#private wealth management firm

Text

Getting to Know Financial Professionals in Canada: Wealth Managers, Portfolio Managers, and Investment Advisors

In Canada, different types of financial experts have titles like wealth managers, portfolio managers, and investment advisors. While these titles might seem similar, they actually have other jobs, qualifications, and responsibilities for people who invest their money.

Wealth Managers vs. Portfolio Managers vs. Investment Advisors: What Makes Them Different?

When you hear about wealth managers, portfolio managers, and investment advisors, you might think they do the same thing. But they're quite different in what they do and how they help you with your money.

Wealth managers offer various services to help with all parts of your financial life. They can help with things like investing your money, planning for what happens to your money after you die, giving advice on taxes, and sometimes even helping with legal stuff. They're suitable for people who want help with all aspects of their money, whether they live in Toronto, Calgary, or anywhere else in Canada.

Investment advisors in Canada mainly focus on advising about investing your money. They can help you choose stocks, bonds, mutual funds, or other investments. Some investment advisors get paid by selling products which might only sometimes be the best for you.

Portfolio managers in Canada have a more specific job. They decide where to invest your money based on what you want to achieve with it and how much risk you're comfortable with. The big difference is that portfolio managers have a legal duty to do what's best for you, not just what makes them money. This is important because it means they must look out for your interests above all else.

The Duty of Portfolio Managers

Portfolio managers have a big responsibility to their clients. They must follow strict rules to ensure they're always doing what's best for you. When you look up your portfolio manager's name, you'll see if they're registered as a "dealing representative," which means they're just selling stuff, or an "advising representative," which means they have to do what's best for you.

Why This Matters

Understanding the differences between these financial professionals is important if you want to find someone you can trust with your money. Knowing whether your advisor must look out for your interests can make a big difference in the advice you get. It's not just about the investments themselves but ensuring your whole financial plan works for you.

At Avenue Investment, we're an independent firm that focuses on helping our clients reach their financial goals. We're trusted always to put our clients first, and we're owned by those who work here. Our main goal is to help you feel secure about your money in the long run.

#financial planners toronto#wealth management firms toronto#portfolio management#investment companies in canada#financial advisors toronto#wealth managers toronto#private wealth management firm#wealth management toronto

0 notes

Text

#wealthmanagementsandiego

#sandiegowealthmanagementfirms

#privatewealthmanagement

#financialadvisorsandiego

www.alohawealthpartners.com

#financial advisor san diego#private wealth management#wealth management san diego#san diego wealth management firms

0 notes

Text

Unlocking Financial Success: The Role of Private Wealth Management in New York

New York City, home to a large number of extremely wealthy individuals and families, is the Financial Capital of the World. It takes a very sophisticated approach to manage large amounts of wealth in this dynamic and fast-changing environment. Private wealth management services in New York are now also available, offering tailored financial solutions to help wealthy people manage the complexity of their finances.

Why Private Wealth Management in New York?

Customized Financial Strategies: The development of tailored financial strategies is one of the main benefits of private wealth management. The advisor will consider the client's unique financial situation, objectives, risk tolerance, and preferences when selecting investment portfolios that match his or her goals.

Diversifying Investment Opportunities: Access to a wide range of investment opportunities including traditional investments, such as stocks and bonds, and alternative assets like real estate, Private Equity, or hedge funds is provided by the management of private wealth.

Comprehensive financial planning: Private wealth management includes several financial aspects in addition to investments. To ensure that all aspects of the client's finances are well managed, it will include inheritance planning, tax optimization, pensions, and philanthropy strategies.

Importance of Trusted Advisors

Finding a trustworthy advisor is of vital importance in New York's lively finance scene. A long-term relationship with clients is often cultivated by private wealth managers, providing not just financial expertise but also peace of mind. They guide customers so that they can make sound decisions and respond to changing financial circumstances.

Conclusion

For wealthy individuals who seek a complete solution to their specific needs, Private Wealth Management in New York offers a valuable resource. These services are of strategic advantage to manage and develop wealth in a city that hasn't slept all day, providing high net-worth individuals and their families with the ability to succeed financially as well as security.

0 notes

Text

Leading Private Wealth Management Firms

Top private wealth management firms specialize in providing tailored financial services to high-net-worth individuals. These firms offer personalized investment strategies, estate planning, tax optimization, and comprehensive financial advice. They focus on building long-term client relationships, understanding unique financial goals, and managing diversified portfolios. Utilizing a blend of financial expertise, these firms ensure confidentiality, risk management, and growth potential for their client's assets.

Through meticulous research, global market insights, and a commitment to excellence, they navigate the complexities of wealth management, aiming to secure and enhance their client's financial well-being over generations. Ace Patrons, a premier private wealth management firm, exemplifies excellence in financial stewardship.

0 notes

Text

Writers are paid less now than they were 50 years ago, for the same work. Ernest Hemingway was paid $1 a word in 1936. That's more than $21 per word in today's dollars. The maximum I was ever paid to write for a glossy magazine in print was $2/word, in 2021. No one (and I really mean no one) in media makes $21/word. That compensation just doesn't exist. You could be the most popular novelist in the world and not make $21/word to report. You could argue that no writer today is as good or popular as Hemingway was at his peak, but no writer today is even making half or a quarter of what he made, and writers only ever get so famous. If someone were paid $5/word in 2022—which is something I have never heard of happening and is a full $2 more than than anyone I know has ever been paid per word—that would be a quarter of what Hemingway was paid. That writer would be able to pay their rent and health insurance premiums and tuck some money away in savings off a standard-issue story per month, but again, that lucky writer does not exist.

What this means is that the door a writer could step through to make a career 50 or even 20 years ago, the one opening onto a life where someone who works hard and does well could buy a house on the strength of that work alone, has been slammed shut.

That's not because there isn't money to be made in any of these industries, either. Some people are making very good money in these fields, and have been for a long time. They are people who profit off art without actually making it.

The reality is that the people with the most money have devised, at every turn, new and more bulletproof ways for them to make and keep more money, and for the people who make things to make less. This is the eternal story of labor and management.

Why should any CEO make more than the actresses whose labor and beauty they sell? Why should a second-year management consultant at every major consulting firm make more than every single writer I have ever known? It's not even a question of principle. People buy things: services and products and experiences and feelings. How is it that the creation and provision of those things is valued so little, when it is so essential?

It's a rhetorical question. The wealth that exists in this country does not come from making things that people love. People spend money on that, obviously, but they've done that long enough that those industries have had time to optimize for their own preferences. The money that sustains all this is, in enough cases that it is worth noting here, coming from young rich people's even richer parents. It is coming from giant corporations awarding it, whether out of ideological commitment or just force of habit, to people who sit behind desks all day. Some of those people might also make art, but they are not the norm. The structure built around these valuable creative products is bloated in ways that starve and imperil that creative process, but those privations also hold it in place. Baseball executives, when they are talking about the same sort of thing, like to use the phrase "cost certainty."

The Money Is In All The Wrong Places

282 notes

·

View notes

Text

All the Time in the World (gr63)

↳ A/N It took me so long to formulate a solid idea to this ask from my 1.5k celebration - the song instilled a vision in my mind so clearly but the details took over a week to come to me. It felt like a relief to finally get this written out! Thank you to the anon who submitted this request!!

↳ Inspired By: 'We Have All the Time in the World' by Louis Armstrong

↳ Pairings: Wealthy!Dark!George x Fem!Reader (NO use of y/n)

↳ Word Count: 1120

↳ Warnings: Dark themes

The dainty sound of lone silverware clinking against china echoed through the spacious dining room, reaching to the peaks of the two-storey ceiling and each corner of the lavishly decorated walls. At the head of the lengthy hand-carved mahogany table, you kept your gaze downcast to your plate, carefully slicing through your steaming supper to spear a bitesize piece with your fork. The tick of the clock on the ornate mantle blanketed the room in the weight of the passage of time. The fire crackled beneath it. You still felt chilled.

“How is it?”

The buttery voice cutting through the eerily silent room had your eyes raising from your plate to gaze down the table to the man at the other end. George looked almost humorously small at such a distance; the two of you taking up a table that otherwise would be used for royal galas of a good few dozen people, you were sure. Over filled platters of whatever food you could possibly want, handmade by private chefs, stretching the length of the sizable table, you offered him a polite smile.

“Lovely. Thank you.”

“Is the roast cooked to your liking?”

“It’s perfect,” you assured him softly, “No complaints.”

George smiled back at you, a gentle smile that made his eyes sparkle in the candlelight.

He had kind eyes. That’s what you first noticed about him when you met. The kindest, sweetest gaze that almost had you weak in the knees. He was so handsome, so easy to trust.

He lifted his crystal wine glass to his lips and sent you a sultry wink over the rim. You turned your flushed gaze back to your plate, your heart racing.

You shared the expensive feast together at the expansive table by candlelight and the warmth of the fireplace. The diamonds on your designer bracelet glittered on your wrist with your every polite movement as you ate daintily, calmly. Yet another gift he had bought for you, doting on you like you were a princess. You couldn’t say no. He wouldn’t let you say no.

It was his way he showed you that he loved you. That you were safe with him. That you were his.

After dinner, George excused himself to the drawing room. He always disappeared there for a half-hour after dinner; having to collect his thoughts from the day and wind down a moment before the rest of the evening. On his way past you, he left a kiss to your head and gave your shoulder a firm squeeze before leaving you all alone in the vast dining room.

You took your time to fold your napkin and set it on the table, staring out at the barely touched serving platters that would be going to waste the moment you stood. Now with a non-existent appetite, you pushed your chair back and rose from the table. A better time than any to have a nightly walk through the never-ending hallways of the mansion before George would be expecting you to bed.

You walked across the marble floors of the vast mansion as the sun set, your red bottom heels clicking faintly, rhythmically, like a heartbeat. Crystal chandeliers hung above your head, glinting the orange fading sunlight that came in through the floor to ceiling French doors along the exterior wall of the corridor. Your home was that of Versailles; a jewel among the countryside, glittering in wealth and luxury. There was nothing you had to complain about.

George chose you. He brought you into his home. You were set for life.

At the end of the hallway, the space opened up into a music gallery. It seemed you were still managing to find new places to explore in the mansion. You had never heard George play or even speak about music so you figured the gallery was simply there for looks – and to host the impressive cream grand piano in the centre of the rounded room. Ghosting past it, you let your eyes linger on the pristine wood and details of the carvings along each edge and corner, each black and white key polished and untouched. It was almost a shame.

The mansion was dimmed to a hazy illumination as the sun dipped below the horizon, painting the world in ink. You took a few cautious strides across the room to the set of French doors at the far end and you pulled them open to reveal yourself to the impending night. The crisp breeze ruffled through the trees that filled the acreage and blew through the body of your flowing dress in ripples like the ocean.

Stepping out onto the balcony, you breathed in the fresh air and shut your eyes to take in the moment. For a second, it truly felt like it was just you in the world; a chance at serenity.

Just as you lifted your hands towards the stone railing, someone grabbed your hand tightly, startling a yelp from your chest.

“Shh,” George stepped right up behind you, his other hand sliding around your middle to pull you back against his chest, “it’s just me, love.”

His velvety, grinning voice sent shivers down your spine, his fingers tightening around your hand.

“Where do you think you’re going, hm?”

You swallowed thickly, staring out across the perfectly manicured grounds as you answered him stagnantly, “Just getting a breath of fresh air before bed.”

“Mhm?” his lips ghosted across your jaw, reminding you in a firm but gentle tone, “You know I don’t like you going outside without me.”

“Sorry,” you exhaled.

“We need nothing more than our love, darling, you know that.” he pressed a slow kiss to your neck, his thumb gently caressing your waist as he held you firmly to his body, “We can just leave the world far, far behind us, and stay here in our sanctuary…together.”

You looked down at his hand holding yours, wincing slightly at the grip he held on you, your fingers squished together in his hand. He kissed your neck again and breathed you in deeply before resting his face against yours as you stared out at the gardens together under the starry sky.

“I love you, my darling.” he promised into the inky night, his voice sultry and provocative and so incredibly calm.

Down below the balcony, just a few yards out of the way, your eyes lingered on the black vintage Mercedes in which you had been bound and gagged by him only a few short weeks earlier, taken to this place to never be seen again.

You were sure there was no way out. You were going to be here, trapped with him, until the end of time.

“I love you too.”

"With the cares of the world far behind us,

We have all the time in the world just for love,

Nothing more, nothing less, only love..."

#george russell x reader#george russell imagine#george russell fanfic#george russell fluff#george russell#gr63#f1 x reader#f1 x you#f1 x female reader#f1 x oc#f1 imagine#f1 one shot#f1 fanfic#f1 fic#f1 fluff#formula 1 x reader#formula 1 x you#formula 1 x female reader#formula 1 x oc#formula 1 imagine#formula 1 one shot#formula 1 fanfic#formula 1 dark#f1 dark#f1 dark fic

157 notes

·

View notes

Text

Taking Risk

I just spent a week talking with some exceptional students from three of the UK's top universities; Cambridge, Oxford and Imperial College. Along with UCL, these British universities represent 4 of the top 10 universities in the world. The US - a country with 5x more people and 8x higher GDP - has the same number of universities in the global top 10.

On these visits, I was struck by the world-class quality of technical talent, especially in AI and biosciences. But I was also struck by something else. After their studies, most of these smart young people wanted to go and work at companies like McKinsey, Goldman Sachs or Google.

I now live in San Francisco and invest in early-stage startups at Y Combinator, and it's striking how undergraduates at top US universities start companies at more than 5x the rate of their British-educated peers. Oxford is ranked 50th in the world, while Cambridge is 61st. Imperial just makes the list at #100. I have been thinking a lot about why this is. The UK certainly doesn't lack the talent or education, and I don't think it's any longer about access to capital.

People like to talk about the role of government incentives, but San Francisco politicians certainly haven't done much to help the startup ecosystem over the last few years, while the UK government has passed a raft of supportive measures.

Instead, I think it's something more deep-rooted - in the UK, the ideas of taking risk and of brazen, commercial ambition are seen as negatives. The American dream is the belief that anyone can be successful if they are smart enough and work hard enough. Whether or not it is the reality for most Americans, Silicon Valley thrives on this optimism.

The US has a positive-sum mindset that business growth will create more wealth and prosperity and that most people overall will benefit as a result. The approach to business in the UK and Europe feels zero-sum. Our instinct is to regulate and tax the technologies that are being pioneered in California, in the misguided belief that it will give us some kind of competitive advantage.

Young people who consider starting businesses are discouraged and the vast majority of our smart, technical graduates take "safe" jobs at prestigious employers. I am trying to figure out why that is.

___

Growing up, every successful adult in my life seemed to be a banker, a lawyer or perhaps a civil engineer, like my father. I didn't know a single person who programmed computers as a job. I taught myself to code entirely from books and the internet in the late 1990s. The pinnacle of my parents' ambition for me was to go to Oxford and study law.

And so I did. While at university, the high-status thing was to work for a prestigious law firm, an investment bank or a management consultancy, and then perhaps move to Private Equity after 3 or 4 years. But while other students were getting summer internships, I launched a startup with two friends. It was an online student marketplace - a bit like eBay - for students. We tried to raise money in the UK in 2006, but found it impossible. One of my cofounders, Kulveer, had a full-time job at Deutsche Bank in London which he left to focus on the startup. His friends were incredulous - they were worried he'd become homeless. My two cofounders eventually got sick of trying to raise money in the UK and moved out to San Francisco. I was too risk-averse to join them - I quit the startup to finish my law degree and then became a management consultant - it seemed like the thing that smart, ambitious students should do. The idea that I could launch a startup instead of getting a "real" job seemed totally implausible.

But in 2011, I turned down a job at McKinsey to start a company, a payments business called GoCardless, with two more friends from university. We managed to get an offer of investment (in the US) just days before my start date at McKinsey, which finally gave me the confidence to choose the startup over a prestigious job offer. My parents were very worried and a friend of my father, who was an investment banker at the time, took me to one side to warn me that this would be the worst decision I ever made. Thirteen years later, GoCardless is worth $2.3bn.

I had a similar experience in 2016, when I was starting Monzo, I had to go through regulatory interviews before I was allowed to work as the CEO of a bank. We hired lawyers and consultants to run mock interviews - and they told me plainly that I was wasting my time. It was inconceivable that the Bank of England would authorise me, a 31 year old who'd never even worked in a bank, to act as the CEO of the UK's newest bank. (It turned out they did.) So much of the UK felt like it was pushing against me as an aspiring entrepreneur. It was like an immune system fighting against a foreign body. The reception I got in the US was dramatically different - people were overwhelmingly encouraging, supportive and helpful. For the benefit of readers who aren't from the UK, I hope it's fair to say that Monzo is now quite successful as well.

___

I don't think I was any smarter or harder working than many of the recent law graduates around me at Oxford. But I probably had an unusual attitude to risk. When we started GoCardless, we were 25 years old, had good degrees, no kids and supportive families. When fundraising was going poorly, we discussed using my parents' garage as an office. McKinsey had told me to contact them if I ever wanted a job in future. I wonder if the offer still stands.

Of course, I benefitted from immense privilege. I had a supportive family whose garage I could have used as an office. I had a good, state-funded education. I lived in a safe, democratic country with free healthcare. And I had a job offer if things didn't work out. And so the downside of the risks we were taking just didn't seem that great.

But there's a pessimism in the UK that often makes people believe they're destined to fail before they start. That it's wrong to even think about being different. Our smartest, most technical young people aspire to work for big companies with prestigious brands, rather than take a risk and start something of their own.

And I still believe the downside risk is small, especially for privileged, smart young people with a great education, a supportive family, and before they accumulate responsibilities like childcare or a mortgage. If you spend a year or two running a startup and it fails, it's not a big deal - the job at Google or McKinsey is still there at the end of it anyway. The potential upside is that you create a product that millions of people use and earn enough money that you never have to work again if you don't want to.

This view is obviously elitist - I'm aware it's not attainable for everyone. But, as a country, we should absolutely want our smartest and hardest working people building very successful companies - these companies are the engines of economic growth. They will employ thousands of people and generate billions in tax revenues. The prosperity that they create will make the entire country wealthier. We need to make our pie bigger, not fight over the economic leftovers of the US. Imagine how different the UK would feel if Google, Microsoft and Facebook were all founded here.

___

When I was talking with many of these smart students this week, many asked me how these American founders get away with all their wild claims. They seem to have limitless ambition and make outlandish claims about their goals - how can they be so sure it will pan out like that? There's always so much uncertainty, especially in scientific research. Aren't they all just bullshitters? Founders in the UK often tell me "I just want to be more realistic," and they pitch their business describing the median expected outcome, which for most startups is failure.

The difference is simple - startup founders in the US imagine the range of possible scenarios and pitch the top one percent outcome. When we were starting Monzo, I said we wanted to build a bank for a billion people around the world. That's a bold ambition, and one it's perhaps unlikely Monzo will meet. Even if we miss that goal, we've still succeeded in building a profitable bank from scratch that has almost 10 million customers.

And it turns out that this approach matches exactly what venture capitalists are looking for. It is an industry based on outlier returns, especially at the earliest stages. Perhaps 70% of investments will fail completely, and another 29% might make a modest return - 1x to 3x the capital invested. But 1% of investments will be worth 1000x what was initially paid. Those 1% of successes easily pay for all the other failures.

On the contrary, many UK investors take an extremely risk-averse view to new business - I lost count of the times that a British investor would ask for me a 3 year cash-flow forecast, and expect the company to break even within that time. UK investors spend too much time trying to mitigate downside risk with all sorts of protective provisions. US venture capital investors are more likely to ask "if this is wildly successful, how big could it be?". The downside of early-stage investing is that you lose 1x your money - it's genuinely not worth worrying much about. The upside is that you make 1000x. This is where you should focus your attention.

___

A thriving tech ecosystem is a virtuous cycle - there's a flywheel effect that takes several revolutions to get up-to-speed. Early pioneers start companies, raise a little money and employ some people. The most successful of these might get acquired or even IPO. The founders get rich and become venture capital investors. The early employees start their own companies or become angel investors. Later employees learn how to scale up these businesses and use their expertise to become the executives of the next wave of successful growth-stage startups.

Skype was a great early example of this - Niklas Zenstrom, the co-founder, launched the VC Atomico. Early employees of Skype started Transferwise or became seed investors at funds like Passion Capital, which invested in both GoCardless and Monzo. Alumni of those two companies have created more than 30 startups between them. Matt Robinson, my cofounder at GoCardless, was one of the UK's most prolific angel investors, before recently becoming a Partner at Accel, one of the top VCs in the world. Relative to 15 or 20 years ago, the UK tech ecosystem is flourishing - our flywheel is starting to accelerate. Silicon Valley has just had a 50 year head start.

There is no longer a shortage of capital for great founders in the UK (although most of the capital still comes from overseas investors). I just believe that people with the highest potential aren't choosing to launch companies, and I want that to change.

___

I don’t think the world is prepared for the tidal wave of technological change that’s about to hit over the next handful of years. Primarily because of the advances in AI, companies are being started this year that are going to transform entire industries over the next decade.

It doesn't seem hyperbolic to say that we should expect to see very significant breakthroughs in quantum computers, nuclear fusion, self-driving vehicles, space exploration and drug discovery in the next 10 or 20 years. I think we are about to enter the biggest period of transformation humanity has ever seen.

Instead of taking safe, well-paying jobs at Goldman Sachs or McKinsey, our young people should take the lead as the world is being rebuilt around us.

8 notes

·

View notes

Text

..."As Republicans grilled Hunter Biden on Wednesday about his business deals overseas, the president’s son turned the question back on his interrogators.

He asked GOP lawmakers about foreign investments secured by Jared Kushner, the son-in-law of former President Trump, shortly after he left the White House, according to Democrats participating in the closed-door deposition.

“He drew the distinction between what he has done in a business world with independent businessmen, versus foreign governments, which he did not do any business with — unlike Jared Kushner,” Rep. Dan Goldman (D-N.Y.) said during a break in the testimony.

Among other roles, Kushner oversaw Middle East policy in the Trump White House, and he raised plenty of eyebrows when he secured a $2 billion investment from Saudi Arabia six months after leaving public service.

The scrutiny mounted further when The New York Times reported that the advisory panel for the Saudi sovereign wealth fund had recommended against investing in Kushner’s newly launched private equity firm, citing “the inexperience of the … management.” The advice was overruled by a larger board led by Saudi Crown Prince Mohammed bin Salman, a close ally of the Trump administration.

Rep. Jamie Raskin (D-Md.) said the questioning throughout the morning has been largely cordial, but Hunter Biden became “assertive” when invoking the Kushner episode.

“He may be a little bit frustrated by some of the double standards relating to Jared Kushner and money that’s just been openly pocketed by Donald Trump in office,” Raskin said. “And Jared Kushner of course brought back $2 billion from Saudi Arabia. And all of that has been a part of the conversation, and he was assertive about that.”

When Democrats controlled the House, they opened an investigation into Kushner’s deal with Saudi Arabia. It was dropped when Republicans flipped the chamber and Rep. James Comer (R-Ky.) took the reins of the Oversight and Accountability Committee, which is now leading the impeachment investigation into Biden.

Still, Democrats said there appeared to be agreement among at least some Republicans when Hunter Biden brought up Kushner’s Saudi deal.

“There’s no cameras in there, [so] Donald Trump ain’t watching, right?” said Rep. Jared Moskowitz (D-Fla.). “For the first time Republicans said they do have a problem with that. But they should do something about it.”

Comer and the other Republicans in the room have largely declined to comment during breaks throughout Wednesday’s deposition, including on the topic of Kushner’s overseas business ventures.

Hunter Biden’s appearance on Capitol Hill has been long anticipated and comes months into House Republicans’ impeachment inquiry into President Biden. That multipronged probe has centered on the younger Biden’s business activities, alleging he used his father’s influence to orchestrate a web of shady overseas business ventures.

In his opening statement, Hunter Biden refuted the allegations.

“I am here today to provide the committees with the one uncontestable fact that should end the false premise of this inquiry: I did not involve my father in my business. Not while I was a practicing lawyer, not in my investments or transactions domestic or international, not as a board member, and not as an artist. Never,” Biden said during his opening statement."

9 notes

·

View notes

Note

I love how you wrote YN in Born Stunna, since it’s mentioned that she has daddy’s money, what was her childhood like? Relationship with parents, how they got their wealth, does she have siblings? What kind of schooling did she have?

omggg i adoree when you guys ask questions 😭😭 love you sm nonnie 🩷🩷

she went to a private school ofcc. Her parents only wanted the best for their daughter hence, golden girl. The reason she works so hard is because, growing up where everyone thinks the only thing you'll amount to is a spoiled rich girl, she had to make a name for herself. Thats why failure isnt an option because if she fails she would be proving them right. Her dad is the owner of an extremely respected law firm and her mother a sports manager, which is where the tennis came from. No siblings, so spoiled only child. She adores her parents, having an amazing relationship with them. Shes a perfectionist, always needed to be the best.

3 notes

·

View notes

Text

Factors to Keep in Mind When Selecting Portfolio Management Services

Securing your financial future is a top priority in the intricate finance world. Selecting the proper portfolio management services is critical to achieving your wealth management goals. The right portfolio manager can make a significant difference in Canada or anywhere in the world. In this article, we'll explore the key factors you should consider when choosing portfolio management services and how Avenue Investments, a leading wealth management firm, excels in these areas.

Experience and Expertise in Portfolio Management

When it comes to managing your investments, experience and expertise are paramount. Look for a portfolio manager in Canada with a proven track record of success in the industry. Seasoned professionals have weathered market ups and downs, developing a deep understanding of market dynamics. They can make informed decisions to navigate various market conditions, ultimately optimizing your investments.

Comprehensive Portfolio Management Services

A reputable portfolio management firm should offer comprehensive services, not just stock-picking. These services should include asset allocation, risk assessment, and financial planning. Comprehensive services ensure that your entire financial picture is considered, allowing you to build a well-rounded strategy that aligns with your goals.

Integrated Wealth and Asset Management

Wealth and asset management encompass more than investments; they cover your entire financial life. Choosing portfolio management services that integrate seamlessly with your broader wealth management strategy is essential. Avenue Investments, a renowned wealth management firm, excels in offering integrated solutions, addressing investments and retirement planning, estate planning, tax optimization, and risk assessment.

Customized Approach

Every investor has unique financial goals and risk tolerance. Look for portfolio management services that take a personalized approach. Avenue Investments, for instance, focuses on understanding your individual needs, allowing them to craft tailored portfolios that align with your specific objectives, whether you're planning for retirement, education funding, or wealth accumulation.

Collaborative Financial Planning

Effective financial planning is the cornerstone of portfolio management. Your portfolio manager should work closely with you to develop and adjust your financial plan as needed. This includes aligning your investments with your long-term goals and adapting your strategy to evolving financial circumstances.

Transparent Fee Structure

Financial transparency is crucial when selecting portfolio management services. Ensure you fully understand the fee structure of the firm you choose, with no hidden fees or costs. This transparency ensures you know the costs associated with the services and helps build trust in your relationship with your portfolio manager.

Client Testimonials and Reviews

One of the most reliable ways to assess the reputation of a portfolio management firm is to read client testimonials and reviews. These insights from other clients can provide valuable information on the level of service and success you can expect from the firm.

Conclusion

Selecting the proper portfolio management services is a pivotal decision in your financial journey. Avenue Investments, a distinguished wealth management firm, stands out as a leading choice that excels in all these key factors. Their expertise, comprehensive services, integrated wealth and asset management, personalized approach, and transparent fee structure ensure that your financial well-being is their top priority.

In pursuing financial success, consider Avenue Investments your partner in building and securing wealth. Their collaborative financial planning and commitment to providing the best-personalized portfolio management services will empower you to navigate the complexities of the financial world and work towards your long-term financial goals. Don't leave your financial future to chance; take the first step with Avenue Investments today.

#financial planners toronto#investment companies in canada#financial planning#portfolio management#wealth management firms toronto#wealth management toronto#private wealth management firm#wealth managers toronto#private wealth management toronto

0 notes

Text

Aloha Wealth Partners, based in the vibrant city of San Diego, California, is a distinguished investment and consulting firm. With a focus on empowering clients in their financial journeys, we specialize in a range of services, including alternative investments, tax planning, comprehensive financial planning, retirement planning, and strategic exit planning for business owners.

www.alohawealthpartners.com

445 Marine View Ave. Suite 300Del Mar, CA 92014

1 888-686-9256

#financial advisor san diego#private wealth management#wealth management san diego#san diego wealth management firms

0 notes

Photo

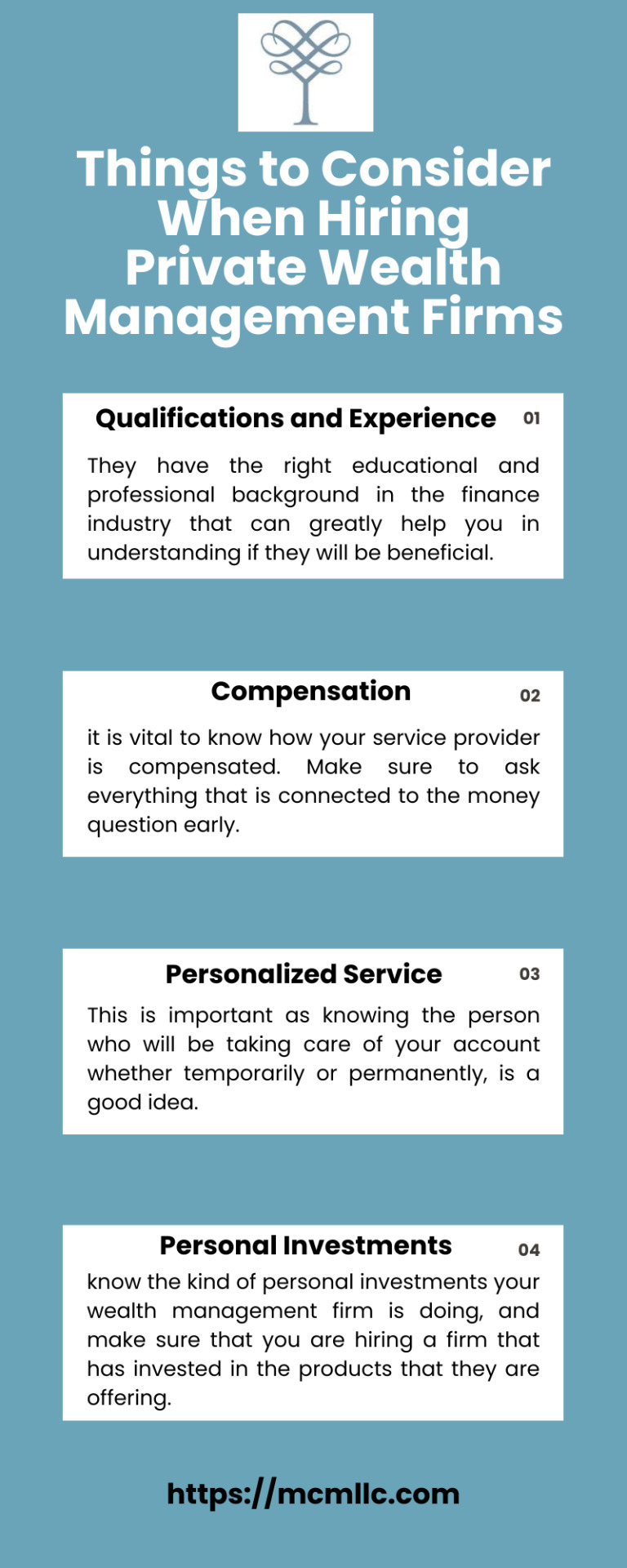

Things to Consider When Hiring Private Wealth Management Firms

If you are looking for private wealth management firms, consider reputable and reliable providers that offer clients personalized support for overall wealth. Check out this infographic for a few things to consider when hiring private wealth management firms. Visit https://bit.ly/3WtCpYS to learn more.

1 note

·

View note

Text

Economic Systems

Economics is the social science that studies how individuals, firms, and societies allocate scarce resources among competing wants and needs. It is concerned with how people make choices and how those choices affect the production, consumption, and distribution of goods and services. Economics also examines how markets and economies function and how policies, such as taxes and regulations, can influence economic outcomes. The field of economics encompasses a broad range of topics, including microeconomics (which focuses on the behavior of individuals and firms), macroeconomics (which examines the performance of the overall economy), international trade, labor economics, environmental economics, and many others. Economists use a variety of tools and methods, including mathematical models, statistical analysis, and experiments, to understand economic phenomena and to inform policy decisions.

Here are some economic systems:

Capitalism: This economic system is based on private ownership of the means of production and the operation of markets for goods, services, and labor. In capitalism, prices and profits are determined by supply and demand, and individuals and firms are motivated by self-interest and the pursuit of profit.

Socialism: This economic system is based on collective ownership of the means of production and the distribution of goods, services, and labor based on the needs of society. In socialism, prices and production are determined by central planning or democratic decision-making, and individuals and firms are motivated by social goals and the public good.

Communism: This economic system is based on the common ownership of the means of production and the distribution of goods, services, and labor based on need. In communism, economic decisions are made by a centralized government, and individuals and firms are motivated by social goals and the public good.

Mixed economy: This economic system combines elements of capitalism and socialism, with both private and public ownership of the means of production and a mix of market and government intervention in economic activity. The mix of capitalism and socialism can vary widely between countries, with some favoring more market-oriented policies and others favoring more state intervention.

Market economy: This economic system is based on the operation of markets for goods, services, and labor, with prices and production determined by supply and demand. In a market economy, economic decisions are made by individuals and firms acting in their own self-interest, without centralized planning or government intervention.

Command economy: This economic system is based on central planning by a government or other central authority, with prices and production determined by the government rather than supply and demand. In a command economy, economic decisions are made by the government, rather than by individuals and firms acting in their own self-interest.

Mercantilism: This economic system emphasizes the accumulation of wealth and power through international trade, with the goal of exporting more than importing to achieve a favorable balance of trade.

Feudalism: This economic system was based on a hierarchical social structure in which land was owned by lords who granted use of the land to peasants in exchange for labor and goods.

Corporatism: This economic system emphasizes the role of large corporations and other organized interest groups in economic decision-making, often in collaboration with government.

Participatory economics: This economic system emphasizes democratic decision-making and equitable distribution of resources, and aims to provide economic opportunities and social justice through decentralized planning and worker self-management.

Market socialism: An economic system in which some or all of the means of production are owned by the state or by worker cooperatives, but the allocation of goods and services is determined by the market.

Mutualism: An economic system that advocates for worker cooperatives, mutual aid, and voluntary association. The goal is to create a society where people can produce and consume goods and services based on principles of equality, reciprocity, and justice.

Post-Keynesian economics: An economic system that builds on the ideas of John Maynard Keynes, emphasizing the role of government intervention in the economy to achieve full employment, price stability, and economic growth.

Georgism: An economic system based on the ideas of Henry George, which emphasizes that land is a common resource and should be taxed accordingly to prevent monopolies and encourage economic growth.

Islamic economics: An economic system based on Islamic principles, including the prohibition of interest, speculation, and hoarding of wealth, and the emphasis on social justice, charity, and cooperation.

Feminist economics: An economic system that emphasizes the role of gender in economic activity and seeks to address gender-based inequalities through policies and practices that promote gender equality and social justice.

Neoclassical economics: A dominant economic system that emphasizes the role of markets in allocating resources and assumes that individuals act rationally to maximize their own self-interest.

Austrian economics: An economic system based on the ideas of Austrian economists, including the emphasis on subjective value, the importance of entrepreneurship, and the rejection of central planning and government intervention in the economy.

Anarcho-capitalism: A political and economic system that advocates for the abolition of the state and the establishment of a free market where all goods and services are privately owned and exchanged.

Behavioral economics: A subfield of economics that combines insights from psychology, sociology, and other social sciences to explain and predict human behavior in economic decision-making.

Institutional economics: An economic system that emphasizes the importance of institutions, such as social norms, laws, and customs, in shaping economic behavior and outcomes.

Technocracy: A political and economic system that advocates for the use of technology and scientific expertise to manage and allocate resources for the benefit of society.

Resource-based economics: An economic system that emphasizes the importance of natural resources in economic activity and advocates for their sustainable use and management.

Social market economy: An economic system that combines free market principles with social welfare policies to promote economic growth, social justice, and ecological sustainability.

Green economics: An economic system that emphasizes the importance of environmental sustainability and advocates for policies and practices that promote the long-term health of the planet and its ecosystems.

Sharing economy: An economic system that emphasizes the sharing of resources, goods, and services among individuals and communities, often facilitated by digital platforms and technologies.

#philosophy#epistemology#economics#politics#sociology#systems#society#resources#goods#services#knowledge#education#learning#chatgpt

22 notes

·

View notes

Note

War strategy anon here, some more ideas

-make business cards with max‘ info on them and give them to private wealth management firms, they will literally be breaking down his doors

-tell Max‘ pa that he would love to go on some podcasts, then make him go on podcasts

-get a celebrity crush that looks nothing like him or is taller than him

- pretend to be jealous over one of Charles friends new bf or gf

-laugh at one Max‘ friends jokes more than at Max‘ jokes

-replace his shirts with the same shirts but a size larger

do you watch Kyle Prue on TikTok, because these ideas have the same energy as his "how to piss off men" series and I'm LIVING for it

these are so funny because Max would genuinely just think he's going insane for like half of them, being like ???? why don't my shirts fit??? OH or better yet, what if they were a size smaller 💀 he'd be walking around like Steve Rogers, tits on display

6 notes

·

View notes

Text

What Would an Economy That Loved Black People Look Like? - Non Profit News | Nonprofit Quarterly

What would it look like if the economy loved Black people? I hold this question in my heart every day as I reflect on our current economic conditions and strategize about building a reimagined economy rooted in equity, justice, and liberation.

To be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South.

One thing I am certain of is that the systemic barriers and inequities that are embedded in present financial structures have no place in a reimagined economy. I would further contend that to transform our economy into one that loves Black people, movements need to get more intimate with the topic of power. Alicia Garza defines power as “the ability to change your circumstances and the circumstances of other people.” She talks about how being precise about power helps us be precise about strategy. Without a clear destination, the steps that are taken are going to be disordered.

As a financial activist and reparative capital investor, power and power building in this context means shifting financial policies, practices, and infrastructure into ones that seed and sustain change. It means joining with values-aligned wealth holders and investors to disrupt power by dismantling the systems that have obstructed Black communities from building generational wealth. And it means that to be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South, where roughly 56 percent of Black people in the United States call home. We must invest in the Southern Black creatives, innovators, and leaders who are the biggest exporters of culture around the world and on the frontlines of change and community power building.

Closing the Racial Wealth Gap in the South

US researcher and agricultural law expert Nathan Rosenberg has said, “If you want to understand wealth and inequality in this country, you have to understand Black land loss.” Jubilee Justice, an organization founded by Konda Mason, who serves as the strategic director of my firm RUNWAY, recognizes that land ownership provides a pathway to create generational wealth, access financial resources, have agency over agricultural and sustainable land management practices, and foster community resilience.

In the rural South, Black farmers have historically experienced—and continue to experience—a lack of access to agricultural resources and credit. They also continue to face discrimination, and exclusion from government programs, loans, and subsidies. This result is the loss of farmland and restricted opportunities for economic growth.

Of all private US agricultural land (excluding Indian Country), according to a US Department of Agriculture study, White people comprise 96 percent of farmers, own 98 percent of the acres, and generate 97 percent of farm earnings. From 1900 to 1997, the number of Black farmers decreased by more than 97 percent; in the South, Black landowners lost 12 million acres of farmland over the past century, amounting to $326 billion worth of lost land in the United States due to discrimination.

The unjust policies that denied, dispossessed, and restricted Black individuals and communities of land ownership in the past have cast a long shadow. Policies that have routinely prevented Black communities from building generational wealth, like redlining and denying Black people mortgage loans and insurance, persist and are reflected in the massive racial wealth gap we’re still seeing today.

Even as the struggles for civil rights, inclusion, and economic justice gain ground, investment in the South remains uneven. Grantmakers for Southern Progress shares that the South receives less than three percent of all philanthropic investment in the United States. We must increase philanthropic action to build the capacity of community-based organizations and networks leading structural change work in the region.

As Tamieka Mosley of Grantmakers for Southern Progress and Nathanial Smith of the Partnership for Southern Equity, share: “If the South—the birthplace of historic and destructive inequities—rallies to end structural injustice, it can model for the country what the journey toward racial justice and equity looks like.”

Black communities continue to experience the ongoing legacy of slavery and racism through blatant discrimination from financial institutions whose inequitable lending practices limit Black entrepreneurs from attracting early critical investments. On average, early-stage entrepreneurs need about $30,000 in capital to get their initiatives off the ground, with friends and family of entrepreneurs on average providing $23,000 or more than three quarters, of the needed amount. All told, nationally friends and family investing exceeds $60 billion a year, nearly three times the investment level of venture capitalists.

However, not everyone has equal access to this vital source of capital. In 2019, the median White family in the United States had $184,000 in wealth compared to just $38,000 and $23,000 for the median Latinx and Black families, respectively. With this racial wealth disparity, Black entrepreneurs are less likely to receive early-stage funding from friends and family—a critical lifeline for business startups and growth opportunities.

It is especially critical because capital from friends and family typically has more flexible lending terms and is not tied to a person’s credit score; rather, it is based on the level of trust people have in the preparation of the business owner. These relationships and informal networks also provide other nonfinancial resources such as business advising, referrals, and support systems. For many Black entrepreneurs, particularly women, racial wealth inequality is the leading factor in why their great ideas never leave the napkin.

RUNWAY believes giving every Black entrepreneur access to the “friends and family” round of investing will be transformational for Black communities. The key to this process, as mentioned, is trust.

By infusing trust into exploitative and extractive systems, we can facilitate pivotal early-stage investments along with wraparound entrepreneurial ecosystem support like business coaching and advising. We can provide “friends and family” funding using patient, flexible capital to advance resiliency for Black businesses and the communities they serve.

Investing in people and places that have been historically excluded from traditional investment support will always appear risky to foundations and fund managers. The best antidote to that risk is to build trust-based, honest relationships with local community leaders and changemakers who deeply understand the region and the specific needs of that region. In the South, those relationships will be based on listening, mutual aid, and physical presence. These types of relationships are critical to making investments that shift the balance of power toward equity and wealth regeneration for Black communities.

Listening to the Community

I recently gathered in my home state of Alabama with a delegation of fund managers, investors, and philanthropists to bring reparative finance to the people and places that have been systemically blocked from wealth building opportunities as part of RUNWAY ROOTED, my organization’s latest initiative to invest in Southern Black entrepreneurship, creativity, and innovation.

It takes long-term, non-extractive, reparative investments . . . to undo the systemic design of racial hierarchy and imagine new possibilities.

We spent a week moving through the region to learn from community leaders, creatives, and local representatives about the unique economic challenges in the area. The experience illuminated the fact that Black business ownership is a mechanism that not only builds economic power, but social and political power as well.

Truth be told, in most cases, resistance from investors and wealth holders goes back to power. Those in power don’t want to let go of it. But the conversations like the ones we had in Alabama signal that things are changing. We must be deliberate in how we apply pressure. This involves deep collaboration between movement leaders, creatives, and community, as well as with investors, funders, and wealth holders. We must collaborate on ways to work together and co-conspire to build collective power.

Building collective power takes telling the truth about why Black people in places like Jackson, MS remain deeply entrenched in age-old, stubborn barriers to economic opportunity. It takes investors who are willing to reckon with a history that built wealth by stealing land from Indigenous nations and extracting free labor from enslaved Africans—and to invest in repairing the conditions that presently uphold the racial wealth gap. And it takes long-term, non-extractive, reparative investments that remind us that the real work is to undo the systemic design of racial hierarchy and imagine new possibilities.

Investing in Southern Creatives

Shaping our collective future into one that loves Black people needs the joy, inspiration, and useful critique of our political, economic, and social systems that come from creative thinkers and makers through their art, organizing, and visionary disruption. To tap into this dynamic force of change, it is vital to ensure that the extractive finance of the past does not block our collective ability to invest in the talent and innovation of the future.

This work requires long-term, flexible commitments of capital, time, and . . . support for Black-led businesses and innovation in the South.

Reimagining and collaboratively shaping a world where Black people are loved means prioritizing investments in creative entrepreneurs and creative placemaking. It means investing in places like Gee’s Bend, AL, to bring long-term business capital to the women who carry the legacy and tradition of West African quilting—one of the most important cultural contributions to the history of art in the United States. It means partnering with organizations like Upstart Co-Lab and Souls Grown Deep Foundation, who journeyed with us in Alabama, to invest in the arts, cultural, design, and innovation industries in the South with a mission toward repair and justice.

Philanthropy and investments that are transformative and inclusive are not only about diversifying the seats at the decision-making table. They also invite multiple voices into the design rooms where the table is carved out and set, ensuring it is broad and deep enough to nourish the future of local and national communities.

This work requires long-term, flexible commitments of capital, time, and capacity with a willingness to resolve disparities in funding and support for Black-led businesses and innovation in the South. It’s also necessary to acknowledge that the economic development programs that work for coastal metros or major cities may not be the same for the South—and need to be thoughtfully adapted to meet the distinct community needs, local infrastructure, and pulse of the region. By listening deeply and building authentic relationships with community leaders, community transformation over time can occur on community terms. Through this process, people are transformed—and so are community social and economic conditions.

I’ve always felt like investing in artists, creatives, and innovators does what Nina Simone famously said: “An artist’s duty, as far as I’m concerned, is to reflect the times.” Simone believed that artists and creatives have a responsibility to create work that reflects and addresses the social, political, and cultural climate of their era; that art has the power to serve as a mirror of society, bringing attention to important issues and fostering dialogue and understanding.

Today, the creative economy represents $985 billion in economic opportunity. This is also a time when art from creators like Amanda Gorman, who became the youngest inaugural poet in US history when she performed “The Hill We Climb” during President Joe Biden’s inauguration in 2021, is being banned in Florida schools. Responses like this tell us that art does indeed have power. Creativity has power. Innovation and truth-telling have power. And power is transformative.

…..

Building an economy that truly loves Black people requires a profound shift in financial structures and the way money moves. Investing in the South and supporting Southern Black creatives, innovators, and leaders is a pivotal step in redressing land loss and the discriminatory lending practices Black entrepreneurs continue to face.

We live in a moment of incredible opportunity. The mission (and the challenge) here is to take this moment and turn it into a movement that sustains the transformative work required to build an economy where we all have the power—and the right—to thrive.

#What Would an Economy That Loved Black People Look Like#Black Economics#Black Peoples Money#Black Money Matters#Black Finance#Black Lives Matter#Black Lifestyles Matter#Finance#financial structures#Black Entrepreneurs

2 notes

·

View notes

Video

youtube

Performance of Junk Removal Service Suppliers

Nobody can deny the way that here we have a ton of rivals in every single space. This isn't that much easy to claim any item or service of the organization. We have wide choices and we can along these lines compare elements of items or services prior to getting one. As far as junk removal services additionally, we will find different organizations that have been serving different areas since years in the particular space. A portion of the organizations have been acquiring consideration for their quality same day services and some for reusing process. However, a few firms are likewise there which have been serving their wide client with the two kinds of services for example gathering of wastes and reuse them for the reuse.

Four valuable elements which can assist one with identifying the performance of professional waste administration organizations are as per the following:

Experience

This is the way that people go for services of the organization that have been working for a really long time. The reason is that they accompany supervisory crew which has made a few junk removal projects fruitful. They accompany all such things which are expected to fulfill clients concerning nature of services, removal of different kinds of rubbish, and so forth.

Kinds of services

For junk removal, kinds of services imply that the organization is fit to remove different kinds of business and private junks. Besides, kinds of junks which a professional and experienced firm removes incorporate development or remodel garbage, carport clean-outs, yard waste, old furniture, concrete from broken deck, fence cutting, black-top shingles, vehicle batteries, paint, and so on.

If any organization has been offering these much choices in waste removal services; it guarantees that the organization is capable and is competent to manage different kinds of wastes tracked down in different areas.

Proficiency

One of the most valuable elements to check the performance is to dissect the proficiency of the organization. Furthermore, the productivity can be estimated by really looking at wealth of staff, all around kept up with vehicle, quality-tried gear and substantially more.

One can likewise check the proficiency by going through the work objective of organizations and coordinating it with project records. A large portion of the organizations present these days have been working fully intent on decreasing the circumstance of landfill.

7 notes

·

View notes