#punjab national bank foundation day

Text

Punjab National Bank has launched its new customer care numbers 1800-1800 & 1800-2021 on the occasion of the bank’s 129th Foundation Day. The new easy-to-recall toll-free number aims to provide PNB customers with a seamless and hassle-free experience whenever they reach out to the customer care team. Additionally, the bank introduced other products such as E-Marketplace and Instant QR on Mobile Banking App PNB One, PABL (Pre-approved business loan), Central Bank Digital Currency (CBDC), Digital KCC through JanSamarth Portal, Current Account opening through TAB and Video-KYC, PNB eSWAR and PNB Metaverse.

#Central Bank Digital Currency#Digital Offerings on 129th Foundation Day#Mobile Banking App#pabl pnb#pnb bank#PNB PRERNA#Punjab National Bank#punjab national bank foundation day#Punjab National Bank launches#Shri Atul Kumar Goel

0 notes

Text

BFSI SECTOR IN INDIA: A JOURNEY OF GROWTH, DISRUPTION & FINANCIAL INCLUSION THROUGH FINTECH

Chapter 1: Historical Evolution of the BFSI Sector in India:

Indigenous banking systems & practices.

Introduction of modern banking institutions during the colonial era.

Birth of indigenous banks in the early 20th century.

Nationalization of banks in 1969 & its impact on inclusive growth.

Technological advancements & computerization in the 1980s.

Economic liberalization & entry of private sector banks in the 1990s.

Rise of insurance as a vital component of the sector.

Once upon a time, in the vast & diverse land of India, the seeds of the BFSI (Banking, Financial Services & Insurance) sector were sown. The roots of this sector can be traced back to ancient times when indigenous banking systems & financial practices thrived. In those days, the community would come together to support each other’s financial needs, fostering a sense of trust & solidarity.

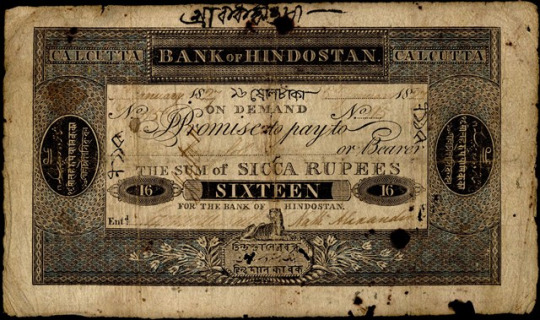

The first bank in India was The Madras Bank which was founded in 1683 & the Bank of Hindostan was the first Western-style commercial bank to open in India in 1770. It was the first bank in Calcutta to be managed by Europeans. It was dissolved between 1830 & 1832.

Bank of Hindostan - Sixteen Sicca Rupees

As time went by, the banking landscape in India began to evolve. During the colonial era, the British introduced modern banking institutions, marking the advent of formal banking in the country. The establishment of the Bank of Calcutta on the 2nd of June 1806 (later renamed as Bank of Bengal on 2nd Jan 1809), followed by the Bank of Bombay & the Bank of Madras, laid the foundation for a structured banking system.

The early 20th century witnessed the birth of indigenous banks, such as Punjab National Bank & Canara Bank, which aimed to serve the needs of the Indian population. These banks were instrumental in supporting India’s growing economy & providing financial services to various sectors.

Post-independence, the Indian government recognized the significance of a robust banking system in fostering economic development & ensuring financial stability. The year 1969 marked a significant milestone in the history of the banking sector in India, as the government nationalized 14 major banks, aiming to bring banking services closer to the masses & promote inclusive growth. With the nationalization of banks, the reach of banking services expanded rapidly. Branches were established in remote villages & banking facilities became accessible to the common people. The sector played a pivotal role in channeling funds to key sectors like agriculture, industry & infrastructure, contributing to the country’s overall progress.

As the Indian economy continued to grow, the banking sector embraced technological advancements. The introduction of computerization in the 1980s brought about a paradigm shift in banking operations. Manual processes gave way to automated systems, enhancing efficiency & customer service. The 1990s marked a turning point in the sector’s history with economic liberalization. The government initiated reforms to foster competition, attract foreign investments & strengthen the banking system. This led to the entry of private sector banks, which brought innovation, customer-centric services & a new wave of competition to the industry.

In the 21st century, the BFSI sector witnessed the emergence of insurance as a vital component. Insurance companies expanded their presence, offering life, health & general insurance products to meet the growing demand for risk mitigation & financial protection.

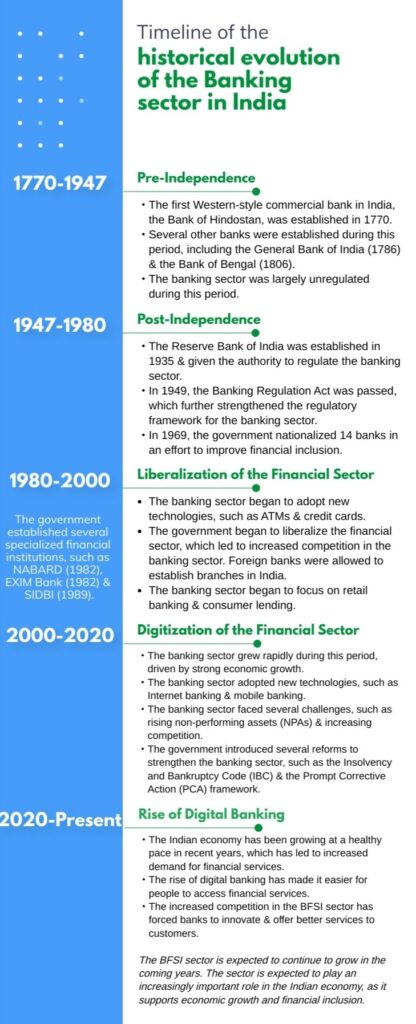

Timeline of the historical evolution of the Banking Sector in India

Chapter 2: The Rise of Fintech & its Transformative Impact:

Definition & significance of fintech.

Fintech revolutionizing traditional financial services.

Introduction of digital payments & the Unified Payments Interface (UPI).

The surge in cashless transactions & financial digitization.

Promoting financial inclusion through mobile banking & digital wallets.

Role of fintech in reshaping lending practices & peer-to-peer lending platforms.

However, the real game-changer in the history of the banking sector in India came with the rise of fintech. Technological advancements, coupled with a burgeoning startup ecosystem, paved the way for fintech companies to disrupt traditional financial services. These innovators leveraged digital platforms, mobile technology & data analytics to provide seamless & personalized financial solutions to customers.

Fintech revolutionized the sector, transforming the way people transact, borrow, invest & manage their finances. Digital payments gained momentum, with the introduction of the Unified Payments Interface (UPI) as a game-changing platform. The ease & convenience of digital transactions led to a massive surge in cashless payments, driving financial digitization across the country.

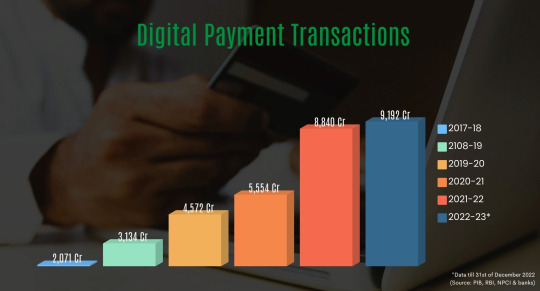

Digital payment transactions have expanded dramatically, from 2,071 crore transactions in FY 2017-18 to 8,840 crore transactions in FY 2021-22.

(Source: RBI, NPCI & banks)

Various simple & convenient modes of digital payments, such as Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), Immediate Payment Service (IMPS) & National Electronic Toll Collection (NETC), have grown significantly in the last five years, transforming the digital payment ecosystem by increasing both person-to-person (P2P) & person-to-merchant (P2M) payments.

BHIM UPI has emerged as citizens’ favorite payment mechanism, with 803.6 crore digital payment transactions worth 12.98 lakh crore conducted in January 2023.

(Source: PIB)

THE TOTAL NUMBER OF DIGITAL PAYMENT TRANSACTIONS UNDERTAKEN DURING THE LAST FIVE FINANCIAL YEARS & THE CURRENT FINANCIAL YEAR ARE AS UNDER:

Note: Digital payment modes considered are BHIM-UPI, IMPS, NACH, AePS, NETC, debit cards, credit cards, NEFT, RTGS, PPI & others

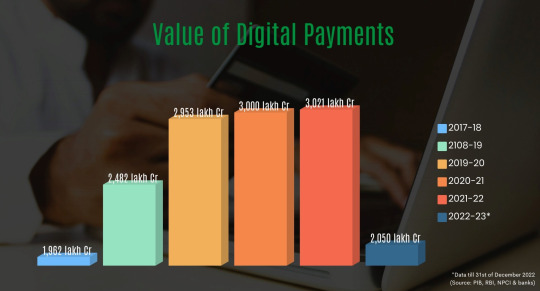

THE TOTAL VALUE OF DIGITAL PAYMENTS DURING THE LAST FIVE FINANCIAL YEARS & IN THE CURRENT FINANCIAL YEAR ARE AS UNDER:

Note: Digital payment modes considered are BHIM-UPI, IMPS, NACH, AePS, NETC, debit cards, credit cards, NEFT, RTGS, PPI & others.

This represents a significant increase, highlighting the growing acceptance of digital payments & the impact of fintech in reshaping the BFSI landscape.

Furthermore, fintech companies played a crucial role in promoting financial inclusion. Through mobile banking, digital wallets & microfinance platforms, they extended financial services to countryside areas & enabled individuals & small businesses to access credit, make payments & improve their financial well-being.

Moreover, fintech has revolutionized lending practices in India. Peer-to-peer lending platforms have emerged as an alternative to traditional lending institutions, providing borrowers with easier access to credit & investors with attractive investment opportunities.

Chapter 3: Embracing Digital Transformation in the BFSI Sector:

Traditional BFSI players investing in digital infrastructure.

Adoption of artificial intelligence, machine learning & data analytics.

Enhancing customer experiences & streamlining processes.

Digital onboarding of customers & virtual assistants for support.

Impact of the recent past years on accelerating digital adoption.

The BFSI sector in India has recognized the need to embrace digital transformation to stay competitive & meet the evolving demands of customers. This has led to several key developments:

Traditional banks & financial institutions investing heavily in upgrading their digital infrastructure. They are modernizing their core banking systems, enhancing online & mobile banking platforms & improving cybersecurity measures. These investments are aimed at providing customers with seamless & secure digital banking experiences.

Artificial intelligence (AI), machine learning (ML) & data analytics are being leveraged by the BFSI sector to gain valuable insights & enhance decision-making processes. Banks are utilizing AI-powered chatbots & virtual assistants to provide instant customer support & personalized services. ML algorithms are used for fraud detection, risk assessment & credit scoring, improving operational efficiency & reducing manual errors.

Digital transformation has paved the way for enhanced customer experiences. Banks are focusing on creating user-friendly interfaces, providing personalized recommendations & offering 24/7 access to banking services. Customers can perform a wide range of transactions online, such as fund transfers, bill payments & account management. This shift to digital channels has significantly reduced the need for physical visits to branches, streamlining processes & saving time for both customers & banks.

Digital onboarding of customers using Video KYC Solutions & virtual assistants for support has simplified the account opening procedures for customers. Through online portals & mobile apps, individuals can complete the entire account opening process remotely, eliminating the need for physical paperwork & branch visits. Additionally, virtual assistants & chatbots are being deployed to handle routine customer queries, providing immediate assistance & improving response times.

In recent past years acted as a catalyst for digital adoption in the BFSI sector. With social measures in place, customers increasingly relied on digital channels for their banking needs. Banks rapidly scaled up their digital capabilities to meet the surge in demand for online services. Digital payment solutions, such as UPI & mobile wallets, witnessed significant growth during this period. This highlighted the importance of robust digital infrastructure & accelerated the pace of digital transformation in the BFSI sector.

Overall, the BFSI sector’s embrace of digital transformation has led to improved customer experiences, streamlined processes & increased access to financial services. The adoption of technologies like AI-driven Credit Underwriting, Bank Statement Analyser, ML & data analytics has enhanced operational efficiency & enabled better risk management. As the sector continues to evolve, the integration of digital technologies will play a crucial role in shaping its future.

Chapter 4: Current Trends & Future Outlook:

Continued focus on digitalization, AI & blockchain.

Open banking frameworks & collaborations between traditional institutions & fintech startups.

Regulatory frameworks to foster innovation & ensure consumer protection.

Expected growth & disruption in the BFSI sector.

Opportunities for further financial inclusion & technological advancements.

THE BFSI SECTOR IN INDIA IS WITNESSING SEVERAL NOTABLE TRENDS & HOLDS PROMISING PROSPECTS FOR THE FUTURE:

In addition to cooperative credit institutions, the Indian banking system includes 12 public sectors, 22 private sectors, 46 foreign, 56 regional rural, 1485 urban cooperatives & 96,000 rural cooperative banks.

The total number of ATMs in India as of Sep 2021 was 2,13,145, with 47.5% located in rural & semi-urban regions.

Bank assets rose in all industries in 2020–2022. In 2022, the total assets of the banking industry (including both public & private sector banks) rose to US$ 2.67 trillion.

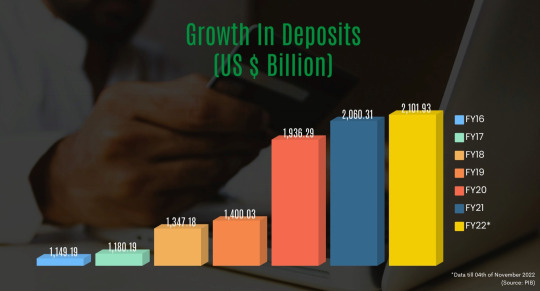

Bank credit grew at a CAGR of 0.62% from FY16 to FY22. Total credit extensions reached US$ 1,532.31 billion as of FY22. Deposits increased at a CAGR of 10.92% from FY16 to FY22, reaching US$ 2.12 trillion by FY22. As of November 4, 2022, bank deposits totaled Rs. 173.70 trillion (2.12 trillion USD).

In March 2020, the SCBs’ Gross Non-Performing Assets ratio (GNPA) was 8.2%; in September 2022, it reached a seven-year low of 5.0%.

(Source: PIB)

GROWTH IN DEPOSITS

Growth In Deposits

These data show that the BFSI sector in India has been growing steadily in recent years. Digitalization will remain a key priority for the BFSI sector. Banks & financial institutions will continue to invest in upgrading their digital infrastructure, enhancing online banking services & providing seamless customer experiences. The adoption of AI & machine learning will further drive automation, data analytics, & personalized services. Additionally, blockchain technology is gaining traction for secure & transparent transactions, enabling faster & more efficient processes.

Open banking is gaining momentum in India, fostering collaboration between traditional BFSI players & fintech startups. Open banking frameworks enable secure data sharing between banks & third-party providers, leading to the development of innovative products & services. Traditional institutions are partnering with fintech startups to leverage their technological expertise, agility & customer-centric solutions. This collaboration is expected to fuel innovation, enhance customer experiences & expand the range of financial services offered.

Regulators in India are actively working towards creating an enabling environment for innovation in the BFSI sector. Regulatory sandboxes & guidelines are being developed to facilitate experimentation with new technologies & business models. Simultaneously, consumer protection measures are being strengthened to ensure transparency, data privacy & security. Regulators are working closely with industry stakeholders to strike a balance between innovation & risk mitigation.

The BFSI sector in India is poised for significant growth & disruption in the coming years. Factors such as increasing internet penetration, smartphone adoption & government initiatives like Digital India & Jan Dhan Yojana are driving financial inclusion & expanding the customer base. Fintech startups are challenging traditional players with their innovative offerings, reshaping the competitive landscape. The sector will witness further digitization, evolving customer expectations & new business models that leverage technology.

India has seen a boom in fintech & microfinancing in recent years. Due to a five-fold growth in digital disbursements, India’s digital lending, which stood at US$ 75 billion in FY18, is predicted to increase to US$ 1 trillion in the coming time.

The Indian fintech sector has so far (January 2017–July 2022) garnered US$ 29 billion in financing across 2,084 agreements, making up 14% of the world’s funding & placing second in terms of deal volume.

India’s fintech business is anticipated to grow to 6.2 trillion rupees (US$ 83.48 billion) by 2025.

The BFSI sector presents ample opportunities for advancing financial inclusion & leveraging technology for societal impact. Fintech solutions can bridge the gap in financial services for underserved populations, enabling access to credit, insurance & savings products. Technology can also play a crucial role in addressing challenges related to identity verification, fraud prevention & cybersecurity. The Adoption of emerging technologies like biometrics, the Internet of Things (IoT) & decentralized finance (DeFi) can unlock new avenues for financial inclusion & innovation.

The journey of the BFSI sector in India has been nothing short of remarkable. From its historical roots in indigenous banking practices to the modernization brought about by colonial influences, the sector has continuously evolved to meet the changing needs of the nation. The nationalization of banks in 1969 & subsequent economic liberalization paved the way for inclusive growth & expansion of financial services to the masses.

The BFSI sector plays a crucial role in India’s progress & development. It acts as a backbone for the economy, providing essential financial services, facilitating investment, promoting savings & channeling funds for productive purposes. The sector’s stability & efficiency are key to ensuring economic stability & supporting various sectors such as agriculture, industry & services.

Looking ahead, the future of the BFSI sector in India appears bright & promising. The sector is poised for continued growth & transformation, driven by technology & innovation. The ongoing focus on digitalization, artificial intelligence & blockchain will further enhance customer experiences, streamline processes & enable the development of innovative financial solutions. Open banking frameworks & collaborations between traditional institutions & fintech startups will lead to the emergence of new business models & a broader range of financial services.

While challenges & risks exist, such as ensuring data security, privacy & regulatory compliance, the overall outlook for the BFSI sector remains optimistic. The sector is well-positioned to leverage technology, adapt to changing customer preferences & drive financial inclusion. By embracing innovation, fostering collaboration & addressing societal needs, the BFSI sector will continue to be a catalyst for economic growth & empowerment in India.

In conclusion, the journey of the BFSI sector in India, from its historical roots to the present-day landscape, showcases the sector’s resilience & adaptability. As a critical driver of the nation’s progress, the sector will continue to evolve, leveraging technology & innovation to meet the evolving needs of the Indian population. With a strong foundation & an optimistic outlook, the BFSI sector is poised to shape a prosperous future for India.

1 note

·

View note

Text

Yobit.net Cash Is Dead Yobit Exchange

“Physical money is out,” said B.S. Kohli, an economic advisor to the top of the Indian state of Punjab. Mothanna Gharaibeh, Jordan’s minister of digital economy and entrepreneurship, agreed.

As of this year, Gharaibeh said, Jordanians can not buy government services, from taxes to hospital bills, with cash. they need to use electronic payment systems like bank transfers or mobile wallets.

“It’s getting to be a troublesome transformation,” he said, pertaining to the nation’s poor and unbanked populations. “But refugees can take mobile wallets using their UN Refugee Agency ID cards. … We just got to stop printing [bills] and put it instead on mobile accounts or in bank accounts.”

Unlike many dollar-dominance-skeptics in Davos for the forum, Gharaibeh said pegging Jordanian dinars to the dollar has served the smaller nation well for many years . He doesn’t see needing to reinvent money, just remove the anonymous properties.

“Because we'd like to prevent evasion ,” he said.

Israeli historian Yuval Noah Harari – author of the bitcoin community cult classic "Sapiens" – said he’s skeptical of bitcoin.

“Money goes within the direction of more and more trust,” he said. “Bitcoin is predicated on mistrust. It’s basically a return to gold.”

On the opposite hand, Harari predicted the entire elimination of monetary privacy could happen “very quickly,” which he described as a “dangerous” prospect.

Ask almost any economist, banker or yobittex.com politician at the WEF about financial privacy and they’ll scoff. With shockingly few exceptions, most will say more financial data collection and passive surveillance will benefit society. (When pressed, they could emphasize the importance of encryption and regulating access to the info .)

RegTech expert Diana Paredes, an underwriter turned CEO of the compliance startup Suade Labs, agreed the sentiment among her public- and private-sector clients is “cash is dead.” However, she added, it’s the work of policymakers to guard consumer interests.

“What we should always be doing is regulating privacy around [electronic payments],” she said. “I want to have my data. It should belong to me, not the bank.”

Bitcoin in Davos

Fear not, bitcoiners: Not all members of the yobit Davos elite are pushing for e-fiat authoritarianism; some leaders here see a future where bitcoin continues to thrive.

“Bitcoin may be a fantastic idea, as long because it is monitored,” Kohli said, praising the compliance standards already upheld by bitcoin-friendly Swiss banks.

Bruno Le Maire, the French minister of finance , offers a shining example of a bitcoin-friendly politician.

He said decentralized digital assets will have a task to play within the way forward for France, as long as organizations just like the crypto custody startup Ledger and therefore the bitcoin development startup ACINQ still pay taxes and uphold regular compliance standards.

“We don’t want digital companies issuing their own currencies like sovereign states,” he said, making a subtle dig at Facebook’s Libra. “But we believe [bitcoin] can reduce the prices and delays of international payments. … We strongly believe fintech.”

Likewise, Mariam Al Muhairi of the state-backed Dubai Future Foundation says her team will spend 2020 exploring the way to support companies that want to use digital assets.

“It’s to assist regulate that area,” she said, emphasizing the team remains within the research phase. “There are entities that do own and use [cryptocurrency].”

Paredes added the simplest thanks to protect bitcoin’s usability is to teach regulators about specific use cases in order that they can make laws and compliance standards without jeopardizing projects useful .

The divide between cypherpunks and banks grows ever more narrow when experts drill right down to the specifics.

wef-2020-bruno

French minister of finance Bruno Le Maire et al. discuss the way to tax Big Tech. (Credit: Leigh Cuen for CoinDesk)

Common ground

Most crypto veterans at the WEF were even as hooked in to financial institution digital currencies (CBDC) because the bankers themselves.

For example, Elizabeth Rossiello, CEO of Aza Financial (formerly known by the name of its retail product, BitPesa), said she’s “really excited” about the People’s Bank of China issuing a CBDC. She sees this so far another customer onramp that enhances the very fact bitcoin makes up 7 percent of her company’s monthly volume.

MakerDAO Foundation CEO Rune Christensen agrees: “Generally i feel it’s specialized for the trend of digitizing the economy,” he said of the CBDC trend. “It’s just a step toward more blockchain adoption.” His project’s DAI stablecoin, he told CoinDesk, could at some point be the liquidity backbone for the world’s CBDCs.

Meanwhile, Cloudflare CTO John Graham-Cumming said his internet infrastructure company generally takes a proactive approach to promoting censorship-resistance, whilst his team supports clients like banks and similar institutions within the public sector.

“What goes over our network isn’t really our business. and that we don’t think it’s our job to work that out because that might be quite creepy,” he said, adding the corporate runs gateways to both ethereum and therefore the InterPlanetary filing system (IPFS).

From Graham-Cumming’s perspective, bitcoin is a powerful experiment because it actually works and continues to figure , no matter political and technical challenges. Yet, Cloudflare is more focused on ethereum.

“When you check out the smart contract stuff, that’s a programing language . we expect someone goes to create something interesting with ethereum and that we hope they’ll find our services useful,” he said. “As people start to figure with new organizations for financial transactions, they have to ask how that organization is brooding about security. … We’re all resting on top of something else.”

The only thanks to protect privacy during a world of digital cash, he said, is with a mixture of excellent regulatory policies and standard “best practices” that promote security throughout the ecosystem’s architecture.

“The idea of Web3 is that you simply should be resilient,” he concluded.

Zack Seward contributed reporting.

1K notes

·

View notes

Text

Rise of Implements & Machinery in Indian Farming Culture

Mechanization of Indian Agriculture

The Indian government is focused on elevating farm mechanization to increment farming yield. This includes reviving the agricultural division by modernizing farm machinery, supporting advancement in farm innovation, and offering motivating forces in the types of endowments to agricultural machinery manufacturers and buyers. The utilization of increasingly effective farm actualizes will cut down work and time costs, improve efficiency per hectare, and losses acquired in the post-harvest phase.

Expanded farm mechanization is required to determine a portion of the approaching difficulties looked by the Indian agricultural sector, for example, work deficiency because of the movement of farm laborers to urban territories to work in other creating areas and conflicting profitability of cultivable lands because of an over-dependence on the undependable monsoon rains. Farm machinery like tractors, tillers, threshers, gatherers, reapers, and harvesters can eliminate work prerequisites, and advanced water irrigation system strategies can resolve crop irrigation water system concerns.

Another positive result of farm mechanization will be a decrease in the number of accidents and injuries brought about by handheld farm executes; these can regularly end up being incredibly exorbitant throughout everyday life and financial terms, debilitating specialists and holding up farm work.

Mechanization of Indian Agriculture (Source – icrisat.org)

Level of Mechanization in the Indian States

Compared with nations, for example, the United States, Canada, France, Japan, and China, India falls behind impressively in the across the board utilization of present-day farm executes and apparatus. Farms in the flatlands of Punjab, Haryana, Uttar Pradesh, and Maharashtra have the most significant levels of mechanization in the nation, while farms in the uneven territories of the North Eastern States have the least. This has a great deal to do with geology, farms estimates, the degree of government endowments and financing, accessibility of transport and transportable streets, and data access to present-day farming practices and technologies.

To support farm mechanization at all levels in every Indian locale, the administration has supported plans like Rashtriya Krishi Vikas Yojana (RKVY), the National Mission on Agricultural Extension and Technology (NMAET), the Sub-Mission on Agricultural Mechanization (SMAM, some portion of NMAET), and the Mission for Integrated Development of Horticulture (MIDH).

The positive result of these plans can be found in the improvement of new ladies driven agricultural actualizes by the Indian Council of Agricultural Research (ICAR) and progressed agricultural machinery like groundnut diggers and sugarcane grower by Indian innovators. Presentation of sun oriented controlled water frameworks in provincial zones to sidestep the dubious force gracefully has additionally come about through government sponsorship.

The government has additionally been advancing custom employing focuses where farmers can enlist the actualizes and apparatus they need. It is all the more monetarily practical for Indian farmers to hire equipment for the restricted term of the planting and gather seasons than to need to tolerate the cost of purchasing, maintaining, and storing the apparatus. Framing cooperatives to employ farm actualizes and apparatus is another successful path for destitute ranchers to get to the most recent agricultural technology.

Factors that Disrupt Mechanization of Indian Farming

Indeed, even with the administration firmly backing automation of farm actualizes and machinery, there are a few problematic elements that shield the Indian agrarian area from pushing forward toward this direction.

Indian farms are not as broad as American and Canadian farms, and a huge level of them, truth be told, are little land possessions that frequently don't surpass 12 sections of land. Gaining huge and over the top expensive farm machinery for such little farmlands doesn't make economic sense, particularly given that the vast majority of the farmers are in the low to the center level of pay.

In hilly regions, land size separated, the landscape utilizes huge farms machinery unfeasible.

Another significant factor is the financial related powerlessness of low-income farmers to manage the cost of expensive farms actualizes and machinery, even with government subsidy assistance. They need to plan of action to high-financing cost advances that require insurance and obligation reimbursement in a generally brief timeframe edge, and which banks and other money-related foundations regularly shrug off giving to them because of the risk of default.

The shortage of prepared professionals in rural zones to give fix and upkeep administrations is another key obstacle. While a considerable lot of the main Indian manufacturers of rural actualizes and hardware do have designers to give after-buy support administrations, they may not be promptly accessible in provincial insides. The accessibility and significant expenses of new parts – particularly on the off chance that they are of remote make – is additionally an issue of concern.

Future Outlook in Farm Mechanization in India

To deliver higher harvest respects feed a developing population, a more extensive degree in farm mechanization is inescapable. Indian farming machinery manufacturers as of now rule the Indian agrarian scene and are probably going to keep on doing as such with increasingly creative actualizes and advances for local and universal agriculture markets.

Proceeded with developments in farm executes and advancements will make agriculture increasingly feasible for farmers, support their earnings, and improve the general state of the Indian farming culture.

#agribusiness#digitalagriculture#agriculture#agrojay#agrosearch businessdirectory mkisan agrimanufacturer agrojay agrojai होयआम्हीशेतकरी मीशेतकरी meshetkari kisankranti iamfarmer kisanSuvidha S

3 notes

·

View notes

Text

Importance Of Distance Education In India

Separation learning offers you the freedom of getting a vocation though discovering all together that once your training is finished you have work aptitude additionally making your resume more grounded and giving you a situation over your rivals. Likewise, it'll without a doubt be in support of you once enrollment specialists see that you essentially have the ability to perform multiple tasks and oppose obligations well.

Separation learning is a great deal of accommodating in talented courses like Associate in Nursing Master in Business Administration. For working experts or center level officials a separation learning Master in Business Administration could be a decent method to highlight on the board abilities, such a course doesn't take your moved from your work anyway includes to aptitudes. Taking a holiday isn't workable for a few people owing to fluctuated imperatives and despite the fact that they're prepared to take a vacation, it ought not be valuable. Since, if the corporate is {functioning} and prepared to work while not your essence then it should mean they are doing not need you. During a universe of ferocious challenge as nowadays this can be not such a genuine arrangement. In this way, while a private could feel that an administration degree goes to help him; it gets extreme to seek after a degree with such a great deal of obstacles.

This is any place a separation learning Master in Business Administration steps in; you get your administration degree while not going out on a limb on your activity. This kind of Associate in Nursing training scores on a lot of levels, it offers you adaptability, accommodation, efficient and it spares you money. a day by day Master in Business Administration from a secondary school can esteem you pools of rupees nonetheless; a separation learning Master in Business Administration program can esteem a small amount of that amount.

online B.COM course is a basic decision to a few work goers of late. In any case, it's hard to choose the correct Distance Education focus as there are many! A look at some of the presumed Distance Education resources in Bharat can help you in acquiring a straightforward picture concerning it.

ICFAI is hierarchic among the most elevated 10 B schools in Bharat and it offers post graduate projects in Management with shifted specializations.

Arrangement openings ar realistic all through Bharat. Candidateswill apply on-line and make an installment of Rs.700 through net installment dish.

School 2: relationship Center for Distance Learning, Pune

Advantageous interaction is that the greatest independent separation learning instruction foundation in Bharat. It offers Post Graduate sheepskin; sheepskin and Certificate programs crosswise over exchange areas just as Business Management, IT, Banking and Finance, SCM, CRM, Insurance Management and so forth. You can buy the outline from SCDL Campuses, SCDLdata Centers, first class AXIS Banks and HDFC Banks.

School 3: land area Manipal University, Manipal

SMU-DE conveys quality training and pulls in the most straightforward understudies in Bharat United Nations office are longing for separation instruction. enormous choice of specializations like Master in Business Administration in Project Management (PM), information Systems (IS), Total Quality Management (TQM), selling Management (MM), Finance International Business (IB), tending Services (HCS), Environmental Management (EM) and give Chain Management (SCM) ar advertised.

School 4: AIMA, Delhi

AIMA offers Management instruction plans for understudies. AIMA have numerous standards identifying with enlistment and beginning of the program. Projects at the Study Centers, assignments, term-end assessments, movement to next module, re-enrollment for excesses (assuming, any) and assembly are referenced inside the site.

School 5: IGNOU, New Delhi

IGNOU offers 490 Certificates sheepskin, Degree and degree programs. it's a center for separation learning with global acknowledgment and nearness with quality instruction and training. Candidates will apply for changed projects of IGNOU on-line.

School 6: Welingkar Institute of Management Development and examination, Mumbai

The Wi-Fi Welingkar field is one the least difficult B-schools with a few offices. HDFC Bank gives instruction advances to understudies United Nations office can verify affirmation. the universities are pondered to be best as far as experience and instructional exercise certifications.

School 7: Pakistani money related Unit University, Chennai

Anna University proposes the production of the Center of Distance Education. Focus has propelled talented Master in Business Administration, MCA and b com in one year through Distance Education. Qualification to hitch Master in Business Administration is fulfillment of any degree and a go inside the passage investigate directed by Pakistani money related Unit University. Projects offered in Master in Business Administration are Master in Business Administration – General Management, Technology Management, financial Services Management, Retail Management, Health Services Management, and Human Resources Management.

School 8: geographic area Technical University, Punjab

The University has 380 Engineering and Architect, Management &Hotel Management and Pharmacy resources and very 2000 learning focuses beneath separation mode. PTU grants the researchers to send their questions to hitch the varying courses gave by the University through totally extraordinary Learning Centers.

School 9: Amity personnel of Distance Learning, Noida

Friendship personnel of Distance Learning (ASoDL) gives Distance Education to understudies and managing experts crosswise over Bharat. Harmony is hierarchic as No.1 B staff organization for separation learning. Harmony understudies have jumped on-grounds arrangements in MNCs and a record of 1309 understudies set during a solitary day by Accenture.

School 10: Bharatiar University, Coimbatore

College has 104 joined resources, ninety two Arts and Science resources, a couple of University resources, twelve Management foundations and one Air Force Administration school. Also, there are twenty five investigation Institutes of the State and Central Governments that are perceived by this University for examination reason. furthermore, every one these foundations take into account the instructional exercise needs of very one, 50,000 understudies and examination understudies

Visit For More Information :- online B.COM course

1 note

·

View note

Text

EVERYTHING ABOUT ABG SHIPYARD; INDIA’S BIGGEST BANK FRAUD

The Central Bureau of Investigation (CBI) has booked ABG Shipyard Limited, its previous Chairman and Managing Director Rishi Kamlesh Agarwal, alongside a few others including Executive Director Santhanam Muthaswamy, Directors Ashwini Kumar, Ravi Vimal Nevetia, and Sushil Kumar Agarwal for supposedly swindling a consortium of banks drove by State Bank of India of over Rs. 22,842 crore, making it India's greatest instance of bank extortion.

"Look were led on Saturday at 13 areas in the premises of denounced including privately owned business, chiefs at Surat, Bharuch, Mumbai, Pune, and so on which prompted the recuperation of implicating archives," said the CBI in a proclamation.

The SBI bank recorded the very first objection in 2019 on November eighth on which the CBI had looked for certain clarifications on March 12, 2020. A new grievance was again recorded in the long stretch of August around the same time. Subsequent to researching the case for oneself and a half years, the CBI followed up on the objection recording a FIR on February 7, 2022.

As per figures from the criminological review that were remembered for the CBI grumbling, ABG Shipyard Limited owed 70.89 billion rupees to ICICI Bank, 36.34 billion rupees to IDBI Bank, 29.25 billion rupees to the State Bank of India, 16.14 billion rupees to Bank of Baroda, 12.44 billion rupees to Punjab National Bank and 12.28 billion rupees to Indian Overseas Bank.

ABOUT ABG SHIPYARD?

It was March 15, 1985, when ABG Shipyard Limited (ABGSL) was consolidated with its enlisted office in Ahmedabad, Gujarat. It is a leader endeavor of the ABG Group, initially advanced by Rishi Agarwal. It is occupied with the matter of shipbuilding and boat fix. It has shipyards situated at Surat and Dahej in Gujarat with the ability to develop vessels to 18,000 extra weight (DWT) at Surat Shipyard and 1,20,000 extra weight (DWT) at Dahej Shipyard.

Since the foundation of the organization, it has built north of 165 vessels over the most recent 16 years including specific vessels like newsprint transporters, interceptor boats, drifting cranes, stacking mass concrete transporters, pusher pulls, dynamic situating plunging support vehicles, and so on

ABG SHIPYARD FRAUD: WHAT EXACTLY HAPPENED?

ABG Shipyard experienced gigantic accomplishment for certain years yet ran into tough situations from the year 2012. The credits were given to the organization between 2005-2010 by the banks.

The organization's credit account was first announced as NPA in July 2016. NPA alludes to Non-Performing Asset; it is a credit for which the head or interest installment is late for 90 days.

The review by Ernst and Young referenced that between 2012-2017, "the blamed have conspired together and serious criminal operations including redirection of assets, misappropriation and criminal break of trust and for purposes other than for the reason for which the assets are delivered by the Bank."

In April 2019, the National Company Law Tribunal (NCLT) requested the liquidation of the organization under the Insolvency and Bankruptcy Code (IBC).

In November 2019, SBI documented its first grievance against the organization.

"From the underlying examination, apparently the credits were endorsed somewhere in the range of 2005 and 2010. Apparently the cash was given out without due steadiness from the banks. The misrepresentation sum being scrutinized could be pretty much than what is reflected at this moment," said a CBI source.

Budget summaries uncovered that the organization redirected the advances it took from different Indian banks to buy inclination partakes in ABG Singapore worth $43.5 million.

0 notes

Text

Bank Merger - Sethurathnam Ravi (S Ravi) Former BSE Chairman enunciate about it

When recently 27 public sector banks merged including the Punjab National Bank, nearly every individual was worried about his savings and even fixed deposits with the public sector banks. As per the announcement made by S Ravi BSE Ex-Chairman, the amalgamation scheme listed the merger of various popular banks like Indian Bank merged with Allahabad Bank, Canara Bank merged with Syndicate Bank, Oriental Bank of Commerce and the United Bank of India merged with Punjab National Bank, and lastly, Andhra Bank and Corporation Bank merged with Union Bank. The announcement of the merger came with a huge impact on the 308732 employees of the banks, 37492 domestic branches, 45448 ATM centers, and Rs. 3179304 crore deposits.

However, the impact of the merger is not only limited to all these. It is much more than the figures and facts that are mentioned in the papers. As per the BSE Chairman, these mergers come with a huge impact on the fixed deposit holders, savings account holders, employees, shareholders, borrowers, and the public. The primary aim of these mergers was to create large banks that are more capable of solving financial issues. Also, the merger was introduced to eradicate any kind of disparity between the small banks and large banks, cost savings from compliances and network overlaps, creating large middle management for selecting eligible candidates for the post of CGM, GMs, and DGMs for HR Department, IT department, and Risk management and much more. Overall, the mergers would improve the efficiency of restructuring and decision-making on high-leading banks.

Today, through this piece of information let’s talk about the impact of bank mergers as discussed by Sethurathnam Ravi with some quick points, making it easy to understand.

· Any kind of consolidation or merger makes dread among the partners, investors, and the representatives associated with the banks. The serious short-term issues can be taken out with the possibilities of long-term advantages given the consolidation process is consistently executed, with firm yet fine adjusting of partner interests. Also, Unions of the bank employees from different affiliations should be ensured that their skills are united for the development of the new element.

· The advantages of the mergers are just accomplished in the medium term to long term as the more grounded banks require critical time, endeavors, and assets to turn around the more fragile monetary records, execute the guide for adjusting HR and foundation like bank branches, bank products, ATMs, and so forth just as the reconciliation of Information Technology which is one of the greatest tests.

· Integration is something that seems to be too difficult when such mergers take place. As per the BSE Chairman, coordinating two organizations on various IT stages into a typical one is harder than setting up another bank as each bank has fostered an interesting framework by drawing in with various sellers, henceforth, making a substance that can flawlessly cover all parts of the financial business will consume most of the day.

· Another essential thought is to evaluate the lack or abundance of land and expand on an all-encompassing premise so they can be ideally utilized or arranged so inefficient resources are uncashed. Lastly, the banks with various principles and progressions to be welcomed in the total agreement are not meant for accomplishment.

So, when everything is considered like the assets and liabilities, culture, technology, etc., what do you think are the chances of success of any merger? To this, Sethurathnam Ravi answers that the success of any merger relies on the capability of managing the repercussion while supporting the changes. When the merger is used in the form of an unconnected initiative due to a lack of reinforcements that would weaken the primary aim of the merger that results in inefficiency.

As per the S Ravi BSE Chairman, the collaboration of the strong bank changes should be completely determined to imbue restored good faith among Public Sector Banks which will rely upon the initiative directing the cycle thinking about the mammoth difficulties of taking care of asset incorporation, data innovation stage reconciliation, administrative compliances, dealing with the requests of the Union, boosting the workers, client maintenance, creating specialty items, rebranding, and repositioning and the progression intending to proceed with the endeavors in the present financial slowdown, challenges in the credit development, and control on Non-performing Assets with the public authority giving the necessary catalyst every once in a while.

Henceforth, it can be concluded that merging the banks is not a small task. It needs massive movement and understanding to make sure that everything is working seamlessly.

0 notes

Text

Learn What S Ravi, Former BSE Chairman says about Bank Merger

When recently 27 public sector banks merged including the Punjab National Bank, nearly every individual was worried about his savings and even fixed deposits with the public sector banks. As per the announcement made by Sethurathnam Ravi, the amalgamation scheme listed the merger of various popular banks like Indian Bank merged with Allahabad Bank, Canara Bank merged with Syndicate Bank, Oriental Bank of Commerce and the United Bank of India merged with Punjab National Bank, and lastly, Andhra Bank and Corporation Bank merged with Union Bank. The announcement of the merger came with a huge impact on the 308732 employees of the banks, 37492 domestic branches, 45448 ATM centers, and Rs. 3179304 crore deposits.

However, the impact of the merger is not only limited to all these. It is much more than the figures and facts that are mentioned in the papers. As per the BSE Chairman, these mergers come with a huge impact on the fixed deposit holders, savings account holders, employees, shareholders, borrowers, and the public. The primary aim of these mergers was to create large banks that are more capable of solving financial issues. Also, the merger was introduced to eradicate any kind of disparity between the small banks and large banks, cost savings from compliances and network overlaps, creating large middle management for selecting eligible candidates for the post of CGM, GMs, and DGMs for HR Department, IT department, and Risk management and much more. Overall, the mergers would improve the efficiency of restructuring and decision-making on high-leading banks.

Today, through this piece of information let’s talk about the impact of bank mergers as discussed by Sethurathnam Ravi with some quick points, making it easy to understand.

Any kind of consolidation or merger makes dread among the partners, investors, and the representatives associated with the banks. The serious short-term issues can be taken out with the possibilities of long-term advantages given the consolidation process is consistently executed, with firm yet fine adjusting of partner interests. Also, Unions of the bank employees from different affiliations should be ensured that their skills are united for the development of the new element.

The advantages of the mergers are just accomplished in the medium term to long term as the more grounded banks require critical time, endeavors, and assets to turn around the more fragile monetary records, execute the guide for adjusting HR and foundation like bank branches, bank products, ATMs, and so forth just as the reconciliation of Information Technology which is one of the greatest tests.

Integration is something that seems to be too difficult when such mergers take place. As per the BSE Chairman, coordinating two organizations on various IT stages into a typical one is harder than setting up another bank as each bank has fostered an interesting framework by drawing in with various sellers, henceforth, making a substance that can flawlessly cover all parts of the financial business will consume most of the day.

Another essential thought is to evaluate the lack or abundance of land and expand on an all-encompassing premise so they can be ideally utilized or arranged so inefficient resources are uncashed. Lastly, the banks with various principles and progressions to be welcomed in the total agreement are not meant for accomplishment.

So, when everything is considered like the assets and liabilities, culture, technology, etc., what do you think are the chances of success of any merger? To this, Sethurathnam Ravi answers that the success of any merger relies on the capability of managing the repercussion while supporting the changes. When the merger is used in the form of an unconnected initiative due to a lack of reinforcements that would weaken the primary aim of the merger that results in inefficiency.

As per the BSE Chairman, the collaboration of the strong bank changes should be completely determined to imbue restored good faith among Public Sector Banks which will rely upon the initiative directing the cycle thinking about the mammoth difficulties of taking care of asset incorporation, data innovation stage reconciliation, administrative compliances, dealing with the requests of the Union, boosting the workers, client maintenance, creating specialty items, rebranding, and repositioning and the progression intending to proceed with the endeavors in the present financial slowdown, challenges in the credit development, and control on Non-performing Assets with the public authority giving the necessary catalyst every once in a while.

Henceforth, it can be concluded that merging the banks is not a small task. It needs massive movement and understanding to make sure that everything is working seamlessly.

#SRaviBse#SRaviBseChairman#SRaviChairman#SethurathnamRavi#SethurathnamRaviBse#SethurathnamBse#SethurathnamBseChairman#BseSRavi#BankMerge#AllahabadBank#FormerBseChairman

0 notes

Text

PEOPLE WANT STRICT ACCOUNTABILITY OF CORRUPT- USMAN BUZDAR

With the compliments of, The Directorate General Public Relations,

Government of the Punjab, Lahore Ph: 99201390.

No.1055/QU/Mujahid

HANDOUT (A)

LAHORE, July 02:

Chief Minister Punjab Sardar Usman Buzdar has said the people want the elimination of corruption and strict accountability of the corrupt.

In a statement, the CM said the people want the looters to be made a symbol of disgrace as they have incurred irreparable losses to the country. The looters will not escape from their logical end, he declared. PTI’s struggle against corruption is yielding positive results and the people are not supporting the corrupt. The nation pays tribute to PM Imran Khan for a firm struggle against corruption; he added and maintained that an honest leadership will resolve problems while introducing new traditions of honesty and transparency.

** **

No.1056/QU/Mujahid

HANDOUT (A)

FOUNDATION OF A TRANSPARENT PAKISTAN HAS BEEN LAID- USMAN BUZDAR

LAHORE, July 02:

Chief Minister Punjab Sardar Usman Buzdar has said the foundation of a transparent Pakistan has been laid under the leadership of PM Imran Khan.

In a statement, the CM said the incumbent government is most transparent adding that people are not influenced by hollow slogans. There is no future for the politics of allegations, he said. The era of real change has begun and welfare projects are designed according to public needs and requirements, added Usman Buzdar. Similarly, he said parliamentarians were consulted while chalking out district development packages to identify the distinct needs. The PTI government has given priority to composite development of the 36 districts, he reiterated. Regrettably, the development schemes succumbed to the attitude of like and dislike in the past and resources were spent on areas of choice while overlooking genuine public needs, concluded the CM.

** **

No.1059/QU/Mujahid

HANDOUT (A)

POLITICS OF LOOTERS IS ALL BUT OVER- USMAN BUZDAR

LAHORE, July 02:

Resources were mercilessly plundered in the past but the PTI government has scrapped this venal culture and the politics of looters have come to an end.

In a statement, Chief Minister Punjab Sardar Usman Buzdar said the development journey is in progress despite anarchist elements' conspiracies. Pakistan is moving forward with renewed vigour towards the destination, he added. Usman Buzdar maintained the people have rejected the negative politics of the opposition adding that the time has passed when corrupt were sheltered under the umbrella of the government. Time has passed when corrupt were patronized and protected, he repeated and regretted that the spate of corruption has ruined the country. A policy of zero-tolerance is followed against corruption, he stated. The government will curb the corrupt mafias and action will be continued against such elements. Meanwhile, the opposition’s occasional rant and rave is nothing more than deception and pretension, concluded the CM.

** **

No.1060/QU/Mujahid

HANDOUT (A)

CM MESSAGE ON INTERNATIONAL DAY OF COOPERATIVES

LAHORE, July 02:

Chief Minister Punjab Sardar Usman Buzdar has said the purpose of the international cooperatives movement is to jointly work for collective wellbeing while getting rid of the forces of exploitation.

In his message, the CM said a revolution can be brought in the agriculture sector through cooperative movement. The role of cooperative societies has remained commendable in the agriculture and housing sectors; he added and appreciated the provision of residential facilities to the needy people and the distribution of loans among farmers through cooperative societies. However, there is a need to reinvigorate the cooperatives movement; he maintained and regretted that the past governments did not perform sufficiently to highlight the strong role of cooperative societies. It was enmity with the farmers but the PTI-led government has taken several steps to revamp cooperative societies because their role is very important in strengthening the agri economy, the CM added.

The CM said the Punjab Provincial Cooperative Bank Ltd is being revamped for strengthening the national economy. The government will promote the cooperative movements by activating the cooperatives department and it will be provided with every sort of assistance, the CM assured. Agri and economic self-reliance targets can also be achieved by activating the cooperatives movements and this day demands that such activities should be further promoted at the grassroots, concluded the CM.

** **

0 notes

Text

New Delhi: Punjab National Bank has launched its new customer care numbers 1800-1800 & 1800-2021 on the occasion of the bank’s 129th Foundation Day. The new easy-to-recall toll-free number aims to provide PNB customers with a seamless and hassle-free experience whenever they reach out to the customer care team. Additionally, the bank introduced other products such as E-Marketplace and Instant QR on Mobile Banking App PNB One, PABL (Pre-approved business loan), Central Bank Digital Currency (CBDC), Digital KCC through JanSamarth Portal, Current Account opening through TAB and Video-KYC, PNB eSWAR and PNB Metaverse.

As a part of the 129th Foundation Day celebrations at the PNB head office, the new offerings were launched by Shri Atul Kumar Goel, MD & CEO and Executive Directors, Shri Vijay Dube, Shri Kalyan Kumar, Shri Binod Kumar and Shri M.Paramasivam in the presence of esteemed customers, senior officials and PNB employees.

Speaking on the launch, Shri Atul Kumar Goel, MD & CEO, said, “As we commemorate 128 years of service to the nation, we recommit to the eternal vision of our founder, Punjab Kesari Lala Lajpat Rai to providing our customers with the best possible banking experience. Hence, these new offerings are significant and innovative steps in this direction.”

The new customer care numbers 1800-1800 & 1800-2021 will be available 24×7 and will offer support in multiple languages. Customers can use this number to get information on their account balance, and past transactions, issue/block debit cards, and avail other key services provided by the bank. They can also register their complaints and queries with the bank’s customer care team.

As a part of the celebration, PNB in collaboration with PNB PRERNA, an association committed to promoting the bank’s CSR efforts, distributed infrastructure support items to government schools in Delhi.

Click here : https://apacnewsnetwork.com/2023/04/punjab-national-bank-launches-digital-offerings-on-129th-foundation-day/

#Central Bank Digital Currency#Digital Offerings on 129th Foundation Day#Mobile Banking App#pabl pnb#pnb bank#PNB PRERNA#Punjab National Bank#punjab national bank foundation day#Punjab National Bank launches#Shri Atul Kumar Goel

0 notes

Text

IIT JEE 2010 Exam Notification - Knowing Beforehand What Lies Ahead

Breaking the IIT JEE is effectively one of the hardest that any youngster can confront while attempting to pick up induction into any of these head specialized foundations, beginning with the IITs. Here a tad about the inquiry design, data about the dates, and so forth of the placement test, lastly certain essential contributions on the most proficient method to get ready is likewise given.

As expressed by an Act of Parliament, the Indian Institutes of Technology which are prevalently known as the IITs are foundations of public significance, as they give magnificent instruction. India has 15 IITs till date. They are situated in Bombay, Madras, Patna, Mandi, Punjab, Rajasthan, Hyderabad, Roorkee, Guwahati, Gandhinagar, Kanpur, Indore, Kharagpur, Bhubneswar, and Delhi.

IITs have been giving premium class schooling since the past endless many years. Hence the educators, teachers, understudies graduated class actually leave an incredible effect in various areas inside and outside India.

The Banaras Hindu University (IT-BHU), Varanasi and Indian School of Mines (ISM), Dhanbad are among the most established foundations in India and are known finished for their amazing examination design. The fundamental destinations behind such establishments are:

To get ready capable researchers and architects.

To illuminate the business soul in the country REET.To make a climate of opportunity of point of view, vision, development related consolation, character advancement and a self-appreciation discipline in the shades of greatness.

Every one of these organizations are English medium. The courses here are credit based which give incredible adaptability to understudies and empower them to follow progress at their own speed. For acceptable advancement, least level is an absolute necessity. All the main certificates in unhitched male projects are being given here. Some of them are on innovative, designing, while other are on various fields of Science.

Coordinated projects in Applied Sciences empower contender to go for M.Sc. M.Tech. coordinated courses in certain zones are offered by some of IITs. A few Institutes offer a Dual-Degree in M. Tech courses.

For affirmation in undergrad projects of these schools a competitor needs to sit in Joint Entrance Examination that is generally known as JEE (Joint Entrance Examination).

For the IIT-JEE 2010 assessment application structures may come out by the third seven day stretch of November. The structures can be gotten from various bank offices, for example, Punjab National Bank, State Bank of India, Axis Bank and Canara Bank.

A few dates that ought to be remembered which are identified with 2010 IIT-JEE tests are:

Date of Examination: second seven day stretch of April, 2010

Date of accessibility of structures: third seven day stretch of November, 2009

Last date for receipt of solicitation for application structure: third seven day stretch of December, 2009

Last date of receipt of finished application structure: Last seven day stretch of December, 2009

Revelation of Results: Last seven day stretch of May, 2010

The qualification models to sit for IIT-JEE test is straightforward. Competitor must be 10+2 or equal with total 60% imprints. For SCs and STs its 55%. The age of the competitor ought not be over 25 years as on first October 2009. For SCs and STs its 30 years. Understudies who are showing up or have showed up in 2009 tests are qualified to sit for tests.

The offered course is that of B.Tech which is of long term span. Its paper comprises of target type inquiries from science, maths and material science. In any case, what ought to be remembered is that for each off-base answer there is a negative stamping too.

0 notes

Text

Virender Sehwag Biography

The swashbuckling former Indian opener, Virender Sehwag is considered as one of the most destructive batsmen in the world. Virender Sehwag is known to clear the ropes in the just the first ball of the innings as his aggressive approach on the field has seen him demolish the opposition’s bowling attack. The “Nawab of Najafgarh” has been the nightmare of the opposition bowlers since the day he started opening the innings for the Indian team.

Sehwag made his International debut against Pakistan in an ODI match in Mohali on April 1, 1999. The 21-year-old came in to bat at the 7th down and he was bundled out cheaply by Shoaib Akhtar. However, he was promoted to bat as an opener in the coming matches and the rest is history. Two years later Sehwag made a cut into the Test team against mighty South Africa where he hammered a century on his test debut. Sehwag has been a great admirer of Sachin Tendulkar due to his batting techniques and loved watching him bat from the non-striker’s end. But he himself had a subtle and unorthodox technique of batting, especially for his square cuts and uppercuts.

Sehwag announced his retirement from the International cricket on 20th October 2015 after getting ignored by the national team selectors for over two years. He played his last international match against Australia in a Test match at Hyderabad in March 2013. Sehwag is currently into a part of the commentary panel and does good commentary in both English and Hindi.

Virender Sehwag's Personal Information

Sehwag’s Date of Birth: Virender Sehwag’s birthday is on 20th October 1978. He was born in Haryana but his family shifted to Najafgarh so he spent his childhood in Najafgarh, Delhi. In fact, after his success, people started calling him the “Nawab of Najafgarh”.

Sehwag’s Age: Virender Sehwag’s age is currently 41 years old and there is still a lot of cricket left in him. Recently, Sehwag smashed 74 runs off 54 balls in the Road Safety Match against West Indies Legends in march 2020 which shows he isn’t rusty till now.

Sehwag’s Height: Virender Sehwag’s height is 5 ft 6 In (1.67 metres)

Virender Sehwag's Family Information

Virender Sehwag was born in a Jat family involved in the grain business. Sehwag has always lived in a Joint family including his three siblings, sixteen cousins and uncle and aunts. After a few years of his birth, Sehwag family shifted to Najafgarh in Delhi where he attended his school and also enrolled himself into a cricket academy.

Virender Sehwag is the third child of Krishan and Krishna Sehwag after his sisters Anju and Manju Sehwag. Manju Sehwag is a politician of the Indian National Congress and a representative of Ward 180 of Dakshinpuri Extension Delhi.

Sehwag got married to his longtime friend Aarti Ahlawat. When Sehwag was 21 years old he proposed her and the couple finally tied the knot on 22nd April 2004. The couple gave birth to two sons: Aryavir Sehwag and Vedant Sehwag. Aryavir is the elder son as he was born in 2007 while Vedant was born in 2010.

Virender Sehwag's Career Stats

Virender Sehwag started his career as one of the most promising batsmen in the Indian team down the order. Unfortunately, he wasn’t able to deliver up to the expectations. It was under the skipper Sourav Ganguly that he was promoted up the batting order and started opening the batting for the side.

Sehwag made his ODI debut against Pakistan in 1999 but it was not an impressive start to his international career. The right-handed batsman was known to be one of the most destructive batting style. Perhaps, he got a few more opportunities and he did bank on those chances as cemented his place in the Indian side. The 21-year-old Sehwag had a dream debut in the white jersey as he scored a century in his first-ever test match against South Africa.

A few months later he was promoted as an opener and started opening with the batting great Sachin Tendulkar as the duo went on to have one of the highest opening partnerships in the World cricket, compiling 3919 runs at a combined average of 42.13, 12 centuries and the highest single inning partnership of 182 runs.

Sehwag has played 104 tests and scored 8586 runs at an average of 49.34 including 24 centuries. In the One Day Internationals, Sehwag has played 251 matches and piled 8273 runs at an average of 35.05. His highest score in ODI is 219 against West Indies in 2011.

The Swashbuckling opener could only play 19 T20Is, scoring 394 runs at an average of 21.88. To check out his career stats, click on Virender Sehwag’s career stats!

Virender Sehwag's IPL Career

Sehwag was way ahead of the other players in playing the aggressive form of cricket, and when the BCCI came up with the Indian Premier League. Sehwag knew he could use some of his signature shots at will in the cash-rich T20 league as he was roped in by the Delhi Daredevils (now Delhi Capitals). Sehwag was the skipper of the Delhi franchise as he led them to one of the best seasons in 2010 when they reached the semi-finals but lost to Kolkata Knight Riders.

Sehwag did peak individual success but couldn’t win a single title for the Daredevils. In 2014, he joined Kings XI Punjab and with his dashing and destructive form, he led Kings XI Punjab till the finals as he scored 122 runs in the semi-finals match against the Chennai Super Kings.

Two years after joining the KXIP as a player, Sehwag took over the job of the mentor of the franchise as he mentored them for three consecutive seasons between 2016-2018 before parting ways with them.

As a player, Sehwag scored 2728 runs in 104 matches in the Indian Premier League at an average of 27.56. His IPL career also includes two centuries, one of which came against CSK in the semi-finals of 2015 season as KXIP advanced into the finals.

Virender Sehwag's Achievements

# Achievements

Virender Sehwag still holds the record of the highest score in an innings by an Indian batsman in the Test cricket when he scored 319 runs against South Africa in 2008.

He also holds the record for becoming the first-ever Indian batsman to score a triple century in test cricket when he smashed 209 runs against Pakistan in 2004 at Multan, that earned him the nickname “Sultan of Multan”. He has scored two triple centuries in his career.

He became the first Indian skipper to score a double century in the ODI when he scored 219 runs off 149 balls. He led the Indian team in absence of the regular skipper MS Dhoni.

Sehwag also holds the record of scoring the fastest triple century in Test cricket in just 278 balls.

Sehwag has the most number of 290+ scores in test matches (scored triple century on two occasions)

Virender Sehwag’s achievements also include him scoring over 7500 runs in both tests and ODI as an opener.

Sehwag is one and the only cricketer in the world to have a rare feat of taking five wickets in an innings along with two consecutive double-century partnerships in test cricket.

# Awards

In 2002 Virender Sehwag received the Arjuna Award by the Ministry of youth affairs and sports for his contribution to Cricket.

In 2007 the former Indian opener received Polly Umrigar Award for international cricketer of the year.

He was the recipient of the Wisden Cricketer in the World for two consecutive years in 2008 and 2009.

Sehwag was named the ICC Test Player of the year in 2010.

In 2010 he was conferred with the Padma Shree Award.

Virender Sehwag's Net worth

Virender Sehwag’s net worth is currently $40 million (305 crores) as of 2020 and most of it comes from his business ventures, brand endorsements, and commentary contract with the BCCI. Sehwag is known to be one of the most money-minded cricketers as he already paved the path of his income even after his retirement.

Here is the breakdown of Sehwag’s net worth and income:

Sehwag has opened a school and named it Sehwag International School which is located in Jhajjar, Haryana. The school has A-class facilities for the students who aspire to be a sportsman.

He launched his own sportswear brand named ‘VS’ which is managed by Viru Retail Pvt. Ltd and Stitched Textiles Pvt. Ltd. With the motive of earning over Rs. 22 crores (estimated) per year, Sehwag launched over 50 stores in the country.

Sehwag endorses the following brands: Boost, Samsung Mobiles, Adidas, Reebok, Hero Honda, etc. and he charges a hefty amount from them for the endorsement.

He has his own house in Najafgarh but recently he bought a mansion in the Hauz Khas which is one of the posh areas of New Delhi.

Sehwag also rakes in a handsome amount from the BCCI for his commentary contract. Besides, he was also the head coach of Kings XI Punjab earning him a good amount of money.

Sehwag owns one of the most luxurious cars in the world and some of them include Bentley Continental Flying Spur (Rs.3.41 crores) and a BMW series cars. He is one of those cricketers to show his fascination for the Big toys.

Virender Sehwag is a philanthropist by nature as he donates in various charity foundations and also feeding the migrant labourers.

Virender Sehwag's Controversies

Seems like diplomacy is not Virender Sehwag’s forte as he tends to live his life on a simple and upfront attitude. But when you are a prominent figure and also represented your country for over 15 years, the controversies surely hit on you at least once in any part of your career. Sehwag is known for a free mind and expressing his views, regardless of what others think and opine.

Here is the list of Virender Sehwag’s controversies on and off the field that has caused him troubles on some occasions:

The cold war with MS Dhoni that barred him from the Indian team: This ought to be the mother of all controversies in Virender Sehwag’s career during his playing days. There have been instances when both Dhoni and Sehwag were seen teasing each other in the dressing room which sometimes didn’t end up well. The tiff between them caused unrest in the Indian dressing room which was followed by the team’s disastrous run in England and Australia in 2011-2012. Sehwag was also going through a rough patch of his career as he was not among the runs for almost a year. Eventually, he was dropped from the side as the youngsters took over his place. Later, Sehwag revealed that MS Dhoni didn’t want him along with two other players in the team due to their slow fielding. He also alleged that MS didn’t even consult with them before saying it in front of the media. Because of that particular incident, many also criticise Dhoni for literally ending Sehwag’s career.

Controversial tweet that incited communal controversy: Virender Sehwag almost put himself in a controversy as he tweeted on an incident in 2018 when a tribal man was killed in Kerala by a mob. Sehwag gave a communal angle to that incident with his tweet but received criticism by the people which led him to delete that tweet in order to not get in trouble.

Madhu stole 1 kg rice: A mob of Ubaid , Hussain and Abdul Kareem lynched the poor tribal man to death. This is a disgrace to a civilised society and I feel ashamed that this happens and kuch farak nahi padta. pic.twitter.com/LXSnjY6sF0

Banned for excessive appealing against South Africa: This controversy doesn’t only involve Virender Sehwag but three other Indian players Deep Dasgupta, Harbhajan Singh and Shib Sunder Das as they were alleged for excessive appealing against South Africa at Port Elizabeth. Match referee Mike Dennes came down really hard on the Indian players as he handed them suspension for the excessive appealing. But the naive Sehwag was the only one who ended up with the suspension. Indian team still picked Sehwag for the test series against England on which ICC issued a statement saying that any match involving Sehwag would be termed “unofficial” until he serves one ban imposed on him.

Missed his century by 1 run: This on-field controversy involving Virender Sehwag and Suraj Randiv takes us back to the tri-series between Indian, Sri Lanka and New Zealand. Apparently, Virender Sehwag was batting on 99* and the Indian team required just one run to win the match. Randiv deliberately bowled a no-ball and Sehwag hammered him for a six. Initially, Sehwag thought that he had earned those six runs as he started celebrating his century and team’s victory. But during the post-match presentation when he was adjudged the Man of the Match, he realised that the no-ball denied him his well-deserved century which he immediately cited signifying the length of the no-ball and subsequently, Randhiv was banned for one match while Tillakaratne Dilshan had to give up his one match’s fees.

Sehwag has also hit the limelight for some of his cheeky yet sarcastic tweets when he has taken a jibe at some of the current and former cricketers.

Virender Sehwag's Social Media

The former batsman is known to be a social media buff and his presence can be felt mostly on Twitter as he leaves no stones unturned in keeping his fans engaged and putting his honest opinions.

Sehwag also keeps his fans engaged on Instagram by posting pictures and giving his fans a glimpse of his daily life. The swashbuckling opener has 5.3 million followers on Instagram, 20.6 million followers on Twitter, and 14 million fans on Facebook.

Use: virendersehwagage, virendersehwagbirthday, virendersehwagheight, virendersehwagbiography, virendersehwagnetworth

#virendersehwagage#virendersehwagbirthday#virendersehwagheight#virendersehwagbiography#virendersehwagnetworth

0 notes

Text

Virender Sehwag Biography

The swashbuckling former Indian opener, Virender Sehwag is considered as one of the most destructive batsmen in the world. Virender Sehwag is known to clear the ropes in the just the first ball of the innings as his aggressive approach on the field has seen him demolish the opposition’s bowling attack. The “Nawab of Najafgarh” has been the nightmare of the opposition bowlers since the day he started opening the innings for the Indian team.

Sehwag made his International debut against Pakistan in an ODI match in Mohali on April 1, 1999. The 21-year-old came in to bat at the 7th down and he was bundled out cheaply by Shoaib Akhtar. However, he was promoted to bat as an opener in the coming matches and the rest is history. Two years later Sehwag made a cut into the Test team against mighty South Africa where he hammered a century on his test debut. Sehwag has been a great admirer of Sachin Tendulkar due to his batting techniques and loved watching him bat from the non-striker’s end. But he himself had a subtle and unorthodox technique of batting, especially for his square cuts and uppercuts.

Sehwag announced his retirement from the International cricket on 20th October 2015 after getting ignored by the national team selectors for over two years. He played his last international match against Australia in a Test match at Hyderabad in March 2013. Sehwag is currently into a part of the commentary panel and does good commentary in both English and Hindi.

Virender Sehwag's Personal Information

Sehwag’s Date of Birth: Virender Sehwag’s birthday is on 20th October 1978. He was born in Haryana but his family shifted to Najafgarh so he spent his childhood in Najafgarh, Delhi. In fact, after his success, people started calling him the “Nawab of Najafgarh”.

Sehwag’s Age: Virender Sehwag’s age is currently 41 years old and there is still a lot of cricket left in him. Recently, Sehwag smashed 74 runs off 54 balls in the Road Safety Match against West Indies Legends in march 2020 which shows he isn’t rusty till now.

Sehwag’s Height: Virender Sehwag’s height is 5 ft 6 In (1.67 metres)

Virender Sehwag's Family Information

Virender Sehwag was born in a Jat family involved in the grain business. Sehwag has always lived in a Joint family including his three siblings, sixteen cousins and uncle and aunts. After a few years of his birth, Sehwag family shifted to Najafgarh in Delhi where he attended his school and also enrolled himself into a cricket academy.

Virender Sehwag is the third child of Krishan and Krishna Sehwag after his sisters Anju and Manju Sehwag. Manju Sehwag is a politician of the Indian National Congress and a representative of Ward 180 of Dakshinpuri Extension Delhi.

Sehwag got married to his longtime friend Aarti Ahlawat. When Sehwag was 21 years old he proposed her and the couple finally tied the knot on 22nd April 2004. The couple gave birth to two sons: Aryavir Sehwag and Vedant Sehwag. Aryavir is the elder son as he was born in 2007 while Vedant was born in 2010.

Virender Sehwag's Career Stats