#pricegouging

Link

Kennedy’s Running Mate Nicole Shanahan Blasts Kamala Harris, Praises Trump

RFK Jr.’s running mate Nicole Shanahan has issued a blistering rebuke of the Democrats and the party presidential nominee Kamala Harris

#nicole shanahan#nicoleshanahan#PraisesTrump#donald trump#donaldtrump#trump 2024#trump2024#kamala harris#kamalaharris#price gouging#pricegouging#price controls#pricecontrol#democrats#communism

27 notes

·

View notes

Text

An open letter to the U.S. Congress

Pass the Price Gouging Prevention Act (S. 3803 / H.R. 7390

1,047 so far! Help us get to 2,000 signers!

Of all the responses to the economic upheavals of the pandemic, price gouging has got to be one of the most egregious. This is when prices go up, or continue to stay high, not due to market pressures or other economic factors, but only because the seller, renter, or provider wants to increase their already excessive profits.

Some CEOs have even bragged to their shareholders about how much their profit-making pricing strategies exceed their inflationary increases in production costs.

To fight back against what they call “greedflation,” Senator Elizabeth Warren and Rep. Jan Schakowsky have reintroduced their Price Gouging Prevention Act (S. 3803 / H.R. 7390) and are now seeking co-sponsors for the bills.

As your constituent, I would like to urge you to co-sponsor and pass this bill. It has several important features: It will prohibit price gouging on a nationwide basis; it will take aim at companies that have taken advantage of the pandemic to jack up prices unnecessarily and keep them up; it will focus on companies whose executives brag to shareholders about increasing prices faster than inflationary costs; it will require public disclosure of companies’ costs and pricing strategies, and it will increase the FTC’s funding to enforce these conditions.

Thank you for considering co-sponsoring the Price Gouging Prevention Act.

▶ Created on March 20 by Jess Craven · 847 signers in the past 7 days

📱 Text SIGN PBVLCW to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PBVLCW#resistbot#open letter#petition#PriceGouging#ConsumerProtection#EconomicJustice#CorporateGreed#Legislation#USCongress#ElizabethWarren#JanSchakowsky#S3803#HR7390#CoSponsor#PassTheBill#FTC#Enforcement#PublicDisclosure#MarketRegulation#FairPricing#PandemicResponse#AntiGouging#PublicInterest#PoliticalAction#GovernmentPolicy#EconomicPolicy#FairMarket#Accountability

10 notes

·

View notes

Photo

Yall really embracing the role of real-life Peasants & Serfs within Beyonce's imaginary Queendom.👑 #PriceGouging 🎟 #ClassCon #ClassEnemy #BlackCapitalist #BlackBourgeoisie #ClassConciousness #ClassWar (at Chicago, Illinois) https://www.instagram.com/p/CoaO5cVOcoW/?igshid=NGJjMDIxMWI=

2 notes

·

View notes

Text

A Much Deeper Problem Facing Our Economy

Productivity in Australia has been on a downward trend for decades. The latest moribund GDP figures for this quarter are not anything particularly new. Yes, interest rates are hurting the economy, as they are supposed to be according to monetary policy in the Reserve Bank’s inflation beating crusade. The greater diminishing productivity trend is, however, an indication of a much deeper problem facing our economy. Successive governments have overseen the concentration of ownership in nearly all of our business sectors. Duopolies have replaced any real competition in our markets and this damages productivity. Capitalism works optimally when there is competition between businesses operating within sectors of the market. These corporate giants have circumvented this by gobbling up their competition via take overs and mergers. The ACCC and ASIC have been asleep at the wheel in preventing the overconcentration of corporate power in Australia.

Figure 4 Impact of lower productivity growth on real GDP growth (annual percentage change)

Source: Treasury, (Canberra: Treasury, June 2021), 53. https://www.aph.gov.au/About_Parliament/Parliamentary_departments/Parliamentary_Library/pubs/BriefingBook47p/AustraliasProductivitySlowdown#:~:text=UsingproductivitycyclesFigure3,throughtotheearly2000s.

Australia’s Non Competitive Domestic Markets

Australia has become a rentier economy, where these duopolies charge their clients fees, subscriptions, and rents rather than being dependent upon productivity growth for their profits. Consumers and B2B clients are billed ‘user pays’ via charges, leases and fees under this economic model. The absence of any real competition within these sectors means innovation and productivity are not being driven by market forces. Similarly, these big companies control the employment market within their sphere’s of influence because they are the only employer in town. Wage growth has been largely stagnant due to this factor for decades in Australia. Yes, there has been some growth in wages over the last couple of years in response to the hikes in cost of living following high inflation. However, it has not kept pace in this regard and real wages have fallen in terms of their buying power within the economy.

Australian Banks Make Record Profits & The Scamming Of Customers Goes On

Governments Have Failed Our Economy

Our governments have not tackled the over concentration of corporate power within the economy. The agencies tasked with protecting competition are toothless tigers. Underfunded and staffed by people in thrall to the business world via future job opportunities, they have been ineffective in doing what their agency was set up to do. There seem to be no consequences for these failures and white collar collusion thrives downunder. Whilst our political parties take campaign donations from corporate sources and allow the free movement of civil servants/politicians from the public to the private sector things will not improve in this regard. The disinterest within the Australian community to endemic corruption like this will see it continue to the detriment of the economy and our lives.

The NACC does a better job than the invisible man at keeping a low profile and so far has done bugger all to address long standing scams within our political and governance systems.

Economists and central banks harp on about the importance of productivity to the economy but little has been said or done about the lack of competition within Australia. These folk have been wilfully blind to the effects of this overconcentration of corporate power within our business sectors for too long. Nobody has stood up to the banks and the big end of town during the decades of mergers and acquisitions. Rather, they have been cheerleaders toasting their success and increased size in the corporate quest for ever more market share. The neoliberal dance has been a conga line of CEO and shareholder aggrandisement sashaying its way across our economy. We now live in a world where consumers are struggling in a cost of living crisis, which shows no sign of abating any time soon. Duopolies can price set because there is no real competition for consumers to choose from. Consumers have lost all their market power in the manipulated version of capitalism currently operating in Australia. This is all economics 101 but our timid governments in thrall to zombie neoliberalism show little sign of doing something about it. You can have all the reviews in the world but if you don’t actually do something nothing changes. Unfortunately, our 21C politicians live in a talk fest alternative universe where empty words are their only currency, it seems.

“The ACCC welcomes today’s announcement by the Australian Government that it will direct the ACCC to conduct an inquiry into Australia’s supermarket sector, including the pricing practices of the supermarkets and the relationship between wholesale, including farmgate, and retail prices. The year-long inquiry will also examine competition in the supermarket sector and how it has changed since the ACCC’s last inquiry in 2008.”

(https://www.accc.gov.au/media-release/accc-to-examine-prices-and-competition-in-supermarket-sector)

We have already had several reviews into the fact that Coles and Woolies control 65% of the market share within the grocery sector. Australian governments love to be seen to be considering doing something without actually doing anything – it happens throughout their remit. Not wanting to offend a vested interest is no way to govern if you are fair dinkum about enacting real change for the better.

Photo by Pixabay on Pexels.com

Money Laundering Via International Investments In Property

In Australia, we have been waiting for 17 years for the loopholes to be closed to international money launderers in the property market. Despots and organised crime have been investing in Australian property for decades and Aussie middlemen have been growing fat on the fees they charge to facilitate such investments. Real estate agents, accountants and lawyers do not want any tightening up in this regard for obvious reasons. Successive governments have been faffing about in this space and dragging the chain.

White collar collusion is thick on the ground downunder and nobody ever gets busted. This illicit investment pushes up property prices in the capital city markets around the nation.

Poor Productivity A Symptom Of Tainted Markets

We have a much deeper problem facing our economy long term and that is a downward trend in productivity over decades. Businesses have gamed the system and are scamming ordinary Australians. The lack of competition in our markets is hurting productivity and price gouging to the detriment of consumers more generally. Our central bank is too embedded with big business to call this out. Our governments are too afraid of hurting vested interests. Our corporate watchdogs are, in practice, owned and fed by the very corporations they are supposed to be policing. It is a bad puppet show really with the ACCC and ASIC going through the motions like a kabuki performance with no real substance.

It is time for some action on this score but we wont get it until the political party donations and job offering carrots are banned. Corporate power needs to be tackled by a government committed to cleaning up the rigged game.

Robert Sudha Hamilton is the author of America Matters: Pre-apocalyptic Posts & Essays in the Shadow of Trump.

©WordsForWeb

Read the full article

#Australia#competition#corporatepower#duopoly#economics#GDP#government#marketconcentration#power#pricegouging#productivity

0 notes

Link

Don't do it. Clean up is a nightmare and you can't get your old place back.

0 notes

Text

Supermarket Giants Coles and Woolworths Accused of Price Gouging: What You Need to Know

#Australiansupermarket #Coles #grocerymarket #pricegouging #Woolworths

0 notes

Text

Egg Suppliers Ordered to Pay $17.7M for Inflated Prices: Fair Competition Laws Prevail!

#anticompetitivebehavior #eggsuppliers #faircompetitionlaws #inflatedeggprices #pricegouging

0 notes

Photo

#Pfizer #prescriptiondrugs #MitchMcConnell #MoscowMitch #pricegouging #briberyworks https://www.instagram.com/p/CnehNEruZPc/?igshid=NGJjMDIxMWI=

0 notes

Photo

#youtube #youtubeissues #youtubeprice #youtubeovercharge #beingovercharged #pricegouging #overpriced #gouging #noresponse #pricehike #pricechange #overcharged #shithappens #notright (at Dania Beach, Florida) https://www.instagram.com/p/ClqgQtaOx-x/?igshid=NGJjMDIxMWI=

#youtube#youtubeissues#youtubeprice#youtubeovercharge#beingovercharged#pricegouging#overpriced#gouging#noresponse#pricehike#pricechange#overcharged#shithappens#notright

0 notes

Photo

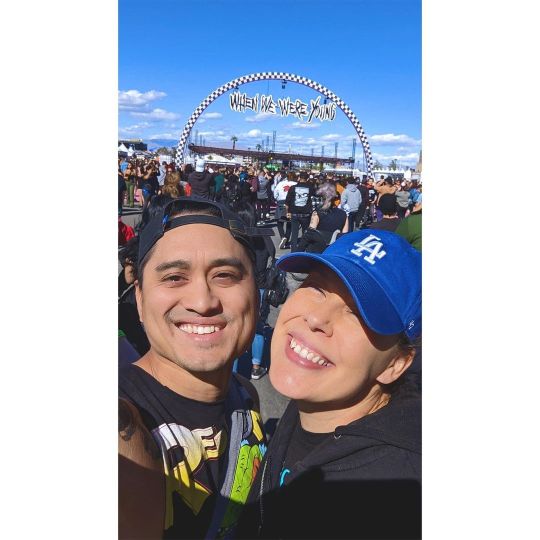

@whenwewereyoungfest, you were worth all the trauma & drama. 🖤🖤 . . . . #WhenWeWereYoung #WWWY #MyFirstFestival #Emo #EmoKids #EmosNotDead #LasVegasFestivalGrounds #LasVegas #LV #MomAndDads1stGetAway #StubHub #PriceGouging (at Las Vegas, Nevada) https://www.instagram.com/p/CkOyQnFywvI/?igshid=NGJjMDIxMWI=

#whenwewereyoung#wwwy#myfirstfestival#emo#emokids#emosnotdead#lasvegasfestivalgrounds#lasvegas#lv#momanddads1stgetaway#stubhub#pricegouging

0 notes

Photo

then #petrolprices tho... #petrol #gas #gasprices #fuel @chevron #chevron #gouge #pricegouging #thecity #sf #SanFrancisco #bayarea #norcal #cali #California #bidenflation #gaslighting (at 525 harrison St. San Francisco) https://www.instagram.com/p/CjQnaZmptoN/?igshid=NGJjMDIxMWI=

#petrolprices#petrol#gas#gasprices#fuel#chevron#gouge#pricegouging#thecity#sf#sanfrancisco#bayarea#norcal#cali#california#bidenflation#gaslighting

1 note

·

View note

Note

Thinking about the Predator movies which has me thinking about serial killer!141 but they hunt by a code similar to the Yautja

I do not need more fic ideas while I have this many wips but I just can’t help myself😭

-🫀

Sorry saw yautja and 141 in the same paragraph and blacked out when I realized soap would still have his mohawk

But yeah regular ppl serial killers cool too. I think they'd either go all Dexter, or Price would select servicemen targets based on how deadly they are, if they got away from him somehow, or if they got his tea wrong

#we are being SO NICE to goji pricegouge because they are NOT a digital artist#and they did this in twenty minutes while sitting in a waiting room okay?#in other news this blog has been and will continue to be run mostly on the queue for a hot minute#will be back to regularly scheduled programming in a few days hopefully#asks#🫀 anon#predator au

16 notes

·

View notes

Note

I just want you to know that I saw long legs earlier and at one point, the price is right (the game show) was playing on a TV and my partner turned to me and was like "price is right," *nudge* as a very astute observation. However, because I have been Pavlov'd in part by your price tag, my brain misfired and I immediately started scouring the scene for an extremely out of place man.

Anyway, minor spoilers for long legs: there are is unfortunately no John Price in the film trust me, I looked :(

-pricegouge

hey! oh i am giggling at that and grinning like a gremlin.

spoil all you want, despite the stuff i share, i am actually a HUGE WUSS when it comes to scary movies! i have no plans to see it.

now. if barry was cast in a horror movie, i'd reconsider. 👀

a quick shop job for you:

13 notes

·

View notes

Text

The Financialization Of Essentials

During a cost of living crisis, which many in the world are now experiencing, it is easier to get in touch with the essentials necessary for living. Food, shelter, and energy are the essential ingredients for survival in our modern worlds. The financialization of essentials by capitalism is proving to be at cross purposes for those trying to survive in a cost of living crisis. What do I mean by this? The march toward a consumer society has meant that all these basic requirements of life are things you have to buy. Few of us go out and dig up or hunt for our food these days. Putting a roof over our head is an expensive purchase in the 21C. Plus, all of our devices and vehicles run on forms of energy which we have to buy. Neoliberalism promised to make things easier and cheaper for all in this regard but has manifestly failed to do so. We were told that if governments got out of the way and let private enterprise do what it’s best at we would all be much better off. Thirty years of this, ‘the market knows best’ ethos, has placed at least a third of working Australians in dire straits when it comes to affording the basics of life. Neoliberal economic policies have failed us in every essential market.

Photo by Michael Burrows on Pexels.com

Food Prices In An Uncompetitive Grocery Sector Downunder

Let us begin with food. Australia has a celebrated duopoly in our grocery sector. Coles and Woolworths control some 65% of this market, which means most Aussies are buying their food from these two supermarket companies at their many stores around the nation. Prices have gone up, up, and up over the last 2 years in every category. High inflation globally has been the major cause of this, apparently. Shopping trolleys half full of food and groceries now cost hundreds of dollars at the checkout. Australia has no price controls, rather it leaves it to what the free market consumers are prepared to pay. However, in economics it is understood that if suppliers have a monopoly or duopoly, which means there is little or no competition in supplying that market, they can then set the price and the consumer just has to pay it. The power in that transactional relationship has shifted to the seller away from the buyer. Competition is an integral part of a functioning free market system. If most economists and people with a basic understanding of how free market economies work know this, why have we ended up with a non-competitive food and grocery sector in Australia?

The Free Market Economy Rigged In Favour Of Big Businesses

Power imbalances and louder voices closer to governments and decision makers within the system, is the simple answer. The supermarket sector is not the only non-competitive market we have in Australia. Oh no, it is, in fact, a common theme running through all of our markets and sectors. This is despite the fact that we have had something called the ACCC, the Australian Competition & Consumer Commission, specifically created to enforce and maintain competition in our business sectors. Complete and utter failure could be words employed to describe their efforts over the last 30 years. In all fairness to those appointed to run this agency it has been undermined and underfunded by successive governments in thrall to powerful business interests. It is but another toothless tiger amid many in the regulatory sphere in Australia. We like to establish such bodies and give them high falutin titles but ensure that they have no real power. This is the underhand card trick performed by those in government who want to be seen to be doing something without upsetting the established status quo. In reality, the big end of town, Corporate Australia, goes about its merry way merging and acquiring its competition to make ever more money for its investors. Coles in its latest half yearly profit is delivering 30% ROI and generating billions along the way.

“The ACTU calls on Coles to reduce its prices following today's announcement of its half-yearly profit of $594 million. The profits generated on items increased, with underlying gross margins up by 7bps to 26.6% and its EBIT margins up since pre-pandemic.”

- (https://www.actu.org.au/media-release/coles-should-drop-prices-after-594m-half-year-profit/#:~:text=TheACTUcallsonColes,marginsupsinceprepandemic.)

Photo by Pixabay on Pexels.com

Canada Has The Same Concentration Of Market Share In Grocery Sector

Canada has exactly the same problem with an oligopoly of 3 giant supermarket chains controlling their grocery sector. This should not be a surprise because corporations regularly look beyond national borders for CEOs and growth strategies. The real issue is that the unregulated market does not look after everybody, especially when it comes to dealing with the essentials of life. Food is not just another product to be treated as an economic unit. If companies, like supermarket chains, become so dominant within their sector they have moral responsibilities beyond delivering ROIs for their shareholders. If they do not realise this themselves, then, governments have to step in. In Australia, we have some 6 official enquiries into this sector, due to what is happening in terms of ordinary citizens not being able to afford to buy food and groceries. However, what will these reviews be able to do? Will they just be more talk fests or can they actually effect positive change? We will have to wait and see.

Is Housing Primarily About Shelter Or Wealth Creation In Australia?

Shelter or housing is another essential of life and it is big business in Australia and Canada. Again, both countries are in the midst of housing rental crises. Again, the market did not take care of business in terms of providing enough low cost housing for the denizens of each nation. Governments stopped building social housing a couple of decades back and let the market do its stuff. Of course, the market was primarily interested in high returns from high cost housing and apartments. In fact, they were rapidly converting existing low cost housing into high cost housing. The market wasn’t interested in the group of people who required budget accommodation to fit their socioeconomic needs. Now, we have a real crisis on our hands with poor people and families living in tents on the fringes of cities here in Australia. Downunder we have a well patronised governmental blame game, where state governments and the federal government each blame the other for not fulfilling their responsibilities to the people. This has been going for decades and probably centuries. It is easy to be cynical about such things but the bitter truth is that another essential of life, another basic, is not being delivered by those in charge of the ship. Why is this happening?

Photo by Josh Hild on Pexels.com

Finance & Business Concerns Driving The Bus

Governments listening to those solely motivated by making large amounts of money. Business people, often, go around thinking and acting as if their pursuits are the only really important thing in the world. We live in a capitalist free market economy and business turns the wheels that make everything work, according to many with an MBA. In actual fact, there are other considerations which need to be factored in to make a modern society function optimally. Economics has ruled the roost over the last 50 years to the detriment of other considerations. The neoliberal economic approach has had the ear of governments across the globe for much of that time. Prior to the 1970s and 1980s governments used to think that they had a moral duty to look after the poor and those unable to look after themselves. A shift happened, which came from the Rand organization during the JFK administration in the United States. Economic studies became the preferred way of looking at everything governments had to do. Everything had a dollar value and this slowly began to change the way we thought about helping others and seeing the world. This economic filter promised to provide dispassionate scientific truth rather than assumptions built on sentiment. In actual fact, economics is not a real science, no matter how hard economists wish it be otherwise, and it is predicated on plenty of assumptions of its own. The upshot of this is that economics became the lingua franca and didn’t the commercial world love that – now you’re talking my language! The financialization of essentials has occurred at pace over the last few decades.

Photo by Binyamin Mellish on Pexels.com

Property Price Inflation- Yeah We Love That!

What is housing primarily for? Ask yourself this. In Australia, the property market has been out of control since former PM John Howard delivered the capital gains tax discount on the family home. Inflation in this sector has been running hot ever since at around 325% over the last 30 years. However, we don’t call it that when it comes to the property market. No, everybody wants the value of their property to go up, up and further up. Buying a house now costs near on average of a million dollars. My parents bought a house in an average suburb in Perth for $30k in the late 1970s and this same house with little done to it but a few licks of paint sold for just under that million mark 4 years ago. Many young home buyers can no longer afford the deposit to get a home loan from our heavily concentrated banking sector. The big 4 banks, they call them, have swallowed up all their competition. Indeed, ANZ knocked back by the ACCC initially, was just granted permission by a court to swallow Suncorp, one of the very few remaining smaller banks. It is hard to justify this decision in the highly concentrated Australian banking sector if anyone in charge was really serious about valuing competition. Is housing primarily about providing shelter or is that an outmoded idea in this day and age? Housing is the biggest financial element within the domestic Australian economy –

“The total value of residential dwellings in Australia rose by $261.0 billion to $10,267.4 billion this quarter.”

- (https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/total-value-dwellings/latest-release)

Photo by David Peterson on Pexels.com

Providing shelter from the storm for poor people and those in need seems a puny consideration amid such a large number of dollars in value for homes in Australia. It is like the game of life is a board game, but with real money, Monopoly, perhaps? A third of the nation already own at least one residential property and many within that cohort own multiple houses. Our members of parliament, in the majority, are home owners and many of them are landlords too. It seems to me that if you did not realise that you were supposed to be playing this board game you are now at a distinct disadvantage economically. Some pundits talk of a 2 speed economy in Australia, where the crucial divide is predicated on property ownership.

This divide between rich and poor has accelerated immensely since the Howard capital gains tax discount effect came in to play. Alan Kohler, the ABC financial journalist penned an excellent essay on this topic just recently.

“High-priced houses do not create wealth; they redistribute it. And the level of housing wealth is both meaningless and destructive. It’s meaningless because we can’t use the wealth to buy anything else – a yacht or a fast car. We can only buy other expensive houses: sell your house and you have to buy another one, cheaper if you’re downsizing, more expensive if you’re still growing a family. At the end of your life, your children get to use your housing wealth for their own housing, except we’re all living so much longer these days it’s usually too late to be useful. And much of this housing wealth is concentrated in Sydney, where the median house value is $1.1 million, double that of Perth and regional Australia.”

- (https://www.quarterlyessay.com.au/essay/2023/11/the-great-divide/extract)

Photo by Monstera Production on Pexels.com

Banking Oligopoly In Australia So Profitable

Our banks in Australia are among the most profitable in the world. The big 4 regularly make profits in the tens of billions of dollars. Large parts of this are down to lending money on home loans for investors. The financialization of shelter is an exceedingly profitable business in Australia.

“AUSTRALIA - A record breaking year for Australia’s major banks saw cash earnings soar to an unprecedented $32.5bn, eclipsing the record last set in 2017 ($31.2bn). This was due to the combination of healthy balance sheet growth and Net Interest Margin (NIM) uplift, with net interest income rising by a never-before-seen $9bn. As notable expenses continue to fall, the result could have been higher, if it weren’t for normalising levels of credit expense and inflationary impacts on costs. “

- (https://www.pwc.com.au/media/2023/major-banks-deliver-record-profits.html)

Our central bank, the Reserve Bank of Australia (RBA), has been steeply raising interest rates on the cash rate over the last 2 years in a bid to dampen demand within the economy and rein in inflation. This monetary policy lever is the preferred means of managing inflation within national economies globally. Of course, it also delivers much increased revenue to banks and the government during the period of higher interest rates. It seems in our system those closest to the controls never lose out no matter the fluctuations within the economy. It is a rigged game for those of us standing on the fringes or unaware we were playing the game in the first place.

“Some businesses are using the “cover” of high inflation and a lack of competition to push up prices, Reserve Bank of Australia governor Michele Bullock has said.

The so-called price-gouging asserted by the Greens and former head of the competition regulator Allan Fels meant it was important to reduce inflation to the RBA’s 2 to 3 per cent band, to make it harder for firms to push up prices, Ms Bullock said.”

- (https://www.afr.com/policy/economy/inflation-is-cover-for-pricing-gouging-rba-boss-says-20240215-p5f58d#:~:text=Somebusinessesareusingthe,governorMicheleBullockhassaid.)

The Governor of the RBA has finally come out and admitted price gouging has been going on under the cover of high inflation by Australian businesses amid the lack of competition within our markets.

Neoliberal Privatization Promised Cheaper Prices

Back in the 1990’s we were promised that the privatization of public utilities would deliver cheaper power prices via the neoliberal economic policies embraced by the LNP and Labor governments. Of course, this has not happened, although some Australian business people have become very wealthy through the privatization of public assets. We have wholesale energy markets setting prices for the generation of electricity in states around the nation. The energy sector is facing the demands of global warming and the need to transform, away from a dependency on fossil fuels like coal. Power stations are ageing and having to be phased out. Solar rooftop has been the runaway success story; after a late start thanks to politicians captured by the money and influence of the coal lobby. We still hear more about the doom and gloom of an uncertain future with renewables because the corporate media oligopoly is also controlled by vested fossil fuel interests via their advertising spend.

The mineral lobby is a powerful entity in Australia, as we can see by the fact that they are so lightly taxed by our governments in comparison to other resource rich nations like Qatar and Norway.

“And if you don’t believe those decisions make a difference, just consider the fact that in Norway, they tax the fossil fuel industry and give kids free university education, in Australia we subsidise the fossil fuel industry and charge kids a fortune to go to university.

Indeed, the Commonwealth collects more revenue from HECS fees than it gets from the Petroleum Resource Rent Tax. Choices matter.”

- (https://australiainstitute.org.au/post/richard-denniss-national-press-club-address/)

Values matter and the decisions made by our leaders tell the story. Australia values those that dig up the rocks more than the minds of our children, who are our future. Rocks run out and we should derive as much revenue and taxes as possible whilst we have them. At the same time, we should provide the best education possible for our kids and make it as accessible as possible to all of them wherever they live around the nation. We need political leaders who are progressive rather than stuck in the past. The world is forever changing and we are challenged to keep up and meet the demands of that ever changing world.

Read the full article

#ACCC#Australia#consumers#economics#financialization#highinflation#lackofcompetition#marketshare#neoliberalism#pricegouging#RBA

0 notes

Note

Hi Charlie! I looove heavy weighs the crown. Do you have a bit of it you're super excited to share?

- @pricegouge

YES!!!! BUT IT'S SPOILERS.

The next chapter is finished but not typed but I have two fun bits from later on typed up so hhhhhnnng here's part of one.

If you don't want spoilers from a couple chapters ahead don't read further! But honestly I think we all know where this story is going I'm pretty sure I tagged it as Poly141. This isn't super explicit but you'll see my vision.

You walk into John's office without knocking, your notes tucked under your arm. You're braced for battle, determined to make him listen to you. He sits behind his desk, chair tilted outwards, a cigar in his hand. Smoke fills the room, turning the air thick and hazy. You still shut the door behind yourself, even though you'd rather leave it open to air things out.

"John, we need to talk," you say firmly.

"Do we?" He gives you a heavy lidded stare, amused, for some unfathomable reason. "So urgently that you couldn't even pause to knock?"

"Are you busy?" You ask archly. "You certainly don't look very busy." Your eyes catch on the fencing mask on the desk. Ghost's mask. Your heart lurches, fear clutches at your stomachs with icy fingers. He'd gone off to deal with that Manticore-- Had he been injured? Had he been killed?

John notices the change in your expression. "No, Sweetpea, Simon's alright. He just got back."

You press your hand to your chest, relieved. The whiplash of emotion leaves you reeling, off balance.

"You care about him," John observes. "You trust him-- Are you attracted to him as well?"

Your cheeks burn. "That's not what I came here to talk about," you say hotly.

"Indulge me."

"We're married now. Whatever I might feel about Ghost is inconsequential."

"Tell me." John's eyes glitter strangely. "What do you feel about him?"

"Well I just-- I mean-- I do find him attractive, yes. But I don't intend to do anything about it."

"What do you find attractive about him? You've never seen his face."

"I don't need to. He's… He makes me feel safe. And he's patient. Strong. His voice makes me want to melt all over the floor." You cross your arms defensively, embarrassed by your admissions. "And he's sweet to me. Tells those awful jokes that still make me laugh. And his hands--"

A grunt that doesn't come from John cuts you off mid sentence. John turns his attention downward, and you suddenly notice a head of short ashy blond hair in his lap.

"Yes, good boy, come on up. Our girl had so many nice things to say about you. Do you want to thank her properly?"

Ghost surfaces with a dazed expression, sitting back on his heels. "Yes," he says hoarsely, his dark, beautiful eyes finding yours. He's handsome without the mask, if a little chewed up, a heavy, serious brow, a thrice broken nose, top lip a little fuller than the bottom, a strong jaw-- Although you knew that much already. He really is the blacksmith’s apprentice, just as you suspected. There's drool on his chin, and it takes you a moment to realize that John's cock is out, and another moment to connect the dots.

The heat that blooms in your belly isn’t anger, although a small, still-rational part of you suggests that it should be. There’s only desire and jealousy, and you’re not even quite sure who you’re jealous of.

#Cave writing#WIP Tag Game#Heavy Weighs the Crown#Pricegouge#I just reread this whole scene and HOOBOY I was cooking when I wrote it

9 notes

·

View notes

Text

Grocery Stores Under Fire: Are They Cheating Us?

#anticompetitivepractices #commercefairness #ConsumerPriceIndex #consumerprotection #corporateaccountability #COVID19pandemic #Economicdownturn #economichardship #fairmarketpractices #FederalTradeCommission #fooddeserts #freshproduceaccessibility #governmentintervention #grocerystores #laborcosts #marketconcentration #NationalGrocersAssociation #pricefixing #pricegouging #pricemanipulation #ruralareadevelopment #supplychaindisruptions

#Politics#anticompetitivepractices#commercefairness#ConsumerPriceIndex#consumerprotection#corporateaccountability#COVID19pandemic#Economicdownturn#economichardship#fairmarketpractices#FederalTradeCommission#fooddeserts#freshproduceaccessibility#governmentintervention#grocerystores#laborcosts#marketconcentration#NationalGrocersAssociation#pricefixing#pricegouging#pricemanipulation#ruralareadevelopment#supplychaindisruptions

0 notes