#r: @

Explore tagged Tumblr posts

Video

youtube

A Railway Collision (1900) Robert W. Paul, Walter R. Booth

A Railway Collision (also known as A Railroad Wreck) is a short trick film from 1900, produced by Robert W. Paul and directed Walter R. Booth. It was made at Paul's Animatograph Works in Muswell Hill, North London.

The film depicts a stretch of single-track railway ( 00:08 ) along which a train travels through a mountainous landscape overlooking the sea. Before entering a tunnel, the train stops, moves in reverse, but another train suddenly emerges from the tunnel ( 00:40 ), colliding with the first and plummeting off the cliff.

( 00:52 ) Although the film was not inspired by any real-life events, and the trains were merely scale models (albeit very well-crafted) moving within an artificial environment, contemporary audiences believed it to be real. Many even congratulated Paul for having had the opportunity to capture such an event on film. In their defense, it is worth noting that cinematographic images of the time were nowhere near as sharp as they are today.

Perhaps it was also the reaction of this audience that inspired Paul’s subsequent The Countryman and the Cinematograph (1901), in which the British director pokes fun at a viewer who confuses reality and fiction.

youtube

In any case, A Railway Collision was highly successful, foreshadowing the popularity that disaster films would later achieve, particularly in the United States, where it was pirated and adapted for cinematographic projection (the film was originally conceived for the kinetoscope).

0 notes

Text

Open Your Possible: The Power of Personal Advancement

""

Are you all set to take control of your life and reach your full capacity? Personal advancement is the key to self-improvement and development in various aspects of your life. By spending time and initiative right into creating on your own, you can improve your skills, improve your confidence, and attain your objectives. Whether it's enhancing your communication skills, constructing resilience, or growing a positive way of thinking, personal growth allows you to end up being the best version of yourself.Embark on a trip of self-discovery and improvement with personal growth. Establish significant objectives, produce a prepare for development, and embrace new difficulties to unlock your true potential. Remember, individual advancement is a long-lasting procedure that needs devotion and a growth frame of mind. Begin your journey today and watch as you evolve right into a stronger, much more confident, and fulfilled individual.

Read more here Read more

0 notes

Text

Open Your Potential: The Power of Personal Development

""

Are you all set to take control of your life and reach your complete potential? Personal development is the crucial to self-improvement and development in numerous aspects of your life. By spending time and initiative into developing yourself, you can enhance your skills, boost your confidence, and accomplish your goals. Whether it's enhancing your communication skills, developing strength, or growing a favorable state of mind, individual advancement permits you to come to be the very best variation of yourself.Embark on a trip of self-discovery and makeover via personal growth. Set meaningful goals, produce a prepare for growth, and embrace brand-new obstacles to open your true potential. Bear in mind, personal growth is a long-lasting procedure that needs commitment and a development attitude. Beginning your journey today and watch as you develop right into a more powerful, much more positive, and met individual.

Read more here Read this

0 notes

Text

"The Freelancer's Tax Toolkit: Saving Money at Tax Time"

Tax-Saving Strategies Every Freelancer and Small Business Must Use

Tax-Saving Strategies Every Freelancer and Small Business Must Use 1. Keep Immaculate Records 2. Max Out Tax-Advantaged Retirement Accounts 3. Deduct All Eligible Business Expenses 4. Claim the Home Office Deduction 5. Track Mileage for Business Travel 6. Hire Family Members 7. Leverage Tax Credits 8. Make Quarterly Estimated Tax Payments 9. Don't Be Afraid to Hire Tax Help 10. Plan for Long-Term Tax Strategies 11. Make Charitable Contributions 12. Open and Fund an HSA 13. Use Tax Loss Harvesting 14. Look Into the R&D Tax Credit 15. Review Your Business Structure As a freelancer or small business owner, taxes can take a big bite out of your bottom line. While you can't eliminate taxes completely, implementing smart tax planning strategies can help you keep more of your hard-earned income. In this comprehensive guide, we'll explore 15 powerful tax-saving tips that every freelancer and small business should consider taking advantage of. Master these strategies, and you'll be well on your way to maximizing your after-tax income.

1. Keep Immaculate Records

Meticulous record keeping is the foundation of tax savings for the self-employed. By maintaining thorough and organized records, you’ll be able to accurately calculate all your eligible business deductions and back up your figures if ever audited by the IRS. Be sure to set up a system to track all business income and expenses. Save receipts and invoices, separate business and personal bank accounts, create expense reports, and have a dedicated record-keeping software like QuickBooks or FreshBooks. The more details you can provide, the more deductions you can claim. Accurate records also help with estimating quarterly taxes, managing cash flow, monitoring the health of your business, and doing comprehensive tax planning. The time invested in record keeping up front can yield significant tax and financial benefits down the road.

2. Max Out Tax-Advantaged Retirement Accounts

Tax-advantaged retirement plans like Solo 401(k)s and SEP IRAs allow freelancers and small business owners to save for the future while lowering taxable income today. The Solo 401(k) is likely the best option for solo entrepreneurs or businesses with no employees besides the owner and a spouse. Solo 401(k)s allow you to contribute both as an employee and an employer, with total contributions up to $61,000 per year for 2022 ($67,500 for those 50 or older). Meanwhile, SEP IRAs permit contributions up to 25% of your net business income, up to $61,000 annually. Maxing out these accounts can slash your taxable income significantly. Be sure to explore them fully and use them as part of an integrated tax minimization strategy.

3. Deduct All Eligible Business Expenses

One of the best parts of being a small business owner is deducting legitimate business expenses to reduce your taxable income. Make sure you're taking advantage of every allowable deduction based on your business model and activities. Common deductible expenses include: - Office supplies and equipment - Professional services like bookkeeping or legal fees - Employee salaries and benefits - Advertising and marketing costs - Travel and transportation related to business activities - Phone, internet, and utility expenses - Insurance premiums - Interest paid on business loans and credit cards - Rent or lease payments for office space - Ongoing education and training Deducting all applicable expenses properly can result in thousands of dollars in tax savings. Consult with a tax pro to identify all potential write-offs.

4. Claim the Home Office Deduction

Many freelancers and small business owners work from home, whether full time or as a hybrid model. If you operate your business out of your home, be sure to take the home office deduction. To qualify, you must use a specific area of your home regularly and exclusively for business. You can then deduct a portion of home-related expenses like rent, mortgage interest, property taxes, utilities, insurance, maintenance, and repairs based on the square footage percentage used for business. Home office deductions can be worth thousands per year, making it well worth setting up a dedicated workspace that meets IRS requirements. Just be sure to use the space only for business to avoid questions.

5. Track Mileage for Business Travel

Business-related travel is another significant tax write-off for the self-employed. For 2022, you can deduct either your actual vehicle expenses or take the standard IRS mileage rate of 58.5 cents per mile. To maximize your deduction, keep meticulous records of mileage driven for business purposes in a vehicle log or app like MileIQ. Calculate the total miles and multiply it by the standard mileage rate. This adds up fast, especially for service businesses like caterers, contractors, realtors, etc. You can also deduct parking, tolls, rideshare services, and other transportation costs related to business activities. Capture these expenses as you go to build your deduction.

6. Hire Family Members

Bringing family members into your business can provide personal and tax benefits. As long as the family member is doing legitimate work for your business, you can deduct their salary as a business expense just like any other employee. Some common examples include hiring a spouse for administrative tasks, children for social media help, or siblings for services like graphic design or bookkeeping. Just be sure to keep proper payroll records like any other employee. The family member must also claim the income on their taxes. But as long as they're doing real work for the business, it's a win-win tax strategy.

7. Leverage Tax Credits

Beyond deductions, small businesses can further reduce taxes through tax credits directly lowering your tax bill on a dollar-for-dollar basis. Some examples of small business tax credits include: - Small Business Healthcare Tax Credit - offers a credit of up to 50% of premium costs for small businesses providing employee health insurance. - Work Opportunity Tax Credit - provides a credit up to $9,600 per employee hired from certain targeted groups like veterans or those receiving government assistance. - Research and Development Tax Credit - available for businesses investing in experimental research and product development. Take time to research what credits make sense for your business situation and ensure you properly claim them. The tax savings can be substantial.

8. Make Quarterly Estimated Tax Payments

As a business owner, you typically don't have taxes withheld from a paycheck like a W-2 employee. As such, you must make quarterly estimated tax payments on your income to avoid penalties and interest charges. Estimated tax payments are due every quarter: April 15, June 15, September 15, and January 15. The IRS requires you to pay either 90% of your total tax bill or 100% of the prior year's tax amount through quarterly payments. Making timely estimated payments not only helps you avoid penalties but also manages your cash flow effectively throughout the year. Don't let estimated taxes catch you off guard.

9. Don't Be Afraid to Hire Tax Help

With all the complexities and responsibilities of running a small business, it can be tempting to take a DIY approach to taxes to save money. However, hiring a knowledgeable tax pro can provide huge value and more than pay for itself. A tax professional can help you: - Navigate complex tax laws and ever-changing regulations - Identify overlooked deductions you may be missing - Structure your business in a more tax-efficient manner - Plan tax strategies to maximize savings both now and in the future - Avoid mistakes that could lead to audits and penalties A good CPA will save you more in tax savings than their fees, giving you confidence at tax time. Their expertise offers peace of mind and allows you to focus on your business.

10. Plan for Long-Term Tax Strategies

Taxes owed each year are important, but also consider long-term tax planning strategies that could benefit your business for years to come. Some examples include: - Incorporating as an S corporation - This changes how business income is taxed and may provide savings for some businesses. - Employee vs independent contractor status - Weigh the tax implications of bringing on employees vs contractors. - Accounting methods - Cash vs accrual accounting affects when income and expenses are recognized for tax purposes. - Buying business property - Carefully consider whether to expense or depreciate capital expenditures over time. - Estate and succession planning - Develop a tax-smart plan for transferring your business as part of your estate. Meeting with a tax advisor annually can help identify the best long-term tax strategies to put in place well before tax time.

11. Make Charitable Contributions

Supporting charitable causes you're passionate about while also lowering your tax bill for the year is a win-win. Some ways to integrate charitable giving into your business tax planning include: - Donating money directly from your business instead of personally - Donating inventory, services, or other non-cash assets - Setting up a donor-advised fund under your business name - Establishing a nonprofit foundation funded by your business - Sponsoring fundraising events, teams, or causes as a business Be sure to track charitable donations closely. While tax deductible, charitable giving should also align with your business values and priorities.

12. Open and Fund an HSA

For small business owners who have a high deductible health plan, contributing to a Health Savings Account (HSA) can provide triple tax benefits. HSAs offer: - An above-the-line deduction lowering your AGI when you contribute. - Tax-deferred growth on the funds just like a 401(k). - Tax-free withdrawals for qualified medical expenses. For 2022, you can contribute up to $3,650 for self-only HDHP coverage or $7,300 for family coverage. If over age 55, you can also make an extra $1,000 catch-up contribution. Maximizing an HSA along with a high deductible health plan can be a wise long-term tax and healthcare savings strategy.

13. Use Tax Loss Harvesting

Tax loss harvesting involves strategically selling investments at a loss to offset capital gains and income taxes. This technique allows you to book losses to lower your tax bill while maintaining your overall investment portfolio and asset allocation. As a business owner, you may have substantial capital gains from selling assets or investments held inside your business. By harvesting losses in your investment accounts, you can generate deductions to offset these gains and reduce what you owe. Work with your financial advisor or CPA to model tax loss harvesting scenarios and improve your after-tax return.

14. Look Into the R&D Tax Credit

Many businesses are unaware that engaging in experimental research and development activities could qualify them for valuable R&D tax credits. According to the IRS, "research" refers to eliminating uncertainty about the development or improvement of a product. "Development" means translating research findings into a new product or process. Some examples that may qualify include: - Developing new technologies, formulas, inventions, or processes - Testing and refining prototypes or models - Clinical studies to obtain FDA approval for a new drug - Software development to improve internal systems/tools - Engineering to improve performance, reliability, or quality Professional services like engineers, designers, software developers, and research scientists can help quantify credits.

15. Review Your Business Structure

The legal structure you choose for your business also impacts your tax situation both now and in the future. Periodically stepping back to assess if your current business structure makes sense can reveal opportunities for tax savings. Some considerations around business structure include: - Sole proprietorship - Simplest structure with no distinction between you and your business for tax purposes. Income is reported on your personal return. - Partnership - Partners report their share of profits/losses on personal tax returns and avoid double taxation. General partners have unlimited liability. - S Corporation - Profits/losses are allocated to shareholders based on ownership percentages and taxed at individual rates. Reasonable salary is subject to FICA taxes. - C Corporation - Subject to corporate income tax rates. Double taxation for dividends distributed to shareholders. Better for raising capital long-term. Your tax and legal advisors can help analyze the best structure for your goals, cash flow, and owner preferences. Putting even a handful of these tax strategies to work can help freelancers and small business owners hold onto more of their hard-earned income to fuel future growth and prosperity. Don't leave potential savings on the table. Partner with your financial and tax advisors to implement a plan tailored to your business. The tax and cash flow benefits will be well worth the effort.

Read the full article

#businessexpenses#charitablecontributions#estimatedtaxpayments#familyhiring#freelancers#homeofficededuction#HSA#long-termtaxstrategies#mileagededuction#R&Dtaxcredit#record-keeping#retirementaccounts#SmallBusiness#taxcredits#taxlossharvesting#taxplanning#taxprofessional#taxsavings

0 notes

Photo

PORTO ROCHA

1K notes

·

View notes

Photo

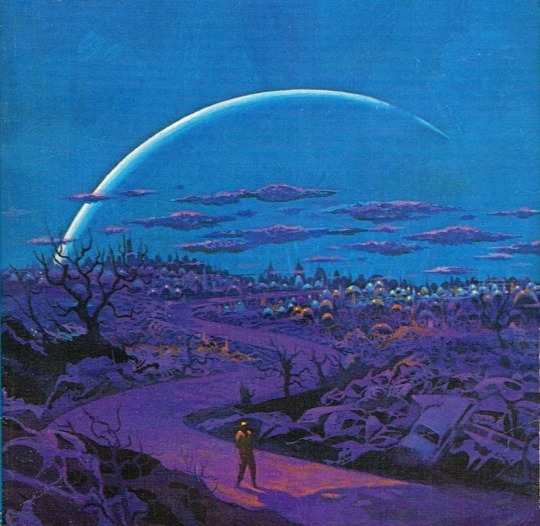

One of my favorites by Paul Lehr, used as a 1971 cover to "Earth Abides," by George R. Stewart. It's also in my upcoming art book!

1K notes

·

View notes

Photo

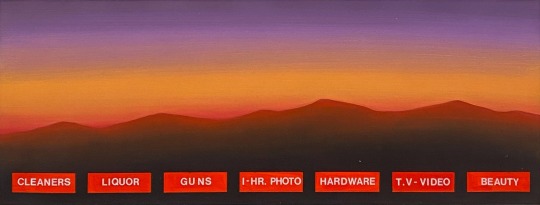

(vía Another America 50 by Phillip Toledano)

77 notes

·

View notes

Quote

もともとは10年ほど前にTumblrにすごくハマっていて。いろんな人をフォローしたらかっこいい写真や色が洪水のように出てきて、もう自分で絵を描かなくて良いじゃん、ってなったんです。それで何年も画像を集めていって、そこで集まった色のイメージやモチーフ、レンズの距離感など画面構成を抽象化して、いまの感覚にアウトプットしています。画像の持つ情報量というものが作品の影響になっていますね。

映画『きみの色』山田尚子監督×はくいきしろい対談。嫉妬し合うふたりが語る、色と光の表現|Tokyo Art Beat

156 notes

·

View notes

Photo

#thistension

XO, KITTY — 1.09 “SNAFU”

#xokittyedit#tatbilbedit#kdramaedit#netflixedit#wlwedit#xokittydaily#asiancentral#cinemapix#cinematv#filmtvcentral#pocfiction#smallscreensource#teendramaedit#wlwgif#kitty song covey#yuri han#xo kitty#anna cathcart#gia kim#~#inspiration: romantic.#dynamic: ff.

1K notes

·

View notes

Photo

No one wants to be here and no one wants to leave, Dave Smith (because)

111 notes

·

View notes

Photo

PORTO ROCHA

770 notes

·

View notes

Text

GENERAL MEMES: Vampire/Immortal Themed 🩸🦇🌹

↳ Please feel free to tweak them.

Themes: violence, death, blood, murder, depression/negative thoughts

SYMBOLS: ↳ Use “↪”to reverse the characters where applicable!

🦇 - To catch my muse transforming into a bat 🌞 - To warn my muse about/see my muse in the sunlight. 🩸 - To witness my muse drinking blood from a bag. 🐇 - To witness To catch my muse drinking blood from an animal. 🧔🏽 - To witness To catch my muse drinking blood from a human. 🦌 - For our muses hunt together for the first time. 🏃🏿♀️ - To see my muse using super speed. 🏋🏼♂️ - To see my muse using their super strength. 🧛🏻♂️ - To confront my muse about being a vampire. 🌕 - For my muse to lament missing the sun. ⏰ - For my muse to tell yours about a story from their long, immortal life. 🤛🏽 - To offer my muse your wrist to drink from. 👩🏿 - For my muse to reminisce about a long lost love. 👩🏽🤝👩🏽 - For your muse to look exactly like my muse's lost love. 👄 - For my muse to bite yours. 👀 - For my muse to glamour/compel yours. 🧄 - To try and sneakily feed my muse garlic to test if they're a vampire. 🔗 - To try and apprehend my muse with silver chains. 🔪 - To try and attack my muse with a wooden stake. 👤 - To notice that my muse doesn't have a reflection. 🌹 - For my muse to turn yours into a vampire. 🌚 - For my muse and yours to spend time together during the night. 🧛🏼♀️ - For my muse to tell yours about their maker/sire.

SENTENCES:

"I've been alive for a long time [ name ], I can handle myself." "I'm over a thousand years old, you can't stop me!" "Lots of windows in this place, not exactly the greatest place for a vampire." "Do you really drink human blood? Don't you feel guilty?" "Vampires are predators, [ name ] hunting is just part of our nature, you can't change that." "You just killed that person! You're a monster!" "Tomorrow at dawn, you'll meet the sun [ name ]." "Can you make me like you?" "Do you really want to live forever?" "You say you want to live forever, [ name ], but forever is a long time, longer than you can imagine." "What was it like to live through [ historic event / time period ]?" "Did people really dress like that when you were young?" "What were you like when you were human?" "We’re vampires, [ name ], we have no soul to save, and I don’t care." "How many people have you killed? You can tell me, I can handle it." "Did you meet [ historic figure ]?" "Everyone dies in the end, what does it matter if I... speed it along." "Every time we feed that person is someone's mother, brother, sister, husband. You better start getting used to that if you want to survive this life." "[ she is / he is / they are ] the strongest vampire anyone has heard of, no one knows how to stop them, and if you try you're going to get yourselves killed." "Vampire hunters are everywhere in this city, you need to watch your back." "Humans will never understand the bond a vampire has with [ his / her / their ] maker, it's a bond like no other." "Here, have this ring, it will protect you from the sunlight." "I get you're an immortal creature of the night and all that, but do you have to be such a downer about it?" "In my [ centuries / decades / millennia ] of living, do you really think no one has tried to kill me before?" "Vampires aren't weakened by garlic, that's a myth." "I used to be a lot worse than I was now, [ name ], I've had time to mellow, to become used to what I am. I'm ashamed of the monster I was." "The worst part of living forever is watching everyone you love die, while you stay frozen, still, constant." "I've lived so long I don't feel anything any more." "Are there more people like you? How many?" "Life has never been fair, [ name ], why would start being fair now you're immortal?" "You want to be young forever? Knock yourself out, I just hope you understand what you're giving up." "You never told me who turned you into a vampire. Who were they? Why did they do it?" "I could spend an eternity with you and never get bored." "Do you really sleep in coffins?" "There are worse things for a vampire than death, of that I can assure you [ name ]." "You need to feed, it's been days. You can drink from me, I can tell you're hungry." "The process of becoming a vampire is risky, [ name ], you could die, and I don't know if I could forgive myself for killing you." "I'm a vampire, I can hold a grudge for a long time, so believe me when I say I will never forgive this. Never." "You were human once! How can you have no empathy?" "You don't have to kill to be a vampire, but what would be the fun in that." "You can spend your first years of immortality doing whatever you want to whoever you want, but when you come back to your senses, it'll hit you harder than anything you've felt before." "One day, [ name ], everything you've done is going to catch up to you, and you're never going to forgive yourself." "Stop kidding yourself, [ name ], you're a vampire, a killer, a predator. You might as well embrace it now because you can't keep this up forever." "You can't [ compel / glamour ] me, I have something to protect me." "When you've lived as long as me, there's not much more in life you can do." "You want me to turn you? You don't know what you're asking me to do." "You really have to stop hissing like that, it's getting on my nerves." "I'm going to drive this stake through your heart, [ name ], and I'm going to enjoy it."

#ask meme#symbol meme#roleplay sentence meme#sentence starter meme#rp sentence prompts#vampire ask meme#ask box#ask memes#vampires#tw : blood#tw: violence#tw: death#tw: depression#tw: vampires#tw: murder

162 notes

·

View notes

Photo

Beautiful photo of the Princess of Wales departing Westminster Abbey after attending the Commonwealth Day Service. --

#catherine elizabeth#princess catherine#princess of wales#princess catherine of wales#catherine the princess of wales#william arthur philip louis#prince william#prince of wales#prince william of wales#william the prince of wales#prince and princess of wales#william and catherine#kensington palace#british royal family

84 notes

·

View notes

Quote

よく「発明は1人でできる。製品化には10人かかる。量産化には100人かかる」とも言われますが、実際に、私はネオジム磁石を1人で発明しました。製品化、量産化については住友特殊金属の仲間たちと一緒に、短期間のうちに成功させました。82年に発明し、83年から生産が始まったのですから、非常に早いです。そしてネオジム磁石は、ハードディスクのVCM(ボイスコイルモーター)の部品などの電子機器を主な用途として大歓迎を受け、生産量も年々倍増して、2000年には世界で1万トンを超えました。

世界最強「ネオジム磁石はこうして見つけた」(佐川眞人 氏 / インターメタリックス株式会社 代表取締役社長) | Science Portal - 科学技術の最新情報サイト「サイエンスポータル」

81 notes

·

View notes