#Payment gateway

Text

Dissecting Crowdfunding Platforms: Are They Making Waves or Waning?

Hey Tumblr fam! Today, let's dive into the world of crowdfunding platforms and take a closer look at their effectiveness. 💸🌟

🤔 The Power of the Crowd: Crowdfunding platforms have revolutionized how entrepreneurs, artists, and innovators fund their projects. By tapping into the collective power of the crowd, they offer a decentralized way to raise capital and bring ideas to life.

💼 Supporting Creative Ventures: From indie films to tech startups, crowdfunding platforms like Kickstarter and Indiegogo have been instrumental in supporting a wide array of creative ventures. They provide a platform for creators to showcase their projects and connect with potential backers worldwide.

📈 Success Stories vs. Struggles: While many projects have found success through crowdfunding, it's essential to acknowledge the challenges and pitfalls that come with it. Not every project reaches its funding goal, and even those that do may face hurdles during execution.

🔍 Analyzing Effectiveness: So, how effective are crowdfunding platforms, really? It's a complex question that requires a nuanced analysis. Factors like project quality, marketing efforts, and audience engagement all play a role in determining success.

🌱 Nurturing Community Engagement: One of the most significant benefits of crowdfunding is its ability to foster community engagement. Backers aren't just providing financial support; they're investing in ideas they believe in and becoming part of the journey.

💡 Future Outlook: As crowdfunding continues to evolve, we can expect to see innovations in platform design, fundraising models, and project management tools. The future holds exciting possibilities for creators and backers alike.

What are your thoughts on crowdfunding platforms? Have you backed any projects or launched one of your own? Share your experiences and let's keep the conversation going! 💬✨

#CommunitySupport#CreativeVentures#Crowdfunding#finance#thefinrate#payment gateway#fintech#financialinsights

3 notes

·

View notes

Text

The Rise of Cashfree Payments: A Paradigm Shift in Financial Transactions

The way we handle financial transactions has undergone a dramatic transformation. Traditional cash payments are gradually being phased out, making way for the era of cashfree payments. With the advent of digital payment methods such as mobile payments, UPI transactions, and international payments, consumers and businesses alike are embracing the convenience and efficiency offered by cashfree solutions. In this blog post, we will explore the various facets of cashfree payments, from their advantages to common misconceptions and their potential impact on the future of finance.

2 notes

·

View notes

Text

IF anyone need help with payment Gateway. Contract

3 notes

·

View notes

Text

Enter for $4,500.00 Cash!

Enter your information now for a chance to win.

#Cashfree#Online Payments#Digital Transactions#Payment Gateway#Fintech Solutions#Cashless Economy#E-commerce Payments#Secure Transactions#Mobile Wallets#Payment Integration#https://sites.google.com/view/cashfree-2/home

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

2 notes

·

View notes

Text

I sale verified Payment gateway

2 notes

·

View notes

Text

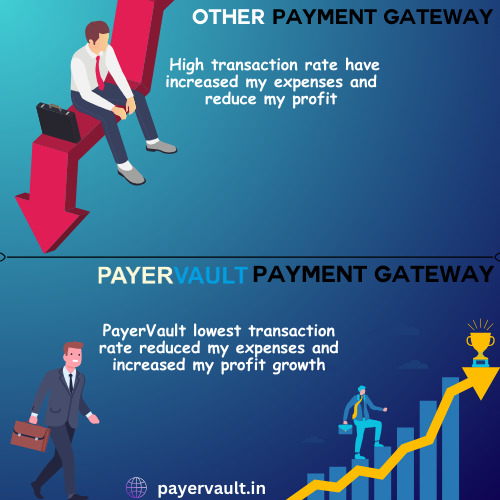

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

1 note

·

View note

Text

Car Rental Business Payment Service Providers - Simplify Your Transactions!

Looking for reliable payment service providers for your car rental business? Our cutting-edge solutions specialize in the car rental industry, ensuring secure transactions.

Key features: seamless integration, multiple payment options, enhanced security, automated billing, real-time reporting, and 24/7 customer support. Simplify transactions, enhance customer satisfaction, and drive profitability.

Contact us today to get the seamless and hassle free payment gateway options for business now: https://gomobi.io/. »

Whatsapp: +60 122902076

Email: [email protected] »

#online payment gateway#top payment gateway malaysia#payment gateway#malaysia payment gateway#paymentgateway

2 notes

·

View notes

Text

The Future of Digital Payments: Trends and Innovations

Introduction

In an increasingly digital world, the way we handle financial transactions has undergone a significant transformation. Digital payments have become a cornerstone of our everyday lives, offering convenience, speed, and security. As we look to the future, it is essential to examine the emerging trends and innovations that will shape the landscape of digital payments. From mobile wallets to cryptocurrencies, from IoT payments to biometric authentication, this blog explores the exciting possibilities that lie ahead.

1- Mobile Wallets and Contactless Payments

Mobile wallets have already gained substantial popularity, enabling users to make payments using their smartphones. As we move forward, the future of mobile wallets looks even more promising. We can expect to see enhanced features such as integration with loyalty programs, personalized offers, and seamless cross-border transactions. The convenience of contactless payments will continue to drive their adoption, with technologies like Near Field Communication (NFC) and biometric authentication ensuring secure and hassle-free transactions.

2- Cryptocurrencies and Blockchain Technology

The rise of cryptocurrencies, led by Bitcoin, has sparked a revolution in financial systems worldwide. As we look ahead, the acceptance and integration of cryptocurrencies into mainstream payment systems will likely continue to grow. Blockchain technology, the underlying technology behind cryptocurrencies, offers unparalleled security, transparency, and efficiency. Smart contracts, enabled by blockchain, will revolutionize business transactions, automating agreements and ensuring trust and immutability.

3- Internet of Things (IoT) Payments

The Internet of Things (IoT) is expanding rapidly, connecting various devices and enabling seamless communication. In the future, IoT devices will play a significant role in digital payments. For instance, smart refrigerators could automatically reorder groceries when supplies run low and connected cars could pay for tolls and parking fees without human intervention. The integration of IoT with payment systems will provide a frictionless experience, streamlining everyday transactions.

4- Biometric Authentication and Facial Recognition

Traditional methods of authentication, such as passwords and PINs, are prone to security breaches. Biometric authentication, including fingerprint and facial recognition, presents a more secure and convenient alternative. As technology advances, we can expect widespread adoption of biometric authentication in digital payments. This will enhance security, reducing the risks of identity theft and fraud while providing a seamless user experience.

5- Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing various industries, and digital payments are no exception. AI-powered systems can analyze vast amounts of data, detect patterns, and identify fraudulent activities in real time. These technologies will strengthen security measures, reduce false positives, and enhance fraud detection and prevention capabilities. AI chatbots and virtual assistants will improve customer support, providing personalized recommendations and assistance in making payment decisions.

6- Cross-Border Payments and Digital Currencies

Cross-border transactions often face challenges such as high fees, long settlement times, and regulatory complexities. Digital currencies and blockchain technology have the potential to revolutionize cross-border payments. By eliminating intermediaries, reducing costs, and increasing transaction speed, cryptocurrencies or stablecoins backed by fiat currencies can facilitate instant and secure cross-border transfers. This will foster global economic integration and financial inclusion.

Conclusion

The future of digital payments holds immense potential for innovation and transformation. Mobile wallets, cryptocurrencies, IoT payments, biometric authentication, AI-powered systems, and cross-border innovations are just some of the trends that will shape the digital payment landscape. As we embrace these advancements, it is crucial to prioritize security, user privacy, and regulatory frameworks to ensure a seamless and secure digital payment experience for all. The digital payment ecosystem is evolving rapidly, and staying informed and adaptable will be key to capitalizing on the opportunities that lie ahead. With technology as an enabler, the future of digital payments is poised to enhance.

2 notes

·

View notes

Text

Payment Aggregator Licensing in India

As updated by the RBI in March 2020, its released framework regarding payment aggregators' and further continuation compliance stated the payment gateways now need to obtain a license and certification from PCI DSS to keep their merchant transactions as it is and smooth going.

Learn More: NBFC Advisory

3 notes

·

View notes

Text

Hello I am a e-commerce website designer on fiverr

I am giving out upto 40% discount on all order with me this month, so kindly check me out and get the best website design for yourself either on wordpress,Etsy,ebay, Shopify and rest of the e-commerce platform

#fiverr#etsyseller#shopifystore#etsy#etsyshop#makemoney#onlinestore#shopify#woocommerce#fashionstore#payment gateway#stripegateway#fashionstyle#wordpressdeveloper#wordpress#redbubble store#ecommerce#etsysellersofinstagram#woman#business#bosslady#virtualassistant

4 notes

·

View notes

Text

Payment gateway vs. shopping cart

If you are creating an online presence to sell your goods or services and are ready to accept credit cards, all of the options, terms, and programmes available can be overwhelming. An online payment gateway and a shopping cart are two common components of an eCommerce credit card processing platform — but what's the difference and how do they work together?

Payment gateway – What is it?

Consider a payment gateway to be your company's online point-of-sale terminal. A gateway is most commonly used to authorise payments for an online eCommerce store; however, today's gateway technology allows businesses to accept payments in a brick-and-mortar retail environment using a credit card reader, POS system, or integration with accounting or CRM software.

A payment gateway works as follows:

i. Credit card information is swiped, dipped, or manually entered into an online hosted payment form or shopping cart.

ii. The payment gateway encrypts the credit card information of the customer and sends it to the payment processor.

iii. The payment processor sends the payment details to the card-issuing bank via the credit card network.

iv. Based on the available funds, the card-issuing bank approves or rejects the transaction.

v. The authorization or decline is communicated back to the payment gateway by the payment processor.

The decision is communicated to the merchant and the customer by the gateway.

What is a shopping cart?

A payment gateway and a shopping cart serve very different purposes. A shopping cart is similar to the grocery cart you use to navigate your local big-box store. You load your items into the cart and drive it to the cash register, which totals your order and gives you the total amount owed.

An online shopping cart does the following:

i. It adds up the costs of your items.

ii. It includes any applicable sales tax and delivery charges.

ii. It deducts discounts obtained through coupon codes and applicable credits.

iii. The total amount owed is then displayed.

To complete the payment process, the online shopping cart is linked to a payment gateway, typically via an API.

A hosted payment form is an alternative to a shopping cart integration. This method is ideal for businesses where each transaction typically consists of only one item or charges the same amount on a consistent basis. A secure hosted payment form is designed to look and feel like it belongs on your eCommerce website, but it is hosted on a third-party secure server to help reduce liability and PCI scope.

Why are payment gateways and shopping carts often confused?

It's easy to see how all of this terminology could confuse a business owner. Many aspects of eCommerce and credit card processing interact with one another. They are sometimes integrated as part of an all-in-one solution. Some websites and businesses use these terms interchangeably, adding to the confusion.

So, which do you require? Is the best online payment gateway India required for your company? Is a shopping cart required for your eCommerce site? What about other elements such as a merchant account? Where should you start?

Do you need an eCommerce solution?

We can help you accept payments the way your business requires, from merchant accounts to payment gateways to software integrations. Make an appointment with a payments expert today to learn more.

#Banking#online payment#payment gateway#ecommerce#PCI#credit card#fintech#UPI#payments#POS#money transfer#merchant#online business

8 notes

·

View notes

Text

Top 5 best payment gateway in Delhi NCR

In the modern world, payment gateways have become an essential tool for businesses, particularly in Delhi NCR, which is a hub of startups and emerging companies. Payment gateways enable secure, quick, and seamless transactions, providing businesses the opportunity to serve their customers with maximum efficiency. The availability of various payment gateways in the region has made it difficult for businesses to choose the most suitable one. In this article, we will discuss the top 5 best payment gateways in Delhi NCR.

1 PayU: PayU is one of the most popular payment gateways in Delhi NCR, serving millions of businesses across the country. PayU offers a variety of payment options such as credit cards, debit cards, net banking, UPI, and more. The platform is known for its ease of use, reliability, and advanced features like auto-retry, dynamic switching, and more. PayU charges a transaction fee of 2% for Indian cards and 3% for international cards.

2 FrenzoPay: FrenzoPay is a payment gateway that is gaining popularity in Delhi NCR due to its advanced features and competitive pricing. The platform offers a wide range of payment options such as credit cards, debit cards, net banking, UPI, and more. FrenzoPay is known for its low transaction fees, multi-currency support, and advanced features such as recurring payments and invoice management. The platform charges a transaction fee of 1.75% for Indian cards and 3% for international cards.

3.Razorpay: Razorpay is another popular payment gateway in Delhi NCR. The platform offers a variety of payment options, including credit cards, debit cards, net banking, UPI, and more. Razorpay is known for its competitive pricing and user-friendly features. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards. It also offers features such as recurring payments, smart routing, and instant refunds.

4.CCAvenue: CCAvenue is one of the oldest payment gateways in India and is a popular choice for businesses in Delhi NCR. The platform offers a wide range of payment options such as credit cards, debit cards, net banking, UPI, and more. CCAvenue is known for its excellent customer support and advanced features like multi-currency support and recurring payments. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards.

5 Cashfree: Cashfree is a popular payment gateway in Delhi NCR, especially among small businesses and freelancers. The platform offers a variety of payment options such as credit cards, debit cards, net banking, UPI, and more. Cashfree is known for its low transaction fees, instant payouts, and automated reminders. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards.

Conclusion:

Choosing the right payment gateway is crucial for any business, especially in Delhi NCR, where competition is intense. While there are many payment gateways available, businesses must choose the one that best suits their needs. PayU, FrenzoPay, Razorpay, CCAvenue, and Cashfree are some of the best payment gateways in Delhi NCR, each offering unique features and pricing. By choosing the right payment gateway, businesses can provide their customers with a seamless and secure payment experience, enabling them to grow their business and stay competitive.

3 notes

·

View notes

Text

#Electronic Check#Digital Check#ACH (Automated Clearing House)#Bank Account Verification#Check Conversion#Paperless Checks#Direct Debit#Payment Processing#Online Payments#Check Clearing#Digital Banking#Payment Gateway#EFT (Electronic Funds Transfer)#Payment Authorization#Check Scanning#Payment Processing Services#Merchant Account#Payment Gateway Solutions#Payment Processing Solutions#Credit Card Processing#Online Payment Solutions#Payment Processing Providers#Point of Sale (POS) Systems#Payment Security#Payment Fraud Prevention#Payment Integration#Mobile Payment Solutions#Payment Processing Fees#Payment Settlement

3 notes

·

View notes