#personalcredit

Photo

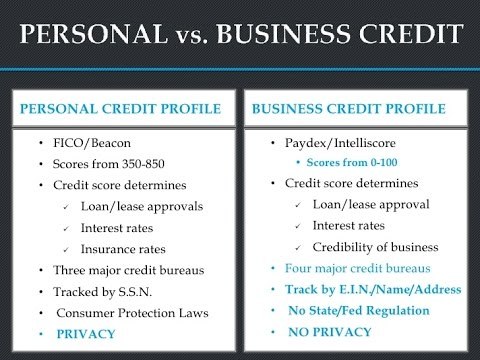

How many business owners need business credit? If you’ve been waiting for a sign, this is it! Now is the time to begin your good credit journey. I am thinking of hosting a monthly Business credit 101 workshop. My formula to building a solid company structure works. Despite what Glorilla says good credit does in fact matter! I have been helping friends and family for years. I think its time to help build the small business community. Who is interested in attending? If you have any questions or need help obtaining business credit inbox us! #businessclass #businesscreditbuilding #funding #businessowner #businessgrowth #businesscredit #credit #businessfunding #businessfinances #business #credit services #entrepreneur #smallbusinesscredit #personalcredit #personaltradelines #newbusiness #businessowner #networth #boost #entrepreneurship #Development #startup #investment #advising #consulting #advisory #creditscore #creditbureau #creditclass #creditworkshop (at Atlanta, Georgia) https://www.instagram.com/p/CpYwP6QAuVr/?igshid=NGJjMDIxMWI=

#businessclass#businesscreditbuilding#funding#businessowner#businessgrowth#businesscredit#credit#businessfunding#businessfinances#business#entrepreneur#smallbusinesscredit#personalcredit#personaltradelines#newbusiness#networth#boost#entrepreneurship#development#startup#investment#advising#consulting#advisory#creditscore#creditbureau#creditclass#creditworkshop

0 notes

Photo

This are 5 secondary credit bureaus everyone should know about . #Godfirst #secondarycreditbureaus #lcreditrepair #windycitycreditrepair #personalcredit #businesscredit #700creditscoreclub https://www.instagram.com/p/CnS7tX_Jzwp/?igshid=NGJjMDIxMWI=

#godfirst#secondarycreditbureaus#lcreditrepair#windycitycreditrepair#personalcredit#businesscredit#700creditscoreclub

0 notes

Text

Need Cash Flexibility? 3 Game-Changing Benefits Of Personal Lines Of Credit! | Samuel Pugh #shorts

Need Cash Flexibility? 3 Game-Changing Benefits Of Personal Lines Of Credit! | Samuel Pugh #shorts

https://www.youtube.com/watch?v=OLN_nFwuNMc

Explore the top reasons to choose a Personal Line of Credit to manage your finances flexibly! In this video, we delve into the benefits of having accessible funds without needing collateral. Learn how to save on interest compared to credit cards and enjoy the convenience of borrowing again without reapplication.

Discover why a Personal Line of Credit might be your best financial tool, perfect for home repairs, medical bills, or consolidating debt.

✅Find the perfect tech course for your career goals: 👉https://ift.tt/lL1znGC

#personalcredit #financialflexibility #creditmanagement #lineofcredit #moneytips #shorts

via Samuel Pugh https://www.youtube.com/channel/UC6zMrXCMeK9qK1mMkWNxdyg

May 04, 2024 at 10:30PM

#asksam#coursecareers#careergoals#techielife#techjobs#60ksalary#entryleveleducation#techlearning#VetToTech#veteran#techsales#tech#navyfederal

0 notes

Photo

e-Transfer financing within 15 minutes! Get up to $15,000 Online. No hidden fees or surprises. bit.ly/ApplyForLoanz #personalloans #loans #loan #credit #creditcard #installment #installmentloans #installments #installmentloans #personal #personalloans #personalcredit

0 notes

Text

About QwikPay Matrix Private Limited

QwikPay Matrix Ptv. Ltd

QwiPay Matrix Private Limited is one of a kind financial service provider that helps people achieve their life goals by helping them getting there desired amount of loan for any kind of there purpose for example To startup their own business or to buy a new Home. We provide all kind of services at your doorstep .

About Us

Incorporated in 2020, QwikPay Matrix Private Limited is linked up with a lot of Banks and NBFC’s in order to serve all kind of loan services that a person can ask for. With the most popular banks of the country one can get a loan at really good interest rates and can choose their tenure to pay it off as long as one wants to.

What We Offer

Personal Loan: One of the best product that we offer us personal loan. Personal loans are unsecured loans that has been provided to working people with lesser documentation and fast and easy approvals.

Home Loan: As the name suggests home loans are for those who are looking to buy a new house or land to build etc. Offered to working persons with adequate salary and great credit profile.

Business Loan: Always want to start up your own business. We can help you cover all your expenses by providing you business loan. Just need to present your yearly turn over and great credit profile.

Professional Loan: Professional loans are offered to those professionals who are looking to expand there business. All you need is a proper professional degree and a great credit score.

Loan Against Property: Loan Against Property(LPA) or Mortgage Loan are for those looking to mortgage their property in order to get a good amount of loan. The benefit of getting a LPA is that one can get lower interest rate and longer tenure.

So these are some of the services we offer currently.

Benefits of getting a loan from us

1) You can choose your interest rate and loan tenure as you wish as there are multiple banks to choose from.

2) No need to visit our office our executives will be there to collect all your documentations.

3) Easy and Fast approvals as we are linked directly with banks and NBFC’s there is almost no delay in your loan application.

4) We are always there to help you and to clear all kinds of doubts you have while processing your loan application.

#loan#homeloan#businessloan#professionalloan#loanagainstproperty#personalloan#housingloan#mortgageloan#startuploan#qwikpay#bestinterestrates#loansfordoctors#loansforca#personalcredit#cibil#creditreport#lowcibilscore

1 note

·

View note

Photo

I got plenty of #business #credit A #att #mobility #account #americanexpress all that but 6 months ago I didn’t have any #personalcredit I just didn’t… I opened my @chime account and got #directdeposit less than six months I got a 700 credit score and a #new #capitolone #platnium card in my own name… #checkout our #contest on my last #chime post… $500 from me and @neekodadondadon plus #share your #story and Chime may hook you up with a #prize as well… #follow the #instructions and #join the #tini&Neeko+chimechallenge #challenge you to #buildcredit make #moneymoves like me #tiniwilson #motovationmonday (at Northstar Drive) https://www.instagram.com/p/CUDs3D5vP-J/?utm_medium=tumblr

#business#credit#att#mobility#account#americanexpress#personalcredit#directdeposit#new#capitolone#platnium#checkout#contest#chime#share#story#prize#follow#instructions#join#tini#challenge#buildcredit#moneymoves#tiniwilson#motovationmonday

0 notes

Photo

Since you're ALREADY holding your phone & ALREADY on social media... Here's a way to monetize your profile on any network as long as you're in the U.S! Sign up & become an Affiliate with me and in your 1st 30 days you can earn an additional $500-$1000 BONUS on top of what you've made thru referrals! Basic is.... well BASIC so Go PRO!! Must be 18+ Have a Smart Phone or Computer with internet access Easy to Follow Training is provided Weekly Direct Deposit Monthly Residuals Go to website on flyer/ in bio OR text "15K" to 404.935.1511 🗣 This isn't for EVERYBODY & I don't want ANYBODY 💯 I will only work with quality people who are coachable that have a hunger for more & are looking for an opportunity. #readthatagain . . . . . . . 🤑 Follow Best Motivation Page on Instagram💸 ⬇️⬇️⬇️⬇️⬇️⬇️⬇️ FOLLOW ➡️ @Sabriyyah_Davis FOLLOW ➡️ @Sabriyyah_Davis FOLLOW ➡️ @Sabriyyah_Davis FOLLOW ➡️ @Sabriyyah_Davis FOLLOW ➡️ @Sabriyyah_Davis 💸💯💸💯💸💯💸💯💸💯💸💯 . . #MuslimahsAboutTheirMoney #Entrepreneurship #workfromphone #businessownership #dailymotivation #BusinessFunding #personalcredit #financialconsultant #businessconsultant #businesscoach #InternetMoneyBag #teachersfollowteachers (at Atlanta, Georgia) https://www.instagram.com/p/CKZ_iErh7X-/?igshid=10z6ysuzk3rt6

#readthatagain#muslimahsabouttheirmoney#entrepreneurship#workfromphone#businessownership#dailymotivation#businessfunding#personalcredit#financialconsultant#businessconsultant#businesscoach#internetmoneybag#teachersfollowteachers

0 notes

Photo

Get your credit together. Get access to capital. Change your LIFE! #personalcredit #business #creditrepair #accesstocapital #credit

4 notes

·

View notes

Photo

Selling authorized users for $500‼️ If your interested call or DM me⁉️ This credit card is five years old and will help your credit score wit the age of credit history, credit limit and the balance of it‼️ #BoostYourCreditScore #CreditIsTheNewCash #BeCreditWorthyToBanks #PersonalCredit (at Manhattan Beach, California) https://www.instagram.com/p/CF71NNmAWQmZSGfEEIzuFiHLD98KqoDJeDsx8k0/?igshid=1arso1ibifm0m

0 notes

Photo

Your credit score provides vital information that represents your overall financial wellbeing. In this Finance Buddha blog, you'll learn the Top Reasons to Check your Credit Score.

https://financebuddha.com/blog/top-reasons-to-check-your-credit-score/

0 notes

Photo

Now, NONE of us 😷 - ...is sure WHERE this craziness is headed, but we ALL know as long as money makes this world go round, CREDIT will be a part of the process 🤔 - Come learn some really simple, but foundational principles for getting your life together financially and your family ready for what will probably be the greatest wealth transfer in the history of the country. Recession just means the whole country’s assets are about to have a fire 🔥 sale👀 - #WeDoAllTheWorkYouGetAllTheCredit #NovaeMoney #PersonalCredit #BusinessCreditBuilding #Funding https://www.instagram.com/p/B_i1T3Ph-J2/?igshid=anh6h3uf5z79

0 notes

Text

Paydex Score vs Fico Score:

How to Achieve a Good Score

As any good investor knows, your investment strategies and goals typically hinge on the type of credit you as an individual or a small business owner has. Depending on the type of deal you are looking to achieve, your credit score may dictate the type of investment you are actually able to make.

Two of the main types of credit scores in factoring your credit worth are Paydex scores and Fico scores. Paydex scores are determined by Dun & Bradstreet and analyze the credit history for small businesses over a rolling 12-month period. Fico scores determine the credit history of individuals.

Paydex scores range from 0-100 with zero being the poorest score and 100 being an excellent credit score. A Paydex credit score of 75-100 is considered a good score. Paydex determines its credit score not just on whether a business makes its payments, but when it makes its payments. The more quickly a business pays its suppliers (and pays ahead of term) the higher the Paydex score. Lateness in payments results in a lower score.

Fico scores on the other hand reviews an individual’s credit and payment history to determine its scoring. A Fico score can range from 300-850 with a better overall credit seeing a higher score. While a Paydex score takes into consideration the timing of payment, Fico looks into an individual’s total debt owed, age of current debt, payment history, as well as types of credit owed.

For small businesses and individuals alike, achieving a good score has one similar trait: making good on debt. For a small business, simply making payments on time scores an 80 on a Paydex credit score. As your business begins to grow and strengthen, early payments to suppliers and lenders will only strengthen your overall score. For example, making a payment 20-days earlier than payment due date jumps your score from 80 to 90, while making payment 30-days sooner jumps your Paydex score to 100.

Similarly to strengthening your Paydex score, improving your personal Fico score comes down to paying your debt on time. As an individual it’s important to review your account records and catch up on any late payments or inaccuracies in your history. Likewise, settle any collections issues or liens against property and ask for a grace period where applicable. Making good on past and present debt will begin to raise your Fico credit score over time.

Improving your credit score goes a long way for both small business and individuals alike. At Peace Properties, we are experts in helping you determine the next steps in clearing up your credit history and credit score. Contact us to determine what steps you need to take to review and begin to strengthen your credit score today.

1 note

·

View note

Text

Your Ultimate Guide To Finding Best No Credit Check Loan

How can I get a loan? The following statistics show the ratio of US citizens savings. Over 62% of people there have a $1000.00 of savings and every fifth person has no account at all. That is the cause why no credit check loans are in such a strong demand. As far as it is the chance to tackle the problems with no efficient effort. So until you haven’t decided, ensure in advance which pitfalls you may falter. Our professionals are going to provide you with detailed guidance on what to do if you didn’t do it before or had a negative previous experience with a bank.

What you should do to receive an affirmative reply?

In order to have an affirmative answer, you may need to use some tricks. Applicants often want to have a backup and that’s why they make a request in several places simultaneously. An appropriate credit story is going to increase the chances as creditors want to see a brief description of your previous payments and check payment ability. This factor is crucial because a lot of applicants get a refusal based on the negative experience with crediting. Did you get a loan shortly prior to giving up your work some time ago? Or your age is not sufficient to guarantee the repayment? Notwithstanding the matter, there is not much choice in tough circumstances.

What I have to pay Attention to trying to obtain a Loan

The most important fact to take into consideration applying for a loan with no credit check is the requirements one is going to adopt. If your credit experience is negative or empty in order to reduce the risks creditors tend to propose you more disadvantageous conditions to be certain you’ll pay the money back. First, look at the whole picture, examine the ratio of extra money you are supposed to repay until signing the deal. Look whether it requires some additional payments as ‘initiation fees’ or any others. Approach the issue in a responsible manner, weigh your costs and benefits before taking such an important decision.

Flexible Credit Requests are preferable to the Hard Ones

As far as an applicant with no loan is more likely to get a denial, one needs to fill several entry forms. Be careful defining the type of request as it will estimate rights for a loan. Basically, we discern two types of loans, to be exact soft and hard ones. They may also be called soft and hard pulls. The soft inquiry doesn’t damage a score in any way, the eminents’ key aim is to get to know the creditability. A hard inquiry is on the contrary implies full and profound search in your debt experience Both these types provide with the content from the past, mainly how many times you've been rejected and how many times you've been approved, display the total quantity of requests you've made and description of the past repayment action. As far as a hard loan is concerned it influences your credit significantly, therefore you need to put a priority, what type of inquiry you will perform before filling an entry form.

make-a-request-in-several-places-simultaneously

Lack of Credit experience may appear as an advantage

Getting the money isn’t the one positive side you may receive, the fact may better your credit story, increase the chances of getting credit in the future. When an applicant has no loan at all, this notion is called ‘credit builder loans’. Aforesaid type gives a possibility to start a credit story and express oneself as a secure and reliable client and affect future borrowings in a positive way. On the one hand, the terms are not very suitable or beneficial but on the other hand, making such a loan lets one enhance your creditability for the next attempt. When an applicant repays appropriately now, chances to get a better one are likely to be higher.

Which Structures offer no Credit Loan?

Here is a wide range of organizations which offer you this service. As a rule, these are credit unions or community banks. Although the easiest way is to look for it and find all the answers on the Internet. Our company renders plenty of favors and lets to level all the accessible variants, so you just need to choose the best one appropriate.

How we can assist to find a Needed Proposal or Summing Up of its Pros and Cons

A lot of people throughout the world resort to no credit check loans when they have a need to, it is not necessarily financial problems or difficulties, people do it when they want to make an important occasion brighter or to organize a long-expected trip. In case you have a negative experience or don’t have it either you still have a solution.

In order to better your chances to receive an appropriate loan one should put a claim the greatest amount possible. At the same time treat the influence of the request with special caution, as a hard inquiry can influence your credit story significantly. We are ready to offer you assistance so you may keep in touch with a variety of trustworthy lenders and reliable companies on the first demand. We possess the first-hand expertise in dealing with similar issues for a long time and our lending system offer flexible terms so you can get the needed sum as soon as we can. Fill in the entry form on our website to look for the best available option.

Read the full article

0 notes

Video

undefined

tumblr

The ultimate 10 steps to building business credit

.

0 notes

Link

0 notes

Photo

Happy Thanksgiving! #creditrepair #creditrestoration #creditscoresmatter #efc #efixcredit #happyholiday #happythanksgivng #happythanksgivingday #happyholidays #gobblegobble #businessfinancing #businesscredit #creditbuilding #creditbuilder #personalcredit #studentloanforgiveness #studentloandebt #studentloans #studentloans #buildbusinesscredit #buildpersonalcredit (at E-FIX Credit INC) https://www.instagram.com/p/CIECn0plm60/?igshid=32me68q5fkia

#creditrepair#creditrestoration#creditscoresmatter#efc#efixcredit#happyholiday#happythanksgivng#happythanksgivingday#happyholidays#gobblegobble#businessfinancing#businesscredit#creditbuilding#creditbuilder#personalcredit#studentloanforgiveness#studentloandebt#studentloans#buildbusinesscredit#buildpersonalcredit

0 notes