#recharge api

Link

Ezulix software is one of the best AEPS service provider company in India over the last 5 years. We have a huge team of skilled and experienced professionals who have expertise in developing fintech solutions.

Our new AEPS portal integrated with recharge software allows you to offer all bank AEPS services plus all in one recharge solutions at same place.

Now by using single b2b admin portal you can offer multiple services to your members and can make it a huge source of Income.

For more details visit our website our request us a free live demo. [email protected]

#aeps software#aeps portal#aeps software provider#mobile recharge software#multi recharge software#aeps api#recharge api

2 notes

·

View notes

Text

Streamline Your Recharge Business with the Best Recharge API Service by Ezytm

Mobile recharge API serve as a catalyst for achieving this objective by driving revenue growth and minimizing operational inefficiencies. By expanding their service offerings to include a wide range of recharge options, businesses can tap into new market segments and capitalize on emerging opportunities.

#recharge api#mobile recharge api#recharge api provider#mobile recharge api provider#multi recharge api#m robotic recharge api#recharge apis#recharge api provider in india#best recharge api provider

0 notes

Text

Nabpower Payment Gateway: Redefining Digital Transactions with Advanced Features

Embark on a journey into the cutting-edge world of digital transactions with Nabpower Payment Gateway. This blog post uncovers the innovative features that make Nabpower a standout choice, providing businesses and users with a secure, seamless, and efficient online payment experience.

1) Robust Security Protocols

Explore Nabpower’s unwavering commitment to security excellence, featuring advanced encryption protocols and stringent security measures. Learn how these measures safeguard sensitive financial data, instilling confidence and trust in every transaction.

2) Seamless Integration Capabilities

Delve into the ease of integrating Nabpower Payment Gateway into various digital platforms. Understand how this seamless integration enhances user experience, offering a consistent and user-friendly payment process across different websites and applications.

3) Diverse Payment Channel Support

Discover Nabpower’s versatility in supporting a wide range of payment channels. From credit cards to digital wallets, explore how Nabpower accommodates diverse customer preferences, expanding payment options for businesses and enhancing user convenience.

4) Real-Time Transaction Monitoring

Experience the immediacy of Nabpower’s real-time transaction monitoring system. Gain insights into payment status promptly, enhancing transparency and providing businesses with real-time control over financial transactions.

5) Customizable User Interface

Explore the flexibility of Nabpower’s customizable user interface, allowing businesses to tailor the payment experience to align with their brand identity. Witness how this feature enhances the overall user experience, creating a seamless and branded payment environment.

6) Responsive Customer Support

Discover Nabpower’s dedication to customer satisfaction with responsive and knowledgeable customer support. Learn how users and businesses can rely on Nabpower’s support team for timely assistance, addressing queries and concerns related to the payment gateway.

7) Analytics and Reporting Tools

Delve into Nabpower’s analytics and reporting tools, providing businesses with valuable insights into transaction trends, customer behavior, and key metrics. Explore how this information empowers businesses to make informed decisions and refine their payment strategies.

Conclusion:

In this comprehensive exploration of Nabpower Payment Gateway features, witness the convergence of innovation, security, and user-centric design. Nabpower is reshaping the online payment landscape, offering businesses and users an advanced, reliable, and seamless transaction experience. As we navigate the digital realm, Nabpower stands as a symbol of progress, shaping the future of secure and efficient online payments.

0 notes

Text

Oxype Payment Gateway Spotlight: Unveiling the Advanced Features of the Dynamic Payment Link

Embark on a journey into the future of digital transactions with Oxype Payment Gateway. This blog post serves as your guide, delving into the innovative features of Oxype's dynamic payment link designed to elevate user experience and streamline online payments.

1) Effortless Payment Initiation

Explore the simplicity of Oxype's payment link, offering users the ease of initiating transactions with just a click. Streamlined and user-friendly, this feature reduces friction in the payment process, providing a seamless experience for both businesses and customers.

2) Customization for Brand Harmony

Discover the flexibility of Oxype's payment link with customizable options. Businesses can tailor the link's appearance to align with their brand identity, ensuring a seamless integration that feels cohesive with the overall user experience.

3) Multiple Payment Options

Delve into the versatility of Oxype's payment link, allowing businesses to accept payments through various channels, including credit cards, digital wallets, and more. This feature caters to diverse customer preferences, expanding payment possibilities.

4) Real-Time Transaction Monitoring

Experience the immediacy of Oxype's payment link with real-time transaction monitoring. Businesses gain instant insights into payment statuses, enhancing transparency and providing a sense of control over financial transactions.

5) Secure and Encrypted Transactions

Delve into the robust security features embedded in Oxype's payment link. With encryption protocols and advanced security measures, users can trust in the security of their transactions, fostering confidence and peace of mind.

6) Seamless Integration with APIs

Learn about Oxype's flexible API, facilitating effortless integration with various platforms and content management systems. The payment link adapts seamlessly to different digital environments, empowering businesses to provide a consistent payment experience.

7) Enhanced Tracking and Reporting

Explore the data analytics capabilities of Oxype's payment link, providing businesses with valuable insights into customer behavior, transaction trends, and other key metrics. This information enables informed decision-making and strategic planning.

Conclusion:

In this exploration of Oxype's payment link features, witness the convergence of innovation and user-centric design. From effortless payment initiation to advanced security measures, Oxype empowers businesses to redefine the online payment experience. As we navigate the digital landscape, the dynamic payment link emerges as a catalyst for enhanced user engagement and efficient transactions, shaping the future of online commerce.

0 notes

Text

Seamless Recharges, Limitless Possibilities: Exploring Payniko Payment Gateway's Transformative Recharge API

Embark on a journey of digital empowerment with Payniko Payment Gateway's cutting-edge Recharge API. In this blog post, we uncover the dynamic features and functionalities that define Payniko's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Payniko is redefining the recharge experience for users and businesses alike.

Effortless Recharge Experience:

Delve into the unmatched efficiency of Payniko's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Versatility in Operator Support:

Highlight the flexibility of Payniko's Recharge API with its extensive support for diverse operators. Users enjoy the freedom to recharge with their preferred mobile service providers, DTH operators, and data card services, enhancing the overall user experience.

Real-Time Transaction Transparency:

Emphasize the importance of real-time transaction updates integrated into Payniko's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Tailored Solutions for Businesses:

Illustrate the customizable options available for businesses integrating Payniko's Recharge API. From branded interfaces to personalized features, Payniko empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security at Its Core:

Assure users of Payniko's unwavering commitment to security, fortified by robust encryption and authentication protocols. Payniko's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance:

Showcase the user-friendly documentation and integration guides provided by Payniko. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Payniko's Recharge API without unnecessary complexities.

User-Centric Design and Accessibility:

Explore how Payniko places user-friendliness at the forefront of its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Payniko guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences:

Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Payniko's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Payniko Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Payniko is at the forefront of reshaping the recharge landscape within the digital era.

1 note

·

View note

Text

Revolutionizing Refills: Yumype Payment Gateway's Recharge API for Seamless Digital Transactions

Step into the future of digital convenience with Yumype Payment Gateway's groundbreaking Recharge API. In this blog post, we explore the dynamic capabilities and user-centric features that define Yumype's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Yumype is redefining the recharge experience.

Effortless Recharge Journey:

Delve into the unmatched efficiency of Yumype's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Multi-Operator Harmony:

Highlight the versatility of Yumype's Recharge API with its support for a myriad of operators. Users enjoy the flexibility to recharge with their preferred mobile service providers, DTH operators, and data card services, creating a truly personalized experience.

Real-Time Transaction Transparency:

Emphasize the importance of real-time transaction updates integrated into Yumype's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Customization for Unique Brands:

Illustrate the customizable options available for businesses integrating Yumype's Recharge API. From branded interfaces to personalized features, Yumype empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security Reinforced:

Assure users of Yumype's unwavering commitment to security, fortified by robust encryption and authentication protocols. Yumype's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance:

Showcase the user-friendly documentation and integration guides provided by Yumype. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Yumype's Recharge API without unnecessary complexities.

User-Centric Design for Accessibility:

Explore how Yumype prioritizes user-friendliness in its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Yumype guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences:

Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Yumype's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Yumype Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Yumype is leading the way in reshaping the recharge landscape within the digital era.

0 notes

Text

Powerful Recharges, Seamless Integration: Unveiling the UPIADDA Payment Gateway’s Recharge API

In the fast-paced world of digital transactions, UPIADDA Payment Gateway stands out with its groundbreaking Recharge API, setting new standards for efficiency and user experience. Join us in this blog post as we delve into the innovative features and functionalities that define UPIADDA's Recharge API, transforming the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how UPIADDA is revolutionizing the recharge experience.

Effortless Transactions, Swift Results:

Dive into the efficiency of UPIADDA's Recharge API, designed to simplify and accelerate the recharge process. Explore how users can effortlessly top up their mobile phones, DTH subscriptions, and data cards, providing unparalleled convenience.

Multi-Operator Support for Diverse Choices:

Highlight the versatility of UPIADDA's Recharge API with its support for a multitude of operators. Whether users have varied preferences for mobile service providers or DTH operators, UPIADDA's API ensures a seamless recharge experience with their preferred choices.

Real-Time Transaction Monitoring:

Emphasize the significance of real-time transaction updates integrated into UPIADDA's Recharge API. Users can stay informed at every step, enhancing transparency and building trust throughout the recharge process.

Tailored Solutions for Businesses:

Illustrate the customizable options available for businesses integrating UPIADDA's Recharge API. From branding elements to tailored features, UPIADDA empowers businesses to craft a recharge experience that aligns perfectly with their unique brand identity.

Security at the Forefront:

Assure users of UPIADDA's commitment to security, boasting robust encryption and authentication protocols. Explore how UPIADDA's Recharge API prioritizes the protection of sensitive information, ensuring a secure environment for all transactions.

Comprehensive Documentation and Integration Guidance:

Showcase the user-friendly documentation and integration guides provided by UPIADDA. Businesses and developers can effortlessly navigate the integration process, harnessing the full potential of UPIADDA's Recharge API without unnecessary complications.

User-Centric Design and Experience:

Explore how UPIADDA places a premium on user-friendliness in its Recharge API. Whether users are seasoned tech enthusiasts or newcomers to digital transactions, UPIADDA ensures a seamless experience, fostering accessibility and convenience for all.

Success Stories and Transformative Outcomes:

Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of UPIADDA's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By illuminating the features and impact of UPIADDA Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users, showcasing how UPIADDA is leading the charge in reshaping the recharge landscape within the digital era.

0 notes

Text

Elevate Your Recharge Experience: Unveiling Payniko Payment Gateway's Dynamic Recharge API

In the era of fast-paced digital living, Payniko Payment Gateway takes center stage with its innovative Recharge API. Join us in this blog post as we explore the dynamic features and benefits that make Payniko the go-to solution for enhancing your recharge experiences. From swift transactions to customizable options, discover how Payniko is transforming the way we recharge in the digital landscape.

Effortless Recharge Process:

Dive into the user-friendly design of Payniko's Recharge API. Explore how the interface simplifies the recharge process, ensuring that users can swiftly top up their accounts or services with ease.

Multi-Operator Support:

Highlight the versatility of Payniko's Recharge API with its multi-operator support. Whether it's mobile phones, DTH services, or data cards, Payniko accommodates a wide range of operators, providing users with a comprehensive solution.

Real-Time Transaction Updates:

Discuss the importance of real-time updates in the world of recharges. Explore how Payniko's Recharge API keeps users informed with instantaneous transaction updates, creating a transparent and trustworthy experience.

Customizable Options for Businesses:

Illustrate the flexibility and customization options available for businesses integrating Payniko's Recharge API. From branding elements to tailored features, businesses can create a recharge experience that aligns seamlessly with their brand identity.

Security Protocols:

Assure users of the robust security protocols embedded in Payniko's Recharge API. Detail how encryption and authentication measures are implemented to safeguard sensitive information, ensuring a secure environment for transactions.

API Documentation and Integration Guides:

Showcase the comprehensive API documentation and integration guides provided by Payniko. Businesses and developers can easily navigate the integration process, leveraging the Recharge API to enhance their services without unnecessary complexities.

User Convenience and Accessibility:

Explore how Payniko prioritizes user convenience and accessibility in its Recharge API. Whether users are tech-savvy or first-time recharge participants, Payniko ensures a seamless experience for all, fostering a user-friendly environment.

Case Studies and Success Stories:

Conclude the blog post by sharing case studies or success stories of businesses that have benefitted from Payniko's Recharge API. Illustrate real-world examples of how the API has added value, efficiency, and convenience to diverse business models.

By unveiling the features and benefits of Payniko Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Payniko is redefining the recharge experience in the digital era.

0 notes

Text

Recharge API | cyrusrecharge.com

Recharge & Bill Pay API Integration solution for Mobile, DTH recharge & utility bills payments businesses with best commission structure.

0 notes

Text

Domestic Money Transfer API Provider

Are you looking for a reliable domestic money transfer API provider? Rainet Technology Private Limited is the perfect choice. We are an experienced software development company that specializes in providing secure and efficient solutions to our clients.

We offer a wide range of services, including iOS applications, Android app development, and domestic money transfer APIs. Our team of experts has extensive experience in developing custom-made solutions that meet your specific needs. With our cutting-edge technology and innovative approach, we can help you create powerful apps with advanced features such as real-time tracking, automated payments processing, and more.

Our domestic money transfer API provides a secure platform for transferring funds between two parties within India or abroad. It is designed to be user friendly so that customers can easily make transactions without any hassle or confusion. The API also offers enhanced security measures such as encryption algorithms to protect customer data from unauthorized access or misuse. Additionally, it supports multiple payment gateways like PayPal and Stripe so customers have more options when making payments online.

At Rainet Technology Private Limited, we understand the importance of delivering quality products on time at competitive prices. That’s why we strive to provide excellent customer service throughout the entire process – from initial consultation through final delivery – ensuring complete satisfaction every step of the way! So if you’re looking for a reliable domestic money transfer API provider then look no further than Rainet Technology Private Limited! Contact us today to learn more about how we can help you achieve success with your project!

Visit Our Website: https://rainet.co.in/Domestic-Money-Transfer.html

#domestic money transfer api provider#domestic money transfer api#api provider#api#software development company#rainet technology private limited#ios app development#android app development#recharge api

0 notes

Text

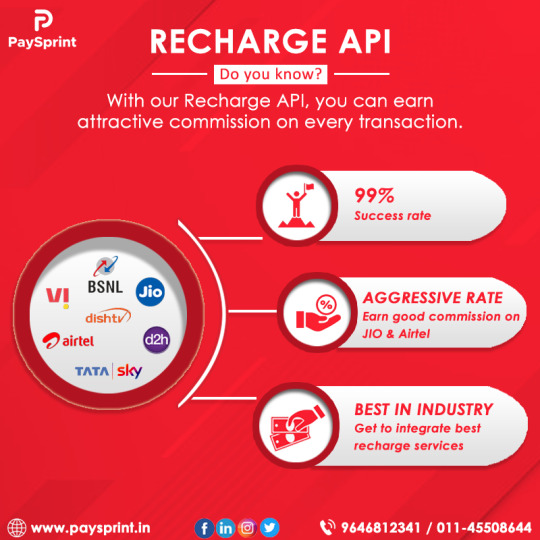

Recharge API Service Provider - PaySprint

Recharge API On-time & convenient recharges are done through our Multi Recharge APIs. It supports all service providers & has negligible failure rates along with the best-in-class response time, making it the best Recharge API service. Integrate and go live now to maximize your profitability. Contact us to know more about Recharge API!

A Recharge API is a type of application programming interface that enables developers to add recharge functionality to their applications. This allows users to recharge their mobile phones or pay bills directly from the app, without having to leave it. The API typically exposes endpoints for initiating a recharge, checking the status of the recharge, and retrieving information about the recharge, such as its amount, date, and status. The API provider may charge a fee for the use of their API or offer it for free. By integrating a Recharge API into their applications, developers can offer their users a convenient and seamless way to manage their mobile recharge needs.

0 notes

Text

#Mobile Recharge API#Mobile Recharge API Provider#Best Mobile Recharge API#Mobile Recharge API Company#Recharge API

0 notes

Text

Explore the Features of Recharge API That Can Boost Your Business Performance

Ezytm technologies provide the best mobile recharge API in India. With the help of our mobile recharge API you can boost your business and increase the profit. You can take your business of new heights

#recharge api#mobile recharge api#recharge api provider#mobile recharge api provider#multi recharge api#m robotic recharge api#recharge apis#recharge api provider in india#best recharge api provider

0 notes

Text

Nabpower Payment Gateway Unleashed: Exploring the Dynamic Features of the Intuitive Payment Button

Embark on a journey into the future of digital transactions with Nabpower Payment Gateway. This blog post serves as your guide, delving into the innovative features of Nabpower's dynamic payment button designed to elevate user experience and streamline online payments.

1) Effortless One-Click Transactions

Discover the simplicity of Nabpower's payment button, offering users the convenience of completing transactions with just one click. Streamlined and intuitive, this feature reduces friction in the payment process, providing a seamless experience for both businesses and customers.

2) Customization for Brand Harmony

Explore the flexibility of Nabpower's payment button with customizable options. Businesses can tailor the button's appearance to align with their brand identity, ensuring a seamless integration that feels cohesive with the overall user interface.

3) Responsive Design Across Devices

In an era of diverse devices, Nabpower's payment button embraces responsive design. Whether accessed on a desktop, tablet, or smartphone, users experience a consistent and visually appealing interface, ensuring accessibility across various platforms.

4) Advanced Security Measures

Delve into the robust security features embedded in Nabpower's payment button. With encryption protocols and fraud detection mechanisms, users can trust in the security of their transactions, fostering confidence and peace of mind.

5) Real-Time Transaction Confirmation

Experience the immediacy of Nabpower's payment button with instant transaction confirmation. Users receive real-time feedback on the success of their transactions, enhancing transparency and providing a sense of assurance.

6) Seamless Integration with Flexible APIs

Learn about Nabpower's flexible API, facilitating effortless integration with various platforms and content management systems. The payment button adapts seamlessly to different digital environments, empowering businesses to provide a consistent payment experience.

7) Subscription and Recurring Payment Options

Explore the versatility of Nabpower's payment button in managing subscription and recurring payments. Businesses can set up automated billing cycles, offering convenience for subscription-based models and enhancing customer loyalty.

Conclusion:

In this exploration of Nabpower's payment button features, witness the convergence of innovation and user-centric design. From streamlined one-click transactions to advanced security measures, Nabpower empowers businesses to redefine the online payment experience. As we navigate the digital landscape, the dynamic payment button emerges as a catalyst for enhanced user engagement and efficient transactions, shaping the future of online commerce.

0 notes

Text

Oxype Payment Gateway Spotlight: Unveiling the Dynamic Features of the Intuitive Payment Button

Embark on a journey into the future of digital transactions with Oxype Payment Gateway. This blog post acts as your guide, dissecting the innovative features of Oxype’s dynamic payment button designed to elevate user experience and streamline online payments.

1) Effortless One-Click Transactions

Discover the simplicity of Oxype’s payment button, offering users the convenience of completing transactions with just one click. Streamlined and intuitive, this feature reduces friction in the payment process, providing a seamless experience for both businesses and customers.

2) Customization for Brand Harmony

Explore the flexibility of Oxype’s payment button with customizable options. Businesses can tailor the button’s appearance to align with their brand identity, ensuring a seamless integration that feels cohesive with the overall user interface.

3) Responsive Design Across Devices

In an era of diverse devices, Oxype’s payment button embraces responsive design. Whether accessed on a desktop, tablet, or smartphone, users experience a consistent and visually appealing interface, ensuring accessibility across various platforms.

4) Advanced Security Measures

Delve into the robust security features embedded in Oxype’s payment button. With encryption protocols and fraud detection mechanisms, users can trust in the security of their transactions, fostering confidence and peace of mind.

5) Real-Time Transaction Confirmation

Experience the immediacy of Oxype’s payment button with instant transaction confirmation. Users receive real-time feedback on the success of their transactions, enhancing transparency and providing a sense of assurance.

6) Seamless Integration with Flexible APIs

Learn about Oxype’s flexible API, facilitating effortless integration with various platforms and content management systems. The payment button adapts seamlessly to different digital environments, empowering businesses to provide a consistent payment experience.

7) Subscription and Recurring Payment Options

Explore the versatility of Oxype’s payment button in managing subscription and recurring payments. Businesses can set up automated billing cycles, offering convenience for subscription-based models and enhancing customer loyalty.

Conclusion:

In this exploration of Oxype’s payment button features, witness the intersection of innovation and user-centric design. From streamlined one-click transactions to advanced security measures, Oxype empowers businesses to redefine the online payment experience. As we navigate the digital landscape, the dynamic payment button emerges as a catalyst for enhanced user engagement and efficient transactions, shaping the future of online commerce.

0 notes

Text

instagram

0 notes