#portfoliodiversification

Text

Investment Management Services in Nepal!!!1

Trust Yoj Invest for the finest investment management services in Nepal, tailored to meet your financial goals. Our high ROI investment strategies and diversified portfolios offer protection during inflation. Visit https://yojinvest.com/ for details.

#InvestmentManagement#NepalInvestment#FinancialGoals#HighROI#PortfolioDiversification#InflationProtection#YojInvestment#TopInvestmentServices#HighReturnInvestments#TrustedInvesting#NepalWealthManagement#InvestmentStrategies#BestInvestmentServices#FinancialSecurity#InvestmentServices

0 notes

Text

Why Real Estate Debt Funds are an Investor's Hidden Gem

Discover why real estate debt funds are considered a hidden gem for investors. This article sheds light on the benefits of investing in real estate debt funds, including regular income, lower risk compared to equity investments, and portfolio diversification. Understand how these funds operate, the types of loans they invest in, and the potential returns they offer. Whether you're a seasoned investor or exploring new opportunities, this guide provides valuable insights into the advantages of real estate debt funds.

Uncover the benefits of real estate debt funds for investors at ReRx Funds.

#RealEstateDebtFunds#InvestmentOpportunities#RegularIncome#PortfolioDiversification#LowerRiskInvesting

0 notes

Text

In Zeiten wirtschaftlicher Unsicherheit wird die Frage, wo man seine Ersparnisse parken soll, immer wichtiger.

Im Bereich der finanziellen Entscheidungen gibt es eine immerwährende Debatte, die immer wieder für Kontroversen sorgt: Bargeld oder Gold? Beide spielen in der Weltwirtschaft eine wichtige Rolle, haben jedoch unterschiedliche Eigenschaften, die verschiedene Anleger und Wirtschaftsideologien ansprechen. Goldinvestitionen sind in den letzten Jahren jedoch immer beliebter geworden - vor allem wegen der einzigartigen Vorteile, die sie in jeder Wirtschaftslage bieten.

Die Entscheidung, ob man in Gold oder Bargeld spart, ist eine persönliche Entscheidung. Dennoch ist das Sparen in Gold im Moment eine sehr attraktive Option. Hier sind ein paar Gründe dafür:

1. Gold wirkt als Absicherung gegen die Inflation, Bargeld nicht.

2. Gold kann Ihr Portfolio diversifizieren, Bargeld aber nicht

3. Im Gegensatz zu Bargeld ist Gold ein Wertbewahrungsmittel

Bargeld hat eine schlechte Haltbarkeit. Papiergeld verschlechtert sich mit der Zeit und muss ersetzt werden. Gold glänzt in puncto Haltbarkeit. Es korrodiert nicht, läuft nicht an und zerfällt nicht mit der Zeit.

Letztendlich hängt die Entscheidung, ob Sie in Gold oder Bargeld sparen, von Ihren individuellen finanziellen Umständen und Zielen ab. Bevor Sie eine Entscheidung treffen, sollten Sie sich jedoch gründlich informieren und eine fundierte Entscheidung treffen, die Ihren finanziellen Zielen entspricht.

Wenden Sie sich an die GOLDINVEST Edelmetalle GMBH für Ihre Gold- und andere Edelmetallanlagen.

#goldinvest#gold#Bargeld#inflationprotection#portfoliodiversification#goldkaufen#TrustedGoldSeller#trustedshop

0 notes

Text

"Your Gateway to the Crypto Universe: Start Trading Now!"

"Embark on your crypto journey with us! Our exchange platform offers a gateway to the vast world of digital currencies. Trade securely, access real-time market data, and diversify your portfolio effortlessly."

0 notes

Text

#EnergyInvestment#InstitutionalInvesting#PortfolioDiversification#EnergyAssets#FamilyOffices#Advisors#Producers#Sellers#CommodityExposure#AssetMonetization

0 notes

Text

"Alternative Investment Funds (AIFs)" are the dynamic and diverse force behind modern investment portfolios. This guide unravels the complexities of AIFs, offering insights into this innovative approach to wealth management.

Explore the world of alternative investments, from private equity and hedge funds to real estate and venture capital. AIFs provide a platform for diversifying portfolios and managing risk, often offering non-traditional asset classes with unique risk-return profiles.

Learn about the investment strategies, structures, and regulatory frameworks that govern AIFs, shaping the landscape of financial innovation. AIFs are redefining traditional investment norms, catering to investors seeking higher returns, lower correlation with conventional markets, and enhanced wealth management solutions.

Join us as we demystify the potential of AIFs and how they can be leveraged to optimize your investment strategies, opening doors to new opportunities in the ever-evolving world of finance.

#AIFs#AlternativeInvestments#PortfolioDiversification#InvestmentStrategies#WealthManagement#FinancialInnovation

0 notes

Text

Safe Investment: Unveiling the Reasons for Purchasing Silver Coins

For a very long time, people have recognized the value of silver as a means of wealth preservation. Due to their portability, liquidity, and resistance to inflation, silver coins are a beloved investment option. They provide capital returns and growth. Due to the scarcity of limited editions, silver coins are excellent investments for both amateurs and experts. Plus, they're physically present, which is reassuring. The value of culturally significant coin collections has risen due to the widespread use of silver in trade throughout human history. Silver stock prices will likely keep going up, according to numismatic experts, because of fundamental difficulties. There are several good reasons why you should buy silver coins. Silver coins, with their inherent value, provide a sense of stability and security in an unpredictable economic world. Let’s discuss the benefits of investing in silver coins in more detail.

Diversification

A mixed-asset portfolio can benefit from silver's hedging and balancing qualities, thanks to the precious metal's reputation as a safe haven. With an allocation of silver, an investor can potentially diversify their portfolio risk, allowing them to raise their risk appetite in other asset classes. The recent global recession has put traditional paper assets at risk, so owning actual silver in the shape of coins or bars is an extra layer of protection.

Silver is a Hard Asset

In a world where paper earnings, digital trade, and currency production are commonplace, actual silver stands out as one of the rare assets that can be carried in your pocket, even between countries. And it can remain completely discreet, if that is what you prefer. If you buy silver coins, it is another powerful defense against cybercrime and hacking. A silver coin is impervious to erasure, whereas a digital asset is equally susceptible.

Protection Against Inflation

In times of economic instability and inflation, silver, like most physical commodities, can serve as a shelter. Silver coins can be a good inflation hedge, meaning that even if the value of fiat money, equities, and bonds decreases, your silver coins and bars will gain in value.

Offer Higher Returns

Compared to gold, silver is far more inexpensive, yet it yields greater returns. When silver prices start to go up, you can anticipate a bigger percentage gain. When it comes to short-term speculative investments, silver has historically performed better than gold during bull runs. One strategy for investors is to hold a higher percentage of silver and a lower percentage of gold.

Control

You can protect some of your wealth from the many counterparty risks faced by banks by purchasing silver in the form of coins or bars. This is one of silver's benefits that a lot of investors fail to see.

The Takeaway

Value, collectability, liquidity, performance history, and portfolio diversification are just a few of the reasons why the silver coin is an outstanding investment. These coins offer unfaltering stability in the ever-changing financial world, making them ideal for anyone seeking to protect funds or increase their investment opportunities. Before moving forward with any investment choices, you should do your research and talk to professionals like Global Gold Investments. Due to their combined 25 years of expertise in the gold and commodities markets, many investors have put their faith in Global Gold Investments members to buy silver coins. Even if you want to sell silver coins in Beverly Hills, CA, you can contact Global Gold Investments.

0 notes

Text

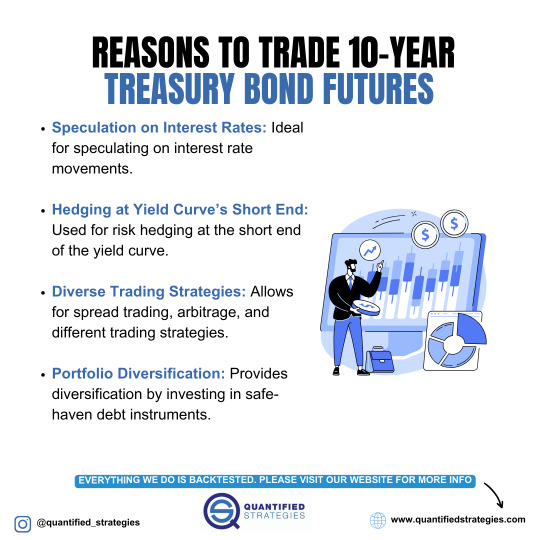

REASONS TO TRADE 10-YEAR TREASURY BOND FUTURES

Trading 10-Year Treasury Bond Futures offers opportunities for speculating on interest rate movements and hedging risks at the short end of the yield curve. With diverse trading strategies like spread trading and arbitrage, it facilitates portfolio diversification through safe-haven debt instruments.

0 notes

Text

10 Strategies for Diversifying Your Investments: Reducing Risk and Maximizing Returns

Investing is a key component of wealth building, but it comes with risks. Diversifying your investments is essential for reducing risk and maximizing returns. By spreading your investments across different asset classes, regions, sectors, and investment styles, you can create a well-rounded portfolio that can weather market fluctuations. In this article, we will explore ten strategies for diversifying your investments, along with real-life examples and practical tips.

Unlock the Secrets of Forex Trading: Discover a Free, Yet Powerful Learning Course at ForexFinanceTips.com

Understanding Diversification

Diversification is the practice of spreading your investments across a variety of assets. It helps reduce the impact of a single investment's performance on your overall portfolio. For instance, if you put all your money into a single stock and it performs poorly, you risk losing a significant portion of your investment. However, by diversifying, you can mitigate that risk.

Assessing Your Current Investment Portfolio

Before implementing any diversification strategies, it's crucial to evaluate your current investment mix. Look at your existing holdings and analyze their performance. Identify any concentration risks or imbalances in your portfolio. For example, if you have a majority of your investments in one industry, such as technology, you might be exposed to sector-specific risks.

Learn Python Coding and Django Web Development, 100% Course, Easy to navigate and complete learning road map at dtlpl.com

10 Strategies for Diversifying Your Investments

- Strategy 1: Asset Allocation One of the fundamental strategies for diversification is asset allocation. This involves dividing your investments among different asset classes, such as stocks, bonds, and cash equivalents. The goal is to create a balanced portfolio that aligns with your risk tolerance and financial goals. For instance, if you have a higher risk tolerance, you may allocate a larger percentage to stocks.

- Strategy 2: Geographic Diversification Geographic diversification involves investing in different countries and regions. By spreading your investments globally, you can reduce the impact of local economic conditions or geopolitical risks. For example, if you have a significant portion of your investments in the US, consider diversifying into international markets, such as Europe or Asia.

- Strategy 3: Sector Diversification Diversifying across sectors is another critical strategy. Different industries perform differently based on market conditions. By investing in a mix of sectors such as technology, healthcare, and consumer goods, you can spread your risk and potentially capture gains in various sectors.

- Strategy 4: Investment Styles and Strategies Exploring different investment styles, such as value investing or growth investing, can further diversify your portfolio. Value investing focuses on finding undervalued stocks, while growth investing aims to identify companies with high growth potential. By combining these approaches, you can capture opportunities in both value and growth stocks.

- Strategy 5: Company Size Diversification Investing in companies of different market capitalizations (large-cap, mid-cap, and small-cap) is another way to diversify. Large-cap companies tend to be more stable, while small-cap companies may offer higher growth potential. By diversifying across different company sizes, you can balance risk and potential returns.

- Strategy 6: Investment Vehicles Diversifying through various investment vehicles adds another layer of diversification. Consider investing in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs). Each investment vehicle has its own risk and return characteristics, allowing you to tailor your portfolio to your preferences.

- Strategy 7: Alternative Investments Alternative investments, such as real estate, commodities, or cryptocurrencies, offer additional diversification opportunities. These assets often have a low correlation with traditional stocks and bonds, providing a hedge against market volatility. However, it's essential to understand the unique risks associated with each alternative investment.

- Strategy 8: Risk Management Techniques Implementing risk management techniques is vital for protecting your investments. Strategies like setting stop-loss orders, hedging with options, or diversifying within an investment through dollar-cost averaging can help manage risk while maintaining the potential for returns.

- Strategy 9: Regular Portfolio Rebalancing Regularly monitoring and rebalancing your portfolio is crucial for maintaining diversification. As investments perform differently over time, your asset allocation may shift. Rebalancing involves selling overperforming assets and buying underperforming ones to restore your desired asset allocation.

- Strategy 10: Professional Guidance Seeking advice from financial advisors or professionals can provide valuable insights into diversification strategies. They can help assess your financial goals, risk tolerance, and time horizon to create a personalized investment plan. Choose an advisor who aligns with your objectives and has a solid track record.

Case Studies and Examples: To illustrate the benefits of diversification, let's consider two investors: John and Lisa. John invests solely in the technology sector, while Lisa diversifies her investments across various sectors and geographies. When the technology sector experiences a downturn, John suffers significant losses. On the other hand, Lisa's diversified portfolio cushions the impact, as her investments in other sectors and regions continue to perform well.

If you have a Dog, Cat, Bird, or any Pet at home, The Most Informative Pet Blog NiceFarming.com

Frequently Asked Questions

Q1: How many different asset classes should I consider for diversification?

- The number of asset classes you should consider for diversification depends on your individual circumstances, risk tolerance, and investment goals. As a general guideline, a well-diversified portfolio typically includes a mix of at least three to five different asset classes, such as stocks, bonds, cash equivalents, real estate, and commodities. However, it's essential to assess your specific needs and consult with a financial advisor to determine the appropriate asset classes for your portfolio.

Q2: Can diversification eliminate all investment risks?

- While diversification is a powerful risk management strategy, it cannot completely eliminate all investment risks. Diversification helps spread risk across different assets, reducing the impact of a single investment's performance on your overall portfolio. However, it does not protect against systemic risks or market-wide downturns that affect all asset classes. It's important to understand that investing always carries some level of risk, and diversification is one tool to manage and minimize those risks.

Q3: Should I diversify equally across all asset classes?

- Diversification does not necessarily mean equal allocation across all asset classes. The optimal allocation will vary based on your financial goals, risk tolerance, and investment horizon. Each asset class carries its own risks and returns, and the allocation should be based on your investment strategy and preferences. For example, if you have a higher risk tolerance and seek long-term growth, you might allocate a larger percentage to stocks. It's crucial to find a balance that aligns with your individual circumstances and goals.

Remember, diversification is a personal strategy, and it's advisable to seek guidance from a qualified financial advisor who can assess your specific situation and help create a diversified investment plan tailored to your needs.

We hope these answers help clarify some common questions about diversification. If you have any further inquiries, please feel free to ask in the comments section below. We value your engagement and look forward to addressing any concerns you may have.

Conclusion

Diversifying your investments is a key strategy for reducing risk and maximizing returns. By implementing asset allocation, geographic diversification, sector diversification, and other strategies discussed in this article, you can create a well-balanced portfolio that can weather market volatility. Remember to regularly monitor and rebalance your portfolio to maintain diversification. Seek professional guidance if needed, as financial advisors can provide personalized advice based on your unique circumstances.

We hope this article has provided you with valuable insights into diversification strategies. If you have any questions or would like to share your experiences with diversifying investments, feel free to leave a comment below. Your feedback is greatly appreciated and can help foster a community of learning and sharing among fellow investors.

Read the full article

1 note

·

View note

Text

The Importance of Investing in Stocks

Stocks offer long-term growth and higher returns compared to other assets. They allow portfolio diversification, reducing risk and minimizing losses. As a shareholder, you participate in company success and benefit from dividends. Stocks also provide inflation protection and potential for higher returns.

TradeRepublic

Rich Dad Poor Dad

#LongTermGrowth#HigherReturns#PortfolioDiversification#RiskManagement#CompanySuccess#Dividends#InflationProtection#Investing#FinancialGrowth#WealthBuilding#FinancialIndependence#Stocks#InvestmentStrategy#AssetAllocation#FinancialSecurity#MarketPerformance#InvestmentOpportunity#FinancialFreedom#InvestmentGoals#StockMarket

0 notes

Text

Stock Trading Tips and Tricks for Beginners: Navigating the Market with Confidence

Stock Trading: A Comprehensive Guide to Help Beginners Navigate the Stock Market with Confidence.

By Amir Shayan

Stock trading can be an exciting and potentially lucrative venture, but it can also be overwhelming for beginners. With the right knowledge and strategies, you can navigate the market with confidence and increase your chances of success. In this article, we will share essential stock trading tips and tricks that every beginner should know. From understanding the basics of stock trading to developing a solid trading plan, we will cover key aspects that will help you on your trading journey.

- Educate Yourself:

The first and most important tip for beginners is to educate yourself about the stock market. Learn the terminology, study different investment strategies, and understand the factors that influence stock prices. There are numerous resources available, including books, online courses, and educational websites that can provide valuable insights into the world of stock trading.

- Set Clear Goals:

Before you start trading, it's crucial to set clear goals. What do you want to achieve through stock trading? Are you looking for short-term gains or long-term investments? Define your objectives and create a plan that aligns with your goals. This will help you stay focused and make informed decisions.

- Start with a Demo Account:

If you're new to stock trading, consider starting with a demo account. Many online brokers offer virtual trading platforms where you can practice trading without risking real money. This allows you to familiarize yourself with the trading platform, test different strategies, and gain experience before trading with real funds.

- Develop a Trading Plan:

A trading plan is a roadmap that outlines your approach to stock trading. It should include your trading goals, risk tolerance, entry and exit strategies, and money management rules. Having a well-defined plan will help you make disciplined and consistent trading decisions.

- Diversify Your Portfolio:

Diversification is a fundamental principle in stock trading. By spreading your investments across different stocks and sectors, you can reduce the risk associated with any single stock. This means that if one stock performs poorly, the impact on your overall portfolio will be minimized by the performance of other stocks.

- Manage Risk:

Risk management is crucial in stock trading. Set a stop-loss order to limit potential losses and always use proper position sizing. Never risk more than you can afford to lose, and be prepared for the possibility of losing money on some trades. Successful traders understand that losses are part of the game and focus on managing risk to protect their capital.

- Stay Informed:

Stay updated with the latest news and developments in the stock market. Keep track of earnings reports, economic indicators, and market trends that can impact stock prices. Subscribe to financial news platforms, follow reputable analysts and investors on social media, and join stock trading communities to gain valuable insights.

- Emotions and Discipline:

Emotions can cloud judgment and lead to poor trading decisions. Greed and fear are common emotions that can drive irrational behavior in the stock market. It's essential to remain disciplined and stick to your trading plan, even during volatile market conditions. Avoid impulsive decisions based on emotions and rely on thorough analysis and research.

- Learn from Mistakes:

Stock trading is a learning process, and mistakes are inevitable, especially for beginners. Instead of dwelling on losses, view them as learning opportunities. Analyze your trades, identify what went wrong, and make adjustments to your strategy. Continuous learning and improvement are key to long-term success in stock trading.

- Seek Professional Advice:

If you're unsure about certain aspects of stock trading, don't hesitate to seek professional advice. Financial advisors and experienced traders can provide valuable insights and guidance tailored to your specific needs and goals. However, always exercise caution and verify the credentials of any professional before taking their advice.

Conclusion:

Stock trading can be a rewarding endeavor when approached with the right knowledge and strategies. By following these stock trading tips and tricks for beginners, you can gain confidence and increase your chances of success in the market. Remember to educate yourself, set clear goals, develop a trading plan, manage risk, stay informed, and learn from your experiences. With time, practice, and a disciplined approach, you can navigate the stock market with confidence and achieve your financial goals.

Read the full article

#beginnertips#investmenttips#marketanalysis#portfoliodiversification#Riskmanagement#stockmarketeducation#stockmarketstrategies#stocktrading#tradingadvice#tradingforbeginners

0 notes

Text

Commercial NNN For Portfolio Diversification

Investing in different stocks and bonds is not really diversifying.

You’re just owning paper assets, but from different companies. These paper assets are still extremely susceptible to market fluctuations.

As a retired investor you will want to have your money invested in a more tangible asset.

Precious metals, exotic cars, collectible fashion items, artwork are a good way to diversify your portfolio and make yourself less volatile to market fluctuations.

Commercial Real Estate is another great choice for diversification, or maybe the best investment choice because you will have a property that appreciates over time, while getting solid, positive cash flow from rent.

The best thing is to buy a single-tenant commercial property and rent it out to a reliable tenant such as 7-11, Taco Bell, or any other store or restaurant brand.

Commercial Triple Net properties can be the smartest way of portfolio diversification.

0 notes

Text

Which Silver Coin Types Are Good for Investing?

Invest in collectible silver coins such as the American Silver Eagle, Silver Canadian Maple Leaf, Austrian Silver Philharmonic, Australian Silver Kangaroo, and Chinese Silver Panda to diversify your holdings and safeguard your investment. Seek advice from professionals such as Global Gold Investments for safe and informed investing decisions.

0 notes

Text

CRAFTING AN EFFECTIVE STRATEGY PORTFOLIO

Discover the significance of crafting an effective strategy portfolio in both long-term investing and short-term trading. Diversification goes beyond asset classes, emphasizing the importance of avoiding overlap and reduced performance when running multiple similar strategies in one market. The holy grail in trading lies in the accumulation and trading of diverse, well-structured strategies across various markets and instruments.

0 notes

Text

Is Over Diversification Good For Your Mutual Fund Portfolio? Know Here

My friends and I have been planning a trip to Goa, but it still is a castle in the air. Whenever we are close to finalizing it, something comes up and postpones our adventure.

One friend wants a luxurious trip, while the other one wants a budget trip. Two of them would like to take this trip in December and the others, in May. With such a contrast of opinions, consensus is nearly impossible.

Remember, “Too many cooks spoil the broth”. This old proverb holds true even today.

Same goes with your investments too.

One of the basics of investing is diversification.

And over diversification of your portfolio is unhealthy for wealth creation.

Let me tell you diversification of your portfolio across the asset classes and instruments is very important.

But diversifying in multiple schemes having a similar style and objective is definitely a mistake!

Investors look for the “best funds", “top funds”, “best performers”, and so on to make good returns.

As soon as someone knows I am research analyst, the first thing I am asked is, “Which is the best fund according to you”.

Or, “I recently invested Rs 1 lakh in XYZ mutual fund; do you think it is good?”

And then, it gets hard to explain to them this is not how you make smart, prudent investment decisions.

Also, not to mention the constant churning that followed, with one fund moving out and another entering in. This hectic pace of activity leaves investors with tons of schemes, most of them looking the same.

So what style of diversification is ok?

Diversify your risk across investment styles

While building a mutual fund portfolio, most investors do forget their basic objective of investing in mutual funds, i.e. long term wealth creation.

Begin with identifying your risk appetite as well as investment time horizon. Then accordingly, allocate your portfolio across asset classes and investment styles that will help you diversify your risk across market cycles and meet your long term goals.

Considering the investment universe and the investment styles followed by mutual funds, we have identified various category of mutual funds like diversified equity mutual funds focusing on various market caps (large cap, predominant large cap, mid cap, mid-small and micro cap, flexi cap) and styles (opportunities, value) also specialty funds like index, ELSS, or thematic funds focusing on specified sectors.

Other categories of funds are Aggressive Hybrid Funds, Conservative Hybrid, Balanced Advantage, Multi-asset allocation, Arbitrage, Equity savings. Under debt category - Income, Liquid, Floating, Gilt, Ultra Short-Term Funds, Money Market Funds, Corporate Bond Funds and so on.

You need not hold 5-10 schemes from each category; only 1 or 2 consistent schemes will facilitate long-term wealth creation.

Holding too many funds with a similar objective is a bad idea With too much diversification, you may overlook the risks and expenses. At times you may even do so to earn better returns.

For instance, many investors keep on adding star performers to their portfolio thinking that it will earn them extra returns. And while doing so they do not check the fund’s objective.

Investors forget that after every boom, there is a gloom; and these stars lose their shine.

Do remember that during a mid cap rally, all mid cap funds top the list and star rankings. Right after the downfall, these lag behind on the list and star rankings.

Moreover, you may not be lucky enough to add mid cap funds before the rally starts. You may have become heavy weight on them only when the mid cap rally is almost reaching exhaustion points. And then volatility starts knocking the doors of your portfolio.

This increases the risk of your portfolio, as the major portion of your portfolio constitutes of mid cap funds.

Remember, while mutual funds are attractive investments because of the exposure to a number of stocks in a single investment vehicle, holding too much of similar objective funds can be a bad idea.

Many investors have the erroneous view that risk is proportionately reduced with each additional scheme in their portfolio. Remember, you can only reduce your risk to a certain point after which there is no further benefit from diversification. Moreover, as the fund managers might be investing in same stocks or sectors, overlapping same underlying investments is possible. With multiple schemes having overlapping objective and investment style, you tend to increase the overall risk to your portfolio.

Once the underlying stocks or sectors start witnessing a dive, your over-diversification would not do any good to your portfolio.

Please note that every additional fund in your portfolio may add to the cost in terms of high expense ratio and multiple transaction cost.

And any bad pick in your portfolio can affect the performance of your overall portfolio.

As a result, there will be an increase in expenses, but a compromise on portfolio performance.

Don’t forget the time which you would spend monitoring the large number of mutual fund schemes and thus the paperwork involved, will be futile.

So, how many schemes should one hold?

Although there are number of mutual funds providing thousands of schemes to invest in, truly speaking, there is no magical number that is right which can help you build an optimal portfolio.

Just remember, you don’t need to have a dozen of schemes in your portfolio to diversify your risk. Even a single diversified equity fund can diversify your risk in “n” number of stocks or multiple sectors. Only thing is, they may not include the other styles on offer.

The magic lies in choosing the right fund (maximum 1 or 2 of each style) with a well established track record. Basically, the funds which stick to their investment mandate and are consistent performers.

Funds which are suitable for you as per your risk appetite and time horizon which help you meet your long term goals.

If you desire to build an ideal portfolio of mutual funds, here are some important points:

Primarily, look at holding funds that have different characteristics and behave differently

Try to limit the number of funds in your portfolio and feel comfortable with your holdings

Consider your investment objectives and goals.

If generating regular income is your primary goal, then mid cap or sector fund may not be suitable to your portfolio; while if your objective is capital preservation, equity funds will not suit you.

Portfolio rebalancing is the key

The higher number of schemes you hold – more complicated your portfolio becomes.

Often people don’t know what to do with their mutual fund portfolio and how to rebalance them. Simply because they are unsure of what their actual holdings represent.

Hence, consider this:

If you hold an existing portfolio, then it is advisable to study and compare the category and the underlying investments in your portfolio.

If you find significant overlapping of similar stocks or sectors, then it makes sense to eliminate some of those funds from your portfolio.

If any of the funds do not match your investment goals or have a similar mandate (say 3-4 large cap funds and 2-3 mid cap funds), it makes sense to exit and invest in a single fund having a more consistent track record in their respective category.

Having a well-diversified portfolio is good but having it in the right quantity is more important. So, periodically review and rebalance your portfolio to eliminate overlapping and create wealth in the long term.

You need to take charge of your investments and avoid over diversification.

Remember, “Too much of anything is good for nothing!”

If you are confused about the health of your mutual portfolio, the investment strategy, your own risk profile, and your asset allocation; do contact your investment adviser or investment counsellor to help you.

PersonalFN can get you best results powered by its ethical and unbiased investment advisers who will comprehensively review your mutual fund portfolio.

Opt for PersonalFN's Mutual Fund Portfolio Review service to check how healthy your portfolio is and get Buy / Sell / Hold recommendations on your existing portfolio, keeping in mind your investment objectives and financial goals. Act now!

Share your queries and thoughts with us via email at [email protected].

Happy Investing!

Rajani Vyas

This post on " Is Over Diversification Good For Your Mutual Fund Portfolio? Know Here " appeared first on "PersonalFN"

#Diversification#Portfoliodiversification#diversifiedportfolio#diversifiedinvestmentportfolio#MutualFundPortfolio

0 notes

Text

Trade Secrets: Strategies for Success in the Financial Market

Unveiling the Proven Strategies and Techniques to Achieve Success in the Financial Market

By Amir Shayan

The financial market is a dynamic and complex ecosystem that offers numerous opportunities for individuals to grow their wealth. However, navigating this landscape can be challenging, especially for beginners. To thrive in the financial market, one needs to understand the intricacies of trading, develop effective strategies, and stay updated with market trends. In this article, we will unveil some trade secrets that can help you achieve success in the financial market. Whether you are a novice investor or an experienced trader looking to enhance your skills, these strategies will provide valuable insights and tips to improve your trading game.

- Set Clear Goals and Define Your Risk Appetite

Before diving into the financial market, it's essential to set clear goals and define your risk appetite. Determine what you want to achieve through trading and establish realistic expectations. Are you looking for short-term gains or long-term investments? Are you comfortable with high-risk ventures or do you prefer safer options? Answering these questions will help you align your trading strategy with your goals and risk tolerance.

- Educate Yourself and Stay Informed

Education is key to success in the financial market. Take the time to learn about different investment instruments, trading strategies, and market dynamics. Familiarize yourself with financial concepts such as fundamental and technical analysis, risk management, and market indicators. There are various educational resources available, including books, online courses, and seminars, that can provide valuable insights and help you make informed trading decisions.

Additionally, stay updated with the latest news and trends in the financial market. Subscribe to reputable financial publications, follow influential traders and analysts on social media, and regularly review financial news websites. This knowledge will enable you to identify opportunities and make timely trading decisions based on current market conditions.

- Develop a Solid Trading Plan

A trading plan is your roadmap to success in the financial market. It outlines your trading objectives, entry and exit strategies, risk management techniques, and the timeframe for achieving your goals. A well-defined trading plan helps you maintain discipline, avoid impulsive decisions, and stay focused on your long-term strategy. Test your trading plan in a demo account or with small positions initially to assess its effectiveness and make necessary adjustments before committing significant capital.

- Implement Risk Management Strategies

Managing risk is crucial in the financial market. It's important to protect your capital and minimize potential losses. One effective risk management strategy is to diversify your portfolio. By investing in a variety of assets across different sectors and regions, you can spread the risk and reduce the impact of individual investment fluctuations. Set stop-loss orders to automatically sell a position if it reaches a predetermined price, limiting potential losses.

Additionally, determine the appropriate position size for each trade based on your risk tolerance and the specific characteristics of the investment. Never risk more than you can afford to lose. Implementing proper risk management strategies will help you navigate market volatility and protect your investment capital.

- Use Fundamental and Technical Analysis

Fundamental and technical analysis are two essential tools in the trader's toolkit. Fundamental analysis involves evaluating the financial health, performance, and prospects of a company or asset. It considers factors such as earnings, revenue, industry trends, and macroeconomic indicators to assess the intrinsic value of an investment.

Technical analysis, on the other hand, focuses on studying price patterns, trends, and market psychology using charts and statistical indicators. It helps identify potential entry and exit points based on historical price movements. By combining both fundamental and technical analysis, you can make more informed trading decisions and increase your chances of success.

- Embrace Technology and Automation

In today's digital age, technology plays a vital role in the financial market. Embrace technological advancements and leverage tools and platforms that can enhance your trading experience. Automated trading systems, such as algorithmic trading or trading bots, can execute trades based on pre-defined criteria and eliminate emotional biases. These tools can help you capitalize on market opportunities and react quickly to changing conditions.

Additionally, utilize online trading platforms that provide real-time market data, advanced charting capabilities, and order execution functionality. These platforms empower you to make faster and more informed trading decisions.

- Learn from Mistakes and Adapt

Trading in the financial market is a continuous learning process. It's inevitable to make mistakes along the way, but it's crucial to view them as learning opportunities. Analyze your trading history, identify patterns of success and failure, and learn from your mistakes. Keep a trading journal to record your trades, rationale behind each decision, and the outcome. This journal will help you track your progress, refine your strategies, and improve your trading performance over time.

Furthermore, be adaptable and open to change. The financial market is constantly evolving, and strategies that worked in the past may not be effective in the future. Stay curious, explore new trading techniques, and adapt your approach as market conditions change.

Conclusion

Success in the financial market requires knowledge, discipline, and a well-defined strategy. By setting clear goals, educating yourself, developing a trading plan, implementing risk management strategies, utilizing analysis techniques, embracing technology, and learning from mistakes, you can enhance your trading skills and increase your chances of success.

Remember that trading involves risks, and there are no guarantees of profits. It's important to stay patient, stay focused on your long-term objectives, and continuously refine your skills. With dedication, perseverance, and the right strategies, you can unlock the potential for success in the financial market and achieve your financial goals.

Trade wisely, stay informed, and may your journey in the financial market be filled with growth and prosperity.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Trading in the financial market involves risks, and individuals should seek professional guidance and conduct thorough research before making any investment decisions.

Read the full article

#FinancialMarket#investmenttips#marketanalysis#markettrends#portfoliodiversification#Riskmanagement#technologyinfinance#tradingplan#tradingstrategies#WealthCreation

0 notes