#quantitative data

Text

How to Conduct Market Research for Food Product Development?

Learn key steps to conduct effective market research for food product development, from identifying trends to understanding customer needs. For more detail visit here : https://www.philomathresearch.com/blog/2024/09/09/how-to-conduct-market-research-for-food-product-development/

#market research#market research for food product development#market research companies#primary market research#quantitative data

0 notes

Text

User Insights in a UX Audit: Comparing Quantitative and Qualitative Data

User Experience (UX) audits are an essential component of every company's digital product and service improvement strategy. Organizations can find areas for development, growth potential, and pain issues by using these audits. One of the most important choices you'll have to make during a UX audit is whether to prioritize qualitative, quantitative, or a combination of the two forms of data.

In this blog article, we'll go over the importance of both quantitative and qualitative data as well as how to combine the two for a comprehensive UX audit.

Quantitative Data in UX Audits

Any information that can be quantified and expressed numerically is considered quantitative data in a UX audit. Included are often key performance indicators (KPIs) and extra statistics, such as click-through, bounce, and conversion rates. Certain statistics are needed in order to comprehend the overall health and efficacy of a digital good or service. The use of quantitative data in UX audits is justified by the following:

Clear and impartial analysis of user interactions with a digital product is made possible by quantitative data. These metrics provide a quick and easy method to assess a user interface's efficacy and spot possible problems.

Benchmarking: Quantitative data allows businesses to benchmark their performance against industry standards or competitors. This information can help identify areas where a product or service is lagging behind or excelling.

Identifying Pain Points: Conversion funnels and quantitative data can pinpoint specific bottlenecks or drop-off points in the user journey. By identifying these pain points, businesses can prioritize improvements that have a direct impact on ROI.

A/B Testing: To perform A/B testing, quantitative data is required. Businesses can make data-driven decisions about which options to deploy by evaluating the performance of two or more versions of a design or feature.

Because quantitative data is more accurate and can demonstrate how UX improvements affect revenue, it is frequently preferred. It is imperative for businesses to recognize the importance of these measures in a fiercely competitive industry.

Qualitative Data is Vital for UX Audits

Although quantitative data is very useful, it does not give the complete story. Qualitative data is equally important to statistics as quantitative data since it clarifies the "why" behind the statistics. Surveys, interviews, usability testing results, and user feedback are examples of qualitative data that can be found in a UX audit. The importance of qualitative data is as follows:

User insights: Using qualitative data can help you understand people's opinions on a deeper level. It exposes their goals, inclinations, and vulnerable spots. Gaining this understanding is necessary to enhance user-centered experiences.

Contextual Understanding: The background is supplied by qualitative data. It aids in your comprehension of the particular situations and environments in which users engage with your product. Keeping this structure in mind is essential while creating solutions for real-world issues.

Prioritizing Changes: Although quantitative data helps pinpoint issues, it is unable to explain their root causes. Qualitative data can be used to rate issues according to user discomfort and importance.

Iterative Design: Qualitative data is a crucial component of iterative design. By regularly gathering user feedback, you may make incremental, minor adjustments to your product or service that will guarantee it adjusts to the needs of changing users.

In a business environment, where customer relationships and long-term value are paramount, qualitative data plays a critical role in understanding the unique challenges and needs of clients. This information can drive product development and UX improvements that directly impact client satisfaction and retention.

Balance in UX Audit

Instead of having to choose between qualitative and quantitative data, businesses must find the right balance between the two. Here are a few strategies for achieving that balance:

Specific Objective in Mind: Clearly define the aim and purpose of your audit. Are you trying to increase conversions, decrease the amount of calls you receive from clients, or increase user satisfaction? How you collect data will depend on your goals.

Combining Data Sources: Utilize data that is both quantitative and qualitative. For example, include user feedback from surveys and interviews with quantitative data from analytics programs like Google Analytics.

Triangulation: Look for patterns and connections in the quantitative and qualitative data you have collected. In your conversion funnels, where do you see drop-off points in relation to user suggestions or complaints? This triangulation may help you pinpoint significant issues.

Iterate and repeat: The process of UX auditing is never-ending. Continue gathering and analyzing data, modifying as needed in light of your conclusions. This iterative process makes sure that your UX enhancements continue to be in line with both user needs and corporate objectives.

Engage Stakeholders: Work together with stakeholders from various departments inside your company. These consist of groups that handle product development, marketing, sales, and customer service. Their perspectives can help prioritize UX improvements and offer insightful context.

Test and Validate: Make sure functionality and designs are tested and confirmed with real users before making any changes based on your data. The efficacy of your UX enhancements can be verified using qualitative data from user testing.

Note for conclusions: Pay attention to the findings and insights that the quantitative and qualitative data provide. This documentation might end up being a very useful tool for auditing and decision-making in the future.

To find out everything there is to know about the UX audit, visit the Techved website.

Conclusion

Combining quantitative and qualitative data in UX audits is key to driving changes in products and services that will improve customer experiences and increase return on investment. Quantitative data gives the framework for measurement, but qualitative data provides the context and insights needed for meaningful change.

It is not only feasible, but necessary to strike the right balance between these two types of data if you want your business to prosper. By implementing the aforementioned tactics and utilizing an iterative process, you can ensure that your user experience audits result in continuous improvement, higher customer satisfaction, and a competitive advantage in the market.

0 notes

Text

Univariate Analysis in Quantitative Social Research

Univariate analysis refers to the analysis of one variable at a time.

The most common approaches are:

Frequency tables.

Diagrams: bar charts, histograms, pie charts.

Measures of central tendency: mean, median, mode.

Measures of dispersion: range and standard deviation.

Frequency Tables

A frequency table provides the number of cases and the percentages belonging to each of the categories…

View On WordPress

1 note

·

View note

Text

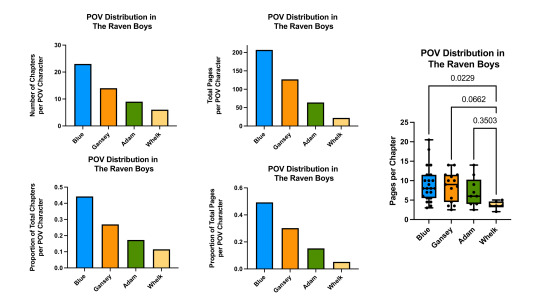

this barbie is quantifying mundane information from a young adult fiction series

#rchl#very fun to run blorbos thru one-way ANOVA w multiple comparisons#if you have an idea for a trc themed spreadsheet or quantitative analysis but don't want to do it. i will lol#trc#trb#the raven cycle#the raven boys#trc data

219 notes

·

View notes

Text

This is a shameless pitch for my field of work but if you like biology and you like coding...consider bioinformatics as a career 👀 Especially if you live in the US, as it's well-known for its bionformatics scene.

#musings#bioinformatics#stem#computer science#python#biology#i was just thinking about how not a lot of people know that a career like bioinformatics exists#hence my little post#most people i tell my job too just look at me confused like they didnt realize you could mix these fields#and a lot of people studying biology forget about how important it is to have a quantitative skill like math or computer science or physics#simply because the programs dont teach those skills#to do any sort of custom data analysis its important to have quantitative skills#and if you're passionate about genomics especially...and dna and the genome...then this may be the field for you!#good money especially in the states#of course a graduate degree is needed#masters minimum phd preferred#i have a masters

55 notes

·

View notes

Text

ah, fall. Or as I like to call it, "aesthetic pictures of the south end in Boston" season

#I love seeing aesthetic pictures with no caption or info and still being like 'ah. south end.'#if it's a brick townhouse with a brick sidewalk (flat) it's the south end#if it's a brick townhouse with a brick sidewalk (treacherous angle) it's beacon hill#I would love quantitative data on how many of the Aesthetic Brick Street In Fall pictures that buzz around the internet#are the south end beacon hill and newbury street#CAUSE THERE'S A LOT OF THEM#THEY MAKE UP A SIZABLE PERCENTAGE

17 notes

·

View notes

Text

if my most reblogged posts are anything to go by then the only thing more popular on this site than transsexualism is mpreg

5 notes

·

View notes

Text

something something you need to be critical of the sex offender list

#being critical of how the government handles any of ts for many other reasons is also important#but here's some quantitative data for who theyre coming for first#txt

4 notes

·

View notes

Text

Baseball season is going to fix me. I’m sure of it.

#yesterday irl bestie told me about the standings#which is like the table in soccer#and there’s HELLA STATS#idk what some of it is#or what it means#but ya girl loves quantitative data#so#that makes it extra fun#I MIGHT be planning an impromptu trip to Atlanta this weekend to watch in the battery 👀#bc. it seems right#I’ve still got a little bit of The Blah that I just can’t seem to shake and I don’t think it’s anything to Worry about#but I would like it to be gone#and I think baseball is the key#at least that’s what I’m going to tell myself#until proven otherwise#just my ramblings

2 notes

·

View notes

Text

(if you have any songs in mind, do specify in the tags/replies !!)

#mhac.txt#fob.posting#i feel like i'm gonna regret making this a week long but also.#knowing me i WON'T do anything this weekend. and the more data the better (<- quantitative anthropologist)

3 notes

·

View notes

Text

How to Conduct Market Research for Food Product Development?

Food product development is an intricate process involving numerous stages, from ideation and concept development to product launch. One of the most crucial steps in this journey is market research, which helps food companies understand consumer preferences, identify gaps in the market, and develop products that are likely to succeed. Conducting comprehensive market research can make or break the success of a new food product. For primary market research companies like Philomath Research, understanding the nuances of this process is essential.

1. Introduction to Food Product Development Market Research

Food product development involves creating new food products or improving existing ones. Market research plays a pivotal role in this process by providing insights into consumer behavior, market trends, competitive analysis, and potential product positioning. This blog will explore the various steps and methodologies involved in conducting market research for food product development.

2. Understanding the Food Market Landscape

Before diving into product development, it is essential to understand the current landscape of the food market. This involves analyzing market size, growth rate, segmentation, key players, and emerging trends. Key areas to focus on include:

Market Segmentation: Identify the different segments within the food market (e.g., organic, vegan, gluten-free, convenience foods) and their respective growth rates.

Consumer Demographics: Analyze the demographics of the target audience, including age, gender, income level, and geographic location.

Market Trends: Study current and emerging trends in the food industry, such as plant-based diets, sustainable packaging, or functional foods that offer health benefits.

Competitive Analysis: Identify key competitors, their product offerings, pricing strategies, and market positioning.

3. Defining Research Objectives

Clear research objectives are crucial for any market research project. In the context of food product development, some common objectives might include:

Understanding consumer preferences for flavors, textures, and ingredients.

Identifying gaps in the current market and unmet consumer needs.

Analyzing competitor products to find opportunities for differentiation.

Gauging potential demand and willingness to pay for a new product.

Testing product concepts and prototypes with target consumers.

4. Types of Market Research for Food Product Development

There are several types of market research methods that can be employed, each offering unique insights into the market and consumer preferences:

a) Primary Market Research

Primary market research involves collecting data directly from the target audience. This is the most effective way to gather specific insights tailored to a company’s needs. Methods include:

Surveys and Questionnaires: Online and offline surveys are a cost-effective way to gather quantitative data on consumer preferences, buying behavior, and price sensitivity.

Focus Groups: Focus groups involve a small group of participants discussing a new product concept or prototype. This method provides qualitative insights into consumer attitudes, perceptions, and motivations.

In-Depth Interviews: One-on-one interviews can provide detailed feedback on specific product features or ideas, offering deeper insights into consumer behavior.

Product Testing and Sensory Evaluation: Conducting taste tests, sensory evaluations, or home usage tests allows companies to gather direct feedback on product formulations, taste, packaging, and more.

b) Secondary Market Research

Secondary market research involves analyzing data that has already been collected and published by others. It can help validate primary research findings and provide a broader context. Sources of secondary research include:

Industry Reports: Market reports from research firms provide valuable information on market size, growth forecasts, and consumer trends.

Academic Journals and Publications: Research papers on food science, nutrition, and consumer behavior can offer valuable insights.

Trade Publications and Magazines: Industry magazines and newsletters provide updates on market trends, new product launches, and innovations.

Government and Public Data: Publicly available data from government agencies can provide information on market regulations, consumer expenditure, and more.

5. Step-by-Step Process of Conducting Market Research for Food Product Development

Step 1: Identify Target Market and Consumer Segment

Define the target market and consumer segment for the new food product. For instance, a plant-based protein snack would target health-conscious consumers, vegans, or fitness enthusiasts. Use demographic and psychographic data to narrow down the audience.

Step 2: Conduct Competitor Analysis

Identify key competitors in the chosen market segment. Analyze their product offerings, price points, packaging, distribution channels, and marketing strategies. This helps identify opportunities for differentiation and potential gaps in the market.

Step 3: Develop Research Instruments

Create research instruments such as surveys, questionnaires, discussion guides, or sensory evaluation forms. Ensure the questions are designed to elicit meaningful insights about consumer preferences, purchase behavior, and product expectations.

Step 4: Recruit Participants for Primary Research

Recruit participants who represent the target consumer segment. This can be done through various channels like social media, email lists, or market research panels. Ensure the sample size is adequate to provide statistically significant insights.

Step 5: Collect Data and Conduct Research

Conduct the research using the chosen methods—be it online surveys, focus groups, in-depth interviews, or sensory evaluations. Ensure the data collection process is consistent and unbiased to ensure the validity of the results.

Step 6: Analyze Data and Generate Insights

Analyze the data collected from primary and secondary research. Use statistical tools and qualitative analysis methods to identify key trends, patterns, and correlations. Generate insights that can inform product development decisions, such as preferred flavors, packaging designs, or optimal price points.

Step 7: Develop and Test Product Concepts

Based on the research findings, develop several product concepts or prototypes. These should vary in terms of flavors, ingredients, packaging, or other attributes. Conduct product testing with a sample of target consumers to gather feedback on these concepts.

Step 8: Refine and Optimize the Product

Use the feedback from product testing to refine the product attributes. This could involve tweaking the recipe, changing packaging materials, or adjusting the price point. Continue testing and refining until the product meets consumer expectations and stands out in the market.

Step 9: Launch and Monitor the Product

Once the product is ready for launch, develop a go-to-market strategy that includes marketing, distribution, and pricing plans. Monitor the product’s performance in the market through sales data, customer feedback, and market trends. Use this information for further optimization and to inform future product development.

6. Challenges in Conducting Market Research for Food Product Development

While market research is crucial for food product development, it comes with its own set of challenges:

Consumer Biases: Consumers may provide biased or inaccurate responses during surveys or focus groups, affecting the validity of the data.

Rapidly Changing Trends: The food industry is subject to rapidly changing consumer trends, making it difficult to predict long-term success.

Cost and Time Constraints: Comprehensive market research can be time-consuming and expensive, especially when multiple rounds of testing are required.

Regulatory Compliance: Understanding and complying with food safety and labeling regulations across different markets can be challenging.

7. The Role of Technology in Modern Food Market Research

Technology has revolutionized the way market research is conducted in the food industry. Here are some ways it has enhanced the research process:

AI and Machine Learning: AI tools can analyze large volumes of data to identify trends and consumer preferences with greater accuracy and speed.

Online Surveys and Panels: Digital platforms have made it easier to reach a global audience, reducing the time and cost associated with traditional research methods.

Virtual Reality (VR) Testing: VR technology allows companies to simulate retail environments for consumer testing, providing a more realistic and immersive experience.

Social Media Listening: Analyzing social media conversations can provide real-time insights into consumer sentiment, emerging trends, and brand perceptions.

8. Conclusion: Importance of Market Research in Food Product Development

Conducting thorough market research is a cornerstone of successful food product development. It provides the foundation for making informed decisions about product features, pricing, packaging, and marketing strategies. For companies in the food industry, understanding consumer needs and market dynamics is crucial to creating products that not only stand out but also meet the evolving demands of today’s consumers.

Primary market research companies like Philomath Research play a vital role in helping food companies navigate this complex landscape, providing them with the insights needed to succeed in a competitive market.

By following the steps outlined in this blog, companies can ensure their food product development efforts are data-driven, consumer-focused, and aligned with market trends, leading to greater chances of success.

FAQs

1. What is market research in food product development?

Market research in food product development involves gathering and analyzing data about consumer preferences, market trends, competitors, and potential product positioning to guide the creation or improvement of food products. It helps in making informed decisions about product features, pricing, and marketing strategies.

2. Why is market research important for developing a new food product?

Market research is essential for developing a new food product because it provides insights into consumer needs, identifies market gaps, and reduces the risk of product failure. It helps companies understand their target audience, competitor landscape, and emerging trends, leading to more successful product launches.

3. What are the types of market research used in food product development?

There are two main types of market research used in food product development:

Primary Market Research: Involves directly collecting data from the target audience through surveys, focus groups, in-depth interviews, and product testing.

Secondary Market Research: Involves analyzing existing data from industry reports, academic journals, trade publications, and government sources to understand the market landscape.

4. How do you define research objectives for food product development?

Research objectives should be specific, measurable, and aligned with the overall goals of the product development process. Common objectives may include understanding consumer preferences, identifying gaps in the market, analyzing competitor products, gauging potential demand, and testing product concepts.

5. What are some effective methods for conducting primary market research for food products?

Effective methods for primary market research include:

Surveys and Questionnaires: To gather quantitative data on consumer preferences and buying behavior.

Focus Groups: To gain qualitative insights into consumer attitudes and perceptions.

In-Depth Interviews: For detailed feedback on specific product features or ideas.

Product Testing and Sensory Evaluation: To obtain direct feedback on product formulations, taste, and packaging.

6. How can competitor analysis benefit food product development?

Competitor analysis helps identify key competitors, their product offerings, pricing strategies, and market positioning. This information can reveal opportunities for differentiation, potential gaps in the market, and strategies to create a unique selling proposition (USP) for the new product.

7. What are the challenges in conducting market research for food product development?

Challenges in market research for food product development include:

Consumer Biases: Potential for biased responses affecting data validity.

Rapidly Changing Trends: Difficulty in predicting long-term success due to fast-changing consumer preferences.

Cost and Time Constraints: High costs and time required for comprehensive research.

Regulatory Compliance: Navigating food safety and labeling regulations across different markets.

8. How does technology enhance market research in the food industry?

Technology enhances market research through tools like AI and machine learning for data analysis, online surveys for quick feedback, virtual reality (VR) for immersive testing experiences, and social media listening to understand real-time consumer sentiment and trends.

9. What steps are involved in conducting market research for a new food product?

Key steps include:

Identifying the target market and consumer segment.

Conducting competitor analysis.

Developing research instruments like surveys and focus group guides.

Recruiting participants and collecting data.

Analyzing data to generate insights.

Developing and testing product concepts.

Refining the product based on feedback.

Launching the product and monitoring its market performance.

10. How can food companies use market research findings to optimize their products?

Food companies can use market research findings to refine product formulations, adjust packaging designs, optimize pricing, and develop targeted marketing strategies. Continuous testing and feedback loops help in further product optimization to align with consumer preferences and market demands.

11. What role does Philomath Research play in food product development market research?

Philomath Research specializes in conducting primary market research for food product development. They provide tailored insights into consumer behavior, market trends, and competitive analysis, helping food companies make data-driven decisions for successful product launches.

#market research#market research for food product development#market research companies#primary market research#quantitative data

0 notes

Text

Sometimes when I'm bored I respond to survey requests that I got from like online retailers and such.

Here I am filling out the super standard demographics section and then it asks what my highest level of education is and the options are either primary or secondary, no option to select any level of higher education... so, I see your survey will have realistic results, company. No incorrect demographic information at all, everyone who took the survey is only educated to secondary level... clearly...

6 notes

·

View notes

Text

no one in my family reps my humanities degree 😞

#me: I’m doing an MSc next year#them: they’re calling silly humanities a SCIENCE NOW?? this is everything wrong with society#me with r studio open making multivariate linear regression analyses from qualitative data: ….#*quantitative data even LOL#AAAAAA#and bc I went to American high school I have AP biology I did honours Chem in final year I did calculus#just. and almost all my friends have stem degrees and I can talk to them abt their degree content#I read medical journals usually psychology/psychiatry for fun like it’s sooooo#and my dad works in medical research and alwsys offloads all the technicalities of that industry to me#just so frustrating not being taken seriously 😭#I have THEE most competitive humanities degree to get into from the best humanities uni in the country and theure like nah fake degree

4 notes

·

View notes

Text

sth that drives me crazy is hwen people use words like 'frequent' and will not specific further what that means when asked to like how the fuck are you defining that. that could mean anything. so i go can you use numbers. and they go no :)

4 notes

·

View notes

Text

“I thought of Sam Bankman-Fried’s numbskull posturing recently when I finally read Nathan Heller’s article about the “The End of the English Major” in the New Yorker. The account of the collapse of undergraduate interest in the humanities touched off a lot of anguish, pained tweets, and op-eds this past month. For me, it clarified something about the trajectory of culture in the recent past, and made me think about the increasing widespread popularity of something I’ll call Quantitative Aesthetics—the way numbers function more and more as a proxy for artistic value.

(…)

The most-shared tidbit from Heller’s piece were the lines from professors lamenting that her Ivy League students who are social-media natives no longer have the attention for reading literature: “The last time I taught The Scarlet Letter, I discovered that my students were really struggling to understand the sentences as sentences—like, having trouble identifying the subject and the verb.”

We’re talking about the period since 2011, the first college class since the introduction of the iPhone, and it is logical that mass adoption of such seductive and pervasive consumer technology has changed people’s relationship to culture.

But 2011-12 is also the first full college class since the financial crisis of 2008, and the other obvious culprit is the greater ruthlessness of the economy post Great Recession, the flight away from the “softness” of the humanities in a time when studying anything not directly seen as useful is viewed more and more as an unsustainable luxury.

(…)

As one student says in the article, “Even if I’m in the humanities, and giving my impression of something, somebody might point out to me, ‘Well, who was your sample?’ I mean, statistics is everywhere. It’s part of any good critical analysis of things.” This provokes Heller to reflect, “I knew at once what [the student] meant: on social media, and in the press that sends data visualizations skittering across it, statistics is now everywhere, our language for exchanging knowledge.”

(…)

Nevertheless, there’s something called the McNamara Fallacy, a.k.a. the Quantitative Fallacy. It is summarized as “if it cannot be measured, it is not important.” The Heller article made me reflect on how a version of it is now very present, and growing, at the grassroots of taste.

On one level, this is seen in a rise of a kind of wonky obsession with business stats in fandoms, invoked as a way to convey the rightness of artistic opinions—what I want to call Quantitative Aesthetics. (There are actually scientists who study aesthetic preference in labs and use the term “quantitative aesthetics.” I am using it in a more diffuse way.)

It manifests in music. As the New York Times wrote in 2020 of the new age of pop fandom, “devotees compare No. 1s and streaming statistics like sports fans do batting averages, championship, wins and shooting percentages.” Last year, another music writer talked about fans internalizing the number-as-proof-of-value mindset to extreme levels: “I see people forcing themselves to listen to certain songs or albums over and over and over just to raise those numbers, to the point they don’t even get enjoyment out of it anymore.”

The same goes for film lovers, who now seem to strangely know a lot about opening-day grosses and foreign box office, and use the stats to argue for the merits of their preferred product. There was an entire campaign by Marvel super-fans to get Avengers: Endgame to outgross Avatar, as if that would prove that comic-book movies really were the best thing in the world.

On the flip side, indie director James Gray (of Ad Astra fame) recently complained about ordinary cinema-goers using business stats as a proxy for artistic merit: “It tells you something of how indoctrinated we are with capitalism that somebody will say, like, ‘His movies haven’t made a dime!’ It’s like, well, do you own stock in Comcast? Or are you just such a lemming that you think that actually has value to anybody?”

It’s not just financial data though. Rotten Tomatoes and Metacritic have recently become go-to arbitrators of taste by boiling down a movie’s value to a single all-purpose statistic. They are influential enough to alarm studios, who say the practice is denying oxygen to potentially niche hits because it “quantifies the unquantifiable.” (How funny to hear Hollywood execs echo Theodor Adorno’s Aesthetic Theory: “If an empirically oriented aesthetics uses quantitative averages as norms, it unconsciously sides with social conformity.”)

As for art, I don’t really feel like I even need to say too much about how the confusion of price data with merit infects the conversation. It’s so well known it is the subject of documentaries from The Mona Lisa Curse (2008) to The Price of Everything (2018). “Art and money have no intrinsic hookup at all,” painter Larry Poons laments in the latter, stating the film’s thesis. “It’s not like sports, where your batting average is your batting average… They’ve tried to make it much like that, like the best artist is the most expensive artist.”

But where Quantitative Aesthetics is really newly intense across society—in art and everywhere—is in how social-media numbers (clicks, likes, shares, retweets, etc.) seep into everything as a shorthand for understanding how important something is. That’s why artist-researcher Ben Grosser created his Demetricator suite of web-browsing tools, which let you view social media stripped of all those numbers and feel, by their absence, the effect they are having on your attention and values.

(…)

Again: Data analysis, done with care, can yield insights of great depth (Albert-László Barabási has even argued for “dataism,” a kind of sophisticated data analysis, as an artform). But as an instrument used to justify consumer preference within a landscape of complex values, a Quantitative Aesthetic often just becomes a way to deal with the problem of not wanting to spend much time thinking—the opposite of deep thought.

If you walk into a wine store, you could get descriptions of various wines, taste them, decide whether you want something more “foxy” or more “herbaceous,” match the subtleties to your palette. But most people will probably just pick the bottle that has the price point they think suggests about the level of quality they are shooting for.

The “McNamara Fallacy” is named after one-time defense secretary Robert McNamara—a Harvard grad, like the students Heller talks to. A numbers whiz, he was the architect of the U.S.’s murderous, ultimately catastrophic Vietnam policy, and known for his obsession with “body counts” as the key metric of success.

McNamara apparatchik Leslie H. Gelb later recalled in Time magazine the debacle fueled by this quantitative mindset:

McNamara didn’t know anything about Vietnam. Nor did the rest of us working with him. But Americans didn’t have to know the culture and history of a place. All we needed to do was apply our military superiority and resources in the right way. We needed to collect the right data, analyze the information properly and come up with a solution on how to win the war.

(…)

Daniel Yankelovich, the sociologist who coined the term “McNamara Fallacy,” actually outlined it as a process, one that could be broken out into four steps of escalating intellectual danger. Here they are, as it is commonly broken down, with his commentary on each:

Measure whatever can be easily measured. (This is OK as far as it goes.)

Disregard that which can’t be easily measured or to give it an arbitrary quantitative value. (This is artificial and misleading.)

Presume that what can’t be measured easily really isn’t important. (This is blindness.)

Say that what can’t be easily measured really doesn’t exist. (This is suicide.)

Based on the data I have, I’d say that we as a culture are approaching somewhere between the third and fourth steps.”

#aesthetics#quant#quantitative aesthetics#numbers#statistics#art#mcnamara#robert mcnamara#mcnamara fallacy#sam bankman fried#ftx collapse#culture#data#taste

8 notes

·

View notes

Text

Precision Insights: Expert Quantitative Market Research Services

Our Quantitative Market Research Services help you quickly gather insights from our panellists and understand the changing consumer behaviour. Using our comprehensive services, we find the answers to the most of your questions! Follow this link to know more https://insighttellers.com/services/quantitative-research-market

#Quantitative Market Research Services#Qualitative Research#Translation#Survey Programming#Data Collection & Analysis#Secondary Research#Panel Aggregation#Contracted Work

2 notes

·

View notes