

At Gupta Consultant, we help businesses navigate the complexities of labor law compliance so you can focus on what matters—growing your business! 🏢💼

Our Labor Law Services include: ✅ Contract Labour Compliances✅ Factory Act Compliances✅ Establishment Compliance✅ PF & ESIC Compliance✅ Shop Act Registration✅ Payroll Processing & Outsourcing

💼 Why Choose Us?Our experts ensure that your business meets all statutory requirements, saving you from penalties and ensuring smooth operations. From registration to compliance audits, we’ve got you covered!

📞 Get in TouchFor personalized consultation and services, call us at +91-8744079902 or visit https://www.guptaconsultants.com/services/labour-laws-licensing/

#LaborLaw#ComplianceExperts#BusinessCompliance#FactoryAct#PayrollProcessing#LabourCompliance#GuptaConsultant#ComplianceAudit#BusinessSolutions#digiujjawal#prowebsquad#pws

0 notes